Asia-Pacific Veterinary Healthcare Market Research Report By Animal Type (Livestock Animals, Companion Animals), Product, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of Asia-Pacific) - Industry Analysis From 2025 to 2033

Asia-Pacific Veterinary Healthcare Market Size

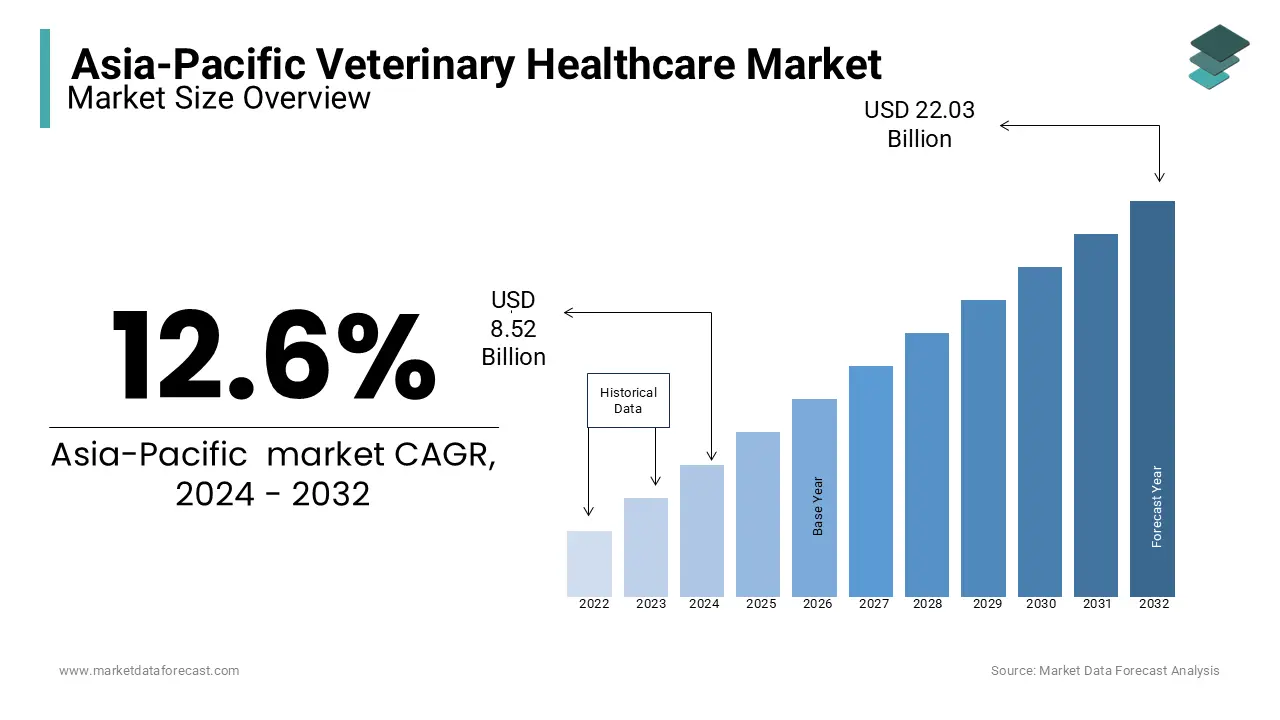

The veterinary healthcare market size in the Asia-Pacific was worth USD 8.52 billion in 2024. The Asia-Pacific market is estimated to be valued at USD 24.78 billion by 2033 from USD 9.59 billion in 2025, growing at a tremendous CAGR of 12.6% from 2025 to 2033.

The Asia Pacific animal healthcare market covers products and services designed to prevent, diagnose, and treat diseases in livestock, companion animals, and aquaculture species. This includes vaccines, pharmaceuticals, diagnostics, therapeutic treatments, feed additives, and digital health solutions tailored for veterinary use. As the region experiences rapid urbanization, rising disposable incomes, and growing awareness about animal welfare, there has been a corresponding increase in demand for advanced veterinary care and disease control mechanisms.

A key trend shaping this market is the expansion of commercial livestock farming and pet ownership across both developed and emerging economies. Additionally, as per the World Organisation for Animal Health (WOAH), the frequency and impact of zoonotic disease outbreaks have intensified in recent years, prompting increased investment in preventive animal healthcare measures. Governments are also stepping up regulatory oversight and promoting biosecurity protocols across farms and breeding centers.

MARKET DRIVERS

Increasing Livestock Production and Government Focus on Disease Prevention

One of the primary drivers of the Asia Pacific animal healthcare market is the surge in livestock production, driven by the need to meet growing domestic and international demand for meat, dairy, and poultry products. Maintaining animal health within these large-scale operations is crucial to preventing productivity losses and ensuring food safety. Governments across the region have recognized the economic importance of healthy livestock and have implemented policies aimed at controlling infectious diseases such as foot-and-mouth disease, avian influenza, and African swine fever. In China, for example, the Ministry of Agriculture and Rural Affairs launched an updated national vaccination program in 2023 targeting major livestock diseases, significantly boosting vaccine procurement and distribution. Similarly, India’s Department of Animal Husbandry and Dairying has strengthened its National Animal Disease Control Programme (NADCP) with mass immunization drives for cattle and buffalo, aiming for brucellosis and foot-and-mouth disease eradication by 2030.

Rising Pet Ownership and Humanization of Companion Animals

Another significant driver of the Asia Pacific animal healthcare market is the growing prevalence of pet ownership and the increasing perception of pets as family members. Like, pet ownership in countries like South Korea, Thailand, and Australia has grown by double digits over the past five years, reflecting a shift in consumer behavior toward premium pet care services and medical interventions. This humanization trend has spurred demand for high-quality veterinary medicines, surgical procedures, and wellness supplements. In Japan, where pet ownership among singles and elderly individuals is particularly high. Similar trends are emerging in India and Indonesia, where online pet care platforms and insurance schemes are gaining traction. The rise in pet-centric lifestyles has also led to a boom in veterinary clinics, diagnostic labs, and specialty hospitals offering services ranging from dental care to oncology.

MARKET RESTRAINTS

Limited Awareness and Low Penetration of Preventive Animal Healthcare Practices

A significant restraint affecting the growth of the Asia Pacific animal healthcare market is the limited awareness and low adoption of preventive healthcare practices, particularly in rural and semi-urban areas. Unlike in Western markets, where routine vaccinations and regular veterinary visits are standard, many smallholder farmers and pet owners in developing Asia still rely on reactive treatment models. According to the World Organisation for Animal Health (WOAH), less percentage of small-scale livestock farmers in Southeast Asia participate in structured vaccination programs, leaving their herds vulnerable to preventable diseases. This gap in preventive care is largely due to insufficient extension services, lack of trained veterinary professionals, and inadequate access to modern healthcare facilities in remote regions. Moreover, misconceptions about vaccine safety and cost constraints further hinder uptake.

Regulatory Hurdles and Fragmented Approval Processes Across Countries

Another key challenge impeding the Asia Pacific animal healthcare market is the inconsistency in regulatory frameworks governing veterinary product approvals and distribution. Unlike the European Union or the United States, where centralized agencies oversee drug registrations and compliance, the Asia Pacific region consists of multiple jurisdictions with varying standards and approval timelines. In countries like Indonesia and the Philippines, overlapping responsibilities between agriculture and health ministries create bureaucratic delays, while in Vietnam and Cambodia, unclear documentation requirements complicate importation and licensing processes. Additionally, small and medium-sized enterprises find it difficult to navigate these complex systems, often resulting in reduced competition and innovation.

MARKET OPPORTUNITIES

Expansion of Aquaculture and Need for Disease Management Solutions

A substantial opportunity emerging in the Asia Pacific animal healthcare market is the rapid expansion of aquaculture and the increasing need for disease prevention and treatment in fish and shellfish farming. As intensification of aquaculture practices increases, so does the risk of disease outbreaks that can wipe out entire harvests. To mitigate these risks, governments and private sector players are investing heavily in aquatic vaccines, antimicrobial alternatives, and water quality management solutions. For instance, the Chinese Ministry of Agriculture estimates that annual economic losses due to fish diseases exceed USD 6 billion, prompting accelerated adoption of prophylactic treatments and biosecurity measures. Similarly, India’s Blue Economy initiative promotes the use of probiotics and immune enhancers to reduce antibiotic dependence, aligning with global sustainable aquaculture goals.

Digitalization of Veterinary Services and Telehealth Adoption

The digital transformation of veterinary medicine presents a promising opportunity for expanding animal healthcare access and service delivery across the Asia Pacific region. The proliferation of mobile technology, telemedicine platforms, and AI-driven diagnostics is enabling faster and more efficient veterinary consultation, especially in underserved areas. According to McKinsey & Company, telehealth adoption in pet care applications has surged in countries like South Korea, Singapore, and Australia, allowing pet owners to consult licensed veterinarians remotely. Moreover, digital tools are being integrated into farm-level animal health monitoring, with wearable sensors, RFID tracking, and predictive analytics enhancing early disease detection in livestock. In Japan, startups like VIVIUS are deploying AI-based imaging technologies to detect lameness and mastitis in dairy cows, improving early intervention rates. Similarly, Indian companies such as Petzcare offer app-based home vet visit services, catering to urban pet owners seeking convenience and affordability.

MARKET CHALLENGES

High Cost of Advanced Animal Healthcare Products and Services

One of the foremost challenges facing the Asia Pacific animal healthcare market is the relatively high cost of advanced veterinary medicines, diagnostic tools, and specialized treatments, which limits accessibility for smaller farmers and lower-income pet owners. While premium products such as recombinant vaccines, monoclonal antibodies, and digital diagnostic equipment are widely available in developed markets like Japan and Australia, they remain prohibitively expensive in many parts of South and Southeast Asia. This price sensitivity extends to the companion animal segment as well, where middle-income households may avoid costly procedures such as surgeries, chronic disease management, or specialist consultations.

Shortage of Skilled Veterinary Professionals and Infrastructure Gaps

A persistent challenge in the Asia Pacific animal healthcare market is the shortage of trained veterinarians, diagnostic laboratories, and organized veterinary service networks, particularly in rural and remote areas. According to the World Organisation for Animal Health (WOAH), many developing countries in the region face a severe deficit in veterinary workforce density with some having fewer than one veterinarian per 10,000 livestock units.

In countries such as Nepal, Bangladesh, and Papua New Guinea, the lack of accredited veterinary colleges and government-funded training programs hampers the development of a skilled workforce. Also, even in more developed economies like India, the distribution of veterinary hospitals and mobile clinics remains uneven, with urban centers being disproportionately served. As noted by the Indian Council of Agricultural Research (ICAR), over 70% of livestock in the country reside in areas with limited or no point-of-care diagnostic facilities, delaying disease detection and treatment.

SEGMENTAL ANALYSIS

By Product Insights

The antimicrobial and antibiotic products hold the largest share in the Asia Pacific animal healthcare market by accounting for 32.4% of total revenue in 2024. This dominance is primarily attributed to their widespread use in treating bacterial infections across both livestock and companion animals. One key growth driver is the extensive reliance on antibiotics in intensive livestock farming to manage disease outbreaks in densely populated farms, particularly in countries such as China, India, and Vietnam, where large-scale poultry and pig production is prevalent. Apart from these, the high incidence of zoonotic diseases has increased veterinary demand for effective antibacterial treatments. Furthermore, the lack of stringent regulations in several developing markets allows over-the-counter availability and sometimes indiscriminate use of antibiotics, contributing to higher consumption volumes. As per the World Organisation for Animal Health (WOAH), misuse and sub-therapeutic application of antibiotics in aquaculture and livestock remain major concerns in parts of Southeast Asia, which, although raising public health issues, also boosts short-term market demand.

Vaccines are emerging as the fastest-growing product category within the Asia Pacific animal healthcare market, projected to grow at a CAGR of 10.4% between 2025 and 2033. This rapid expansion is driven by increasing government investments in national immunization programs and greater emphasis on preventive healthcare for both livestock and pets. A primary growth catalyst is the surge in government-led vaccination campaigns targeting endemic diseases such as foot-and-mouth disease, avian influenza, and brucellosis in cattle. For instance, the Indian government’s National Animal Disease Control Programme (NADCP) aims to eliminate foot-and-mouth disease and brucellosis through mass immunization, with over 500 million doses of vaccines procured annually. Similarly, China has expanded its procurement of swine fever and poultry flu vaccines to prevent economic losses from disease outbreaks. Simultaneously, pet vaccine adoption is rising rapidly due to increased pet ownership and urban pet registration mandates, especially in Japan, South Korea, and Australia.

By Animal Type Insights

The livestock segment commanded the Asia Pacific animal healthcare market by capturing 68.5% of the total market share in 2024. The significance of this segment stems from the region's vast agricultural base, high dependence on animal protein, and the need to maintain productivity in large-scale farming operations. One of the key drivers is the massive scale of livestock rearing in countries like China, India, Indonesia, and Thailand, where millions of cattle, pigs, poultry, and goats are raised annually for domestic consumption and export. Ensuring herd protection against infectious diseases is crucial to minimizing yield loss and maintaining profitability. In addition, governments across the region have launched extensive animal disease control initiatives, including mandatory vaccination drives and biosecurity measures. In India, the Department of Animal Husbandry estimates that over 1 billion livestock animals receive vaccinations annually under national programs, significantly boosting demand for veterinary pharmaceuticals and diagnostics.

The companion animal segment is the fastest-growing category in the Asia Pacific animal healthcare market, expected to expand at a CAGR of 11.2% during the forecast period. This rapid ascent is fueled by changing societal attitudes toward pets, rising disposable incomes, and the growth of premium pet care services across urban centers. One major factor driving this growth is the increasing number of pet owners who view their animals as family members and are willing to spend significantly on veterinary treatment and wellness products . These trends have led to a surge in demand for advanced medical procedures, preventive vaccines, and specialty nutrition products. Moreover, the rise of digital veterinary services, insurance schemes, and premium pet retail stores has made high-quality care more accessible.

By End-User Insights

The animal segment represented the largest end-user segment in the Asia Pacific animal healthcare market by accounting for 57% of total revenue in 2024. This dominance is primarily due to the vast scale of commercial livestock operations and the necessity for regular disease prevention, treatment, and productivity optimization measures. A key growth factor is the concentration of large-scale poultry, dairy, and pig farms in countries like China, India, and Vietnam, where efficient disease management directly impacts food production and economic returns. Additionally, the presence of organized farming systems and government-backed extension services supports systematic healthcare practices on farms. In India, cooperative dairy farms are increasingly adopting mobile veterinary units for on-site diagnosis and medication.

The homecare segment is the rapidly growing end-user category in the Asia Pacific animal healthcare market, expected to register a CAGR of 12.6% through 2033. This expansion is driven by the increasing preference for at-home pet healthcare, supported by rising disposable incomes, digital platform adoption, and the convenience of doorstep services. One of the key growth enablers is the proliferation of online pet care platforms offering subscription-based medications, teleconsultations, and home delivery of therapeutic products pa particularly in countries like Japan, South Korea, and Australia. Moreover, there is a growing trend toward do-it-yourself pet care, with pet owners investing in self-administered diagnostic kits, supplements, and wellness products . n India, startups like Dogsee Chew and Petmojo have seen a substantial increase in demand for home-use probiotics, immunity boosters, and grooming aids.

REGIONAL ANALYSIS

China held the largest share of the Asia Pacific animal healthcare market by contributing 25.7% of total regional revenue in 2024, according to data from Frost & Sullivan. The country’s leadership position is rooted in its massive livestock population, expanding pet ownership, and aggressive government investments in disease control and food safety. A key growth driver is the rapid modernization of China’s livestock industry, which includes large-scale poultry, pig, and dairy farms requiring comprehensive veterinary support. The African swine fever outbreak in recent years prompted a surge in demand for preventive healthcare solutions, reinforcing the role of animal health in economic stability. In addition, urban pet ownership is rising sharply, particularly among younger generations, leading to increased spending on premium veterinary services and pet medications.

India commanded a major share of the market. The country’s robust agricultural economy, vast livestock population, and rising pet ownership collectively drive demand for veterinary products and services. A core growth factor is India's status as the world’s largest milk producer and one of the top five egg producers, necessitating extensive animal healthcare infrastructure. According to the Department of Animal Husbandry and Dairying, India is home to over 530 million livestock animals, making disease prevention a critical priority for policymakers and farmers alike. Moreover, urban pet ownership is witnessing exponential growth, particularly in Tier I and Tier II cities, where veterinary clinics and e-commerce platforms are expanding rapidly .

Japan has a strong presence and is driven by its advanced veterinary healthcare system, high per capita pet ownership, and well-established pharmaceutical and biotech industries. A primary growth factor is the aging demographic profile and declining birth rate, which has led to an increase in pet companionship, particularly among singles and elderly individuals. This includes a growing demand for premium pet foods, prescription medications, and specialized veterinary treatments. In addition, Japan has a highly developed animal vaccine and diagnostics market, reinforced by strong government oversight and private sector innovation. Companies like Kyoritsu Seiyaku Corporation and Nippon Zenyaku Kogyo Co., Ltd. play a pivotal role in supplying high-quality veterinary products. The country also maintains stringent biosecurity protocols in the livestock and aquaculture sectors, ensuring consistent demand for prophylactic and therapeutic solutions.

Australia and New Zealand together represent a smaller but high-value segment characterized by strong regulatory frameworks and premium pet care trends. A key growth driver is the high pet ownership rates and willingness to invest in advanced veterinary services, particularly in Australia, where over 60.2% of households own at least one pet. The country’s veterinary sector is highly regulated, ensuring quality standards in diagnostics, therapeutics, and surgeries, which in turn encourages recurring healthcare expenditures. Additionally, New Zealand’s agricultural exports rely heavily on healthy livestock populations, prompting continuous investment in animal vaccines, parasiticides, and trace mineral supplements.

South Korea is positioning itself as a rapidly growing player driven by urbanization, rising disposable income, and increasing pet humanization. A major growth engine is the sharp rise in pet ownership, particularly in Seoul and other metropolitan areas where companies like Lotte Mart and E-Mart Pet offer premium pet food, accessories, and healthcare kits. Also, South Korea is investing in biotechnological advancements in veterinary medicine, with firms such as Green Cross Vet and Kolon Life Science developing regenerative therapies and gene-based treatments for companion animals. The government is also enhancing biosecurity protocols in livestock farms to meet export market requirements.

KEY MARKET PARTICIPANTS

Companies playing a notable role in the Asia-Pacific veterinary healthcare market profiled in this report are Merck & Co., Inc., Bayer AG, Boehringer Ingelheim GmbH, Cargill, Inc., Ceva Santé Animale, Novasep, Eli Lilly and Company, Koninklijke DSM NN.V., Novartis AG, Nutreco N.V., Sanofi S.A., SeQuent Scientific Ltd., Virbac S.A., Vétoquinol S.A., and Zoetis Inc.

The competition in the Asia Pacific animal healthcare market is marked by a dynamic mix of global industry leaders and a growing number of regional players striving to capture market share through innovation, localization, and strategic expansion. While multinational corporations leverage their extensive R&D capabilities, established distribution networks, and brand recognition, local firms are capitalizing on cost advantages, proximity to end-users, and a deep understanding of regional disease patterns and consumer preferences. The market is witnessing increased investment in biologics, digital health solutions, and sustainable animal nutrition products as companies aim to align with evolving regulatory standards and consumer expectations. Competition is also intensifying in the companion animal segment, where rising pet ownership and premiumization of pet care services have spurred new product launches and marketing campaigns. Additionally, the integration of smart technologies such as AI-driven diagnostics and wearable monitoring devices is reshaping service delivery models and creating differentiation opportunities. As demand for advanced animal healthcare continues to rise across both livestock and pet segments, the competitive environment is expected to become even more robust and diversified.

Top Players in the Asia Pacific Animal Healthcare Market

Zoetis Inc.

Zoetis is a global leader in animal health, with a strong and expanding presence in the Asia Pacific region. The company offers a comprehensive portfolio of veterinary pharmaceuticals, vaccines, diagnostics, and genetic testing solutions for both livestock and companion animals. In Asia Pacific, Zoetis has been actively engaging with governments, academic institutions, and private stakeholders to promote responsible animal healthcare practices and enhance disease prevention strategies.

Boehringer Ingelheim Animal Health

Boehringer Ingelheim plays a vital role in the Asia Pacific animal healthcare market through its innovative vaccine development, parasite control products, and digital health initiatives tailored for livestock and pets. The company has invested heavily in regional research centers and manufacturing facilities to meet growing demand and ensure rapid response to disease outbreaks, particularly in the poultry and swine sectors.

Elanco Animal Health

Elanco is a major contributor to the advancement of veterinary medicine across the Asia Pacific region, offering a diverse range of products that support animal nutrition, disease prevention, and performance optimization. With a focus on sustainable livestock production and pet wellness, Elanco collaborates with local distributors and digital platforms to expand access to high-quality animal healthcare solutions in both rural and urban markets.

Top Strategies Used by Key Market Participants

Expansion into Emerging Markets through Local Partnerships

Leading companies are forming strategic alliances with domestic manufacturers, distributors, and veterinary associations to strengthen their foothold in emerging Asia Pacific economies. These partnerships help navigate regulatory landscapes, build brand trust, and tailor product offerings to local farming and pet care needs.

Investment in Research and Development for Disease-Specific Solutions

Major players are directing resources toward developing region-specific vaccines and therapeutics to combat prevalent diseases in livestock and companion animals. This includes innovations in recombinant DNA technology, RNA-based vaccines, and antimicrobial alternatives tailored for tropical climates and endemic pathogens.

Digital Integration and Telehealth Services for Pet and Livestock Care

To improve accessibility and service delivery, key participants are investing in digital veterinary platforms, mobile diagnostic tools, and telemedicine services. These technologies enable real-time monitoring, remote consultations, and personalized treatment plans, enhancing engagement with pet owners and farm managers alike.

RECENT MARKET DEVELOPMENTS

- In June 2024, Zoetis Inc. launched a new regional innovation hub in Singapore focused on developing climate-resilient vaccines for tropical livestock diseases. This initiative was aimed at accelerating product development and addressing region-specific health challenges faced by farmers across Southeast Asia.

- In March 2024, Boehringer Ingelheim Animal Health entered into a joint venture with a leading Indian veterinary diagnostics firm to expand its disease surveillance capabilities and improve early detection of infectious diseases in poultry and cattle. This collaboration supported Boehringer’s goal of strengthening preventive healthcare infrastructure in South Asia.

- In August 2024, Elanco Animal Health introduced a digital pet wellness platform in Japan, integrating teleconsultations, medication tracking, and preventive care reminders for pet owners. This move was designed to enhance customer engagement and position Elanco as a leader in tech-enabled companion animal healthcare services.

- In January 2024, Ceva Santé Animale expanded its manufacturing facility in Thailand to increase production capacity for poultry vaccines, responding to rising demand from commercial farms in Indochina and the Mekong region. This expansion reinforced Ceva’s supply chain resilience and regional market presence.

- In October 2024, Merck Animal Health acquired a majority stake in a South Korean startup specializing in AI-powered livestock health monitoring systems. This acquisition was intended to integrate predictive analytics into farm-level disease management and establish Merck as a pioneer in digital veterinary solutions in the Asia Pacific market.

MARKET SEGMENTATION

This research report on the Asia-Pacific veterinary healthcare market has been segmented and sub-segmented into the following categories.

By Animal Type

- Livestock Animals

- Companion Animals

By Product

- Antimicrobial & Antibiotic

- Vaccines

By End-User

- Animal Farms

- Homecare

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

Which countries in the APAC region contribute significantly to the veterinary healthcare market share?

China, Japan, India, Australia, and South Korea are contributing majorly to the veterinary healthcare market in APAC.

What challenges does the APAC veterinary healthcare market face?

Regulatory complexities, the high cost of advanced veterinary treatments, and limited awareness in certain regions are some of the major challenges to the APAC veterinary healthcare market.

How has the COVID-19 pandemic impacted the veterinary healthcare market in the APAC region?

The pandemic has led to disruptions in the supply chain, reduced veterinary clinic visits, and an increased focus on telehealth solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com