Global Agricultural Enzymes Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report, Segmented By Type (Phosphatases, Dehydrogenases, Sulfatases), Product Type (Soil fertility products and Growth enhancing products), Crop Type (Cereals & grains, Fruits & vegetables, Oilseeds & pulses, Turfs & ornamentals, and Others), Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Industry Analysis From 2025 to 2033

Global Agricultural Enzymes Market Size

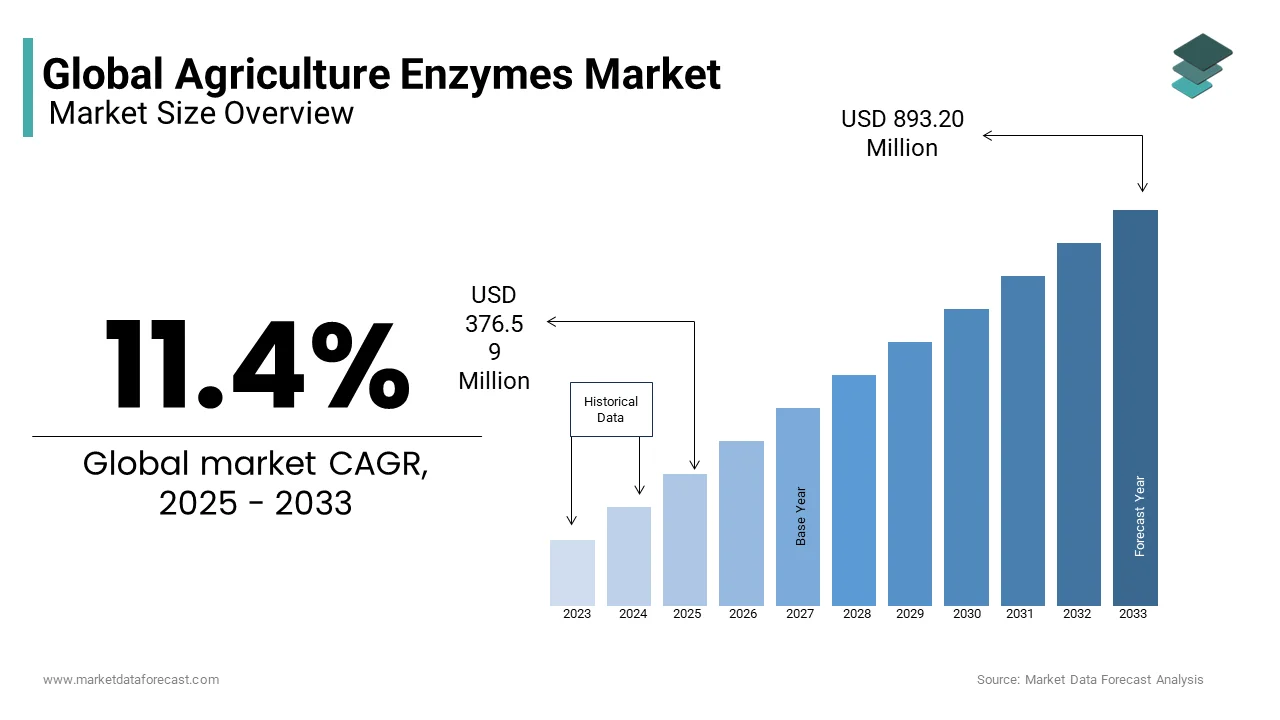

The global agricultural enzymes market size is expected to be valued at USD 338.05 million in 2024 and reach USD 376.59 million in 2025, from USD 893.20 million by 2033, growing at a CAGR of 11.4% during the forecast period from 2025 to 2033.

Modern agriculture costs less than traditional agriculture; hence, the adoption of modern agriculture is increasing, and the usage of agricultural enzymes will be more in this type of farming, which is anticipated to open a wide range of growth possibilities to the market participants. Furthermore, the growing demand for agricultural enzymes as these can reduce soil pollution, increasing investments by the key market participants, and the untouched potential in the developing countries are further anticipated to provide promising opportunities in the agricultural enzymes market.

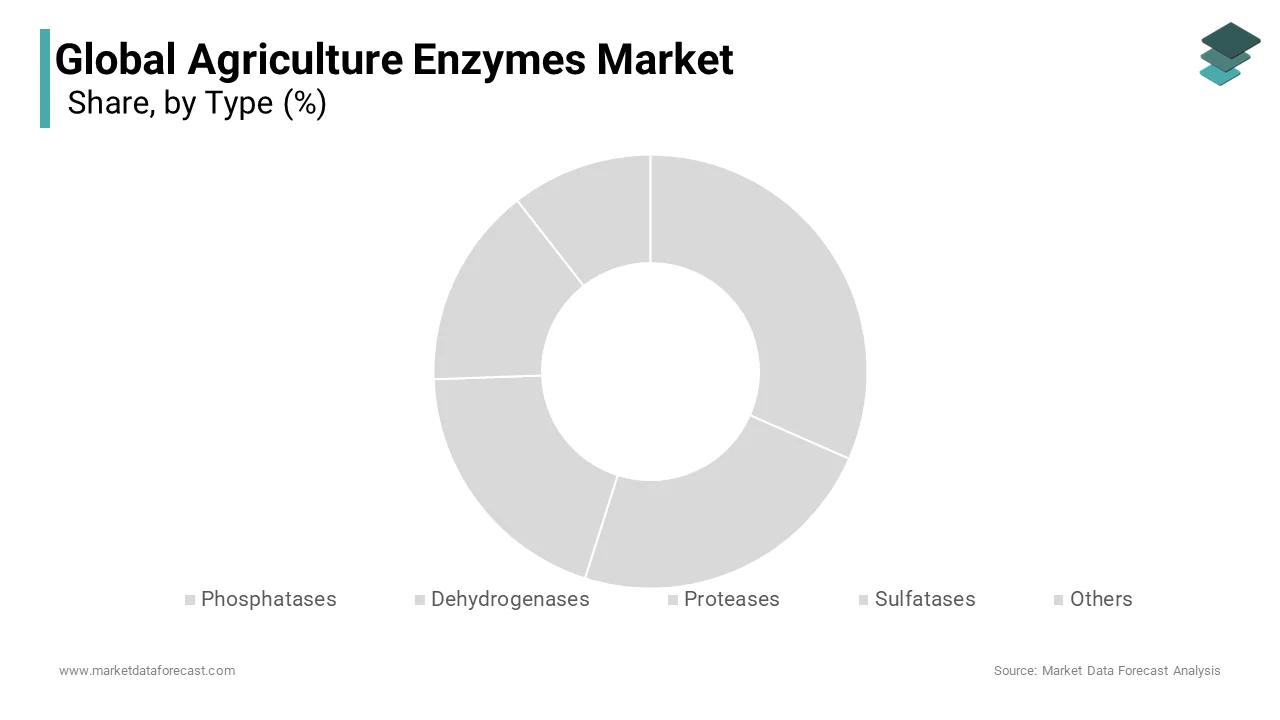

Agricultural enzymes work like change agents and promote the chemical reaction of supplying nutrients to the plant roots from the soil and enhancing the growth of the plants. Plants would not be getting these nutrients in the absence of agricultural enzymes. Therefore, using agricultural enzymes reduces the usage of chemicals in agriculture. Phosphatases, dehydrogenases, ureases, carbohydrates, proteases, phytases, sulfatases, and amylases are a few examples of agricultural enzymes. Among them, phosphatases are widely used.

MARKET DRIVERS

Growing adoption of organic farming worldwide and increasing demand for organic food propel the growth of the agricultural enzymes market. Organic farming is now in practice in more than 170 countries. The organic farming sector is booming in developing countries owing to the increasing investments in organic farming and the growing need for natural and healthy food for well-being. Enzymes are biodegradable and fit great in organic farming. On the other hand, the preference for organic food is increasing because of its nutritional benefits.

The usage of agricultural enzymes is growing significantly.

Agricultural enzymes help in increased crop production. The fact that costs associated with fertilizers are growing consistently leads to the growing adoption of agricultural enzymes. In addition, the increasing investments in conducting R&D around agricultural enzymes further promote the growth of the agricultural enzyme market. Agricultural enzymes play a critical role in increasing the production yields in arable lands, boosting market growth. The agricultural enzymes market has intense competition between the market participants, and to strengthen their position in the market, the key market players are making huge investments in R&D and focussing on developing cost-effective enzymes.

MARKET RESTRAINTS

High costs associated with R&D are one of the key factors limiting the growth rate of the agricultural enzymes market. In addition, strict regulations around biological products further hamper the growth of the agricultural enzymes market. The unwillingness of the farmers to accept the microbe-derived products is showcasing a negative impact on the market growth.

COVID-19 Impact on the Global Agricultural Enzymes Market

The agricultural enzymes market has experienced a mixed impact due to the COVID-19 pandemic. People have become more health conscious, and the desire to eat healthily has grown significantly with the impact created by the coronavirus. This paved the way and increased the demand for organic food and organic farming, further accelerating the agricultural enzymes market growth. On the other hand, the supply chain ecosystem has been impacted severely due to the imposed lockdowns and travel bans to control the spread of the virus. This has resulted in a negative impact on the market growth for a short period. However, considering the new normalization and increased demand for organic food from an increased audience, the market for agricultural enzymes is expected to register healthy growth during the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2029 |

|

CAGR |

11.4% |

|

Segments Covered |

By Product Type, Crop Type, Type, Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Novozymes, Agrinos, Agrilife, Stoller USA, Inc., BioWorks Inc., Syngenta AG, Aries Agro Limited, GreenMax AgroTech., Camson Bio Technologies Limited, Valmont Industries, Aum Enzymes, Cypher Environmental, DuPont and Deepak Fertilizers and Petrochemicals, Chr. Hansen Holding A/S, Amano Enzyme Inc., Aumgene Biosciences, Megazyme Ltd., Enzyme Supplies Limited |

SEGMENTAL ANALYSIS

By Type Insights

The phosphatases segment accounted for the largest share of the agricultural enzymes market in 2021. Phosphatases are one of the most used agricultural enzymes among all segments. In most cases, the phosphatases are used to eliminate the phosphate group from protein and can further solubilize the soil mineral elements. Therefore, the growing usage of phosphatases is one of the major factors promoting the growth of this segment.

By Crop Type Insights

The cereals and grains segment had the largest share of the market in 2021. Cereals and grains have significant demand worldwide, and more crops are required to satisfy the food requirements of the worldwide population. The usage of agricultural enzymes is high in cereals and grains as they fertilize the soil help promote plant growth and enhance yield. Regions such as Asia-Pacific that depend heavily on rice crops use agricultural enzymes.

The fruits and vegetables segment was the second largest segment in the global market in 2021. The demand for fruits and vegetables that have grown organically is growing considerably. Organic fruits and vegetables have better nutritional value and offer numerous benefits to fight diseases. To satisfy the growing need for organic fruits and vegetables, more organic farming that requires the growing usage of agricultural enzymes should happen. Likewise, the market is anticipated to grow further.

On the other hand, the oil seeds and pulses segment is expected to register a healthy CAGR during the forecast period.

By Product Type

The soil fertility products segment is anticipated to have the highest CAGR during the forecast period. The usage of soil fertility products has seen a spike recently as there was a drastic decrease in soil fertility. The trend is expected to continue for more years and help the segment to grow considerably. In addition, these products aid in improving the fertility levels of soil.

On the other hand, the growth-enhancing products segment is also expected to register a healthy CAGR from 2022 to 2027. This is because the demand for growth-enhancing products is growing decently owing to the increasing usage of these products to improve flowering and promote plant growth.

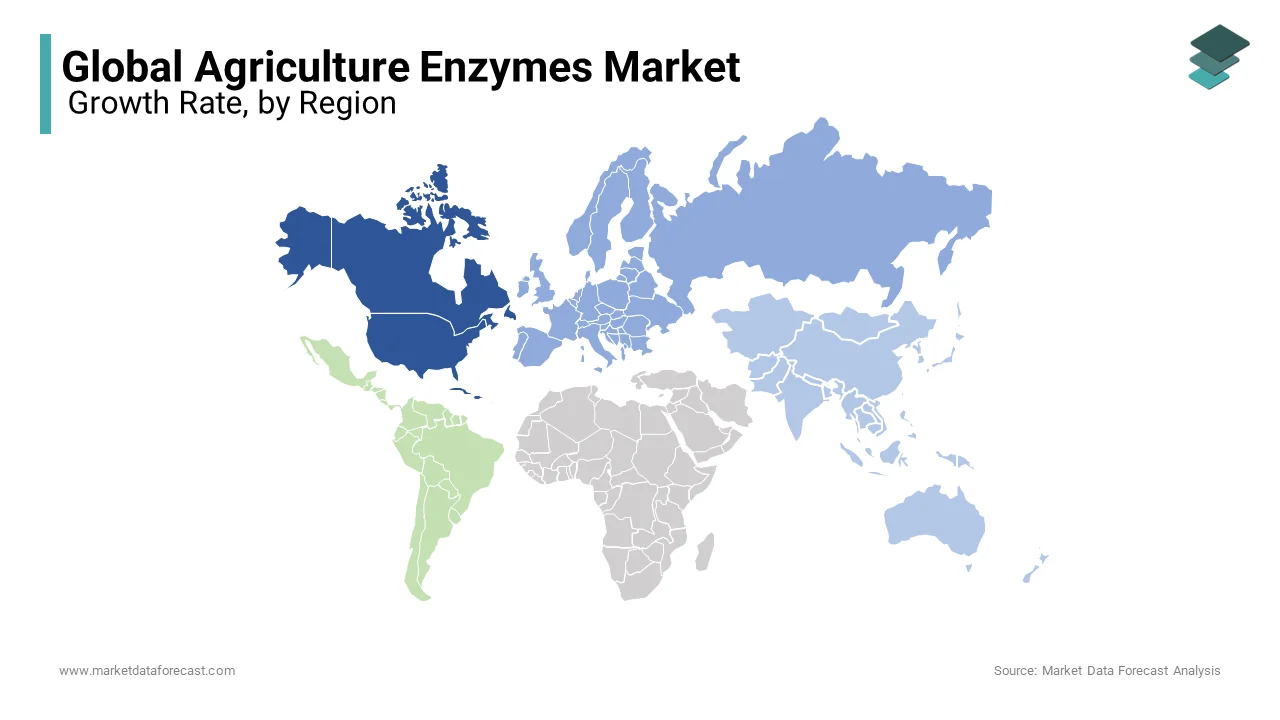

REGIONAL ANALYSIS

North America led the worldwide agricultural enzymes market in 2021, and the domination of this region is projected to be there throughout the forecast period. The domination of North America is attributed to technological advancements in the agriculture industry and the massive availability of investments. In addition, farmers becoming aware of agriculture biotechnology and the growing usage of agricultural biologics in North America are further fuelling the market growth in this region. The U.S. market is showcasing significant domination, followed by Canada in the North American region.

The European region had a substantial share of the global market in 2021. Growing demand for organic food is one factor boosting Europe's market growth. In addition, countries such as Spain, Italy, and France have large areas of organic farmland in Europe.

During the forecast period, the APAC region is expected to grow at the highest CAGR among all regions in the global market. APAC is one of the untapped markets for agricultural enzymes. In the Asia-Pacific region, the awareness and implementation of organic farming are growing rapidly, primarily promoting the agricultural enzymes market. In addition, the adoption of technological farming advancements is increasing in the APAC market, further estimated to boost the market growth.

KEY MARKET PLAYERS

Novozymes, Agrinos, Agrilife, Stoller USA, Inc, BioWorks Inc, Syngenta AG, Aries Agro Limited, GreenMax AgroTech, Camson Bio Technologies Limited, Valmont Industries, Aum Enzymes, Cypher Environmental, DuPont and Deepak Fertilisers and Petrochemicals, Chr. Hansen Holding A/S, Amano Enzyme Inc, Aumgene Biosciences, Megazyme Ltd, Enzyme Supplies Limited. Some of the market players dominate the global agriculture enzymes market.

RECENT HAPPENIGS IN THE MARKET

- In June 2022, Biotalys and Novozymes announced their partnership to generate more opportunities for the biodegradable, protein-based product called Evoca™.

- In August 2022, BASF, one of the largest chemical producers from Germany, announced the divesting of its Nutrilife® baking enzymes business to Lallemand.

- In March 2021, BASF announced the expansion of R&D towards sustainable agriculture solutions.

MARKET SEGMENTATION

This research report on the agriculture enzymes market has been segmented & sub-segmented into the following categories.

By Type

- Phosphatases

- Dehydrogenases

- Proteases

- Sulfatases

- Others

By Crop Type

- Cereals & grains

- Fruits & vegetables

- Oilseeds & pulses

- Turfs & ornamentals

- Others

By Product Type

- Soil fertility products

- Growth enhancing products

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the global agriculture enzymes market?

The global agriculture enzymes market is valued at USD 376.59 million in 2025.

Which regions are leading in terms of market share for agriculture enzymes?

North America and Europe currently hold the largest market share for agriculture enzymes, driven by the adoption of sustainable agricultural practices and the presence of advanced farming technologies.

How is the agriculture enzymes market in North America responding to the shift towards bio-based agricultural inputs?

In North America, the agriculture enzymes market is witnessing increased demand for bio-based agricultural inputs as farmers seek alternatives to chemical fertilizers and pesticides, driving market growth.

What factors are hindering the growth of the agriculture enzymes market in Latin America?

In Latin America, factors such as limited awareness about the benefits of agriculture enzymes, price sensitivity among farmers, and the prevalence of traditional farming practices are hindering market growth.

Who are the key players dominating the agriculture enzymes market in Asia Pacific?

Companies such as Novozymes A/S, Syngenta Group, and BASF SE are among the key players dominating the agriculture enzymes market in Asia Pacific.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]