Global Veterinary Software Market Size, Share, Trends & Growth Forecast Report By Type of Software, Delivery Model, Practice Type, End-Use and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Veterinary Software Market Size

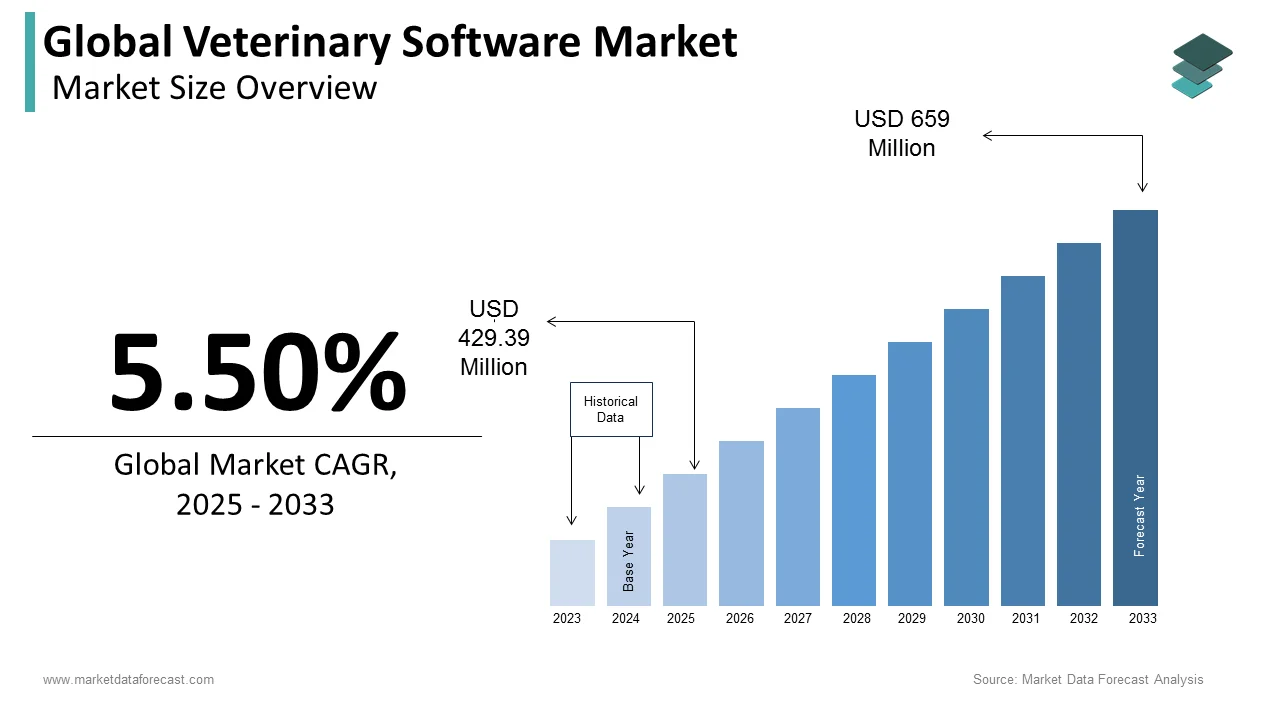

The size of the global veterinary software market was worth USD 407 million in 2024. The global market is anticipated to grow at a CAGR of 5.50% from 2025 to 2033 and be worth USD 659 million by 2033 from USD 429.39 million in 2025.

MARKET DRIVERS

The growing number of pet owners and veterinary practitioners fuels the global veterinary software market growth. The growing emphasis on efficiency and safety in livestock production is contributing to the growing demand for veterinary software and driving market growth. The service providers of such systems have comprehensive solutions for managing a veterinarian's office, including scheduling and maintaining records. The growing awareness of animal health worldwide, the rising animal population, increasing demand for animal food products, growing animal health expenditure and rapid adoption of pet insurance propels the veterinary software market growth.

In addition, the rising incidence of zoonotic diseases, growing demand for animal monitoring services and health diagnostics, growing product innovation and integration of additional functionalities drive the demand for veterinary software and favor the market growth. The growing awareness of veterinary software among the end-users and increasing demand for protein-rich foods support the market’s growth rate.

Furthermore, the growing penetration of cloud-based technology and increasing adoption of veterinary software in developing countries are expected to offer lucrative opportunities for market participants in the coming years. Product innovation and software integration by market players, expanding opportunities for practice management, and rapid adoption of information systems in veterinary healthcare favor the veterinary software market. The key market leaders respond with innovative products in response to the growing interest of veterinarians in software management in veterinary healthcare.

MARKET RESTRAINTS

Limited adoption of veterinary software solutions in several countries is one of the key factors hampering market growth. Many veterinary practices still have been depending on traditional methods to manage their operations despite the availability of veterinary software solutions. High costs associated with the implementation and maintenance of veterinary software solutions are another significant obstacle to the growth rate of the market. These high costs are unaffordable to small and independent veterinary practitioners. The complexity of veterinary software solutions and the scarcity of skilled professionals to handle the operations with veterinary software in some countries further hinder the global market growth. Lack of interoperability, security concerns and limited features of veterinary software solutions further inhibit the growth rate of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type of Software, Delivery Model, Practice Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Challenges, Opportunities, Restraints, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

SEGMENTAL ANALYSIS

Global Veterinary Software Market Analysis By Type of Software

Based on software type, the veterinary practice management software segment held the leading share of the global market in 2024 and is expected to grow at the highest CAGR during the forecast period. The efficiency in veterinary practices through streamlined administrative processes can be improved significantly using the practice management software and the same factor is driving the segmental growth primarily. The benefits of practice management software such as quick access to patient information and better decision-making with integrated electronic health records (EHR) and medical history boost the segment’s growth rate. The rising demand for cloud-based solutions that offer remote access and enhanced data security, increasing adoption of telemedicine and remote consultations that drive the need for digital solutions and compliance with regulatory requirements for accurate medical records and client confidentiality further promote the segmental growth.

The imaging segment is anticipated to witness a healthy CAGR during the forecast period owing to the accurate diagnosis and treatment planning facilitated by advanced imaging capabilities and smooth transfer of images and results through integration with practice management systems. The growing use of cloud-based solutions for remote access and collaboration and the rapid adoption of artificial intelligence (AI) for automated image analysis and pattern recognition contribute to the growth rate of the segment.

Global Veterinary Software Market Analysis By Delivery Model

By the delivery model segment, the on-premises model segment held the largest share of the global market in 2024 and is expected to grow considerably during the forecast period. On-premises offer customizable solutions tailored to specific needs and requirements of veterinary practices and due to this, on-premises have become the favorite choice for veterinarians. Enhanced control and security over data with software and servers hosted on-premises is another key factor favoring segmental growth.

The cloud/web-based segment is estimated to account for a substantial share of the global market during the forecast period. The accessibility, convenience, scalability and flexibility of web-based solutions that allow for easy upgrades, customization and integration with other software systems majorly drive the segmental growth. Lower upfront costs and reduced IT infrastructure investment associated with cloud/web-based delivery further boost segmental growth.

Global Veterinary Software Market Analysis By Practice Type

Based on the practice type segment, the small animal practices segment had the major share of the global market in 2024 and is predicted to grow at the highest CAGR during the forecast period owing to the growing annual expenditure on pet care and an increasing number of small animal pet owners.

Global Veterinary Software Market Analysis By End-User

Based on end-user, the hospital segment had the dominating share of the global market in 2024 and is expected to grow at a healthy CAGR during the forecast period. The growing importance of streamlined workflow and improved operational efficiency in hospitals is driving the adoption of veterinary software and propelling segmental growth. The growing demand for advanced diagnostic capabilities and treatment planning and the rising emphasis on telemedicine and remote consultations for convenient healthcare delivery further contribute to the segmental growth.

The reference laboratories segment accounted for a substantial share of the global market in 2024 and is predicted to grow at a steady CAGR during the forecast period. The need for standardization and quality control in laboratory processes for accurate and reliable results, growing demand for genetic testing and specialized diagnostic services, and increasing number of collaborations with veterinary hospitals and clinics for shared data and referrals drive the segmental growth.

REGIONAL ANALYSIS

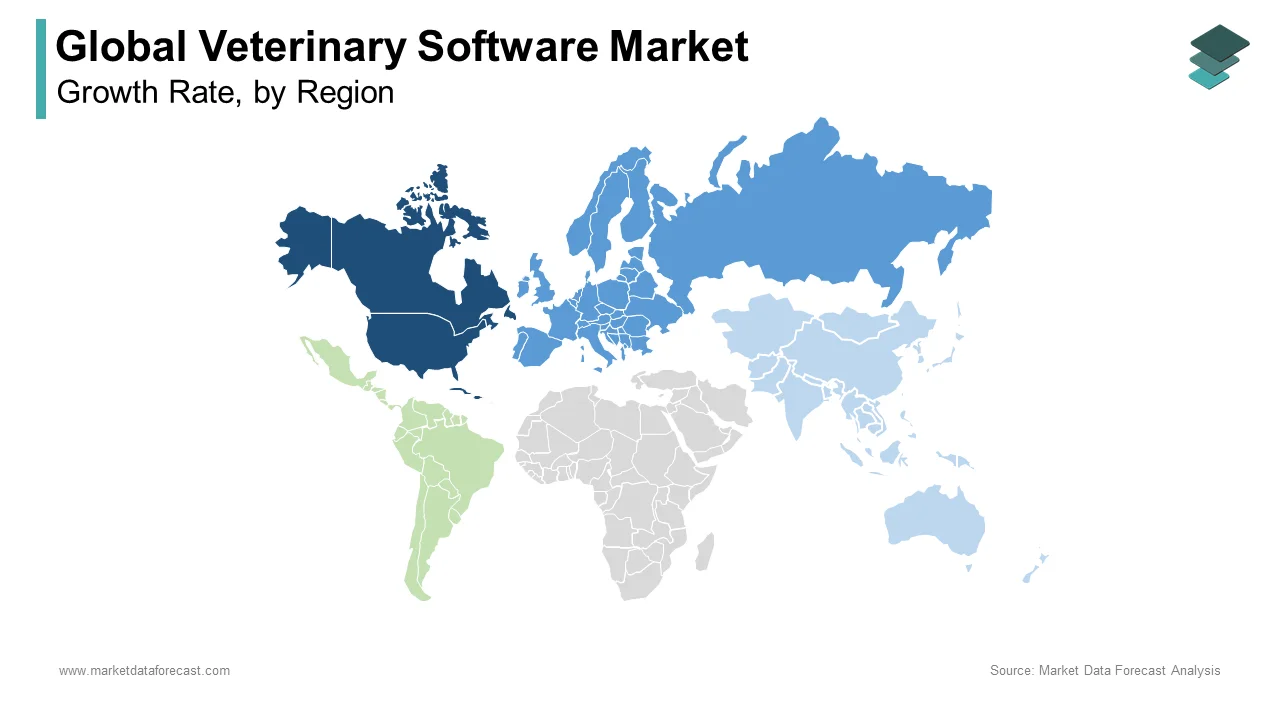

The North American veterinary software market had a major share of the global market in 2024.

The domination of the North American region is anticipated to continue throughout the forecast period. The presence of advanced healthcare IT infrastructure, growing spending on pets by owners and the presence of key market participants drives the market growth in the North American region. Technological advancements, stringent regulatory standards and a focus on data security and privacy, high adoption of digital solutions in the veterinary industry and well-established veterinary infrastructure further contribute to the growth rate of the North American market. The U.S. held the largest share of the North American market in 2024. The same trend is estimated to continue throughout the forecast period owing to factors such as growing pet ownership, increasing demand for quality veterinary care, rise in veterinary specialization, an increasing need for specialized software solutions and strong presence of veterinary software vendors and service providers.

Europe is a noteworthy regional market for veterinary software and is estimated to grow at a healthy CAGR during the forecast period. Favorable regulations by the European governments, an increasing number of initiatives promoting digital healthcare solutions, rising awareness of pet health, increased spending on veterinary services, the presence of leading veterinary research institutes and academic collaborations and rapid adoption of advanced technologies such as telemedicine and digital imaging drive the European veterinary software market growth. The UK followed by Germany, Spain and France held the leading share of the European market in 2024 and this trend is much likely to continue during the forecast period.

The Asia Pacific veterinary software market is predicted to grow at the highest CAGR during the forecast period. The growing pet adoption rates, increasing disposable income in emerging economies, rising adoption of veterinary services and the establishment of veterinary hospitals and clinics primarily drive the APAC veterinary software market growth. The growing adoption of digital transformation in the veterinary industry for improved patient care, increasing demand for telemedicine and remote consultations in remote areas, technological advancements in veterinary diagnostics and imaging and a growing number of initiatives from the governments of APAC region to promote animal health and welfare further promote the regional market growth. China, Japan and India are expected to hold the major share of the APAC market during the forecast period.

The Latin American veterinary software market is predicted to grow at a steady CAGR during the forecast period owing to the growing number of pet owners, increasing awareness among the Latin American population regarding veterinary healthcare, growing veterinary tourism, rising adoption of mobile and cloud-based veterinary software solutions and increasing support from the governments of Latin American region for the development of veterinary infrastructure.

The MEA veterinary software market is anticipated to witness a moderate CAGR in the coming years.

KEY MARKET PLAYERS

IDEXX Laboratories, Henry Schein, and Patterson Companies are the three dominating players in the Veterinary software market.

Among these three top companies, Henry Schein leads the significant share in veterinary software practices globally, with 36.5%. Strong geography and an exhaustive product portfolio are the attributing factors to lead the company as the top one. Across the globe, Henry-Schein is a company with a well-established and customer base of 1 million across 33 companies, which has a competitive edge in the market. Acquisitions with companies like eVetPractice, Vetstreet, and RxWorks are the inorganic strategies followed by this company to expand its growth.

Some of the other promising companies leading the Global Veterinary Software Market profiled in this report are Britton's Wise Computer, Inc. (U.S.), Firmcloud Corporation (U.S.), Timeless Veterinary Systems, Inc. (Canada), ezyVET Limited (New Zealand), MedaNext Inc. (U.S.), and Animal Intelligence Software, Inc. (U.S.).

RECENT MARKET DEVELOPMENTS

- In 2017, To integrate Vetter’s practice management solution, Vetter software partnered with Vetstoria through the online appointment booking solution.

- In 2017, Vetter software collaborated with Pawprint to integrate Vetter’s practice management solution with Pawprint’s client engagement tools.

DETAILED SEGMENTATION OF THE GLOBAL VETERINARY SOFTWARE MARKET INCLUDED IN THIS REPORT

This market research report on the global veterinary software market has been segmented and sub-segmented based on the type of software, delivery model, practice type, end-user, and region.

By Type of Software

- Practice Management Software

- Imaging Software

By Delivery Model

- On-Premises

- Cloud/Web-based

By Practice Type

- Small Animal

- Mixed

- Large Animal

- Equine

By End-User

- Hospitals

- Reference Laboratories

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

At What CAGR, The veterinary software market is expected to grow from 2025 to 2033?

The veterinary software market is expected to grow at a CAGR of 5.50% during the forecast period 2025-2033.

Which region has the highest market share in the veterinary software market ?

The North American region was holding highest market share in the veterinary software market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com