Asia Pacific HPLC Market Size, Share, Trends & Growth Forecast Report By Product, Application and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From (2025 to 2033)

Asia Pacific HPLC Market Size

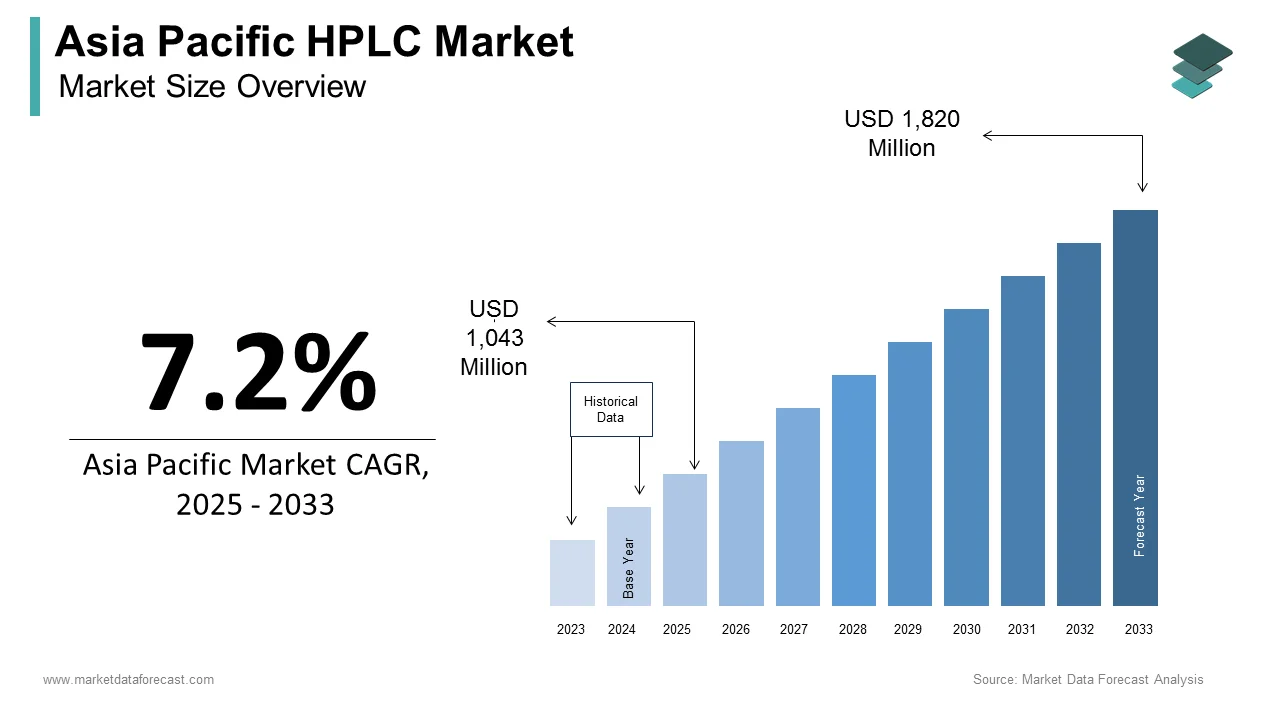

The size of the high-performance liquid chromatography market in Asia Pacific was valued at USD 973 million in 2024. The Asia Pacific market is expected to be valued at USD 1,043 million in 2025 and USD 1,820 million by 2033, exhibiting a CAGR of 7.2% from 2025 to 2033.

MARKET DRIVERS

Growing Importance of HPLC in Drug Approvals

HPLC technology's high sensitivity and precision, the growing importance of HPLC tests in drug approvals, the growing use of hyphenated processes, and rising pharmaceutical R&D spending are majorly driving the HPLC market growth in the Asia Pacific. The other key factors predicted to fuel the development of the Asia Pacific HPLC market over the forecast period include accuracy compared to conventional chromatographic procedures. In addition, increased use of high-performance liquid chromatography in biological research, rising research and development activities, a growing number of pharmaceutical companies and contract research institutes, high prevalence of chronic diseases, and increasing investment in life sciences and academics are expected to contribute to the market's growth.

Growing Clinical Research for Cancer Treatment

Clinical research is being conducted at several research facilities to develop cancer treatment technology. In addition, healthcare spending in this country has surged across recent years in the region. As a result, the market's growth potential is likely to increase in the future years. As a result of the Chinese government's massive investments in R&D, China has emerged as a vital participant in the biotechnology business. The Chinese life science sector has risen steadily due to solid R&D and funding, which has contributed significantly to the market's expansion. The market is primarily driven by the government's increased expenditure in pharmaceutical R&D, as well as advanced clinical research efforts in China and Japan.

MARKET RESTRAINTS

The Asia Pacific high-performance liquid chromatography market's growth is expected to be restrained by the high cost of the equipment and a scarcity of skilled analysts.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Instruments, Consumables, Application, and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest Of APAC. |

|

Market Leader Profiled |

Waters Corporation, Agilent Technologies, Shimadzu Corporation, Thermo Fisher Scientific Inc., GE Healthcare, PerkinElmer Inc., Bio-Rad Laboratories Inc., Gilson Inc., Phenomenex Inc., and JASCO Inc., and Others. |

SEGMENTAL ANALYSIS

By Product Insights

REGIONAL ANALYSIS

Regionally, Asia-Pacific is expected to witness significant growth during the forecast period. Increasing interest in research activities in developing countries is estimated to boost market expansion. In addition, due to newer technology, more disposable income, and increased funding for research activities, Asia Pacific is predicted to develop faster among all the regions in the global HPLC market. Therefore, during the forecast period, Asia Pacific is expected to grow at the fastest rate. Extensive sales of biosimilars and generics in Japan and expansion in the pharma and biotech sectors in India and China are some of the key factors driving the HPLC market in this area.

The Asia Pacific is expected to be the most attractive regional market for the global HPLC market expansion. Increased investment by leading companies in clinical research and development of new drugs to provide innovative treatment choices accounts for a substantial percentage of the HPLC market's growth in Asia-Pacific. In addition, manufacturers are increasingly concentrating their efforts on improving technology that might aid researchers in conducting high-quality research. Over the next five years, this will drive the HPLC market forward.

Furthermore, growing economies such as China and India are predicted to generate new opportunities for HPLC equipment vendors over the forecasted period. The market is growing due to Chinese oncologists' increasing use of biomarker-driven targeted therapies. Even without in-house manufacturing facilities, the government is encouraging local research by seeking medicinal licensing. Thus, the HPLC market will benefit from China's substantial position in the biotechnology sector.

KEY MARKET PLAYERS

A few promising companies operating in the Asia Pacific high-performance liquid chromatography market profiled in this report are Waters Corporation, Agilent Technologies, Shimadzu Corporation, Thermo Fisher Scientific Inc., GE Healthcare, PerkinElmer Inc., Bio-Rad Laboratories Inc., Gilson Inc., Phenomenex Inc., JASCO Inc., and Others.

MARKET SEGMENTATION

This research report on the Asia Pacific high-performance liquid chromatography market has been segmented and sub-segmented based on product, instruments, consumables, application, and region.

By Product

- Instruments

- Consumables

- Accessories

By Instruments

- Systems

- Detectors

By Consumables

- Columns

- Filters

By Application

- Clinical Research

- Diagnostics

- Forensics

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com