Global Biopesticides Market Size, Share, Trends & Growth Forecast Report - Segmented ByType (Bio Insecticides, Bio Fungicides, Bionematicides and Bio Herbicides), Source (Microbial, Biochemical and Beneficial Insects), Mode of Application (Seed treatment, Soil treatment, Foliar Spray and Others), Formulation (Liquid and Dry), Crop (Grains and Cereals, Pulses and Oilseeds, Vegetables and Fruits, Others) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis from 2025 to 2033

Global Biopesticides Market Size

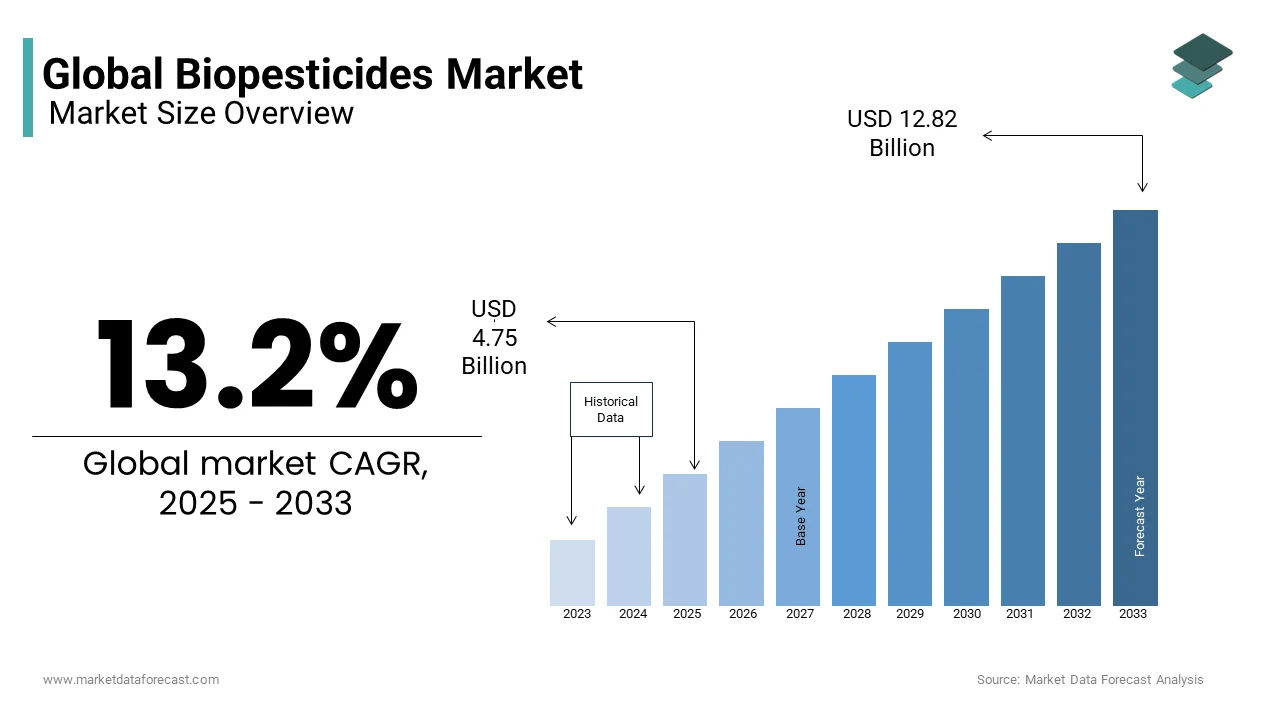

The global biopesticides market was valued at USD 4.20 billion in 2024 and is anticipated to reach USD 4.75 billion in 2025 from USD 12.82 billion by 2033, growing at a CAGR of 13.2% during the forecast period from 2025 and 2033.

CURRENT SCENARIO OF THE GLOBAL BIOPESTICIDES MARKET

Biopesticides are substances that are made of bio-based formulations such as animals, plants, bacteria, and minerals. Biopesticides are used to kill pests, which will damage the crops and exhibit the growth of the plant as well as crops. Sometimes, biopesticides contain live bacteria, which produce toxins, and these toxins kill harmful pests that damage the crops. The biopesticides can be classified into Biochemical insecticides, Microbials and Plant-incorporated protectants. The biopesticides do not cause any harmful effects on the environment as it does not leave any residue over the plants like chemical products. Bio-pesticides offer long-term protection to the crop as well as soil. It is easy to handle and use. Biopesticides are safer as it does not contain harmful chemicals that cause hazards to crops, humans, animals, and the soil as compared to synthetic pesticides. Biopesticides are very useful in those cases where farmers are not able to control pests in spite of using heavy usages of chemical pesticides. Owing to these benefits, the demand for biopesticides is increasing, which further propelling the growth of the global biopesticides market in the forecast period between 2023 and 2028.

MARKET DRIVERS

The driving force of the biopesticides market is the increasing demand for organic food by the population around the globe.

Consumers are becoming more concerned about health and shifting their focus towards organic food, which is fueling the demand for biopesticides in the market. Also, to meet the demand for export quality products, the use of biopesticides is increasing.

Biopesticides or biological are safer and easier for the environment than chemical products and are often formulated to only affect pests, which is propelling the demand for biopesticides over chemical products. The bio-pesticides are residue-free and do not affect the environment. Therefore, the governments of several countries have imposed strict regulations for environmental pollution, which is driving the growth of the biopesticides market.

The increasing awareness of the adverse effects of chemicals in the crops as well as health and the benefits of using biopesticides, fueling the demand for biopesticides in developing countries. Moreover, the governments of these countries are supporting farmers for organic agriculture, further fueling the growth of the market in the forecast period. Additionally, the key players are also investing huge amounts in research and development of bio-based crop protection solutions, which if boosting the growth of the global biopesticides market in the forecast period.

MARKET RESTRAINTS

Lack of awareness related to the benefits of biopesticides among farmers in developing countries and some of the developing countries hampering the growth of the market. Additionally, biopesticides have less shelf life as compared to synthetic chemicals, which is restricting the growth of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.2% |

|

Segments Covered |

By Type, Source, Formulation, Mode of Application, Crop, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BASF SE (Germany), BAYER AG (Germany), Biobest Group NV (Belgium), Certis USA LLC (US), Novozymes A/S(Denmark), Marrone Bio Innovations (US), Syngenta AG (Switzerland), Nufarm (Australia), Som Phytopharma India Ltd (India), Valent Biosciences LLC (US) and others. |

SEGMENTAL ANALYSIS

Global Biopesticides Market By Type

Based on type, the bioinsecticides segment is expected to dominate the market during the forecast period.

As bioinsecticides are safe for use and pose no hazards to the environment and they do not leave behind any chemical residue on the plants. Also, the reduced product development cost and the time associated with bioinsecticides offer advantages to the manufacturers and they can also register within a short duration while chemical registration can take as long as three years.

Global Biopesticides Market By Source

Based on sources, the global biopesticides market is segmented into Microbials, Biochemicals, and Beneficial Insects. Microbial biopesticides are estimated to dominate the biopesticides market in the forecast period as microbial-origin pesticides are naturally composed of occurring viruses, fungi, or bacteria. The microbials are the most preferred organic and residue-free food production. Factors such as the higher advantage of selectivity, high affectivity, no adverse effects on humans, plants, and animals, and ease of use are propelling the growth of the biopesticides market.

Global Biopesticides Market By Formulation

Based on Formulation, the global biopesticides market is segmented into liquid and dry. Liquid biopesticides are estimated to record the highest CAGR during the forecast period. Liquid biopesticides have a longer term of action (up to 6 months) than dry biopesticides (up to 3 months) and provide effective and efficient disease control performance.

Global Biopesticides Market By Mode of Application

Based on Formulation, the global biopesticides market is segmented into Seed treatment, Soil treatment, Foliar Spray, and Others. Foliar spray is widely used among farmers because it helps in the immediate recovery of the pests and insecticide parts of the plants. This is the most effective mode of application as it is a safe and easily handled application.

Global Biopesticides Market By Crop

Based on Crop, the global biopesticides market is segmented into grains and cereals, Pulses and Oilseeds, Vegetables and Fruits, and Others. The vegetable and fruit segment is expected to boost market growth during the forecast period due to the growing trend of organic agriculture and the increasing demand for organic fruits and vegetables. Moreover, the farmers are using a combination of biopesticides with other chemicals in order to meet the demand for export quality fruits and vegetables.

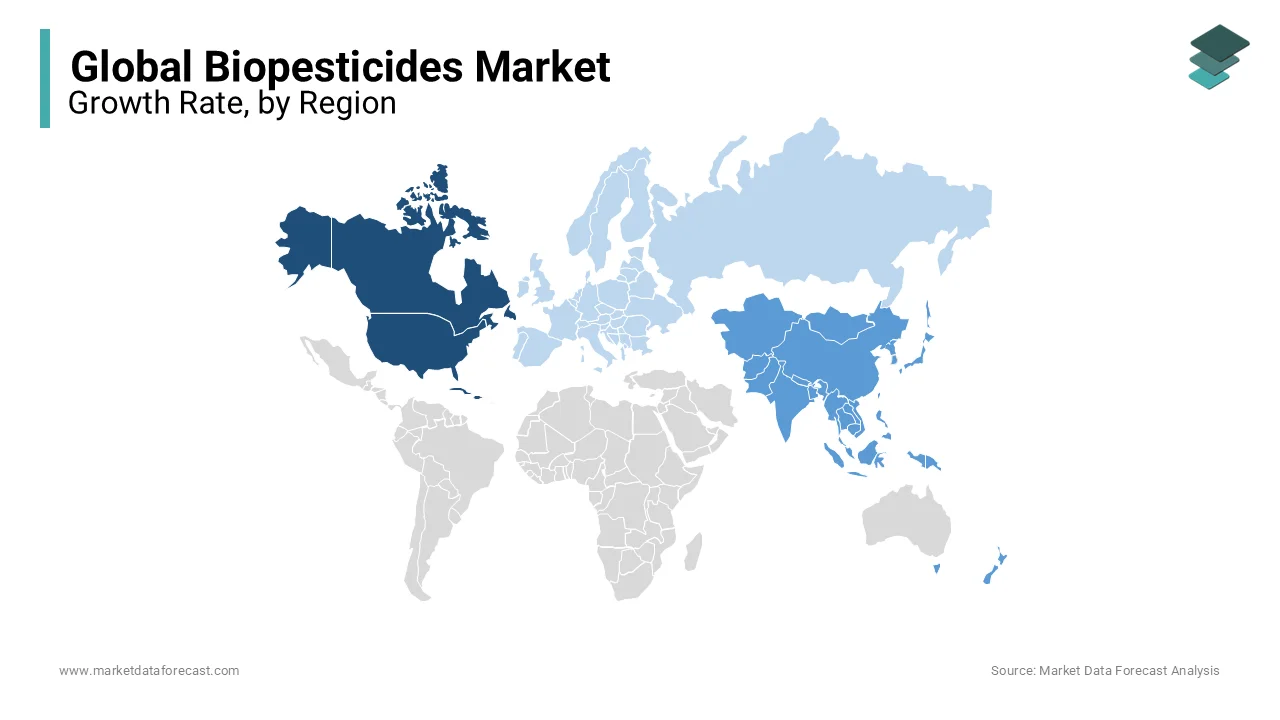

REGIONAL ANALYSIS

North America accounts for the largest market share of the biopesticides market. Due to rising concerns over the harmful chemicals on the environment, the governments of several countries have imposed strict regulations associated with the environment. United States is one of the leading countries for the export of various fruits and vegetables, which fuel the demand for biopesticides in the U.S. The increasing demand for organic and residue-free crops is the adoption of bioinsecticides. Moreover, the presence of a huge number of key players in this region leads to investment in research and development in crop production and protection is attributing the growth of the market in the projected period.

Asia-Pacific is expected to become the fastest-growing market for biopesticides during the forecast period. Countries like India, China, Japan, and others have high plant diversities and a large set of different climatic conditions. Furthermore, the increasing awareness of consumers towards the toxic substance in the food chain makes it imperative for crop producers to use non-toxic solutions such as bio-based pesticides, which are fueling the growth of the biopesticides market future.

Europe is also going to witness a steady growth rate during this period due to the growing demand for safe and quality food, increasing demand of consumers for organic food, and rising government initiatives in promoting biocontrol products.

KEY MARKET PLAYERS

Some of the leading companies operating in the global biopesticides market are basf SE (Germany), BAYER AG (Germany), Biobest Group NV (Belgium), Certis USA LLC (US), Novozymes A/S(Denmark), Marrone Bio Innovations (US), Syngenta AG (Switzerland), Nufarm (Australia), Som Phytopharma India Ltd (India), Valent Biosciences LLC (US)

RECENT HAPPENINGS IN THIS MARKET

- In March 2021, Bayer introduced its latest launch, “Vynyty Citrus,” during the International Symposium on Horticulture in Europe. Vynyty Citrus is the latest biological and pheromone-based crop production product that would be used in order to control pests on citrus farms.

- In March 2021, BASF and AgBiome signed an agreement in order to bring new biological fungicides to the market, particularly in Europe and key countries in the Middle East, Asia, and Africa.

- In July 2019, BASF received a registration from the Australian Pests and Veterinary Medicine Association for its new advanced biological pest control solution, “Velifer.” Verifier can help in preventing insects from becoming resistant to pesticide treatment in protected cropping.

MARKET SEGMENTATION

This research report on the global biopesticides market has been segmented and sub-segmented into the following categories.

By Type

- Bioinsecticides

- Bio fungicides

- Bio nematicides

- Bioherbicides

By Source

- Microbials

- Biochemicals

- Beneficial Insects

By Formulation

- Dry

- Liquid

By Mode of Application

- Seed treatment

- Soil treatment

- Foliar Spray

- Others

By Crop

- Grains and Cereals

- Pulses and Oilseeds

- Vegetables and Fruits

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

what are key players involved in biopestiocides market?

basf SE (Germany), BAYER AG (Germany), Biobest Group NV (Belgium), Certis USA LLC (US), Novozymes A/S(Denmark), Marrone Bio Innovations (US), Syngenta AG (Switzerland), Nufarm (Australia), Som Phytopharma India Ltd (India), Valent Biosciences LLC (US)

what is the current CAGR of biopesticides market?

The biopesticides market be growing at a CAGR of 13.2% by 2033.

How big is the global biopestiocides market?

The Global Biopesticides Market is expected to be valued at USD 4.75 billion in 2025, and it is estimated to reach a valuation of USD 12.82 billion by the end of 2033.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]