Global Veterinary Diagnostics Market Size, Share, Trends & Growth Analysis Report – Segmented By Product Type (Clinical Chemistry, Molecular Diagnostics, Hematology, Diagnostic Imaging and Immunodiagnostics), Animal and Region - Industry Forecast From 2024 to 2032

Global Veterinary Diagnostics Market Size

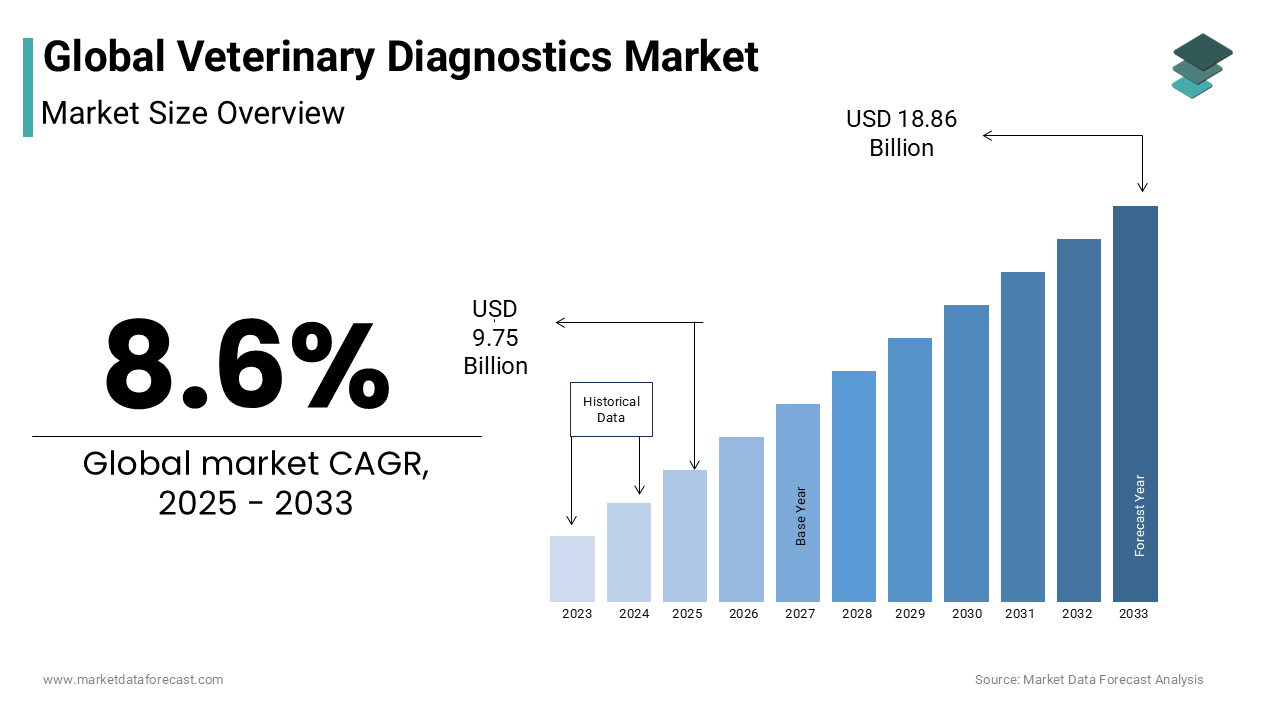

The global veterinary diagnostics market was valued at USD 8.98 billion in 2024. The global market size for veterinary diagnostics is anticipated to grow to USD 18.86 billion by 2033 from USD 9.75 billion in 2025, growing at a CAGR of 8.6% from 2025 to 2033.

Current Scenario of the Global Veterinary Diagnostics Market

The global veterinary diagnostics market has grown significantly due to the rising prevalence of zoonotic diseases among animals, which have passed to humans. The disease prevalence is enhancing the demand for diagnostics to detect the disease and its severity among veterinary animals. The increasing adoption of pets and the rising trend of pet humanization allow pet owners to provide quality healthcare to their pets. Growing government initiatives in animal care are propelling the market growth with broader adoption of veterinary diagnostic services. The escalated advancements in pet insurance and growing veterinary healthcare infrastructure fuel the growth of veterinary diagnostic services. The global veterinary diagnostics market is projected to grow prominently during the forecast period due to rising technological advancements in the veterinary healthcare industry, increasing diagnostic laboratories, and continuous R&D activities to enhance diagnostic procedures. The introduction of advanced diagnostic procedures in veterinary healthcare, such as molecular diagnostics and PoC testing, is expanding the growth opportunities in the veterinary diagnostics market.

MARKET DRIVERS

The growing incidence of zoonotic diseases is propelling the veterinary diagnostics market growth.

According to the data published by the Centers for Disease Prevention and Control (CDC), a considerable population suffers from zoonotic diseases. The growing companion animal population and increased animal care prevalence drive the global veterinary diagnostics market. The veterinary diagnostics market has grown significantly over the past few years by introducing technologically improved products that have positively impacted market growth. In addition, the growth in the pet insurance industry and increasing animal healthcare expenditure further accelerate the growth of the global veterinary diagnostic market. The growing establishment of various diagnostic laboratories across developing nations by major market players is fueling market growth opportunities. The rising government support initiatives and private organizations regarding animal care and health, conducted through campaigns and awareness programs, are estimated to impact market expansion positively. The rising awareness among people regarding the necessity of early diagnosis and advanced treatment procedures and escalating technological advancements in diagnostic methods are augmenting the growth of the market size. The rising inclination towards the adoption of pets across various regions, majorly the U.S. and Europe, are the primary factors driving the market growth. It is estimated that one in three own pets as this helps in treating their depression and ill-health conditions.

The rising adoption of point-of-care testing as the traditional diagnostic method involves the transportation of samples to external labs, which delays the diagnosis and treatment. In contrast, the POC tests provide rapid results that drive global market growth. For Instance, in March 2022, Randox Laboratories Ltd. Introduced VeraSTAT-V and VeraSTAT in its point-of-care diagnostics portfolio for equine health. The market players are accelerating product launches that are innovative and effective in animal diagnostic procedures, enhancing the adoption of these services and propelling market share growth. The introduction of advanced diagnostic techniques like molecular diagnostics, imaging modalities, and POC testing has significantly expanded the capabilities of diagnosing animal diseases.

MARKET RESTRAINTS

The high costs associated with veterinary healthcare significantly hinder market growth.

In addition, the unavailability of infrastructure and veterinary healthcare centers for animals in some regions worldwide is hampering the market's growth rate. Furthermore, a lack of awareness among people regarding the available treatment options and a scarcity of veterinary professionals are impeding the veterinary diagnostics market growth. The presence of stringent regulations regarding the approval of diagnostic procedures and products is a significant challenge for the manufacturers due to time consumption, leading to launch delays.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Product, Animal, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Qiagen N.V., ZoetisInc., IDEXX Laboratories, Inc., and Heska Corporation, VCA Inc., Abaxis, Inc., VIRBAC, Life Technologies Corporation, Bio-Rad Laboratories Inc., Prionics AG, and Pfizer, Inc. |

SEGMENTAL ANALYSIS

Global Veterinary Diagnostics Market Analysis By Product

Based on the product, the clinical chemistry segment dominated the veterinary diagnostics market in 2023 owing to the rise in the scale of clinics and laboratories. In addition, research on developing innovative drugs and vaccines concerning veterinary healthcare, growing government investments in the rising advancements of drugs for animals, and primary care mechanisms support the segment's revenue. Additionally, growing pharmacies that have undertaken animal medicine research will support the rise of this market.

The global market for immunodiagnostics is expected to grow at a higher CAGR due to the increase in foodborne diseases affecting animals. As a result, the need to perform various tests has increased gradually. In turn, the market for molecular diagnostics is expected to grow higher than immunodiagnostics due to its broad scope over immunodiagnostics. In addition, an increase in the purchase and usage of various diagnostic instruments utilized in veterinary practices, in-clinic diagnostic procedures, and high-income households that keep pets and regularly visit veterinary laboratories are propelling the growth of this market. Among the various sub-segments, the ELISA segment is predicted to hike at an impressive rate during the forecast period.

Global Veterinary Diagnostics Market Analysis By Animal

The companion animal segment is anticipated to lead the global veterinary diagnostics market during the forecast period. The rise in the number of companion animals and the growing number of pet lovers globally significantly influence the segment's growth. Additionally, the rising awareness regarding the need to adopt and care for abandoned animals is helping the segment's growth.

The poultry animal segment is another lucrative segment and is forecasted to register a CAGR of 9.1% during the forecast period. The poultry and farmland animals need to be grown with the utmost care as they are prone to contracting infections and diseases and need continuous medical care to stay healthy. Moreover, the protocols of doing the meat, milk, eggs, or animal resources businesses make it impertinent to keep the animals in top health to ensure the safety of the consumers, leading to heightened demand and need in the poultry market.

REGIONAL ANALYSIS

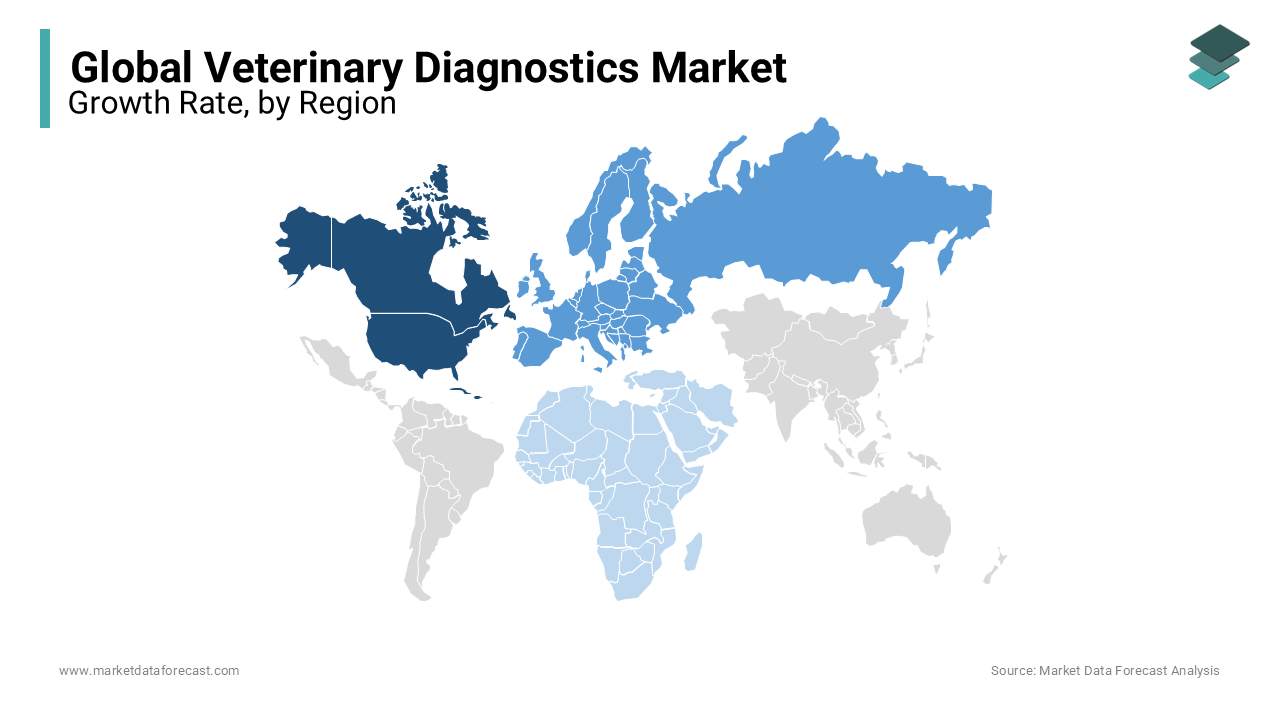

North America is estimated to be the most dominating regional market in the global veterinary diagnostics market, with the largest market share, followed by the European market. The North American market is predicted to continue its dominating trend throughout the forecast period. Factors such as increasing healthcare expenditure and the prevalence of veterinary diseases propel the market's growth rate. In addition, primarily rising pet owners are additionally driving the growth rate of the veterinary diagnostic market in this region.

On the other hand, Europe is expected to account for a substantial share of the global market in 2023 and register a healthy CAGR during the forecast period. Increasing awareness about advanced techniques and the rise in the prevalence of animal diseases are likely to promote market growth.

The Latin American and Asia-Pacific regional markets are expected to be the most profitable in terms of growth rate. The Asia Pacific market is the fastest-growing region in the global market. The growing animal healthcare awareness programs and the prevalence of veterinary diseases contribute to market growth. With the government's rising investments in healthcare and increasing demand to improve the services in veterinary hospitals, Latin Americans will register a healthy CAGR between 2024 and 2032.

The Middle East and Africa is expected to grow at a stable CAGR during the forecast period. An increasing number of rare diseases among animals is likely to fuel the market demand in this region.

KEY PLAYERS IN THE GLOBAL VETERINARY DIAGNOSTICS MARKET

Qiagen N.V., ZoetisInc., IDEXX Laboratories, Inc., and Heska Corporation play a leading role in the global veterinary diagnostics market. Other notable companies active in the market are VCA Inc., Abaxis, Inc., VIRBAC, Life Technologies Corporation, Bio-Rad Laboratories Inc., Prionics AG and Pfizer, Inc. are a few of the prominent companies in the global veterinary diagnostics market.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Center Point Bio-Tech, LLC launched AlphaION at the 2024 Veterinary Meeting & Expo in the U.S. AlphaION is a novel, patent-pending veterinary practice diagnostic system.

- In November 2023, Antech opened a new U.K. veterinary diagnostics laboratory in Warwick. It is expected to expand the company'scompany's U.K. lab network.

- In June 2023, IDEXX launched the first test for detecting kidney injury in cats and dogs, the IDEXX Cystatin B Test.

- In June 2023, Mars, Inc. acquired Heska by merging it into its Petcare Science & Diagnostics division, which expanded the company portfolio.

- In March 2023, Zoetis, Inc. announced two updates to the VETscan Imagst platform: A.I. dermaA.I.logy and A.I. equine FEC analysA.I. These diagnostic updates broaden Vetscan Imagst testing capabilities.

- In February 2023, Virbac opened its research and development center dedicated to warm water aquaculture in Vietnam. The center also serves as a diagnostic center.

- In February 2023, Heska Corporation announced that Volition Rx Limited's Limited's Nu. Q veterinary Cancer test was available for pre-order through its point-of-care segment.

- In August 2022, PepiPets launched a new mobile diagnostic testing service that allows clients to receive diagnostic testing for their pets at home. Pepipets launched this service to make the pets feel comfortable with the procedure and save time on travel.

- In October 2022, OncoK9, a first-in-class multi-cancer early detection (MCED) test for dogs from PetDx—The Liquid Biopsy Company for PetsTM, is now accessible to veterinary practices in Hong Kong, Singapore, Malaysia, South Korea, and Cambodia through Asia Veterinary Diagnostics, Powered by Antech. This is the first time markets outside North America have been given access to the ground-breaking blood-based liquid biopsy test. However, veterinary clinics in the U.S. and Canada already have access to OncoK9.

DETAILED SEGMENTATION OF THE GLOBAL VETERINARY DIAGNOSTICS MARKET INCLUDED IN THIS REPORT

This research report on the global veterinary diagnostics market has been segmented and sub-segmented based on animals, products, and regions.

By Product

- Clinical Chemistry

- Urine Analysis

- Glucose Monitoring

- Blood Gas Electrolyte Analysis

- Molecular Diagnostics

- Micro Arrays

- PCR Tests

- Other Molecular Diagnostics Tests

- Hematology

- Hematology Analysers

- Hematology Cartridges

- Diagnostic Imaging

- Radiography Systems

- Ultrasound Imaging Systems

- CT Scanners

- MRI Scanners

- Immunodiagnostics

- Immunoassay Analysers

- ELISA Tests

- Lateral-Flow Strip Readers

- Lateral-Flow Rapid Tests

- Allergen-specific Immunodiagnostic Tests

By Animal

- Companion Animals

- Canine Diagnostics

- Feline Diagnostics

- Other Veterinary Diagnostics

- Food-Producing Animals

- Bovine Diagnostics

- Porcine Diagnostics

- Ovine Diagnostics

- Poultry Diagnostics

- Piscine Diagnostics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What was the size of the veterinary diagnostics market worldwide in 2023?

The global veterinary diagnostics market size was valued at USD 8.27 billion in 2023.

Does this report include the impact of COVID-19 on the veterinary diagnostics market?

Yes, we have studied and included the COVID-19 impact on the global veterinary diagnostics market in this report.

Which region is anticipated to witness fastest growth in the veterinary diagnostics market?

During the forecast period, the Asia-Pacific region is anticipated to grow at the fastest CAGR in the worldwide market.

Who are the key players in the global veterinary diagnostics market?

Qiagen N.V., ZoetisInc., IDEXX Laboratories, Inc., Heska Corporation, VCA Inc., Abaxis, Inc., VIRBAC, Life Technologies Corporation, Bio-Rad Laboratories Inc., Prionics AG, and Pfizer, Inc. are some of the notable companies in the veterinary diagnostics market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]