Global Active Pharmaceutical Ingredients Market Size, Share, Trends & Growth Forecast Report By Type of Manufacturing Process, Type of Synthesis, API Formulation, Application, Molecules, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Active Pharmaceutical Ingredients Market Size

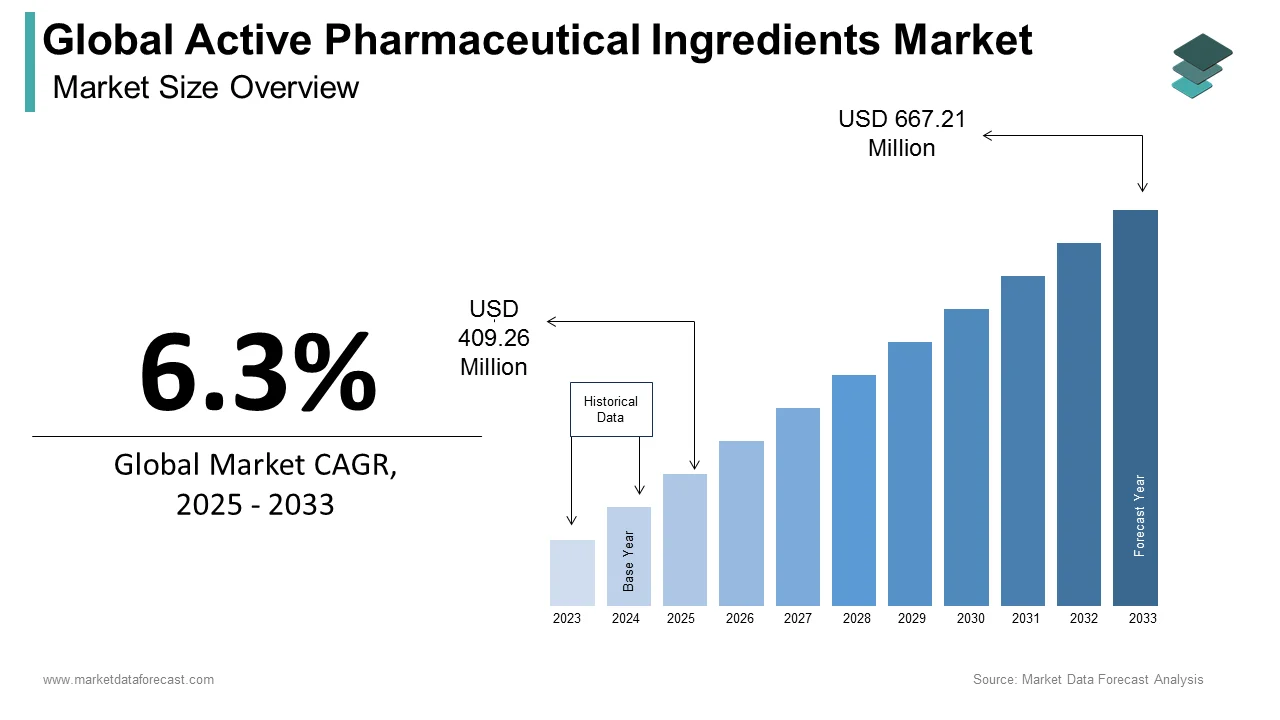

The size of the global active pharmaceutical ingredients market was worth USD 385 million in 2024. The global market is anticipated to grow at a CAGR of 6.3% from 2025 to 2033 and be worth USD 667.21 million by 2033 from USD 409.26 million in 2025.

The active pharmaceutical ingredients are chemically and biologically active components of drugs directly affecting the mitigation, cure, prevention, and treatment of diseases. Chemical synthesis, fermentation, biotechnological approaches, and improved natural sources are all used to create APIs. The API represents the primary ingredient. Excipients are a term used to describe other substances. Medicine may include numerous APIs, and the impact on a patient is determined by the dose administered, which varies from person to person. Two or more active substances are used in combination treatments to treat different symptoms in various ways. Since the API is the key component examined when writing a prescription, strict quality control is required for medication manufacture. There are two main processes in the production of pharmaceuticals. Manufacturers turn raw ingredients into APIs in the first phase. The last step entails combining APIs and excipients into tablets, capsules, solutions, and other forms and packaging the medicine for usage by end-users. APIs are sold on the open market (also known as the merchant market) or used as inputs by manufacturers in final formulations.

Today, there is significant excitement surrounding ground-breaking new medical treatments, like cancer therapies utilising modified immune cells or antibodies. Such therapies, however, are very complicated and expensive and so companies only look for restricted application. The majority of healthcare treatments continue to be based on small compounds of chemicals which can be made in mass numbers and thus at reduced cost. Additionally, natural APIs are applied in the production of biologics, which are rapidly emerging as the best-selling drugs in the market. Even though, the rising demand, biologics are nowadays considerably lesser in quantities in contrast to small molecule medicines.

MARKET DRIVERS

Increasing Importance of Generic Medications

Y-O-Y growth in the incidence of chronic diseases, the growing importance of generics, and the increased uptake of biopharmaceuticals are majorly accelerating the growth rate of the global active pharmaceutical ingredients market. In the last few decades, there has been an increase in incidences of chronic diseases such as coronary artery disease, diabetes, chronic obstructive pulmonary disease (COPD), arthritis, hepatitis, cancer, and asthma across the globe, which is estimated to drive demand for the global active pharmaceutical ingredients market growth. In addition, the rise in the geriatric population around the globe and changes in lifestyle and diet due to rapid urbanization are significant factors contributing to the market's growth.

Patent Expirations Driving Biosimilar Demand

Favorable government policies with many preparations for drug activities and a price hike are significant positive signs for the global active pharmaceutical ingredients market growth. Companies cannot prepare a generic drug unless the drug's patent expires. Besides the emerging biosimilar market, the growing reach of HPAPI solutions, emerging markets, and emerging technologies have opened up many opportunities for the global active pharmaceutical ingredients market growth. The global active pharmaceutical ingredients market is providing opportunities for the emerging biosimilars market. Due to the rise in various disease incidences, numerous off-patent biologics demands for biosimilars in different therapeutic applications are incremented. Over the next decade, expect the expiration of patents and other intellectual property rights for biologics originators is growing, and many biosimilar opportunities help enter the API market.

MARKET RESTRAINTS

Strict Regulatory Requirements

Strict regulatory requirements and unfavourable drug price control policies can slow down several countries' global active pharmaceutical ingredients market. The major restraint in the global active pharmaceutical ingredients market is the high costs of manufacturing APIs. However, to improve manufacturing facilities, increased investments are needed for key players to comply with standards like CGMP. Renovation of product facilities, inculcating familiarity with the requirement of qualification processes. In addition, there is a high expenditure to obtain regulatory approvals from authorities. Even chemical synthesis of APIs also requires high expenses, and uncommon building blocks and raw materials add to manufacturing costs. Factors such as lessening or shortening the developing time, cost of the development to be reduced, improving the process design, compromising the gain or profits, a meeting the standard quality are the challenges on the other side. The global active pharmaceutical ingredients market is marked by violent criminal competition, which is challenging.

Apart from these, control of quality has also emerged as one of the primary obstructions to the market growth rate. Maintaining the quality of API raw materials is crucial to ensure that medications are both effective and safe. Yet, problems like diversity of input materials and production methods can complicate efforts to maintain the uniform quality of APIs.

MARKE OPPORTUNITIES

Rising Incidence of Chronic Diseases

Even though the cost of manufacturing is high, severe regulatory policies and policies in managing drug prices in several nations, lucrative opportunities have risen in the API market because of the escalating incidence of chronic diseases, involving cancer, asthma, and diabetes. The potential for larger demand and market growth in this market is significantly high. The rising need for medications is expected to surge the demand for active ingredients which are utilised in their drugs. The World Health Organization (WHO) focuses on equal availability of safe and cost-effective medicines is crucial in achieving the greatest possible criteria of health for everyone. Maintaining equitable access to medicines (ATM) is also a major narrative of the Sustainable Development Goals (SDGs), i.e. SDG 3.8 which states the availability of affordable, high-quality, effective, and safe essential drugs and vaccines for everyone. It is a central element of universal health coverage (UHC). In addition, the SDG 3.b points out the necessity to develop medicines to resolve continuous breaks in treatments. especially in lower- and middle-income economies in the world.

- According to a study published in the National Library of Medicine, approximately 22 billion people in the world have no access to vital drugs or medicines, especially in lower- and middle-income nations.

Apart from these, various advancements and trends are expected to reshape the landscape for API applications, regulation, and production. This includes advanced manufacturing technologies, personalised medicines, biosimilars and biologics, and digitalization and data-driven methods. It is believed that procedures such as 3D printing, continuous manufacturing, and process automation will continue to move forward in the production of APIs. Also, these technologies can elevate API manufacturing efficiency, sustainability, and adaptability, leading to superior quality and more affordable.

MARKET CHALLENGES

Safety Concerns Impacting Market Expansion

Safety concerns challenge the expansion of the active pharmaceutical ingredients market. APIs might result in side effects or detrimental responses that threaten patient well-being. Safety remains a primary concern in medical practice. Despite detailed assessment and approval, it can still lead to negative outcomes, such as drug interactions, toxic effects, or allergic responses.

- For instance, in September 2024, it was reported that the Central Drugs Standards Control Organization (CDSCO) in its last month’s report expressed safety concerns by classifying more than 50 drugs as ‘substandard’.

The list featured widely used medications like calcium supplements, Pan D, and paracetamol, along with their specific batch numbers and manufacturing dates for straightforward identification. Hence, this is a major hindrance to the market expansion.

Another factor impacting the growth of the market is environmental issues. The manufacturing of APIs can affect the environment, which leads to energy consumption, pollution, and waste generation. Mitigating ecological problems, such as minimising the effects of API production on nature, can be challenging and demands strict adherence to environmental laws and sustainable practices.

- Like, the National Green Tribunal (NGT) has lately addressed key concerns associated with pharmaceutical-induced ecological contamination. On 6th May 2024, the NGT released a directive following an article in Current Science that reported nearly 43 per cent of the rivers in the world are threatened by pollution from active pharmaceutical ingredients (APIs).

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type of Manufacturing Process, Type of Synthesis, API Formulation, Application, Molecules, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Sanofi, Bayer AG, Pfizer Inc., F. Hoffmann-La Roche AG, Abbott Laboratories, Merck & Co., Inc., Boehringer Ingelheim GmbH, GlaxoSmithKline Plc (GSK), Novartis AG, Eli Lilly and Company and Teva Pharmaceutical Industries Ltd., and Others. |

SEGMENTAL ANALYSIS

By Type of Manufacturing Process Insights

The contract manufacturing segment is the leading and most popular process in the active pharmaceutical ingredients market. The shift towards this production approach is increasing, as numerous companies choose to outsource in order to concentrate on their primary strength, like research and development, which drives the market share of the segment. In addition, this manufacturing process, especially through Contract Development and Manufacturing Organizations (CDMOs), has gained significant traction in the API sector. Several companies in the pharmaceutical industry prefer outsourcing to CDMOs to leverage their specialised expertise, advanced technologies, and cost efficiencies. Therefore, all these factors are accelerating the segment’s market share.

By Type of Synthesis Insights

Synthetic APIs have been the most widely used type of synthesis in the last few years. This can be attributed to its cost-effectiveness, precision and consistency, scalability, broader therapeutic range, and regulatory compliance. These APIs benefit from advanced manufacturing technologies such as process intensification and continuous manufacturing. In addition, continuous manufacturing lowers downtime and enhances productivity, while intensification methods allow for faster reactions and higher yields. As a result, this reduces the cost of production and expands the segment’s market size. Moreover, the incorporation of robotics and automation in API production improves accuracy and decreases manual labour expenses. The automated systems contribute to consistent quality, which minimizes the need for extensive quality control measures. Therefore, reducing operational expenses.

By API Formulation Insights

Based on API formulation, the innovative API segment is expected to account for the majority in 2023. The large share of this segment can be attributed to the increasing number of FDA approvals for new molecular entities, higher prices commanded by innovative APIs as compared to their generic equivalents, and the growing focus of innovator APIs companies on R&D for the development of novel, innovative API products to cater to the unmet medical needs of the Global active pharmaceutical ingredients market.

By Molecule Insights

The small molecules segment is expected to dominate the market during the forecast period, as 90% of the current pharmaceutical markets use small molecules. Drug development has always been based on small molecules. They are easily ingested in the gastrointestinal tract because of their small size, and their active ingredients are promptly absorbed into the bloodstream, where they can go to any part of the body. In addition, these molecules are tiny enough to easily pass through cell membranes as they move around the body. Therefore, their advantageous nature helps them dominate the market revenue.

By Application Insights

The cardiovascular disease segment is expected to dominate the market during the forecast period due to the rising cases of cardiovascular diseases and the incidences of rising cholesterol levels in cardiac patients resulting in a risk of heart attacks and diseases. For example, according to WHO stats, each year, 17.9 million people die from cardiovascular diseases (CVDs), the most significant cause of death in the world. Additionally, the government has taken several initiatives to raise awareness regarding the rising risks of high cholesterol and cardiovascular diseases ad has even promoted cardiac drugs leading to segment growth.

REGIONAL ANALYSIS

The North American Active pharmaceutical ingredients market is predicted to dominate the global API market during the forecast period due to technological advancements and the high development of the economy. Moreover, the increase in the prevalence of cancer and other lifestyle-related diseases to encourage R&D activities propels the market's demand.

The Asia Pacific API market is expected to register a high growth rate compared to other regions in the global active pharmaceutical ingredients market during the forecast period. Factors such as increasing healthcare expenditures and a growing aging population create a vast patient pool and rising economies in this region. Additionally, key players' initiatives in setting up API manufacturing plants in developing countries like India and China and laborers' availability contribute to growth in the Asia-Pacific region.

China is considered to be the leader in API manufacturing in the APAC region. Many domestic companies are involved in manufacturing and supplying API all over the world. Not just in the Asia-Pacific region, China exports a significant share of its domestically produced API worldwide.

KEY MARKET PLAYERS

List of key market participants leading the global active pharmaceutical ingredients market profiled in this report is Sanofi, Bayer AG, Pfizer Inc., F. Hoffmann-La Roche AG, Abbott Laboratories, Merck & Co., Inc., Boehringer Ingelheim GmbH, GlaxoSmithKline Plc (GSK), Novartis AG, Eli Lilly and Company and Teva Pharmaceutical Industries Ltd.

RECENT MARKET DEVELOPMENTS

In September 2024, at ETH Zurich, researchers discovered a method to produce and test enormous collections of molecules, named DNA-encoded chemical libraries (DEL), through magnetic particles. The co-development of technology of DNA-encoded chemical libraries which is now enhanced at ETH Zurich assures to find novel active pharmaceutical ingredients. This was made possible by a recently advanced self-purification process and this technology is apt for the first time to make bigger molecules that are fit together or assembled from various chemical building blocks.

In September 2024, Siegfried, a prominent global Contract Development and Manufacturing Organization (CDMO) in the pharmaceutical sector, which has headquarters in Zofingen (Switzerland), officially opened its new advanced laboratory in Minden, Germany. With a capacity of over 60 employees and an area exceeding 600 square meters, the new laboratory consolidates multiple quality control units into a single location and fosters synergies and effectiveness while enhancing the overall quality control potential throughout the facility. Moreover, the inauguration of the new lab and the ongoing construction of the plant enhance Siegfried’s presence in Germany, where it operates two facilities in Hameln and Minden.

MARKET SEGMENTATION

This research report on the global active pharmaceutical ingredients market has been segmented and sub-segmented based on the manufacturing process type, synthesis, API formulation, application, molecules, and region.

By Type of Manufacturing Process

- Captive Manufacturing

- Contract Manufacturing

By Type of Synthesis

- Synthetic

- Biotech

By API Formulation

- Generic API

- Innovative API

By Application

- Cardiovascular Diseases

- Oncology

- Neurological Disorders

- Orthopedic Disorders

- Respiratory

- Gastrointestinal Disorders

- Urology

- Others

By Molecule

- Large Molecule

- Small Molecule

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

At What CAGR, the global home active pharmaceutical ingredients market is expected to grow from 2025 to 2033?

The global active pharmaceutical ingredients market is estimated to grow at a CAGR of 6.3% from 2025 to 2033.

Does this report include the impact of COVID-19 on the active pharmaceutical ingredients market?

Yes, we have studied and included the COVID-19 impact on the global active pharmaceutical ingredients market in this report.

Which region is growing the fastest in the global active pharmaceutical ingredients market?

Geographically, the North American active pharmaceutical ingredients market accounted for the largest share of the global market in 2024.

How much is the global active pharmaceutical ingredients market going to be worth by 2033?

As per our research report, the global active pharmaceutical ingredients market size is projected to be 667.21 million by 2033.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]