Global Antibiotics Market Size, Share, Trends & Growth Forecast Report By Action Mechanism, Drug Class and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Antibiotics Market Size

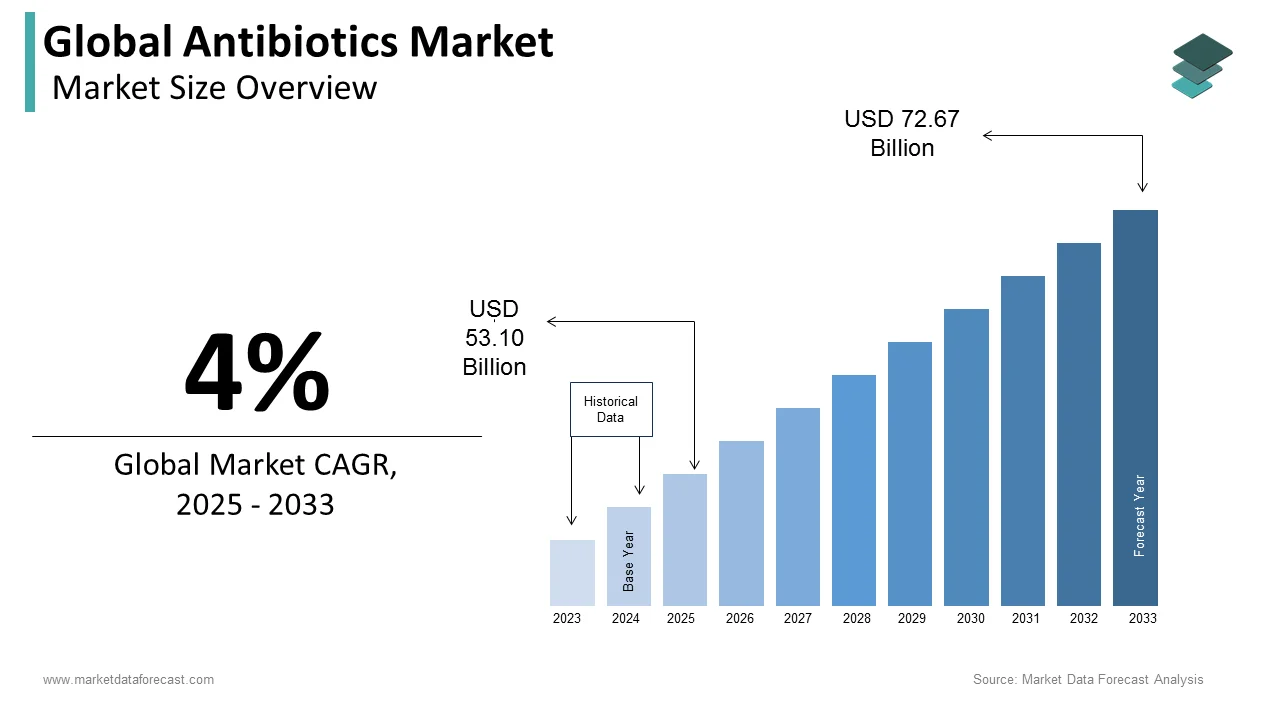

The size of the global antibiotics market was worth USD 51.06 billion in 2024. The global market is anticipated to grow at a CAGR of 4.0% from 2025 to 2033 and be worth USD 72.67 billion by 2033 from USD 53.10 billion in 2025.

MARKET DRIVERS

Y-O-Y growth in the incidence of infectious diseases and increasing government support drive the global antibiotics market growth.

Y-O-Y growth in the incidence of chronic disorders, rising demand for new antibiotics, and risk investments for research in developing drugs for multi-resistant pathogens are a few other significant factors boosting the global antibiotics market. Also, the growing support from various governmental organizations is expected to improve the development of generic antibiotics, fuelling the growth rate of the global antibiotics market.

The increased efforts of pharmaceutical companies to develop new therapies to treat infectious diseases are a big plus to the growth of the global antibiotics market.

Introducing new antibiotic drugs and collaborating with key market players with other companies to develop better antibiotic products are expected to fuel the market's growth rate. Furthermore, pharmaceutical companies' cooperation in developing new therapies to limit the pricing pressure and increased initiatives of various governments to develop new therapies in treating drug-resistant propel the market growth. For instance, in March 2019, the Global Antibiotic Research and Development Partnership (GARDP) disclosed a private partnership with Evotec AG to develop first-in-class antibiotics for treating drug-resistant bacterial infections.

MARKET RESTRAINTS

Strict regulatory rules for the acceptance of new products are inhibiting the growth of the antibiotics market. In addition, the side effects triggered by antibiotic drugs and the lack of knowledge among people about antibiotic drugs impede the growth of the antibiotics market. Nonetheless, continuing clinical trials are being performed by various pharmaceutical firms and will increase the demand for antibiotics in the future.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

Based on action metabolism, drug call, and region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Johnson and Johnson, GlaxoSmithKline, Pfizer PLC, Bayer AG, Novartis AG, Abbott Inc., Merck & Co. Inc., Sanofi SA, and F. Hoffmann-La Roche AG. |

SEGMENTAL ANALYSIS

Antibiotics Market By Action Mechanism

Cell wall synthesis inhibitors are expected to maintain dominance throughout the forecast period. High consumption based on prescription trends and significant government expenditures drives this market. Antibiotics that inhibit cell wall construction are the most widely used because they offer a broad spectrum of effectiveness against gram-positive and gram-negative bacteria. Due to increased research activity and government support, cell wall synthesis inhibitors are predicted to develop significantly throughout the forecast period. The drugs prevent the bacteria from synthesizing a molecule in the cell wall called peptidoglycan, which provides the cell wall with the strength to survive in the human body. Therefore, these drugs are expected to grow at the fastest rate.

Many antibiotic drugs work to inhibit DNA synthesis and the transformation of DNA into RNA. It is a significant discovery as it can help cure many natural diseases we could not fix. These types of drugs have the second-largest share.

The drugs shown to inhibit mycolic acid biosynthesis are isoniazid and triclosan. Besides, pyrazinamide was shown to inhibit fatty acid synthase type I, which, in turn, provides precursors for fatty acid elongation to long-chain mycolic acids by fatty acid synthase II. Essential for viability and virulence, enzymes in mycolic acid biosynthesis represent novel targets for drug development.

Folic acid helps the body to maintain and produce new cells. Many antibiotics are now on the market, inhibiting folic acid synthesis and reducing excessive cell generation. Due to fewer known diseases, the drugs have the lowest market share but can soon overtake others as we identify new conditions.

Antibiotics Market By Drug Class

The other antibiotics segment includes tetracyclines, imidazoles, lincosamides, and monoclonal antibodies and is projected to grow at the highest CAGR during the forecast period. The development of monoclonal antibodies for individuals with antibiotic resistance is a key highlight of this segment. Penicillin is the oldest drug to be discovered and still holds a significant share of the market. Cephalosporins have the largest market share ahead of penicillin. Increasing incidence of pneumonia, bloodstream infections, and Urinary Tract Infections (UTI) is anticipated to foster the carbapenems class of antibiotics.

REGIONAL ANALYSIS

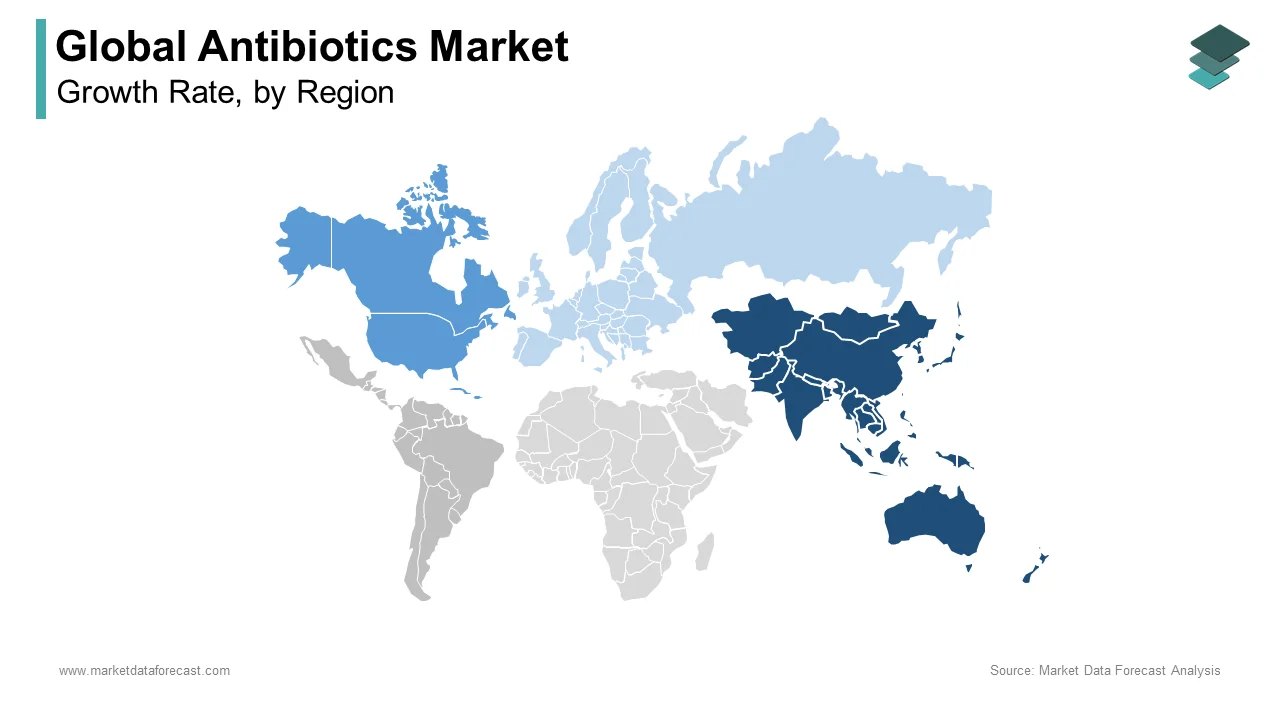

The Asia Pacific is the global antibiotics market leader as they have extensive production facilities in countries like India.

The ability to produce drugs in large quantities drives the antibiotics market's growth, and the Asia Pacific will remain the leader during the forecast period. In addition, the need to cater to large populations can make the companies self-sustained, giving room for other companies in other countries. As a result, the Asia Pacific had the largest share in the global antibiotics market, predicted to rise substantially over the forecast period. This is due to increased antibiotic use, a rise in infectious diseases, and increased government programs to find novel treatments for drug-resistant infections.

Furthermore, the presence of generic companies aids in expanding the regional market. India and China are the region's leading markets for antibiotics. Unregulated sales and excessive antibiotic consumption are the key factors driving market expansion in these countries.

On the other hand, North America is expected to develop at the fastest rate throughout the forecast period due to established market players' efforts to extend their presence in this area. These markets are heavily regulated, and the healthcare infrastructure is well-developed. The rising prevalence of infectious diseases and the government's increasing healthcare spending are two significant reasons driving the North American market. Antibiotic stewardship initiatives and boosting R&D activities of novel medicines to control infectious diseases are among the actions taken by the U.S. government.

Europe is expected to be the second-largest regional market worldwide during the forecast period. The rapid growth of healthcare infrastructure in various European nations and increased investments in research and development activities propel the antibiotics market in Europe. In addition, the rising number of hospitals in the European region is estimated to result in regional market growth.

KEY MARKET PLAYERS

Johnson and Johnson, GlaxoSmithKline, Pfizer PLC, Bayer AG, Novartis AG, Abbott Inc., Merck & Co. Inc., Sanofi SA, and F. Hoffmann-La Roche AG are some of the promising companies in the global antibiotics market.

RECENT HAPPENINGS IN THIS MARKET

- In March 2021, the U.S. FDA approved Melinta Therapeutics Kimyrsa (Oritavancin). The antibiotic drug is for treating adults with critical acute bacterial skin and skin structure infections (ABSSSI) caused by vulnerable isolates of designated Gram-positive microorganisms.

- In December 2020, Elecsys, an Anti-SARS-CoV-2 antibody of Roche, received the Emergency Use Authorization (EUA) from the U.S Food and Drug Administration (FDA). The test can be used to measure the level of antibodies present in people who have been exposed to the COVID-19 virus.

- In November 2020, the National Medical Products Association (NMPA) permitted a license for drug approval for Shenzhen China Resources Gosun Pharmaceuticals Co. Ltd., license partner of Basilea Pharmaceuticals Ltd. The antibiotic drug was approved in China to treat community-acquired pneumonia (CAP) and hospital-acquired pneumonia in adult patients.

- In July 2019, a new triple-drug antibiotic called Recarbio of Merck received FDA approval for patients suffering from complicated urinary tract and intra-abdominal infections as they have no other options.

- In August 2016, Pfizer, Inc. agreed to purchase a part of AstraZeneca PLC's antibiotics business for USD 1.575 billion. The agreement deals with three approved antibiotics and two drugs in clinical trials—AstraZeneca handovers Pfizer all rights to sell those drugs.

DETAILED SEGMENTATION OF THE GLOBAL ANTIBIOTICS MARKET INCLUDED IN THIS REPORT

This research report on the global antibiotics market has been segmented and sub-segmented into the following categories.

By Action Mechanism

- Cell Wall Synthesis Inhibitors

- DNA Synthesis Inhibitors

- Rna Synthesis Inhibitors

- Mycolic Acid Synthesis Inhibitors

- Folic Acid Synthesis Inhibitors

By Drug Class

- Cephalosporins

- Penicillins

- Fluoroquinolones

- Macrolides

- Carbapenems

- Aminoglycosides

- Sulfonamides

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How big is the global antibiotics market?

As per our research report, the global antibiotics market is predicted to value USD 72.67 billion by 2033.

Who is the largest manufacturer of antibiotics?

Johnson and Johnson, GlaxoSmithKline, Pfizer PLC, Bayer AG, Novartis AG, Abbott Inc., Merck & Co. Inc., Sanofi SA, and F. Hoffmann-La Roche AG are some of the largest manufacturers of antibiotics.

Which region is expected to be the market leader in the coming years?

Across the globe, the APAC region is forecasted to be the market leader for antibiotics during the forecast period.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com