Global Pet Wearable Market Research Report – Segmented By Technology (GPS, RFID, Sensors, Batteries and Bluetooth), Application (Medical diagnosis & Treatment and Identification & tracking), Product (Smart cameras, Smart collars and Smart harnesses) and Region (North America, Europe, APAC, Latin America, Middle East and Africa) – Industry Analysis (2024 to 2032)

Global Pet Wearable Market Size (2024 to 2032)

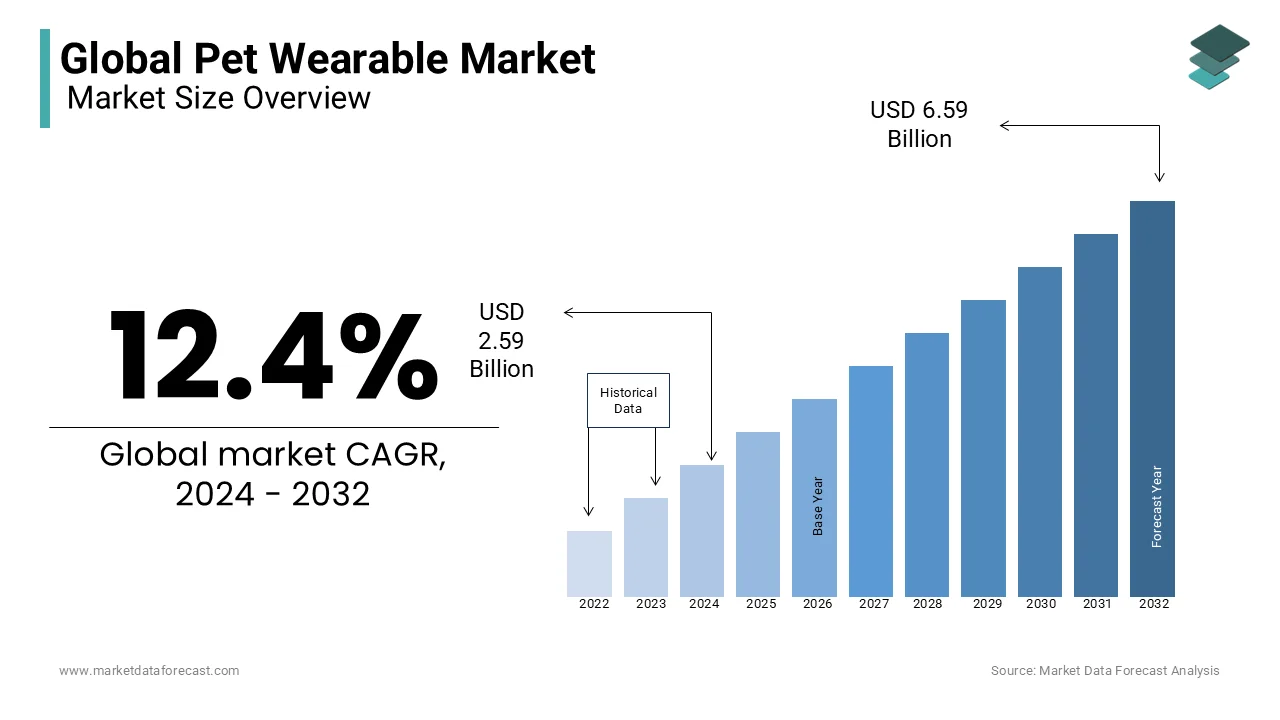

The size of the global pet wearable market was worth USD 2.3 Billion in 2023. The global market is projected to reach USD 6.59 billion by 2032 from USD 2.59 billion in 2024, showcasing a CAGR of 12.4% from 2024 to 2032.

Current Scenario of the Global Pet Wearable Market

The demand for pet wearables is on the rise worldwide. Pet wearables are primarily used for identification, tracking, monitoring, controlling, medical diagnosis, treatment, facilitation, safety, and security of pets. Technological advancements such as RFID sensors, GPS trackers, motion sensors, Bluetooth, accelerometer sensors, cameras, transmitters, and antennas have significantly improved the capabilities of pet wearables and helped pet owners take the required care at ease. Pet wearables measure the physiological and biomechanical systems of pets and perform the continuous monitoring of body movement, which helps pet owners and veterinarians with early disease detection and treatment appropriately. Pet wearables also allow pet owners to keep track of their pets’ behavior and improve their interaction with the outside world. The awareness regarding the benefits of pet wearables among pet owners has significantly improved in the last few years and resulted in increased adoption. Growing worries about pet health and wellness, rising pet population & pet humanization, surging demand for IoT in pet monitoring devices, and rising pet expenditure due to high disposal income have contributed to the increased demand for pet wearables in the recent past. The demand for pet wearables in developing countries is also growing gradually owing to the increasing disposable income, growing pet expenditure, and rising pet ownership rates. Due to the factors mentioned above, the demand for pet wearables is likely to continue further during the forecast period and boost the global market growth.

MARKET DRIVERS

Y-O-Y growth in the pet ownership rates worldwide is one of the major factors driving the growth of the global pet wearables market.

The number of households owing a pet is increasing exponentially worldwide. The awareness among pet owners regarding the available technologies that can help them to take effective care of their pets has considerably increased over the past few years. People who own a pet feel taking a good care of their pet as their responsibility and gives priority to the pet health and well-being. Over the past few years, the pet ownership rates have significantly increased and resulted in the increased demand for pet accessories including pet wearables. According to sources, an estimated 70% of the households worldwide are owning a pet worldwide as of February 2024. Across the world, 471 million dogs and about 370 million cats are there as pets. With the growing number of pet owners worldwide, the demand for pet wearables is expected to increase and propel the global market growth.

Y-o-Y growth in the incidence of obesity among pets and rising demand for fitness monitoring of pets are further contributing to the expansion of the pet wearable market. The need for fitness monitoring for pets has become one of the important aspects to the pet owners as it directly leads to the health and well-bring of the pet. Obesity and overweight of pets are one of the significant worries to the pet owners. According to Burgess Pet Care 2021, 51% of pets in the United Kingdom are obese, with over 600,000 being overweight. Due to this scenario, pet owners have been adopting technological solutions such as pet wearables to keep a check on the health of the pets. As a result, demand for new pet wearable technologies that accurately monitor a pet's health and well-being has risen dramatically. Early diagnosis of diseases and behavioral concerns in pets is made easier with these gadgets. It continuously collects vital signs to alert pet owners to early indicators of illness, stress, or other health-related issues.

Technological advancements in pet wearables are boosting the growth rate of the global market.

Wearable technology is gaining popularity because to its many uses in tracking and identifying people, monitoring behavior, diagnosing medical problems, and ensuring the safety and security of pets. These wearable devices allow pet owners to keep track of their pets' everyday activities. They also track statistics like sleep patterns and calories burned, as well as heart rate monitoring. The expansion of the pet wearable market has been affected by the integration of various technologies such as GPS and Radio Frequency Identification (RFID) for improving the quality of life of companion animals. In addition, IoT technology is likely to play a key role in providing owners and vets with critical information on animal health measures. The combination of mobile applications, data analytics technologies, and wearable devices may become a handy choice for value-based care in the coming years. In addition to wearable devices, market participants are offering cloud-based data analytics services. Data analytics give clinical information obtained by real-time direct observation, which can be utilized to help veterinarians diagnose and treat pets more efficiently. Therefore, these factors further fuel the global pet wearables market growth during the forecast period.

Furthermore, factors such as the growing availability of pet wearable products across e-commerce channels, rapid adoption of smart collars and tags for pet identification, increasing demand for remote pet monitoring solutions, and growing pet population in emerging markets are supporting the growth of the pet wearable market.

MARKET RESTRAINTS

The high cost of pet wearables, especially those designed with the integration of the most advanced technologies, is clearly degrading the growth rate of the market.

The manufacturing of pet wearables requires highly skilled people, and it is highly difficult to recruit skilled persons who have high technical knowledge in the present scenario, which can also impede the growth rate of the market. Frequently changing technological developments are one of the factors for the lack of skilled persons in manufacturing pet wearables. Limitations of battery life and high consumption of power additionally impede the growth rate of the pet wearable market.

MARKET OPPORTUNITIES

The rising expenditure on pets with the growing disposable income, especially in developed and developing countries, is certainly creating huge growth opportunities for the market.

The COVID-19 outbreak in 2020 has spiked the number of people owning pets to avoid loneliness. The growth in the adoption of pets among households also spiked the amount of spending on pets. According to a survey by Morgan Stanley, the amount of household spending on pets is likely to reach USD 1445 per animal by the end of 2026. Millennial and Genz people are more likely to adopt every new technological development at higher rates without compromising the cost of pets. This is gearing up with the huge growth opportunities for the market in the coming years. Also, people aged 18-24 are more likely to spend huge amounts on pets, whether it be for health and diagnostics or anything else related to pets, respectively, emphasizing the growth rate of the pet wearable market.

MARKET CHALLENGES

The easy availability of locally made pet wearable devices manufactured with low-quality raw materials that don't last long is merely a challenging thing for the market key players to come to these factors.

In undeveloped countries, people are less aware of the benefits of using pet wearables due to less popularity. However, the growing number of social media influencers can overcome this challenge by creating popularity over pet wearable devices, which will slightly enhance the growth rate of the market in the future, especially in economic countries.

REPORT COVERAGE

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

12.4% |

|

Segments Covered |

By Technology, Application, Product, and Region |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Whistle Labs, PetPace, Garmin, FitBark, Tractive, Link AKC, Motorola, KYON, Scollar and GoPro |

SEGMENTAL ANALYSIS

Global Pet Wearable Market Analysis By Technology

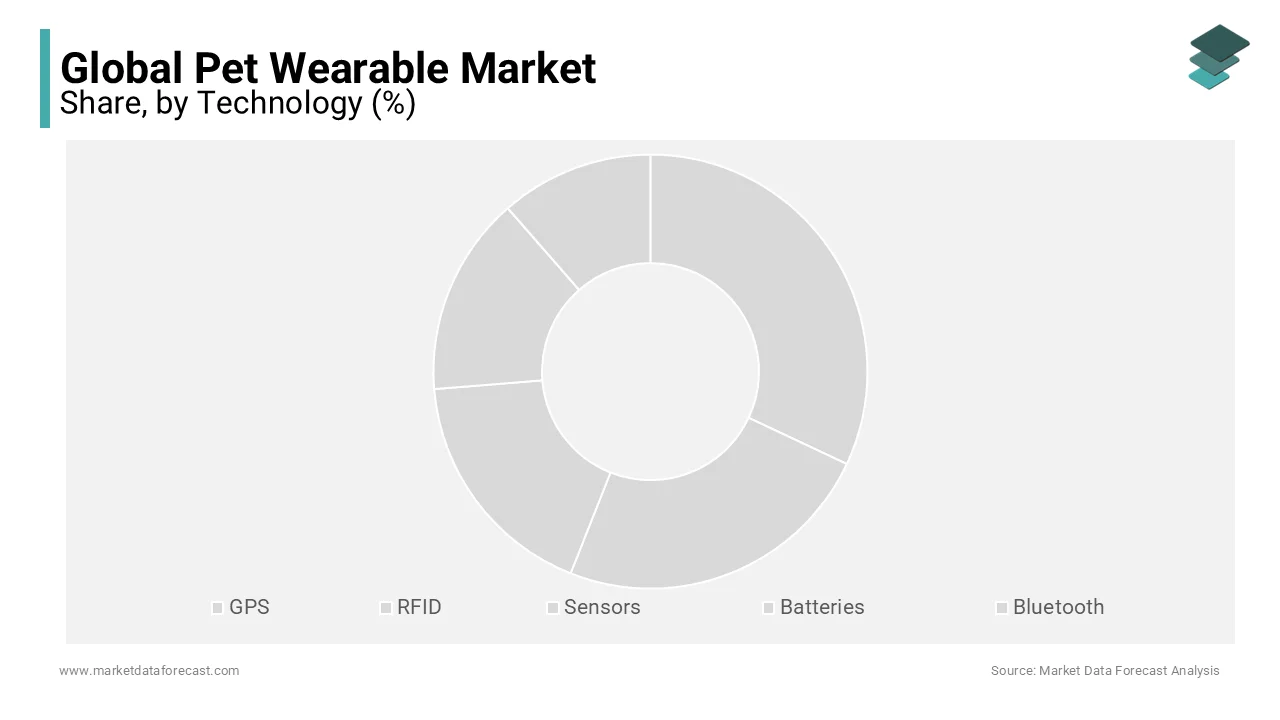

The RFID segment dominated the pet wearable market, accounting for 32.7% of the global market share, and is expected to grow substantially during the forecast period. The growing usage of RFID for the identification of pets and tracking of various health-related metrics such as body temperature, pulse, HRV, respiration, calorie intake, and postures of pets is majorly propelling the growth of the RFID segment in the global market. The rapid adoption of Wi-Fi-enabled RFID pet wearable devices for location-based services that constantly track the whereabouts of pets is further boosting the expansion of the RFID segment in the global market.

The sensors segment is a promising segment in the global market and is expected to account for a notable share of the worldwide market during the forecast period. Sensors play a vital role in pet wearables and enable access to various functionalities such as activity monitoring, health tracking, and behavior analysis. An increasing demand for actionable insights to optimize the health and lifestyle of pets from pet owners is driving the growth of the sensors segment in the global market. The growing number of advancements in sensor technology and the emergence of smart pet care ecosystems are promoting the growth of the sensors segment in the global market.

Due to the rising demand for pet wearable devices for security and monitoring, the GPS segment is predicted to register the fastest CAGR during the forecast period. GPS-based wearable gadgets play an important role in locating lost and stolen dogs and in informing their owners of their whereabouts via a smartphone app.

Global Pet Wearable Market Analysis By Product

The smart collars segment led the market and accounted for 42.1% of the global market share in 2023, and the domination of the smart collars segment in the worldwide market is expected to continue throughout the forecast period. The lead of the smart collars segment is primarily attributed to the rising need for effective identification and tracking solutions for pets and an increasing number of advancements in smart collars for pets. The demand for smart collar products is expected to fuel further during the forecast period as pet owners continue to prioritize the safety, security and health of their pets.

The smart cameras segment is predicted to account for a substantial share of the global pet wearable market during the forecast period, The growing prevalence of remote work and busy lifestyles of people is resulting in the increasing adoption of smart cameras to monitor and interact with their pets while away from home, which is one of the major factors promoting the growth of the smart camera segment in the global market.

The smart harnesses segment is anticipated to register a prominent CAGR during the forecast period. A smart harness contains a number of detectors and technology for detecting and covering the pet's posture, body language, and sounds. The smart harness's physiological sensors track the pet's heart rate and body temperature. In addition to tracking a dog's physical well-being, the sensors can provide information on its mental state, such as whether it is excited or stressed. The technology could be especially useful for guiding dogs and health monitoring.

Global Pet Wearable Market Analysis By Application

The identification and tracking segment led the pet wearable market in 2023, holding 54.9% of the global market share, and this trend is likely to continue over the forecast period. The growing awareness of pet theft risks is primarily boosting the growth of the identification and tracking segment in the global market. For instance, around 10 million cats and dogs are stolen or lost in the United States every year, according to the American Humane Association. To avoid such accidents, pet owners are investing in wearable tracking equipment for dogs, such as smart collars and smartwatches, which is fueling the growth of the segment in the global market.

The medical diagnostic and treatment segment is also a major segment and is expected to grow at the fastest CAGR during the forecast period. The growth of the medical diagnostic and treatment segment is majorly driven by the increased desire for wearable gadgets that give owners with quantitative information on their companion animals' health and physical activities. Obesity in cats and dogs, for example, can cause serious illnesses and shorten their lifespan by two to three years.

REGIONAL ANALYSIS

North America had the largest share of the global pet wearable market in 2023 and is expected to continue dominating the market throughout the forecast period.

The domination of the North American market is majorly attributed to the increasing tendency toward pet adoption and humanization, rising disposable income, and rising per capita animal healthcare spending. In addition, rising pet health awareness and increasing acceptance of new pet care products by a growing number of tech-savvy pet owners are propelling the growth of the pet wearable market in North America. The US and Canada are the most popular countries comprising innovative launches of pet wearables with the presence of a huge number of companies. The US has been the most popular country for owning a number of pets across the world for many years. Americans spend huge amounts on the health and wellness of pets and adopt new technologies that are easy to use for their safety, irrespective of the cost of the devices. This factor will also contribute to the growth rate of the pet wearable market in the coming years.

Over the forecast period, the Asia-Pacific regional market is expected to have the fastest CAGR in the global market. The rising awareness of pet fitness and health, as well as an increase in the adoption of companion animals in emerging economies such as India and Australia, are projected to propel regional market expansion. The growing millennial and Gen Z population in emerging countries such as India and China are gearing up for the growth rate of the pet wearable market. Gen Z people, especially, give high priority to companion animals while their knowledge of the latest technologies is set to create lucrative growth opportunities for the market in the Asia Pacific region.

The European market is a promising regional market for pet wearables and is estimated to hold a substantial share of the worldwide market during the forecast period. With the growing trend of pet humanization in nations like the United Kingdom, France, and Spain, the market will gain traction. Smart pet wearable gadgets, like security cameras and smart harnesses, are getting a lot of traction in the market as the number of pets in Europe grows. The demand to launch various wearable devices for pet animals is gearing up the growth rate of the market in Europe. Germany and France's countries do spend lucrative amounts on launching high-quality products, which are likely to surge the market's growth rate during the forecast period.

Latin America, the Middle East & Africa are likely to have steady growth opportunities in the years with the growing economy and rising awareness of having a pet for various aspects.

KEY PLAYERS IN THE GLOBAL PET WEARABLE MARKET

Companies playing a prominent role in the global pet wearable market include Whistle Labs, PetPace, Garmin, FitBark, Tractive, Link AKC, Motorola, KYON, Scollar, and Others.

RECENT HAPPENINGS IN THE GLOBAL PET WEARABLE MARKET

- In 2024, PetPace 2.0 was prestigiously launched by PetPace, which can be a sign of a life-saving device for pets and also enable various activities required for researchers and veterinarians. PetPace 2.0 is the only Vet-Grade AI-powered canine pet collar that continuously monitors the pet's vital signs. It can be connected to a smartphone or laptop via Bluetooth, which provides peace for pet owners by monitoring their pets remotely. The activities that were recorded can help veterinary doctors to provide specific, accurate treatment procedures.

DETAILED SEGMENTATION OF THE GLOBAL PET WEARABLE MARKET INCLUDED IN THIS REPORT

This research report on the global pet wearable market has been segmented and sub-segmented based on technology, product, application, and region.

By Technology

- GPS

- RFID

- Sensors

- Batteries

- Bluetooth

By Application

- Medical Diagnosis & Treatment

- Identification & Tracking

By Product

- Smart Cameras

- Smart Collars

- Smart Harnesses

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the projected growth rate of the Global Pet Wearable Market?

The global pet wearable market was worth USD 2.3 billion in 2023. It is projected to reach USD 6.59 billion by 2032 from USD 2.59 billion in 2024, showcasing a CAGR of 12.4% from 2024 to 2032.

What are the primary drivers of the Pet Wearable Market?

The primary drivers of the Pet Wearable Market include growing concerns about pet health and wellness, rising pet population and humanization, increasing demand for IoT in pet monitoring devices, and rising pet expenditure due to higher disposable income.

What are the key opportunities in the Pet Wearable Market?

Key opportunities in the Pet Wearable Market include the adoption of IoT technology, the integration of various technologies like GPS and RFID, and the development of wearable devices tailored for specific pet health monitoring and security needs.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]