Global X-Ray Detectors Market Size, Share, Trends & Growth Forecast Report By Type (CSI, GADOX, CCD, FPD and Line Scan), Application (Mammogram, Security, Industrial, Dental, Medical, Orthopedic and NDT), Panels, Portability, Digital Systems and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global X-ray Detectors Market Size

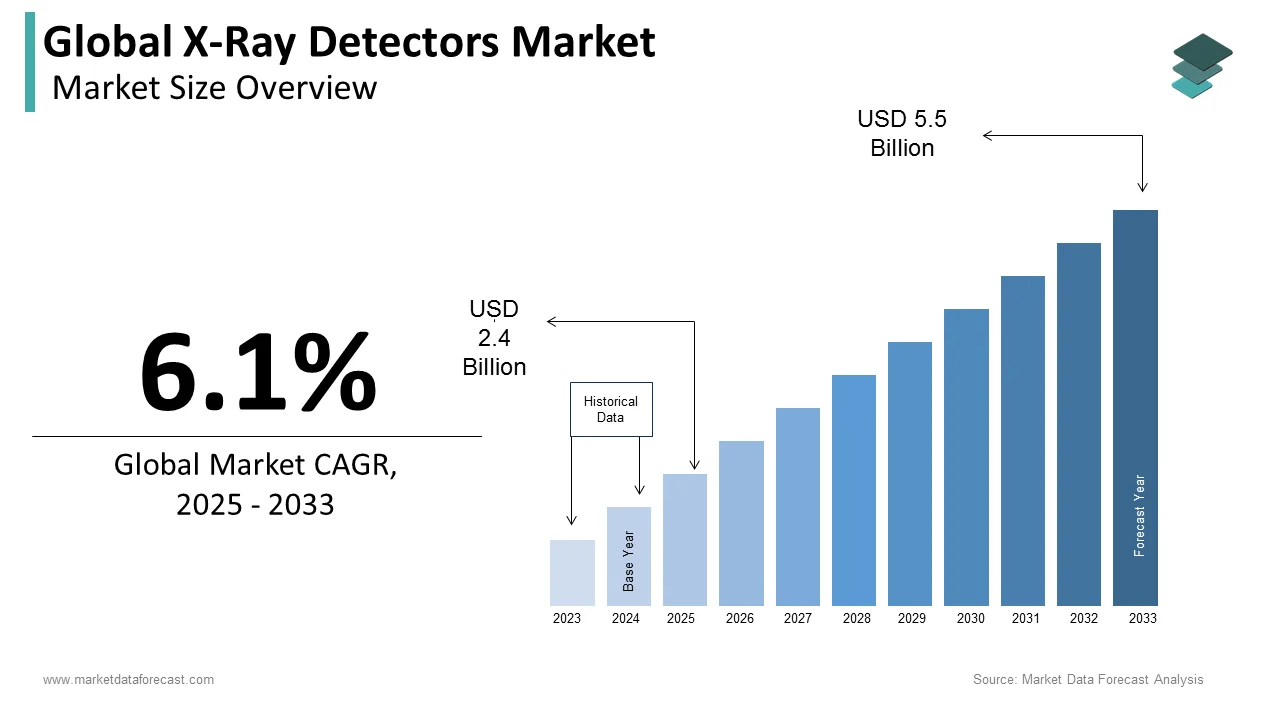

The size of the global X-ray detectors market was worth USD 3.2 billion in 2024. The global market is anticipated to grow at a CAGR of 6.1% from 2025 to 2033 and be worth USD 5.5 billion by 2033 from USD 3.4 billion in 2025.

X-implantation of X-ray detectors plays a crucial role in security and safety against smuggling weapons, explosives, and drugs at the borderline of defense. Advancements in X-ray technology detection are primarily utilized to screen individuals for treatment monitoring and medical analysis as they produce high accuracy while penetrating skin and tissues.

MARKET DRIVERS

Increasing investments support digital imaging technologies, and digital detectors' cost-friendly nature primarily accelerates the global x-ray detectors market growth.

The innovations of wireless X-ray detectors and growing medical tourism in developing countries and emerging markets are expected to provide a wide range of growth opportunities for players in this market during the forecast period. Furthermore, YOY's growth in the prevalence of chronic disorders such as arthritis, orthopedic diseases, and respiratory diseases demands a greater need for X-ray imaging and hence the market for X-ray detectors. Across the globe, an estimated 350 people have arthritis. According to WHO, 1.71 billion people worldwide suffer from musculoskeletal conditions, and as per the same source, more than 3 million are dying yearly due to COPD. Besides, an increasing number of diagnostic centers, fuelled by the growing need for early diagnosis, propel the demand for advanced X-ray systems. After exposure, the processing need culminates the market for photographic films and boosts the demand for flat-panel and line-scan detectors.

Factors such as a decrease in equipment cost due to increasing the accessibility of x-ray imaging equipment and improving the efficiency of imaging tools to image many objects primarily drive the global x-ray detectors market. Furthermore, high-quality imaging, advancements in medical technology, multiple storage options, the rising geriatric population, and the rising incidence of orthopedic and cardiovascular diseases further accelerate market growth.

Furthermore, technological advancements, increasing the geriatric population, rising incidences of orthopedics, and growing imaging technology are other factors propelling the global x-ray detectors market growth. According to WHO, the number of people aged 60 or over will reach 2.1 billion worldwide by 2050. As there are innovations of capable x-ray devices such as filmless imaging machines, better image quality and decreased cost drive the market's growth. Increasing support from governments in the funding process and continuous research and development will lead to the progress and development of X-ray detector devices, which are anticipated to increase the adoption of X-ray detectors, thus boosting the market growth.

MARKET RESTRAINTS

However, the significant challenges restricting the growth of the X-ray detectors market are stringent regulatory procedures and obligations of excise tax by governments. In addition, as per the analysis, the high cost of Digital X-ray systems is expected to restrain the growth of this market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, Panels, Portability, Digital Systems, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Varian Medical Systems (U.S.), PerkinElmer, Inc. (U.S.), Agfa-Gevaert Group (Belgium), Carestream Health (U.S.), Vieworks Co., Ltd (South Korea), Analogic Corporation (U.S.), Rayence (South Korea), Thales Group (France), Canon, Inc. (Japan), Konica Minolta, Inc. (Japan), |

SEGMENTAL ANALYSIS

By Type Insights

Based on type, the flat panel detector (FPD) segment is predicted to hold the largest share in the global x-ray detectors market during the forecast period. Benefits associated with the flat panel detectors, such as excellent image quality and the capacity to retrofit into the existing x-ray tables, reduce costs, and increase demand for FPDs, successfully drive the segment's growth. The FPDs are deformation-free imaging, highly sensitive, and quicker than photographic films. In the Asia-Pacific region, the FPDs market witnesses a high double-digit growth rate in terms of volume. Growth in digital technology, rising affordability for digital detectors, and good regulatory reforms support the quick adoption of FPDs.

The line scan and CCD segments are expected to experience the fastest growth rate in the global x-ray detectors market during the forecast period.

By Application Insights

Based on the application, the medical application x-ray detectors segment is predicted to account for the maximum share in the global x-ray detectors market during the forecast period. The increase in the aging population majorly drives segment growth as they are more exposed to chronic ailments and a growing number of orthopedic and mammography procedures. In addition, technological advancements in x-ray devices contribute significantly to market growth.

By Panels Insights

The large area flat panel detectors section is expected to dominate the global x-ray detectors market based on panel size. Therefore, it is likely to expand rapidly with a CAGR of 6% in North America and the Asia Pacific during the estimated forecast period.

By Portability Insights

Based on the portability analysis, the fixed x-ray detectors segment is predicted to dominate the x-ray detectors market. In India and China, the fixed portability segment is growing significantly due to the increased demand for varied healthcare settings and significant improvements in healthcare infrastructure.

By Digital Systems Insights

Based on the digital systems, the retrofit segment is projected to hit a high CAGR during the analysis period based on the digital systems analysis. This is because the cost of these products is low, and high-quality imaging efficiency escalates the x-ray detectors market growth.

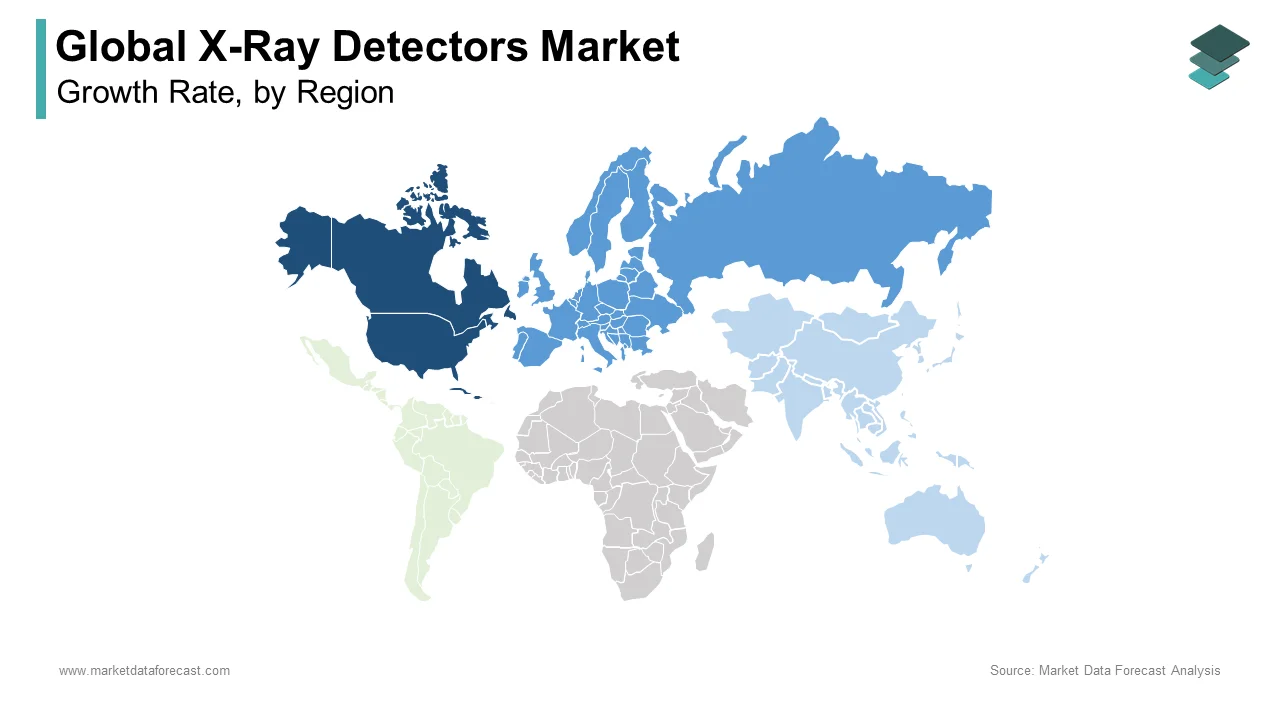

REGIONAL ANALYSIS

Regionally, the North American x-ray detectors market is predicted to lead the global market during the forecast period, followed by Asia-Pacific and Europe. North America has a robust healthcare system and is fully equipped with technological innovations, estimated to favor the North American X-ray detectors market. As per our report, North America is way forward of other regions to dominate the global X-ray detectors market during the forecast period and accounted for the highest number of shares in 2024, followed by Europe and Asia. The large share of North America is attributed to technological innovations, increasing healthcare spending, venture capital and government funding availability, and the growing incidence of chronic diseases.

The Europe x-ray detectors market is anticipated to register a promising CAGR during the forecast period.

The x-ray detectors market in Asia-Pacific is expected to witness the highest growth during the forecast period. The growing adoption of digital imaging systems, rising disposable income, awareness programs, symposia, and increasing venture capital investments have significant growth in the market. Y-O-Y growth in the adoption of digital X-ray systems is touted to fuel the demand for X-ray detectors in the Asia Pacific. Furthermore, emerging economies such as India, China, Brazil, Russia, and Mexico are target markets for companies offering X-ray equipment due to the rapidly growing economy and untapped opportunities in these countries.

The Latin America x-ray detectors market is anticipated to grow steadily from 2024 to 2033. Brazilian X-ray equipment firm Xpro was bought by GE Healthcare in 2012 to increase its market presence in the Latin America region.

The x-ray detectors market in MEA is expected to account for a moderate global market share during the forecast period.

KEY MARKET PARTICIPANTS

Some of the prominent manufacturers in the market include Varian Medical Systems (U.S.), PerkinElmer, Inc. (U.S.), Agfa-Gevaert Group (Belgium), Carestream Health (U.S.), Vieworks Co., Ltd (South Korea), Analogic Corporation (U.S.), Rayence (South Korea), Thales Group (France), Canon, Inc. (Japan), Konica Minolta, Inc. (Japan), Teledyne DALSA Inc. (U.S.), Fujifilm Holdings Corporation (Japan), YXLON International GmbH (Germany), DRTECH (Korea), and Hamamatsu Photonics K.K. (Japan).

The global x-ray detectors market is filled with numerous companies and has fierce competition. As a result, key market participants adopted acquisitions and new product launches to better their market position.

RECENT MARKET DEVELOPMENTS

- In April 2019, Varex Imaging Corporation expanded its product portfolio by acquiring primary shares in Direct Conversion AAB (publ).

- In March 2018, Teledyne Corporation announced its manufacturing units' extension due to the high demand for CMOS-based digital x-ray detectors or metal-oxide-semiconductors.

- In May 2017, Varex Imaging Corporation acquired PerkinElmer's medical imaging business to expand its digital flat-panel detectors business.

- In December 2016, Canon Inc. acquired Toshiba Medical Systems Corporation to enhance its healthcare industry position.

- In November 2015, FujiFilm Medical Systems announced its highly enhanced digital x-ray detectors.

MARKET SEGMENTATION

This market research report on the global x-ray detectors market has been segmented based on type, application, panels, portability, digital systems, and region.

By Type

- CSI

- GADOX

- CCD

- FPD

- Line Scan

By Application

- Mammogram

- Security

- Industrial

- Dental

- Medical

- Orthopedic

- NDT

By Panels

- Small

- Large

By Portability

- Fixed

- Portable

By Digital Systems

- New

- Retrofit

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What was the size of the global x-ray detectors market in 2023?

The global x-ray detectors market size was valued at USD 3.03 billion in 2023.

What is the growth rate of the x-ray detectors market?

Between 2025 and 2033, the global X-ray detectors market is expected to grow at a CAGR of 6.1%.

Which region dominated the x-ray detectors market in 2024?

North America was the largest region in the global x-ray detectors market in 2024.

Who are the leading players in the x-ray detectors market?

Varian Medical Systems (U.S.), PerkinElmer, Inc. (U.S.), Agfa-Gevaert Group (Belgium), Carestream Health (U.S.), Vieworks Co., Ltd (South Korea), Analogic Corporation (U.S.), Rayence (South Korea), Thales Group (France), Canon, Inc. (Japan), Konica Minolta, Inc. (Japan), Teledyne DALSA Inc. (U.S.), Fujifilm Holdings Corporation (Japan), YXLON International GmbH (Germany), DRTECH (Korea), and Hamamatsu Photonics K.K. (Japan) are some of the promising players in the x-ray detectors market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com