Asia-Pacific Artificial Intelligence (AI) Market Size, Share, Trends, & Growth Forecast Report By Offering, Technology, Business Function, Deployment Mode, and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC), Industry Analysis From 2024 to 2033

APAC Artificial Intelligence Market Size

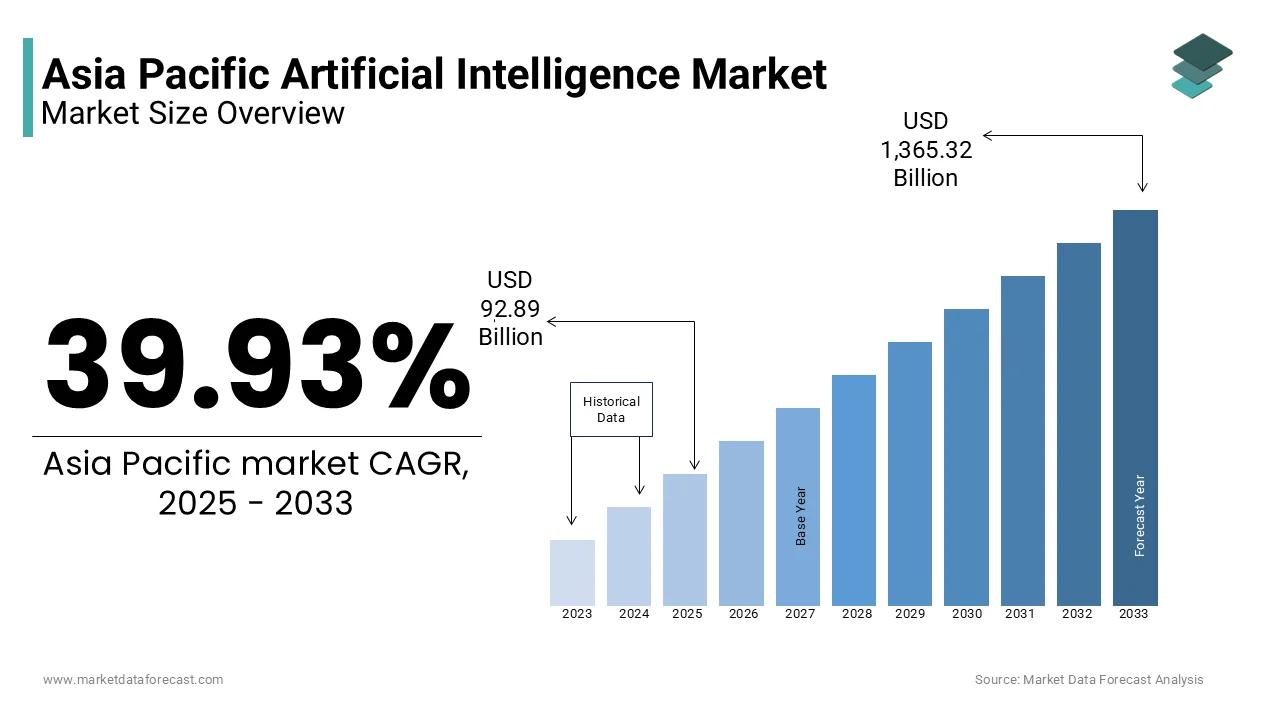

The Asia-Pacific Artificial Intelligence market was worth USD 66.38 billion in 2024. The APAC market is predicted to grow at a CAGR of 39.93% from 2025 to 2033 and the regional market size is expected to be valued at USD 1,365.32 billion by 2033 from USD 92.89 billion in 2025.

MARKET DRIVRS

The growing digitalization of the banking, financial services, insurance, healthcare and telecommunications industries

The growth of the Asia Pacific artificial intelligence market is primarily driven by the growing digitalization of the banking, financial services, insurance, healthcare and telecommunications industries. AI systems are also used to analyze vast volumes of data and derive insights that are used to boost productivity and enhance customer satisfaction. In addition, rising 5G infrastructure and increasing demand for intelligent virtual assistants are fueling the expansion of this market industry in the region. Furthermore, the rapid spread of coronavirus has forced pharmaceutical vendors to invest in AI research and development which is another driver boosting the market growth. The region has emerged as a center for AI innovation and adoption, implemented in several financial markets, vibrant cultures, and an unwavering quest for technological advancement.

By mid-2025, New technology frames and artificial intelligence will augment more than 50 percent of the Asia-Pacific workforce which is expected to cause a steady shift of organizations towards higher technology utilization and improved performance. AI will also induce an organizational cultural shift. It will further push businesses towards more technology use and increase human-machine interaction which will raise the demand for strategic responsibilities that AI and GenAI are unable to do. Furthermore, around 2000 companies in the region will change how they view and are open to human-machine cooperation internally between 2024 and 2025.

MARKET RESTRAINTS

The trust in technology is hindering the growth

The trust in technology is hindering the growth of the Asia Pacific artificial intelligence market. It is regularly observed that physicians are hesitant to use new technologies. For example, physicians wrongly think that artificial intelligence will someday replace them in the medical industry. Since doctors and radiologists believe that empathy and persuasion are human characteristics, they believe that using technology to replace medical care cannot be done completely. Additionally, it is anticipated that patients could establish an unhealthy relationship with these technologies and disregard necessary in-person treatments, thereby harming long-term patient-physician relationships. Many medical professionals doubt AI's capacity to accurately identify patient issues.

Ethical decision-making is one of the major issues limiting the Asia Pacific artificial intelligence market from expanding. Concerns of privacy, bias and responsibility surface as AI systems grow more independent. Data security and privacy is another issue derailing the growth rate. AI programs rely a lot on data. This problem is raised by the gathering, storing and analysis of huge amounts of private and sensitive data.

Impact of COVID-19

The COVID-19 pandemic has caused huge monetary losses to the Asia Pacific Artificial Intelligence market. The manufacturing sectors of India, China, Taiwan and South Korea were severely impacted by COVID-19 and the nationwide shutdowns. This slowed down the development and implementation of AI-based products in the manufacturing industry. The pandemic increased the adoption of remote technologies in the region. Also, data privacy and algorithmic bias in AI applications are two ethical issues that have gained prominence. Post-pandemic it is also assisting in economic recovery and efficiency. It is more frequently applied in different industries to improve supply chain resilience, automate operations and optimize processes.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

39.93% |

|

Segments Covered |

By Offering, Technology, Business Function, End Use, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Microsoft Corporation, Google Inc., IBM, Oracle Corporation, Apple Inc., Amazon Web Services, SAP, Salesforce, Cisco, Meta (Facebook), Intel Corp, H2O.ai., Hewlett Packard Enterprise, Siemens AG, Huawei, NVIDIA, OpenAI, SAS Institute, Baidu, Alibaba Cloud, AIBrain, Lumen5, Advanced Micro Devices, Iris.ai AS, Lifegraph, Sensely, Inc., and DiDi Global |

SEGMENTAL ANALYSIS

By Offering Insights

Based on the offering, the services segment is expected to lead the major share of the APAC AI market during the forecast period. The increased demand for operational efficiency and shifting customer preferences are propelling the Asia Pacific artificial intelligence market growth. APAC businesses are utilizing AI services like predictive maintenance, automated workflows and data-driven decision-making to enhance operational efficiency, reduce costs and boost productivity. They are using AI-driven chatbots, virtual assistants and intelligent customer support systems to meet the ever-increasing demands of their clientele for smooth and customized interactions.

By Technology Insights

Based on technology, the machine learning segment is a rapidly expanding market in the Asia Pacific region. The rising application in retail, healthcare, Transport and finance is driving the regional market growth. One of the main opportunities is the ability of AI and ML to automate routine and repetitive operations which allows human workers to concentrate on complicated and creative work. Healthcare is experiencing a transformation due to AI and ML. For instance, Thai company Perceptra has introduced Inspectra an AI-powered diagnostic imaging service to address the shortage of medical experts.

By Business Function Insights

Based on business function, the marketing & sales segment is anticipated to account for the leading share of the Asia-Pacific AI market during the forecast period. Southeast Asia's (SEA) annual year-end shopping festival has grown into an incredible opportunity for companies and businesses to increase sales. Customers in the region shop across multiple channels with more than 70 percent using search, video and social media during peak sales events compared to 56 percent in Australia and 58 percent in South Korea.

By End Use Insights

Based on end-users, the information technology segment is expected to have the largest share of the APAC AI market during the forecast period. The main factors elevating the growth rate are cloud computing, data analytics, cybersecurity, software and talent pool. The widespread use of cloud platforms offers the scalability and infrastructure required to deploy and develop AI applications. IT companies are leveraging vast data generated in the region to develop tools and expertise for data analysis and AI algorithms.

REGIONAL ANALYSIS

China is one of the largest markets for artificial intelligence and is expected to achieve a higher CAGR in the coming years. The Chinese government has provided substantial support to the artificial intelligence (AI) sector, positioning it as a crucial component of the country's strategy and a primary area of concentration for global competition. To boost the long-term expansion, the government has adopted measures such as the "Next Generation Artificial Intelligence Development Plan" and other industrial policies.

India is expected to propel at a faster rate during the forecast period. Machine learning, natural language processing and autonomous & sensor technology are the most prevalent technologies and will contribute to the market growth. The market is supported mostly by the expanding semiconductor industry. Also, automotive, healthcare, retail and consumer are anticipated to account for 60 percent of AI’s Gross Value Added in India's GDP.

Japan is anticipated to witness an upward trend in the market growth rate in the future. The primary factors propelling the market are the country's ageing population and declining labour force which have forced businesses to look for AI-driven automation solutions to deal with labour shortages and boost output.

South Korea is growing quickly making it one of the major players in the global AI market. The government's dedicated programs, substantial investments and growing focus on AI research and development are the main reasons behind this expansion. As a result of rising AI applications across various industries including BFSI, healthcare, manufacturing, automotive, retail & e-commerce and telecom South Korea's artificial intelligence industry is expanding quickly.

Singapore is estimated to expand at a faster pace during the forecast period. As part of its AI policy, Singapore has promised to boost government incentives for the industry to support the AI startup accelerator programs and encourage businesses to establish AI "centers of excellence." Authorities aim to hire more international talent to expand local AI training programs and provide GPUs to academics.

KEY MARKET PLAYERS

Microsoft Corporation, Google Inc., IBM, Oracle Corporation, Apple Inc., Amazon Web Services, SAP, Salesforce, Cisco, Meta (Facebook), Intel Corp, H2O.ai., Hewlett Packard Enterprise, Siemens AG, Huawei, NVIDIA, OpenAI, SAS Institute, Baidu, Alibaba Cloud, AIBrain, Lumen5, Advanced Micro Devices, Iris.ai AS, Lifegraph, Sensely, Inc., and DiDi Global are a few of the notable companies in the Asia-Pacific AI market.

RECENT HAPPENINGS IN THE MARKET

-

In December 2023, UNESCO and the Asia Pacific Artificial Intelligence Society (AAIA) announced a strategic partnership to deepen collaboration in bolstering AI higher education, investigating novel systems, opportunities and challenges in AI training & education, developing the workforce and fostering international exchanges.

-

In December 2023, Singapore is investing S$70 million in a major AI project to build the first extensive language model ecosystem in Southeast Asia that will support the varied cultures and languages of the area.

MARKET SEGMENTATION

This research report on the APAC artificial intelligence (AI) market has been segmented and sub-segmented into the following categories.

By Offering

-

Hardware

-

Software

-

Services

By Technology

-

Machine Learning

-

Natural Language Processing

-

Computer Vision

-

Context Awareness

By Business Function

-

Supply Chain Management

-

Finance

-

Law

-

Human Resources

-

Marketing & Sales

-

Service & Operations

-

Security

By End Use

-

Information Technology

-

BFSI

-

Healthcare

-

Automotive

-

Retail & E-commerce

-

Advertising & Media

-

Manufacturing

-

Transportation & Logistics

-

Military & Defense

-

Agriculture

-

Energy & Utilities

-

Telecommunication

-

Others

By Country

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

New Zealand

-

Thailand

-

Malaysia

-

Vietnam

-

Philippines

-

Indonesia

-

Singapore

-

Rest Of APAC

Frequently Asked Questions

Which countries in the Asia-Pacific region are leading contributors to the AI market share?

China, Japan, and India are among the leading contributors to the AI market share in the Asia-Pacific region, with each country showcasing dynamic growth in AI adoption and innovation.

How has the COVID-19 pandemic impacted AI adoption in the Asia-Pacific region?

The COVID-19 pandemic has accelerated AI adoption in the Asia-Pacific region, particularly in healthcare, e-commerce, and remote collaboration, highlighting the technology's resilience and adaptability.

What are the key challenges faced by AI startups in Asia?

AI startups in Asia may encounter challenges related to funding, talent acquisition, and navigating diverse regulatory landscapes. Overcoming these challenges is essential for sustained growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com