Global Companion Animal Healthcare Market Size, Share, Trends & Growth Forecast Report By Product Type (Feed Additives, Pharmaceutics and Vaccines), Pharmaceutical Products (Ectoparasiticides, Endectocides, Antibiotics, Anti-inflammatories and Medicines for curing reproductive problems) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Companion Animal Healthcare Market Size

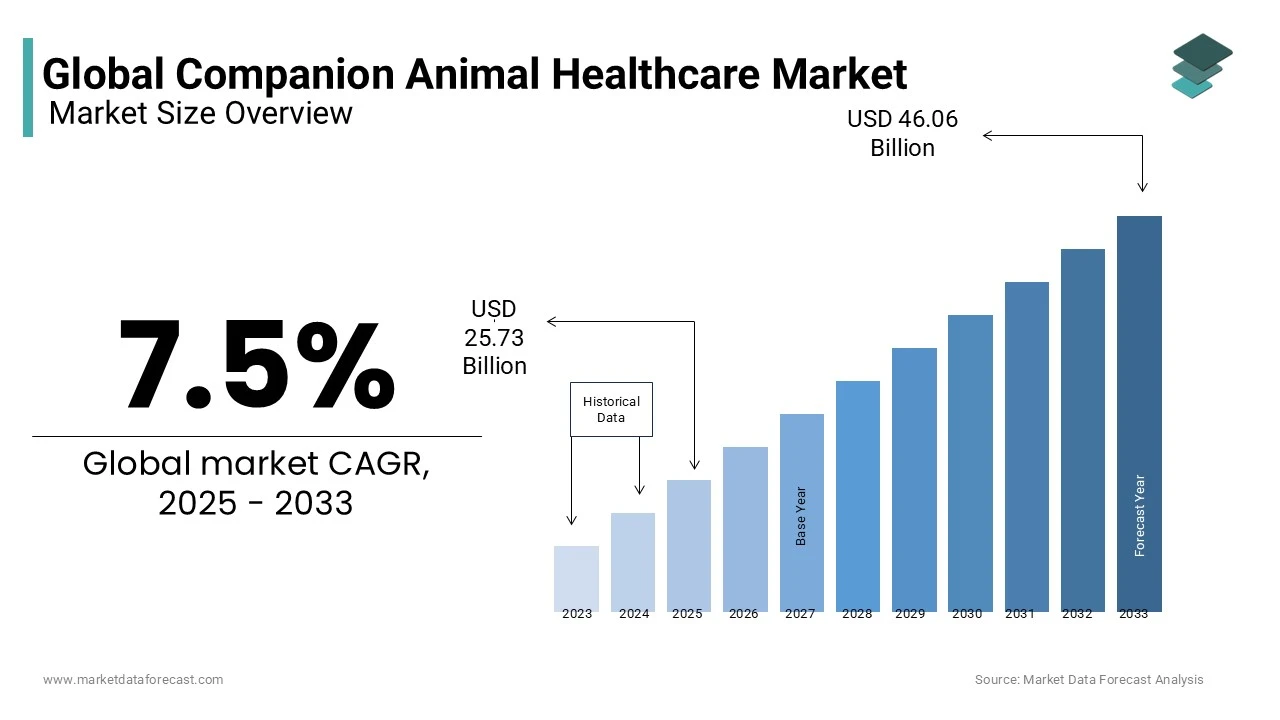

In 2024, the global companion animal healthcare market was valued at USD 23.92 billion and it is expected to reach USD 46.06 billion by 2033 from USD 25.73 billion in 2025, growing at a CAGR of 7.5% during the forecast period.

The companion animal healthcare market refers to the industry that provides medical care, products, and services for pets, such as dogs, cats, birds, and small mammals, that are kept primarily for companionship. This market includes veterinary services, pet medications, pet food and nutrition, diagnostics and imaging, and other related products and services. The companion animal healthcare market is an important segment of the larger animal healthcare industry, including livestock and other production animals.

MARKET DRIVERS

Growing Ownership of Companion Animals

Pets play a vital role in many lives by protecting a person, property, or residence, accelerating ownership worldwide. The growth in pet ownership is undoubtedly a significant factor in boosting the global companion animal healthcare market. According to the data published by Pet Secure, the United States has the highest ownership among all the nations (which includes 69,929,000 dogs, 74,059,000 cats, 8,300,000 birds, and 57,750,000 Fish) and further stated that America is spending 50 billion USD per annum on pets.

The Rising Incidence of Foodborne and Zoonotic Diseases

Zoonotic diseases (FBZD) constantly threaten public health, socio-economic development, and international trade. Through foods contaminated with pathogenic microorganisms such as bacteria, more than 200 known diseases are transmitted to humans, infecting their toxins, viruses, and parasites. The World Health Organization's initiative to estimate the global burden of zoonotic diseases reported that 31 zoonotic diseases are caused by food poisoning, affecting more than 600 million animals and accounting for an estimated 10,000 deaths. The burden of illness is highest in Africa (43%), followed by Southeast Asia (24%) and the Eastern Mediterranean (16%). Foodborne zoonotic illness has been rising due to several factors, including pathogen behavior, rapid population growth, and increased global trade in foods and farm animals from countries where appropriate microbiological safety procedures are not followed and implemented. Preventing illness and mortality from food-derived zoonotic disorders remains a significant public health challenge. Thus, Zoonotic diseases and rising food poisoning propel the global companion healthcare market.

Technological Advancements

Advancements in technology have revolutionized radiography in both human and veterinary healthcare. One technique used for humans is finding a place in veterinary healthcare. This helps veterinarians treat tumors, examine internal organs, unblock blood vessels, and treat diseases. The latest innovation in imaging and treatment technologies has led to more accurate, less invasive, and faster diagnoses, improving pet outcomes. In the last few years, the introduction of various new treatments, development of diagnostic tools, innovative veterinary disciplines, identification of disease roots, and establishment of proven genetic testing have been hallmarks of improved animal health. These technological advancements help pets live longer, healthier lives and create a need for more specialized studies. Hence, technological advancements in animal healthcare will boost the future growth of the companion animal healthcare market.

In addition, the growing urbanized population and increasing prevalence of taking care of animal health by providing quality food products further enhance the growth rate of the companion animal healthcare market. The rise in the scale of veterinary hospitals with the help of private and public organizations is also favoring market growth. The global companion animal healthcare market is fuelled by increasing investments in the pharmaceutical industries to improve the quality of drugs and vaccines. An increase in disposable income and recent trends are leading to a rise in companion animals. In addition, growing pet insurance options in many countries are further propelling the growth of the companion animal healthcare market.

Furthermore, Key factors influencing the companion animal healthcare market include the inclination toward nuclear families and the expansion of government initiatives to promote veterinary care products. Additionally, increased government spending on R&D is projected to support the market. Additionally, the market is anticipated to grow favorably due to advances in companion animal health care services, increased animal life expectancy, and increased availability of therapies for various disorders. Furthermore, better goods have been produced recently due to the increased integration of numerous animals into households.The introduction of veterinary therapeutic diets is a significant opportunity in the companion animal healthcare market. Veterinary therapeutic diets are formulated to help modify a particular disease process in cats and dogs or help support animals during a specific life stage. With increased pet food marketing and advertising, especially for "specialty" foods, pet owners may have varying perceptions about selecting a pet food and may be unclear about the difference between a veterinary therapeutic diet and an OTC food. Veterinary therapeutic diets can be necessary for the nutritional management of various diseases. Thus, introducing veterinary therapeutic diets will enhance the growth of the companion animal healthcare market.

MARKET RESTRAINTS

Restrictions by Regulatory Bodies on the Sales of Antibiotics

Antimicrobial resistance is a global public health issue exacerbated by antibiotic usage worldwide. Antibiotic overuse is linked to an increased risk of side effects, more frequent re-attendance, and the medicalization of self-limiting diseases. Hence, regulatory bodies framed certain restrictions on the sale of antibiotics. For instance, PAMTA is the Preservation of Antibiotics for Medical Treatment Act (H.R. 1549/S. 619). The bill's stated purpose is to decrease the development of antibiotic-resistant bacteria in humans by eliminating the "nontherapeutic" use of antibiotic drugs. Banning or severely restricting antimicrobials in animals may negatively impact the veterinarian's ability to protect animal health and prevent suffering from disease, leading to poor companion animal healthcare.

In addition, the high cost of animal diagnosis of a product recall, rise in complication issues, and lack of standardization are expected to hamper the growth rate of the companion animal healthcare market. Also, less knowledge of the dosage levels of the drugs and fluctuations in the availability of the raw materials are raising the price of the final products, further hindering the growth of the global companion animal healthcare market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Production Technologies and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Key Market Players |

MSD, Bayer HealthCare AG, Bioniche Animal Health Canada, Sanofi Animal Health, Inc., Biogenesis Bago SA, Heska Corporation, Indian Immunologicals Ltd., Boehringer Ingelheim GmbH, Zoetis, Novartis Animal Health, Inc., Merck & Co. Inc. and Protein Sciences |

SEGMENTAL ANALYSIS

By Product Type Insights

The pharmaceuticals segment held a significant market share of 46.04% of the global companion animal healthcare market in 2024, with a growth rate of 7.55% during the forecast period.

The vaccines segment is expected to grow competently during the forecast period. Increasing capital income in both developed and developing countries and rising incidences of various health disorders in companion animals are expected to fuel the growth rate of this segment.

By Companion Type Insights

The dogs segment accounted for a high market share with 51.94% in 2024, owing to the growing dog population and ownership rate, the rising prevalence of zoonotic diseases and other skin allergies in dogs, and rising canine healthcare costs. In addition, the growing number of pet insurers worldwide contributes to this segment's size. On the other hand, the Cats segment is anticipated to grow at a high CAGR of 8.3% during the forecast period. This surge is due to, in certain nations, such as Canada, cats becoming more popular and being chosen over dogs. Furthermore, because cats are more susceptible to infections than other pet animals, several companies are focusing on expanding their cat product line.

REGIONAL ANALYSIS

Geographically, North America accounted for a promising share in the global companion animal healthcare market in 2024 with the largest market share of 46.83%, owing to the region's well-established animal health sectors, an increase in the number of pet adoptions, increased pet expenditure, and the presence of major market participants nearby. Furthermore, in nations like the U.S. and Canada, rising pet adoption is resulting in rising costs for pet healthcare and medicines, resulting in the dominance of the market in the region.

Europe accounted for a substantial share of the global in 2024 due to the adoption of the latest technologies in treatment procedures and increasing support from the governments with the upcoming construction activities of the hospitals.

The Asia Pacific market is anticipated to register the highest CAGR of 9.63% during the forecast period. China is expected to witness a high CAGR, followed by India during the forecast period. The increasing number of pet adoptions and the evolving awareness of pet care are the main factors resulting in the growth of animal health care in these regions.

Latin America is anticipated to register a healthy CAGR during the forecast period. On the other hand, the Middle East and Africa are anticipated to have slight variations in the growth rate in foreseen years.

KEY MARKET PLAYERS

A few of the notable players in the global companion animal healthcare market profiled in the report are MSD, Bayer HealthCare AG, Bioniche Animal Health Canada, Sanofi Animal Health, Inc., Biogenesis Bago SA, Heska Corporation, Indian Immunologicals Ltd., Boehringer Ingelheim GmbH, Zoetis, Novartis Animal Health, Inc., Merck & Co. Inc. and Protein Sciences. Apart from these major players, many other companies operate in the companion animal healthcare market, including regional and local players. Additionally, many startups and emerging companies are developing innovative products and technologies for the market.

RECENT HAPPENINGS IN THIS MARKET

- In February 2023, MSD Animal Health launched a redesigned platform for predicting poultry health, preventing disease, and improving performance.

- In January 2023, one of the major global companies providing veterinary diagnostic and specialty products and solutions, Heska Corporation, acquired MBio Diagnostics, Inc. d/b/a LightDeck Diagnostics to expand its research and development and manufacturing capabilities. The LightDeck’s fully automated Longmont facility, which is expected to go online in 2023, will boost the manufacturing capacity and R&D efforts of Heska’s Corporation in the future.

- In November 2022, A significant animal health pharmaceutical firm and the animal health biotechnology company Vetigenics announced a second discovery cooperation for utilizing the VETIGENICS CANIBODYTM Platform. The goal is to cooperatively identify and create new therapeutic antibodies to treat chronic illnesses in companion animals. The all-canine, best-in-class phage display technology from Metagenics has specific benefits over other strategies. A patented process creates CANIBODIES, or single chain variable fragments (scFvs), which are 100% canine in origin and structure since they are extracted from canine genetic material.

- In November 2022, According to Dr. K. Anand Kumar, the managing director of Indian Immunologicals, thirty new infections have been found in the past three decades, 75% from animals. Zoonoses are responsible for one billion instances of disease and millions of fatalities. Given the preceding context, there is a clear connection between human and animal health. The market opportunity is without a shadow of a doubt. The Indian Federation of Animal Health Companies (INFAH) estimates that the country's healthcare business will be worth around Rs 7,000 crore in 2021–22.

- In November 2022, Phibro Animal Health Corporation reported financial results for the first quarter that ended on September 30, 2022. It reaffirmed its financial outlook for net sales and adjusted earnings per share (EPS) for the year ending June 30, 2023. Despite hurting the adjusted EBITDA generated by our Animal Health division this quarter, the firm successfully addressed labor and logistical issues with one of our crucial suppliers.

- In November 2022, Relief Services for Veterinary Practitioners and Animal Care Technologies be acquired mainly by Patterson Companies, Inc. (Nasdaq PDCO), according to an announcement today (RSVP and ACT). Founded in 1992, RSVP and ACT is a privately held business. With the addition of RSVP and ACT workers to the Patterson Veterinary staff, the purchased firm will be incorporated into the company's operations.

MARKET SEGMENTATION

This research report on the global companion animal healthcare market has been segmented based on the product type, companion type, and region.

By Product Type

- Feed Additives

- Nutritional Feed Additives

- Proteins

- Minerals

- Amino Acids

- Vitamins

- Medicinal Feed Additives

- Enzymes

- Probiotics

- Hormones

- Immune Modulators

- Prebiotics

- Feed Acidifiers

- Nutritional Feed Additives

- Pharmaceuticals

- Vaccines

By Companion Type

- Dogs

- Cats

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much was the global companion animal healthcare market worth in 2024?

The global companion animal healthcare market size was valued at USD 23.92 billion in 2024.

Does this report include the impact of COVID-19 on the companion animal healthcare market?

An analysis on how has the COVID-19 impacted the companion animal healthcare market is included in this report.

Which are the major players operating in the companion animal healthcare market?

Bayer HealthCare AG, Bioniche Animal Health Canada, Sanofi Animal Health, Inc., Biogenesis Bago SA, Heska Corporation, Indian Immunologicals Ltd., Boehringer Ingelheim GmbH, Zoetis, Novartis Animal Health, Inc., Merck & Co. Inc. and Protein Sciences are a few of the major participants in the companion animal healthcare market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com