Global Wind Turbine Market Size, Share, Trends, & Growth Forecast Report By Axis (Horizontal (HAWTs) and Vertical (VAWTs)), Installation, Connectivity, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Wind Turbine Market Size

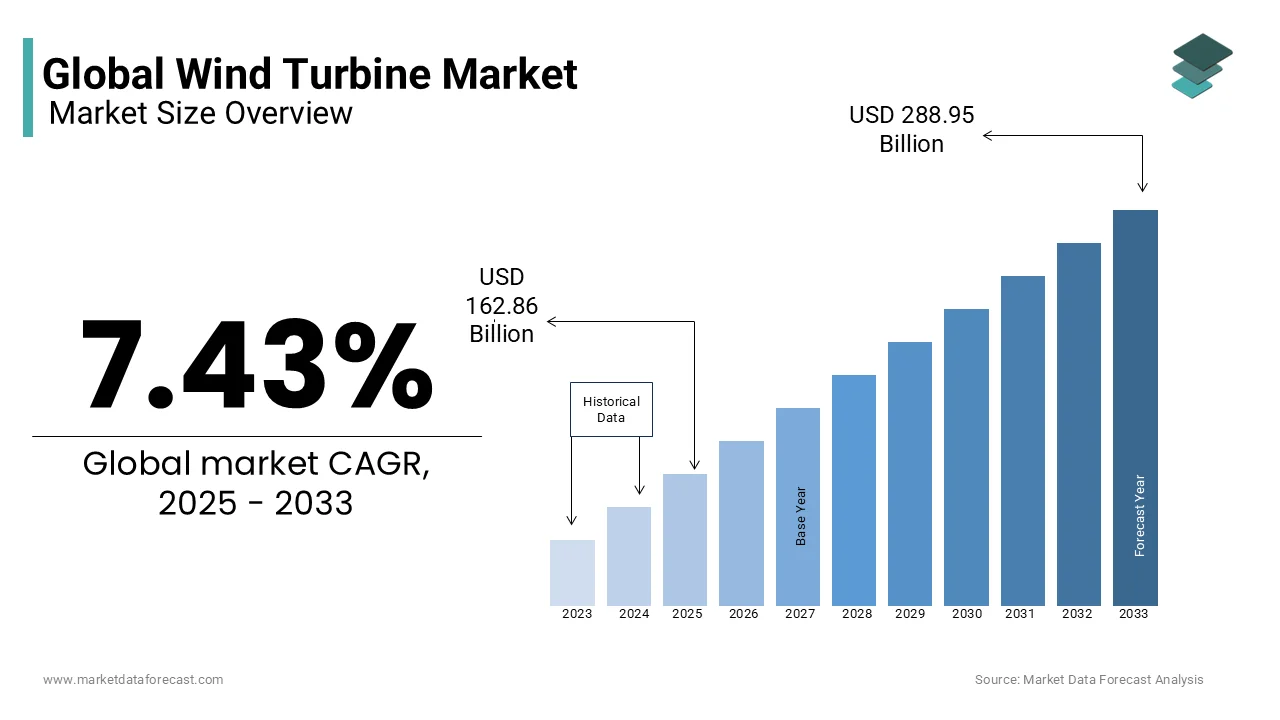

The global wind turbine market was worth USD 151.6 billion in 2024. The global market is projected to reach USD 288.95 billion by 2033 from USD 162.86 in 2025, rising at a CAGR of 7.43% from 2025 to 2033.

A wind turbine is a machine that captures energy from the wind and turns it into electricity. It offers a clean and sustainable way to produce power instead of using traditional methods that harm the environment. In 2023, the global wind turbine market has grown significantly. The total capacity of wind energy installed around the world has now surpassed 837 gigawatts (GW), according to the Global Wind Energy Council. This growth shows that more countries, both rich and developing, are embracing wind energy.

Today, the wind energy sector is shaped by new technologies, government support, and people’s increasing awareness of environmental issues. Offshore wind farms, which are built in oceans, have become very popular. Europe and the Asia-Pacific region are leading this trend. The International Renewable Energy Agency predicts that offshore wind capacity will grow by 14% every year until 2030. This growth is due to bigger and more efficient turbines. Onshore wind farms, which are located on land, still make up most of the wind energy projects, accounting for about 90% of all installations worldwide. Major companies like Vestas, Siemens Gamesa, and GE Renewable Energy are working hard to create better turbines that produce more energy at lower costs. However, the industry faces challenges, such as problems in the supply chain and rising prices of raw materials. Despite these issues, the market is expected to keep growing because many countries have set goals to cut carbon emissions under global climate agreements. This makes wind energy an important part of creating a cleaner and greener future.

MARKET DRIVERS

Government Policies and Incentives

Government policies and incentives are significant drivers of the wind turbine market. Many countries have introduced subsidies, tax benefits, and renewable energy mandates to promote clean energy adoption. For instance, the U.S. Inflation Reduction Act of 2022 extended production tax credits for wind energy, boosting investments in the sector. Similarly, the European Union’s Green Deal aims to achieve 40% renewable energy by 2030, encouraging wind projects. According to the International Energy Agency, policy support has helped global wind capacity grow by an average of 10% annually over the past decade. These measures reduce financial risks for developers and attract private funding. Additionally, auctions and feed-in tariffs have made wind energy more competitive with fossil fuels. The Global Wind Energy Council shows that supportive frameworks have led to a 50% increase in offshore wind investments since 2020, showcasing how policies directly stimulate market expansion.

Technological Advancements

Technological advancements are propelling the wind turbine market forward. Innovations such as larger rotor diameters and taller turbines have significantly improved efficiency. For example, modern turbines can generate up to 15 megawatts (MW) per unit, compared to just 2 MW a decade ago, as reported by the National Renewable Energy Laboratory. These improvements reduce costs, making wind energy more affordable. Floating offshore wind technology is another breakthrough, enabling turbines to be installed in deeper waters where wind speeds are higher. Bloomberg New Energy Finance states that technological progress has lowered the levelized cost of electricity (LCOE) from wind by 68% since 2010. Enhanced grid integration solutions also minimize energy losses during transmission. Such advancements not only expand deployment possibilities but also enhance profitability, driving further investment into the sector.

MARKET RESTRAINTS

Environmental and Social Concerns

Environmental and social concerns are emerging as significant restraints for the wind turbine market. While wind energy is considered clean, its infrastructure can disrupt local ecosystems. For instance, wind turbines have been linked to bird and bat mortality, with studies from the American Bird Conservancy estimating that U.S. wind farms cause approximately 500,000 bird deaths annually. Such ecological impacts often lead to opposition from environmental groups and local communities. Additionally, the construction of wind farms, particularly offshore projects, can disturb marine habitats, raising concerns among conservationists. Social resistance also arises due to noise pollution and visual impacts, with some communities opposing projects near residential areas. The World Health Organization acknowledges that while turbine noise is generally low, it can still be perceived as a nuisance by nearby residents. These environmental and social challenges often delay project approvals, increasing costs and complicating expansion efforts in sensitive regions.

Grid Integration Challenges

Grid integration challenges represent another key restraint for the wind turbine market. Wind energy is inherently intermittent, as it depends on weather conditions, making it difficult to ensure a stable power supply. According to the International Energy Agency, integrating variable renewable energy sources like wind into existing grids requires significant upgrades, which can cost billions of dollars globally. Many regions lack the advanced grid infrastructure needed to handle fluctuating energy inputs, leading to curtailment where excess energy is wasted because the grid cannot absorb it. In China, for example, wind curtailment rates reached 4% in 2021, as reported by the National Energy Administration. Furthermore, energy storage solutions, such as batteries, remain expensive and insufficiently scalable to address these issues comprehensively.

MARKET OPPORTUNITIES

Green Hydrogen Integration

The integration of wind energy with green hydrogen production presents a transformative opportunity for the wind turbine market. Green hydrogen, produced by electrolyzing water using renewable energy, is gaining traction as a clean fuel for industries like steel, chemicals, and transportation. The International Renewable Energy Agency estimates that green hydrogen could meet 12% of global energy demand by 2050, creating a massive market for wind energy. Wind turbines are ideal for powering electrolyzers due to their scalability and cost-effectiveness. For instance, Siemens Gamesa has partnered with European utilities to develop wind-to-hydrogen projects, aiming to produce 40 gigawatts (GW) of hydrogen capacity by 2030. Additionally, offshore wind farms, located near industrial hubs, can directly supply renewable energy for hydrogen production. This synergy not only diversifies revenue streams but also positions wind energy as a cornerstone of the global decarbonization strategy.

Circular Economy and Recycling Innovations

The adoption of circular economy principles in the wind turbine market offers significant growth potential. As older turbines reach the end of their lifecycle, recycling their components especially blades made of composite materials has become a priority. Currently, over 85% of a turbine’s components are recyclable, but blade recycling remains challenging, according to the European Environment Agency. Innovations in this space, such as thermal decomposition and mechanical grinding, are emerging as solutions. Companies like GE Renewable Energy have partnered with Veolia to recycle blades into raw materials for cement production. Embracing circular economy practices not only reduces waste but also enhances the sustainability credentials of wind energy, attracting environmentally conscious investors.

MARKET CHALLENGES

Climate Change Impact on Wind Patterns

A growing challenge for the wind turbine market is the potential impact of climate change on wind patterns. Changes in atmospheric conditions could alter wind speeds and consistency, affecting energy generation. A study published in Nature Geoscience reveals that wind speeds in key regions like the U.S. Midwest and Northern Europe have declined by up to 10% over the past four decades, a phenomenon known as "global stilling." Such trends could reduce the efficiency of wind farms, particularly in historically high-wind areas. The International Energy Agency warns that unpredictable weather patterns may increase reliance on backup power sources, raising operational costs. Additionally, extreme weather events, such as hurricanes and storms, pose risks to turbine infrastructure. Adapting to these changes requires advanced forecasting tools and resilient turbine designs, which remain costly and technically complex to implement.

Land Use Conflicts and Zoning Regulations

Land use conflicts and stringent zoning regulations are increasingly becoming barriers to wind turbine deployment. In densely populated or agriculturally rich regions, securing land for wind farms often sparks disputes between developers, local communities, and farmers. The Food and Agriculture Organization stresses that competition for arable land is intensifying, particularly in developing countries where food security is a priority. Furthermore, zoning laws in urbanized areas often restrict turbine placement due to height limitations or aesthetic concerns. For example, in Japan, strict land-use policies have limited onshore wind development, resulting in just 4.8 GW of installed capacity as of 2023, according to the Japan Wind Power Association. Navigating these regulatory hurdles requires extensive stakeholder engagement and compromises, which can delay projects and inflate costs, hindering market expansion in certain regions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.43% |

|

Segments Covered |

By Axis, Installation, Connectivity, Rating, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Envision group, Enercon, General Electric, Goldwind, Mingyang Smart Energy Group Co., Ltd., Nordex, Siemens Gamesa Renewable Energy, Suzlon Energy, Senvion, Vestas, Zhejiang Windey Co., Ltd. |

SEGMENT ANALYSIS

By Axis Insights

The Horizontal-axis wind turbines (HAWTs) segment dominated the market with a substantial share in 2024. Their position is due to their compatibility with advanced technologies like predictive maintenance systems, which reduce downtime and operational costs. For instance, GE’s Digital Wind Farm platform uses AI to optimize HAWT performance, increasing energy output by up to 20%. Additionally, HAWTs are ideal for offshore applications due to their ability to harness strong, consistent winds at sea. The U.S. Department of Energy reveals that offshore HAWTs can achieve capacity factors exceeding 50%, far higher than other renewable sources. This efficiency ensures HAWTs remain the backbone of utility-scale projects worldwide.

The Vertical-axis wind turbines (VAWTs) segment is the fastest-growing segment, with a CAGR of 14.8% projected through 2033. Their growth is driven by innovations in hybrid systems, where VAWTs are paired with solar panels or energy storage solutions. A study by the National Renewable Energy Laboratory found that hybrid systems improve energy reliability by 35%. VAWTs are also gaining traction in disaster-prone areas due to their resilience against extreme weather. Japan, for example, has deployed VAWTs in coastal regions to ensure power continuity during typhoons. Furthermore, their modular design allows for easy integration into smart city infrastructure, making them a key player in urban sustainability initiatives.

By Installation Insights

The onshore wind turbines segment accounted for a major share of the global market in 2024. Their dominance is bolstered by advancements in repowering older sites, where outdated turbines are replaced with modern, high-capacity models. The European Environment Agency reports that repowering can increase energy output by up to 250% while reducing land use. Onshore projects also benefit from community ownership models, particularly in Europe, where local cooperatives invest in wind farms to share profits. For instance, Denmark’s community-owned wind projects contribute 20% of its total wind capacity. These factors make onshore wind a cornerstone of decentralized energy systems.

The offshore wind turbines segment is the rapidly-growing segment, with a CAGR of 17.3%. Their rapid expansion is fueled by green hydrogen initiatives, where offshore wind powers electrolyzers to produce clean fuel. Siemens Gamesa’s Green Hydrogen Hub project in Germany exemplifies this trend, aiming to generate 1 GW of hydrogen annually by 2030. Offshore wind is also benefiting from floating platforms, which open up deep-water sites previously considered inaccessible. The UK’s Floating Offshore Wind Taskforce estimates that floating turbines could unlock 70% of global offshore wind potential.

By Connectivity Insights

The Grid-connected wind turbines segment held a significant market share in 2024 and is supported by advancements in grid modernization, such as smart inverters and dynamic load balancing. The U.S. Department of Energy states that these technologies reduce curtailment rates by 40%, ensuring more efficient energy utilization. Grid-connected systems also play a critical role in stabilizing grids through ancillary services like frequency regulation. For example, Spain’s wind farms provide 30% of its grid stability services.

The stand-alone wind turbines segment is the fastest-expanding segment, with a CAGR of 12.6%. Their growth is driven by the rise of microgrids, which combine stand-alone turbines with solar panels and battery storage to create self-sufficient energy systems. The World Bank highlights that microgrids powered by renewables can reduce energy costs by 50% in remote areas. In Sub-Saharan Africa, organizations like Power Africa have deployed over 1,000 microgrid projects using stand-alone turbines. Additionally, portable wind turbines are emerging as a solution for disaster relief, providing quick access to electricity in emergency zones.

By Rating Insights

The turbines rated above 2 MW segment dominated the market with a 60.4% share in 2024 which is reinforced by their adaptability to diverse environments, from deserts to coastal regions. Vestas’ latest 15 MW turbine, for example, is designed for both onshore and offshore use, offering unparalleled versatility. Larger turbines also benefit from lower levelized costs of energy (LCOE), with Bloomberg New Energy Finance reporting a 40% reduction since 2015. Their scalability and cost-effectiveness make them essential for meeting global decarbonization targets.

The turbines rated between 500 kW and 1 MW are the emerging category, with a CAGR of 13.5%. Their growth is fueled by their suitability for island nations, where space constraints and limited grid capacity favor medium-sized systems. The International Renewable Energy Agency notes that these turbines are being widely adopted in the Caribbean, with Jamaica installing over 60 MW in 2022. Additionally, their modular design allows for phased deployment, reducing upfront costs for developers. For instance, Indonesia’s distributed wind program uses these turbines to electrify rural islands.

By Application Insights

The Utility-scale wind turbines segment accounted for 70.3% of the market in 2024. Their dominance is strengthened by their role in corporate power purchase agreements (PPAs), where companies buy renewable energy directly from wind farms. BloombergNEF reports that corporate PPAs accounted for 20% of all wind deals in 2022. Utility projects also benefit from long-term contracts, ensuring stable revenue streams for developers. For example, Amazon’s commitment to powering its operations with 100% renewable energy has driven significant investment in utility-scale wind. These factors solidify utility turbines as the primary driver of global wind energy growth.

The residential wind turbines segment is the fastest-growing segment, with a CAGR of 15.2% owing to the rise of prosumers the consumers who produce and consume their own energy. The European Commission highlights that prosumerism is expected to grow by 30% annually through 2030. Residential turbines are also benefiting from blockchain-based energy trading platforms, which allow homeowners to sell excess energy to neighbors. Estonia’s WePower project, for instance, enables peer-to-peer energy trading using residential wind systems. As energy independence becomes a priority, residential turbines are transforming how individuals interact with the grid, driving their rapid adoption.

REGIONAL ANALYSIS

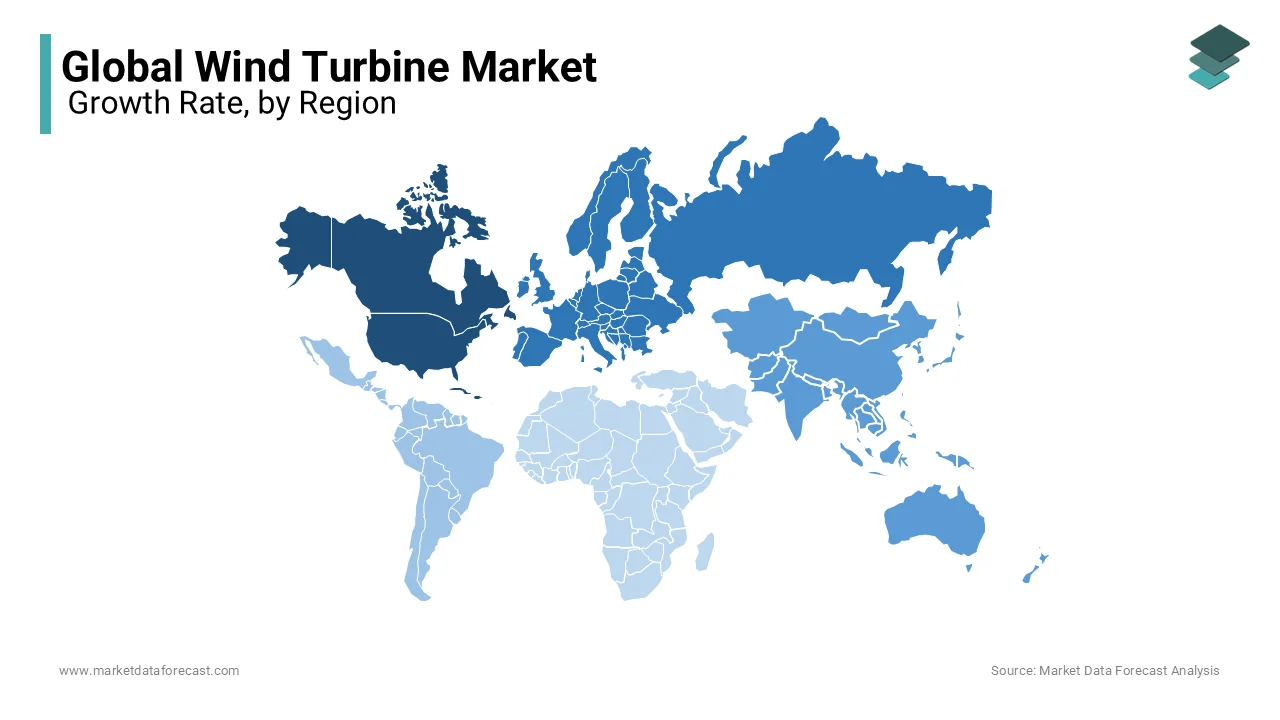

North America prevailed in the wind turbine market by having a substantial share in 2024, with the U.S. being the primary driver of growth. In 2022, the U.S. added 8.3 gigawatts (GW) of new wind capacity, bringing its total to over 140 GW, according to the American Clean Power Association. The region benefits from favorable federal policies like the Inflation Reduction Act, which extends tax credits for renewable energy. Texas alone accounts for nearly 35% of the country’s wind capacity, thanks to its vast open spaces and strong wind resources. Canada also contributes significantly, ranking as the 9th largest wind energy producer globally. North America’s rise due to technological innovation, robust infrastructure, and private sector investments, making it a cornerstone of global wind energy adoption.

Europe dominates the wind turbine market, particularly through offshore wind projects, by holding a 40% market share in 2024, the largest globally. In 2022, Europe installed 16 GW of new wind capacity, with offshore installations accounting for 40%, as per WindEurope. The United Kingdom leads the region, boasting over 14 GW of offshore wind capacity, the highest globally. Germany follows closely, with onshore wind contributing significantly to its energy mix. The European Green Deal, aiming for climate neutrality by 2050, has spurred massive investments in wind energy. Denmark exemplifies success, generating 47% of its electricity from wind in 2022.

Asia Pacific is the fastest-growing wind turbine market, with a CAGR of 12.5% projected from 2025 to 2033, led by China, which accounted for over 50% of global installations in 2022, according to the Global Wind Energy Council. China added 51 GW of wind capacity, bringing its total to 365 GW, the largest in the world. India ranks fourth globally, with over 42 GW of installed capacity, supported by ambitious renewable energy targets. Australia and Japan are also expanding their wind portfolios, focusing on offshore projects due to limited land availability. The region’s dominance stems from rapid industrialization, supportive government policies, and declining technology costs.

Latin America is emerging as a key player in the wind turbine market, led by Brazil, which accounts for over 70% of the region’s installed capacity. As of 2022, Brazil had over 23 GW of wind power, making it the 7th largest market globally, according to the Brazilian Wind Energy Association. Mexico follows, with 8.5 GW of capacity, driven by competitive auctions and private investments. The region benefits from abundant wind resources, particularly in coastal areas, and favorable regulatory frameworks. Chile and Argentina are also investing heavily in wind energy to diversify their energy mix. Latin America’s leadership is fueled by its commitment to reducing carbon emissions and leveraging renewable energy to meet growing electricity demands, positioning it as a vital contributor to global clean energy efforts.

The Middle East & Africa region is gaining traction in the wind turbine market, with Morocco and South Africa leading the charge. Morocco boasts over 1.5 GW of installed capacity, including the Tarfaya Wind Farm, one of Africa’s largest, as reported by the International Renewable Energy Agency. South Africa follows with 2.4 GW, driven by its Renewable Energy Independent Power Producer Procurement Program. The UAE is pioneering wind energy in the Gulf, with projects like the Dhofar Wind Farm in Oman setting regional benchmarks. These countries benefit from strong government initiatives, abundant wind resources, and a push to reduce reliance on fossil fuels.

KEY MARKET PLAYERS

The major players in the global wind turbine market include Envision group, Enercon, General Electric, Goldwind, Mingyang Smart Energy Group Co., Ltd., Nordex, Siemens Gamesa Renewable Energy, Suzlon Energy, Senvion, Vestas, Zhejiang Windey Co., Ltd.

TOP 3 PLAYERS IN THE MARKET

Vestas (Denmark)

Vestas is the largest player in the global wind turbine market, holding approximately 17% of the market share as of 2023, according to the Global Wind Energy Council. The company has installed over 160 GW of wind turbines across 88 countries, making it a pioneer in both onshore and offshore wind energy. Vestas is renowned for its cutting-edge technology, including the V236-15.0 MW turbine, which is one of the most powerful turbines available, capable of powering 20,000 households annually. Its rise in technological advancements has driven efficiency and scalability in the industry, enabling large-scale renewable energy deployment. Vestas also leads in service agreements, managing over 145 GW of turbines globally, ensuring long-term reliability and performance. This focus on after-sales services addresses operational challenges and contributes significantly to reducing downtime and maintenance costs. With a strong presence in Europe, North America, and Asia-Pacific, Vestas plays a pivotal role in advancing global wind energy adoption and promoting sustainability, as evidenced by its commitment to achieving carbon neutrality in its operations by 2030.

Siemens Gamesa Renewable Energy (Spain/Germany)

Siemens Gamesa ranks second in the global wind turbine market, with a 12% market share in 2023, as reported by Bloomberg New Energy Finance. The company is a global leader in offshore wind energy, having installed over 120 GW of capacity worldwide. Siemens Gamesa’s SG 14-222 DD turbine, with a capacity of 14 MW, is a game-changer for offshore projects, particularly in Europe and Asia, driving the industry toward higher efficiency and lower costs. The company has also played a pivotal role in advancing floating offshore wind technology, enabling turbines to operate in deep waters where traditional foundations are impractical. This innovation has unlocked new regions for wind energy development, contributing to the global expansion of renewables. Siemens Gamesa is committed to sustainability, aiming to make its turbines fully recyclable by 2040, addressing one of the industry’s growing environmental concerns. Its robust pipeline of projects in emerging markets like India and Brazil highlights its strategic focus on democratizing access to clean energy, further solidifying its contribution to the global wind turbine market.

GE Renewable Energy (United States)

GE Renewable Energy holds the third-largest position in the global wind turbine market, with an estimated 10% market share in 2023, according to Wood Mackenzie. The company is best known for its Haliade-X turbine, the world’s most powerful offshore wind turbine, with a capacity of 14-15 MW, setting new standards for efficiency and energy output. GE Renewable Energy has installed over 75 GW of onshore wind capacity globally, with significant contributions in the U.S., where it dominates the onshore market. Its leadership in hybrid renewable systems, combining wind with solar and storage solutions, enhances grid stability and supports the integration of variable renewable energy sources into existing infrastructure. GE’s digital solutions, such as its Predix platform, optimize turbine performance and reduce operational costs, addressing key challenges in the industry. By partnering with governments and private entities in Africa and Latin America, GE Renewable Energy is instrumental in expanding renewable energy access in underserved regions, contributing to the global transition toward sustainable energy.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Technological Innovation and Product Development

Key players in the wind turbine market are prioritizing technological innovation to design larger, more efficient turbines that reduce costs and improve energy output. Vestas has developed the V236-15.0 MW turbine, which features one of the largest rotor diameters (236 meters) and can power approximately 20,000 households annually. Siemens Gamesa introduced the SG 14-222 DD offshore turbine, capable of generating 14 MW, significantly increasing energy production per unit. GE Renewable Energy launched the Haliade-X turbine, the world’s most powerful offshore turbine at 14-15 MW, setting new benchmarks for efficiency. These innovations enhance scalability, reduce the levelized cost of energy (LCOE), and enable companies to cater to utility-scale projects, solidifying their leadership in the global market.

Geographic Expansion into Emerging Markets

Expanding into untapped or underdeveloped markets is a key strategy for growth, allowing companies to tap into regions with high wind potential and supportive government policies. Vestas has strengthened its presence in Asia-Pacific, particularly in India and Australia, while also exploring opportunities in Africa and Latin America. Siemens Gamesa has made significant inroads in India and Brazil, leveraging their strong wind resources and securing contracts for both onshore and offshore projects. GE Renewable Energy has focused on Africa, partnering with governments to develop hybrid renewable systems that combine wind, solar, and storage solutions. This geographic diversification helps companies mitigate risks and capitalize on emerging opportunities.

Strategic Partnerships and Collaborations

Collaborations with governments, private entities, and research institutions are critical for enhancing capabilities and expanding reach. Vestas partners with local developers and utilities to execute large-scale projects, such as its collaboration with Microsoft to power data centers using renewable energy from its wind farms. Siemens Gamesa has partnered with European utilities to develop green hydrogen projects, integrating offshore wind with electrolyzers to produce clean fuel. GE Renewable Energy works closely with governments in Africa and Latin America to deploy microgrid solutions, combining wind turbines with solar panels and battery storage. These partnerships ensure long-term project viability and foster goodwill while opening new revenue streams.

COMPETITIVE LANDSCAPE

The wind turbine market is highly competitive, with companies striving to innovate and expand in a rapidly growing industry. One fresh perspective is the role of digitalization in shaping competition. Companies like Vestas and GE Renewable Energy are using advanced data analytics and IoT platforms to monitor turbine performance in real-time. This not only improves efficiency but also allows them to offer predictive maintenance services, reducing downtime for customers. This digital edge is becoming a key differentiator, especially as clients seek long-term reliability.

Another emerging trend is the focus on localization strategies. Instead of relying solely on global supply chains, companies are setting up local manufacturing hubs to reduce costs and avoid geopolitical risks. For example, Siemens Gamesa has established production facilities in India and Brazil, enabling it to cater to regional markets more effectively. This localization helps companies comply with government policies that favor domestic content, giving them a competitive advantage.

Additionally, smaller players are disrupting the market by targeting niche segments like urban wind solutions or portable turbines for remote areas. These innovations challenge traditional giants to rethink their strategies. The rise of green financing is another factor, as companies secure low-interest loans for sustainable projects, making it easier to fund large-scale installations. Overall, competition in the wind turbine market is no longer just about size or capacity—it’s about adaptability, innovation, and aligning with global sustainability goals.

RECENT MARKET DEVELOPMENTS

- In June 2024, the European Commission proposed an annual EU budget of almost €200 billion for 2025, reinforced by €72 billion raised under the post-COVID recovery plan, NextGenerationEU. This budget aims to finance EU priorities and help tackle current and future challenges, potentially impacting the wind turbine market.

- In January 2025, the Chinese government announced subsidies totaling ¥50 billion to support the development and deployment of advanced wind turbine technologies, aiming to maintain its leadership in renewable energy production.

- In March 2025, Siemens Gamesa announced the development of recyclable wind turbine blades, aiming to address sustainability concerns associated with wind energy infrastructure.

- In May 2024, the U.S. Department of Energy (DOE) announced a $100 million investment in offshore wind energy projects, aiming to enhance turbine technology and reduce costs. This initiative is expected to bolster the U.S. wind energy sector and promote technological advancements in turbine design.

- In October 2024, the Indian Ministry of New and Renewable Energy (MNRE) approved a policy framework to facilitate the development of offshore wind energy, targeting 30 GW by 2030. This policy aims to attract investment and promote technological innovations in wind turbine manufacturing within India.

MARKET SEGMENTATION

This research report on the global wind turbine market is segmented and sub-segmented into the following categories.

By Axis

- Horizontal (HAWTs)

- Up-wind

- Down-wind

- Vertical (VAWTs)

By Installation

- Onshore

- Offshore

By Connectivity

- Grid connected

- Stand alone

By Rating

- 100 kW

- 100 kW to 250 kW

- > 250 kW to 500 kW

- > 500 kW to 1 MW

- 1 MW to 2 MW

- > 2 MW

By Application

- Residential

- Commercial & Industrial

- Utility

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is driving the growth of the global wind turbine market?

The global wind turbine market is expanding due to government incentives promoting renewable energy and the increasing demand for cost-effective, sustainable power solutions.

How do offshore wind turbines differ from onshore turbines?

Offshore turbines are installed in bodies of water and can harness stronger, more consistent winds, leading to higher energy yields compared to onshore turbines.

What advancements are being made in wind turbine technology?

Advancements include the development of floating wind turbines, allowing installations in deeper waters with stronger wind resources.

What are the maintenance requirements for wind turbines?

Wind turbines require regular scheduled and unscheduled maintenance to ensure efficient operation and extend their operational life.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]