Global Wireless Sensor Networks Market Size, Share, Trends & Growth Forecast Report By Offering (Hardware, Software, Services), Sensor Type, Connectivity Type, End-user Industry (Building Automation, Wearable Devices, Healthcare, Automotive & Transportation, Industrial) & Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Wireless Sensor Networks Market Size

The size of the global wireless sensor network market was worth USD 80.24 billion in 2024. The global market is predicted to reach USD 94.68 billion in 2025 and USD 355.90 billion by 2033, growing at a CAGR of 18% during the forecast period 2025 to 2033.

MARKET DRIVERS

The market for wireless sensor networks (WSN) is projected to grow significantly over the coming years due to the increasing demand for network infrastructure and advancements in Artificial Intelligence (AI), Machine Learning (ML), and Big Data Analytics. These technologies have enabled companies to analyze large volumes of data collected from multiple types of sensors such as temperature, motion, pressure, gas, flow, and chemical. Emerging economies worldwide focus on improving communication ties between industrial devices to ensure smooth wireless communication. As a result, industries such as oil and gas and utilities are adopting wireless sensor networks because of their ability to operate seamlessly in harsh, remote locations. Increase in the popularity of wireless sensor networks across vertical sectors such as oil & gas, automotive, manufacturing, healthcare, and other industries. Increased need to boost system efficiency and quickly implement the industrial wireless sensor networks. The advantages, such as its easy-to-use and application-specific nature, further drive its adoption.

MARKET RESTRAINTS

Increasing data security and privacy concerns are key factors hindering the market's growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

18% |

|

Segments Covered |

By Offering, Sensor Type, Connectivity Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ABB Ltd, STMicroelectronics, Honeywell International Inc, Texas Instruments Inc, Siemens AG, Endress+Hauser AG, Linear Technology Corporation, NXP Semiconductors, Schneider Electric, Emersion Electric, and Others. |

SEGMENTAL ANALYSIS

By Offering Insights

The hardware segment dominates in terms of market share. This is because wireless sensor networks depends on physical components like sensors, transceivers, and power units, which are important for data collection and communication.

By End User Insights

Oil & Gas is one of the fastest-growing application areas for WSNs, as these networks are set up at difficult sites, such as offshore natural gas fields, to detect oil flow and leakage in oil and gas pipelines. Wireless sensor networks are becoming important for companies that need real-time access to data on their plant environment, processes and equipment to avoid disruption.

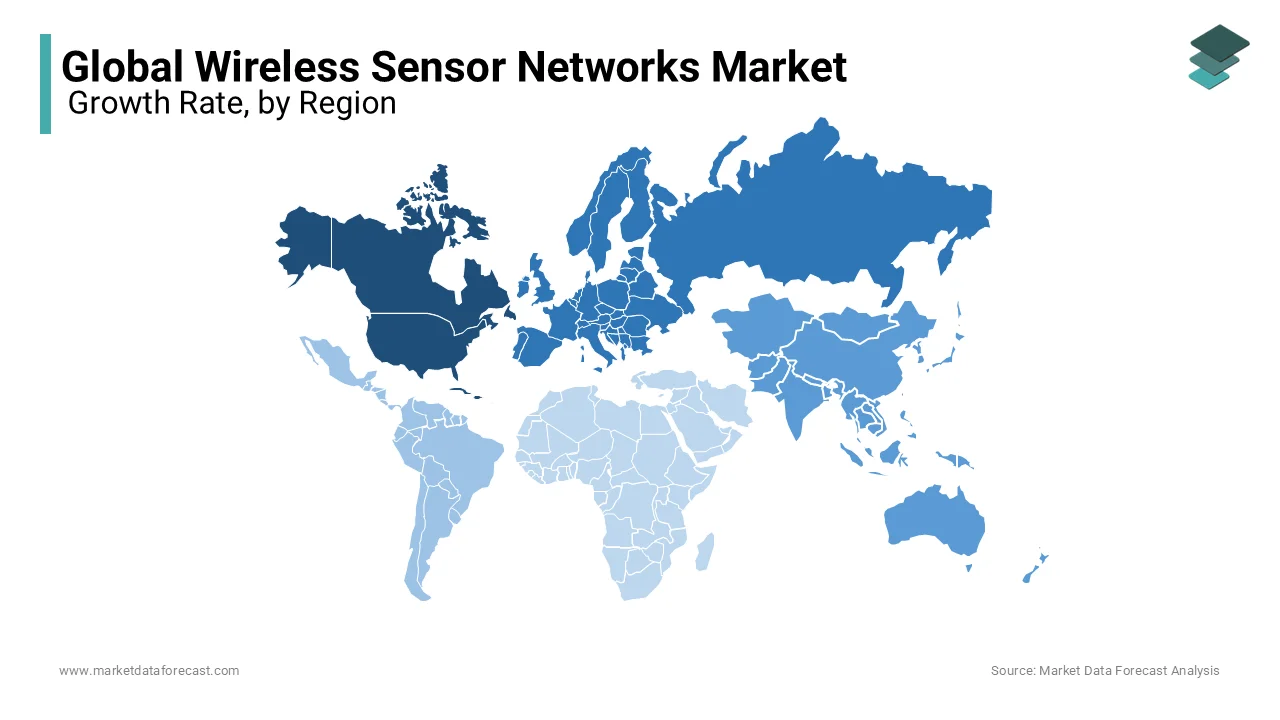

REGIONAL ANALYSIS

North America has emerged as a priority option for business vendors in the market under research, as the area greatly benefits from the critical infrastructure required for a solution. The introduction of smart factories and smart manufacturing and the involvement of many advanced wireless sensor network manufacturers are expected to drive the growth of the North American market in the near future. Moreover, the North American rail freight industry is also trying to leverage WSN onboard rail cars for automated tracking and alerting. In railway settings, WSN freight trains exhibit a linear chain-like topology of significant length. Also, due to their numerous advantages, wearable devices are becoming increasingly popular for industrial use due to their increasing proliferation in the commercial market.

KEY MARKET PARTICIPANTS

The major companies operating in the global wireless sensor networks market include ABB Ltd., STMicroelectronics, Honeywell International Inc., Texas Instruments Inc., Siemens AG, Endress+Hauser AG, Linear Technology Corporation, NXP Semiconductors, Schneider Electric, and Emersion Electric.

RECENT HAPPENINGS IN THE MARKET

- In November 2018, Honeywell launched the new wired gas sensors to enable secure industrial operations. The new Sense Point XRL is a fixed gas detector that tracks industrial activities for hazardous gasses such as carbon monoxide and methane.

MARKET SEGMENTATION

This research report on the global wireless sensor networks market has been segmented and sub-segmented based on the offering, sensor type, connectivity, end user, and region.

By Offering

- Hardware

- Software

- Services

By Sensor Type

- Ant

- Bluetooth

- Bluetooth Smart/Bluetooth Low Energy (BLE)

- Zigbee

- Wireless Fidelity (Wi-Fi)

- Near-Field Communication (NFC)

- Cellular Network

- Wireless Highway Addressable Remote Transducer (WHART)

- Global Navigation Satellite System (GNSS) Module

- ISA100

- Bluetooth/ Wlan

By Connectivity Type

- Ambient Light Sensors

- Motion and Position Sensors

- Temperature Sensors

- Heart Rate Sensors

- Pressure Sensors

- Inertial Measurement Units (IMU)

- Accelerometers

- Blood Glucose Sensors

- Image Sensors

- Humidity Sensors

- Carbon Monoxide Sensors

- Blood Oxygen Sensors

- Flow Sensors

- Level Sensors

- Chemical Sensors

- Electrocardiogram (ECG) Sensors

- Others

By End User

- Building Automation

- Wearable Devices

- Healthcare

- Automotive & Transportation

- Industrial

- Oil & Gas

- Retail

- Agriculture

- Aerospace & Defense

- Banking, Financial Services, and Insurance

By Region

- North America

- Europe

- Asia-Pacific

- Middle East and Africa

- Latin America

Frequently Asked Questions

What are the key applications of Wireless Sensor Networks in the industrial sector?

WSNs find extensive applications in industrial sectors for tasks such as remote monitoring, predictive maintenance, and process optimization. Industries leverage WSNs for real-time data collection, improving efficiency, and reducing operational costs.

What security measures are in place to protect data in Wireless Sensor Networks?

WSNs implement various security measures, including encryption protocols, authentication mechanisms, and secure communication channels. Additionally, continuous advancements in cybersecurity technologies are being adopted to address evolving threats.

How are advancements in wireless communication technologies impacting the performance of Wireless Sensor Networks?

Continuous advancements in wireless communication technologies, such as 5G and LPWAN (Low Power Wide Area Network), are enhancing the performance of WSNs. These technologies enable faster data transmission, lower latency, and improved connectivity.

How is the healthcare sector leveraging Wireless Sensor Networks for patient monitoring?

In healthcare, WSNs are used for real-time patient monitoring, tracking vital signs, and ensuring timely response to emergencies. This leads to improved patient care, reduced hospitalization costs, and enhanced overall healthcare efficiency.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com