Asia Pacific Smoothies Market Research Report - Segmented Based on Product, Distribution Channel, and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC)- Analysis on Size, Share, Trends, & Growth Forecast from 2025 to 2033

Asia Pacific Smoothies Market Size

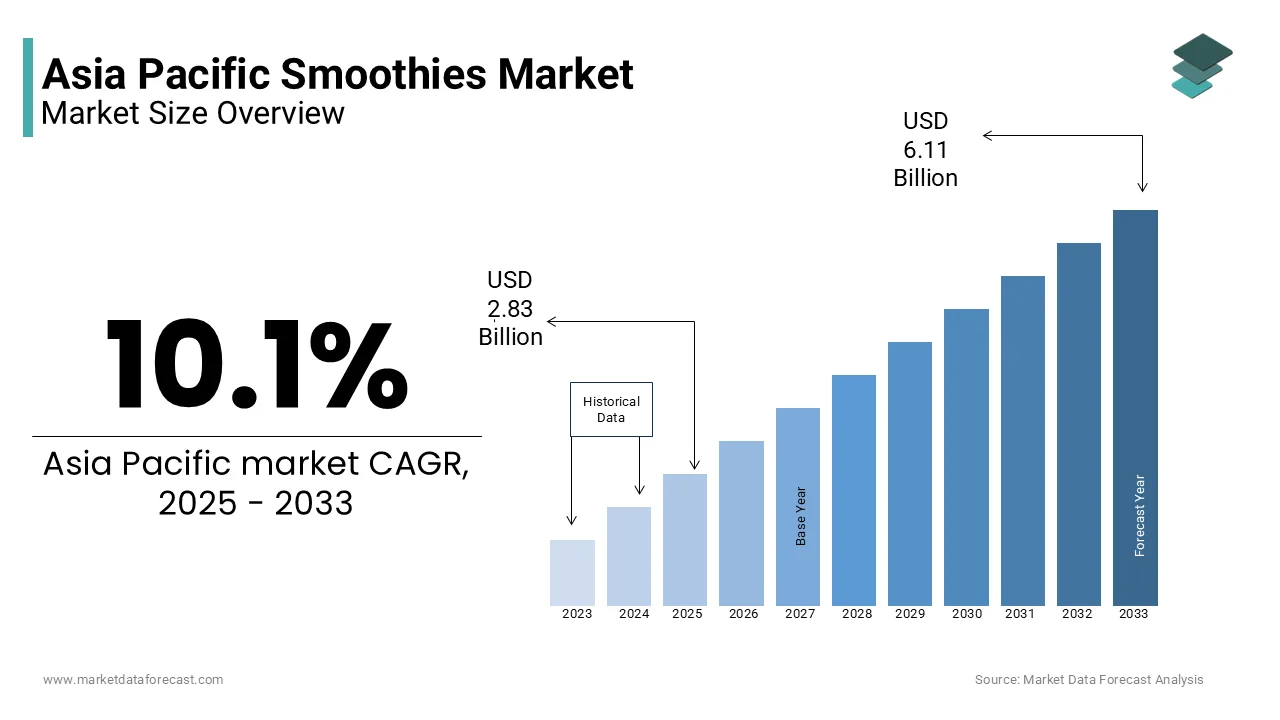

The size of the smoothies market in Asia Pacific was worth USD 2.57 billion in 2024. The regional market is further projected to grow at a CAGR of 10.1% from 2025 to 2033 and be worth USD 6.11 billion by 2033 from USD 2.83 billion in 2025.

MARKET DRIVERS

Rising Health Consciousness

Rising health consciousness serves as a major driver propelling the Asia Pacific smoothies market forward, particularly among younger demographics. This trend is further amplified by the growing influence of social media platforms, which promote smoothies as a convenient way to incorporate fruits, vegetables, and superfoods into busy lifestyles. Moreover, collaborations with celebrity chefs and nutritionists have further amplified this trend. Influencer-driven campaigns promoting smoothies have increased sales in markets like Malaysia and Singapore. These dynamics shows how health consciousness continues to fuel the dominance of smoothies in the region.

Increasing Demand for Convenience Foods

The increasing demand for convenience foods represents another significant driver for the Asia Pacific smoothies market which is fueled by urbanization and changing lifestyles. This trend is especially pronounced in countries like China and South Korea, where dual-income households prioritize quick yet nutritious meal solutions. Besides, the rise of e-commerce platforms has amplified accessibility, with online sales of smoothies growing considerably in recent years. Another significant factor is the influence of global food trends, such as the popularity of meal kits and home-cooked gourmet meals, which have bolstered the adoption of smoothies as versatile meal enhancers. A study by the Australian Institute of Food Science and Technology notes that smoothies with unique flavor profiles, such as tropical fruit blends and green vegetable variants, now account for 30% of total sales in urban markets.

MARKET RESTRAINTS

Limited Awareness of Nutritional Benefits

Limited awareness of the nutritional benefits of smoothies poses a significant restraint to the Asia Pacific smoothies market, particularly in rural and underdeveloped areas. These inconsistencies directly translate into lower retail penetration rates. Also, cultural perceptions also play a role; for instance, a study by the Indian Council of Agricultural Research notes that traditional beliefs associating smoothies with high sugar content deter regular consumption, particularly among older generations. Compounding these challenges, inadequate retail infrastructure in remote areas restricts product availability, further stifling demand. Without targeted educational campaigns and affordable pricing strategies tailored to rural demographics, the market risks alienating a significant segment of the population.

Fluctuating Raw Material Costs

Fluctuating raw material costs present another critical restraint hampering the Asia Pacific smoothies market, impacting production timelines and profitability. The reliance on key ingredients like fresh fruits, vegetables, and dairy alternatives makes the industry vulnerable to price volatility, especially in regions prone to extreme weather events. According to the Food and Agriculture Organization (FAO), global fruit prices surged notably in 2022 due to droughts and export restrictions, directly affecting smoothie manufacturers. These inconsistencies translate into higher retail prices, deterring price-sensitive consumers in emerging markets. Additionally, import tariffs and trade barriers further complicate cross-border movement of raw materials, resulting in financial losses for exporters. For instance, stringent quality certifications required by countries like Japan and South Korea delay shipments, exacerbating operational inefficiencies. Such challenges not only inflate production costs but also limit market penetration in high-demand areas, threatening the market's ability to sustain growth amidst rising consumer expectations.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

The expansion into emerging markets offers a lucrative opportunity for the Asia Pacific smoothies market, driven by untapped consumer bases and evolving purchasing power. Countries like Vietnam, Indonesia, and the Philippines present fertile ground for growth, with their expanding middle-class populations increasingly gravitating toward healthier and convenient food options. Companies investing in localized distribution networks stand to capture significant market share, particularly through partnerships with small retailers and cooperatives. Moreover, government initiatives promoting agribusiness in Southeast Asia have facilitated the establishment of new fruit farms, ensuring a steady supply of high-quality raw materials. For instance, Vietnam’s recent focus on sustainable agriculture has led to an increase in fruit-based smoothie production over the past three years.

Innovation in Product Offerings

Innovation in product offerings represents a transformative opportunity for the Asia Pacific smoothies market, enabling brands to differentiate themselves and attract diverse consumer segments. As consumer preferences evolve, there is a growing appetite for value-added variants such as organic, plant-based, and functional smoothies tailored to specific dietary needs. This trend has spurred companies to experiment with formulations like keto-friendly and vegan smoothies, catering to niche markets seeking specialized nutrition. Moreover, the introduction of eco-friendly packaging, such as biodegradable bottles and reusable containers, has resonated strongly with environmentally conscious buyers, boosting brand loyalty in urban areas. Innovations in processing techniques, such as cold-pressed extraction, have also enhanced product quality, preserving natural flavors while extending shelf life. For instance, cold-pressed smoothies retain more nutrients compared to conventionally processed variants, appealing to health enthusiasts. This focus on innovation not only diversifies product portfolios but also positions the Asia Pacific region as a hub for next-generation beverage solutions.

MARKET CHALLENGES

Intense Market Competition

Intense market competition poses a significant challenge to the Asia Pacific smoothies market, as numerous players vie for dominance in an increasingly saturated landscape. The entry of multinational corporations alongside local brands has fragmented the market, leading to aggressive pricing wars and eroding profit margins. Also, the number of smoothie brands operating in the region has increased notably since 2018, creating a highly competitive environment. This proliferation forces smaller players to either consolidate or exit the market, as they struggle to match the marketing budgets and distribution networks of larger conglomerates. Furthermore, Brand differentiation has become increasingly difficult, with consumers often prioritizing cost over loyalty. Additionally, counterfeit products and unauthorized imports exacerbate the issue, as noted by the study, which estimates that a notable portion of smoothies sold in informal channels lack proper quality assurance. Without strategic innovations or collaborations, companies risk being overshadowed by competitors, making market saturation a persistent obstacle to sustainable growth.

Supply Chain Disruptions

Supply chain disruptions pose a significant challenge to the Asia Pacific smoothies market and is impacting production timelines and distribution efficiency. The reliance on imported raw materials like exotic fruits and dairy alternatives makes the industry vulnerable to logistical bottlenecks, especially in regions prone to extreme weather events and geopolitical tensions. According to the Asian Development Bank, typhoons and monsoon floods caused significant reduction in cold chain logistics capacity in Southeast Asia during 2021, leading to shortages and increased operational costs. These disruptions are exacerbated by inadequate infrastructure in rural farming areas, where transportation networks often struggle to meet the demands of large-scale production. Compounding the issue, export restrictions and trade barriers further complicate cross-border movement of smoothie products. For instance, stringent quality certifications required by countries like Japan and South Korea delay shipments, resulting in financial losses for exporters. A report by the Food and Agriculture Organization highlights that nearly 20% of smoothies produced in the region fail to reach international markets due to compliance issues. Such inefficiencies not only inflate operational expenses but also limit market penetration in high-demand areas. While investments in cold chain logistics and warehousing are underway, progress remains uneven, particularly in less-developed economies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.1% |

|

Segments Covered |

By Product, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of Asia Pacific |

|

Market Leaders Profiled |

Smoothie King, Maui Wowi Hawaiian Coffees & Smoothies, Suja Juice, Innocent Drinks, Bolthouse Farms, Jamba Juice Company, Ella’s Kitchen Ltd, Barfresh Food Group, Inc and Tropical Smoothie Cafe, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The fruit-based smoothies segment spearheaded the Asia Pacific smoothies market by capturing a 60.5% of the total product in 2024. This control over the market is driven by their refreshing taste profiles, natural ingredients, and alignment with health-conscious trends. A key factor fueling this dominance is the growing trend of incorporating fruits into daily diets for their perceived nutritional benefits. Like, fruit-based smoothies dominate all smoothie sales in urban areas, where consumers prioritize convenience and wellness. Another contributing factor is the influence of social media influencers, who promote these products as part of trendy lifestyle choices. Also, influencer-driven campaigns promoting fruit-based smoothies have increased online sales in markets.

The dairy-based smoothies segment is predicted to rise at a CAGR of 8.5%, emerging as the fastest-growing category in the Asia Pacific smoothies market. This rapid expansion is attributed by the increasing popularity of protein-rich beverages among fitness enthusiasts and health-conscious consumers. One of the primary drivers of this growth is the rising demand for post-workout recovery drinks. Further significant factor is the influence of global wellness trends, which emphasize the importance of balanced nutrition. These trends position dairy-based smoothies as a high-potential segment poised for exponential growth

By Distribution Channel Insights

The segment of supermarkets dominated the Asia Pacific smoothies market by holding a 45% share in 2024. This leading position is underpinned by their extensive reach and ability to cater to diverse consumer demographics, from urban professionals to rural households. A critical factor driving this dominance is the strategic placement of smoothie products in prominent aisles, enhancing visibility and impulse purchases. Additionally, the integration of private-label smoothies by major retailers like Woolworths in Australia and Big Bazaar in India has further solidified this segment's position. As per the International Trade Centre, private-label products now account for a significant market share of supermarket sales in the region, offering affordable alternatives to branded offerings. Another contributing factor is the growing trend of bulk purchasing, particularly in rural areas.

The smoothie bars segment is the fastest-growing distribution channel in the Asia Pacific smoothies market, with a projected CAGR of 10.5%. This is fueled by the increasing popularity of experiential dining and on-the-go consumption habits across the region. One of the primary drivers of this surge is the growing trend of socializing in casual settings. According to the Asian Development Bank, the number of smoothie bars in urban areas has increased significantly over the past five years, with smoothies being a central menu item. Another significant factor is the influence of social media marketing.

REGIONAL ANALYSIS

India is a significant and rapidly growing market of the Asia Pacific smoothies business, accounting for a 22.6% of regional revenue in 2024. The country's vast population and rising disposable incomes make it a natural hub for consumption. A key driving factor is the government's push for modernizing food processing industries, with initiatives encouraging the adoption of healthier dietary habits. Urbanization has also spurred demand, particularly in cities like Mumbai and Delhi, where smoothies are increasingly viewed as a quick yet nutritious snack. According to Euromonitor, urban consumption of smoothies increased by 30% in 2022, reflecting shifting preferences toward functional beverages.

China dominates the Asia Pacific smoothies market, holding a major share. The country's youthful population and growing exposure to global cuisines drive demand for smoothies, particularly in metropolitan cities. Additionally, the rise of e-commerce platforms has amplified accessibility, with online sales growing in recent years.

Japan is a major player in the Asia-Pacific smoothies market, benefiting from its aging population's reliance on convenience foods. Smoothies have become a staple due to their ease of preparation and variety, with urban areas witnessing a annual growth in demand. Government initiatives promoting sustainable agriculture have further expanded availability, enhancing market penetration.

Australia is a significant player within the larger Asia Pacific smoothies market, with its emphasis on fitness and wellness positioning smoothies as essential for daily routines. Like, a significant portion of adults regularly consume smoothies, with healthier variants like low-sugar options gaining popularity.

South Korea is a growing market within the broader Asia Pacific smoothies market. It is driven by its tech-savvy population and booming e-commerce sector. Urban centers like Seoul witness an annual growth in online smoothie sales, fueled by influencer-driven campaigns and subscription models.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Some of the major players in the Asia Pacific smoothies market include Smoothie King, Maui Wowi Hawaiian Coffees & Smoothies, Suja Juice, Innocent Drinks, Bolthouse Farms, Jamba Juice Company, Ella’s Kitchen Ltd, Barfresh Food Group, Inc and Tropical Smoothie Cafe.

The Asia Pacific smoothies market is characterized by intense competition, with numerous players vying for dominance in an increasingly saturated landscape. Established global brands like Innocent Drinks and Naked Juice compete alongside regional leaders such as Boost Juice Bars, each striving to differentiate themselves through unique value propositions. While multinational corporations leverage their extensive distribution networks and marketing budgets to capture urban markets, local players focus on affordability and cultural relevance to appeal to broader demographics. The entry of private-label products from major retailers further intensifies the rivalry, pressuring branded manufacturers to innovate continuously. Sustainability and health consciousness have emerged as key battlegrounds, with companies investing in eco-friendly packaging and clean-label formulations to gain a competitive edge. Additionally, the rise of e-commerce has leveled the playing field, enabling smaller brands to challenge incumbents by reaching consumers directly

TOP PLAYERS IN THE MARKET

Innocent Drinks

Innocent Drinks is a dominant player in the Asia Pacific smoothies market, known for its innovative and health-focused product offerings. The company has significantly contributed to the global market by introducing premium fruit-based smoothies that cater to diverse consumer preferences. Its commitment to sustainability and ethical sourcing practices, such as using recyclable packaging and supporting local farmers, has strengthened its reputation, making it a trusted choice among environmentally conscious buyers. Innocent Drinks’ strategic partnerships with major retailers and e-commerce platforms have further solidified its presence in urban markets across the region.

Naked Juice (PepsiCo)

Naked Juice, under PepsiCo, has carved a niche in the Asia Pacific market through its focus on nutrient-dense and organic smoothies. The company’s emphasis on clean-label ingredients and bold flavor profiles resonates with consumers seeking authentic and wholesome beverages. Its contributions to the global market include pioneering cold-pressed technology, which has set new standards for freshness and nutritional value in the industry.

Boost Juice Bars

Boost Juice Bars is a regional leader that leverages its deep understanding of local consumer preferences to tailor its smoothie offerings. The company’s strong distribution network and collaborations with supermarkets and convenience stores have enabled it to penetrate both urban and rural markets effectively. Boost Juice Bars’ efforts to promote healthier and more sustainable beverage options have expanded its appeal beyond traditional consumers to health enthusiasts. Globally, the brand is recognized for its affordability and accessibility, contributing to the democratization of smoothie consumption.

TOP STRATEGIES USED BY KEY PLAYERS

Localized Flavor Innovations

Key players in the Asia Pacific smoothies market are increasingly focusing on localized flavor innovations to cater to diverse consumer preferences. By incorporating region-specific fruits and ingredients, companies are able to resonate with local tastes and cultural traditions. This strategy not only enhances brand acceptance but also strengthens their competitive edge in a crowded marketplace. Collaborations with local chefs and culinary experts further amplify the authenticity of these offerings, driving consumer engagement and loyalty.

Sustainability Initiatives

Sustainability has become a cornerstone of market strategies, with companies emphasizing eco-friendly practices to appeal to environmentally conscious buyers. From adopting recyclable packaging to promoting sustainable sourcing of raw materials, key players are investing in initiatives that reduce their environmental footprint. These efforts not only align with global trends toward green consumption but also position brands as responsible corporate citizens. Partnerships with environmental organizations further reinforce their commitment to sustainability, enhancing brand equity and fostering long-term relationships with consumers.

Digital Marketing and E-commerce Expansion

To strengthen their position, leading companies are leveraging digital marketing and expanding their e-commerce presence. Social media campaigns, influencer collaborations, and targeted advertisements are being used to reach tech-savvy consumers, particularly in urban areas. Simultaneously, investments in online platforms and subscription models ensure seamless accessibility and convenience.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Innocent Drinks launched a series of limited-edition smoothies infused with locally sourced tropical fruits from Southeast Asia. This move was aimed at appealing to regional taste preferences and expanding its product portfolio in urban markets.

- In June 2023, Naked Juice partnered with local organic farms in Vietnam to source sustainable ingredients for its smoothie range. This initiative reinforced the company’s commitment to ethical sourcing and enhanced its reputation among eco-conscious buyers.

- In August 2023, Boost Juice Bars introduced recyclable packaging for its entire product line. This shift toward sustainable packaging aligned with global environmental trends and strengthened its market positioning.

- In October 2023, Innocent Drinks collaborated with fitness influencers across Australia and New Zealand to promote its low-sugar smoothies as guilt-free indulgences. This campaign boosted brand visibility and engagement among health-conscious consumers.

- In February 2024, Naked Juice expanded its e-commerce operations by partnering with major online retailers in India and Indonesia. This strategic move increased accessibility and tapped into the growing demand for online purchases of health beverages in these regions.

MARKET SEGMENTATION

This research report on the Asia Pacific smoothies market has been segmented and sub-segmented based on the following categories.

By Product

By Distribution Channel

- Fruit-based

- Dairy-based

- Restaurants

- Smoothie bars

- Supermarkets

- Convenience Stores

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia Pacific

Frequently Asked Questions

1. What is the projected size of the Asia-Pacific smoothies market by 2033?

The market is expected to grow to USD 6.11 billion by 2033, with a CAGR of 10.1% from 2025 to 2033

2. What factors are driving the growth of the smoothies market in Asia-Pacific?

Key drivers include increasing health consciousness, changing food habits, rising disposable incomes, demand for meal replacement beverages, and growing popularity of juice and smoothie bars

3. What challenges does the smoothies market face in the region?

High prices of smoothies and packaging issues due to their raw ingredient composition are significant challenges

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com