Global Veterinary Healthcare Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report By Animal Type (Livestock Animals and Companion Animals), Product (Pharmaceuticals and Feed Additives) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis from 2025 to 2033

Global Veterinary Healthcare Market Size

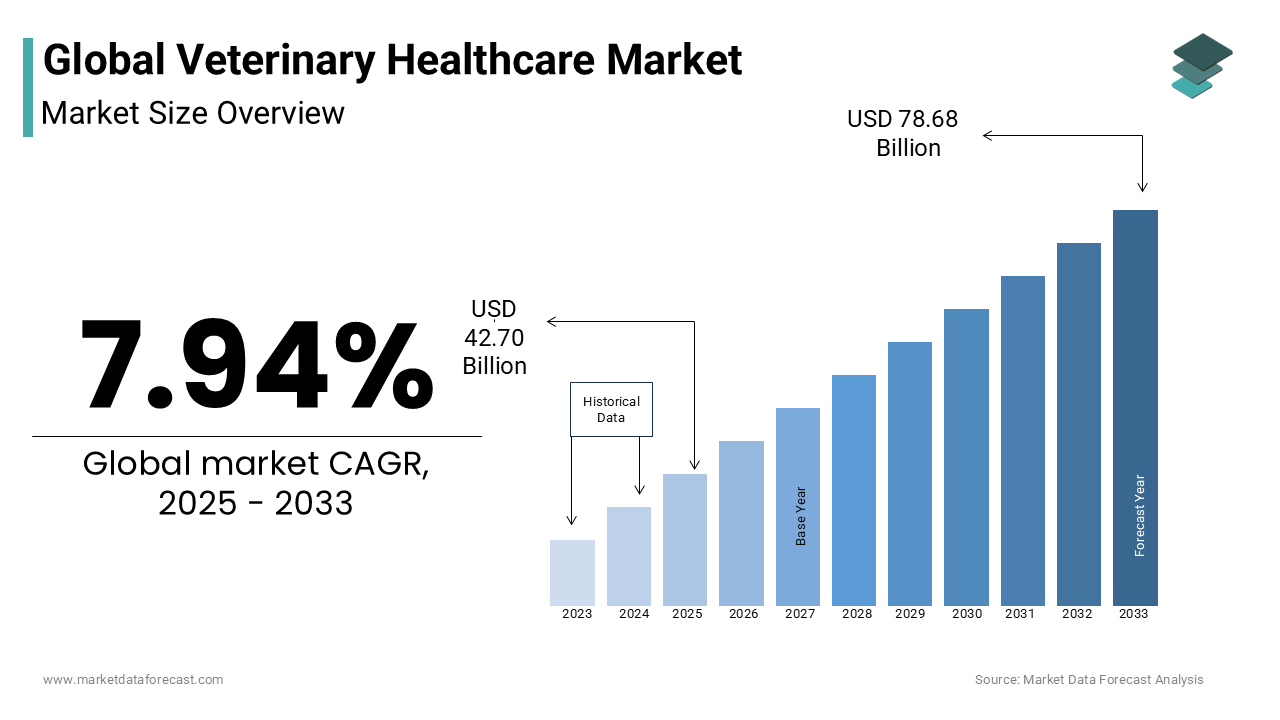

The global veterinary healthcare market was valued at USD 39.56 billion in 2024. The size of the global veterinary healthcare market is expected to be valued at USD 42.70 billion in 2025 and USD 78.68 billion by 2033, growing at a CAGR of 7.94% from 2025 to 2033.

Veterinary healthcare is a part of a science that deals with the diagnosis, treatment, and prevention of various diseases in animals to expand their lifespan. The veterinary healthcare market consists of sales of veterinary healthcare goods and services. It involves several services, including regular monitoring of animal health and deployment of medicated animal feeds, diagnostic products, drugs, and vaccines for limiting the spread of diseases among animals and people. These amenities are extensively provided by sole traders, pharmacies, veterinary hospitals, clinics, and laboratory testing services. The increase in the importance of the production of livestock animals is generating growth in the global veterinary healthcare market.

The prominence of the care of working animals, companion animals, farm animals, and animals living in zoos is rising all around the world, and the demand for the launch of various treatment procedures is also growing at a higher rate. The rising prevalence of various chronic diseases among animals is solely to level up the need for high-quality and effective treatment procedures. On March 25, 2024, the Centre for Disease Control and Prevention (CDC) reported the multistate outbreak of HPAI A (H5N1) bird flu in dairy cows. This is the first case where bird flu was found in cows. Although the occurrence of the bird flu virus in mammals is very rare, the demand to take certain measures in veterinary healthcare is increasing eventually to avoid huge risk factors in the coming years. Government authorities are taking frequent steps to measure and prevent the risk of infectious rates by hugely investing in research and development activities in the veterinary healthcare sector.

MARKET DRIVERS

Growing Prevalence of Zoonosis Diseases across the Globe

According to the World Health Organization, Zoonosis is a disease that is naturally transmissible from vertebrate animals to humans. For instance, the outbreak of COVID-19 is an example of the impact of zoonotic disease, in which viruses jump from animals to infect humans. Also, growing animal health disorders bolsters the market's growth rate. Many government organizations have been taking the initiative to provide quality veterinary healthcare services. These organizations also monitor the launch of various vaccines to avoid infectious diseases like foot and mouth diseases among animals. In addition, the rise in funds to develop new vaccines, increasing investments in veterinary hospitals to ensure quality services, and growing concern towards animal healthcare are promoting the growth of the veterinary healthcare market. Pet lovers seek the best treatment procedure at any cost, positively impacting the market's growth. Increasing the livestock population is another attribute focused on expanding the market's growth rate. Furthermore, people's need for quality poultry products for a healthy lifestyle will likely outshine the market's growth extensively.

Penetration of New Policies for Pet Owners

In developed countries, the penetration rate of pet insurance policies is very high. For example, in the United States, the need for pet insurance policies is growing at a high CAGR during the forecast period. Similarly, in the U.K., the penetration rate of pet insurance is 20%. Introducing various pet insurance policies increases visits to veterinary healthcare centers or clinics. The growth of the global market is also driven by the approval of new products related to treating animal disorders and rising meat production. The increasing meat production is especially prominent in developing countries such as China, India, and Brazil, where increasing populations and rising income levels are stimulating the demand for meat products. By 2029, the production of meat and poultry in emerging markets is expected to increase by 76%.

MARKET RESTRAINTS

The number of veterinarians is decreasing due to fewer training programs, which is one significant restraint on the global veterinary healthcare market. Reluctance to adopt new technologies in undeveloped countries is a significant attribute of the veterinarian shortage in these places. Strict rules and regulations are a significant challenge. Government authorities are imposing strict rules and regulations to approve a vaccine. It remains a major restraining factor for the key players. Some vaccines are unavailable against livestock vector-borne pathogens, hampering the market's growth rate. Fluctuations in the availability of raw materials and the unavailability of vaccines for some diseases restrict the market's growth rate. Additionally, increasing regulation on antibiotics is expected to remain a major restraint for the market. Apart from that, growing cost regulations related to animal testing are also significant hurdles to the growth of the veterinary healthcare market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Animal Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Merck & Co. Inc., Bayer AG, Boehringer Ingelheim International GmbH, Eli Lilly and Company, Ceva Animal Health Inc., Novasep, Novartis AG, Nutreco N.V., Sanofi S.A., Sequent Scientific Ltd., Virbac S.A., Zoetic S.A. |

SEGMENTAL ANALYSIS

By Product Insights

The pharmaceutical segment is expected to showcase dominance in the global market over the forecasting period due to the increase in the prevalence of zoonotic diseases across the globe. New advanced vaccines have been manufactured containing genetically engineered components derived from those disease agents. Additionally, market players are developing and launching new vaccines globally to enhance their market presence. For instance, in March 2021, the world's first animal vaccine against the novel coronavirus was registered in Russia, named Carnivac-Cov, developed by a unit of Rosselkhoznadzor (Federal Service for Veterinary and Phytosanitary Surveillance. The clinical trials of Carnivac-Cov were started in October 2021 and involved dogs, cats, and other animals. Additionally, in June 2022, in India, the Union Minister of Agriculture & Farmers, farmers Shri Narendra Singh Tomar, launched animal vaccines and other diagnostic kits developed by the ICAR-National Research Centre on Equines.

By Animal Type Insights

Among these, the livestock animals segment is expected to register dominance in the global market during the forecast period. According to the Food and Agriculture Organization, in emerging economies, animal-based food products hold for one-third of human protein consumption, leading to an increase in livestock productivity, which is critical to meet the dietary needs of the growing human population. These factors cumulatively are responsible for the significant share captured by production animals in this segment.

The companion animals segment is anticipated to capture a considerable share of the worldwide market during the forecast period. Companion animals are known to lower blood pressure, provide psychological stability, and reduce the frequency of cardiac arrhythmias and anxiety attacks, enhancing humans' overall well-being. Consequentially, animal-assisted therapy is increasingly preferred as a result of these companion animal products. The companion animal segment is expected to have the fastest CAGR in the coming years.

REGIONAL ANALYSIS

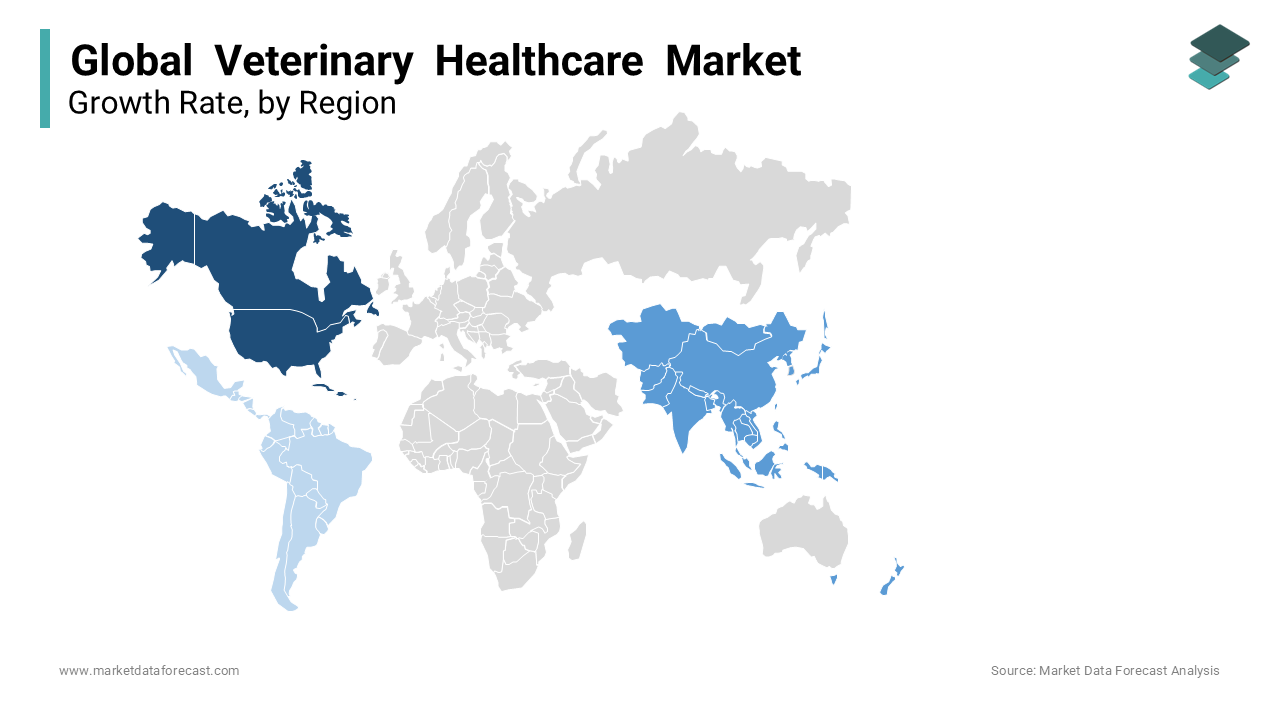

North America is leading with the largest share of the market in the past few years and shall continue the same growth rate in the coming years. The presence of a high number of clinical and laboratory research centers is elevating the growth rate of the veterinary healthcare market in North America. Government officials in developed countries like the US and Canada focus highly on the launch of innovative medical options to treat various infectious diseases, which is likely to showcase huge growth opportunities for the market in the coming years. In recent years, the high number of approvals for new drugs or vaccines is escalating the growth rate of the market. For instance, in 2024, Food Drug and Administration (FDA) approved pradofloxacin injection (Pradlex) that helps treat certain respiratory diseases in cattle and swine.

Asia Pacific is anticipated to reach the highest CAGR by the end of 2032, owing to the increasing number of pet owners in India and China. According to recent survey reports, nearly 31 million pet dogs and 2.44 million pet cats in India in 2023. It is expected that the pet cat population will go beyond 4.89 million by 2026. Nowadays, people are showing much interest in companion animals, and the reports show that approximately 11% of Indians own at least four pets. Therefore, the veterinary healthcare market size is deemed to grow at a faster rate during the forecast period in Asia Pacific.

Europe's veterinary healthcare market is next to North America, leading the largest share throughout the forecast period 2024-2032. High investments in veterinary healthcare in Europe by top companies shall leverage the growth rate of the market in the coming years. The availability of advanced infrastructure for R&D activities in European countries is a major attribute that accelerates the market’s growth rate. Increasing awareness among pet owners to give effective treatment for their pets is additionally to fuel the growth rate of the veterinary healthcare market.

The prominence of the launch of various treatment options for the growing zoonotic and food-borne diseases is ascribed to fueling the growth rate of the veterinary healthcare market in the Middle East and Africa. Huge responses from pet owners regarding the development of innovative healthcare services for animals are greatly influencing the growth rate of the market in this region. Saudi Arabia and UAE are the major countries contributing the largest share of the market. High disposable income in these countries and growing interest in companionship, especially among elderly people, are attributed to leveling up the market’s growth rate.

The Latin American veterinary healthcare market has been substantially growing at a steady pace in recent years. Key companies’ strategies to expand their footprints in various regions are amplifying the market’s growth rate in Latin America. The demand for availing the best treatment services for their pets among owners is evaluating the growth rate of the market. The expansion of the top companies in Brazil and Mexico will solely create growth opportunities in the coming years. Pet owners are showing huge interest in preventive healthcare solutions. The increasing awareness of the importance of vaccinations and regular checks accounts for the surging growth rate of the market in Latin America.

KEY MARKET PARTICIPANTS

Companies playing a key role in the global veterinary healthcare market include Merck & Co. Inc., Bayer AG, Boehringer Ingelheim International GmbH, Eli Lilly and Company, Ceva Animal Health Inc., Novasep, Novartis AG, Nutreco N.V., Sanofi S.A., Sequent Scientific Ltd., Virbac S.A. and Zoetic S.A.

RECENT HAPPENINGS IN THE MARKET

- In June 2023, the FDA approved an apoquel in chewable options, the new formulation, which is indicated for the treatment of canine pruritus associated with allergic dermatitis and atopy.

- In June 2023, the U.S. Food and Drug Administration and the European Union are expanding their Mutual Recognition Agreement’s (MRA) Sectoral Annex for Pharmaceuticals Good Manufacturing Practices to include veterinary pharmaceuticals.

- In April 2023, the FDA approved Modulis to Treat Feline Allergic Dermatitis Provetica’s generic product, which has the same active ingredient as Atopica for Cats.

- In September 2022, Merck Animal Health announced the new label indication for both fluralaner topical solution (Bravecto) and fluralaner and moxidectin topical solution (Bravecto Plus) for the treatment and control of Asian long-horned tick infestations in cats. Both products are the first US products labeled for both the treatment and control of Asian long-horned tick infestations.

MARKET SEGMENTATION

This research report on the global veterinary healthcare market has been segmented and sub-segmented based on the product, animal type, and region.

By Product

- Pharmaceuticals

- Vaccines

- Antibiotics

- Parasiticides

- Others

- Feed Additives

- Medical Feed Additives

- Nutritional Feed Additives

By Animal Type

- Livestock Animals

- Cattles

- Swine

- Sheep

- Poultry

- Aquatic

- Others

- Companion Animals

- Cats

- Dogs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Frequently Asked Questions

What are the factors fueling the veterinary healthcare market?

Increased pet ownership across the world and growing incidence of animal diseases are primarily promoting the veterinary healthcare market growth.

Which region accounted for the largest share of the market in 2023?

Geographically, the North American region held the major share of the market in 2023.

Who are the major participants in the veterinary healthcare market?

Merck & Co., Inc., Bayer AG, Boehringer Ingelheim GmbH, Cargill, Inc., Ceva Santé Animale, Novasep, Eli Lilly and Company, Koninklijke DSM N.V., Novartis AG, Nutreco N.V., Sanofi S.A., Sequent Scientific Ltd., Virbac S.A., Vétoquinol S.A., and Zoetis Inc. are some of the noteworthy companies in the veterinary healthcare market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com