Global Pet Food Market Size, Share, Trends, & Growth Forecast Report – Segmented By Food Type (Dry Food, Wet Food/Canned Foods, Nutraceuticals/Supplements, Snacks & Treats, and Veterinary Diets), Pet Type (Dog, Cat and Fish), Sales Channels (Specialized Pet Stores, Supermarkets & Hypermarkets, And Online Stores) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis From 2025 to 2033

Global Pet Food Market Size

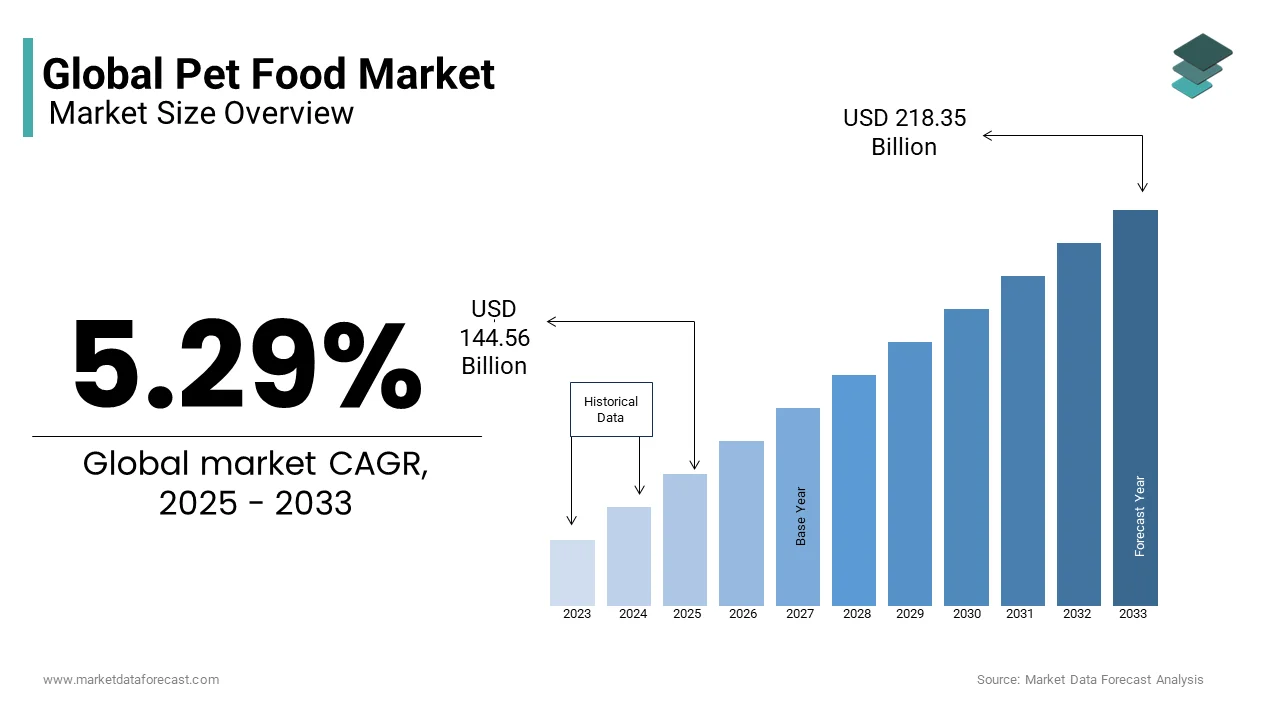

The global pet food market was valued at USD 137.30 billion in 2024 and is anticipated to reach USD 144.56 billion in 2025 from USD 218.35 billion by 2033, growing at a (CAGR) of 5.29% during the forecast from 2025 to 2033.

MARKET DRIVERS

The expanding trend of urbanization across the world has increased the ownership of pets.

This rise in pet ownership, along with the growth of nuclear family conditions, is the major factor driving the global pet food market. The consumer focus on companionship and consideration of pets as an integral part of the family is pushing the demand for high-quality pet food products. The growing awareness about the health of pets drives the need for more nutritional foods. Also, the surge in consumer disposable income improved the spending on specialized pet foods and organic foods prepared from natural sources. In addition, the makers are also creating new formulations and ingredients that consider health conditions like increased weight, joint issues, etc., which is acting positively on sales in the global pet food market. In recent years, functional ingredients, grain-free foods, and growth supplements have found more demand among consumers, benefitting the global pet food market.

Besides, the online distribution channel has flourished drastically in the last few years, expanding the consumer base for the providers and offering a lot of alternatives for the buyers. Also, the augmented impact of social media has increased individuals' awareness and opened the doors for new pet food products to reach different parts of the world. In addition, with the surge in research and development activities, several new flavors and food formulations were created, propelling the pet food market growth. Pet healthcare providers and veterinary doctors also play a crucial role in the usage of pet foods, driving the sales of more specialized and customized pet foods. Furthermore, the availability of environmentally friendly packing options and biodegradable components is also promoting the pet food market. Moreover, the changing lifestyle conditions resulting in single individual households and the need for a companion during the later stages of life are likely to create more opportunities for the global pet food market in the following years.

MARKET RESTRAINTS

Strict government compliance related to the manufacturing of high-quality products and maintaining safety standards for food products are the major challenges to the global pet food market.

Also, the supply chain disruptions that impact the consistent delivery of raw materials and end products are limiting the sales in the pet food market. In addition, with the increased consumer awareness, there is a rising need for more transparency in terms of ingredients used in pet foods, the production process involved, and the packing methods applied. Also, the challenges surrounding the sources used for ingredients and waste created during food packing are negatively affecting the pet food market. Besides, the increased recall of products because of quality and safety features is having a profound impact on the pet food market. Furthermore, the intense market competition leading to increased product prices and more expenses involved in the development of customized food formulations are also posing a threat to the global pet food market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.29% |

|

Segments Covered |

By Pets Type, Food Type, Sales Channel, and Region |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Nestlé Purina, Mars, Inc., Agthia Group, Hill's Pet Nutrition, JM Smucker Company, LUPUS Alimentos, General Mills, Inc., WellPet LLC, Total Alimentos, The Hartz Mountain Corp, Archer Daniel Midlands, Diamond Pet Foods, Blue Buffalo, Simmons Pet Foods, Agrolimen SA, Deuerer, and Heristo AG. |

SEGMENTAL ANALYSIS

Global Pet Food Market Analysis By Pet Type

The dog segment accounted for the majority share of the global pet food market because of the rising demand for canines in all parts of the world. Dogs are also increasingly used in ranches, criminal tracking, and house safety, which is also contributing to the growth of this pet type. Also, the rise in consumer disposable income coupled with the emphasis on the health of pets is creating a positive aspect for the adoption of dogs across the world. Similarly, cats are also expected to witness more adoption in the coming years, creating a market for more animal-based protein foods and supplements.

Global Pet Food Market Analysis By Food Type

The dry food segment dominates the global market because of its advantages, such as easy availability, cost affordability, and long shelf lives. Besides, wet foods/canned foods are also finding more demand due to their easy digestion capabilities and inclusion of different proteins, vitamins, fibers, and nutrients. Similarly, snacks and treats are anticipated to register more growth in the forecast period owing to the high number of online sales and availability of healthy snack options.

Global Pet Food Market Analysis By Sales Channel

Specialized pet stores accounted for a dominant portion of the global pet food market because of the easy access to multiple food types in a single place. Also, the availability of more premium and international brands propels sales in this segment. However, online stores are touted to find more sales owing to the well-established e-commerce infrastructure in developed and developing nations.

Global Pet Food Market Analysis By Region

North America dominated the global pet food market owing to the rising consumer spending on healthy foods and the growth of single-person households in the region. The high adoption rate of pets and awareness about pet humanization is the primary reason supporting the business in this area. The United States of America, followed by Canada, is the leading nation in North America. In addition, the presence of some of the key market players and continuous investments to improve pet food formulations are likely to boost sales in this continent in the coming days.

Europe is the second largest region for the pet food business, with a high concentration of sales in nations like the United Kingdom, Germany, and France. The availability of different options of organic and naturally sourced ingredient-based products and consumer demand for more transparency options are promoting the pet foods business in this locale.

Asia Pacific is predicted to witness the highest growth rate in the global pet food market in the foreseen period owing to the large population and adoption of pets in nations like China, India, Japan, Australia, and South Korea. The ongoing foreign investments in the Asia Pacific countries are likely to create huge growth opportunities for the pet food market in the future.

Latin America is an emerging region in the international marketplace with a huge contribution from Brazil. The augmented consumer expenses, increase in nuclear families, and presence of multicultural individuals are expected to propel the sales of pet foods in this area.

The Middle East and Africa are relatively smaller markets for pet foods compared to the above regions. The surge in the adoption of canines, the growth of the middle-class population, imports from other regions, and the availability of local pet food manufacturers are boosting the business in this locale.

KEY MARKET PLAYERS

Nestlé Purina, Mars, Inc., Agthia Group, Hill's Pet Nutrition, JM Smucker Company, LUPUS Alimentos, General Mills, Inc., WellPet LLC, Total Alimentos, The Hartz Mountain Corp, Archer Daniel Midlands, Diamond Pet Foods, Blue Buffalo, Simmons Pet Foods, Agrolimen SA, Deuerer, and Heristo AG. Some of the major key players involved in the global pet food market.

RECENT HAPPENINGS IN THIS MARKET

- In August 2023, HelloFresh, a meal kit company, launched its new premium pet food brand, ‘The Pets Table,’ to offer a subscription model to pet owners, offering healthy nutrients at affordable prices.

- In October 2023, Prime100, a renowned Australian-based pet food provider, joined forces with Tetra Pak packaging company to introduce a new line of premium dog food products, SPD (Single Protein Diet), in seven flavors. This new product is available to customers in a Tetra Recart packing with the lowest footprint of carbon dioxide.

- In October 2023, Colgate-Palmolive’s subsidiary Hill’s Pet Nutrition started its new advanced smart production plant in Kansas to double the manufacturing of its canned pet food.

- In January 2023, a Saudi Arabia-based e-commerce company, Ninja, which also retails pet food products, announced its new mega-seed funding for the last quarter of 2022. Ninja, operating fully in Riyadh, Jeddah, and the Eastern Province of the kingdom aims to expand its operations and pet food offerings with the new investments.

MARKET SEGMENTATION

This research report on the global pet food market has been segmented & sub-segmented based on the pet, ingredients, form, and region.

By Pet Type

- Dogs

- Cats

- Others

By Food Type

- Dry Food

- Wet Food/Canned Foods

- Nutraceuticals/Supplements

- Snacks & Treats

- Veterinary Diets

By Sales Channel

- Specialized Pet Stores

- Supermarkets & Hypermarkets

- Online Stores

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the pet food market?

The pet food market is expected to be valued at USD 218.35 Million in 2025.

Which regions are leading in terms of market share for pet food consumption?

North America and Europe currently lead in market share for pet food consumption, driven by high pet ownership rates and strong demand for premium pet food products.

What are the key trends driving growth in the pet food market in Asia Pacific?

In Asia Pacific, increasing urbanization, rising disposable incomes, and changing lifestyles are driving the demand for pet food, especially premium and natural products.

How is the pet food market in North America responding to consumer preferences for natural and organic pet food?

In North America, the pet food market is witnessing increased demand for natural and organic pet food products, with consumers seeking healthier options for their pets.

Which companies are the major players in the pet food market in the United States?

Companies such as Mars Petcare Inc., Nestle Purina Petcare, and Hill's Pet Nutrition Inc. are among the major players in the pet food market in the United States.

Who are the key players dominating the pet food market in Europe?

Companies such as Mars Petcare, Nestle Purina Petcare, and Hill's Pet Nutrition are among the key players dominating the pet food market in Europe.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com