Asia Pacific Cloud Storage Market Size, Share, Trends, & Growth Forecast Report By Type (Solution - Primary Cloud, Disaster Recovery & Backup, Gateway, Data Archiving; Services - Professional, Managed), Deployment Model (Public, Private, Hybrid), Organization Size (Small & Medium Enterprises, Large Enterprises), Vertical (BFSI, IT & Telecom, Retail, Healthcare, Manufacturing, Government & Public Sector, Media & Entertainment), Industry Analysis From 2024 to 2033

Asia Pacific Cloud Storage Market Size

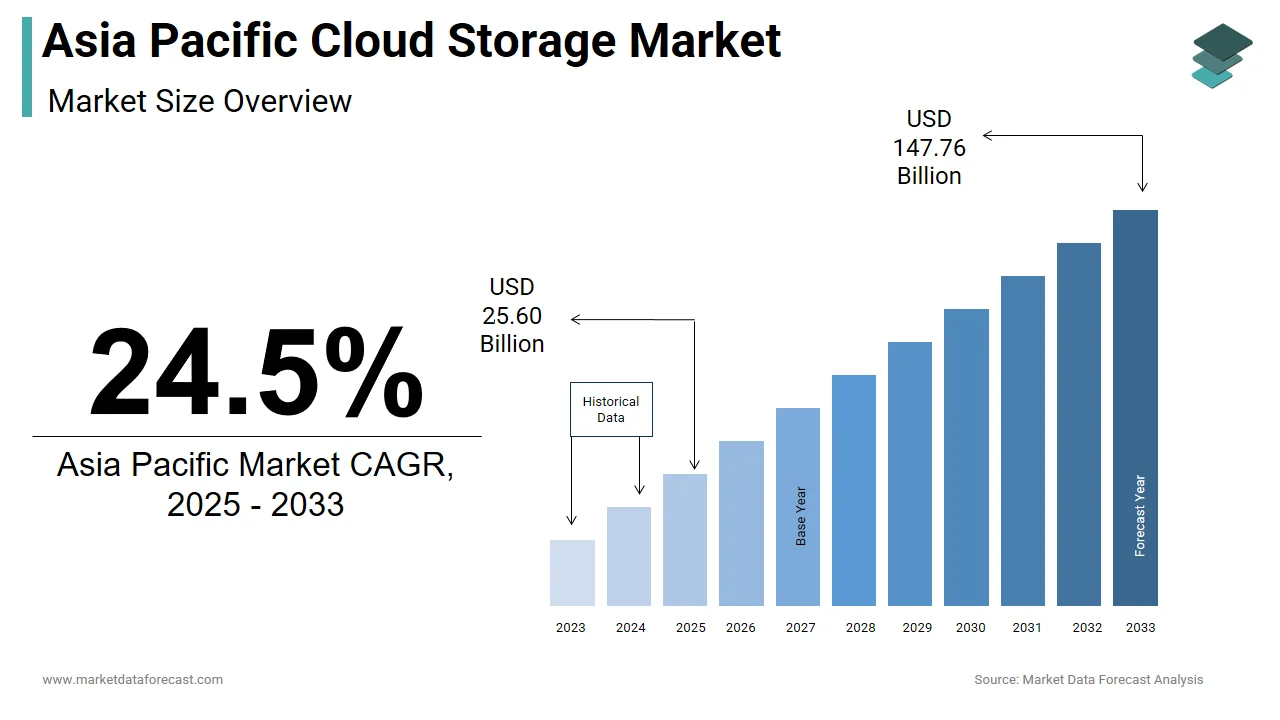

The cloud storage market in Asia-Pacific was worth USD 20.56 billion in 2024. The Asia Pacific market is estimated to grow USD 25.60 billion in 2025 and USD 147.76 billion by 2033, growing at a CAGR of 24.5% during the forecast period 2025 to 2033.

The rapid technological adoption and increasing data generation are propelling the growth of the Asia Pacific cloud storage market. According to Gartner, the region accounts for over 35% of global cloud spending, with countries like China, India, and Japan leading the charge. The proliferation of smartphones, IoT devices, and e-commerce platforms has created an exponential surge in data, necessitating robust cloud storage solutions. Additionally, government initiatives promoting digitalization amplify this growth. However, challenges such as data privacy concerns and cybersecurity threats persist by influencing market dynamics.

MARKET DRIVERS

Rising Adoption of Remote Work Technologies

The widespread adoption of remote work technologies serves as a primary driver for the Asia Pacific cloud storage market, fueled by the post-pandemic shift toward hybrid work models. According to McKinsey & Company, over 60% of companies in the region have implemented remote work policies, necessitating secure and scalable cloud solutions for data management. Government support further amplifies this trend. As per the Ministry of Electronics and Information Technology in India, subsidies for digital infrastructure have increased by 25% since 2020 by encouraging businesses to adopt cloud-based tools. Additionally, the rise of collaborative platforms such as Zoom and Microsoft Teams creates new opportunities, as these applications require seamless integration with cloud storage systems.

Increasing Data Generation from IoT Devices

The exponential increase in data generation from IoT devices is another critical driver propelling the Asia Pacific cloud storage market. According to IDC, the number of connected devices in the region is expected to surpass 5 billion by 2025 by creating immense demand for scalable storage solutions. The proliferation of smart cities further amplifies adoption. Additionally, sectors like healthcare and retail utilize IoT-generated data for personalized services, driving demand for secure and efficient storage systems. These factors collectively reinforce the pivotal role of IoT-driven data generation in shaping the cloud storage market’s growth trajectory.

MARKET RESTRAINTS

Data Privacy and Security Concerns

Data privacy and security concerns pose significant restraints to the Asia Pacific cloud storage market. For instance, China’s stringent Cybersecurity Law mandates that critical data be stored locally, complicating operations for multinational firms reliant on global cloud platforms. Similarly, India’s Personal Data Protection Bill imposes strict regulations on cross-border data transfers, which limit flexibility for cloud service providers. Moreover, high-profile data breaches exacerbate the issue. Smaller players often lack the resources to mitigate risks effectively, while larger corporations can invest in advanced encryption and threat detection systems. The data privacy and security concerns not only hinder market inclusivity but also slow down the widespread adoption of cloud storage solutions in the region.

High Initial Costs and Complexity

High initial costs and technical complexity present another major restraint for the Asia Pacific cloud storage market for small and medium enterprises (SMEs) seeking to transition from traditional on-premise systems. According to Deloitte, the average cost of migrating to cloud storage ranges from 150,000to500,000, depending on the scale and complexity of operations by making it inaccessible for budget-constrained businesses.

Additionally, the need for specialized skills to manage cloud infrastructure compounds the issue. While larger corporations can absorb these costs, smaller players often prioritize short-term affordability over long-term scalability. Consequently, high initial costs and complexity not only hinder market penetration but also restrict growth opportunities by forcing stakeholders to invest heavily in training and after-sales support to address these barriers effectively.

MARKET OPPORTUNITIES

Expansion of Edge Computing Solutions

The expansion of edge computing solutions presents a transformative opportunity for the Asia Pacific cloud storage market, enabling businesses to process data closer to the source and reduce latency. According to PwC, edge computing is projected to account for 30% of global data processing by 2025, which is creating robust demand for hybrid cloud architectures that integrate edge and centralized storage systems. China, a leader in digital innovation, is spearheading the adoption of edge-enabled cloud storage in smart factories. Additionally, industries like autonomous vehicles and telemedicine create new opportunities, as edge computing enhances operational efficiency and reliability.

Rising Investments in Artificial Intelligence and Big Data Analytics

Rising investments in artificial intelligence (AI) and big data analytics offer significant growth avenues for the Asia Pacific cloud storage market, driven by the region’s commitment to innovation. For example, India’s healthcare sector utilizes cloud storage to manage patient data and power AI-driven diagnostic tools by enhancing operational efficiency. Similarly, China’s dominance in AI research drives the need for advanced cloud infrastructure. Retail and e-commerce sectors further amplify demand, as AI-powered recommendation engines require seamless integration with cloud storage systems. The cloud storage providers can capitalize on these investments by fostering partnerships with tech firms and securing long-term contracts.

MARKET CHALLENGES

Intense Market Competition

Intense market competition poses a formidable challenge for the Asia Pacific cloud storage market, characterized by the presence of numerous domestic and international players vying for market share. For instance, Chinese providers like Alibaba Cloud dominate the market with cost-effective offerings by leveraging economies of scale to undercut competitors.

Local players in India and Southeast Asia face challenges in competing against established brands. A study by the Confederation of Indian Industry reveals that price sensitivity among buyers exacerbates the issue, with 60% of customers prioritizing cost over quality. Additionally, the lack of product differentiation limits growth opportunities by forcing companies to focus on aggressive marketing strategies rather than innovation. Intellectual property disputes further complicate the scenario, as per the World Intellectual Property Organization, with allegations of design infringements being common. These competitive pressures hinder profitability and stifle technological advancements by challenging manufacturers to strike a balance between affordability and innovation to remain relevant in the market.

Skilled Labor Shortages

Skilled labor shortages represent another pressing challenge for the Asia Pacific cloud storage market, undermining operational efficiency and hindering growth. According to the International Labour Organization, the IT and digital transformation sector faces a deficit of skilled professionals, particularly in emerging economies like India and Indonesia. For instance, a survey by the Associated Chambers of Commerce and Industry of India reveals that nearly 40% of cloud migration projects experience delays due to a lack of trained personnel. This shortage is exacerbated by the rapid pace of technological advancements, which outstrips workforce availability.

Furthermore, the complexity of modern cloud storage systems requires specialized training, which is often inaccessible to workers in rural areas. This scarcity not only impacts project timelines but also increases operational risks, as untrained personnel are more prone to errors. To address this challenge, industry stakeholders must collaborate with educational institutions and government bodies to establish comprehensive training initiatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Deployment Model, Vertical, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

Emerson Electric Co., ABB Ltd, Schneider Electric SE, Riello Elettronica SpA, EATON Corporation PLC, and others. |

|

Market Leaders Profiled |

Amazon Web Services, Inc., Apple Inc, IBM Corporation, Microsoft Corporation, Oracle, Salesforce.com, inc., VMware, Inc, RACKSPACE US, INC., HP Development Company, LP, Google, FUJITSU, Dell, Inc., Cisco Systems |

SEGMENTAL ANALYSIS

By Type Insights

The cloud storage solutions dominated the Asia Pacific market with a dominant share in 2024, with the region's rapid adoption of scalable and cost-effective cloud platforms to manage exponential data growth. For instance, China’s e-commerce sector, valued at over $2 trillion annually, relies heavily on cloud storage solutions like AWS and Microsoft Azure to handle consumer data efficiently. Another key factor is the rise of IoT devices.

The cloud storage services segment is likely to register a CAGR of 18.5% throughout the forecast period. The growth of the segment can be attributed due to the increasing demand for managed services, including consulting, migration, and support, particularly among small and medium enterprises (SMEs). For example, India’s IT sector, contributing approximately 8% to its GDP, utilizes cloud service providers to facilitate seamless transitions from legacy systems to cloud platforms.

The proliferation of hybrid work models further amplifies adoption. As per PwC, over 60% of companies in the region have implemented remote work policies, which is necessitating cloud-based collaboration tools and services. Additionally, industries like healthcare and retail rely on cloud services for personalized customer experiences are driving demand for specialized solutions.

By Deployment Model Insights

The public cloud dominated the Asia Pacific cloud storage market by holding 55.3% of the share in 2024. This dominance is driven by its affordability and scalability by making it ideal for startups and SMEs seeking cost-effective solutions. For instance, South Korea’s gaming industry relies heavily on public cloud infrastructure to deliver seamless online experiences, which is driving the growth of the segment.

Government initiatives further amplify this trend. As per the Ministry of Electronics and Information Technology in India, subsidies for digital infrastructure have increased by 25% since 2020 by encouraging businesses to adopt public cloud solutions. Additionally, the proliferation of e-commerce platforms creates new opportunities, as these applications require scalable storage systems.

The hybrid cloud is projected to exhibit a CAGR of 20.3% in the coming years. This growth is fueled by its flexibility and ability to integrate public and private cloud environments, catering to diverse business needs. The rise of edge computing further amplifies adoption. As per PwC, edge computing is projected to account for 30% of global data processing by 2025 by creating robust demand for hybrid architectures. Additionally, industries like healthcare and manufacturing rely on a hybrid cloud for real-time data analytics and secure storage.

By Vertical Type Insights

The IT & telecom sector was the largest by capturing 25.4% of the Asia Pacific cloud storage market in 2024, owing to the region’s rapid digital transformation and reliance on cloud infrastructure to manage vast amounts of data. The growing investments in 5G infrastructure in the region by adopting advanced cloud storage solutions which expected to substantially propel the growth of the market.

The healthcare industry is lucratively to grow with a CAGR of 19.8% in the coming years. This growth is fueled by the increasing adoption of telemedicine and AI-driven diagnostic tools, which rely on cloud storage for data management. For example, China’s healthcare sector utilizes cloud platforms to manage patient records and power AI-driven diagnostic tools by enhancing operational efficiency.

Government initiatives further amplify adoption. As per the World Health Organization, investments in digital healthcare infrastructure in the region are projected to exceed $50 billion annually by 2025, which is creating substantial demand for scalable storage solutions. Additionally, the rise of personalized medicine drives demand for secure and efficient cloud systems.

COUNTRY LEVEL ANALYSIS

China was the largest contributor in the Asia Pacific cloud storage market with 40.4% of the share in 2024 due to its massive digital economy and stringent localization laws. For instance, China’s Cybersecurity Law mandates that critical data be stored locally by creating robust demand for domestic cloud providers like Alibaba Cloud. Additionally, the proliferation of IoT devices and smart manufacturing initiatives drives adoption. Government support further amplifies growth. According to the Ministry of Industry and Information Technology, subsidies for digital infrastructure have increased by 30% since 2020 by ensuring widespread adoption. Collaborations with global players like Microsoft and AWS strengthen its technological edge.

India accounted in holding 20.1% of the Asia Pacific cloud storage market share in 2024. The country’s rapid digitalization and startup ecosystem drive demand for scalable cloud solutions. According to the Ministry of Electronics and Information Technology, investments in digital infrastructure have increased by 25% since 2020, which is encouraging businesses to adopt cloud platforms.

The proliferation of e-commerce platforms further amplifies adoption. For instance, Flipkart and Amazon India rely heavily on cloud storage to manage consumer data, reducing operational costs. Additionally, partnerships with domestic providers like Tata Consultancy Services bolster supply chain resilience. ss

Japan's cloud storage market growth is driven by its expertise in advanced technologies in sectors like automotive and electronics manufacturing. For instance, Toyota and Sony utilize cloud storage extensively in production lines by enhancing precision and energy efficiency. Government initiatives play a pivotal role. According to the Ministry of Economy, Trade, and Industry, Japan plans to invest $5 billion in sustainable manufacturing by 2025, focusing on eco-friendly technologies. Collaborations with global players like IBM ensure access to cutting-edge systems.

South Korea's cloud storage market is likely to have prominent growth opportunities in the coming years. The country’s dominance is driven by its dominance in the gaming and entertainment sectors. For example, Nexon and NCSoft rely heavily on cloud storage for delivering seamless online experiences. Government support further amplifies growth. According to the Ministry of Science and ICT, investments in 5G infrastructure have increased by 40% since 2020 by ensuring access to advanced technologies. Collaborations with domestic players like Naver Cloud bolster supply chain resilience.

Australia and New Zealand are likely to grow steadily with its focus on sustainability and renewable energy projects. Government initiatives further amplify growth. According to the Department of Industry, Science, and Resources, subsidies for green energy projects have increased by 20% since 2020 by encouraging the adoption of energy-efficient technologies. Collaborations with global players like Google Cloud ensure access to cutting-edge systems.

KEY PARTICIPANTS IN THE MARKET

The major players covered in the Asia Pacific cloud storage market report are Amazon Web Services, Inc., Apple Inc, IBM Corporation, Microsoft Corporation, Oracle, Salesforce.com, inc., VMware, Inc, RACKSPACE US, INC., HP Development Company, LP, Google, FUJITSU, Dell, Inc., Cisco Systems, among other national and global players. Market share data is available separately for Global, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and South America. DBMR analysts understand competitive forces and provide competitive analysis for each competitor separately.

TOP LEADING PLAYERS IN THE MARKET

Alibaba Cloud

Alibaba Cloud is a dominant player in the Asia Pacific cloud storage market, renowned for its innovative and scalable solutions tailored to regional needs. The company offers a comprehensive suite of services, including data analytics, AI integration, and hybrid cloud solutions, catering to industries like e-commerce, finance, and manufacturing. Recently, Alibaba Cloud expanded its data centers in Indonesia and Malaysia by enhancing accessibility for local businesses. Additionally, partnerships with government bodies ensure compliance with stringent data localization laws.

Amazon Web Services (AWS)

Amazon Web Services (AWS) plays a pivotal role in the Asia Pacific cloud storage market by offering robust infrastructure and cutting-edge technologies. AWS’s focus on innovation is evident in its development of AI-driven tools and edge computing capabilities, which are widely adopted by enterprises across sectors like healthcare and retail. Recently, AWS launched its "Asia Pacific Mumbai Region Expansion," enabling faster access for Indian customers. The company also partnered with local startups to provide cost-effective migration services, which is driving adoption among SMEs.

Microsoft Azure

Microsoft Azure is a key force in the Asia Pacific cloud storage market in industries like BFSI, IT, and manufacturing. Its Azure Stack Edge and hybrid cloud solutions are widely used for secure and efficient data management. Recently, Microsoft introduced its "Azure Space" initiative in Australia by enabling real-time satellite data processing for agriculture and mining sectors. The company also expanded its partnership with Telstra to enhance cloud connectivity in remote regions. Collaborations with educational institutions further solidify its position.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the Asia Pacific cloud storage market employ diverse strategies to maintain their competitive edge. Innovation and R&D investments rank among the most prominent approaches, with companies developing AI-driven and edge computing solutions. Strategic partnerships and collaborations are also widely adopted, enabling firms to tap into emerging markets and secure contracts for large-scale projects. Localization efforts, such as establishing regional data centers, reduce latency and improve accessibility. Sustainability-focused measures, such as developing energy-efficient platforms, further strengthen market positioning. Lastly, after-sales services, including predictive maintenance and migration support, play a pivotal role in fostering customer loyalty and driving repeat business.

COMPETITION OVERVIEW

The Asia Pacific cloud storage market is characterized by intense competition, driven by the presence of global giants and regional players vying for dominance. Established companies like Alibaba Cloud, AWS, and Microsoft Azure leverage their technological expertise and extensive distribution networks to maintain its dominance. Meanwhile, local manufacturers compete aggressively on pricing, offering cost-effective solutions tailored to budget-conscious customers. The market’s competitive landscape is further shaped by rapid technological advancements and government initiatives aimed at boosting digital infrastructure. To differentiate themselves, players focus on innovation, introducing cutting-edge products for AI, IoT, and edge computing. Sustainability initiatives, such as low-emission data centers, are also gaining traction amid stricter environmental regulations.

TOP 5 MAJOR ACTIONS TAKEN BY COMPANIES

- In March 2023, Alibaba Cloud expanded its data centers in Indonesia, enhancing accessibility for local businesses and supporting regional digitalization efforts.

- In May 2023, Amazon Web Services launched its "Asia Pacific Mumbai Region Expansion by enabling faster access for Indian customers and strengthening its regional presence.

- In July 2023, Microsoft Azure introduced its "Azure Space" initiative in Australia by enabling real-time satellite data processing for agriculture and mining sectors.

- In September 2023, Google Cloud partnered with Tata Consultancy Services to offer AI-driven solutions for India’s healthcare sector by targeting telemedicine applications.

- In November 2023, IBM Cloud collaborated with South Korean firms to develop hybrid cloud solutions for the gaming industry by enhancing scalability and security.

MARKET SEGMENTATION

This research report on the Asia Pacific cloud storage market has been segmented and sub-segmented based on the following categories.

By Type

- Solutions

- Services

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Vertical

- BFSI

- IT & Telecom

- Retail

- Healthcare

- Manufacturing

- Government & Public-Sector

- Media & Entertainment

- Others

By Region

- China

- India

- japan

- South Korea

- South East Asia

- Australia & NZ

- Rest of Asia-Pacific

Frequently Asked Questions

What are the main drivers of growth in the Asia Pacific Cloud Storage Market?

The main drivers include the rapid digital transformation of businesses, increasing adoption of cloud services, growing data generation from various sectors, advancements in technology, and supportive government policies.

How is the demand for cloud storage services evolving in the Asia Pacific region?

The demand for cloud storage services is growing rapidly due to increased data creation from IoT devices, mobile usage, and enterprise digital transformation. This demand is further fueled by the need for data backup, disaster recovery, and remote work solutions.

What are the major challenges faced by the Asia Pacific Cloud Storage Market?

Major challenges include concerns over data security and privacy, regulatory compliance issues, high initial costs of deployment, and the need for reliable internet infrastructure in certain areas.

What trends are shaping the future of the Asia Pacific Cloud Storage Market?

Trends shaping the future include the rise of hybrid cloud solutions, increasing investment in data centers, the growth of edge computing, and the adoption of AI and machine learning for data management and analytics.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com