Global Aircraft Engine Blades Market Size, Share, Trends, & Growth Forecast Report Segmented, By Blade Type (Compressor Blades, Turbine Blades, And Fan Blades), Application (Commercial, Military, and General Aviation), Material (Titanium, Nickel Alloy, Composites, Aluminum Alloy, and Other Materials), & Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Aircraft Engine Blades Market Size

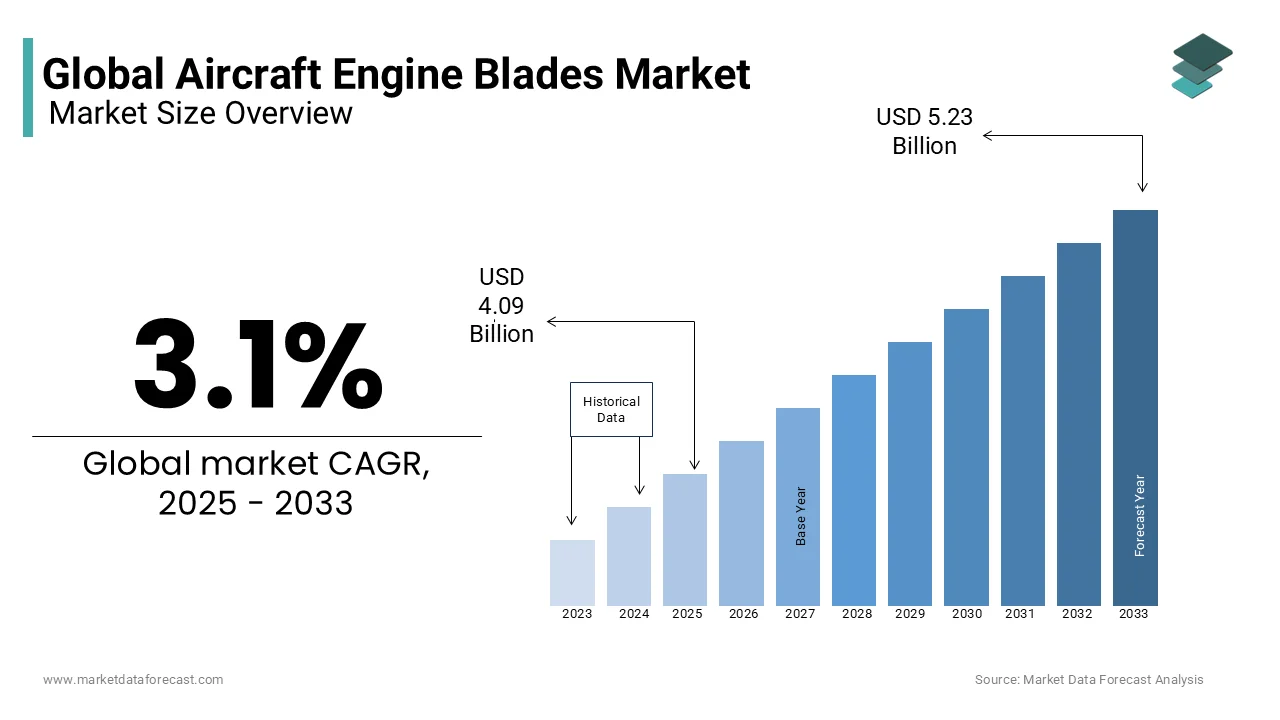

The global aircraft engine blades market was valued at USD 3.97 billion in 2024 and is anticipated to reach USD 4.09 billion by 2025 from USD 5.23 billion in 2033, growing at a CAGR of 3.1% during the forecast period from 2025 to 2033.

Aircraft engine blades include blades and wings, such as external blades, compressor blades, and turbine blades that absorb air. The engines covered within the scope of the investigation are all types of turbine engines with blades and wings as part of the engine. In addition, the blades and vanes used in fans, turbines, and compressors were included in the study.

MARKET DRIVERS

Y-o-Y growth in aircraft delivery and the periodic replacement of engine blades are majorly propelling the growth of the aircraft engine blades market.

The demand for new engines creates demand for compressors and turbine blades. As the aviation market grows, new orders for fuel-efficient aircraft will continue to drive market growth. Technological advances to create lightweight blades and fan structures are also supporting market growth. The aircraft manufacturing industry is also turning to electrical architecture for various reasons. Reducing aircraft emissions is another main driving force for adopting electric and hybrid driving schemes. The transition to these new architectures will further facilitate the penetration of agile technologies in designing and manufacturing fan blades, turbines, and compressors. These aspects are predicted to fuel the demand for aircraft engine blades in the coming years.

MARKET RESTRAINTS

The high price of the compounds is a significant limitation observed in the global aircraft engine blades market. The cost of composite materials used in the aerospace industry is higher than the traditional materials used in aircraft manufacturing.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.1% |

|

Segments Covered |

By Type, Application, Material & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Market Players |

GE Aviation, CFM International, Rolls-Royce Holdings Plc, Albany International Corporation, Collins Aerospace, Arconic Inc., MTU Aero Engines, Pratt & Whitney, CFAN Company, GKN Aerospace, and Safran Aircraft Engines |

SEGMENTAL ANALYSIS

By Type Insights

The fan blades segment is predicted to account for a promising share of the global market during the forecast period.

By Application Insights

Of these, the commercial segment dominates the global market due to the increasing demand for new aircraft from international and local airlines worldwide. The rise in air travel passengers, growth in tourism, increase in disposable income, and advances in technology are supporting the development of the commercial segment of this market. However, the military sector is predicted to be an essential part of the expected period, owing to the increasing investments and military and defense budgets worldwide.

By Material Insights

Among these, the titanium blades are expected to show a significant growth rate in the estimated period due to the benefits of the material, including excellent strength and low weight.

REGIONAL ANALYSIS

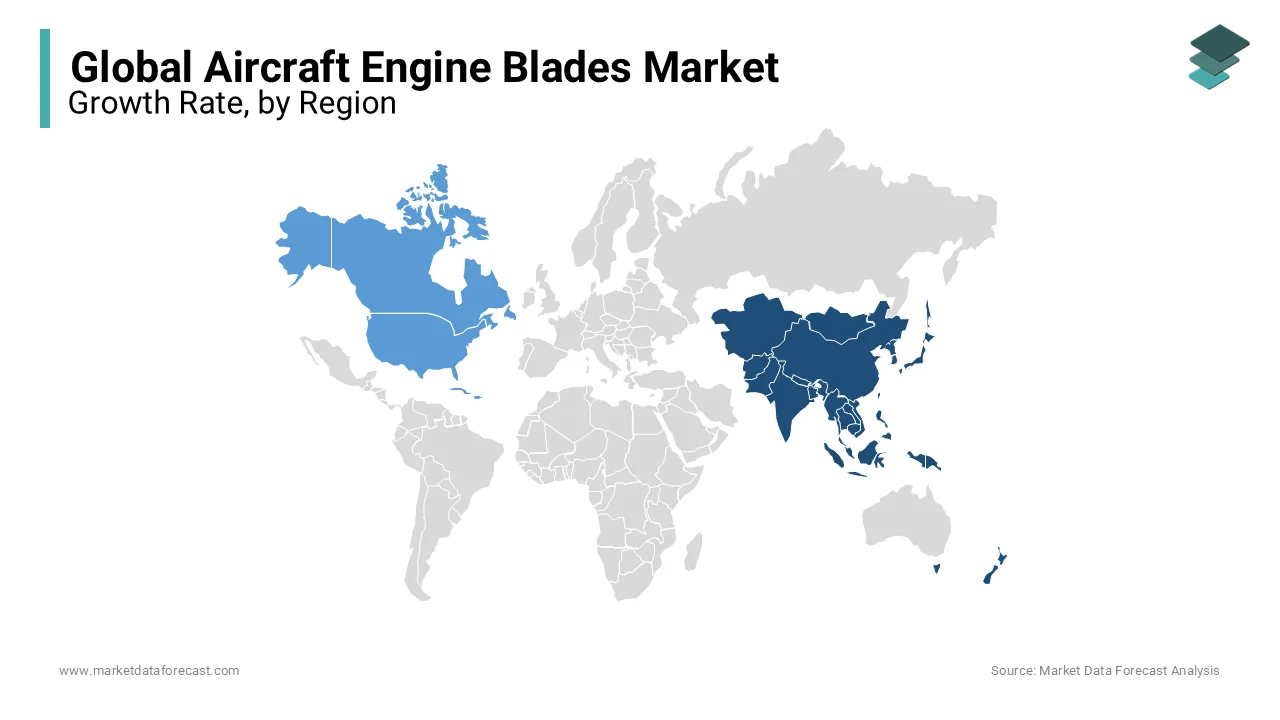

The Asia-Pacific region is foreseen to experience the highest growth rate in the global market during the forecast period. There has been a significant rise in the number of air travel passengers across the region, which forced several airlines operating in the area to scale the advanced aircraft. As a result, China and India are the leading countries generating demand in this industry. In addition, in the Asia Pacific, along with the original aircraft equipment manufacturers, several engine component manufacturers are expanding to reduce the complexity of the supply chain and enter emerging markets. Also, the increase in military spending is strengthening the development and acquisition of military aircraft, and the general aviation fleet in the region is further driving the growth of the aircraft engine blades market in the area.

On the other hand, the North American region dominates the global market in terms of revenue share. It is also predicted to witness a considerable growth rate in the estimated time. The presence of leading market giants and the increasing commercial and personal travel scenarios are boosting the industry growth in this region.

KEY MARKET PLAYERS

Some prominent players in the global aircraft engine blades market are GE Aviation, CFM International, Rolls-Royce Holdings Plc, Albany International Corporation, Collins Aerospace, Arconic Inc., MTU Aero Engines, Pratt & Whitney, CFAN Company, GKN Aerospace, and Safran Aircraft Engines. In addition, Rolls-Royce opened a motor assembly and test facility in early 2012 to manufacture hollow titanium wide-wire fan blades. The installation has a production capacity of 8,600 fan blades per year.

RECENT HAPPENINGS IN THE MARKET

- Rolls-Royce launched a single-crystal turbine made of a combination of nickel and aluminum alloys in 2017. In addition, the single-crystal structure can withstand greater mechanical loads due to the high rotation speed, which improves efficiency.

- In 2019, Boeing introduced a 777x aircraft with advanced turbine blades manufactured with GE 3D printing technology. Also, printed parts provide excellent strength and low weight, dramatically improving the weight/flight ratio.

- In April 2018, the Federal Aviation Administration (FAA) announced the inspection of aircraft operating in the United States, encouraging industry participants to test and evaluate engine blade products before commercialization.

MARKET SEGMENTATION

This research report on the global aircraft engine blades market has been segmented and sub-segmented into the following categories.

By Type

- Fan Blades

- Compressor Blades

- Turbine Blades

By Application

- Commercial Airplanes

- Military Airplanes

- General Aviation

By Material

- Titanium

- Nickel Alloys

- Composites

- Aluminum Alloys

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the primary drivers for growth in the aircraft engine blades market?

The primary drivers include the rising number of air passengers, increasing demand for fuel-efficient and lightweight engines, technological advancements in materials like composite materials, and the expanding aerospace industry in emerging markets.

What types of materials are commonly used in manufacturing aircraft engine blades?

Common materials include titanium alloys, nickel-based superalloys, and composite materials like carbon fiber-reinforced plastics. These materials offer high strength, lightweight, and resistance to extreme temperatures and corrosion.

What technological advancements are shaping the future of aircraft engine blades?

Technological advancements include the development of 3D printing for complex blade designs, improved materials like ceramic matrix composites (CMCs), and innovative cooling technologies. These advancements aim to enhance engine efficiency and performance.

How is the aircraft engine blades market addressing environmental concerns?

The market is addressing environmental concerns by developing blades that contribute to more fuel-efficient engines, reducing carbon emissions, and exploring sustainable materials and manufacturing practices.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com