Global Wet Pet Food Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (Dog Food and Cat Food), Distribution Channel (Offline Retailers and Online Retailers), Application (Residential and Commercial) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) – Industry Analysis (2025 to 2033)

Global Wet Pet Food Market Size

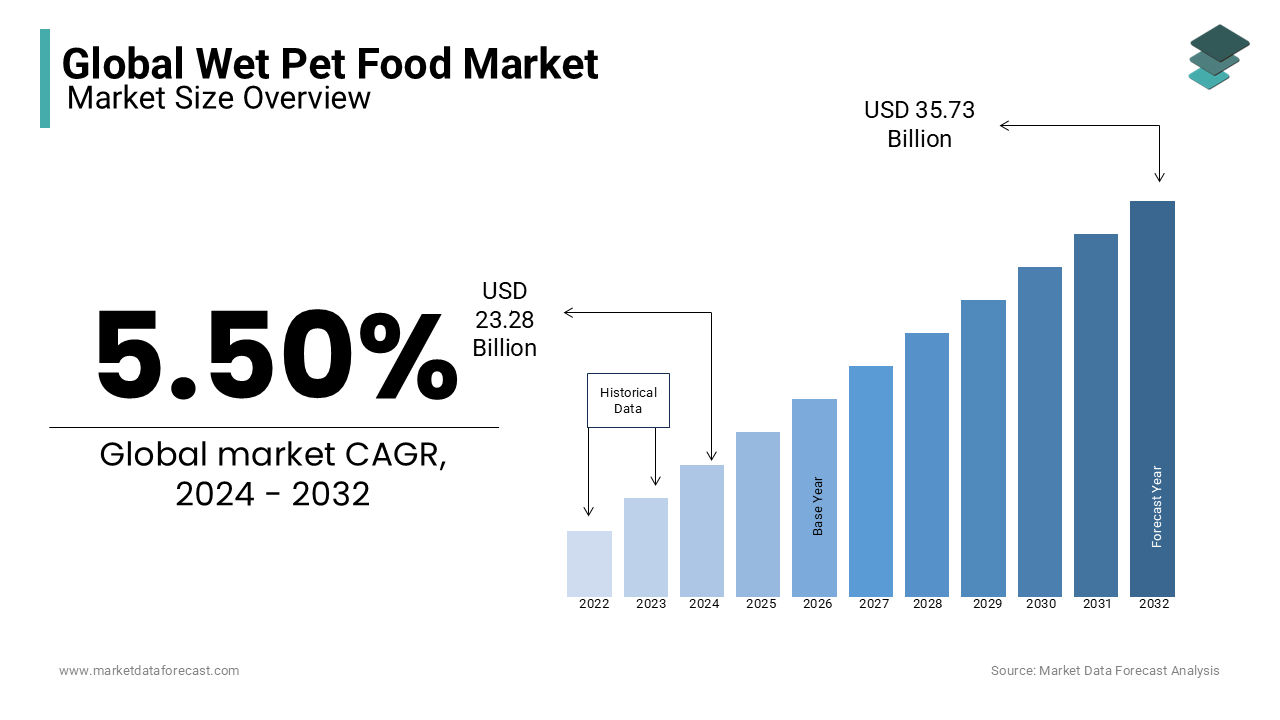

The global wet pet food market size was valued at USD 23.28 billion in 2024. The global market size is expected to reach USD 37.69 billion by 2033 from USD 24.56 billion in 2025, growing at a CAGR of 5.5% throughout the forecast period.

Wet pet food is a recent addition to the existing dry food products for domestic animals, which plays a vital role in animal health and bone and muscle development. The presence of 70% to 80% water content in the food allows the animals to eat food without inhibition, resulting in quick absorption of required nutrients. They become an instant hit among pet owners, and the market is expected to skyrocket in the coming years.

Current Scenario of the Global Wet Pet Food Market

The wet pet food has high demand in different regions of the world due to the increasing pet adoption and the owners’ focus on pet health. The market is steadily moving forward. Today, insect protein is one of the many unique sources of protein gaining traction between pet parents who are looking for substitutes for traditional meat-based pet foods. This inclination towards alternatives is partly fuelled by their recognised environmental and nutritional advantages. In addition, following the trend of sustainability and eco-friendly products in other industries, the market players as well as consumers are increasingly producing and consuming ecological wet pet foods, which contributes minimal, same as to chicken MDM, to climate change and considerably less than other protein sources based on meat. Also, pet owners are progressively examining goods on environmental and nutritional parameters, there are other elements leading to their decision on their pet’s diet. One of these is the level of satisfaction the pet experiences from its food.

• According to a recent study, it was discovered that palatability is the 4th best crucial feature of a pet food (based on out of fourteen characteristics survey).

Further, nowadays, people specifically pay attention to the digestibility of food, like in case of dogs where owner particularly look after this. So, it is another factor influencing and shaping the wet pet food market.

MARKET DRIVERS

The growing awareness among the benefits of wet pet food among the pet owners is one of the significant factors propelling the growth of the global market.

Wet pet food has numerous health benefits for pets, such as easy digestion, instant energy, muscle growth, and lean mass, and this awareness among pet owners has been growing continuously over the last few years. The increasing adoption of pets in North American and European countries has created a vast market space for pet food manufacturers to develop new and exciting products to attract consumers. The rise in consumer disposable income has pushed them towards premium products that are rich in quality and offer the best nutritional value to domestic animals. The increasing demand for single and nuclear families increases the adoption of pets, which is promoting the market for different types of pet foods.

The trend of premiumization is gaining traction is another factor driving the market growth. There has been a significant rise in super-premium and premium brands, with this tendency of premiumization accelerating the entire market forward. Several pet owners are inclined to pay higher for both the types of brands due to them consider these items provide superior ingredients and enhanced nutrition for their pets. Also, these brands can utilise higher-quality sources of protein, like fresh fish or meat, and can have less or no preservatives and additives.

• For instance, “, a premium pet food brand for dog might prioritize fresh, whole protein as the key element instead of depending on dehydrated protein powder.

MARKET RESTRAINTS

On the contrary, the allergies caused due to the intake of certain ingredients among pets are acting as a significant restraint to the global wet pet food market. Also, the lack of proper publicity for these products in developing nations limits the rapid expansion of the market.

The market growth is also affected the exorbitant investment requirement for the development of sustainable and environment friendly product, establishment of production setup, cost of technology, creating a robust distribution network, etc. This makes it tough for the small and medium businesses pour a huge amount to be on par with ongoing trends and consumer preferences in the market and compete against big companies and organizations. Consequently, leading to price hike for newer offerings, making the entire ecosystem expensive, and transferring full burden on end customer.

• For instance, in April 2025, Nestle announced the investment of 195 million dollars for the expansion of its pet food plant in the United States to accelerate the manufacturing of Purina wet pet-food brands by closely 50 per cent. Their processing plant is situated in the US state of Wisconsin. Moreover, an extra 35 thousand square feet will be joined to the factory in Jefferson. The company is also investing CHF 200 million to broaden its pet food plant in Silao city in Mexico.

MARKET OPPORTUNITIES

The wet pet food market holds immense potential for expansion in the coming years due to various factor. One of the factors in emerging new alternate protein sources, like insect protein. In the constantly changing landscape of pet nutrition, the search for or interest in substitute proteins is rapidly increasing. Customers are looking for new dietary choices propelled by several preferences and priorities, like controlling pet allergies, environment, and animal welfare. Customarily, these foods overly depended on animal-based proteins from provided meat meals and fresh meals. Conversely, a notable change is taking place as customer demands and the pattern of treating pets like family fuels the search for novel protein sources, comprising fermented varieties, microbial, insect, and animal. So, this present a good opportunity for the market players.

Resolving the worldwide issue of protein supply is important for the maintenance of the global food system for both humankind and their animal companions. In this scenario, yeast- and plant-based proteins are becoming as viable options which can complement or substitute animal origin ingredients in pet treats and foods.

• According to a 2022 survey of 2,639 dog and a 2023 study of 1,418 owners conducted by the same experts at the University of Winchester in the United Kingdom, it was found that both cats and dogs on well-balanced vegan diets tend to be healthier than those consuming traditional meat-based diet, with parents observing fewer veterinary visits, lower medication usage, and a decrease in health problems and serious illnesses.

MARKET CHALLENGES

Carbon emissions is one of the key challenges impeding the expansion of the wet pet food market. Currently, climate change, sustainability, greenhouse gases discharge is among the hottest concerns for all the industries, companies, governments and other public agencies. So, this makes it the number one issue in front of players operating in this market.

• As per an assessment of nearly 940 types of Brazilian dog and cat foods, the production of wet food generates 690 per cent higher greenhouse gas discharge as compared to the manufacturing of dry food. Pouched and can-based products seems to be closely 7 folds as harmful for the surroundings and atmosphere as commercial dry food.

In another study it was revealed that wet food leads to 8 times greater temperature-increasing emissions. The examination discovered that this kind of diet for a normal dog causes an ecological trace or footprint for animal reflecting same as for its human owner. This makes it a universal problem irrespective of region and culture. There are approximately over 900 million dogs and about 600 million cats globally, and with this figure increasing, the ecological effect of feeding them is under intense scrutiny.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.5% |

|

Segments Covered |

By Type, Distribution Channel, Application, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Violife Foods, Daiya Foods, Tyne Chease Limited, Vtopian Artisan Cheese Company, Kite Hill, Miyoko’s Kitchen Company, Vermont Farmstead Company, Good Planet Foods, Follow Your Heart, Galaxy Nutritional Foods, Inc. |

SEGMENTAL ANALYSIS

By Type Insights

The dog food segment accounted for the dominant share in the global wet pet food business in the previous years and is likely to continue its dominion in the forecast period. The increasing adoption of dogs for security in both residential and commercial applications, along with the availability of numerous products results in the highest demand for wet dog food across the globe.

• As per the research, in the United States the sales of dog food increased to 42.1 billion dollars, i.e. 8.4 per cent, and on the other hand cat food sales rose to 18.5 billion dollars, i.e. 10.1 per cent.

By Distribution Channel Insights

The offline segment, which comprises supermarkets/hypermarkets, convenience stores, and others, accounts for the leading share in the world wet pet food market due to the various options available in a single place. However, with the increasing penetration of smartphones and the use of the internet, online retail stores are predicted to garner the highest growth rate and market revenue in the coming years.

• According to Petfood industry, supermarkets continue to be the prominent channel for the purchase of pet food globally by owner, accounting for 46 per cent of customers.

By Application Insights

The residential segment holds the leading position in the international marketplace with the adoption of dogs, cats, and others by single families in developed regions. The commercial sector is also anticipated to account for a considerable market share in the future, owing to the adoption of dogs for safety and security.

REGIONAL ANALYSIS

North America Wet Pet Food Market was dominating the global business and accounted for the highest market share in 2025. The presence of key market players, rising adoption of pets, consumer demand for more healthy pet foods, and other factors are promoting market expansion in North America.

• According to World Population Review, the United States ranks the first in the list of nation having higher number of cats and dogs. There are about 74 million domestic cats and 70 million domestic dogs in the United states.

Additionally, as a country it does not restrict or stops itself from showing their love and affection for their feline and canine correspondents, which is one of the primary factors fuelling the segment’s market growth. Moreover, pet parents in the nation will receive professional pictures done, celebrate by giving birthday parties for their companions, and even seal off private housing spaces for cats and dogs in their living structures. In addition, over 50 per cent of households in the country possess at least one cat or dog in their families, and number of them are permitted to roam or walk in the neighbourhood.

Europe's Wet Pet Food Market is also showing a positive development owing to the rising living standards of the people who are allowed to spend more on pet health. The region is also experiencing a major shift towards environment friendly and zero emission products for their pets. This trend in the Europe is a key factor elevating its market share in the global level. In 2022, the yearly revenue from the pet food items in the region touched 29.2 billion euros, a slight surge from the last reported data by the European Pet Food Industry Federation's (FEDIAF) for the year. Further, the region’s market size is set to expand with the emergence of lab-grown meat for pet food and countries have begun taking note out of this.

• For instance, in July 2025, the United Kingdom authorised the sales of meat grown in laboratory for the consumption by dogs and cats via their pet food. This made the UK the foremost nation in the Europe to do this.

However, the region also battles various challenges which hinders its market growth. Increasing prices and inflation is one of the main issues affecting the consumption of wet pet food. Like, pet parents are being struck by shrinkflation which is the cost remains the same but the size of pouches is reduced. The companies are charging 3.75 pounds for a Purina Felix Original multipack however, the 1 single sachets weight gets down to only 85 grams against those of original 100 grams.

Nonetheless, the Asia-Pacific Wet Pet Food Market with countries such as China, India, Japan and South Korea is an emerging industry with a lot of growth potential. This local market has great potential for expansion of this business, particularly with the rising per capita spending and love towards domestic animals.

RECENT HAPPENINGS IN THE MARKET

- In October 2025, it was reported the initial outcomes of two new studies which showed regarding the latest mealworm-based wet pet food ingredient by Ynsect, WetPro15 which it launched in October 2025, when included in the diet it exhibited no negative impact on tastiness or palatability for pets or domestic animals, and no harmful effects on faecal regularity in dogs.

- In September 2025, Inspired Pet Nutrition (IPN), the autonomous pet food company based in United Kingdom which is controlled by CapVest Partners LLP, has reported the purchase of Butcher’s Pet Care (BPC), one of the prominent producers of high-quality wet pet food. The conditions of the deal, which is anticipated to be concluded in the 4th quarter of 2025. With this, IPN will get access to BPC’s wide customer base, decades of experience in operating in this space alongwith its cost-effective, superior-quality, and naturally nourishing dog and cat foods. The BPC also had established position and significant consumer base in Poland

- In July 2025, Pets Choices, a pet food maker based in UK, announced the purchase of HOWND, a premium vegan dog food brand, to broaden its presence in the premium market segment. Moreover, the company already taken charge of the sales of HOWND brand from 5th August 2025. The brand was previously owned by the Power Pet Brand. In addition, the procurement will also imply listings and customers alike will gain from the distribution channel or system of Pets Choice, turning HOWND products into considerably more approachable to everyone. HOWND will supplement our current portfolio of rising brands taking them into another expanding premium sector of this market.

MARKET SEGMENTATION

This research report on the global wet pet food market has been segmented and sub-segmented based on type, distribution channel, application & region.

By Type

- Dog Food

- Cat Food

- Others

By Application

- Residential

- Commercial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1.Can wet pet food be used as the primary diet for pets?

Wet pet food can be used as the primary diet for pets, but it's essential to consider factors such as the pet's age, breed, size, activity level, and any underlying health conditions. Some pets may require a combination of wet and dry food to meet their nutritional needs adequately.

2.How should wet pet food be stored?

Wet pet food should be stored in a cool, dry place away from direct sunlight. Once opened, unused portions should be refrigerated and consumed within a few days to prevent spoilage and bacterial growth. It's essential to follow the manufacturer's storage and feeding instructions to ensure food safety.

3.Are there different types of wet pet food available?

Yes, there are various types of wet pet food available, including pâtés, chunks in gravy or sauce, shredded varieties, and specialty formulations for specific dietary needs or preferences. Pet owners can choose from a wide range of flavors, protein sources, and textures to cater to their pet's preferences.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com