Global 5G Services Market Size, Share, Trends, & Growth Forecast Report By Vertical (Smart Cities, Connected Vehicles, Connected Factories, Smart Buildings, Smart Utilities, Connected Healthcare, and Broadband Services), Application (eMBB, MMTC and URLLC, and FWA) & Region - Industry Forecast From 2025 to 2033

Global 5G Services Market Size

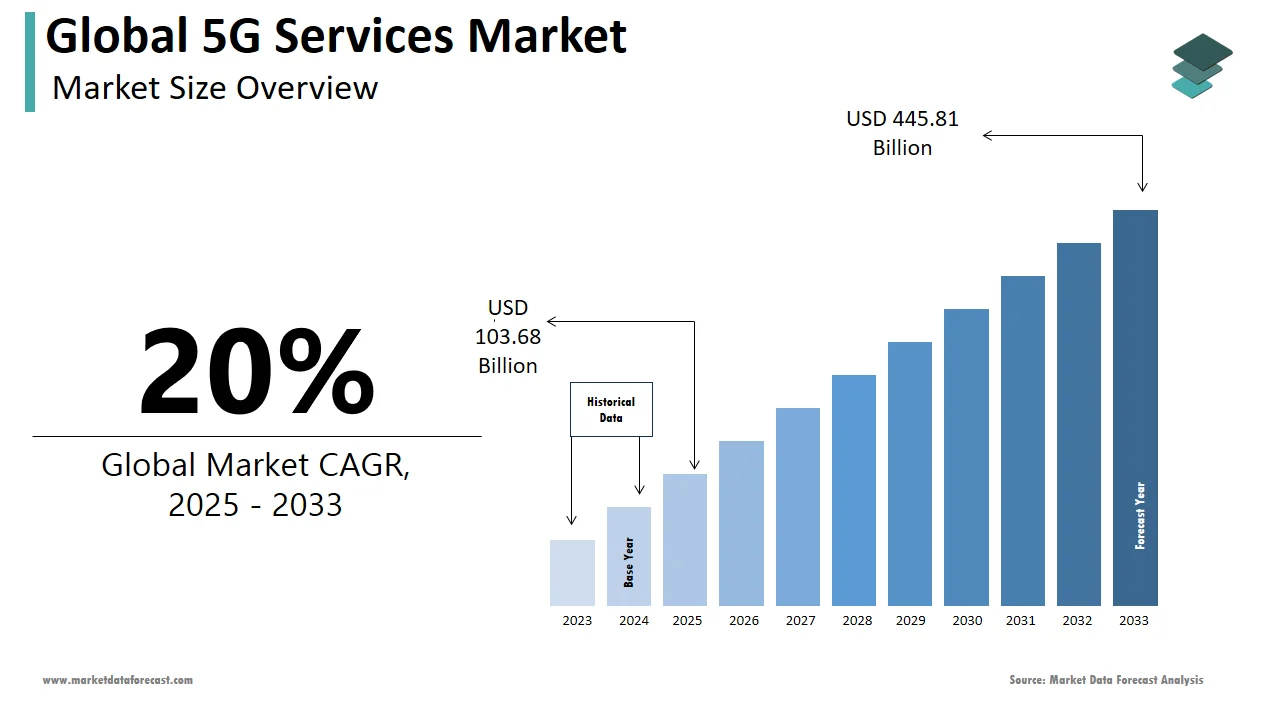

The global 5G services market was worth USD 86.4 billion in 2024. The global market value is estimated at USD 103.68 billion in 2025 and is expected to reach USD 445.81 billion by 2033, growing at a 20% CAGR during the forecast period.

The increasing demand for high-speed data connectivity for IoT-based (smart home energy management) applications is estimated to propel the 5G services market over the projection period. Moreover, North America is leading the industry with the highest number of patents filed, deployment rate, and network coverage, followed by the Asia Pacific region. Whereas the European countries fall behind in this field due to slow roll-out and implementation. Another reason could be the wait-and-see approach adopted by some regional regulators and operators. Additionally, the APAC has the biggest number of standalone 5G services, with 15 active services against 3 in North America and 4 in Europe. This shows that Asia holds tremendous growth prospects for the 5G services market.

MARKET DRIVERS

The fast growth of Internet of Things (IoT) systems, increased data traffic, expanding user base, and technological advancements are driving the 5G services market.

The rising number of new applications and upgradation of existing facilities with IoT devices is surging the demand for the 5G network with enhanced data capacities. The shift from 4G to 5G emphasized having better information handling ability for operations like smartphone browsing and video streaming. It is estimated that the volume of IoT devices will remain high, ranging between tens of billions to hundreds of billions of linked systems by the end of the decade. This includes a wide and augmenting list of wearables, smart home devices, and mobile phones, as well as industrial sensors, healthcare equipment, and autonomous vehicles.

Likewise, according to a study, 5G subscriptions will surpass 690 million by 2028. This constitutes close to 53 percent of the overall mobile users of India, Bhutan, and Nepal combined. Also, Indian customers used 3.6 times more mobile data than 4G consumers after its launch in October 2022. In 2023, people used 17.4 exabytes every month, with a growth rate of over 26 percent.

MARKET RESTRAINTS

High setup costs are a major obstacle for companies operating in the 5G services market.

The dynamic situation of investment for service companies across the regions is making it difficult to produce sufficient returns. This limits the domestic and international investors of new technologies entering the industry. In May 2024, Japan released the prototype of the world’s first high-speed 6G device, which ensures data transmission rates at lightning speed. As a result, this may divide the overall investment amount between 5G and 6G, which will decrease the expansion of this market. Apart from this, currently, European industry is behind North America and Asia despite making a big capital expenditure (CapEx) of 500 billion euros in constructing mobile and fixed networks in the last decade.

MARKET OPPORTUNITIES

The rising demand for enhanced mobile broadband (eMBB) is providing potential opportunities for the 5G services market.

According to a survey, over 80 percent of customers demand 5G connectivity when they have enough understanding versus 23 percent of consumers who aren’t familiar with it. Also, people's spending behaviour has changed, and they are willing to pay extra money for good-quality network services. Moreover, more than 50 percent of them will most likely change companies to get 5G services if the existing provider doesn’t give them in the next 12 months.

MARKET CHALLENGES

Geopolitical uncertainties and security threats are hampering the growth of the 5G services market value.

Considering the United States-China trade war and technological rivalry placing Europe, APAC and the Middle East region in a tough position since both countries have made significant advancements in this field. Like, the US has banned the Chinese company Huawei from conducting business in its market because of suspicion of spying. In addition, Europe's reliance on outside network technologies is making it vulnerable. Also, the extra pressure from interstate instabilities, such as the energy industry, impacts the Russia-Ukraine war and subsequent inflation. This further highlights security challenges like signal intelligence, network or frequency swapping, or any other type of risks. All these collectively derail the 5G services market.

5G Services Industry In-depth Analysis

5G network promises to succeed 4G in speed and application instances, including full high bandwidth, elevated density links, and ultra-low latency in the fifth generation of mobile cellular services. The low communication latency is a remarkable feature that differs 5G from its predecessor. Growing market growth is encouraged by the increased demand for credible and ultra-latent connectivity facilities. In addition to the rich user experience, exceptionally high information velocity would revolutionize business models.

Several mobile services megatrends have also affected the worldwide 5G industry. The market for 5G service is also anticipated to boost rapid advances in IoT (Internet of Things). Unconnected systems hamper IoT applications. And the 5G bandwidth link is what IoT needs to perform seamlessly. It would assist in deploying more associated equipment without latency problems. Consequently, increasing connected devices would boost 5G service market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

20% |

|

Segments Covered |

By Vertical, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AT&T Inc., BT Group plc, China Mobile Ltd, China Telecom Corporation Limited, Bharti Airtel Limited, KT, Saudi Telecom Corporation, Vodafone, Limited, Deutsche Telekom Group, SK Telecom Co., Ltd, Verison Communications Inc., and Others. |

SEGMENTAL ANALYSIS

By Vertical Insights

The smart cities segment is expected to account for a major share of the 5G services market in the coming years. This is due to the growing application of Internet of Things (IoT) systems to strengthen the progress of modern urban infrastructure initiatives and work efficiency. Several countries have started to take advantage of IoT devices to gather huge volumes of live data for analysis and further supervision. This will assist in improving the performance of city management procedures.

On the other hand, the connected healthcare segment is also predicted to grow further due to the growing need for remote medical services, better handling of patient data, and enhanced online platform-based offerings. Likewise, the European Parliament has passed the European Health Data Space (EHDS) rule, which will elevate the development rate and opportunities for the connected healthcare system in the European Union.

By Application Insights

The eMBB segment is gaining traction worldwide due to superior user experience and is estimated to capture a sizeable portion of the 5G services market share during the forecast period. It improves the service quality of virtual reality (VR) applications, augmented reality (AR) experiences, and the availability of ultra-high definition (UHD) content. Moreover, global telecommunications companies aim to expand activities through fifth-generation networks involving enhanced mobile broadband, differentiated connectivity solutions, ecosystem innovation, and fixed wireless access (FWA). For instance, in December 2023, US-based Mavenir and Japanese Rakuten Symphony commenced services of 1&1’s Open Radio Access Network (OpenRan) network in Germany. It began offering eMBB services, but the German telecommunication operator has already been providing their Fixed Wireless Access (FWA) offerings since December 2022.

REGIONAL ANALYSIS

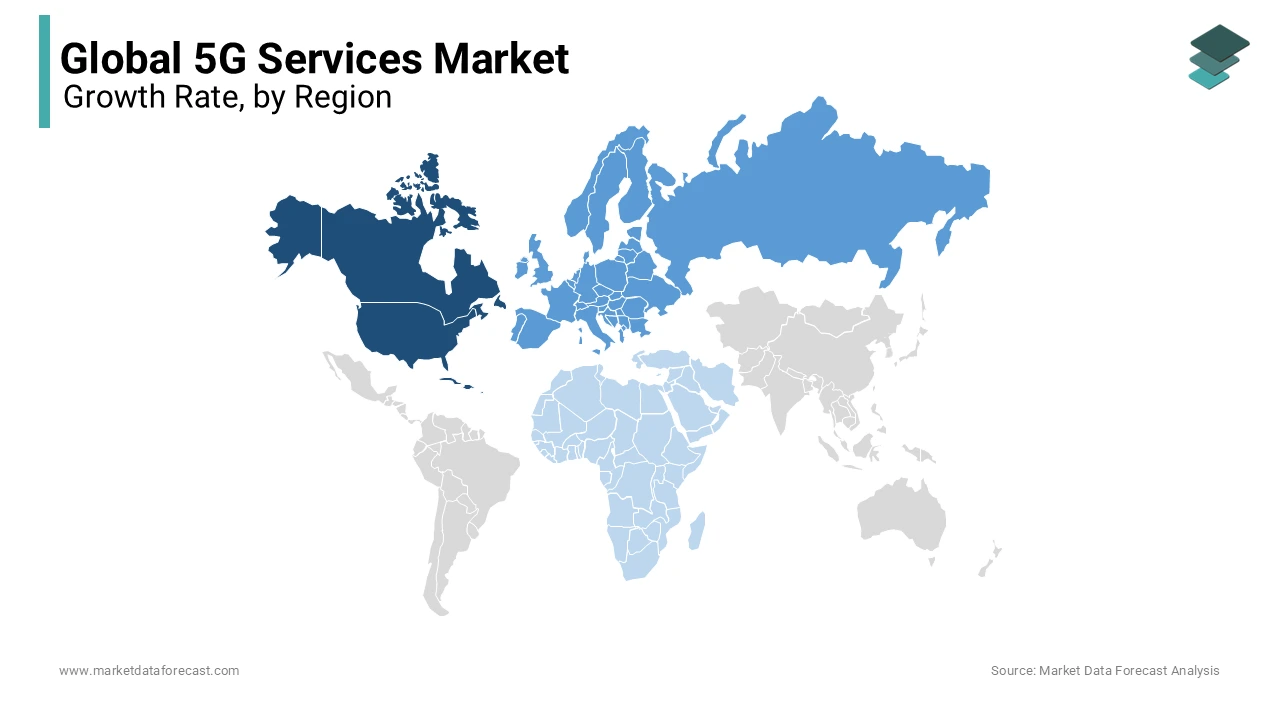

North America is witnessing growth in the 5G services market and is estimated to capture a significant share during the forecast period. Just a few years ago, people were experiencing the sudden appearance of this network in random places but with range restrictions due to fundamental challenges associated with this technology. As per projections, it is expected that between 35 per cent to 40 per cent of North American mobile connections will be on a 5G service. In the United States, wireless broadband internet providers like Verizon, AT&T, T-Mobile, and various other small enterprises are currently available, and their 5G offerings and related services are available in the country. 5G Nationwide has coverage in more than 2000 cities.

Europe's 5G services market is anticipated to increase the deployment rate and is likely to grow steadily in the coming years. The current situation of security and competition has made advanced network connections extremely important. Also, the telecommunication sector saw record-breaking investments of around 59.1 billion euros. And, by the end of 2023, 6 out of 10 regional countries had access to Fibre to the Home (FTTH). But, surprisingly, the number of 5G standalone in Europe was only 10 in 114 networks. In addition, its industry is behind Asian and North American industry on edge cloud offers. This means that the European connectivity environment is at a crossroads. Hence, edge cloud and Open RAN technologies will reshape dominance in the network and are important to the region’s socioeconomic targets providing Open Strategic Autonomy in technology.

Asia Pacific is swiftly driving upwards and is believed to attain a higher CAGR during the 5G services market forecast period. Recently, in May 2024, Huawei, in collaboration with AIS and China Unicom, started the first completely 5G-connected factory in Southeast Asia. This program leverages the 5G network coverage of the Midea Industrial Park in Chonburi (Thailand) and a 5G advanced commercial online platform. As per South Korea’s Ministry of Science and ICT, it is projected that about 90 percent of mobile customers will be shifted to an upgraded network by 2026. On the other hand, China is ahead in deployment and in the number of users of this network. Also, some companies in the country have already started working on the next-generation ultrafast network technology.

Latin America is anticipated to grow rapidly growth during the projection period and will have a noticeable portion of the 5G services market share. Brazil, Chile, Mexico, and Paraguay had the advantage of early testing and launch of this network. The region began to see the 5G roll-out in late 2019, but this has been uneven. All the countries mentioned above in this region have made it commercially available before the end of 2022. Whereas in Colombia, trials were done throughout 2020 and 2021. Moreover, by 2028, Latin America will maintain its pace of expanding 5G services, and network coverage and number of connections are expected to surpass an overall figure of 501 million.

Middle East and Africa are experiencing a noticeable surge in the deployment of industrial 5G networks and are estimated to capture a considerable market share in the future. Till the end of 2023, more than 18 nations in the area have the services of commercial 5G. The United Arab Emirates is at the forefront of regional industry’s progress. In 2019, Etisalat in UAE launched the first completely commercial 5G mobile service, and in the same month, its competitor Du introduced the same. Whereas in Africa, the South African area is witnessing significant expansion in network coverage and speed. Vodacom Group gained the first mover’s advantage in all 4G, 3G, and 2G services in SA.

KEY MARKET PARTICIPANTS

AT&T Inc., BT Group plc, China Mobile Ltd, China Telecom Corporation Limited, Bharti Airtel Limited, KT, Saudi Telecom Corporation, Vodafone, Limited, Deutsche Telekom Group, SK Telecom Co., Ltd, Verison Communications Inc., and Others.

RECENT MARKET HAPPENINGS

- In May 2024, EchoStar was granted an indefinite supply and quantity contract under the U.S. Naval Supply Systems Command Spiral 4 wireless products and services purchasing program. For this purpose, its subsidiary Hughes Network Systems and Boost Mobile will furnish 5G wireless devices and services to assist the Department of Defense (DoD)application of the entire 50 states and the U.S. areas and for interim duty international travel.

- In April 2024, Openvia Mobility, which is under the Globalvia Group and NTT DATA, is in the process of implementing Private 5G mobile network infrastructure for roads in the United States. Openvia Mobility supported and devised a digitalization program for traditional roads, converting them into smart and internet-linked corridors to serve the online customers of the present and future.

- The Enterprise (EE) section of the BT Group plc purchased a spectrum of 40 MHz in April 2018 of 3,4 GHz (3540-3580MHz) for about USD 426,5 m.

MARKET SEGMENTATION

This research report on the global 5G services market has been segmented and sub-segmented based on the vertical, application, and region

By Vertical

- Smart Cities

- Connected Vehicles

- Connected Factories

- Smart Buildings

- Smart Utilities

- Connected Healthcare

- Broadband Services

By Application

- eMBB

- MMTC

- URLLC

- FWA

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Rest of the World

Frequently Asked Questions

What are the key drivers fueling the growth of the global 5G services market?

The growth of the global 5G services market is primarily driven by increasing demand for high-speed internet connectivity, rising adoption of Internet of Things (IoT) devices, and advancements in technologies like artificial intelligence and augmented reality.

What are the primary challenges hindering the widespread adoption of 5G services globally?

Challenges such as high initial infrastructure costs, spectrum allocation issues, regulatory hurdles, and concerns regarding cybersecurity and privacy are among the primary factors hindering the widespread adoption of 5G services globally.

How is the global 5G services market expected to evolve in the next five years?

The global 5G services market is anticipated to witness robust growth over the next five years, propelled by the continuous rollout of 5G networks worldwide, expansion of use cases across various industries, and increasing investments in infrastructure development.

How does 5G technology contribute to the advancement of smart cities globally?

5G technology enables the development of smart cities by facilitating the deployment of connected infrastructure, such as smart grids, intelligent transportation systems, and public safety solutions, which enhance efficiency, sustainability, and quality of life for urban residents.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com