Smoothies Market Size, Share, Trends & Growth Forecast Report By Product (Fruit-based, Dairy-based and Others), Distribution Channel, Region, and Industry Analysis from 2025 to 2033

Smoothies Market Size

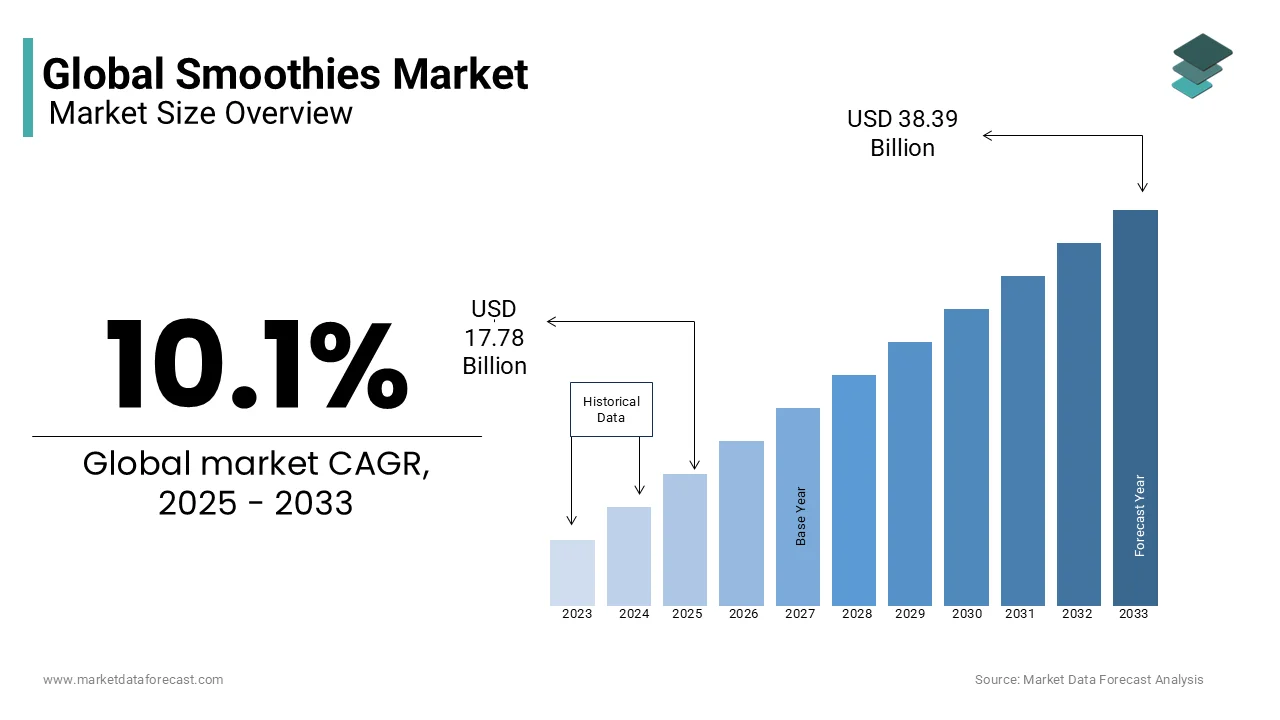

The size of the global smoothies market was valued at USD 16.15 billion in 2024 and the global smoothies market size is expected to reach USD 38.39 billion by 2033 from USD 17.78 billion in 2025. The market's promising CAGR for the predicted period is 10.1%.

Smoothie drinks are widely consumed beverages sold, particularly in fast food chains, outlets, or quick-service restaurants. It is a thick, non-alcoholic beverage made from raw vegetables or fruits along with some other ingredients. Other smoothie ingredients include water, ice, sweeteners, chocolate, nuts, dairy products such as milk and yogurt, and other nutritional supplements. According to Tastewise, the fastest-growing flavor and ingredients for smoothies are protein shakes, which increased by 53.54%, followed by cake at 45.48%, Acai bowl at 33.95%, coffee at 32.05% and berry at 31.08%. The progressively growing public inclination towards healthy living has escalated the intake of freshly made fruit drinks.

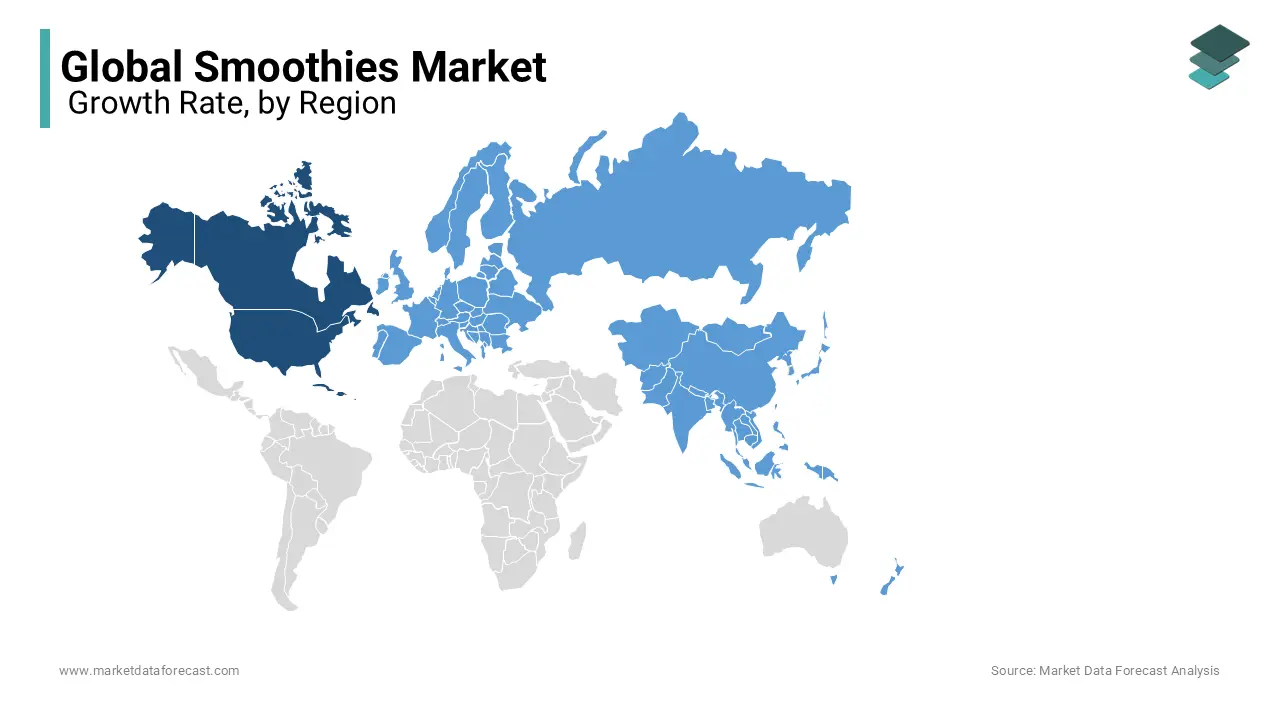

The market saw the rise of plant-based smoothies, a relatively new commercial innovation. This category is propelled by convenience, sustainability, organicness, and healthiness. Modern technologies are increasingly employed to maintain organoleptic characteristics and nutritional quality while matching with sustainability objectives. Furthermore, the North American region leads the global market due to the high demand for healthy, non-alcoholic drinks in this region. The Asia Pacific region is estimated to be a speedy-growing market with a CAGR of over 9% due to the growing number of people with disposable incomes and changing food habits.

MARKET DRIVERS

Growing Awareness of the Health Benefits of Smoothies

An increasing number of health-conscious people, changing lifestyles and food habits, and health benefits associated with smoothies are promoting market growth. Increasing popularity for meal replacement food and beverages, growing prominence for juice and smoothie bars, and rising demand for non-carbonated soft drinks are also expected to propel the smoothie market. Smoothies that include a large serving of fruits and vegetables are recommended for a healthy diet. As per IFIC, in 2024, about 67% of consumers attempted to consume more protein.

Also, 30% of buyers want less sugar when purchasing food and beverages, which is 3% higher than in 2022. With the growing trend for green smoothies, there is a rise in demand for smoothies incorporated with green leafy vegetables, such as kale, spinach, lettuce, and green cabbage leaves, to improve digestion and the immune system and minimize unhealthy cravings. Additionally, due to rising healthcare costs, consumers are inclined to use smoothies as breakfast and snacks to stay healthy. Increased consumer awareness of the benefits associated with the product is also spurring market growth. The growing demand for functional foods and beverages is also driving the growth of smoothies.

In addition, continuous product launches to address the needs of specific preferences of consumers and to offer a diverse range of options in smoothies stimulate the smoothies market growth. Also, the strategic initiatives undertaken by the prominent market players will accelerate the market expansion. Additionally, increasing consumer awareness of health and changes in lifestyle and eating habits, as well as health benefits, are driving growth in the global smoothie market.

Carbohydrate intake, especially when smoothies are made without sugar, is low. So, most gym coaches recommend shakes for people considering losing weight. Thus, smoothies have become perfect meal replacements. They're healthier than other snack products and offer good taste, convenience, and portability.

MARKET RESTRAINTS

However, using too many sweeteners, protein powders, and ice creams is unhealthy. Smoothies have high dietary fiber content, making them healthier than fruit juices. Green smoothies made from healthy vegetables are gaining prominence, especially in health-conscious people. Smoothies with increased carbohydrate content using sugar additives can replace a meal. High prices of smoothies and packaging problems, as they are made from raw ingredients, are the major factors restraining the growth of the smoothies market.

MARKET OPPORTUNITIES

The increasing demand for innovative plant-based drinks among health-aware consumers, especially those in European countries, is a potential prospect for the expansion of the smoothies market. For instance, in August 2024, Smoothie King, a prominent player known for its unique offering in this business, press released the introduction of its newest Coconut Bowls. This smoothie bowl is launched with the theme of awarding physical exercise or training and will be available at the participating locations of their outlets.

Also, it further expands the brand's famous Bowl range. Such product launches are setting up the market landscape and customers what to expect from them. Additionally, the steady rise in awareness regarding the unintentional extensive intake of microplastics from plastic bottles, cups, or bowls is expected to boost the demand for eco-friendly packaging materials further. Implementation of plastic bans by several countries is directed at this motive to enhance quality assurance and safety.

Hyper-local ingredients obtained from nearby gardens and farms are experiencing a surge in popularity, particularly as the movement "farm-to-table" gains momentum, which is another factor presenting an opportunity for market growth. This sustains domestic agriculture and provides fresher and more nutrient-packed elements. Therefore, the demand for homegrown herbs like basil and mint, local greens such as kale or spinach, and seasonal berries is estimated to escalate in the future. Seasonal berries, local greens like spinach or kale, and homegrown herbs such as mint and basil.

MARKET CHALLENGES

Caffeine's presence hinders the smoothies market's expansion in certain drinks. The consumption of energy drinks has risen tremendously with a surge in physical activity. Brands and companies enjoy this demand, and so do national coffee chains. People want different flavors today, and the market is flooded with various smoothie ingredient options. Many people like adding coffee to their smoothies, which is becoming common due to busy lifestyles, leading to tiredness and inattentiveness.

Hence, this increase in coffee-based smoothies is causing a caffeine influx, impacting intracellular calcium concentration. For instance, searches for "contains caffeine" in the food and beverage industry rose 17% in 2024, while "high caffeine" searches witnessed a 113% jump.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.1% |

|

Segments Covered |

By Product, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

PepsiCo, Inc, Smoothie King, Maui Wowi Hawaiian Coffees & Smoothies, Suja Juice, Innocent Drinks, Bolthouse Farms, Jamba Juice Company, Ella’s Kitchen Ltd, Barfresh Food Group, Tropical Smoothie Cafe and Others. |

SEGMENTAL ANALYSIS

By Product Insights

Based on the product, the smoothies market is segmented into fruit-based and dairy-based. The fruit-based segment holds the largest share of the global market and is also expected to be the fastest-growing segment. This is attributed to the growing demand for healthy beverages. Fruit-based smoothies are further segmented into organic and inorganic smoothies. The inorganic smoothies sub-segment is expected to be the largest segment as most of the fruits and vegetables produced from farms are inorganic.

The organic smoothies sub-segment is expected to be the fastest-growing segment as the demand for organic fruits and vegetables is increasing. According to Grocer, about 57% of Generation Z is more inclined towards smoothies and juices with less sugary flavors. Given their inherently reduced sugar content, vegetarian choices distinctly have a lead in the growing health-conscious culture. As per new research released in the Antioxidants journal, an apple fruit or strawberry tree smoothie can be a vital source of bioactive elements obstructing few antioxidant activity and digestive enzymes.

By Distribution Channel Insights

The restaurant segment is likely to have maintained its position in the smoothies market. This is due to the growing trend of snacking and the strong presence of online food ordering applications. Moreover, managing the cold chain and providing various product varieties at affordable prices are driving the segment's market share. According to Restaurant Dive, restaurant consumer expenditures increased 5% in 2024 compared to a 4% rise in 2022.

Total consumer outlay surged by 7% and reached 313 billion dollars against a 2% dollar rise in 2024. On the other hand, smoothie bars experienced rapid growth owing to a broad range of options with different flavors, additions, and ingredients to serve all customers. Currently, Asia Pacific is witnessing swift expansion in this segment, especially India.

REGIONAL ANALYSIS

North America held the major portion of the global market in 2024. North America dominates the smoothie market due to the high demand for healthy, non-alcoholic beverages in this region. Moreover, the increased trend of consumption of non-alcoholic beverages among adults in the United States in the last few years is influencing the demand for smoothies in the region. According to the 2025 study published in the PubMed National Center for Biotechnology Information, in 2024, non-alcoholic beverage use was supported by 28.44% of participants (67.7% ever consumed).

Consumption of non-alcoholic beverages is a harm reduction strategy for people who drink alcohol and have alcohol use disorder. In comparison to earlier generations, the younger customers from Generation Z show less enthusiasm for drinking alcohol. In Canada, smoothies appear to be the most common among young people. As per the Daily Survey Panel by Caddle, most Canadians, i.e., 61.9%, drink smoothies that are store-bought and homemade weekly or more.

Europe is a significant regional market for smoothies globally. Europe is projected to increase its share during the forecast period. The fresh wave of non-alcoholic beverages has had a clear-headed class and flavor, exuding flair and glow-up, which is influencing the growth of the segment's market share. The EU food and drinks industry is a significant contributor to its economy. According to a 2024 report by FoodDrinkEurope, this industry is one of the most significant manufacturing sectors in the European Union, with a value addition of 229 billion euros, a turnover of 1.1 trillion euros, and employs 4.6 million individuals.

Approximately 60% of exports outside, i.e., worth 182 billion euros, of EU food and drink items are directed towards the single markets. However, the regional market's growth is impacted by the EU food supply chain's high prices and input costs. This may decrease its consumption as people are expected to reduce their expenditure on outside food and drinks. As per Euronews, the yearly food and non-alcoholic drinks inflation crossed total inflation in 33 out of 37 nations in the region, including 11% in Turkey, 10.9% in Belgium, and 8.8% in the Netherlands.

Asia Pacific is expected to be the fastest-growing regional segment worldwide. The growth of the Asia-Pacific regional market is majorly driven by the increasing number of people with disposable incomes and changing food habits. The region's customers are more willing to pay for healthy drinks, which is expected to influence the growth rate of APAC's market. Also, it is an emerging market for global players to spread their footprint. Similarly, India spearheads the Asia Pacific region in introducing new supplements, drinks, and food offerings with immune-enhancing claims, exhibiting a rising buyer interest in immune wellness.

COVID-19 fueled this trend and showed a transition towards more balanced eating patterns and favoring nutritional quality and safety. Indian customers are enthusiastic about items that merge immunity and additional health advantages, like better sleep and stress relief. For instance, in June 2024, Keventers, the famous Indian dairy brand of milkshakes and ice creams, introduced an interesting new variety of smoothies for summer. Japan is another primary market for smoothies in this region, with green tea smoothies being the most popular option. It is leading this emerging trend.

LIST OF KEY PLAYERS IN THE SMOOTHIES MARKET

Companies that hold a notable presence in the global smoothies market include

- PepsiCo, Inc.

- Smoothie King

- Maui Wowi Hawaiian Coffees & Smoothies

- Suja Juice

- Innocent Drinks

- Bolthouse Farms

- Jamba Juice Company

- Ella’s Kitchen Ltd

- Barfresh Food Group Inc.

- Tropical Smoothie Café

RECENT HAPPENINGS IN THE SMOOTHIES MARKET

- In August 2024, Jamba Press released that it is introducing the Sunrise Smoothie Tour to recognize the debut of the new blended coffees. The tour will take place at three of the best places in California to witness sunrise and offer customers a unique opportunity to be among the first to taste the new blended coffees.

- In June 2024, Nutrisco reported it had taken over LiveMore Superfoods by purchasing most of the ownership of the smoothie company. LiveMore is a US-based company that specializes in fruit and vegetable smoothie mixes. With this procurement, Nutrisco expanded its product portfolio and gained access to a wide presence in American and Mexican retailers. This includes some popular chains like Costco, CVS, HEB, and Target.

- In June 2024, SAMBAZON and Generous Brands reported signing a partnership agreement. As per this deal, Generous Brands will produce, distribute, and market SAMBAZON Smoothie and Juice Beverages. This is a strategic collaboration to boost customer availability of the rapidly increasing consumer popularity of functional superfruit juices and smoothies and will support retailers in scaling up distribution throughout North America.

- Focus Brands (FBI) completed the acquisition of the Jamba Juice smoothie chain in a transaction valued at approximately $ 200 million. Pursuant to the terms of the agreement, an FBI subsidiary has launched a takeover bid for all outstanding common shares of Jamba at a price of $ 13 per share in cash.

- Coca-Cola took over Innocent after the young founders of the ethical smoothie maker decided to sell their remaining shares, for the staggering £ 100 million, according to reports. The soft drink empire, which already owned 58% of Innocent, took bets from founders Richard Reed, Adam Balon, and John Wright in a deal that gives Coca Cola at least 90% ownership and values Innocent at £ 320 million regions.

- The smoothie brand, which will rub elbows with the Tropicana and Copella juice brands, will be a key element in PepsiCo's effort to increase revenue in its juice division and counter government criticism that its products, such as Walkers potato chips contribute to obesity. PepsiCo will also use the PJ brand to strengthen its ties to McDonald's.

- the Fazer Group acquires the leading Nordic shake brand Froosh, which is a leading smoothie brand in Finland and Sweden and the second famous brand in Denmark and Norway. By acquiring Froosh, Fazer will enter a new category and expand its presence in the retail industry.

- Peak Foods LLC, a manufacturer of frozen whipped toppings for the food and retail markets, acquired Blendtopia, a Nashville-based startup that offers high-quality, nutrient-rich superfood shakes in select retail locations and online. Blendtopia founder Tiffany Taylor will join the Peak Foods team and coordinate sales, marketing, and product development for the smoothie line.

- Kellogg's venture capital fund is seeking "next-generation innovation," which increases its access to new ideas and trends, an approach that is becoming more common among the world's largest food companies. Unilever and Tate & Lyle have implemented venture capital weapons, while other companies have chosen the acquisition path, buying innovative startups that exploit the latest consumer trends. Hershey acquired Krave without uneven nitrite in 2015, and General Mills took over natural and organic specialist Annie a year earlier.

MARKET SEGMENTATION

This research report on the global smoothies market has been segmented and sub-segmented based on product, distribution channel, and region.

By Product

- Fruit-Based

- Organic

- Inorganic

- Dairy-Based

By Distribution Channel

- Restaurants

- Supermarkets

- Convenience Stores

- Smoothie Bars

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- The United Kingdom

- Spain

- Germany

- Italy

- France

- Rest of Europe

- The Asia Pacific

- India

- Japan

- China

- Australia

- Singapore

- Malaysia

- South Korea

- New Zealand

- Southeast Asia

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- UAE

- Lebanon

- Jordan

- Cyprus

Frequently Asked Questions

1. What is the size of the global smoothies market in 2024?

The global smoothies market is expected to be valued at USD 16.15 billion in 2024.

2. What is the projected CAGR of the global smoothies market?

The market is forecasted to grow at a CAGR of 10.1% from 2025 to 2033.

3. What factors are driving the growth of the smoothies market?

Increasing health awareness and demand for nutritious, on-the-go beverages are key growth drivers.

4. Which regions are leading in the global smoothies market?

North America and Europe are the dominant regions due to high health-conscious consumer bases.

5. What types of smoothies are popular in the market?

Fruit-based, dairy-based, and green smoothies are among the most popular segments.

6. Is plant-based smoothie demand increasing?

Yes, demand for plant-based and vegan smoothies is rising with the shift toward plant-based diets.

7. Who are the major players in the global smoothies market?

Key players include Jamba Juice, Smoothie King, Bolthouse Farms, and PepsiCo’s Naked Juice.

8. What consumer trends are shaping the smoothies market?

Preferences for clean-label, organic, low-sugar, and functional ingredients are shaping the market.

9. How are e-commerce and delivery apps influencing the market?

Online platforms and delivery apps are expanding smoothie accessibility and boosting market growth.

10. What challenges does the smoothies market face?

High prices, shelf-life limitations, and sugar content concerns are key challenges.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com