Global Veterinary Ultrasound Market Size, Share, Trends & Growth Forecast Report By Type, Animal Type, Technology, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Veterinary Ultrasound Market Size

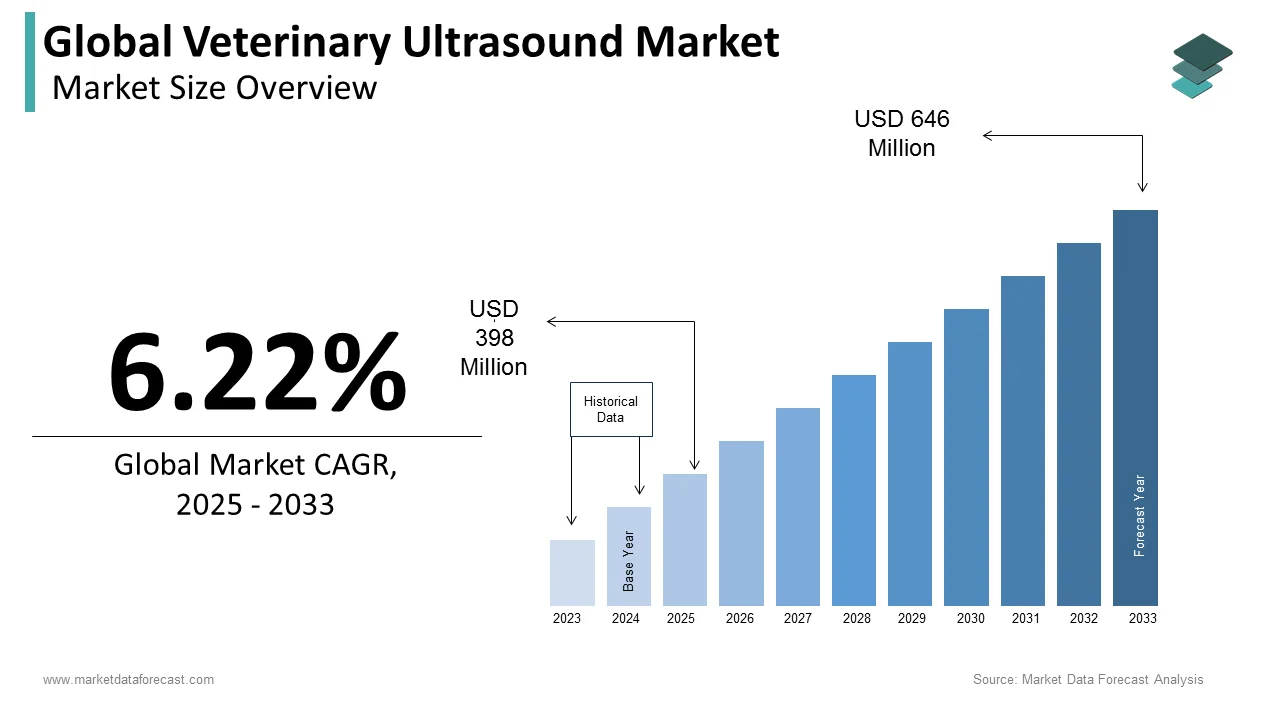

The size of the global veterinary ultrasound market was worth USD 375.1 million in 2024. The global market is anticipated to grow at a CAGR of 6.22% from 2025 to 2033 and be worth USD 646 million by 2033 from USD 398 million in 2025.

Ultrasound equipment aids doctors in detecting cancers inside body locations that are difficult to see on X-rays. For example, veterinarians frequently utilize ultrasonography to guide a needle when executing a biopsy. Ultrasound devices are commonly used because they offer a risk-free and pain-free technique to examine an animal's interior organs. Ultrasound is also occasionally preferred because it is rapid and does not require special equipment. Ultrasound in animals and veterinary medicine uses ultrasonic sound waves in the range of 1.5–15 megahertz (MHz) to create images of body structures based on the pattern of echoes reflected from the tissues and organs being examined.

MARKET DRIVERS

The growing incidence of various internal injuries as well as other diseases in companion animals, such as cats, dogs, and horses, as well as livestock animals, such as cattle, swine, and others, as well as the rise in need for detection of those diseases, are expected to propel the global veterinary ultrasound market expansion.

Rapid advancements in ultrasound equipment quality and growing awareness of the benefits of ultrasound as an imaging technique in the diagnosis and detection of animal diseases have broadened the application scope of animal ultrasound and are expected to drive market growth over the forecast period. Other factors predicted to drive the increase in the market in the future include software advancements in ultrasound examination, the advent of remote diagnosis, and the expanding application of ultrasound-guided interventional methods for diagnostic and therapeutic applications.

Undeveloped rising markets in developing countries provide profitable opportunities for market participants. In these countries, many pet owners are willing to spend extra on pet care, particularly for healthcare treatments. With an increase in companion animals, rising demand for animal food products, a large population of livestock animals, and rising animal health spending in emerging countries across APAC and Latin America, these regions present high-growth opportunities. Increased animal diagnostic requirements for various health issues, such as pregnancy, organ enlargement, foreign body ingestion, and internal injuries, have increased veterinary healthcare spending and expanded the market.

MARKET RESTRAINTS

High ultrasound equipment prices, a lack of awareness about routine clinical check-ups for pets and companion animals, and a lack of proper veterinary care infrastructure are projected to limit the growth of the global veterinary ultrasound market throughout the projection period. Lack of acceptable reimbursement policies and confusing ultrasound images are other significant obstacles that limit ultrasonic imaging usage and limit the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Animal Type, Technology, End-User & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Fujifilm Holdings Corporation, Esaote SpA, GE Healthcare, Heska Corporation |

SEGMENTAL ANALYSIS

By Type Insights

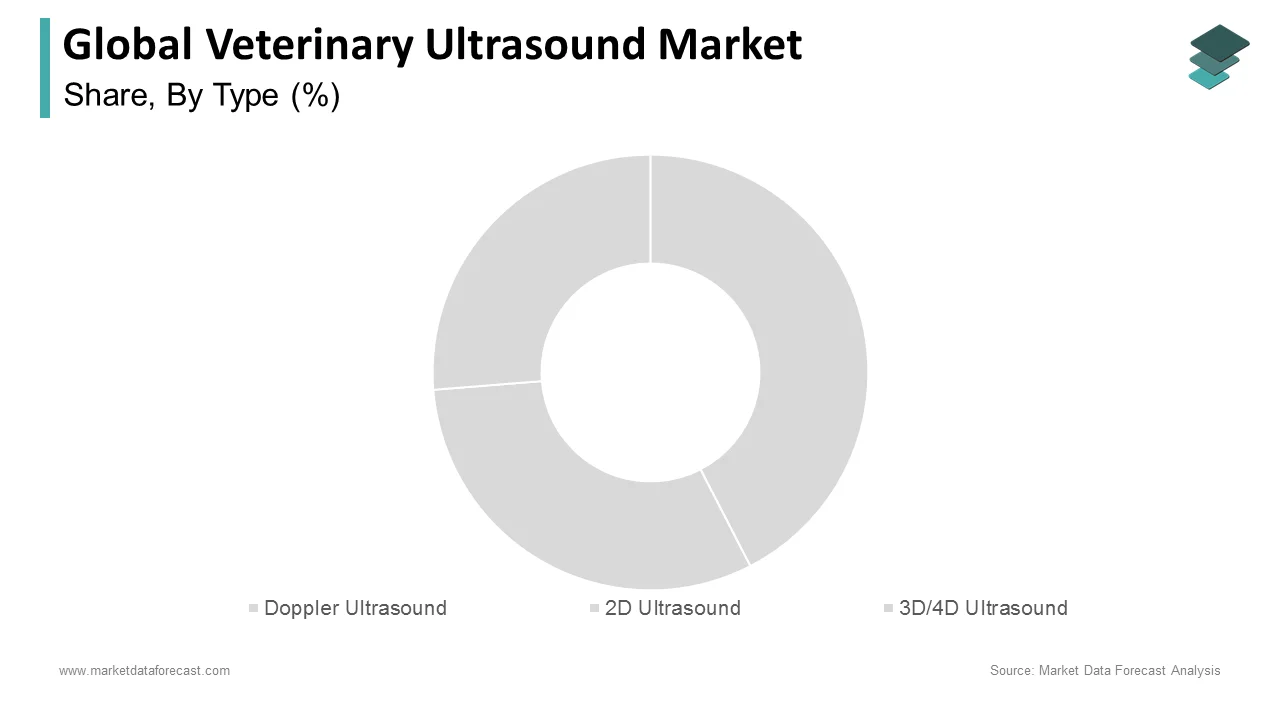

The 2D ultrasound market is predicted to rise faster during the forecast period in the global veterinary ultrasound market. The growth in this segment is likely to be driven by the increasing adoption of 2D ultrasound imaging equipment in prenatal screening and disease diagnosis. In addition, the segment's expansion is predicted to be fueled by reduced costs compared to other forms of ultrasound imaging techniques.

By Application Insights

During the forecast period, the cardiology segment is expected to account for the most share of the global market. The rising prevalence of cardiovascular disorders in animals is likely to boost this segment's growth.

By Animal Type Insights

The small companion animals segment accounted for the most significant share of the global veterinary ultrasound market in 2024. This market is predicted to develop due to increased adoption of companion animals and higher spending on animal well-being and care. In addition, the rising prevalence of cancer and heart disease in cats and dogs is predicted to improve the segment's revenue growth.

By Technology Insights

Due to rising adoption in veterinary clinics and hospitals, the contrast imaging segment is predicted to grow at a much faster rate over the forecast period. Myocardial perfusion and M-mode imaging are both done with contrast imaging. Myocardial perfusion is used to examine the left ventricular free wall and septum in pets such as dogs and cats. It is mainly used for myocardial infarction diagnosis.

By End-User Insights

Over the forecast period, the global market for veterinary hospitals and clinics is expected to rise faster. This segment's expansion is likely to be fueled by the increasing availability of various diagnostics solutions at veterinary hospitals and clinics. Rapid technical improvements, such as effective pet ownership mobile technologies and cloud-based information management, are also predicted to drive this segment's growth.

REGIONAL ANALYSIS

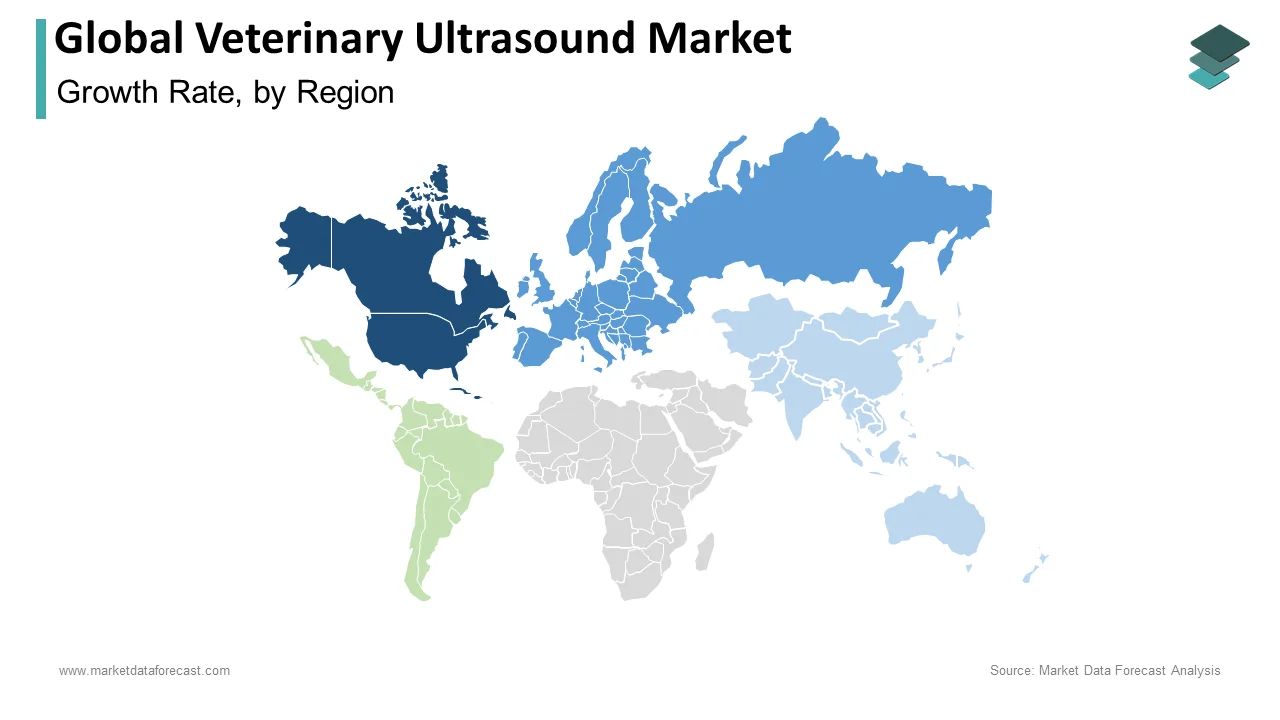

Geographically, North America is predicted to contribute a considerable share to the global veterinary ultrasound market over the forecast period, with the number of pet adoptions hitting an all-time high. Furthermore, rising animal healthcare expenditures, caused by the incidence of health issues such as internal injuries and diseases in pets and livestock animals, may promote the expansion of the market in North America. Therefore, due to expanding pet adoption and rising per capita animal healthcare expenditure, the United States will dominate the veterinary ultrasound devices market.

The veterinary ultrasound market in Western Europe accounts for a substantial portion of the global market. The market for veterinary ultrasound scanners in this region is mainly driven by rising awareness of animal and human safety and health. Therefore, the market for animal ultrasound scanners in Germany is likely to be the most profitable.

The growing livestock population, increasing pet adoption, increased awareness about animal health, progressive urbanization, and rising per capita animal health spending drive market expansion in the APAC region. As a result, the veterinary ultrasonography market has considerable and appealing growth possibilities in emerging markets. Furthermore, the demand for veterinary ultrasound has increased as the number of veterinary clinics and hospitals has expanded.

The market for veterinary ultrasound scanners in Latin America now accounts for 3.5% of the global market. As a result, this region's market share is likely to grow slower than other regions. However, this trend is expected to reverse towards the end of the forecast period as disposable income rises.

KEY MARKET PLAYERS

IDEXX Laboratories, Inc., Carestream Health, Inc., Fujifilm Holdings Corporation, Esaote SpA, GE Healthcare, Heska Corporation, Diagnostic Imaging Systems, Inc., Clarius Mobile Health Corp., Dramifiski S.A., and Hallmarg Veterinary Imaging Limited are a few of the prominent companies operating in the global veterinary ultrasound market profiled in this report.

RECENT HAPPENINGS IN THIS MARKET

-

GE Healthcare acquired BK Medical in 2021, expanding its ultrasound portfolio to include surgical visualization.

-

IDEXX Laboratories, Inc., a global leader in veterinary diagnostics and software, announced buying ezyVet, a fast-growing, innovative practice information management system, in 2021.

MARKET SEGMENTATION

This research report on the global veterinary ultrasound market has been segmented and sub-segmented based on type, animal type, technology, end-user & region.

By Type

- Doppler Ultrasound

- 2D Ultrasound

- 3D/4D Ultrasound

By Application

- Cardiology

- Orthopedics

- Obstetrics & Gynecology

- Oncology

By Animal Type

- Large Animals

- Small Companion Animals

By Technology

- Digital Imaging Technology

- Analog Imaging Technology

- Contrast Imaging Technology

By End-User

- Veterinary Hospitals & Clinics

- Academic & Research Centers

- Laboratories

- Point-of-care (POC) Facilities

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the latest technological advancements in the veterinary ultrasound market?

The latest technological advancements in the veterinary ultrasound market include the development of 3D and 4D imaging, the use of advanced software for image analysis, and the integration of ultrasound with other diagnostic tools.

Who are the key players in the veterinary ultrasound market?

Esaote SpA, GE Healthcare, Fujifilm Holdings Corporation, Hitachi, Ltd., and Mindray Medical International Limited are some of the notable companies in the veterinary ultrasound market.

What is the current size of the veterinary ultrasound market?

The global veterinary ultrasound market size is anticipated to be valued at USD 375.1 million in 2024.

What are the key drivers of growth in the veterinary ultrasound market?

The key drivers of growth in the veterinary ultrasound market include the increasing demand for pet insurance, the growing pet population, and the rising demand for non-invasive diagnostic procedures.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com