Global Agricultural Biologicals Testing Market Size, Share, Trends & Growth Forecast Report, Segmented By Product Type (Bio Pesticides, Biofertilizers and Bio Stimulants), Application (Field Support, Analytical and Regulatory), End User (Biological Product Manufacturers, Government Agencies and Others) and By Region (North America, Europe, Asia-Pacific, Middle East & Africa, Latin America), Industry Analysis from 2025 to 2033

Global Agricultural Biologicals Testing Market Size

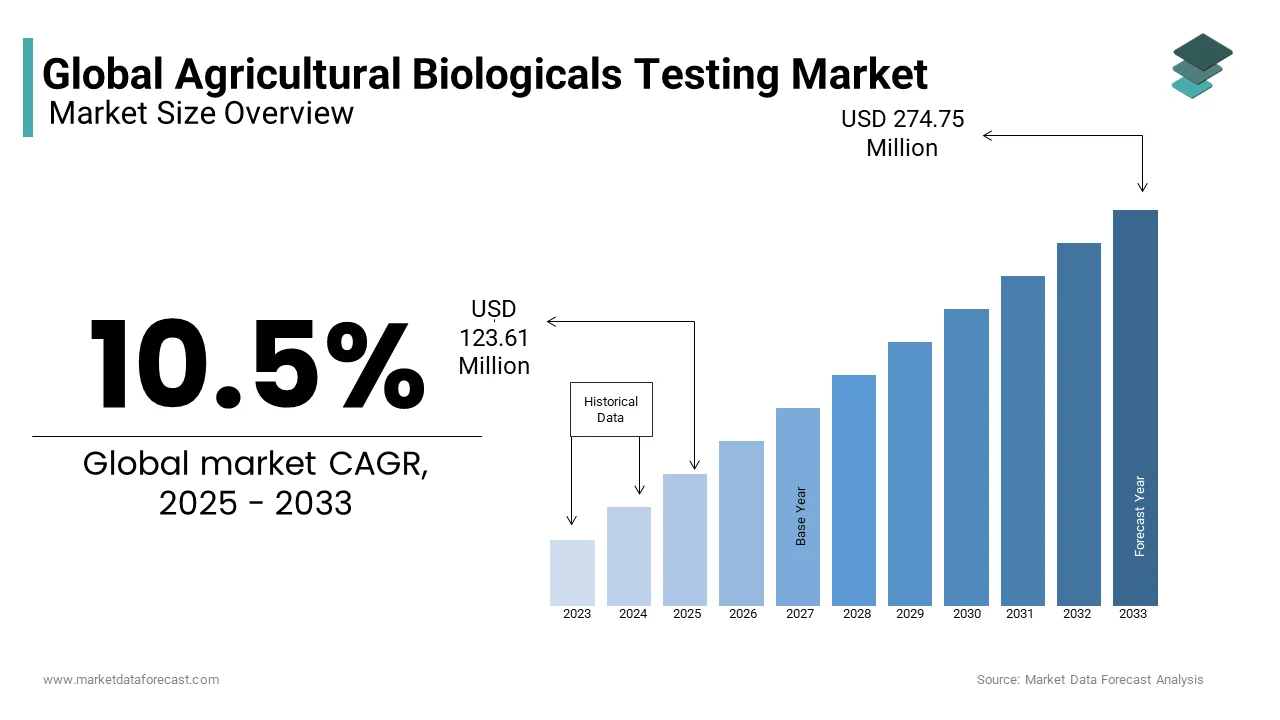

The global agricultural biological testing market was valued at USD 111.86 million in 2024 and is anticipated to reach USD 123.61 million in 2024 from USD 274.75 million by 2033, growing at a CAGR of 10.5% during the forecast period from 2025 to 2033.

MARKET DRIVERS

The growing awareness of sustainable agriculture among farmers and consumers is primarily propelling the growth of the agricultural biological testing market. As concerns about environmental and health risks rise, there is also a growing demand for eco-friendly alternatives. This shift in perception has driven the adoption of biological products and sustainable farming practices. To meet this demand, the market for testing and certification of agricultural biologicals has grown significantly. Regulatory bodies and industry standards now play a crucial role in ensuring the safety and effectiveness of these eco-friendly solutions. As consumers and farmers alike prioritize environmentally responsible agriculture, the need for rigorous testing and verification of agricultural biologicals has never been more important. This market's growth is not only a response to consumer preferences but also a vital step towards a more sustainable and eco-conscious future in agriculture.

Technology advancements play a significant role in promoting the growth of the agricultural biological testing market. These sophisticated techniques enable more precise, efficient, and comprehensive evaluation of the performance of biological products. Genomic analysis, for instance, allows for the detailed examination of genetic material in organisms, helping identify specific traits and characteristics that can enhance the effectiveness of agricultural biologicals. These technological breakthroughs not only expedite the testing process but also enhance the accuracy and reliability of results. This, in turn, instills greater confidence in the safety and efficacy of agricultural biologicals, fostering their wider adoption. As these innovations continue to shape the landscape of agricultural testing, the market is poised for continued growth and evolution.

MARKET RESTRAINTS

The high costs associated with the testing tools used in agricultural biological testing are one of the key factors hindering global market growth. The adoption of advanced testing methods and specialized equipment, coupled with the requirement for expertise in the field, contributes to elevated testing expenses. This issue can be particularly daunting for smaller agricultural businesses with limited financial resources. The cost barrier could deter them from investing in comprehensive testing services for agricultural biologicals, potentially limiting their access to these vital resources. To mitigate this restraint, industry stakeholders, regulatory bodies, and research institutions must collaborate to develop cost-effective testing solutions and promote knowledge sharing. Streamlining testing processes, providing subsidies or incentives, and offering training programs can make testing more accessible to a broader range of agricultural industries.

Impact Of COVID-19 On The Agricultural Biologicals Testing Market

The COVID-19 pandemic had both detrimental and beneficial effects on the agricultural biological testing market. Initially, pandemic-related disruptions negatively impacted the supply chains for testing reagents, equipment, and materials, leading to delays in testing processes and reduced productivity. Many testing facilities faced temporary closures or capacity restrictions, resulting in testing backlogs. Moreover, economic uncertainties during the pandemic led some agricultural businesses to reduce their testing budgets, affecting market growth negatively. But over time, the pandemic also highlighted the importance of food security and sustainable agriculture. As awareness of eco-friendly and safe agricultural practices grew, there was an increased focus on agricultural biological testing, which ensures product quality and safety. This shift in perspective is expected to have a lasting positive impact, driving market growth as stakeholders recognize the importance of resilient and sustainable agricultural supply chains in the face of global crises.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.5% |

|

Segments Covered |

By Product, Application, End-user, and Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Eurofins Scientific, SGS SA, Intertek Group plc, Bureau Veritas S.A., ALS Limited, Microbac Laboratories, Inc., R.J. Hill Laboratories Ltd., Anadiag Group, SYNLAB International GmbH, I2L Research, Biotechnol S.A., Apal Agricultural Laboratory, R.J. Hill Laboratories Ltd, Laboratory Crop. Srl, Bionema Limited, Staphyt SA, Omic USA Inc., I2L Research, ABBA S.A. |

SEGMENTAL ANALYSIS

By Product Type Insights

Bio-pesticides are often considered the most dominant product type. This is because of the growing emphasis on reducing chemical pesticide usage to minimize environmental and health risks. Bio-pesticides, derived from living organisms, offer effective pest control while being environmentally friendly. Regulatory support for reducing chemical pesticide use has further fuelled the demand for Bio-pesticide testing services.

Bio-fertilizers play a crucial role in enhancing soil fertility and plant nutrition through beneficial microorganisms. While they are essential for sustainable agriculture, they are often the second most dominant product type. The dominance of Bio-fertilizers is influenced by their role in improving soil health, reducing chemical fertilizer dependency, and promoting nutrient cycling.

Bio-stimulants are substances that enhance plant growth and development without being nutrients or pesticides. They often come from natural sources and are used to improve crop resilience and yield. Bio-stimulants are valuable for their ability to enhance nutrient uptake, stress tolerance, and overall plant health.

By Application Insights

Field support services involve on-site testing, monitoring, and technical assistance for farmers and agriculture. While essential for the successful application of agricultural biologicals, field support is typically not a dominating sector in the market. This is because the testing aspect is often performed in a laboratory setting, and field support is a complementary service to ensure proper product application and effectiveness in real-world farming conditions.

Analytical testing services are the backbone of the agricultural biological testing market. They include laboratory-based assessments of the chemical, physical, and biological properties of agricultural biological products. Analytical testing is the most dominant application as it directly ensures the quality, consistency, and safety of biologicals. This type of testing covers a wide range of parameters, from verifying the presence of active ingredients to assessing product stability and shelf life.

Regulatory compliance services involve testing and documentation to meet the requirements of regulatory bodies and certification programs. These services ensure that agricultural biological products adhere to established standards and guidelines. While crucial for market entry and consumer trust, regulatory compliance is not as dominant as analytical testing, primarily because it is a specific phase of the testing process that occurs after the product's development.

By End-Users Insights

The biological product segment held the major share of the global market in 2022 and is expected to continue to be the most dominant segment in the market throughout the forecast period. Biological products are directly responsible for ensuring the quality, safety, and efficacy of their products before they reach the buyers. Manufacturers rely on testing services to meet regulatory requirements, verify product claims, and maintain consumer trust.

Government agencies hold the second-largest share in the agricultural biological testing market as they require testing and certification to ensure that these products meet safety and environmental criteria. Farmers and growers apply agricultural biological products in the field. While they may not directly drive the demand for testing services, their decisions are influenced by the quality and effectiveness of these products.

REGIONAL ANALYSIS

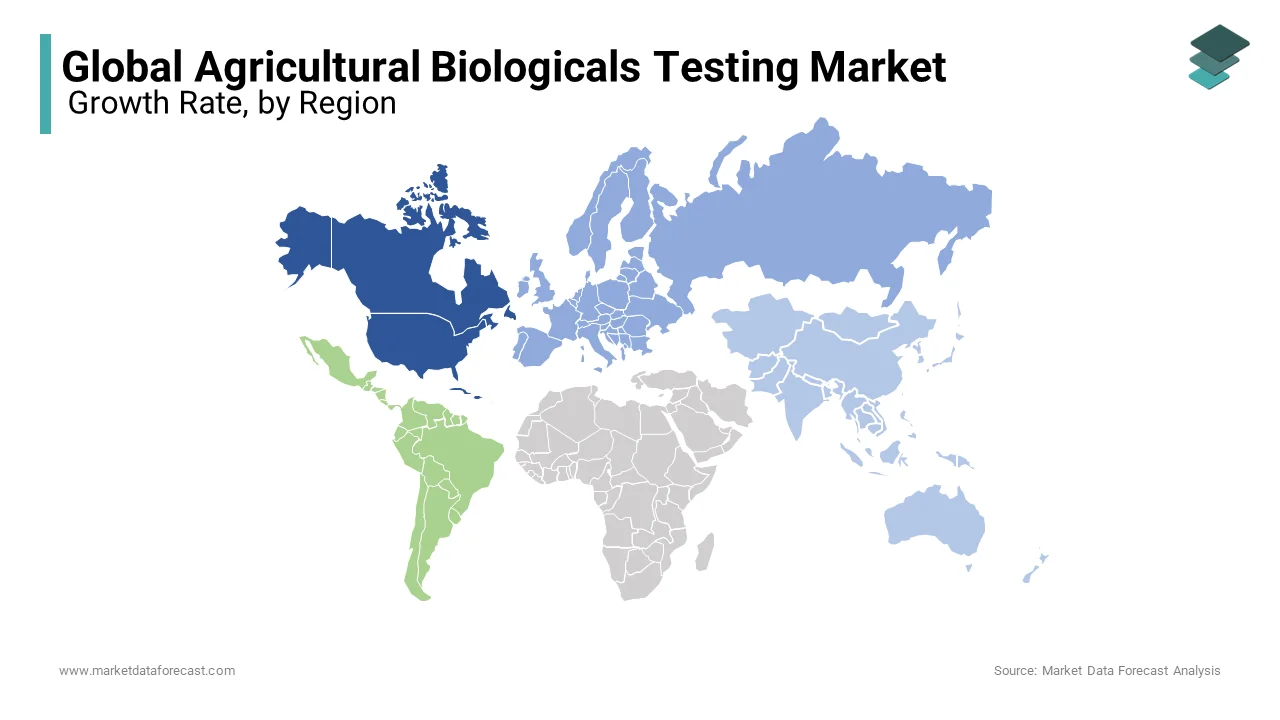

North America is one of the dominant regions in the global agricultural biological testing market. This dominance is due to a well-established agriculture sector, strong regulatory support, and a growing awareness of sustainable farming practices. The United States and Canada are key players, with significant adoption of agricultural biologicals and robust testing requirements.

Europe is another dominant region in the global agricultural biological testing market. European countries have been at the forefront of promoting sustainable and organic farming practices, leading to a high demand for testing services to verify the quality and safety of agricultural biologicals. Stringent regulations and consumer preferences for eco-friendly products further drive the market.

The Asia Pacific region is witnessing rapid growth in the adoption of agricultural biologicals and testing services. This is driven by the need to increase agricultural productivity while minimizing the environmental impact of farming.

Latin America is emerging as a dominant region in the agricultural biological testing market, with a focus on sustainable agriculture and increasing organic farming practices. Countries like Brazil, Argentina, and Mexico are witnessing significant growth in the adoption of agricultural biologicals and testing services.

The Middle East and Africa region, while showing potential, may be the least dominant in the market due to factors like arid climates and resource limitations. However, as awareness of sustainable farming practices grows and the need for food security increases, there is potential for market growth in this region.

KEY MARKET PLAYERS

Eurofins Scientific, SGS SA, Intertek Group plc, Bureau Veritas S.A., ALS Limited, Microbac Laboratories, Inc., R.J. Hill Laboratories Ltd., Anadiag Group, SYNLAB International GmbH, I2L Research, Biotechnol S.A., Apal Agricultural Laboratory, R.J. Hill Laboratories Ltd, Laboratory Crop. Srl, Bionema Limited, Staphyt SA, Omic USA Inc., I2L Research, and ABBA S.A. are playing a dominating role in the global agricultural biological testing market.

RECENT HAPPENINGS IN THE MARKET

- In 2023, SGS SA expanded its testing services for agricultural biologicals, including biopesticides and biofertilizers, ensuring compliance with regulatory standards and safety requirements.

- In 2023, Eurofins Scientific S.E. continued to enhance its testing capabilities, offering a comprehensive range of services for assessing the efficacy and safety of agricultural biological products.

- In 2023, BASF SE invested in research and development to improve the formulation and performance of agricultural biologicals, collaborating with testing laboratories to validate product efficacy.

- In 2022, I2L Research collaborated with industry stakeholders to conduct field trials and efficacy testing of various agricultural biological products, contributing to the advancement of bio-based solutions.

MARKET SEGMENTATION

This research report on the global agricultural biological testing market has been segmented & sub-segmented based on the product type, application, end-user, and region.

By Product Type

- Bio-Pesticides

- Bio-Fertilizers

- Bio-Stimulants

By Application

- Field Support

- Analytical

- Regulatory

By End-Users

- Biological Product

- Manufacturers

- Government Agencies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the global agriculture biological testing market?

The global agriculture biological testing market is expected to be valued at USD 123.61 million in 2025.

How is the agriculture biological testing market in North America responding to the demand for GMO testing?

In North America, the agriculture biological testing market is witnessing increased demand for GMO testing services to ensure compliance with labeling regulations and meet consumer preferences for non-GMO products.

What factors are hindering the growth of the agriculture biological testing market in Asia Pacific?

In Asia Pacific, factors such as a lack of standardized testing methods, limited awareness about biological testing services, and budget constraints among small-scale farmers are hindering market growth.

How is the adoption of sustainable agriculture practices influencing the agriculture biological testing market in North America?

In North America, the adoption of sustainable agriculture practices such as crop rotation, cover cropping, and reduced tillage is driving the demand for biological testing services to assess soil health and biodiversity.

How is the agriculture biological testing market in Canada responding to changing regulations for pesticide use?

In Canada, the agriculture biological testing market is witnessing increased demand for testing services to assess the efficacy and environmental impact of pesticides, as well as compliance with regulations on pesticide residues in food.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com