Latin America Wet Pet Food Market Size, Share, Trends & Growth Forecast Report By Type (Dog Food, Cat Food and Others), Application (Residential and Commercial), Distribution Channel (Offline Retailers and Online Retailers) and Country (Argentina, Mexico, Brazil, Chile and Rest of Latin America), Industry Analysis From 2024 to 2032

Latin America Wet Pet Food Market Size

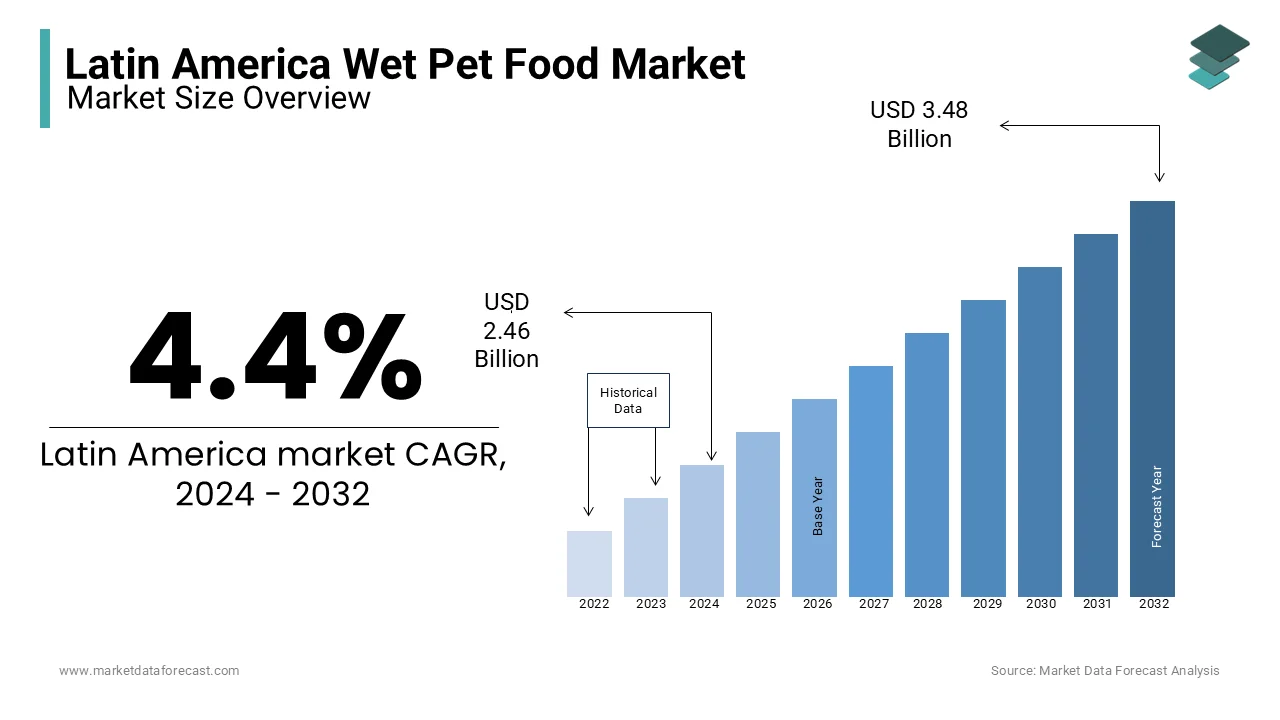

The wet pet food market size in Latin America was valued at USD 2.36 billion in 2023. The Latin American market is predicted to be worth USD 2.46 billion in 2024 and USD 3.48 billion by 2032, growing at a CAGR of 4.4% during the forecast period.

Animal feed that comprises a substantial portion of water, around 75% to 85%, combined with a few dry ingredients, is often termed wet pet food. These types of foods are considered an ideal choice for pets that cannot chew properly due to missing teeth, improper jaw setting, or other animal-related problems. However, the demand for wet pet food still depends on the health of the animal and the choice of pet owners. The developing nations offer huge growth potential for this market.

The wet pet food market in the South American region held a significant portion of the overall market share in 2023 and is supposed to experience a high CAGR during the forecast period. The increasing adoption of dogs and cats has been the principal factor supporting the growth of the local market. In addition, the surge in consumer awareness about the health maintenance of their pets is also supporting the expansion of the wet pet food market in Latin America. To ensure good quality imports, the countries of the region have imposed numerous restrictions on the import of food products on importing countries.

SEGMENTAL ANALYSIS

By Type Insights

The dog food segment in the Latin American wet pet food market is estimated to account for the leading share, while the cat food segment is likely to grow at the fastest rate. Dogs are one of the most popular domestic animals in this area. They are omnivores and, therefore, adopt traditional eating habits, such as meat and meat scraps. They need proper nutrition at every stage of their life.

By Application Insights

The residential segment held the dominant share of the local market and is estimated to continue the same trend in the following years.

By Distribution Channel Insights

Offline retailers are further divided into supermarkets and hypermarkets, specialty pet stores, online stores, and others. The supermarket and hypermarket segment is foreseen to register the largest market share, while the online retailer's segment is determined to grow at a rapid pace.

REGIONAL ANALYSIS

Brazil surpassed Japan as the world's second-largest wet pet food market in the forecast period, and it is only behind the United States. Brazilian pet food companies rely on US companies to source the ingredients for their formulas. With the growth of the Brazilian Wet Pet Food Market and an increase in demand for innovative pet products, ingredient suppliers must register with the Department of Inspection and Development of Animal Production (DFIP). Specialty pet stores are gaining popularity in the country due to the constant price range offered by these small outlets, in contrast to the price volatility of the large-scale outlets of the big brands. These stores are often involved in the production of innovative materials of natural and ethical origin and therefore their product lines dedicated to pet food capture the interest of consumers.

KEY MARKET PLAYERS

Companies playing a prominent role in the Latin American wet pet food market include Hill’s Pet Nutrition, Nestle and Mars Incorporated.

RECENT HAPPENINGS IN THE MARKET

- Partner in Pet Food (PPF), a renowned pet food maker in Europe, announced its intention to procure Doggy, a pet food processor based in Sweden.

- US consumer group Spectrum Brands purchased Armitage Pet Care, a specialist in treats and toys for pets that is based in the United Kingdom, for a business value of £ 140 million from private equity investor Rutland Partners. The Grocer revealed in September that Rutland, which bought the producer from Good Boy and Meowee in September 2017, had tasked PwC with managing a sales process for Armitage Pet Care.

- Goodmans represents the Menu Foods Income Fund in connection with the $ 239 million acquisition of Menu Foods Limited, an operating subsidiary of the company by Simmons Pet Food, Inc., a division of Simmons Foods, Inc. Menu Foods Limited is a leading North American private supplier of wet pet food products. Headquartered in Arkansas, the Simmons family of companies represents a highly diverse agricultural organization with annual sales of more than $ 1 billion.

- The acquisition of Ainsworth Pet Nutrition LLC by JM Smucker Co. played a crucial role in improving the performance of the latter for fiscal year 2019. JM Smucker Co. posted net income of $ 514.4 million, or $ 4.52 per share in common stock, a 62% drop from the same period last year when the company earned $ 1,338.6 million, or $ 11.79 per action. The large difference in profitability is attributed to a tax benefit the company received in fiscal 2018. Sales of Smucker's pet food retail business in the US increased 35% to $ 2,879.5 million, reflecting the Ainsworth acquisition.

MARKET SEGMENTATION

This research report on the Latin America wet pet food market is segmented and sub-segmented into the following categories.

By Type

- Dog Food

- Cat Food

By Application

- Residential

- Commercial

By Distribution Channel

- Offline Retailers

- Online Retailers

By Country

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]