Global Organic Beverage Market Size, Share, Trends,& Growth Forecast Report - Segmented By Product (Non-Dairy, Fruit, Coffee & Tea, Beer & Wine), Distribution Channel (Offline, Online), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Organic Beverage Market Size

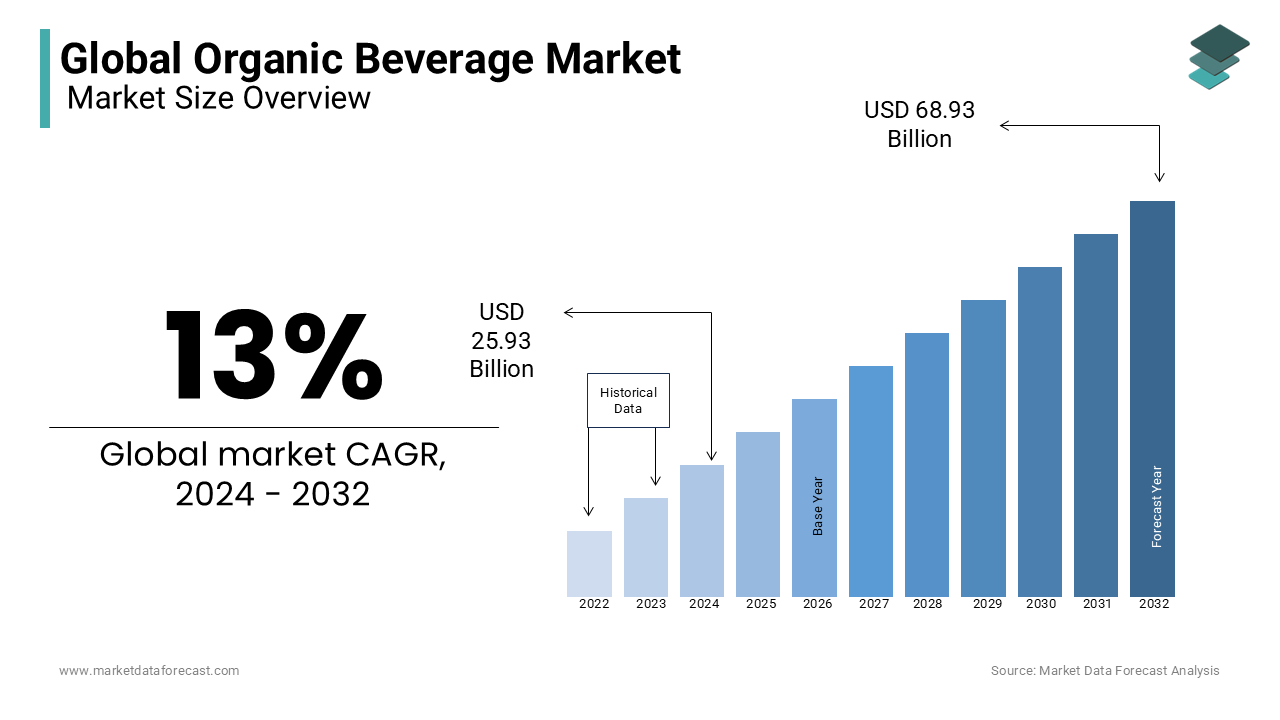

The global organic beverage market size was calculated to be USD 25.93 billion in 2024 and is anticipated to be worth USD 77.89 billion by 2033 from USD 29.30 billion In 2025, growing at a CAGR of 13% during the forecast period. The demand for sugar-free caffeine-free beverages will increase demand for products in the coming years.

Organic drinks are made without the use of synthetic pesticides, genetic engineering, artificial flavors, preservatives, and colors. Natural juices are, among other things, a type of drink without synthetic pesticides, growth hormones, genetic engineering, artificial flavors, pigments, and preservatives. The organic drinks market is approaching as people begin to take an interest in natural drinks instead of carbonated drinks. Organic juices offer several health benefits. The rise in demand for organic and clean-label ingredients in different parts of the planet is primarily driving the demand in the organic beverage market.

MARKET DRIVERS

The growing awareness of the health benefits associated with consuming organic products worldwide is primarily boosting the growth of the global organic beverage market.

High global demand for products and rising disposable income levels in developing countries are some of the main drivers of market growth. The need for sugar-free caffeine-free beverages will increase demand for products in the coming years. The availability of products with new flavors and ingredients, such as turmeric, aloe vera, and activated charcoal, will also spur demand for attractive, portable retail packaging. The non-dairy beverage product segment held the largest market share in 2018. Non-dairy beverages are made from sources such as legumes, vegetable ingredients, nuts, and grains, thus acting as functional beverages. Organic drinks can also be used in place of milk.

Furthermore, initiatives aimed at raising awareness of organic and non-GM products by governments around the world are driving demand to drive market growth further. Different certification processes and standards for different products to channel products in specific regions are some of the main limitations for market growth. However, extensive R&D from leading manufacturers to improve product shelf life, texture, taste, and nutritional value is likely to have a positive impact on market development. Demand for organic beverages is increasing in developed countries such as the United States, the United Kingdom, France, and Germany. It is supposed to lead the growth of the global market in the coming years as awareness of personal health increases. The incidence of diseases, such as diabetes and obesity, is assumed to support the growth of potential markets.

Additionally, consumer preference for natural products over products made with synthetic ingredients is anticipated to drive growth in the organic beverage market. Increased awareness of the benefits of eating the organic food and beverage industry is assumed to spur market growth in the near future. The impact of these drivers is presumed to increase significantly due to increasing consumer health problems. Organic drinks still occupy a small portion of the health and wellness market but show growth opportunities based on changing consumer priorities for natural beverage consumption and a greater interest in social and environmental responsibility. The increase in numerous supermarkets, retail stores, and convenience stores has also accelerated growth as the global organic drinks market showcases its products, with some having assigned different sections for organic foods in stores.

MARKET RESTRAINTS

Premium costs of organic beverages and the wide availability of substitute products are majorly hindering the global market growth.

If the price of organic drinks is relatively high compared to general products, it is challenging to grow the market. Furthermore, the high cost of manufacturing organic beverages compared to other drinks produced through synthetic chemicals is an essential factor in inhibiting growth in the target market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13% |

|

Segments Covered |

By Product, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Boncafe International, Empresa, Uncle Matt's Organic Inc., Parker's organic juices, Bison organic beer, Heavenly Body Servant, Belvoir Fruit Farms Ltd, Coca-Cola Corporation, Whitewave Foods Company, PepsiCo, Inc |

SEGMENTAL ANALYSIS

Global Organic Beverage Market Analysis By Product

The non-dairy drinks segment held the largest share of the global organic beverage market in 2023, which is made from sources such as legumes, vegetable ingredients, nuts, and cereals to serve as functional drinks. Coffee and tea are the fastest-growing sectors, with a compound annual rate of over 13.0%, and are presumed to remain the fastest-growing market during the forecast period. Factors such as increased health awareness, preference for organic and natural drinks, and lifestyle changes are accelerating the growth of the segment.

Global Organic Beverage Market Analysis By Distribution Channel

The online distribution segment is anticipated to show the fastest growth of CAGR of 13.6% during the forecast period owing to the increasing popularity of e-commerce platforms, the positive impact of social media advertising, and the higher use of smartphones and the Internet. As the number of organic food restaurants and coffee shops increases, the offline distribution channel is suspected of having the largest market share by 2025. Natural drinks are widely used in coffee shops and restaurants around the world.

REGIONAL ANALYSIS

North America continues to be the largest market for organic beverages as consumer attention shifts to clean, original-label products. In the United States, biological products, including drinks, have changed from lifestyle choices to what most Americans consume. Along with consumer products that contain pure, natural ingredients, factors such as shifting consumer preferences toward healthy lifestyles are foreseen to support the growth of the organic beverage market during the projection period. Organic fruit and vegetable juices continue to work well as consumers grow and their knowledge of certifications like the USDA increases. The Asia Pacific is estimated to be the fastest-growing market during the prediction period. This growth is due to rapid urbanization, rising disposable income levels, and the establishment of several international outlets in emerging countries such as China and India.

KEY PLAYERS IN THE GLOBAL ORGANIC BEVERAGE MARKET

Major Key Players in the Global Organic Beverage Market are Boncafe International, Empresa, Uncle Matt's Organic Inc., Parker's organic juices, Bison organic beer, Heavenly Body Servant, Belvoir Fruit Farms Ltd, Coca-Cola Corporation, Whitewave Foods Company, PepsiCo, Inc.

RECENT HAPPENINGS IN THE MARKET

- Nestlé, in May 2019, confirmed that it is planning to extend its existing product portfolio with the addition of organic food portions to Nestlé Ceregrow, India. This expansion increased the product portfolio and grew the company's market share in the Indian market.

- In March 2018, VegMart started operating to supply organic products to the market. They will offer the product at a low cost to expand the company to customers and increase customer retention.

- In March 2018, Truefarm Foods started selling organic products on the Amazon e-commerce platform. This increases the company's profits, as the product can reach more customers.

- April 2017: Danone acquired WhiteWave to expand its dairy portfolio. Additionally, the acquisition will strengthen the company's product line with brands, including Horizon Organic Milk.

- In 2017, a quarter of all food and beverage products launched in Germany in 2017 were organic, and almost three-quarters of consumers want a much more extensive range of organic food and beverages at the point of sale.

- Prairie Organic Spirits has started new packaging. Prairie Organic Spirits launched new packaging to demonstrate the company's commitment to agriculture.

DETAILED SEGMENTATION OF GLOBAL ORGANIC BEVERAGE MARKET INCLUDED IN THIS REPORT

This research report on the global organic beverage market has been segmented and sub-segmented based on product, distribution channel, & region.

By Product

- Non-dairy drinks (soy, rice, and oats)

- Fruit drinks

- Coffee and tea

- Beer and wine

By Distribution channel

- Offline

- Online

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What types of organic beverages are available?

Organic beverages include organic juices (like orange juice or apple juice), organic tea and coffee, organic sodas, organic energy drinks, organic smoothies, and organic alcoholic beverages (such as organic wine or beer).

2. What are the benefits of organic beverages?

Organic beverages are often perceived as healthier because they are made from ingredients grown without synthetic chemicals. They may have higher nutrient content and fewer residues from pesticides or other harmful substances.

3. What are some popular trends in the organic beverage market?

Some current trends in the organic beverage market include the rise of organic energy drinks, organic cold-pressed juices, organic plant-based milk alternatives (like almond milk or oat milk), and organic kombucha (a fermented tea drink)

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com