Global Antivenom Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Vaccines & Hyperimmune Sera), Animal (Snakes, Scorpions, Spiders and Others) & Region (North America, Europe, APAC, Latin America, Middle East and Africa) – Industry Analysis From 2025 to 2033

Global Antivenom Market Size

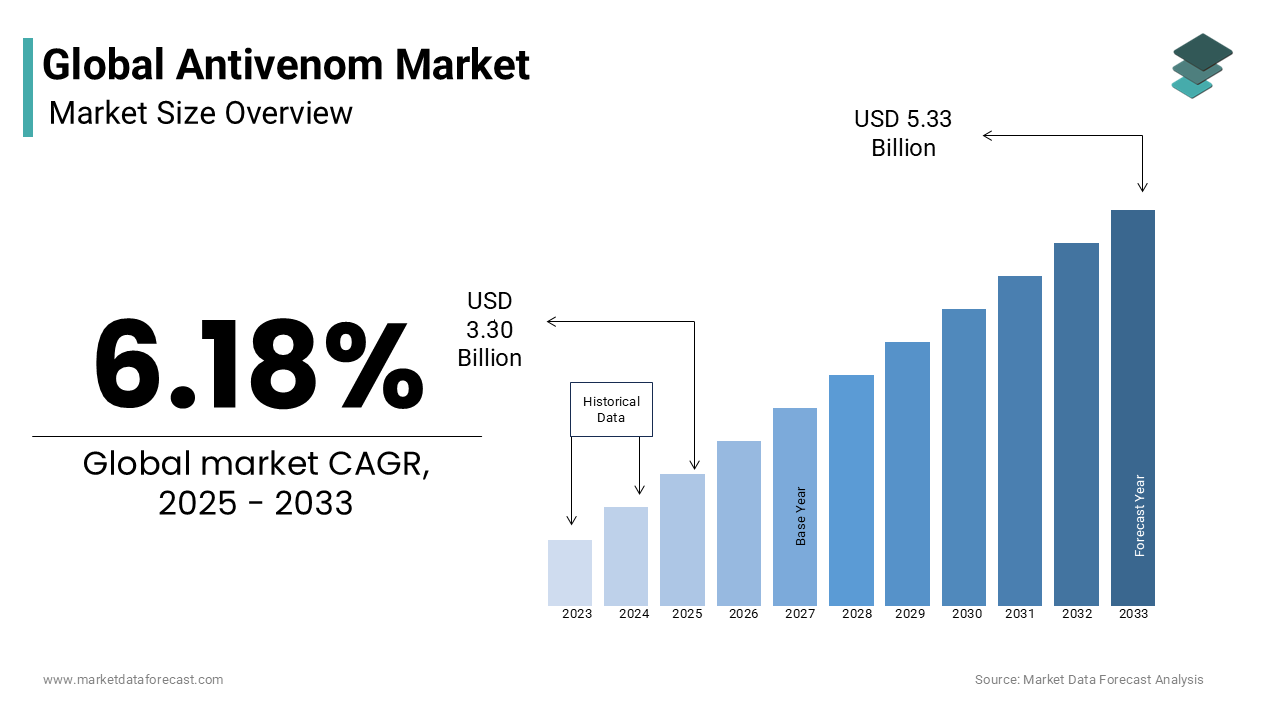

The global antivenom market size was valued at USD 3.11 billion in 2024. The antivenom market size at a global level is expected to reach USD 5.33 billion by 2033 from USD 3.30 billion in 2025, growing at a CAGR of 6.18% during the forecast period.

Antivenom treats venomous bites from spiders, snakes, scorpions, and others. Out of all bites, snake bites are dangerous. Many people die from snake bites yearly due to a lack of timely treatment. Antivenom is a life-saving treatment option for people who get bites from venomous animals. Antivenom mainly helps by reducing the severity of the symptoms and preventing long-term health complications. There are two types of antivenom which are known as monovalent and polyvalent.

MARKET DRIVERS

The growing incidence of snake bites and people's increasing awareness of treatments due to modernization and globalization are propelling the growth of the global antivenom market.

According to the World Health Organization (WHO), around 5.5 million snake bites occur each year, resulting in up to 2.8 million poisonings (snakebite poisoning), and at least 85,000 to 143,000 people die from snakebites. Besides, about three times more amputations and other permanent disabilities. Due to international health organizations' involvement in producing safe and effective antidotes, people are familiar with antivenom drugs. However, the production of antivenom is difficult and expensive. Government authorities in developing countries are taking measures to prevent loss of life due to snake bites and other venomous bites to enhance healthcare services, fueling the growth of the antivenom market. In addition, medical research organizations are also continually developing effective treatment methods and antivenom to tackle the seriousness of venomous bites, catalyzing the business.

Rising awareness among people and recognizing snakebites as a medical emergency in rural areas is expected to boost the antivenom market for snakebite treatments.

Furthermore, the rising focus on research and development activities from private and public organizations for developing high-quality antivenoms owing to immense advancements in medical science and technology to meet the continuously rising demand for antivenoms due to the rise in mortality rate is expected to create more growth opportunities for the market over the forecast period. The market is supposed to offer several options for the key players owing to the unmet demand for antivenoms in countries like Africa, Asia, and Latin America. In addition, an increasing number of novel product developments and launches and a more natural approval process are also foreseen to create lucrative growth opportunities for the global antivenom market during the forecast period.

MARKET RESTRAINTS

Uncertainties in standards of quality and improper application of antivenom limit the growth rate of the global antivenom market.

High costs associated with manufacturing, lack of proper investments by public and private organizations, and inefficient manufacturing procedures restrain the growth of the worldwide antivenom market. Other factors that are challenging the development of the market are inappropriate regulations, shortage of skilled professionals in drug control laboratories, lack of specifications and proper knowledge regarding the types of toxic and lethal venom types that would affect the treatment procedure, belief systems in some countries like India and particularly in rural areas where the incidence of snake bites are more frequent, and lack of proper distribution networks of venom due to the inadequate infrastructure of healthcare in developing countries.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Animal, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Instituto Bioclon, S.A. de C.V. (Mexico), Pfizer AG (Switzerland), CSL Limited (Australia), F. Hoffmann-La Roche Ltd. (Switzerland), Merck & Co., Inc. (U.S.), Rare Disease Therapeutics, Inc. (U.S.), Vins Bioproducts Limited (India), BTG Plc (U.K.), Incepta Vaccine Ltd. (Bangladesh) and Bharat Serum. |

SEGMENTAL ANALYSIS

By Type Insights

The antivenom vaccines segment is expected to play the dominating role in the global antivenom market during the forecast period. Factors such as the growing prevalence of vaccines in the healthcare systems and the efficiency of vaccines are contributing to segmental growth. In addition, antivenom vaccines must be approved by the FDA before they are provided to the public and follow strict guidelines for approval to qualify. Therefore, the credibility of vaccines helps the dominance of the market.

However, the hyperimmune sera segment is anticipated to hold a considerable share of the worldwide market during the forecast period. The hyperimmune serum is a commercial antivenom that has been gaining popularity recently and is expected to show growth during the forecast period. The only drawback holding the segment behind vaccines is that hyperimmune serums can be expensive and difficult to afford, especially in lower economic countries.

By Animal Insights

The snake segment dominates the market and will likely continue the domination throughout the forecast period. Factors such as the occurrence rate of snake bites in countries like India, Pakistan, Bangladesh, and other Asian and African countries lead to a constant rise in demand for antivenom. In addition, increasing awareness among people in rural areas about the seriousness of snakebites, unmet demand conditions of the antivenoms, improvisation of regulatory frameworks and approval procedures, and increased government investments in developing high-quality antivenoms contribute to the growth of the snake segment in this market.

However, the scorpion segment is projected to hold a considerable share of the worldwide antivenom market during the forecast period. The scorpion is another species whose bite requires immediate antivenom assistance in case the scorpion is venomous. Although only about 30 of about 1500 scorpion species are venomous, their venom is extremely dangerous and deadly if not treated. In addition, there are more than a million scorpion bites in the world every year; therefore, regular occurrence increases the possibility of being poisoned.

REGIONAL ANALYSIS

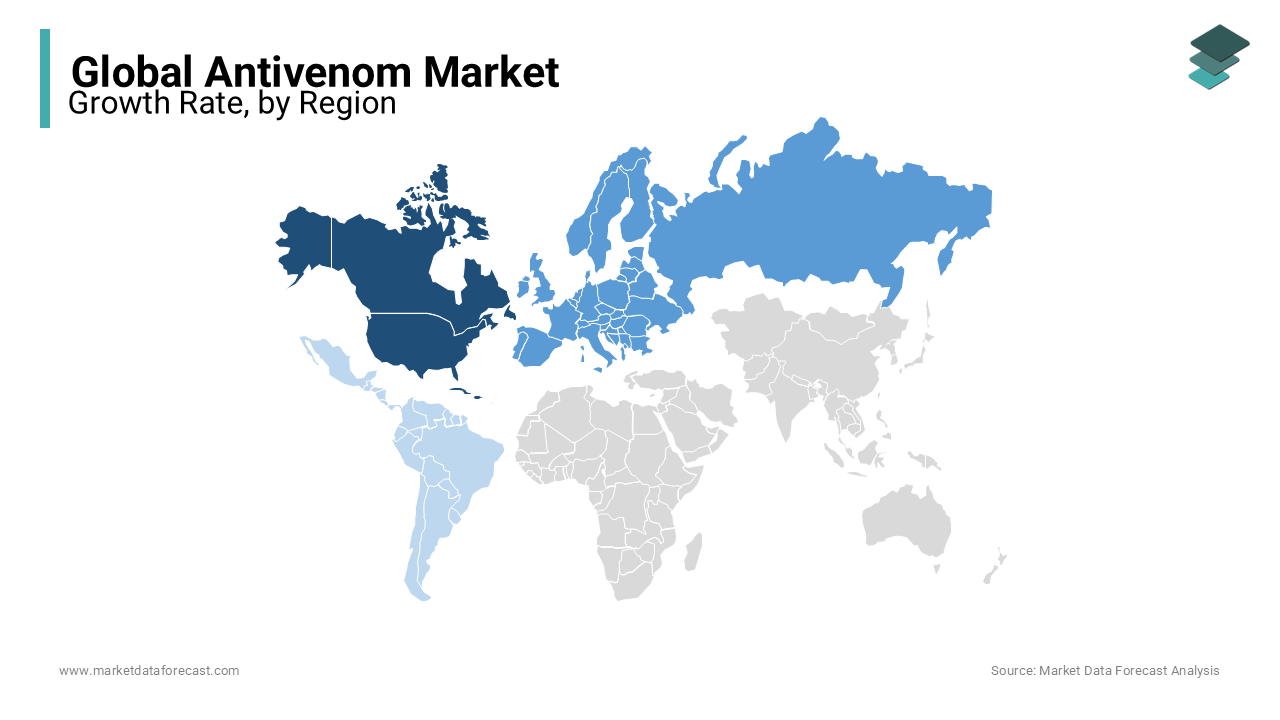

North America is the dominating global market accounting for approximately 39.0%, followed by Europe in 2024. The growth of the North American antivenom market is primarily driven by the growing number of snake bites, increasing awareness among people regarding the available antivenom treatments and the rising number of initiatives by North American countries to promote the availability and production of antivenom products. In North America, the U.S. contributed the majority share of the antivenom market over the forecast period. An estimated 7000 to 8000 people are affected by snakebites in the United States each year, and 30% are expected to be venomous.

Europe accounted for the second-largest global market share in 2024. As per the report, it is estimated that around 81,000 to 1,38,000 people die every year. In addition, snakebite is a neglected public health issue in many typical areas; these factors influence the antivenom market growth in this region. The growing number of people experiencing bites from snakes, spiders, scorpions, and other venomous animals every year in Europe is one of the key factors propelling the European antivenom market. Countries such as France, Italy, Spain, Greece, and Portugal have the highest incidence of snake bites in Europe.

The Asia-Pacific region is the fastest-growing region at this moment and growing at a CAGR of 8.59% during the forecast period. An increase in the prevalence of snake bites and other venomous bites is expected to drive market growth. India and Bangladesh are the major contributors to this market. The Journal of the Association of Physicians of India stated that there are 50,000 people annually dying in India. Governments and non-private organizations are conducting research activities for the treatment of therapeutics. However, in rural areas in the Asia Pacific, such as India, Bangladesh, and Nepal, antivenom adoption is shallow due to a lack of awareness.

Latin America is predicted to capture a considerable share of the worldwide market and the market in Middle East and Africa occupied the lowest share of the global market in 2024. However, the slow development of antivenom adoption, and the lack of technical knowledge among the people in this region about the treatment therapeutics, which lead to death and poor medical facilities, contribute to the market growth of the antivenom market in this region.

KEY MARKET PLAYERS

Companies leading the Global Antivenom Market profiled in the report are Instituto Bioclon, S.A. de C.V. (Mexico), Pfizer AG (Switzerland), CSL Limited (Australia), F. Hoffmann-La Roche Ltd. (Switzerland), Merck & Co., Inc. (U.S.), Rare Disease Therapeutics, Inc. (U.S.), Vins Bioproducts Limited (India), BTG Plc (U.K.), Incepta Vaccine Ltd. (Bangladesh) and Bharat Serum.

RECENT HAPPENINGS IN THE MARKET

- In August 2022, Bharat Serums and Vaccines (BSV), a biopharmaceutical company from India collaborated with the Indian Institute of Science (IISc) Labs to conduct R&D around the next-generation snake bite therapies.

- In March 2022, Irula Snake Catchers' Industrial Cooperative Society in India was granted permission to sell their snake venom by a government order and to catch snakes from the forest department. The snake venom was worth 57 lakh rupees, and the permissions granted livelihood resumption for many of the irulas snake catchers.

- In April 2021, Rare Disease Therapeutics, Inc. announced its FDA approval for the expanded version of equine-derived antivenin, ANAVIP. This expanded antivenom includes more snakes, like rattlesnakes, copperheads and others in its formula and provides more half-life and reduces the after-effects of venom in the body.

- In 2018, Pzifer Company extended the expiration date to 12 months for its antivenin product with food and drug administration.

- In 2018, the University of Arizona developed an antivenom called polyvalent F(ab)2 Equine, which can be used for treating bites caused by a snake in North America called Micrurus.

- In May 2017, Snakebite911, an app that contains educational information on snakes and snake bite first-aid support, was developed by BTG PLC.

MARKET SEGMENTATION

This research report on the global antivenom market has been segmented and sub-segmented based on type, animal, and region.

By Type

- Vaccines

- Hyperimmune Sera

- Homologous

- Heterologous

By Animal

- Snakes

- Scorpions

- Spiders

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Who are the leading companies in the antivenom market?

Instituto Bioclon, S.A. de C.V. (Mexico), Pfizer AG (Switzerland), CSL Limited (Australia), F. Hoffmann-La Roche Ltd. (Switzerland), Merck & Co., Inc. (U.S.), Rare Disease Therapeutics, Inc. (U.S.) are some of the key market players in the antivenom market in 2024.

Which region led the antivenom market in 2024?

The North American region accounted for the leading share of the antivenom market in 2024.

Which segment by animal accounted for the largest share of the antivenom market in 2024?

Based on the animal, the snakes segment led the antivenom market in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]