Asia Pacific Dropshipping Market Size, Share, Trends & Growth Forecast By Product Type (Hobby, Toys, DIY, Food and Personal Care, Furniture and Appliances, Fashion, Electronics and Media and Others) and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC) - Industry Analysis From (2025 to 2033)

Asia Pacific Dropshipping Market Size

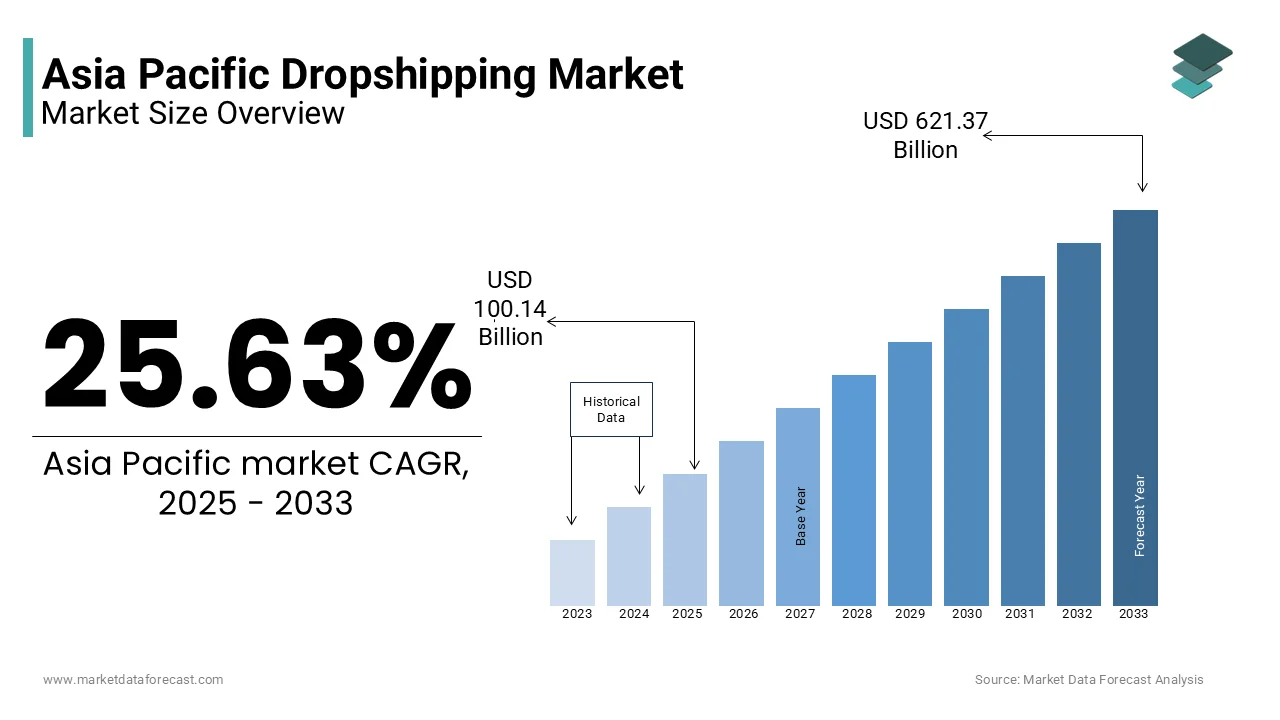

The size of the dropshipping market in the Asia-Pacific region was worth USD 79.71 billion in 2024, and is anticipated to grow at a CAGR of 25.63% from 2025 to 2033, and the APAC dropshipping market is predicted to be worth USD 621.37 billion by 2033 from USD 100.14 billion in 2025.

The Asia Pacific dropshipping market has emerged as a dynamic hub for e-commerce innovation, driven by rising internet penetration and consumer demand for affordable online shopping options. Countries like China, India, and Japan are at the forefront of this growth, supported by robust logistics networks and digital payment systems.

MARKET DRIVERS

Rising E-Commerce Adoption Among SMEs

The rapid adoption of e-commerce by small and medium-sized enterprises (SMEs) is a key driver propelling the Asia Pacific dropshipping market. The proliferation of social commerce platforms, such as TikTok Shop and Instagram Shopping, has further amplified the growth of the Asia pacific dropshipping market. According to App Annie, mobile commerce accounted for 68% of total e-commerce sales in the region by creating new opportunities for SMEs to leverage dropshipping models.

Expansion of Cross-Border Trade Agreements

Another significant driver is the expansion of cross-border trade agreements, which have facilitated seamless international transactions and reduced operational barriers for dropshipping businesses.. This agreement has lowered tariffs and streamlined customs procedures, which is enabling dropshippers to access a broader customer base. Furthermore, a study by PwC revealed that over 65% of dropshipping businesses in the region have expanded their operations internationally, leveraging these trade agreements. The growing demand for imported goods, coupled with efficient logistics networks, has positioned cross-border dropshipping as a lucrative opportunity for regional players.

MARKET RESTRAINTS

Logistical Challenges and Delivery Delays

One of the primary restraints hindering the growth of the Asia Pacific dropshipping market is the prevalence of logistical inefficiencies and delivery delays. The region’s vast geographical expanse and varying infrastructure quality create significant challenges in ensuring timely deliveries. According to a report by DHL, over 40% of dropshipping businesses in rural areas of India and Indonesia face delivery delays exceeding five days is leading to customer dissatisfaction and order cancellations. Additionally, the lack of standardized address systems in certain regions complicates last-mile delivery. While urban centers benefit from advanced logistics networks, rural areas often remain underserved, which is limiting the scalability of dropshipping operations. Addressing these logistical bottlenecks requires substantial investments in infrastructure and technology by posing a barrier for smaller players in the market.

Proliferation of Counterfeit Products

Another critical restraint is the widespread availability of counterfeit products, which undermines consumer trust and tarnishes the reputation of legitimate dropshipping businesses. This issue is particularly pronounced on platforms like Taobao and Lazada, where counterfeit sellers exploit the anonymity of online marketplaces to distribute fake products. The absence of stringent regulatory frameworks and enforcement mechanisms further exacerbates the problem, which is leaving consumers vulnerable to fraud. Moreover, the reputational damage caused by counterfeit incidents often leads to lost sales and increased return rates by impacting the profitability of genuine sellers. Combatting this issue requires collaboration between platforms, governments, and businesses to implement robust verification systems.

MARKET OPPORTUNITIES

Integration of AI-Driven Supply Chain Solutions

The integration of artificial intelligence (AI) into supply chain management presents a transformative opportunity for the Asia Pacific dropshipping market. AI-powered tools enable predictive analytics, real-time inventory tracking, and optimized route planning, significantly enhancing operational efficiency. According to Accenture, AI-driven supply chain solutions can reduce delivery times by up to 30%, while improving accuracy and customer satisfaction. The region’s rapidly evolving technological landscape, supported by government initiatives like China’s New Infrastructure Plan, provides a conducive environment for adopting these innovations. For instance, JD.com implemented AI-based logistics systems to streamline its dropshipping operations by achieving a 25% reduction in fulfillment costs. Furthermore, the increasing complexity of cross-border dropshipping demands advanced solutions capable of handling diverse regulations and shipping protocols.

Growing Demand for Niche Product Offerings

Another promising opportunity lies in the growing demand for niche product offerings, which cater to the unique preferences of Asia Pacific consumers. The region’s diverse cultural and demographic landscape creates a fertile ground for specialized dropshipping models targeting underserved markets. For example, a Singapore-based dropshipper specializing in eco-friendly home decor reported a 40% increase in sales after targeting environmentally conscious consumers. Additionally, the rise of influencer marketing and social commerce platforms has enabled niche sellers to reach highly engaged audiences.

MARKET CHALLENGES

Regulatory Compliance Across Borders

A significant challenge facing the Asia Pacific dropshipping market is the complexity of navigating regulatory compliance across multiple jurisdictions. Each country in the region has its own set of import/export regulations, tax policies, and customs procedures, which is creating operational hurdles for cross-border dropshipping businesses. According to a report by Ernst & Young, over 50% of dropshipping vendors in the region cited regulatory compliance as a major obstacle to scaling their operations. For instance, Australian dropshippers exporting goods to Southeast Asia often encounter discrepancies in tariff classifications, which is leading to unexpected costs and delays. Additionally, the lack of harmonized standards for product safety and labeling further complicates compliance efforts. A study by the Asian Development Bank revealed that non-compliance with local regulations resulted in a 15% loss in revenue for affected businesses. Addressing this challenge requires close collaboration between governments and industry stakeholders to establish unified frameworks and streamline cross-border processes.

Intense Competition and Price Wars

Another pressing challenge is the intense competition and prevalence of price wars, which erode profit margins and hinder sustainable growth. The low barrier to entry in the dropshipping market has led to an influx of new players, saturating the competitive landscape. For example, Indian dropshippers offering generic electronics reported a 20% decline in profitability due to undercutting competitors’ prices. Furthermore, the dominance of large e-commerce platforms like Amazon and Alibaba intensifies the pressure on smaller players to offer discounts and promotions, further straining their financial resources. Overcoming this challenge requires innovative strategies, such as focusing on value-added services and personalized customer experiences, to stand out in a crowded market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

25.63% |

|

Segments Covered |

By Product, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Doba Inc., Alidropship.Com, Megagoods, Inc., Stock source, Orderhive, Printify, Inc., Modalyst, Inc. and Sunrise Wholesale Merchandise LLC |

SEGMENTAL ANALYSIS

By Product Insightsx`

The electronics and media segment dominated the Asia Pacific dropshipping market by accounting for 35.3% of the total share in 2024 due to the region’s status as a global hub for electronics manufacturing and consumption. The affordability and accessibility of electronics through dropshipping platforms like AliExpress and Lazada have fueled demand among price-sensitive consumers. For instance, Xiaomi reported a 40% increase in sales of smart home devices through dropshipping channels in Southeast Asia. The proliferation of mobile devices and internet connectivity further amplifies demand for electronics. A report by App Annie reveals that over 70% of online shoppers in the region use smartphones to purchase gadgets by creating a robust market for dropshipping vendors. Additionally, advancements in digital payment systems, such as Alipay and Paytm, have streamlined transactions by making electronics more accessible to rural consumers.

The food and personal care segment is lucratively growing with a projected CAGR of 22.5% from 2025 to 2033. This rapid growth is fueled by changing consumer preferences toward health-conscious and sustainable products. Consumers in the region prioritize organic and eco-friendly personal care items, which is creating opportunities for niche dropshipping businesses.

The rise of social commerce platforms has further accelerated the segment’s expansion. According to a study by Facebook, 65% of consumers in the region discover new food and personal care products through social media, enabling dropshippers to reach highly engaged audiences. Additionally, cross-border trade agreements, such as the RCEP, have facilitated the import of premium international brands, broadening product availability. For instance, South Korean skincare brands gained significant traction in India through dropshipping platforms like Flipkart.

COUNTRY LEVEL ANALYSIS

China led the Asia Pacific dropshipping market with 45.3% of the share in 2024 with its robust manufacturing base and advanced logistics infrastructure. Platforms like Alibaba and JD.com have established themselves as global leaders in e-commerce are offering seamless dropshipping solutions. According to Deloitte, over 70% of cross-border dropshipping transactions in the region originate from China, which is driven by affordable pricing and extensive product catalogs.

India was positioned second by holding 20.3% of the Asia Pacific dropshipping market share in 2024. The country’s burgeoning startup ecosystem and rising internet penetration have fueled the adoption of dropshipping among SMEs. A study by KPMG highlights that over 60% of Indian entrepreneurs leverage dropshipping to enter the e-commerce space without significant upfront investment. For instance, Meesho, a homegrown platform, enabled local artisans to sell handmade products globally, which is achieving a 45% growth in exports.

Japan is lucratively having a fastest growth rate throughout the forecast period. Consumers in Japan prioritize premium products, which is creating opportunities for dropshippers offering high-end electronics and fashion items.

KEY MARKET PLAYERS

Doba Inc., Alidropship.Com, Megagoods, Inc., Stock source, Orderhive, Printify, Inc., Modalyst, Inc. and Sunrise Wholesale Merchandise LLC are some of the major players in the Asia pacic dropshipping market.

TOP LEADING PLAYERS IN THE MARKET

Alibaba Group

Alibaba Group has established itself as a dominant player in the Asia Pacific dropshipping market through its platforms, AliExpress and Taobao Global. The company’s extensive supplier network and advanced logistics infrastructure enable seamless cross-border transactions. In 2023, Alibaba launched an AI-driven supply chain optimization tool to enhance delivery efficiency for its dropshipping vendors. Its focus on integrating blockchain technology to combat counterfeit products further strengthens its reputation among global buyers.

Shopify

Shopify plays a pivotal role in empowering SMEs across the Asia Pacific region to adopt dropshipping models. The platform provides intuitive tools for entrepreneurs to integrate suppliers directly into their online stores. In early 2024, Shopify introduced AI-powered analytics to help merchants predict consumer trends and optimize inventory management. Additionally, its emphasis on social commerce integration enables sellers to leverage platforms like TikTok and Instagram, enhancing visibility and sales.

Lazada

Lazada has emerged as a key player in Southeast Asia’s dropshipping ecosystem, offering localized solutions tailored to regional markets. The platform’s partnership with logistics providers like Ninja Van ensures efficient delivery networks. In mid-2023, Lazada introduced a fulfillment center initiative in Indonesia to support dropshippers with warehousing and packaging services. Its recent collaboration with Korean beauty brands highlights its commitment to expanding niche product categories, strengthening its competitive edge.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the Asia Pacific dropshipping market employ innovative strategies to strengthen their positions. Partnerships with logistics providers ensure efficient supply chain operations, while AI-driven tools optimize inventory and delivery processes. Companies also focus on combating counterfeit products through blockchain verification systems. Expanding into niche categories like sustainable goods and health products allows players to tap into emerging consumer trends. Additionally, collaborations with social commerce platforms and influencers drive brand awareness and customer engagement. Investments in localized solutions cater to diverse regional preferences, fostering trust and loyalty among users

COMPETITION OVERVIEW

The Asia Pacific dropshipping market is highly competitive, characterized by the presence of global giants like Alibaba and regional players such as Lazada and Shopify. These companies leverage their technological expertise and logistics networks to offer seamless solutions for SMEs and individual entrepreneurs. The market also witnesses the entry of niche platforms focusing on specialized product categories, intensifying rivalry. Strategic collaborations with payment gateways and logistics providers are critical differentiators, enabling players to address challenges like counterfeit products and delivery inefficiencies. Furthermore, the growing adoption of AI and blockchain technologies fosters innovation, driving advancements in operational efficiency. This competitive environment encourages continuous improvement by positioning the region as a leader in global e-commerce innovation.

RECENT MARKET DEVELOPMENTS

- In April 2023, Alibaba launched an AI-driven logistics platform to optimize supply chain operations by reducing delivery times by 25% for its dropshipping vendors.

- In June 2023, Lazada partnered with Ninja Van to establish fulfillment centers in Indonesia by enhancing warehousing and packaging services for dropshippers.

- In August 2023, Shopify integrated AI-powered analytics tools to help merchants predict consumer trends and improve inventory management.

- In November 2023, Shopee collaborated with regional banks to offer microloans to SMEs engaged in dropshipping, enabling them to scale operations without upfront capital.

- In February 2024, JD.com introduced a blockchain-based verification system to combat counterfeit products, improving trust among its dropshipping merchants and customers.

MARKET SEGMENTATION

This research report on the Asia Pacific dropshipping market has been segmented and sub-segmented into the following categories.

By Product

-

Toys

-

Hobbies And DIY

-

Furniture And Appliances

-

Food And Personal Care

-

Electronics And Media

-

Fashion

By Region

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

New Zealand

-

Thailand

-

Malaysia

-

Vietnam

-

Philippines

-

Indonesia

-

Singapore

-

Rest of APAC

Frequently Asked Questions

What are the main product categories in the APAC dropshipping market?

The main product categories include consumer electronics, fashion and apparel, home and garden products, beauty and health products, and sports and outdoor gear.

What are the major challenges faced by dropshippers in the APAC region?

Major challenges include supply chain disruptions, customs regulations, language barriers, and managing customer expectations regarding shipping times and product quality.

What are the key factors driving the growth of the dropshipping market in APAC?

Key factors include the rise of e-commerce platforms, increasing internet penetration, growing consumer disposable income, and advancements in logistics and payment solutions.

What trends are shaping the future of the APAC dropshipping market?

Trends include the adoption of artificial intelligence for personalized marketing, the use of big data for inventory management, the growth of cross-border e-commerce, and increasing consumer demand for sustainable and ethical products.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com