Global Animal Feed Additives Market Size, Share, Trends & Growth Forecast Report – Segmented By Product (Vitamins, Antibiotics, Feed Enzymes, Acidifiers, Amino Acids and Antioxidants), Livestock (Ruminants, Poultry, Swine, Aquatic Animal), Form (Dry and Liquid), By Source (Natural and Synthetic) And Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From (2025 to 2033)

Global Animal Feed Additives Market Size

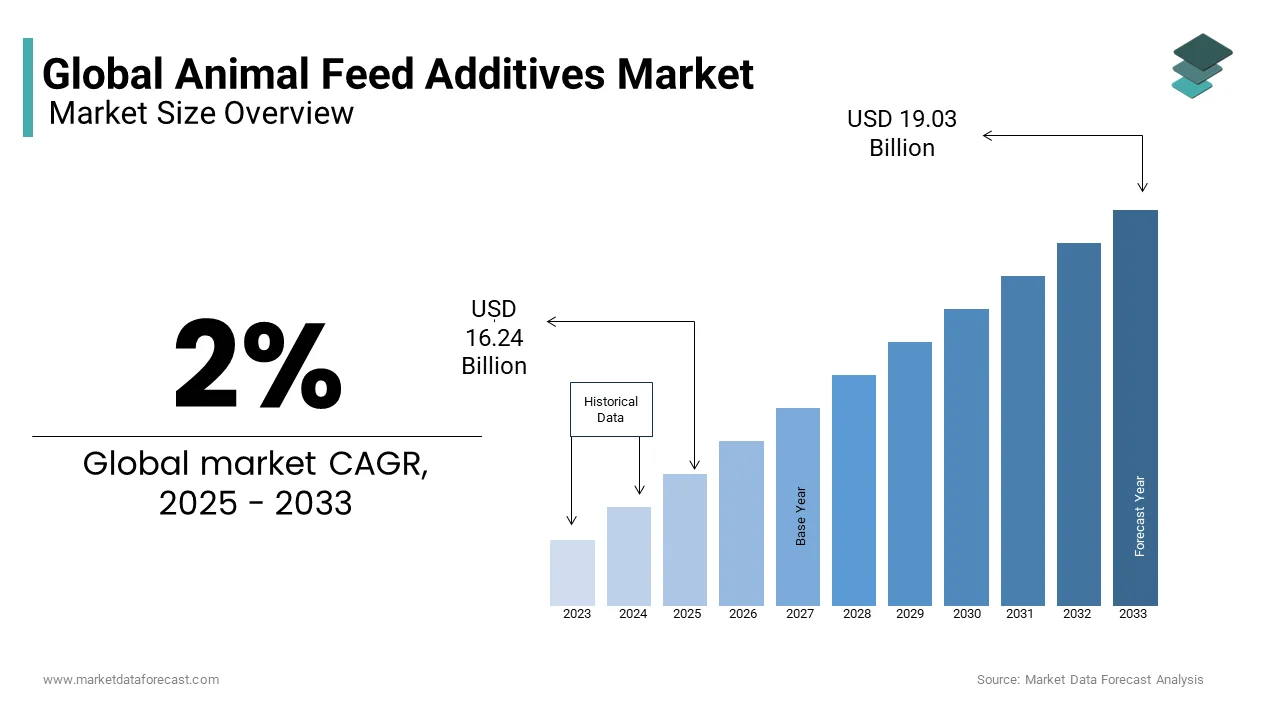

The global animal feed additives market was valued at USD 15.92 billion in 2024 and is anticipated to reach USD 16.24 billion in 2025 from USD 19.03 billion by 2033, growing at a CAGR of 2% during the forecast period from 2025 to 2033.

Feed additives are an essential component of increasing meat production. Feed additives are widely used in animal feed for a variety of benefits, including achieving nutritional balance and promoting animal health. Animal feed additives are mixed with plain feeds to provide nutrition and enhance the overall growth of the animal. Feed additives offer benefits such as weight gain, better digestion of feed, and prevention of various diseases. The diversity of applications, including nutritional value, food preservation, and imparting texture and flavor of food, have become the main drivers of market growth. Feed additives are substances that are used to improve animal health. Feed additives are incorporated in different doses and forms depending on the breed and species of the animal.

MARKET DRIVERS

The demand for animal feed additives is constantly increasing, and this is an achievement that can be recognized as the consumption of poultry and meat feeds increases worldwide. Improving animal feed with a variety of nutrients can help prevent disease outbreaks, as well as improve weight gain and digestion in animals. Feed additives play an important role in protecting the health and quality of raw livestock, so it is very important for manufacturers to ensure the welfare of livestock and livestock, so there is a significant demand for nutritional food products. Therefore, there is a possibility that the adoption of feed additives will increase in the coming years. These developments are expected to have a positive impact on the expansion of the global animal feed additives market. These additives play an important role in increasing the nutritional value of meat and meat products to meet the growing demand for healthy and nutritious meat and feed. Additives are important components for improving the health and performance of animals. As meat consumption increases with the recent disease outbreak, the need for additives in poultry, water, and other animal products is expected to increase demand for products. Eating feed that contains the right number of additives has a positive effect on livestock, including better digestion and reproduction. Therefore, these products cyclically affect the properties of human food. Significant increases in livestock farming will increase the demand for animal feed additives during the forecast period. These factors are expected to further restrict the market growth during the outlook period. Increased consumption of meat products due to rising consumer per capita and changes in consumer behavior toward a high-protein diet will further strengthen the growth of the industry.

The global market for animal feed additives will expand as concerns about the safety and quality of meat and meat products increase due to the outbreak of numerous diseases in livestock, such as foot-and-mouth disease, bird flu, swine flu, etc., during the last decade.

Cows are a major source of dairy products throughout the world. Also, the benefits of additives and increased awareness of the recent emergence of various diseases have had a positive effect on demand. Increased meat consumption due to rapidly increasing energy needs has led to increased demand for a variety of processed products, such as poultry and dairy products. The changing climate and the availability of poor-quality feed products have been known to cause many diseases to livestock in recent years, which has accelerated the demand for high-quality feed additives. The development of new technologies, together with the continuous improvement of finished products, will lead to industrial growth. Increased life expectancy, limited water availability, and optimal feed utilization in the meat industry will further strengthen demand for products.

MARKET RESTRAINTS

Since feed additives are supplied by contract, price instability and the volatility of the raw material supply of feed additives is a major concern for manufacturers.

These contracts are exposed to unsystematic risks such as climate change, interest rate volatility, and geopolitical tensions. These factors can hamper the growth of the animal feed additives market. Product and raw material cost issues, especially for specialty products such as acidifiers, enzymes, and minerals, are expected to become major challenges for market participants in the global feed additives market in the coming years. Diverse regulatory structures, unstable economies, and higher operating costs are the main limitations of the market. Rising feed additive raw material prices is another major challenge in the global feed additive market. Furthermore, strict government regulations related to product approvals are another factor that is expected to pose some challenges to the growth of the global market for animal feed additives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2% |

|

Segments Covered |

By Product, Livestock, Form, Source and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill, Inc, Danisco Animal Nutrition, Koninklijke DSM NV, BASF SE, Archer Daniels Midland Company, Nutreco NV, Evonik Industries AG, Addcon Group, KeminIndustries Inc, Aliphos Belgium SA, Alltech, Inc, Phibro Animal Health Corporation, Ajinomoto Co., Inc, Biomin, Adisseo France SAS and Others. |

SEGMENTAL ANALYSIS

Global Animal Feed Additives Market By Product

Based on the product, the market for additives for animal feed is divided into vitamins, amino acids, antibiotics, acidulants, antioxidants, enzymes, etc. Amino acids accounted for 33.6% of the total market in terms of sales in 2019. Demand was supported by increasing consumer awareness of the benefits associated with using food additives to reduce the prevalence of disease. Amino acids are considered a protein component for the health of livestock. Amino acids play a role in improving gut health, food intake, and reproductive and metabolic processes, among other things. Antibiotics also improve the quality of meat; they are rich in protein and low in fat. The overuse of antibiotics as growth promoters has made the local bacterial population more resistant to antibiotics. Traces of antibiotics in meat can also affect human health due to the presence of an excess of growth promoters.

Global Animal Feed Additives Market By Livestock

By livestock, the market is segmented by poultry and has become a major livestock segment with an expected revenue of $ 1.92 trillion in 2019. The rise in diseases such as bird flu has led to regulations and standards. Strict, further increasing the demand for certain additives. Furthermore, global poultry production is expected to increase at a rapid pace, which is expected to increase the demand for poultry feed during the forecast period.

Global Animal Feed Additives Market By Form By Source

By form, the global animal feed additives market is divided into dry and liquid. Based on the source, the market is bifurcated into natural and synthetic.

REGIONAL ANALYSIS

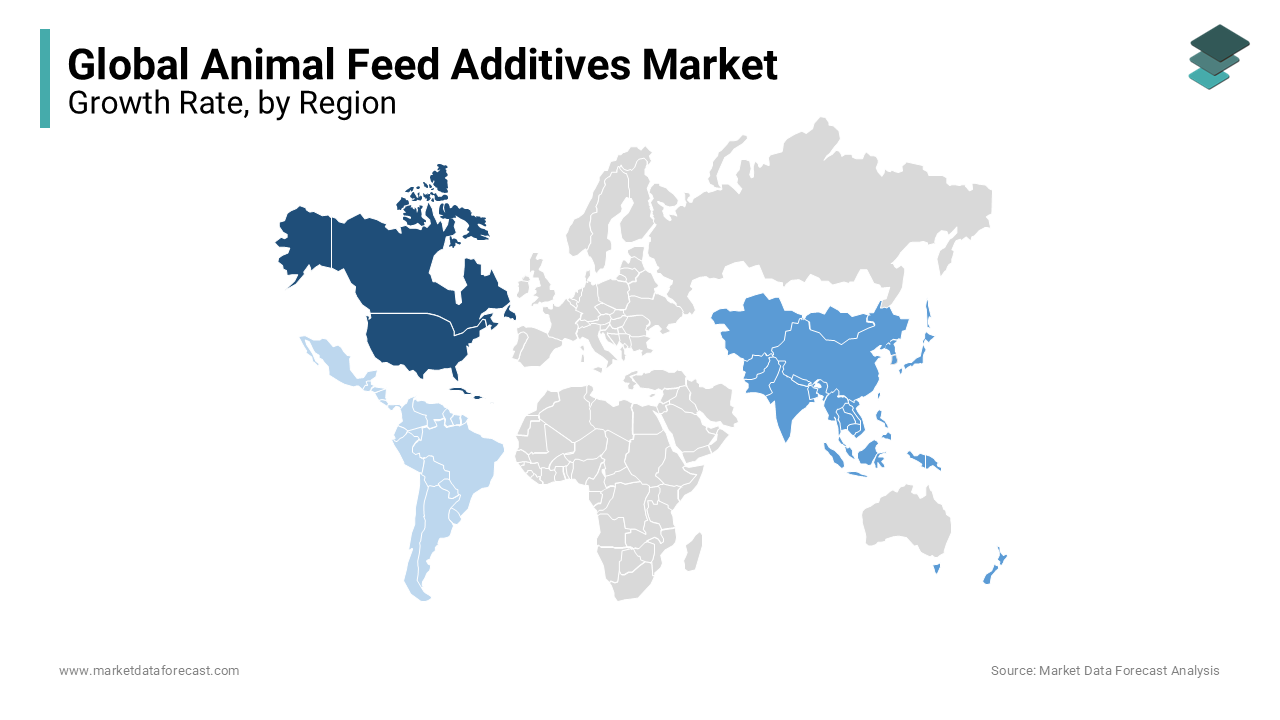

North America accounted for 21% of the total market share in 2019. Also, the high availability of raw materials such as glucose, corn and corn are expected to drive demand during the forecast period. Asia Pacific is expected to grow as the largest regional market for animal feed additives. The region has seen a significant increase in demand due to strong economic growth from emerging economies such as China, Indonesia and India. Coupled with China's rapid economic growth, rising demand due to factors such as lifestyle changes in India, Indonesia, and Vietnam and rising disposable income are expected to increase local demand for nutrient-rich animal feed. in the next years. The Russian animal feed additives market is also expected to show strong growth during the forecast period due to high regional production and consumption rates. The size of the European animal feed additives market, led by Germany, France and the UK, is expected to grow by more than 3.5% due to strong application prospects in the livestock industry. Latin America, driven by the size of the Brazilian and Argentine feed additives market, will grow more than 4% during the forecast period. This growth can be attributed to increased investment in agribusiness, coupled with government initiatives to promote agriculture, as nutrition and health of livestock must be maintained and industrial growth promoted.

KEY MARKET PLAYERS

Cargill, Inc, Danisco Animal Nutrition, Koninklijke DSM NV, BASF SE, Archer Daniels Midland Company, Nutreco NV, Evonik Industries AG, Addcon Group, KeminIndustries Inc, Aliphos Belgium SA, Alltech, Inc, Phibro Animal Health Corporation, Ajinomoto Co., Inc, Biomin, Adisseo France SAS. Some of the market players.

RECENT DEVELOPMENTS IN THIS MARKET

- In March 2019, BASF SE launched Natuphos E phytase in Indonesia. When added to feed, it is an enzyme that improves animal health.

MARKET SEGMENTATION

This research report on the global feed additives market is segmented and sub-segmented based on the By Product, Livestock, Form, Source, and Region.

By Product

- Vitamins

- Antibiotics

- Feed Enzymes

- Acidifiers

- Aminoacids

- Antioxidants

By Livestock

- Ruminants

- Poultry

- Swine

- Aquatic Animal

By Form

- Dry

- Liquid

By Source

- Natural

- Synthetics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the current market size of the global animal feed additives market?

The current market size of the global animal feed additives market was valued at USD 16.24 billion in 2025

What market drivers are driving the global animal feed additives market?

The increase in consumption of poultry and meat feeds worldwide is the major driver in the animal feed additives market.

Who are the market players that ae dominating the global animal feed additives market?

Cargill, Inc, Danisco Animal Nutrition, Koninklijke DSM NV, BASF SE, Archer Daniels Midland Company, Nutreco NV, Evonik Industries AG, Addcon Group, KeminIndustries Inc, Aliphos Belgium SA, Alltech, Inc, Phibro Animal Health Corporation, Ajinomoto Co., Inc, Biomin, Adisseo France SAS.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com