Global Amyotrophic Lateral Sclerosis (ALS) Market Size, Share, Trends & Growth Forecast Report By Treatment (Medication, Physical Therapy, Speech Therapy), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Others), and Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) – Industry Analysis From 2025 to 2033.

Global Amyotrophic Lateral Sclerosis (ALS) Market Size

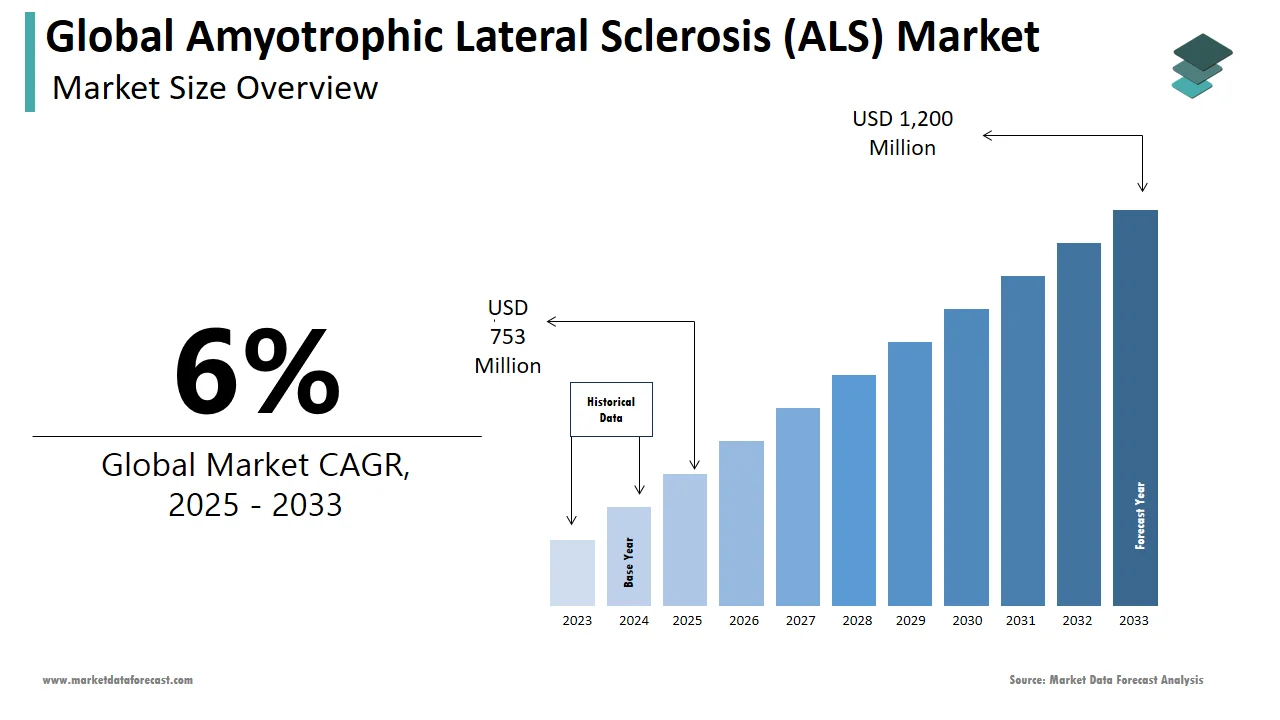

The size of the global amyotrophic lateral sclerosis (ALS) market was worth USD 710 million in 2024. The global market is anticipated to grow at a CAGR of 6% from 2025 to 2033 and be worth USD 1,200 million by 2033 from USD 753 million in 2025.

The global amyotrophic lateral sclerosis (ALS) market is witnessing steady growth as a result of increasing prevalence rates and advancements in therapeutic research. According to the ALS Association, approximately 30,000 people in the United States are living with ALS, with 5,000 new cases diagnosed annually. Globally, the prevalence of ALS ranges from 4 to 8 cases per 100,000 individuals, as per the World Health Organization. The market is characterized by a growing demand for effective treatments, driven by rising awareness campaigns and government funding for rare disease research. North America currently dominates the market due to its robust healthcare infrastructure and high R&D investments. Europe follows closely, supported by initiatives like the European Medicines Agency’s orphan drug designation program. Meanwhile, the Asia-Pacific region is emerging as a key player, with countries like Japan investing heavily in ALS research. The scarcity of curative therapies and the chronic nature of ALS continue to fuel demand for innovative solutions.

MARKET DRIVERS

Rising Prevalence and Awareness Campaigns

The rising prevalence of ALS is one of the major factors driving the amyotrophic lateral sclerosis (ALS) market forward. According to the National Institute of Neurological Disorders and Stroke, ALS affects an estimated 16,000 individuals in the U.S. alone, with the average life expectancy post-diagnosis being 2 to 5 years. Additionally, awareness campaigns led by organizations like the ALS Association and the Ice Bucket Challenge have played a pivotal role in raising funds and fostering public understanding. The Ice Bucket Challenge, for instance, raised over USD 115 million in 2014, as per the ALS Association, which was instrumental in advancing research and clinical trials. Increased awareness has also encouraged governments to allocate resources for ALS research. For example, the U.S. National Institutes of Health allocated USD 84 million in 2022 for ALS studies, reflecting the growing importance of addressing this debilitating condition. These efforts have not only accelerated drug development but also expanded patient access to emerging therapies, driving market growth.

Advancements in Precision Medicine and Gene Therapies

Advancements in precision medicine and gene therapies are further fueling the growth of the amyotrophic lateral sclerosis market growth. According to a study published in Nature Neuroscience , genetic mutations account for 5-10% of ALS cases, creating opportunities for targeted therapies. Companies like Biogen and Ionis Pharmaceuticals have made significant strides in developing antisense oligonucleotide therapies, such as tofersen, which targets the SOD1 gene mutation responsible for familial ALS. Clinical trials for tofersen have shown promising results, with a 25% reduction in neurofilament levels, as per data presented at the American Academy of Neurology’s 2022 conference. Furthermore, the FDA’s approval of Radicava (edaravone) and its oral formulation Radicava ORS has set a precedent for innovative treatments. These developments have spurred pharmaceutical companies to invest heavily in ALS research, with global R&D spending on rare diseases reaching USD 15 billion in 2022, according to Evaluate Pharma. The focus on personalized medicine and cutting-edge technologies is expected to drive the ALS market significantly in the coming years.

MARKET RESTRAINTS

High Cost of Treatment and Limited Accessibility

One of the major restraints in the ALS market is the exorbitant cost of treatments, which limits accessibility for many patients. Radicava, for instance, costs approximately USD 145,000 annually, as per data from Mitsubishi Tanabe Pharma. This financial burden is compounded by the fact that ALS is a progressive and incurable disease, requiring lifelong management. Many patients face additional expenses for supportive care, including respiratory aids and mobility devices, which can exceed USD 200,000 annually, according to the ALS Therapy Development Institute. Insurance coverage for ALS treatments remains inconsistent, particularly in low-income regions, where out-of-pocket expenses deter patients from seeking care. In developing countries, the lack of specialized healthcare facilities further exacerbates the problem. For example, a report by the World Federation of Neurology states that less than 10% of ALS patients in Sub-Saharan Africa have access to advanced therapies. These barriers hinder market expansion and underscore the need for affordable and accessible treatment options.

Limited Understanding of Disease Mechanisms

The limited understanding of the disease’s underlying mechanisms is hampering the development of effective therapies, which is also hindering the global ALS market expansion. According to a study published in The Lancet Neurology, the exact cause of sporadic ALS, which accounts for 90-95% of cases, remains unknown. This ambiguity complicates drug development, leading to a high failure rate in clinical trials. For instance, between 2000 and 2020, nearly 80% of ALS drug candidates failed to demonstrate efficacy in Phase III trials, as per data from the ALSUntangled Group. The complexity of ALS, characterized by both genetic and environmental factors, poses additional challenges. Moreover, the heterogeneity of the disease means that treatments effective for one subgroup may not work for others. This lack of clarity not only delays innovation but also increases R&D costs, discouraging smaller biotech firms from entering the market. Addressing these knowledge gaps is critical to unlocking the full potential of the ALS market.

MARKET OPPORTUNITIES

Expansion of Orphan Drug Designations

The expansion of orphan drug designations is a prominent opportunity for growth in the ALS market. According to the U.S. Food and Drug Administration, orphan drugs receive incentives such as tax credits, grant funding, and market exclusivity for seven years, making them highly attractive to pharmaceutical companies. Since 2010, over 30 ALS-related drugs have received orphan drug status, as per the Genetic and Rare Diseases Information Center. This regulatory support has accelerated the development of novel therapies, such as AMX0035, which demonstrated a 25% reduction in functional decline during clinical trials, as reported by Amylyx Pharmaceuticals. Additionally, the European Medicines Agency’s orphan drug program has facilitated collaborations between academia and industry, fostering innovation. For example, the HEALEY ALS Platform Trial, launched in 2020, evaluates multiple treatments simultaneously, reducing time and costs associated with traditional trials. These initiatives not only streamline drug development but also expand the pipeline of potential therapies, creating lucrative opportunities for market players.

Growing Focus on Biomarkers and Early Diagnosis

The growing emphasis on biomarkers and early diagnosis is another promising opportunity in the ALS market. According to a study published in Frontiers in Neurology, identifying reliable biomarkers can improve patient stratification and accelerate clinical trials. Neurofilament light chain (NfL), for instance, has emerged as a promising biomarker, with studies showing a correlation between elevated NfL levels and disease progression. A 2022 trial by the Barrow Neurological Institute found that NfL measurements could predict ALS progression with 85% accuracy. Early diagnosis enables timely intervention, improving patient outcomes and reducing healthcare costs. Furthermore, advancements in artificial intelligence and machine learning are enhancing diagnostic capabilities. For example, IBM Watson Health collaborated with ALS researchers to develop predictive models that identify at-risk individuals up to two years before symptom onset. These innovations not only address unmet medical needs but also position the ALS market as a hub for cutting-edge research and technology integration.

MARKET CHALLENGES

Ethical Concerns in Clinical Trials

Ethical concerns surrounding clinical trials is inhibiting the growth of the global ALS market. Given the progressive and terminal nature of ALS, patients often enroll in trials as a last resort, raising questions about informed consent and equitable access. According to a report by the International Alliance of ALS/MND Associations, nearly 40% of ALS patients experience cognitive impairment, complicating their ability to provide informed consent. Additionally, placebo-controlled trials, while scientifically necessary, are ethically contentious, as they deny some participants access to potentially life-extending treatments. A 2021 study published in Clinical Trials highlighted that only 30% of ALS patients who participate in trials receive active treatment, underscoring the ethical dilemma. Regulatory bodies like the FDA are increasingly scrutinizing trial designs to ensure fairness, which can delay approvals. Addressing these ethical challenges requires innovative trial methodologies, such as adaptive designs and real-world evidence collection, to balance scientific rigor with patient welfare.

Regulatory Hurdles and Approval Delays

Regulatory hurdles and approval delays is another major challenge to the growth of the ALS market, particularly given the urgency of the disease. As per the ALS Association, the average time from drug discovery to FDA approval is 12 years, which far surpasses the typical life expectancy of ALS patients. Stringent regulatory requirements, including large-scale clinical trials and extensive safety data, often prolong the approval process. For example, the FDA’s rejection of NurOwn in 2021, despite promising Phase II results, highlights the challenges faced by developers. A study by the Tufts Center for the Study of Drug Development found that only 10% of rare disease drugs receive approval within five years of submission, compared to 40% for non-rare conditions. Furthermore, the lack of standardized endpoints for ALS trials complicates evaluations, leading to inconsistent outcomes. Streamlining regulatory pathways, such as adopting conditional approvals or surrogate endpoints, could mitigate these delays and accelerate access to life-saving therapies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Treatment, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Orion Corporation, Bausch Health Companies Inc., CYTOKINETICS, INC., Aquestive Therapeutics, Inc., Sanofi, Covis Pharma, Sun Pharmaceuticals Industries Ltd, Mitsubishi Tanabe Pharma Corporation, BrainStorm Cell Limited, ViroMed Co., Ltd, Ionis Pharmaceuticals, Genervon Biopharmaceuticals, LLC, Biogen, Orphazyme A/S, Apotex Inc, Neuralstem, Inc., Implicit Bioscience, F. Hoffmann-La Roche Ltd, AB Science, and ADVANZ PHARMA |

SEGMENTAL ANALYSIS

By Treatment Insights

The medication segment dominated the ALS treatment market by accounting for 65.6% of the global market share in 2024. The dominance of medication segment in the global ALS market is driven by the availability of FDA-approved drugs like Riluzole and Edaravone, which remain the cornerstone of ALS management. The proven efficacy of medications in slowing disease progression is a key driver. According to the ALS Association, Riluzole extends survival by approximately 3-6 months, making it a critical treatment option. Similarly, Edaravone, approved in 2017, has shown a 33% reduction in functional decline during clinical trials, as reported by Mitsubishi Tanabe Pharma. These results have solidified their position as first-line treatments, with over 70% of ALS patients prescribed these drugs globally. The high adoption rate is further supported by insurance coverage in developed nations, ensuring affordability for patients. For example, Medicare in the U.S. covers both Riluzole and Edaravone, reducing out-of-pocket expenses.

The growing pipeline of ALS medications is further boosting the expansion of the medication segment in the global ALS market. According to Evaluate Pharma, there are over 30 ALS drug candidates in various stages of development, including AMX0035, which demonstrated a 25% reduction in functional decline in Phase II trials, as per Amylyx Pharmaceuticals. Additionally, the FDA’s orphan drug designation program incentivizes pharmaceutical companies to invest in ALS research, with global R&D spending on rare diseases reaching USD 15 billion in 2022. These advancements not only expand treatment options but also enhance patient outcomes, reinforcing the dominance of the medication segment.

The physical therapy segment is predicted to witness a promising CAGR of 8.55% over the forecast period due to the increasing awareness of multidisciplinary care approaches and the rising demand for non-pharmacological interventions. Multidisciplinary care models emphasize physical therapy as a critical component of ALS management. According to a study published in The Lancet Neurology , ALS patients receiving physical therapy alongside medication experienced a 20% improvement in mobility and quality of life compared to those relying solely on medication. This evidence-based approach has led to widespread adoption, particularly in Europe, where healthcare systems prioritize holistic care. For instance, the European Network for the Cure of ALS (ENCALS) recommends integrating physical therapy into standard treatment protocols, driving demand.

Technological advancements in rehabilitation equipment are propelling the growth of physical therapy segment in the global market. According to a report by the World Federation of Neurology, robotic-assisted devices have improved therapy outcomes by 30%, enabling patients to maintain muscle strength longer. Companies like ReWalk Robotics have introduced wearable exoskeletons designed for ALS patients, enhancing accessibility to advanced rehabilitation solutions. These innovations not only improve patient engagement but also expand the reach of physical therapy services, particularly in underserved regions.

By Distribution Channel Insights

The hospital pharmacies segment accounted for the leading share of 51.5% of the global ALS market in 2024. The critical role that hospital pharmacies play as primary dispensers of specialized ALS medications and therapies. Hospital pharmacies serve as centralized hubs for ALS treatments, ensuring timely access to medications like Riluzole and Edaravone. According to the National Institute of Neurological Disorders and Stroke, over 60% of ALS patients receive their prescriptions directly from hospital pharmacies due to the complex nature of the disease. These facilities are equipped to handle insurance claims and provide financial assistance programs, reducing barriers to treatment. For example, hospitals in the U.S. collaborate with pharmaceutical companies to offer co-pay assistance, benefiting low-income patients. The integration of hospital pharmacies with multidisciplinary care teams enhances patient outcomes. According to a study published in Frontiers in Neurology , ALS patients receiving coordinated care through hospital pharmacies showed a 25% improvement in adherence to treatment regimens. Hospitals often employ pharmacists specializing in neurology, ensuring personalized medication management. This holistic approach not only improves patient satisfaction but also strengthens the role of hospital pharmacies in the ALS market.

The retail pharmacies segment is anticipated to exhibit a CAGR of 8.04% over the forecast period owing to the increasing accessibility and convenience for ALS patients. The expansion of retail pharmacy chains has significantly boosted accessibility to ALS medications. According to the International Alliance of ALS/MND Associations, retail pharmacies now account for 30% of ALS prescriptions globally, up from 20% in 2018. Chains like CVS Health and Walgreens have partnered with pharmaceutical companies to streamline distribution, ensuring availability even in remote areas. This network expansion has reduced travel burdens for patients, particularly in rural regions. The adoption of telepharmacy services is another key driver. According to a report by the American Pharmacists Association, telepharmacy consultations increased by 40% during the COVID-19 pandemic, with ALS patients benefiting from virtual medication counseling. Retail pharmacies like Boots UK have integrated digital platforms to provide real-time support, enhancing patient engagement and adherence to treatment plans.

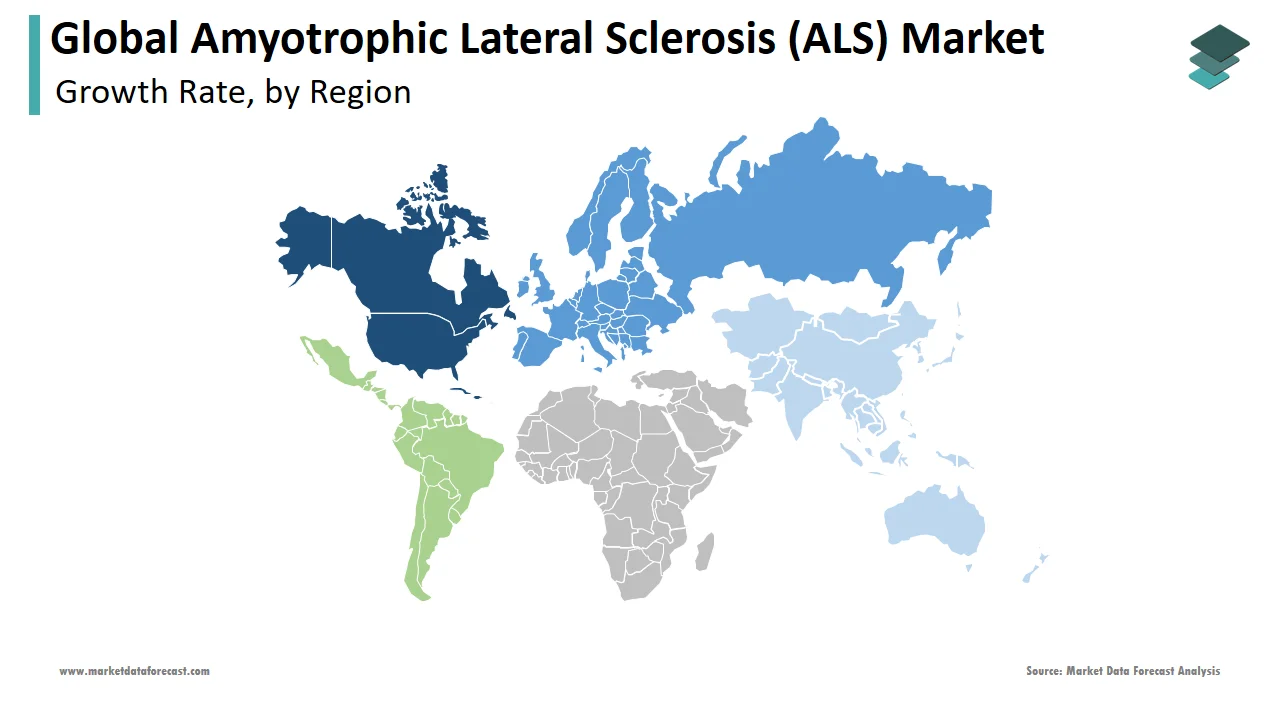

REGIONAL ANALYSIS

North America led the ALS market by commanding 40.7% of the global market share in 2024. The dominance of North America in the global market can be credited to its robust healthcare infrastructure and high prevalence rates. The U.S. accounts for the majority of North America’s ALS cases, with an estimated 16,000 patients, as per the ALS Association. Rising awareness campaigns, such as the Ice Bucket Challenge, have raised over USD 115 million for ALS research, fostering innovation. Government initiatives, like the FDA’s orphan drug designation program, have accelerated drug development, with AMX0035 receiving conditional approval in 2022. Additionally, Medicare and Medicaid ensure widespread access to treatments, which is contributing to the dominance of North America in the global market.

Europe is another prominent market ALS worldwide and held a substantial share of the worldwide market in 2024. The region benefits from strong regulatory frameworks and collaborative research initiatives. The European Medicines Agency’s orphan drug program has facilitated the development of ALS therapies, with Radicava ORS receiving approval in 2022. According to ENCALS, multidisciplinary care models are widely adopted, improving patient outcomes. Countries like Germany and the UK lead in ALS research, with annual funding exceeding USD 50 million. Public-private partnerships further enhance accessibility to advanced treatments.

The Asia-Pacific region is projected to witness the fastest growth in the global ALS market. Increasing awareness and government investments drive the market growth in this region. Japan dominates the region, with Mitsubishi Tanabe Pharma spearheading ALS research. According to the Japanese Ministry of Health, the government allocated USD 20 million in 2022 for rare disease studies. China and India are emerging markets, with urbanization increasing demand for ALS treatments. Collaborations between regional firms and global players ensure affordability and accessibility.

Latin America holds a moderate share of the global market, with Brazil leading due to improving healthcare infrastructure. The Brazilian Ministry of Health reports that ALS prevalence is rising, prompting government-led initiatives. Partnerships with international organizations, like the ALS Association, have expanded access to treatments. However, affordability remains a challenge, with less than 30% of patients receiving comprehensive care.

The Middle East and Africa captured a smallest share of the global ALS market in 2024. Limited awareness and infrastructure hinder the market growth in this region. South Africa leads efforts, with ALS South Africa raising awareness through advocacy programs. According to the World Health Organization, less than 10% of ALS patients in Sub-Saharan Africa have access to advanced therapies. Collaborations with global NGOs aim to bridge this gap, offering hope for future expansion.

KEY MARKET PLAYERS

Some of the notable companies dominating the global amyotrophic lateral sclerosis (ALS) market profiled in this report are Orion Corporation, Bausch Health Companies Inc., CYTOKINETICS, INC., Aquestive Therapeutics, Inc., Sanofi, Covis Pharma, Sun Pharmaceuticals Industries Ltd, Mitsubishi Tanabe Pharma Corporation, BrainStorm Cell Limited, ViroMed Co., Ltd, Ionis Pharmaceuticals, Genervon Biopharmaceuticals, LLC, Biogen, Orphazyme A/S, Apotex Inc, Neuralstem, Inc., Implicit Bioscience, F. Hoffmann-La Roche Ltd, AB Science, and ADVANZ PHARMA

TOP LEADING PLAYERS IN THE MARKET

Biogen Inc.

Biogen is a leading player in the ALS market, known for its pioneering work in neurology and rare diseases. The company’s focus on innovative therapies has positioned it as a key contributor to ALS research. Biogen’s collaboration with Ionis Pharmaceuticals led to the development of Tofersen, a groundbreaking antisense oligonucleotide therapy targeting the SOD1 gene mutation in familial ALS. Biogen also invests heavily in clinical trials and partnerships with global research institutions, ensuring its therapies address unmet medical needs. Its commitment to advancing precision medicine has strengthened its reputation in the ALS community.

Mitsubishi Tanabe Pharma Corporation

Mitsubishi Tanabe Pharma is a major player, recognized for developing Radicava (edaravone), the first FDA-approved ALS treatment in over two decades. The company’s introduction of Radicava ORS, an oral formulation, has improved patient convenience and adherence. Mitsubishi Tanabe Pharma collaborates with regulatory bodies and patient advocacy groups to expand access to its therapies. Its focus on R&D and patient-centric innovations has solidified its position as a leader in ALS treatment. The company’s efforts in Asia-Pacific have also enhanced regional accessibility to advanced therapies.

Amylyx Pharmaceuticals

Amylyx Pharmaceuticals has gained prominence with AMX0035, a novel combination therapy designed to slow ALS progression. The drug demonstrated a 25% reduction in functional decline during Phase II trials, as reported by the company. Amylyx’s approach to addressing neurodegeneration through mitochondrial protection and inflammation reduction sets it apart. The company actively engages with regulatory agencies and patient communities to accelerate approvals and improve affordability. Amylyx’s innovative pipeline and patient-focused strategies make it a rising force in the ALS market.

TOP STRATEGIES USED BY KEY PLAYERS

Pipeline Expansion and Innovation

Key players like Biogen and Amylyx prioritize expanding their pipelines with cutting-edge therapies. For instance, Biogen’s Tofersen targets genetic mutations, while Amylyx’s AMX0035 addresses neurodegeneration through novel mechanisms. These innovations differentiate companies in a competitive market. Investments in R&D ensure compliance with evolving regulatory standards, enhancing product credibility and appeal.

Strategic Collaborations and Partnerships

Collaborations are central to advancing ALS research. For example, Biogen partners with Ionis Pharmaceuticals to develop antisense therapies, while Mitsubishi Tanabe Pharma collaborates with global health organizations to expand Radicava’s reach. These partnerships streamline drug development, reduce costs, and ensure broader patient access, strengthening market positions.

Patient-Centric Initiatives

Companies focus on improving patient outcomes through education and financial assistance programs. Mitsubishi Tanabe Pharma offers co-pay support for Radicava, while Amylyx engages with ALS advocacy groups to raise awareness. These initiatives not only enhance patient trust but also foster brand loyalty, driving long-term growth.

COMPETITION OVERVIEW

The ALS market is characterized by intense competition among key players like Biogen, Mitsubishi Tanabe Pharma, and Amylyx Pharmaceuticals, each striving to address unmet medical needs. Biogen leads with its focus on precision medicine and genetic therapies, while Mitsubishi Tanabe Pharma dominates with approved treatments like Radicava. Amylyx, a newer entrant, is gaining traction with its innovative pipeline. Regulatory hurdles and high R&D costs intensify rivalry, prompting companies to adopt strategies like strategic partnerships and patient-centric initiatives. The market’s competitive landscape is further shaped by advancements in biomarkers and gene therapies, which offer lucrative opportunities for differentiation. As demand for effective ALS treatments grows, companies are investing in cutting-edge research to maintain their edge.

RECENT MARKET DEVELOPMENTS

- In April 2023, Biogen partnered with Ionis Pharmaceuticals to advance Tofersen, an antisense therapy targeting the SOD1 gene mutation in ALS. This collaboration accelerates the development of precision medicine solutions.

- In June 2023, Mitsubishi Tanabe Pharma launched Radicava ORS, an oral formulation of edaravone, improving patient convenience and adherence to treatment.

- In August 2023, Amylyx Pharmaceuticals received conditional FDA approval for AMX0035, positioning it as a key player in the ALS market.

- In October 2023, Biogen initiated a global clinical trial for a new ALS drug targeting neuroinflammation, expanding its therapeutic pipeline.

- In December 2023, Mitsubishi Tanabe Pharma collaborated with ALS advocacy groups to launch educational campaigns, raising awareness and improving patient access to treatments.

MARKET SEGMENTATION

This research report on the global amyotrophic lateral sclerosis (ALS) market has been segmented and sub-segmented based on the type, end-user, and region.

By Treatment

- Medication

- Physical Therapy

- Speech Therapy

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the expected growth of the amyotrophic lateral sclerosis (ALS) market and what are the primary drivers?

The ALS market, valued at USD 710 million in 2024, is projected to reach USD 1.2 billion by 2033, growing at a CAGR of 6%. This growth is driven by the rising prevalence of ALS, increased awareness, and advancements in precision medicine and gene therapies.

2. What are the key challenges hindering market growth?

The high cost of treatments, such as Radicava (USD 145,000 annually), and limited understanding of the underlying disease mechanisms are significant challenges. Additionally, ethical concerns surrounding clinical trials and regulatory hurdles contribute to market restraints.

3. Which regions lead the market and where is the fastest growth expected?

North America dominated the market in 2024 with a 40.7% share due to robust healthcare infrastructure and high prevalence rates. The Asia-Pacific region is projected to witness the fastest growth, driven by increasing awareness and government investments in healthcare.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]