Global Air Conditioners Market Size, Share, Trends & Growth Forecast Report By Product (Portable AC, Window AC and Split AC), Application (RAC, PAC and VRF), End-User (Residential, Commercial and Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis from 2024 to 2032

Global Air Conditioners Market Size

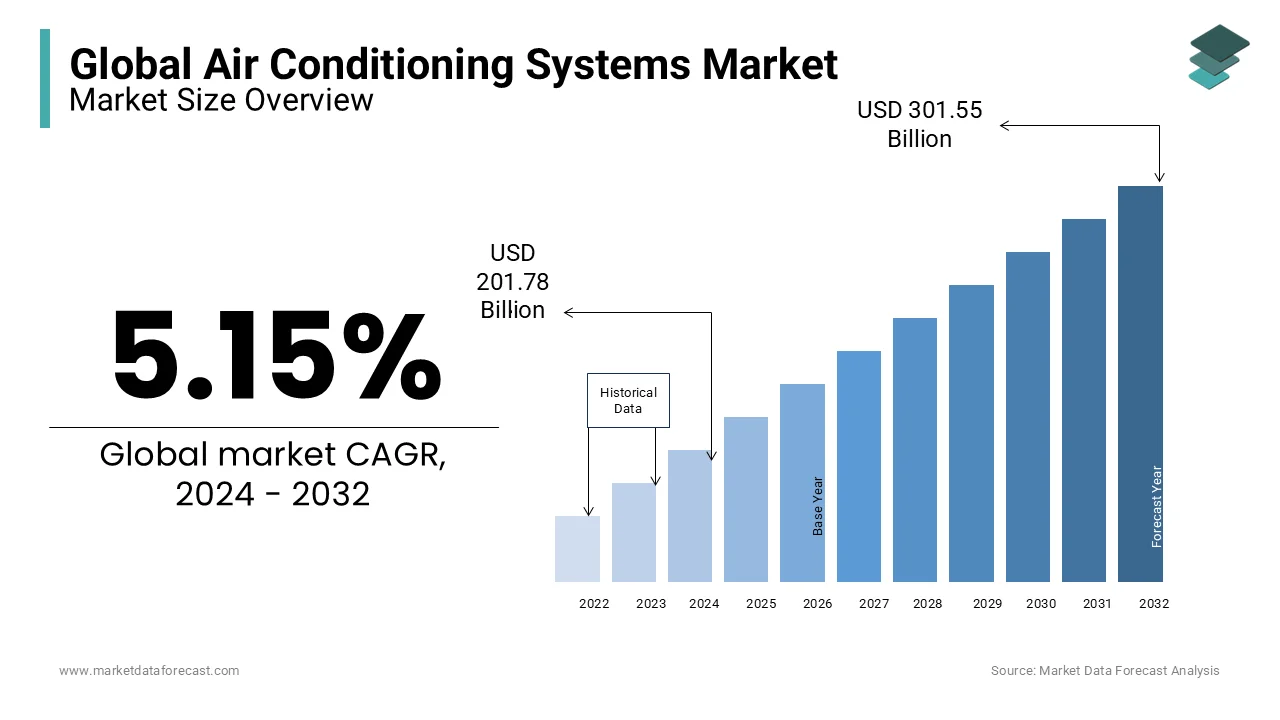

The size of the global air conditioner market was worth USD 191.9 billion in 2023. The global market is anticipated to grow at a CAGR of 5.15% from 2024 to 2032 and be worth USD 301.55 billion by 2032 from USD 201.78 billion in 2024.

The demand for air conditioners is growing at a brisk pace worldwide owing to the increasing temperatures. According to NASA, 2024 was predicted to be among the hottest years on record, with temperatures projected to be 1.1°C higher than pre-industrial levels because global temperatures continue to climb. Air conditioning contributes to approximately 10% of global electricity usage and the International Energy Agency (IEA) predicts that demand could triple by 2050.

MARKET DRIVERS

Rising Temperatures Worldwide

Rising global temperatures are a primary driver of the air conditioner market. This has led to a surge in demand for cooling solutions, especially in regions experiencing frequent heat waves. The International Energy Agency (IEA) highlights that the number of cooling-degree days, an indicator of energy demand for cooling, has risen by over 20% in the past decade. This trend is pushing the adoption of air conditioners as a necessity rather than a luxury in many parts of the world.

Urbanization and Infrastructure Development

Urbanization and rapid infrastructure development are fueling demand for air conditioners in residential and commercial buildings. The United Nations projects that 57% of the global population will live in urban areas by 2024, up from 55% in 2020. This shift is accompanied by increased construction activities in developing economies and is particularly in Asia-Pacific. According to the World Bank, India and China collectively accounted for over 35% of global urban expansion between 2020 and 2024. These developments, when coupled with rising disposable incomes, are driving the adoption of energy-efficient air conditioning systems to cater to growing urban demands.

MARKET RESTRAINTS

High Energy Consumption and Costs

The high energy consumption associated with air conditioners is a significant restraint. According to the International Energy Agency (IEA), air conditioning accounts for nearly 10% of global electricity consumption which contributes to rising energy bills for consumers and increasing pressure on power grids. This has deterred middle-income households from adopting air conditioners in regions with high electricity prices. Additionally, the IEA estimates that cooling energy demand will triple by 2050 if current trends continue raising concerns about energy sustainability and affordability. Governments are implementing stricter energy efficiency standards but initial costs for energy-efficient systems remain a barrier for many.

Environmental Concerns and Regulations

Environmental concerns regarding refrigerants like HFCs used in air conditioners pose a significant challenge. The United Nations Environmental Programme (UNEP) highlights that HFCs are potent greenhouse gases, with some having a global warming potential (GWP) thousands of times higher than CO2. The Kigali Amendment to the Montreal Protocol mandates an 80% reduction in HFC emissions by 2047, which leads to increased costs for manufacturers to develop eco-friendly alternatives. Furthermore, compliance with regulations like Minimum Energy Performance Standards (MEPS) in over 50 countries has raised production costs, which limits affordability and market expansion, especially in price-sensitive regions.

MARKET OPPORTUNITIES

Adoption of Renewable Energy-Powered Cooling Systems

The integration of renewable energy in air conditioning systems presents a significant growth opportunity. According to the International Renewable Energy Agency (IRENA), solar-powered cooling systems can reduce energy costs by up to 40% while significantly cutting greenhouse gas emissions. With the global renewable energy capacity reaching over 3,372 GW in 2024, incorporating solar and hybrid cooling systems into residential and commercial buildings aligns with global sustainability goals. Governments, particularly in emerging economies, are offering subsidies for renewable energy solutions, which fosters the adoption of green air conditioners and creates opportunities for manufacturers to innovate and capture this niche market.

Smart Air Conditioning Technology

Smart air conditioners enabled by IoT and AI are rapidly gaining traction as consumers prioritize energy efficiency and convenience. The U.S. Department of Energy highlights that smart ACs can reduce energy consumption by 10-30% through automated settings and demand-response capabilities. The global penetration of smart home technologies is projected to reach over 15% by 2025, which is driven by rising internet connectivity and adoption of smart devices. Manufacturers leveraging AI-driven climate control and integration with smart home ecosystems such as Alexa or Google Home are positioned to capture this growing demand for advanced and user-friendly cooling solutions, particularly in developed markets.

MARKET CHALLENGES

Recycling and Disposal of Air Conditioning Units

The disposal of air conditioning units poses a critical environmental challenge. According to the United Nations Environment Programme (UNEP), less than 20% of air conditioners are recycled globally, leading to significant waste accumulation, including harmful refrigerants and non-biodegradable components. The improper disposal of HFCs contributes to ozone depletion and climate change which prompts stricter regulations. For instance, the European Union mandates proper end-of-life refrigerant recovery under the F-Gas Regulation is increasing compliance costs. Developing economies face additional challenges due to a lack of recycling infrastructure and further complicating efforts to address this growing environmental issue.

Supply Chain Disruptions

Global supply chain disruptions are exacerbated by geopolitical tensions, and the COVID-19 pandemic remains a major challenge for the air conditioner market. The World Trade Organization (WTO) reported a 5.2% decline in global merchandise trade in 2023, impacting the availability of critical components like semiconductors and refrigerants. Prolonged delays and rising raw material costs have hindered manufacturers' ability to meet growing demand. In 2024, high freight costs and supply chain bottlenecks and particularly in Asia-Pacific, have increased production costs and reduced profitability and delayed product launches. Manufacturers are now focusing on regional supply chains to mitigate these challenges.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

5.15% |

|

Segments Covered |

By Product Type, Distribution Channel, End-User & Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

Daikin Industries, Carrier Global Corporation, Johnson Controls International, Mitsubishi Electric Corporation, LG Electronics Inc., Samsung Electronics Co., Ltd., Hitachi, Ltd., Fujitsu General Ltd., Trane Technologies plc, Lennox International Inc., Panasonic Corporation, Midea Group Co., Ltd., Haier Smart Home Co., Ltd., GREE Electric Appliances Inc., Dover Corporation (Unified Brands), Rheem Manufacturing Company, Emerson Electric Co., Nortek Global HVAC LLC, Bosch Thermotechnology Corporation |

SEGMENTAL ANALYSIS

By Product Type Insights

The split air conditioners segment accounted for 61.02% of the market share in 2023. Their widespread adoption is due to their effectiveness in providing efficient cooling with lower energy consumption. These units are ideal for both residential and commercial applications making them a preferred choice for cooling needs worldwide. According to the International Energy Agency (IEA), air conditioning accounted for nearly 10% of global electricity consumption in 2020, and split air conditioners, known for their energy efficiency, play a significant role in reducing overall energy use compared to older cooling systems. Their dominant position in the market underscores their essential role in fulfilling the growing demand for reliable and energy-efficient cooling solutions across different regions.

The ductless air conditioners segment is growing promisingly and is estimated to register a CAGR of 10.75% from 2024 to 2032. Ductless systems are increasingly popular because they offer flexibility in installation, energy efficiency, and integration with smart home technologies. Their rapid growth is fueled by rising demand for customizable and sustainable cooling solutions, especially in urbanized areas with rising temperatures. According to the U.S. Department of Energy, ductless systems can be up to 30% more efficient than traditional central air systems which makes them increasingly popular as energy-conscious consumers seek more sustainable solutions. The strong CAGR reflects a shift in consumer preferences toward more adaptable and eco-friendly cooling systems.

By Distribution Channel Insights

The multi-bard stores segment led the market in 2023 and is projected to grow at the fastest CAGR in the global market during the forecast period. Multi-brand stores are dominating the market as they carry products from various manufacturers and have traditionally been a significant distribution channel. These stores provide consumers with a range of options, allowing them to compare different brands and models in one location. They are particularly prevalent in regions where consumers value choice and prefer to physically inspect products before making a purchase.

The exclusive stores segment is predicted to witness a noteworthy CAGR during the forecast period. Exclusive stores have gained prominence in direct and focused brand experience. These stores often emphasize brand loyalty, showcasing the full range of products and providing expert advice.

The online distribution channel has seen the third substantial growth, driven by the increasing trend of e-commerce. Consumers appreciate the convenience of browsing and purchasing air conditioning systems online. This channel allows for easy price comparison, reviews, and doorstep delivery.

By End-User Insights

The residential segment dominated the market worldwide by accounting the major share of the global market in 2023. This dominance is driven by factors such as the rise in global temperatures and more frequent heatwaves, which make cooling solutions essential in many homes. The U.S. Department of Energy reports a 40% increase in air-conditioned homes in the last two decades, as per the US-DOE. Urbanization, especially in emerging markets and has further contributed to the surge in residential construction, where air conditioning is now a common feature. Additionally, growing disposable incomes in regions like Asia-Pacific and Latin America have made air conditioners more accessible to homeowners.

Meanwhile, the commercial segment is swiftly advancing and is predicted to exhibit a CAGR of 4.7% during the forecast period. The demand for air conditioning in commercial spaces, including office buildings, hotels, and retail outlets, is expanding rapidly. The U.S. Energy Information Administration notes that more than 50% of commercial buildings in the U.S. are equipped with air conditioning, and this adoption rate is expected to increase with growing commercial infrastructure globally. Additionally, advancements like Variable Refrigerant Flow (VRF) systems and energy-efficient controls are enhancing the appeal of these solutions in business environments, driving further market growth.

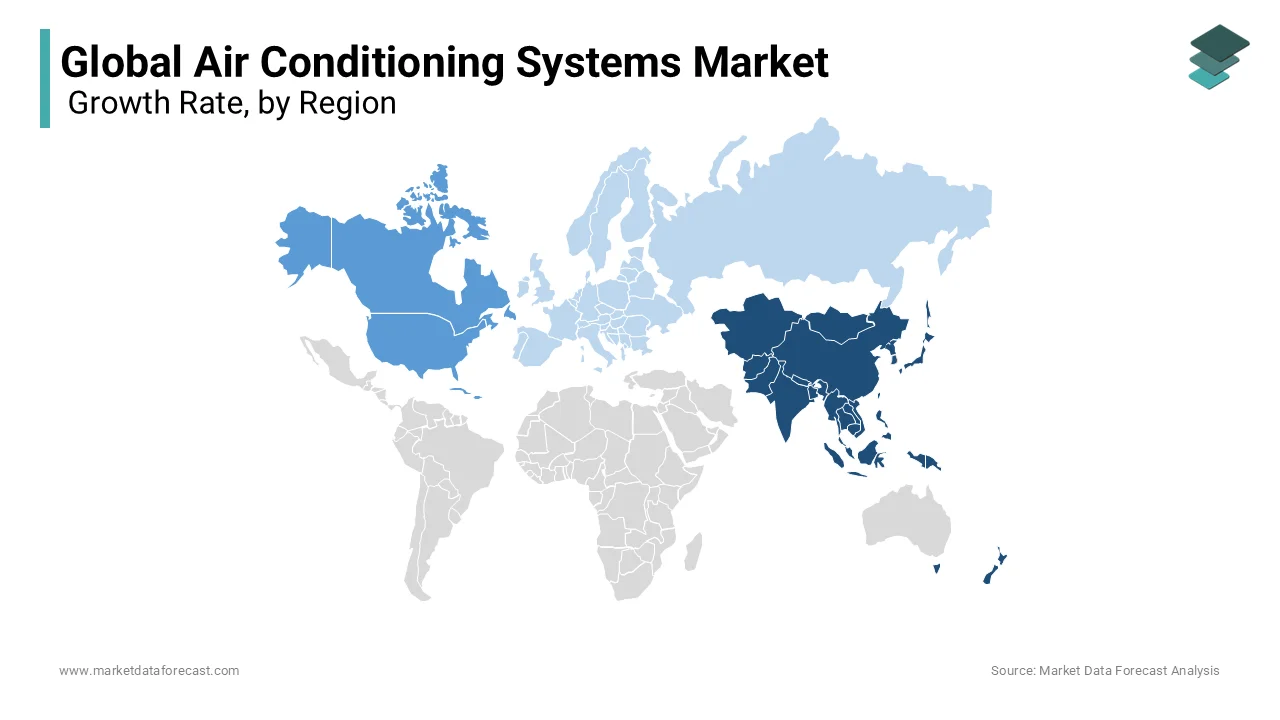

REGIONAL ANALYSIS

North America led the air conditioner market worldwide in 2023 and held 31.8% of the global market share. The domination of North America in the global market is driven by rising temperatures, urbanization, and consumer preferences for energy-efficient and smart cooling solutions. According to the International Energy Agency (IEA), the increasing use of air conditioners is one of the key drivers of global electricity demand growth. The region is characterized by high penetration rates and significant energy consumption. In the United States, approximately 88% of households are equipped with air conditioning systems, and 66% utilize central air systems, as per the US Department of Energy (DOE). This widespread usage contributes to air conditioners accounting for about 12% of total household electricity consumption in the U.S., with an annual expenditure of approximately $29 billion for homeowners, according to DOE.

Europe is another major market for air conditioners and is projected to grow at a prominent CAGR during the forecast period due to stricter energy efficiency regulations and the adoption of reversible systems that offer both cooling and heating. Nearly all RACs sold in Europe are now multifunctional, which reflects consumer demand for energy-efficient and sustainable solutions, as per the European Product Registry for Energy Labelling (EPREL). Moreover, by 2020, this number surged to over 57 million, with figures estimating more than 100 million RACs by 2030, equating to approximately 35% of European households equipped with at least one unit, according to EPREL. Despite this growth, air conditioning remains less prevalent in Europe compared to regions like the United States or Asia due to Europe's historically milder climate. However, climate change has intensified the need for cooling solutions. Data from Eurostat indicates that cooling degree days are a measure of demand for energy to cool buildings and closely tripled from 37 in 1979 to 100 in 2021.

Asia-Pacific is experiencing rapid growth and is estimated to grow at a CAGR of 6.5% for the forecast period. It is fueled by increasing urbanization, rising incomes and escalating temperatures due to climate change. In Southeast Asia, only 15% of households owned an air conditioner as of 2019, indicating substantial potential for market expansion, as per the IEA. The International Energy Agency (IEA) projects that the stock of air conditioning units in Southeast Asia will rise from nearly 50 million units in 2020 to 300 million units by 2040 which is a sixfold increase. Electricity consumption for space cooling in the ASEAN region is expected to grow to 300 terawatt-hours (TWh) by 2040, which is equivalent to the current electricity consumption of Indonesia and Singapore combined. Implementing energy efficiency measures could save up to 110 TWh, reducing projected energy use by over one-third.

Latin America is poised for significant growth and is projected to grow at a CAGR of 5.8% throughout the estimation period. This reflects the increasing demand for cooling solutions. The regional market is influenced by rising incomes, urbanization and increasing temperatures. Currently, only about 15% of households in Latin America and the Caribbean own air conditioners, which indicates substantial room for market expansion. Further, the International Energy Agency (IEA) projects that air conditioner ownership in the region will increase by 40% by 2030, driven by the growing middle class and rising temperatures. In response to the increasing demand and associated energy consumption, countries are implementing energy efficiency regulations. For instance, the Central American Integration System (SICA) introduced a regional regulation on energy efficiency for inverter air conditioners in 2022 which is aimed at reducing energy use and harmonizing standards.

The market in the Middle East and Africa is estimated to showcase a steady CAGR during the forecast period owing to the increasing demand for residential and commercial cooling and is experiencing rapid growth driven by rising temperatures, urbanization and economic development. The International Energy Agency (IEA) forecasts a substantial increase in air conditioner stock in the Middle East, which will contribute to a global rise from approximately 1.6 billion units in 2020 to an estimated 5.6 billion units by 2050. In Africa, residential cooling demand is expected to surge, with electricity consumption for cooling anticipated to reach nearly 200 terawatt-hours (TWh) by 2040 under the IEA’s Stated Policies Scenario, which is a significant rise from minimal levels in 2018. This surge in demand poses challenges for energy infrastructure, which highlights the need for greater energy efficiency. Implementing minimum energy performance standards (MEPS) can effectively manage energy use because it demonstrates successful savings in Kenya. Sustainable practices will be essential to managing this market’s expansion.

KEY MARKET PLAYERS

Companies playing a prominent role in the global air conditioning systems market include Daikin Industries, Carrier Global Corporation, Johnson Controls International, Mitsubishi Electric Corporation, LG Electronics Inc., Samsung Electronics Co., Ltd., Hitachi, Ltd., Fujitsu General Ltd., Trane Technologies plc, Lennox International Inc., Panasonic Corporation, Midea Group Co., Ltd., Haier Smart Home Co., Ltd., GREE Electric Appliances Inc., Dover Corporation (Unified Brands), Rheem Manufacturing Company, Emerson Electric Co., Nortek Global HVAC LLC, Bosch Thermotechnology Corporation.

The Air Conditioner Market is highly competitive, consisting of established players and emerging companies vying for market share. Dominated by key manufacturers like Daikin Industries, Carrier Global, Midea Group, LG Electronics, and Hitachi, the competition revolves around innovation, energy efficiency, and sustainability. These companies are investing heavily in R&D with a focus on developing smart, eco-friendly and energy-efficient cooling systems to meet regulatory standards and evolving consumer preferences. The market is also witnessing significant regional dynamics. In Asia-Pacific, local players like Gree and Haier compete aggressively with global brands by offering cost-effective and high-performance solutions. In contrast, North America and Europe emphasize premium products and green technologies and is driven by stricter environmental regulations.

Strategic initiatives like mergers and acquisitions, such as Daikin’s acquisition of Alliance Air Products in 2024, have allowed companies to expand product portfolios and strengthen regional footholds. Additionally, partnerships with renewable energy firms and advancements in AI-driven smart technologies are intensifying competition. Rising demand for affordable solutions in developing economies further heightens competition among budget-oriented players. However, supply chain disruptions and regulatory compliance challenges are reshaping competitive strategies and is pushing companies to localize production and innovate to maintain profitability while catering to sustainability goals.

RECENT HAPPENINGS IN THE MARKET

- In July 2024, Carrier Global sold its building security business to Honeywell for approximately $5 billion, allowing Carrier to focus more on its core HVAC operations.

- In January 2024, Rheem Manufacturing Company announced plans to focus on decarbonization and sustainability in HVAC systems, aligning with industry trends towards eco-friendly solutions.

- In 2023, Daikin focused on energy-efficient solutions. They might have introduced new products or technologies aimed at improving energy efficiency and sustainability in air conditioning systems.

- In 2023, Carrier introduced advancements in smart HVAC systems, integrating IoT for improved efficiency and control.

- In 2023, LG has been active in the air conditioning market, and their developments include advancements in air purification technologies, energy efficiency, and smart connectivity features in their systems.

MARKET SEGMENTATION

This global air conditioners market research report has been segmented and sub-segmented into the following categories.

By Product Type

- Window

- Split And Multi-Split

- Packaged Air Conditioner

- Variable Refrigerant Flow

- Others

By Distribution Channel

- Multi-Brand Stores

- Exclusive Stores

- Online

- Others

By End-user

- Residential

- Commercial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the predicted market size for Air Conditioning Systems Market by the end of 2032?

The Air Conditioning Systems Market is USD 301.55 billion in 2032

Which region is expected to have a high market share?

The Asia-Pacific region has the highest share of the Air Conditioning Systems Market.

What is the expected CAGR of the Air Conditioning Systems Market by the end of 2032?

The expected CAGR of the air conditioning systems market by the end of 2032 is 5.15%.

Who are the key players in the Air Conditioning Systems Market?

Haier Group Corporation, Daikin Industries Ltd, Hitachi-Johnson Controls Air Conditioning Inc., LG Electronics Inc., Mitsubishi Electric Trane HVAC US LLC, Whirlpool Corporation, Electrolux North America, Inc., Lennox International Inc., Panasonic Corporation, Samsung Electronics Co. Ltd.

What is the major challenge faced by the Air Conditioning Systems Market?

The major challenge faced by the market is the high installation costs and maintenance costs of the air conditioning systems market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com