Global Pet Insurance Market Size, Share, Trends & Growth Forecast Report By Policy Type, Animal Type (Dog, Cat and Others) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis (2025 to 2033)

Global Pet Insurance Market Size

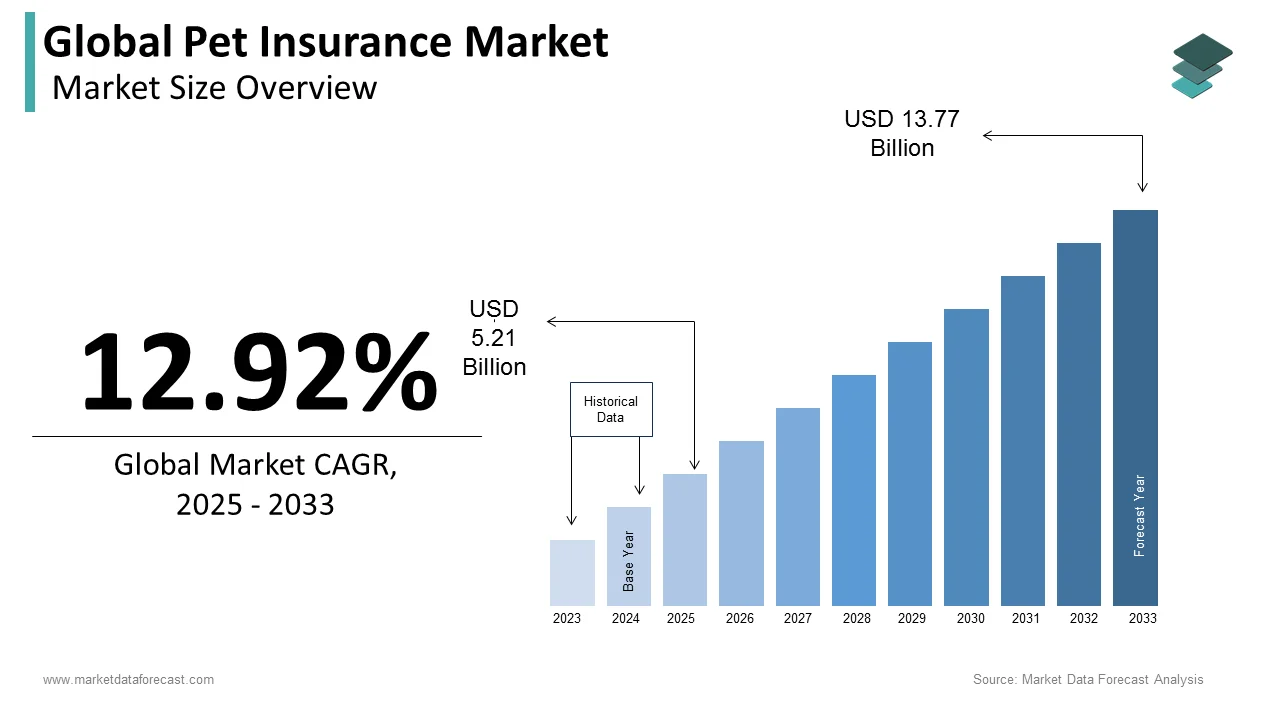

The global pet insurance market size was valued at USD 4.61 billion in 2024. The global market is estimated to be worth USD 5.21 billion in 2025 and is projected to reach USD 13.77 billion by 2033, registering a CAGR of 12.92% from 2025 to 2033.

The pet insurance market has witnessed robust growth in recent years, driven by escalating veterinary costs and an increase in pet ownership. As pets are increasingly regarded as family members, owners are investing more in their health and well-being, boosting demand for insurance policies that cover a wide range of medical expenses, from accidents to chronic conditions. North America and Europe represent the largest markets, with the U.S. leading in pet ownership and insurance adoption. Meanwhile, the Asia-Pacific region is rapidly emerging as a significant market due to rising disposable incomes and evolving attitudes toward pet care. Countries such as India and China are seeing a surge in pet adoption, which is expected to drive further growth in the pet insurance sector. The market is poised for continued expansion as more pet owners recognize the importance of protecting their pets against unexpected medical expenses.

PET INSURANCE MARKET TRENDS

Growing Preference for Comprehensive Coverage Plans

There has been a marked increase in demand for comprehensive pet insurance policies, particularly Accident & Illness plans, which now dominate the market with over 80% share. These policies provide extensive coverage, including chronic and hereditary conditions, making them a preferred choice among pet owners. Rising veterinary costs and heightened awareness of holistic pet healthcare are significant drivers of this trend. Leading providers like Nationwide and Embrace are enhancing their offerings by introducing customizable plans that integrate wellness and preventive care, thus appealing to a broader customer base.

Proliferation of Digital and Direct Sales Channels

The adoption of digital platforms for purchasing pet insurance is gaining momentum, especially in North America and Europe. Direct sales through company websites and mobile apps have become the most popular distribution channels, representing over 30% of the market share. This shift is supported by the convenience of digital platforms, which enable pet owners to compare plans, obtain quotes, and manage policies with ease. Companies like Figo and Trupanion are investing in digital infrastructure to enhance user experiences, offering features such as real-time claims processing and telehealth consultations to cater to the growing demand for seamless service.

Expanding Presence in Emerging Markets

While North America and Europe continue to lead the global market, the Asia-Pacific and Latin American regions are experiencing rapid growth, with projected compound annual growth rates (CAGR) of over 18% and 12%, respectively. The surge in pet ownership, coupled with rising disposable incomes and greater awareness of pet health, is driving demand in countries such as China, India, and Brazil. Insurers are responding by developing tailored products to meet local needs, such as affordable basic coverage and specialized plans for exotic pets. Companies like Future Generali and Chubb are expanding their footprints in these regions through strategic partnerships and localized product offerings.

MARKET DRIVERS

Rising Pet Population

The global pet population is on the rise, with more households embracing pets as family members. In the U.S. alone, the percentage of households owning a pet increased from 68% in 2016 to 70% in 2021. This trend is driving demand for pet insurance as owners seek financial security against unexpected veterinary expenses. The market is poised to grow as more people invest in their pets' health and well-being.

Escalating Veterinary Costs

Veterinary care has become more advanced and, consequently, more expensive. Costs for surgeries, cancer treatments, and chronic disease management have risen significantly, prompting more pet owners to seek insurance coverage. This trend is particularly pronounced in North America and Europe, where high veterinary expenses drive demand for comprehensive coverage plans.

Growing Awareness and Adoption

Awareness of the benefits of pet insurance is increasing globally, leading to higher adoption rates. For instance, in the U.S., the number of insured pets rose by 28% from 2020 to 2021. New entrants and innovative policies are making insurance more accessible and attractive, contributing to a broader market reach.

MARKET CHALLENGES

Low Adoption in Emerging Markets

Despite global awareness, pet insurance adoption remains low in emerging markets such as India and several African countries. High veterinary costs, low disposable incomes, and limited insurance options present significant barriers to growth. Additionally, cultural differences and lack of awareness hinder market expansion in these regions.

Lack of Standardization in Reimbursement

The absence of standardized reimbursement processes poses challenges for the pet insurance industry. Unlike human healthcare, pet insurance lacks universal codes for medical procedures, leading to confusion and dissatisfaction among policyholders. This inconsistency complicates the claims process and may deter potential customers.

High Premiums and Policy Complexity

The high cost of premiums and the complexity of policy terms can be deterrents for many pet owners. While comprehensive plans offer extensive coverage, they are often prohibitively expensive for owners of older pets or breeds prone to health issues. Navigating the fine print of various policies can also lead to confusion, discouraging consumers from purchasing insurance.

MARKET OPPORTUNITIES

Digital Integration and Telemedicine

The integration of digital platforms and telemedicine into pet insurance represents a significant growth opportunity. Digital tools such as mobile apps and online portals can streamline policy management and claims processing, making the insurance process more accessible and user-friendly. Telemedicine offers a convenient way for pet owners to consult with veterinarians, potentially reducing the frequency and cost of claims.

Expansion into Preventive and Holistic Care

As pet care trends evolve, there is an opportunity for insurers to expand coverage into preventive and holistic care, including wellness plans, dental care, and alternative therapies. Offering comprehensive packages can attract a health-conscious customer base and increase policyholder satisfaction and retention.

Targeting Emerging Markets

With rising pet adoption rates in regions like Asia-Pacific and Latin America, there is significant potential for growth. Tailoring affordable and flexible insurance plans to meet the needs of these markets can open new revenue streams for insurers. Educational campaigns and partnerships with local veterinary clinics can help raise awareness and drive adoption in these regions.

IMPACT OF COVID-19 ON THE PET INSURANCE MARKET

The COVID-19 pandemic had a profound effect on the global pet insurance market, accelerating existing trends and reshaping consumer behavior in several key areas:

Surge in Pet Adoption and Ownership

The pandemic period saw a notable increase in pet adoption rates as individuals and families sought companionship during lockdowns and social isolation. This trend significantly boosted the demand for pet insurance, as new pet owners sought to safeguard their pets' health amidst uncertain times. In the United States, pet adoption rates surged by nearly 40% in the early months of the pandemic, leading to a corresponding rise in pet insurance enrollments. This trend was mirrored globally, with similar increases observed in Europe and Asia-Pacific, where pet adoption gained momentum as people adjusted to new work-from-home lifestyles and looked for companionship.

Digital Transformation of the Pet Insurance Market

The pandemic accelerated the digital transformation of the pet insurance sector. With restrictions on in-person interactions, consumers increasingly turned to digital platforms for purchasing and managing their insurance policies. In response, companies enhanced their digital offerings, such as mobile apps and online portals, to provide seamless policy management and claims processing. For example, Figo expanded its Pet Cloud app to include telehealth services and real-time claim tracking, catering to the growing demand for digital-first solutions. This shift towards digital channels has not only improved accessibility but also increased consumer engagement with insurance products.

Rising Veterinary Costs and Financial Uncertainty

The economic uncertainty brought on by COVID-19 has made pet insurance an attractive financial safety net. Veterinary costs continued to rise during the pandemic, with reported increases of 5-10% annually in 2020 and 2021. This trend has heightened the appeal of comprehensive pet insurance plans that can help manage these escalating expenses. However, the financial strain on households led some pet owners to reassess their insurance coverage, resulting in policy downgrades or cancellations as they balanced their need for coverage with affordability concerns. This dynamic illustrates the dual impact of the pandemic on the market—while overall adoption increased, financial constraints led to a more cautious approach among some consumers.

Overall, COVID-19 has reshaped the pet insurance market by accelerating digital adoption and increasing the number of insured pets globally. These changes are likely to have a lasting impact on the market as it continues to adapt to the evolving needs of pet owners in a post-pandemic world.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Animal, Policy Type, Sales Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

Petplan Pet Insurance, Embrace Pet Insurance Agency, Royal & Sun Alliance (RSA), Pethealth Inc., Agria Pet Insurance, Pet first Healthcare, Nationwide Pet Insurance, PetSure Pty Ltd., Petsecure Pet Health Insurance and Hartville Group. |

SEGMENTAL ANALYSIS

By Policy Insights

The dog insurance segment led the market by accounting for 51.8% of the global market share in 2024. Dogs remain the most insured animals due to their popularity as companion pets and the higher costs associated with their healthcare. Insurance policies for dogs typically cover breed-specific conditions, hereditary diseases, and general health issues such as hip dysplasia and allergies. Dogs are the most popular pets globally, particularly in North America and Europe. The demand for dog insurance is driven by the growing number of dog adoptions and heightened awareness of the benefits of insuring against breed-specific health issues.

The cat insurance segment is another major segment and is expected to register a CAGR of 7.78% during the forecast period. Cats are gaining traction in the market, with more owners seeking insurance to manage the rising costs of treating chronic feline conditions. Cat insurance covers common feline health issues, including urinary tract infections, kidney disease, and diabetes, which can be costly to treat. Although cats represent a smaller segment of the pet insurance market, their share is growing as more specialized insurance products become available. Rising cat ownership in urban areas and a greater focus on feline health are expected to drive the segmental expansion.

By Policy Type Insights

The accident and illness policies segment held for 82.12% of the global market share in 2024. Accident & Illness policies dominate the market, primarily due to the increasing costs of veterinary care and a heightened understanding among pet owners of the importance of comprehensive coverage. This segment's growth is further propelled by advancements in pet healthcare technology, which have made sophisticated treatments more accessible. Representing the most comprehensive and widely chosen policy type, Accident & Illness plans cover both injury-related incidents and a broad spectrum of illnesses, including chronic conditions such as diabetes, cancer, and allergies. These policies often extend to include diagnostic tests, surgeries, and prescription medications. With over 80% market share, this segment is the cornerstone of the pet insurance industry, reflecting the growing awareness among pet owners of the benefits of extensive healthcare coverage.

On the other hand, the accident only policies segment represents a smaller share of the market but continue to grow steadily. They provide a cost-effective solution for pet owners who prioritize basic protection without the higher premiums associated with comprehensive plans. This policy type is designed to cover costs related to injuries such as fractures, poisonings, and lacerations, excluding any illness-related expenses. It is particularly favored by owners of younger, healthier pets or those seeking a more economical insurance option. This segment serves as an entry-level choice for pet owners who want protection against unexpected accidents without the financial burden of more comprehensive plans.

By Sales Channel Insights

The direct sales segment captured the major share of the global market in 2024, which is 42.3%. The direct sales segment is anticipated to continue growing as digital adoption increases, particularly among younger demographics accustomed to digital-first services. These policies are sold directly to consumers through online platforms, company websites, or call centers. This channel is growing rapidly due to its convenience and the increasing consumer preference for managing policies online. It currently holds over 30% of the market share, driven by the digital transformation of the insurance industry and the appeal of online platforms to younger pet owners.

The agency segment is expected to maintain a stable growth rate, catering to pet owners who prefer a more personalized approach to purchasing insurance. Policies sold through insurance agents offer personalized advice and support, helping consumers choose the right coverage. This channel remains important for pet owners who value human interaction and detailed consultations, especially new pet owners or those insuring high-risk breeds.

The others sales channel segment is predicted to exhibit a promising CAGR during the forecast period. Other Sales Channels are gaining traction, especially with the integration of insurance offerings at veterinary clinics and pet stores, providing a seamless experience for pet owners. This category includes sales through veterinary clinics, pet stores, and partnerships with organizations. Such channels often provide insurance as part of a broader pet care package, making it convenient for pet owners to secure coverage while attending to their pets’ healthcare needs. This segment is expected to grow at a CAGR above 15%, driven by partnerships between insurance companies and veterinary networks, as well as the increasing availability of pet insurance at point-of-care locations.

REGIONAL ANALYSIS

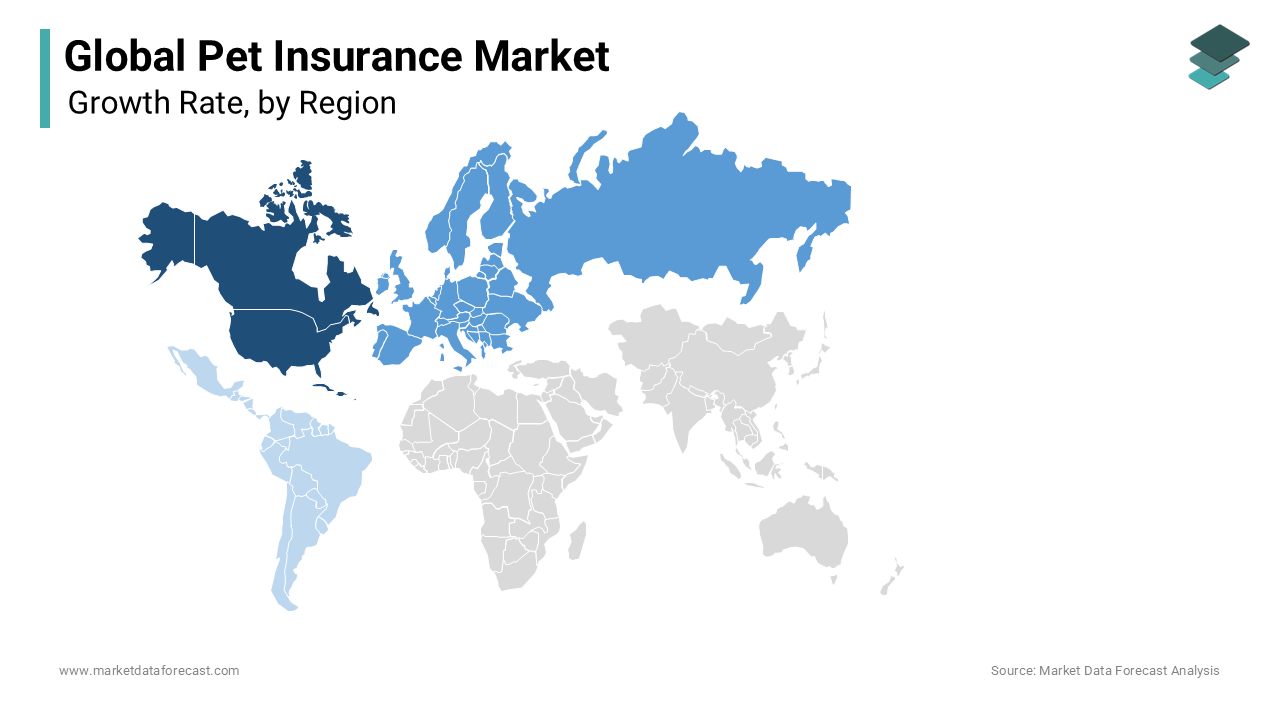

North America remains the largest market for pet insurance, holding 40.9% of the global share. The region is projected to maintain a robust compound annual growth rate (CAGR) of around 12% over the next few years, driven by high pet ownership rates and increasing awareness of the benefits of pet insurance. North America is expected to remain the largest market, driven by high disposable incomes, established insurance infrastructure, and a cultural emphasis on pet healthcare. The growing trend of telehealth for pets and the increasing availability of specialized insurance products, such as wellness plans, are likely to sustain growth. The U.S. dominates the North American market, with 67% of households owning at least one pet. The rising costs of veterinary care are a significant growth factor, leading to a steady increase in average annual premiums for dog insurance. This trend reflects a broader shift towards more comprehensive coverage options as pet owners seek financial protection against escalating healthcare expenses. In Canada, pet insurance adoption is on the rise, particularly in urban areas where pet healthcare costs are higher. Companies are offering more tailored plans to attract Canadian pet owners, contributing to greater market penetration and growth.

Europe was the second largest regional segment in the global market in 2024. Europe benefits from high insurance penetration and a mature market. The region is witnessing innovations such as digital claims processing and personalized insurance plans, which are enhancing customer experience and expanding market reach. The U.K. leads the European market, benefiting from high insurance penetration rates due to a well-established insurance industry and robust awareness campaigns. Germany and France follow, driven by increasing pet ownership and stringent regulations, such as mandatory liability insurance for specific dog breeds. Over 25% of pet owners in the U.K. have insurance, a significantly higher rate than in most other countries. In France, the market is expanding with the introduction of more comprehensive coverage options that include wellness and preventive care, reflecting a trend towards holistic pet health management.

Asia-Pacific is the fastest-growing region in the global pet insurance market. Asia-Pacific is emerging as a key market with rapid growth, fueled by rising pet adoption and economic development. The use of digital platforms to purchase insurance is gaining popularity, making it easier for consumers to access and understand insurance products. Despite holding a smaller market share of around 15%, the region is rapidly catching up due to rising pet adoption and economic growth. The markets in China and India are expanding rapidly, driven by rising middle-class incomes and increasing pet ownership. Although awareness of pet insurance remains relatively low, it is growing, particularly in urban areas where digital platforms are making insurance more accessible. In China, the market is in its early stages but is seeing rapid growth as more companies enter the space. India has witnessed a surge in pet adoption during the COVID-19 pandemic, spurring the development of new insurance products tailored to local needs.

Latin America is expected to grow at a steady CAGR during the forecast period. Brazil and Mexico are the largest markets in the region, driven by growing pet populations and increasing disposable incomes. However, awareness and adoption of pet insurance remain relatively low compared to North America and Europe. In Brazil, the market is slowly gaining traction, supported by a robust pet food and care industry. In Mexico, pet insurance adoption is increasing gradually, especially in urban areas where pet ownership is more prevalent and veterinary costs are higher.

The Middle East & Africa region holds the smallest share of the global market. However, this region is likely to witness a healthy CAGR during the forecast period In the Middle East, the trend of rising pet ownership is particularly strong among expatriates and wealthy nationals. However, the adoption of pet insurance is still in its early stages. In Africa, the market remains nascent, with limited availability of pet insurance products and low awareness among pet owners. In the UAE, the pet insurance market is slowly developing, with new entrants offering niche products tailored to the expatriate population. South Africa is another emerging market, where increasing awareness about the benefits of pet insurance is contributing to growth, particularly among higher-income groups.

COMPETITIVE LANDSCAPE & KEY PLAYERS

The global pet insurance market is characterized by intense competition, with numerous players striving to gain market share through innovative products, strategic alliances, and geographic expansion. This competitive environment is largely driven by increasing demand for pet insurance across North America and Europe, where insurance penetration rates are the highest. Key companies in this space include Trupanion, Figo Pet Insurance, Healthy Paws, Petplan Pet Insurance, Embrace Pet Insurance Agency, Royal & Sun Alliance (RSA), Pethealth Inc., Agria Pet Insurance, Pet first Healthcare, Nationwide Pet Insurance, PetSure Pty Ltd., Petsecure Pet Health Insurance and Hartville Group. These players dominate the market by leveraging diverse strategies aimed at enhancing product offerings, expanding digital capabilities, and entering new markets.

Key Players and Market Positions

- Trupanion: A prominent leader in the U.S. and Canada, Trupanion is recognized for its comprehensive coverage plans and unique direct-to-vet payment model, which simplifies the claims process by directly paying veterinarians. The company has been expanding its product offerings and recently partnered with Chewy to offer exclusive insurance plans to Chewy’s extensive customer base, further strengthening its market position.

- Nationwide: As one of the largest pet insurance providers in the U.S., Nationwide offers a variety of plans, including those for exotic pets. The company has focused on innovation in wellness plans, covering preventive care such as vaccinations and screenings. In March 2024, Nationwide launched a new line of customizable pet insurance products in collaboration with Petco, integrating wellness and emergency care to attract a broader customer base.

- Petplan (Allianz): A major player in the U.K. and European markets, Petplan offers extensive coverage options tailored to different breeds and pet types. The company has been investing in digital capabilities, making it easier for customers to manage their policies and file claims online. This focus on digital innovation is part of Petplan's strategy to enhance customer experience and streamline operations.

- Embrace Pet Insurance: Known for its wellness rewards programs and customizable policies, Embrace differentiates itself by allowing pet owners to select coverage levels that best meet their needs. The company has been expanding its presence in the U.S. through partnerships with veterinary clinics and pet stores. In 2024, Embrace processed over one million claims, highlighting its strong market presence and operational efficiency.

- Figo Pet Insurance: Targeting a younger, tech-savvy demographic, Figo stands out with its user-friendly digital platform, the Pet Cloud app. This app enables users to manage all aspects of their pet’s health and insurance in one place, offering features like vaccination reminders, appointment scheduling, and streamlined claims submission. Figo's focus on digital engagement is helping it attract a new generation of pet owners.

- Healthy Paws: Specializing in straightforward, no-annual-limit plans, Healthy Paws has built a reputation for fast and efficient claims processing. The company’s focus on customer service and transparency has resulted in high customer satisfaction and loyalty. Recent initiatives include enhanced customer support to address concerns over rising premiums, reflecting the company’s commitment to maintaining a strong relationship with its policyholders.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Trupanion expanded its direct-to-vet payment network, enabling 24/7 service access. This move aims to simplify the claims process and eliminate out-of-pocket expenses for pet owners by paying veterinarians directly at the time of service.

- In March 2024, Nationwide and Petco launched a new line of customizable pet insurance plans, integrating wellness and emergency care. This partnership is designed to attract a wider audience by offering comprehensive coverage options.

- In February 2024, Embrace reported over one million claims processed in 2024, with significant increases in claim costs for conditions like allergic dermatitis and osteoarthritis. This data-driven approach has led to adjustments in coverage options to serve better pet owners facing rising veterinary costs.

- In April 2024, Figo enhanced its Pet Cloud app to include features like vaccination reminders and streamlined claims submission. This upgrade aims to improve user experience and cater to the growing demand for digital solutions.

- In September 2024, Healthy Paws introduced enhanced customer support initiatives, focusing on transparency and direct engagement with policyholders to address concerns about premium increases. This strategy is intended to maintain high customer satisfaction despite the rising costs of veterinary care.

MARKET SEGMENTATION

This research report on the global pet insurance market is segmented & sub-segmented based on animal type, policy type, sales channel, and region.

By Policy Type

- Accident & Illness

- Accident only

- Others

By Animal Type

- Dogs

- Cats

- Others

By Sales Channel

- Agency

- Broke

- Direct

- Bancassurance

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much is the global pet insurance market going to be worth by 2033?

As per our research report, the global pet insurance market size is predicted to be worth USD 13.77 billion by 2033.

Which segment by policy is dominating the pet insurance market?

Based on the policy, the dog insurance policy segment led the pet insurance market in 2024 and the domination projected to be continuing throughout the forecast period.

Which region accounted for the largest share of the global pet insurance market in 2024?

Geographically, the North American regional market led the pet insurance market in 2024.

Which are the major market participants in the pet insurance market?

Petplan Pet Insurance, Embrace Pet Insurance Agency, Royal & Sun Alliance (RSA), Pethealth Inc., Agria Pet Insurance, Pet first Healthcare, Nationwide Pet Insurance, PetSure Pty Ltd., Petsecure Pet Health Insurance and Hartville Group are some of the notable companies in the global pet insurance market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com