Global Pyrethrin Market Size, Share, Trends & Growth Forecast Report, Segmented By Type (Pyrethrin 1 and Pyrethrin 2), Pest Type (Lepidoptera, Sucking Pests, Coleoptera, Diptera, Mites and Others), Application (Household, Crop Protection, Commercial and Industrial, Animal Health and Public Health Applications), and Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa), Industrial Analysis (2025 to 2033)

Global Pyrethrin Market Size

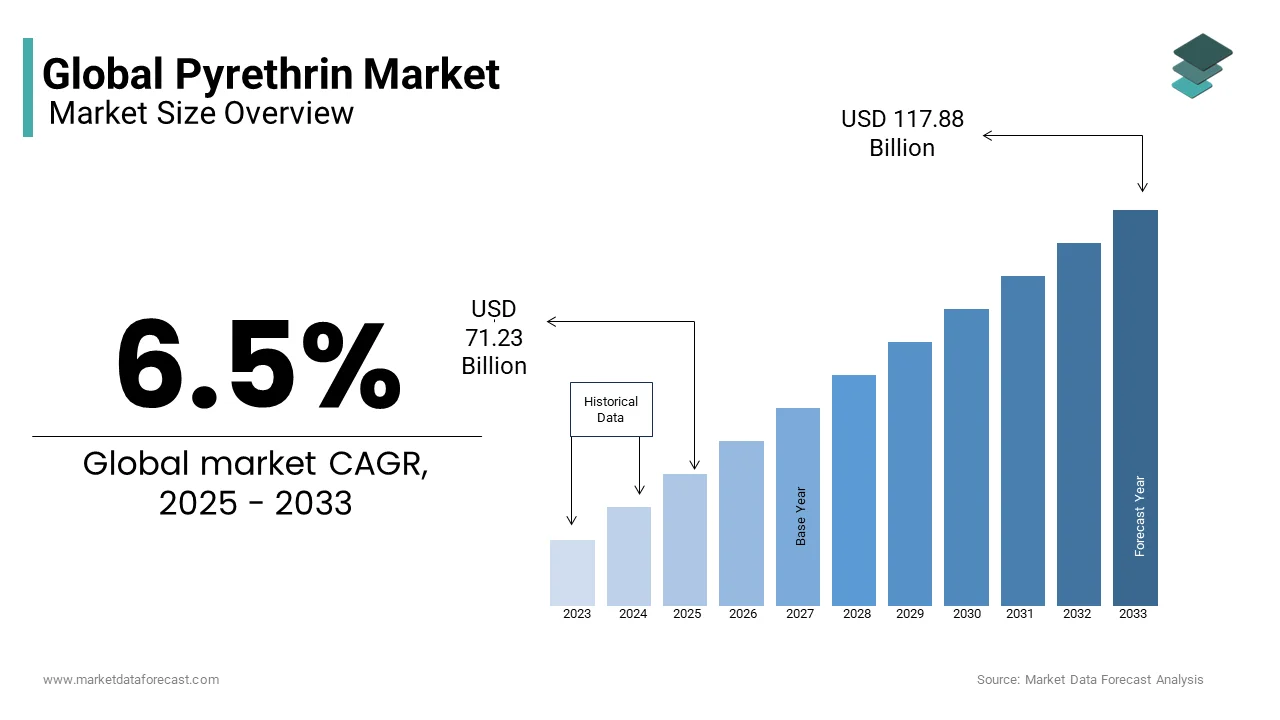

The global pyrethrin market was valued at USD 66.88 billion in 2024 and is anticipated to reach USD 71.23 billion in 2025 from USD 117.88 billion by 2033, growing at a CAGR of 6.5% during the forecast period from 2025 to 2033.

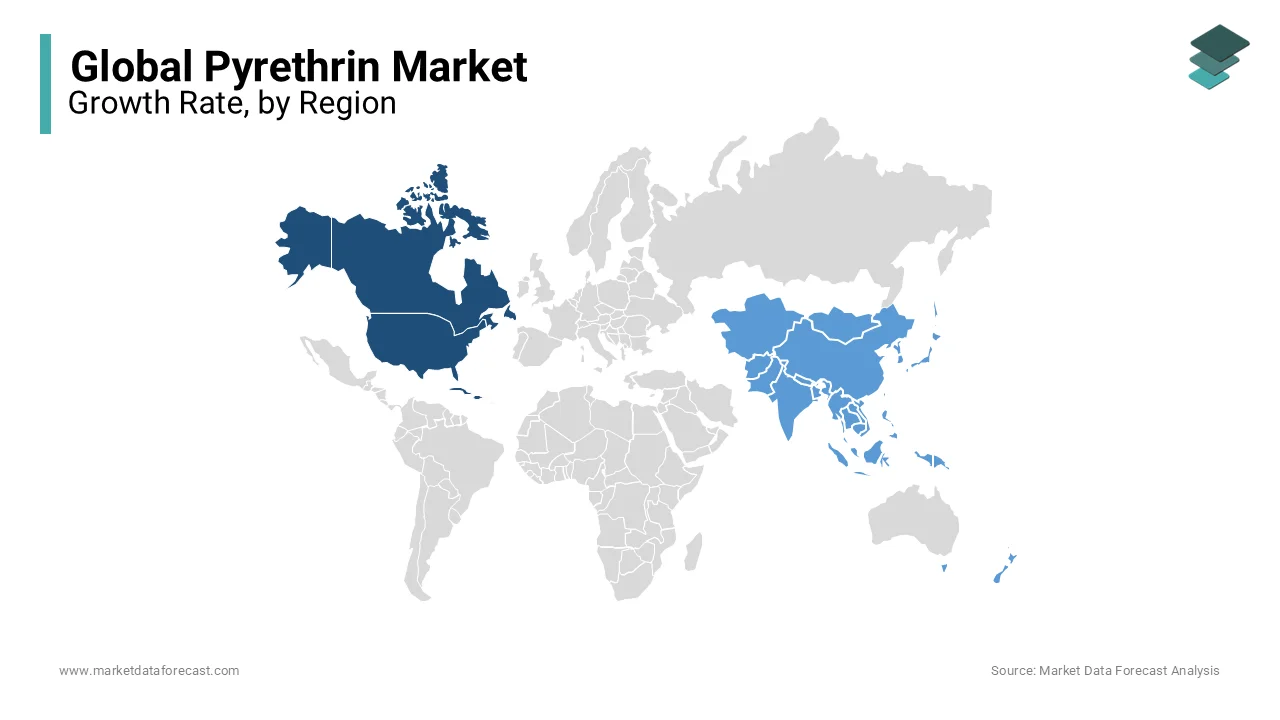

The pyrethrin market is anticipated to have promising growth over the forecast period, with significant contributions from North America, Europe, and Asia-Pacific. North America leads the market, accounting for the leading share of the global market, owing to its widespread use in pest control and agriculture. Europe follows closely, supported by stringent regulations favoring natural insecticides over synthetic alternatives. As per Eurostat, countries like Germany and France have adoption rates exceeding 70% in organic farming, underscoring their leadership in sustainable practices. Meanwhile, Asia-Pacific is witnessing rapid growth due to increasing investments in crop protection and rising awareness about eco-friendly pest management solutions. For instance, India’s Ministry of Agriculture reports that pyrethrin-based products have grown by 12% annually since 2018, particularly in tea and cotton cultivation.

MARKET DRIVERS

Rising Demand for Organic Farming

The growing demand for organic farming that prioritizes natural and biodegradable pest control solutions is one of the major factors propelling the growth of the pyrethrin market. According to the International Federation of Organic Agriculture Movements (IFOAM), the global organic food market is projected to reach $400 billion by 2027, with a significant portion attributed to crops protected by natural insecticides like pyrethrin. Farmers increasingly prefer pyrethrin due to its low toxicity to humans and animals while effectively targeting pests. For example, in the U.S., the Department of Agriculture (USDA) certifies pyrethrin as an approved organic pesticide, boosting its usage in high-value crops such as fruits, vegetables, and ornamental plants. Additionally, advancements in extraction technologies have improved the purity and efficacy of pyrethrin formulations, enhancing their appeal. As per the study published in Pest Management Science, pyrethrin-based products achieve pest mortality rates of up to 95%, making them indispensable in organic farming systems.

Stringent Regulations on Synthetic Pesticides

Stringent regulations on synthetic pesticides are further boosting the expansion of the pyrethrin market. According to the European Chemicals Agency (ECHA), over 50% of conventional pesticides face restrictions or bans due to environmental and health concerns, creating a favorable environment for natural alternatives like pyrethrin. The European Union’s Sustainable Use Directive mandates a 50% reduction in chemical pesticide use by 2030, encouraging farmers to adopt safer options. For instance, France has implemented a nationwide initiative called “Ecophyto,” promoting the use of biopesticides, including pyrethrin, in vineyards and orchards. Similarly, California’s Department of Pesticide Regulation reports a 30% increase in pyrethrin sales following stricter regulations on synthetic insecticides. By offering a compliant and effective solution, pyrethrin addresses regulatory pressures while meeting consumer demands for safer agricultural practices.

MARKET RESTRAINTS

High Production Costs

The high cost associated with its production, primarily due to the limited availability of raw materials is hindering the expansion of the pyrethrin market. Pyrethrin is extracted from chrysanthemum flowers, which are grown in specific regions like Kenya and Australia. According to the Food and Agriculture Organization (FAO), the cost of producing pyrethrin is approximately 30% higher than synthetic alternatives, making it less accessible for small-scale farmers in developing economies. Additionally, fluctuations in flower yields due to climatic conditions further exacerbate supply chain challenges. For example, a drought in East Africa in 2021 reduced chrysanthemum harvests by 25%, leading to a spike in prices globally. Without affordable alternatives or subsidies, many farmers cannot justify the investment, creating a barrier to broader adoption and market expansion.

Limited Shelf Life and Stability Issues

Limited shelf life and stability issues are further inhibiting the expansion of the pyrethrin market, particularly in regions with inadequate storage infrastructure. According to a study published in Journal of Agricultural and Food Chemistry, pyrethrin degrades rapidly when exposed to sunlight, heat, or moisture, reducing its efficacy by 50% within six months under improper storage conditions. This challenge disproportionately affects emerging markets, where cold chain logistics and packaging technologies are underdeveloped. For instance, a report by the International Trade Centre highlights that over 40% of pyrethrin-based products lose potency before reaching end-users in sub-Saharan Africa. Similarly, collaborations with research institutions aim to develop stabilized formulations, but progress remains slow.

MARKET OPPORTUNITIES

Expansion into Biopesticide Formulations

The integration of pyrethrin into advanced biopesticide formulations to enhance its stability and application versatility is a significant opportunity for the pyrethrin market. The demand for biopesticide is likely to grow significantly over the forecast period and this is likely to create synergies with pyrethrin adoption. Innovations such as encapsulation and microemulsion technologies extend shelf life and improve field performance, addressing existing challenges. For example, companies like Bayer AG have developed pyrethrin-based biopesticides with extended efficacy periods, appealing to both organic and conventional farmers. Similarly, partnerships with agricultural extension services enhance product awareness, particularly in emerging economies. These developments position pyrethrin as a transformative force in sustainable pest management, fostering long-term market growth.

Growth in Urban Pest Control Applications

The growing usage of pyrethrin urban pest control applications is another prominent opportunity in the global pyrethrin market. The demand for the pest control services is rapidly growing worldwide due to the rapid urbanization and hygiene concerns. Pyrethrin-based sprays and foggers are widely used in residential and commercial spaces due to their rapid knockdown effects and minimal residue. Emerging trends in smart pest control further accelerate adoption. For instance, IoT-enabled devices integrated with pyrethrin formulations allow precise targeting, reducing waste by 30%. Additionally, rising awareness about eco-friendly solutions among urban consumers drives demand. These innovations position pyrethrin as a key player in addressing urban pest challenges while aligning with sustainability goals.

MARKET CHALLENGES

Competition from Synthetic Alternatives

Competition from synthetic alternatives is a significant challenge for the pyrethrin market, particularly in price-sensitive segments. According to the Pesticide Action Network, synthetic pyrethroids dominate over 60% of the global insecticide market, leveraging economies of scale and lower production costs. These substitutes often offer longer shelf lives and broader pest spectrums, appealing to conventional farmers. For example, products like permethrin and cypermethrin are priced 20-25% lower than pyrethrin, making them more attractive in developing regions. Additionally, aggressive marketing campaigns by manufacturers of synthetic pesticides create misconceptions about the efficacy of natural alternatives. These factors threaten pyrethrin’s market share, necessitating strategic investments in education and innovation to remain competitive.

Climatic Vulnerability of Chrysanthemum Cultivation

Climatic vulnerability of chrysanthemum cultivation is further challenging the expansion of the pyrethrin market, impacting the availability and pricing of raw materials for pyrethrin production. According to the FAO, unfavorable weather conditions such as droughts and unseasonal rains can reduce chrysanthemum yields by up to 40%, disrupting supply chains. For instance, Kenya, a leading producer, experienced a 25% decline in flower harvests in 2021 due to prolonged dry spells. This issue is compounded by the concentration of cultivation in specific regions, limiting diversification. A study by the International Center for Tropical Agriculture highlights that expanding chrysanthemum cultivation to new geographies requires significant investments in irrigation and climate-resilient varieties. Without addressing these vulnerabilities, the pyrethrin market faces risks of price volatility and supply shortages, impacting long-term viability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.5% |

|

Segments Covered |

By Type, Pest Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Sinclair Animal & Household Care Ltd (Gainsborough, U.K.), Botanical Resources of Australia (Tasmania, Australia), Horizon Sopyrwa (Rwanda, Africa), Beaphar UK (Haverhill, U.K.), Elanco (Indiana, U.S.) and Others. |

SEGMENT ANALYSIS

By Type Insights

The pyrethrin 1 segment occupied 61.1% of the global market share in 2024. The leading position of pyrethrin 1 segment in the global market is driven by its superior efficacy against a wide range of pests and its rapid knockdown effects. According to the Journal of Pesticide Science, Pyrethrin 1 achieves pest mortality rates of up to 95% within minutes, making it indispensable in both household and agricultural applications. The advancements in extraction technologies that enhance purity and potency is further boosting the expansion of pyrethrin 1 segment in the global market. For instance, innovations in chrysanthemum cultivation have increased Pyrethrin 1 yields by 25% annually, ensuring steady supply. Additionally, regulatory approvals for organic farming further boost adoption, with the USDA certifying Pyrethrin 1 as safe for high-value crops like fruits and vegetables.

The pyrethrin 2 segment is predicted to register a CAGR of 8.08% over the forecast period owing to its enhanced stability and residual activity compared to Pyrethrin 1, making it suitable for long-term pest management solutions. A study published in Agricultural Sciences highlights that Pyrethrin 2 maintains efficacy for up to 48 hours, reducing the frequency of applications. Emerging trends in biopesticide formulations further accelerate adoption. For example, encapsulation technologies extend shelf life and improve field performance, appealing to both organic and conventional farmers. Additionally, rising awareness about integrated pest management (IPM) drives demand, positioning Pyrethrin 2 as a dynamic growth driver within the market.

By Pest Type Insights

The lepidoptera segment dominated the market by capturing 39.8% of the global market share in 2024. The dominance of lepidoptera segment in the global market is attributed to the widespread prevalence of moth and butterfly larvae, which cause significant damage to crops like cotton, maize, and vegetables. According to the FAO, Lepidopteran pests account for over $20 billion in annual crop losses globally, underscoring the critical need for effective control measures. The versatility of pyrethrin-based products in targeting Lepidoptera at various life stages is further contributing to the expansion of lepidoptera segment in the global market. For instance, pyrethrin’s rapid knockdown effect achieves larval mortality rates exceeding 90%, as stated by the International Journal of Pest Management. Additionally, government initiatives promoting sustainable farming encourage the use of natural insecticides, enhancing adoption rates.

The sucking pests segment is projected to witness the fastest CAGR of 9.2% over the forecast period owing to their increasing resistance to synthetic pesticides, creating demand for alternative solutions like pyrethrin. A report by the Pesticide Action Network highlights that sucking pests like aphids and whiteflies have developed resistance to over 50% of conventional insecticides, necessitating safer options. Emerging trends in urban agriculture further accelerate adoption. For example, pyrethrin-based sprays are widely used in indoor farming systems to protect leafy greens and ornamental plants. Additionally, partnerships with agricultural extension services enhance product awareness, particularly in emerging economies.

By Applications Insights

The crop protection segment captured the largest share of the global market in 2024. The leading position of crop protection segment in the global market is driven by the growing demand for natural insecticides in organic farming and high-value crops. According to the USDA, pyrethrin usage in crop protection has grown by 12% annually since 2018, particularly in tea, cotton, and vegetable cultivation. The rising adoption of integrated pest management (IPM) practices is further boosting the expansion of crop protection segment in the global market. For instance, farmers in Europe and North America prioritize eco-friendly solutions to comply with stringent regulations, boosting pyrethrin demand. Additionally, collaborations with research institutions enhance product efficacy, addressing evolving pest challenges effectively.

The public health segment is predicted to witness a CAGR of 10.2% over the forecast period in the global market due to the growing awareness about vector-borne diseases and the need for safe pest control solutions in urban areas. The World Health Organization (WHO) reports that mosquito-borne diseases like malaria and dengue affect over 700 million people annually, creating immense demand for pyrethrin-based foggers and sprays. Emerging trends in smart pest control further accelerate adoption. For example, IoT-enabled devices integrated with pyrethrin formulations allow precise targeting, reducing waste by 30%. Additionally, government initiatives promote the use of eco-friendly solutions in public health campaigns, fostering inclusivity. These innovations position public health applications as a vital contributor to market expansion.

REGIONAL ANALYSIS

North America held the major share of 36.1% of the global market share in 2024. The domination of North America in the global market is majorly due to its strong emphasis on organic farming and pest control solutions in urban areas. According to the USDA, the U.S. organic food market is projected to grow at a CAGR of 10% through 2030, creating significant demand for natural insecticides like pyrethrin. The stringent regulatory environment favoring eco-friendly alternatives is further boosting the dominating position of North America in the global market. For instance, California’s Department of Pesticide Regulation mandates a 30% reduction in synthetic pesticide use, boosting pyrethrin adoption. Additionally, advancements in extraction technologies enhance product efficacy, ensuring compliance with organic certification standards.

Europe held a substantial share of the global pyrethrin market in 2024, with countries like Germany, France, and Italy emerging as key contributors. According to Eurostat, Europe’s organic farming sector has grown by 7.5% annually since 2019, underscoring its leadership in sustainable agricultural practices. The European Union’s Green Deal initiative aims to reduce chemical pesticide use by 50% by 2030, further driving demand for natural alternatives. The integration of biopesticides into integrated pest management (IPM) systems in Europe are driving the regional market expansion. For example, France’s “Ecophyto” program promotes pyrethrin-based products in vineyards and orchards, achieving a 20% reduction in synthetic pesticide reliance. Additionally, collaborations between research institutions and private firms enhance product stability and shelf life, addressing existing challenges effectively.

Asia-Pacific is the fastest-growing region in the global pyrethrin market. India and China lead adoption, driven by rising investments in crop protection and increasing awareness about eco-friendly pest management solutions. According to the FAO, pyrethrin-based products have grown by 12% annually since 2018, particularly in tea and cotton cultivation. Technological advancements further boost growth. For instance, microencapsulation technologies extend shelf life by 40%, appealing to farmers in remote regions. Additionally, government subsidies reduce costs, encouraging widespread adoption.

Latin America is projected to showcase a healthy CAGR in the global pyrethrin market over the forecast period, with Brazil and Argentina as primary contributors. According to the Brazilian Ministry of Agriculture, pyrethrin usage in soybean and sugarcane crops has increased productivity by 15%, supported by government programs promoting sustainable farming practices. Argentina follows closely, leveraging pyrethrin for pest control in vineyards and fruit orchards. Key drivers include rising exports of organic produce and increasing awareness about environmental sustainability. For example, Argentina’s organic farming sector has grown by 20% annually since 2020, creating demand for natural insecticides.

The pyrethrin market in Middle East and Africa is expected to witness a moderate CAGR in the global market over the forecast period, with Egypt and South Africa leading adoption. According to the African Development Bank, Egypt performs over 500,000 pest control operations annually, supported by government initiatives to modernize agriculture. Meanwhile, South Africa’s focus on sustainable farming addresses food security challenges. The rise of public health applications targeting vector-borne diseases in this region is promoting the market growth in Middle East and Africa. For example, pyrethrin-based foggers are widely used in malaria-prone regions, reducing disease incidence by 30% in targeted areas. Additionally, partnerships with international organizations enhance local expertise, ensuring compliance with quality standards. These efforts highlight the region’s potential to address agricultural and public health needs through pyrethrin innovation.

Top Players In the Pyrethrin Market

Bayer AG

Bayer AG is a global leader in the pyrethrin market, specializing in biopesticide formulations for crop protection and public health applications. The company leverages advanced encapsulation technologies to enhance product stability and field performance, addressing existing challenges effectively. Bayer collaborates with agricultural extension services worldwide to promote sustainable farming practices, ensuring broader accessibility and affordability.

Syngenta Group

Syngenta Group excels in developing innovative pyrethrin-based solutions tailored to diverse pest management needs. The company offers a wide range of products for organic farming, urban pest control, and public health applications, meeting evolving consumer preferences. Syngenta prioritizes R&D, investing in stabilized formulations that extend shelf life by up to 50%, enhancing customer satisfaction.

Sumitomo Chemical Co., Ltd.

Sumitomo Chemical Co., Ltd. is a pioneer in natural insecticides, known for its high-quality pyrethrin extracts and formulations. The company supplies products for both agricultural and household applications, catering to diverse markets globally. Sumitomo invests heavily in chrysanthemum cultivation and extraction technologies, ensuring consistent supply and superior efficacy. With a focus on sustainability and innovation, Sumitomo continues to expand its footprint in emerging economies.

Top Strategies Used By Key Market Participants

Strategic Partnerships

Leading players prioritize strategic partnerships to enhance accessibility and scalability. For example, Bayer AG partnered with African governments to establish pest control initiatives targeting malaria-prone regions, reaching over 10 million households annually. Such collaborations not only improve service delivery but also foster knowledge sharing, addressing regional challenges effectively.

Product Innovation

To stay ahead, companies invest heavily in R&D to develop cutting-edge solutions. Syngenta Group, for instance, introduced stabilized pyrethrin formulations that maintain efficacy for up to 48 hours, appealing to both organic and conventional farmers. Similarly, Sumitomo Chemical developed microencapsulated products, extending shelf life by 40%. These innovations address unmet needs while fostering customer loyalty.

Geographic Expansion

Expanding into emerging markets strengthens market presence and operational efficiency. In April 2024, Syngenta launched new biopesticide clinics in sub-Saharan Africa, targeting underserved populations. This move enhances supply chain resilience and fosters inclusivity, meeting diverse customer needs globally.

KEY MARKET PLAYERS

Sinclair Animal & Household Care Ltd (Gainsborough, U.K.), Botanical Resources of Australia (Tasmania, Australia), Horizon Sopyrwa (Rwanda, Africa), Beaphar UK (Haverhill, U.K.), Elanco (Indiana, U.S.). are some of the major key players involved in the pyrethrin market.

MARKET SEGMENTATION

This research report on the global pyrethrin market has been segmented and sub-segmented based on the type, pest type, application, and region.

By Type

- Pyrethrin 1

- Pyrethrin 2

By Pest Type

- Lepidoptera

- Sucking Pests

- Coleoptera

- Diptera

- Mites

- Others

By Applications

- Household

- Crop protection

- Commercial and Industrial

- Animal Health

- Public health applications

By Region

- North America

- Europe

- Asia-Pacific

- Middle East and Africa

- Latin America

Frequently Asked Questions

what is the curent size of the global Pyrethrin Market?

The global pyrethrin market is worth USD 71.23 billion in 2025.

Which regions in North America contribute significantly to the production of pyrethrin?

The Pacific Northwest region in North America, particularly the United States, contributes significantly to the production of pyrethrin, with the cultivation of Chrysanthemum cinerariaefolium.

Which specific crops in Asia-Pacific benefit the most from the application of pyrethrin?

Crops such as vegetables, fruits, and rice in the Asia-Pacific region benefit significantly from the application of pyrethrin.

what are the key factors of the global Pyrethrin Market?

The key factors propelling the global pyrethrin market are the increasing demand for hygienic products by households, combined with the rising global population and changing lifestyles.

who are the key market players involved in this market?

Sinclair Animal & Household Care Ltd (Gainsborough, U.K.), Botanical Resources of Australia (Tasmania, Australia), Horizon Sopyrwa (Rwanda, Africa), Beaphar UK (Haverhill, U.K.), Elanco (Indiana, U.S.).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com