Global Aircraft Lighting Market Size, Share, Trends, & Growth Forecast Report – Segmented by Aircraft Type (Commercial, Military, Business Jets & General Aviation, Helicopters), Light Source (LED, Fluorescent), Light Type (Interior Lights, Exterior Lights), End User (OEM, Aftermarket), & Region - Industry Forecast From 2024 to 2032

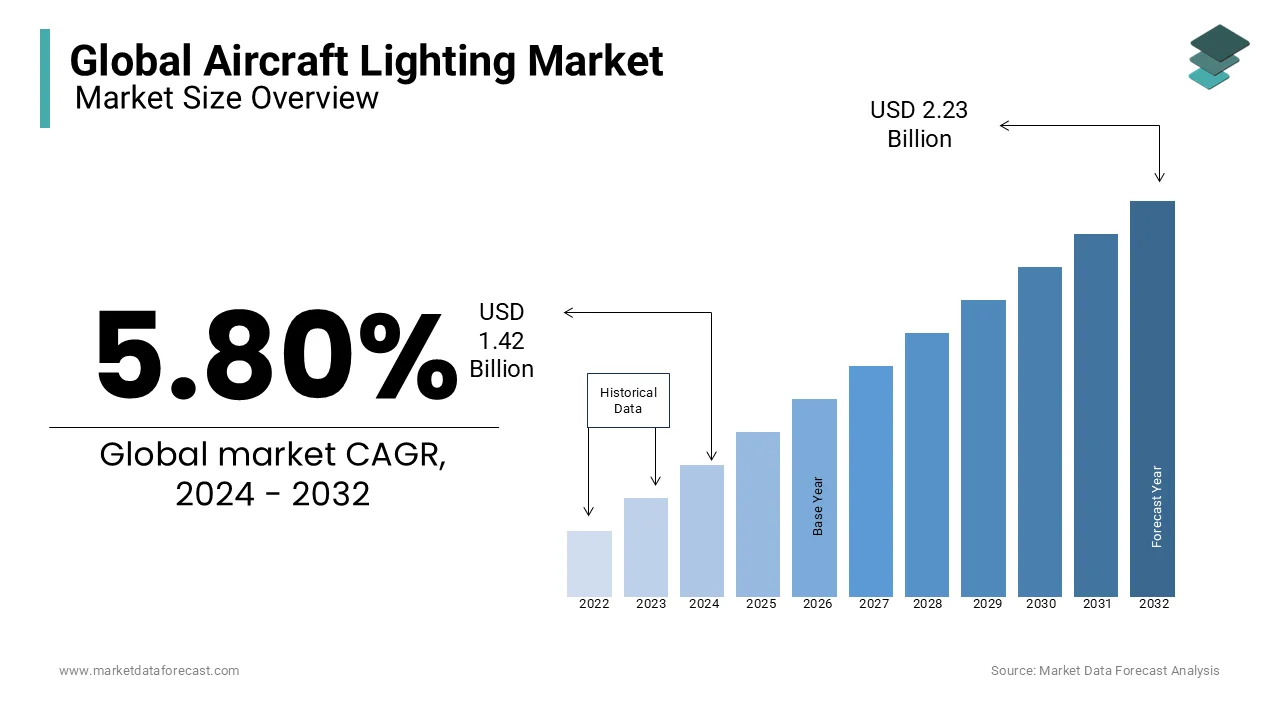

Global Aircraft Lighting Market Size (2024 to 2032)

The global aircraft lighting market was worth USD 1.34 billion in 2023. The global market is expected to be worth USD 1.42 billion in 2024. It is expected to grow at a CAGR of 5.80% during the forecast period and reach a value of USD 2.23 billion by 2032.

Aircraft lighting is a vital component of the aviation system. It provides protection, visibility, and correct navigation for aircraft service. Numerous advances have been made on the basis of the technology that enhances performance and fuel consumption. Such lights give the pilots in the cockpit visibility in order to avoid accidents and to correct the course in harsh climatic conditions. Aircraft lighting plays a useful role in indicating the ground personnel at the time of take-off and landing.

MARKET DRIVERS

The increase in the number of passengers and their preference for air transport is a driving factor for the aircraft lighting industry.

Significant economic growth in developing countries, as well as in small regions making considerable efforts to improve their financial status, are other factors driving the aviation sector that indirectly impact aircraft market growth. Rising demand for aircraft to meet transport needs, new players emerging in aircraft production, and the development of low-cost aircraft. Advances in engineering, intelligent lighting solutions, the advent of LED lights, and newly constructed lightweight products.

Besides, collaborations and acquisitions are expected to enable leading players to enhance their product portfolios and expand into different geographic regions. High demand for energy-efficient lighting systems in emerging economies, such as Asia-Pacific and LAMEA, along with increased privatization of airline companies, is expected to provide numerous growth opportunities during the forecast period.

MARKET RESTRAINTS

Customized lighting systems and equipment have been developed by leading market players to meet the needs of customers. Also, they concentrate on exploring innovations and applications through software demonstrations to increase their business outreach. LED lighting systems are adopted by airline operators due to higher efficiency, lower costs, and improved lighting quality.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

5.80% |

|

Segments Covered |

By Aircraft Type, Light Source, Light Type, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Astronics (US), Cobham (US), Honeywell (US), Luminator Technology Group (US), Collins Aerospace (US), Soderberg Manufacturing Company (US), Diehl Stiftung (Germany), Oxley Group (UK), and STG Aerospace (UK), among others. |

SEGMENTAL ANALYSIS

Global Aircraft Lighting Market Analysis By Aircraft Type

On the basis of aircraft type, the Aircraft Lighting market is segmented into commercial aviation, military aviation, business jets, and general aviation and helicopters. Among these segments, the helicopter aircraft type segment holds the major share of the market, with a rise in tourism through commercial helicopters as there is a rise in demand for deploying advanced cabin comfort features.

Global Aircraft Lighting Market Analysis By Light Source

On the basis of the light source, the Aircraft Lighting market is segmented into two types: LED and fluorescent. Among these segments, the LED segment holds the major share of the market.

Global Aircraft Lighting Market Analysis By Light Type

Interior lighting includes reading lamps, ceiling and wall lights, signs, ground path lighting bars, and laundry lights, among others. Airlines insist on the installation of multi-color indoor lighting to create an atmosphere depending on the demand or mood of the passengers. The growing demand for enhanced passenger experience and comfort is expected to fuel the segment of interior lighting.

Global Aircraft Lighting Market Analysis By End User

Based on end-user, the Aircraft Lighting market is segmented into two types, namely OEM and aftermarket. Among these segments, the OEM segment holds the major share of the market.

REGIONAL ANALYSIS

North America's Aircraft Lightning market growth is driven mainly by the high demand for air travel and increased flight experience. The increase in passenger traffic in this region is leading to an increase in aircraft orders, which in turn leads to a rise in the demand for aircraft lights. In addition, the high demand for aircraft lighting products in North America can also be due to the presence of major aircraft manufacturers in the area. There is also a massive demand from OEMs and airlines for highly efficient LED lights to reduce carbon emissions in the area.

KEY MARKET PLAYERS

The key market players in the Aircraft Lighting Market are Astronics (US), Cobham (US), Honeywell (US), Luminator Technology Group (US), Collins Aerospace (US), Soderberg Manufacturing Company (US), Diehl Stiftung (Germany), Oxley Group (UK), and STG Aerospace (UK), among others.

RECENT HAPPENINGS IN THE MARKET

- In November 2018, United Technologies (UTC) obtained final regulatory approval to buy Rockwell Collins, which is one of the biggest acquisitions in the history of the aerospace industry. As part of the new purchase, Rockwell Collins became Collins Aerospace in a combined restructuring with UTC Aerospace Systems.

DETAILED SEGMENTATION OF THE GLOBAL AIRCRAFT LIGHTING MARKET INCLUDED IN THIS REPORT

This research report on the global aircraft lighting market has been segmented and sub-segmented based on the aircraft type, light source, light type, end-user, and region.

By Aircraft Type

- Commercial

- Military

- Business Jets & General Aviation

- Helicopters

By Light Source

- LED

- Fluorescent

By Light Type

- Interior Lights

- Exterior Lights

By End User

- OEM

- Aftermarket

By Region

- North America

- Europe

- Asia-Pacific

- Middle East and Africa

- Latin America

Frequently Asked Questions

What are the major factors driving the growth of the aircraft lighting market?

Key factors driving market growth include increasing demand for new aircraft, advancements in LED lighting technology, rising focus on passenger comfort and safety, and the growing trend of modernizing existing aircraft fleets.

Which types of aircraft lighting systems are most commonly used?

The most commonly used aircraft lighting systems include interior lighting (such as cabin, cockpit, and emergency lighting) and exterior lighting (such as navigation, landing, and runway turnoff lights). LED technology is increasingly being adopted across these applications due to its energy efficiency and longer lifespan.

What are the challenges faced by the global aircraft lighting market?

Challenges include high initial costs of LED lighting systems, stringent regulatory requirements, and the complexity of integrating advanced lighting systems into existing aircraft. Additionally, the impact of COVID-19 on the aviation industry has led to delays and reductions in aircraft orders and deliveries.

What future trends are expected to shape the aircraft lighting market?

Future trends include the integration of smart lighting systems with advanced features like automated brightness adjustment, color-changing capabilities, and IoT connectivity. Additionally, the development of lightweight and flexible OLED lighting technologies is anticipated to further revolutionize the market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com