Global Seed Treatment Market Size, Share, Trends, & Growth Forecast Report - Segmented By Crop Type (Corn/Maize, Soybeans, Wheat, Rice, Canola, Cotton And Other Products), Application (Chemical Agents (Insecticides, Fungicides And Other Chemicals) And Biological Agents), Function (Crop Protection Chemicals And Seed Enhancement), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 to 2033

Global Seed Treatment Market Size

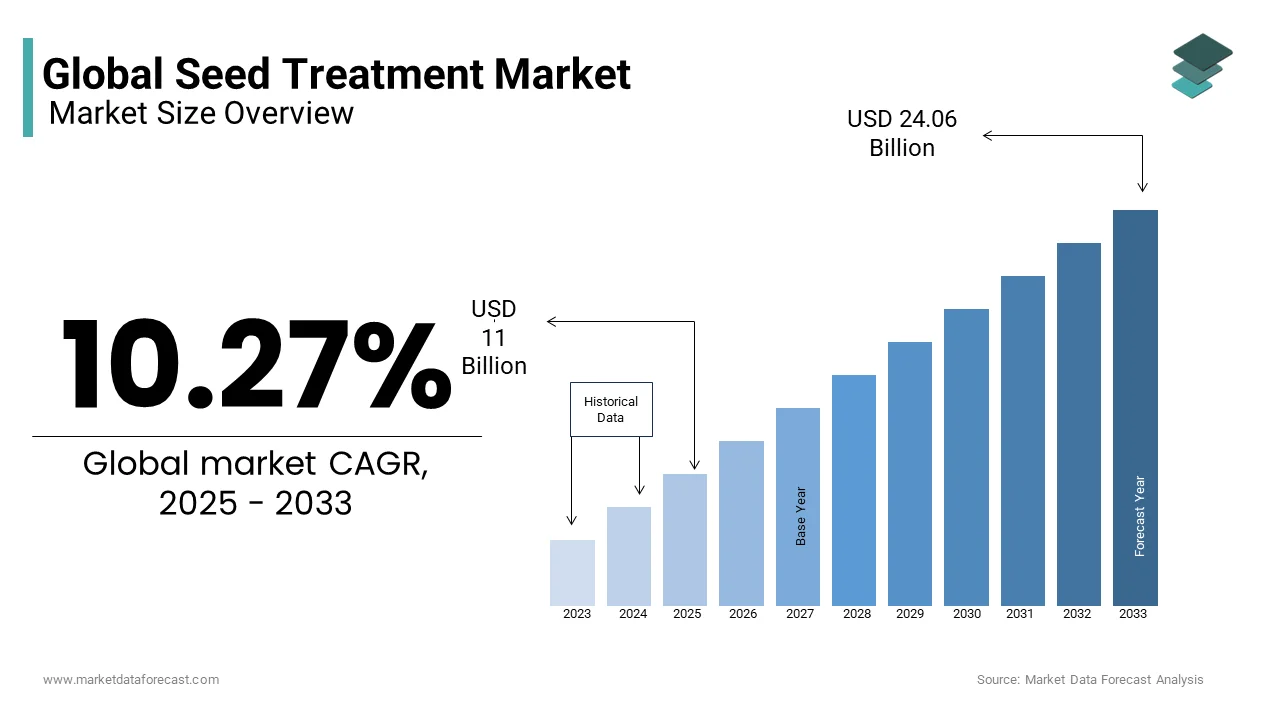

The global seed treatment market was valued at USD 9.98 billion in 2024 and is anticipated to reach USD 11 billion in 2025 from USD 24.06 billion by 2033, growing at a CAGR of 10.27% during the forecast period from 2025 to 2033.

Current Scenario Of The Global Seed Treatment Market

Currently, seed treatment involves the application of biological, physical, and chemical agents during planting to improve the health of crops. It can be a more environmentally friendly way of using pesticides as the amounts used can be very small. Also, biological seed treatment agents are antagonistic fungi or bacteria used for protecting seeds. So, the global market is poised for growth owing to the growing research & development initiatives to improve the seed’s potential for genetic yielding. In recent decades, seeds have become progressively commodified forming the core of the majority of the food supply chain worldwide. The unification of the agrochemical and seed industries, particularly in the past few years, has thus elevated several issues regarding this increasing concentration of power. These patterns have blurred earlier clear boundaries between biotechnology, agrochemicals and seeds, and more lately, among other sectors involving biologicals (nature-inspired plant strengthening and protection products) and digital agriculture (the inception of sophisticated data analysis, automation, software and robotics).

MARKET DRIVERS

Increasing World Population

The major driver of the seed treatment market is the increasing world population, which in turn led to an increase in food requirements. According to the Food and Agriculture Organization, the forecast shows that feeding the global population of 9.1 billion individuals in 2050 would need to increase entire food cultivation by 70 % between 2005/07 and 2050. Yield in the developing nations would require almost twofold. This makes the seed treatment extremely important to elevate its quality. So, green development of seed industries is essential to supply food for the growing population of the world. Moreover, top brass of prominent companies around the world are emphasizing enhancing the quality of seeds that are immune from climate burden, improving the application of organic resources, and augmenting nutrition and food security, which is a significant contribution to safeguarding greater crop output.

Including Rising Food Demand Worldwide

Modern-day seed treatment is propelled by various factors, including rising food demand worldwide, legislative pressures to lower chemical usage, developments in biotechnology and microbiology, and the raising of awareness of sustainable agriculture practices. As a consequence, the market is witnessing an increase in unique products that offer more than protection to provide holistic solutions for managing crops.

Furthermore, among the most important trends in this market is the growing acceptance of biological solutions. Industry players such as Andermatt, Locus Agriculture and Lavie Bio are spearheading this movement, advancing microbial and bio-inoculant treatments that leverage the strength of beneficial organisms. The incorporation of biologicals into this treatment is a substantial measure towards more ecologically friendly farming. It facilitates cultivators to mitigate their dependence on synthetic chemicals and at the same time continue to hold or even enhance crop productivity.

MARKET RESTRAINTS

Microplastics are restraining the growth of the seed treatment. After being discharged into the environment, they notably slow to decompose, posing major ecological and health hazards. Apart from the main contributors to this, agriculture also plays a part via the microplastics in polymers utilised to treat seeds. Despite that, presently, calculated at only 1% of the overall microplastics discharged, the seed sector intends for zero contributions. According to the ECHA, it is forecasted that every year 42000 tons of microplastics are discharged into the ecological system. However, as per the industry experts, the most important function of polymers in this treatment is to ensure correct compliance with seed treatment products (STPs) at its surface.

MARKET OPPORTUNITIES

The growing support for sustainable options is providing potential opportunities for the seed treatment market. There is wide support to furnish microplastic-free offerings from the international seed community. The market has started to see the arrival of seed-applied polymers free from microplastics are increasingly accessible as the industry players shift their portfolios. However, the problem persists with more complications for STPs which need legal approvals and comprehensive reformulation. To address this and strive towards sustainable and secure crop growth, the current studies are working on unique and ecologically friendly substitutes.

Additionally, the recent developments in Nano-enabled seed treatment are expected to boost the market growth. It is a sustainable technology which can lower the dose-related toxicity of this treatment. Thus, enhancing seed feasibility with controlled discharge of nano agrochemical active elements. However, worries about toxicological effects, safety, and exposure levels to human health and the environment remain.

MARKET CHALLENGES

The growth of the seed treatment market is hampered by legal challenges. As of now, the Environment Protection Agency (EPA) in the USA pardons seeds covered with insecticides as TAE – Treated Articles Exempt. The EPA regulations consider the seeds treated with pesticides as “treated articles”. Also, the pesticide itself is listed for this application by the EPA, not having this “TAE” tag for seed, which might result in an expensive duplication of legal effort without any extra advantage to the environment, safety, and health. Besides this, there is a lack of standard methods and protocols for evaluating the toxicity of nanomaterial-based agrochemicals. This makes it tough to compare results and attain a consensus on its toxicity.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.27% |

|

Segments Covered |

By Crop Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Syngenta, Bayer CropScience, BASF, Monsanto, BioWorks Inc, Valent USA Corp, Adama Agricultural Solutions Ltd, Advanced Biological Marketing Inc, Brettyoung Limited, Chemtura Agrosolutions, Dupont, Germains Seed Technology. |

SEGMENT ANALYSIS

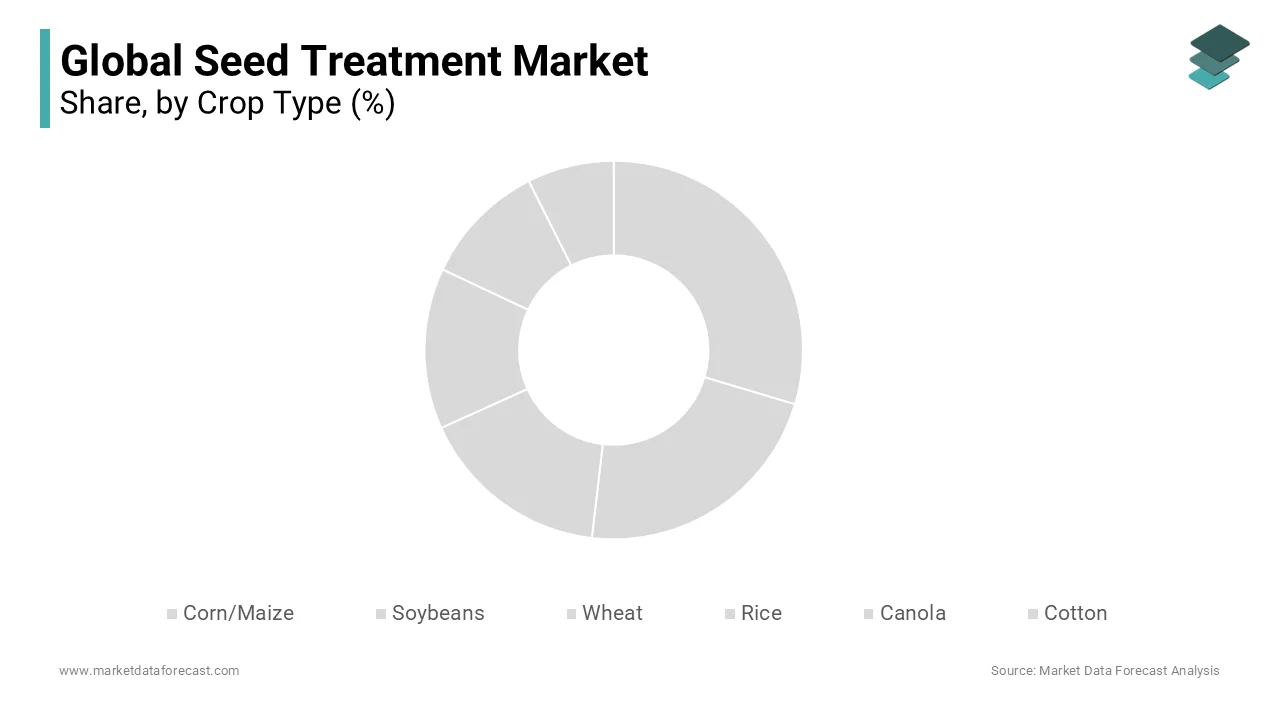

Global Seed Market Analysis By Crop Type

Corn/maize held the largest share of over 25% of the overall market revenue. The high market share of maize is major because of the increasing corn demand for producing biofuels. The segment’s market growth can be credited to its extensive production, with a huge world impression. The segment also grew because it is a primary food and a key source of livestock supply. This prevalent cultivation positions it as an organic option for seed treatment to protect the yield from ecological factors, pests and diseases is important to make sure cultivation is consistent. On the other hand, Canola is anticipated to witness maximum growth as these seeds possess a high oil content, which leads to increasing demand.

Global Seed Market By Application

Based on function, the market can be divided into crop protection chemicals and seed enhancement. Corn/maize held the largest share of over 25% of the overall market revenue. The high market share of maize is majorly because of the increasing corn demand for producing biofuels. Canola is anticipated to witness maximum growth as these seeds possess a high oil content, which leads to increasing demand.

The chemical agents segment accounted for the biggest market share in recent years. This is because of its extensive application in high crop output and enables consistent seedling emergence in conjunction with reducing the harm to seeds by either diseases or insects. Furthermore, improving crop resilience and finding solutions beyond pest control are driving the demand for chemical agents. While safety against diseases and pests continues to be a primary operation of seed treatments, there's a surging focus on improving complete crop strength and resistance. This is especially vital despite weather changes and progressively unpredictable climate trends. For example, YaraVita N-RHIZO and BIOTRAC by Yara represent this pattern.

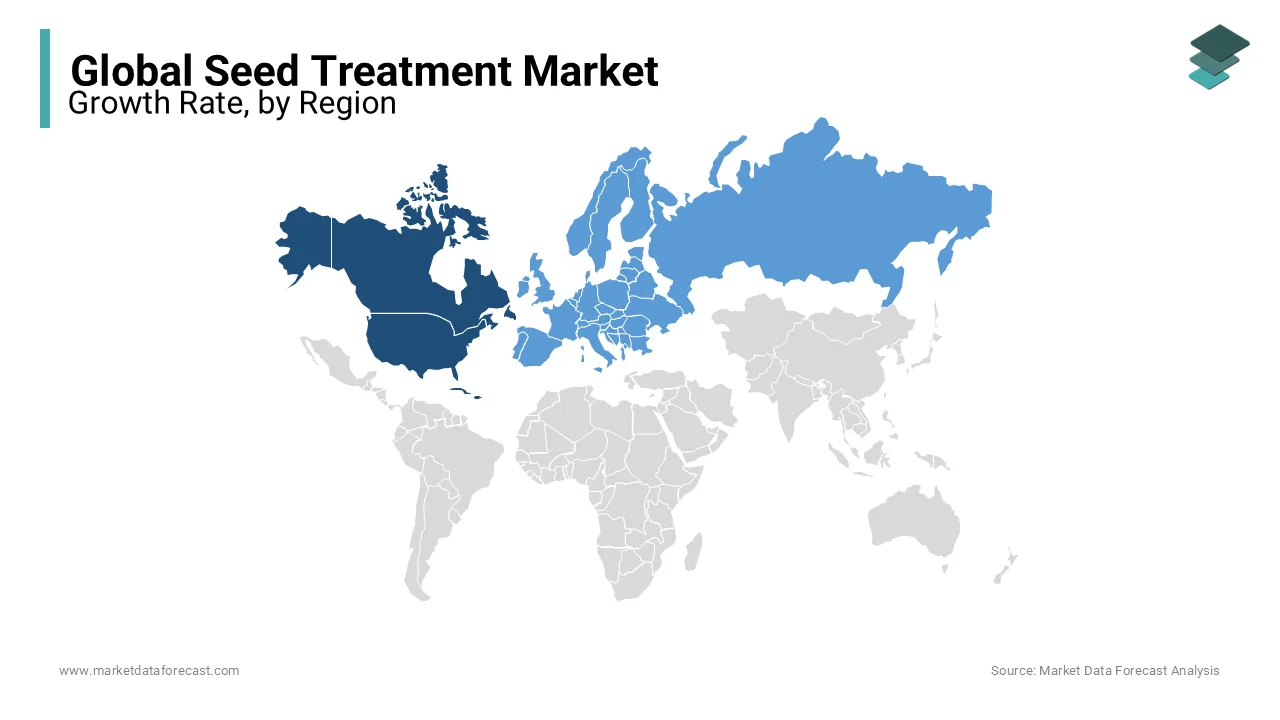

REGIONAL ANALYSIS

North America is the largest market for seed treatment and is expected to continue its dominance. Much of the region’s growth comes from the US, which is one of the largest treated seed exporting countries in the world. Moreover, seed treatment products are extremely controlled and governed as are seed-applied and sprayed pesticides. They go through a complete assessment by the US EPA and relevant state authorities before commercialization and regularly thereafter. The regional market is expected to expand in the coming as the demand for food is rising and the country is experiencing a decline of millions of acres that produce it. Urbanization alone was responsible for 11 million acres of cultivable land in the last 10 years. Hence, the segment’s market size is believed to expand during the forecast period.

Europe is likely to witness notable growth over the estimation period for the seed treatment. In the past few years, the political environment about this treatment has transformed. Moreover, the European seed treatment market is dedicated to supplying superior-quality treated seeds to cultivators and producers all over the continent. In addition, the regional market share is expected to increase due to a rise in the supply of treated seeds. Likewise, the supply of these to the United Kingdom farms is anticipated to be protected following the engagement of the Agricultural Industries Confederation (AIC) with the industry and Government to prevent a serious shortage.

The seed treatment market is projected to expand in the Asia Pacific due to higher economic growth in the region. This can be attributed to the surging demand for fodder plants. Moreover, the growing need for chemicals for crop protection is boosting the region’s market size in the coming years. Apart from these, this growth is also led by India and China, which captured a substantial market share. China established about 20 % of the APAC’s value, and India accounted for around 10 % of it. Further, the foundations, corporations and governments forcing these seeds have also been compelling the region to change its regulations about laws. This includes attempting to get regional nations to accept PVP and patent regulations, along with seed certification systems.

KEY MARKET PLAYERS

The Major Key market players in the global seed treatment market are Syngenta, Bayer CropScience, BASF, Monsanto, BioWorks Inc, Valent USA Corp, Adama Agricultural Solutions Ltd, Advanced Biological Marketing Inc, Brettyoung Limited, Chemtura Agrosolutions, Dupont, Germains Seed Technology.

RECENT HAPPENINGS IN THIS MARKET

- In August 2024, Relentless AG press released the launch of grower-first agricultural support for a modern age. It is committed to providing excellent-quality Pioneer seed, advanced solutions for crop protection and extensive agronomy services developed to optimise farm profitability and productivity.

- In March 2024, Helena Agri-Enterprises, to increase yield and sustainability, introduced two new products called “Entertia” and “Resgenix”. Entertia is a treatment for soybean seed with protected design technology which is designed to enhance root structure. And, Resgenix is a tool for water management to encourage consistent water absorption via the soil profile.

MARKET SEGMENTATION

This research report on the global seed treatment market has been segmented and sub-segmented based on crop type, Application, and Region.

By Crop Type

- Corn/Maize

- Soybeans

- Wheat

- Rice

- Canola

- Cotton

- Other Products

By Application

- Chemical Agents

- Insecticides

- Fungicides

- other chemicals

- Biological Agents

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the benefits of seed treatment?

Seed treatment offers several benefits, including improved seed germination, enhanced seedling vigor, protection against pests and diseases, reduced reliance on chemical pesticides, and increased crop yields. Additionally, seed treatments can help minimize the environmental impact of agricultural practices by targeting specific pests and diseases and reducing the need for blanket pesticide applications.

2. What factors are driving growth in the seed treatment market?

Several factors are driving growth in the seed treatment market, including increasing demand for higher crop yields and improved crop protection, growing awareness of the benefits of seed treatments among farmers, and the development of new and more effective seed treatment technologies. Additionally, stricter regulations on pesticide use and a greater focus on sustainable agricultural practices are also driving demand for seed treatments as alternatives to traditional chemical pesticides.

3. What are some challenges facing the seed treatment industry?

Some challenges facing the seed treatment industry include regulatory hurdles related to the approval and registration of new seed treatment products, concerns about the environmental and health impacts of certain chemical treatments, and the development of resistance among pests and diseases to commonly used seed treatment agents. Additionally, there is ongoing research and development to address these challenges and develop more sustainable and effective seed treatment solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com