Global Ultrasound Devices Market Size, Share, Trends & Growth Forecast Report – Segmented By Technology (Diagnostic Ultrasound and Therapeutic Ultrasound), Device Display (Color and Black and White), Portability (Trolley/Cart-based and Compact/Handheld), Application and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From 2025 to 2033

Global Ultrasound Devices Market Size

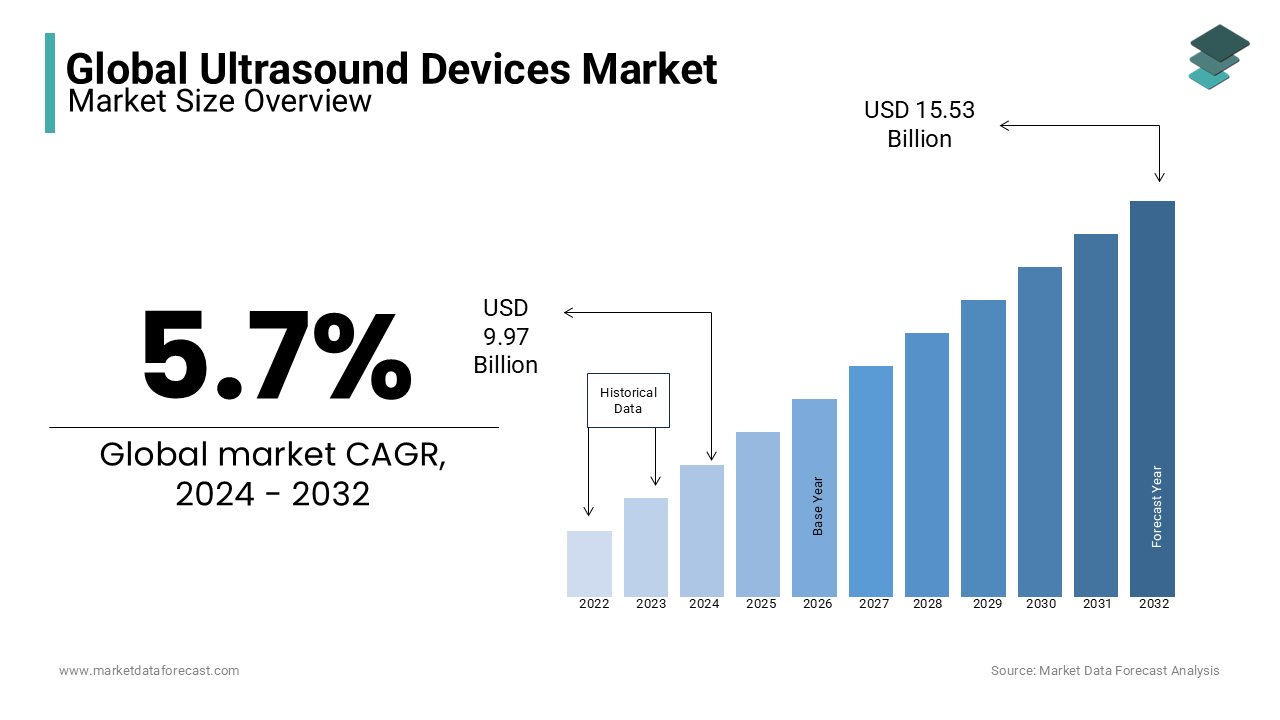

The value of the global ultrasound devices market is projected to grow to USD 16.42 billion by 2033 and USD 10.54 billion in 2025, growing at a CAGR of 5.7% during the forecast period. The ultrasound devices market size was valued at USD 9.97 billion in 2024.

A significant rise in demand for minimally encroaching diagnostic and therapeutic devices is primarily driving the market's growth. Additionally, the increasing adoption of ultrasound techniques for various treatment procedures fuels the market growth.

Ultrasound devices are protruding diagnostic imaging devices capable of obtaining images of the body's internal organs. Healthcare professionals will use these devices to conduct and examine tests in diagnosis and therapeutic procedures. The critical nature of ultrasound devices has enlarged their scope to gynecological, cardiac, urological, cerebrovascular, abdominal, and breast examinations. In addition, smaller versions of these devices have led to their application in point-of-care settings. A significant rise in medical tourism will likely provide opportunities for the ultrasound devices market to expand.

The screening ultrasound is considered a standard for fetal screening globally. Thus, the rising birth rates and in-vitro fertilization treatment rates add to the demand for sonography devices. In addition, several organizations, such as the American Cancer Society, recommend periodic mammographic screening for women above 40 years to detect breast cancer. As a result, several new cases diagnosed with breast cancer are rising rapidly. Therefore, the usage of 3D ultrasound and 4D ultrasound is increasing in breast cancer screening. In addition, it provides better visualization of the coronal plane in breasts with dense tissues, as recommended by the government and health agencies.

MARKET DRIVERS

The rising demand for ultrasound diagnostic imaging procedures and increasing investments in R&D are propelling the global ultrasound devices market.

Technological developments, medical reimbursements, awareness for early disease detection, and healthcare expenditure are estimated to propel market growth further. In addition, Y-O-Y growth in the birth rate worldwide is estimated to accelerate the need for more ultrasound devices during the forecast period. According to the Centers for Disease Control and Prevention (CDC), the total number of births in the United States was 3,978,497 in 2016. Moreover, the birth rate in the U.S. was 12.4 births per 1,000 population.

The accentuating number of pregnancies and an increasing number of childbirths every year are factors responsible for the ultrasound devices market growth. Additionally, the growing requirement for minimally invasive is another significant factor boosting the market growth. The minimally invasive procedures cause low pain and involve less stay in the hospital, and the significance of these methods is snowballing.

The escalating number of healthcare providers, rising funds and investments for R&D in ultrasound imaging, and the increasing number of chronic diseases are expected to expand the market growth soon. The advanced and inventive technologies resulted in the state-of-the-art medical devices industry. Medical device manufacturers are focusing on emerging high-quality images, which is expected to drive market growth. In addition, the flourishing number of hospitals ensuring demand for ultrasound imaging infrastructure augments the market development.

MARKET RESTRAINTS

Lack of awareness among the people and scarcity of expert sonography professionals for ultrasound devices hamper the market growth. In addition, the high cost of ultrasound devices and strict government rules and regulations obstruct market growth. Therefore, the latest product recall in the ultrasound devices market posed a significant challenge. For instance, in May 2020, Koninklijke Philips N.V. was given a class II product recall for the S83 compact by the U.S. FDA. The product recall initiation was due to the defective auto cool function of the Transoesophageal transducer that can harm the patient while examining.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Technology, Device Display, Portability, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

General Electric Company (U.S.), Koninklijke Philips N.V. (Netherlands), Toshiba Corporation (Japan), Siemens AG (Germany), Hitachi Ltd. (Japan), Samsung Electronics Co., Ltd. (South Korea), FUJIFILM Holdings Corporation (Japan), |

SEGMENTAL ANALYSIS

By Technology Insights

The diagnostic ultrasound segment is projected to occupy the largest share of the global ultrasound devices market during the forecast period. Of this segment, the 2D ultrasound sub-segment is widely used for women's health attainability of medical reimbursements for diagnostic ultrasound procedures, continuously advanced technologies in ultrasound imaging, and increasing applications for existing ultrasound techniques propelling the technology segment of the ultrasound devices market growth. As a result, the Doppler ultrasound segment is anticipated to show prominent growth during the forecast period. Doppler ultrasound provides great help in determining and diagnosing a blocked blood vessel and certain heart conditions. In addition, it uses sound waves to show blood moving through blood vessels, unlike a regular ultrasound, which does not show blood flow.

On the other hand, the therapeutic ultrasound segment is forecasted to show a promising CAGR over the forecast period. High-Intensity Focused Ultrasound or HIFU has been observed to be the most adopted type due to being a new cosmetic skin-tightening non-invasive replacement for facelifts, which uses ultrasound energy to produce collagen, since these results in firmer skin. Although it is highly used for tumor treatment, it has other cosmetic benefits, such as improvement of cheeks, reduction of wrinkles, improvement of jawline definition, tightening of sagging turkey neck, firming of cleavage, and overall skin smoothing, including eyebrows and eyelids.

By Device Display Insights

The color ultrasound devices segment is projected to hold the leading market of the global ultrasound devices market during the forecast period. Factors such as advantages provided by the color ultrasound devices, increasing market accessibility of color ultrasound devices incorporated with the ongoing decline in cost across significant countries, and enlarging distribution of networks of huge producers among the existing countries support the growth of the segments. Colored ultrasound devices give a clear indication of blood accumulation and flow changes, especially in the case of a colored Doppler ultrasound device, which significantly helps simplify diagnosis for physicians; quick recognition of turbulent flow, visual description of the blood flow in the heart quantify volume and percentage of vascularity with advanced 3D mode and assess flow speed and direction.

By Portability Insights

The trolley/cart-based ultrasound devices segment is expected to account for the largest share of the global ultrasound market during the forecast period due to factors such as the growing usage of acute and censorious emergencies. These ultrasound devices provide accurate and quick diagnoses of the patient's location, eliminating the need to move it from one facility to another or to move the patient from one location to another. Also, trolley/cart-based ultrasound devices take less space, provide crucial help in diagnosing critical health patients, and can be moved from room to room. Also, these machines provide high-quality images at once due to the technological advancements in portable ultrasound equipment.

However, the compact/handheld ultrasound devices segment is expected to grow at the highest CAGR during the forecast period. The benefits of these handheld ultrasound devices are their non-invasive nature, the ability to deliver real-time results, high speed, avoidance of radiation, and portability, even beside the bed.

By Application Insights

The cardiology application is expected to be the fastest-growing segment during the forecast period due to the rising incidence of cardiac diseases worldwide. Cardiac ultrasound helps diagnose the patient's condition so doctors can understand the health of the patient's heart through the most painless, easiest, and quickest assessment to assess the structure and function of the heart and vessels. In addition, growing chronic diseases and rising older populations surge the application segment of the ultrasound devices market.

On the other hand, the urology segment is anticipated to perform well during the forecast period. Ultrasound devices for urology have proven to accurately evaluate urological problems in patients, such as detecting uropathology, urinary tract infections, kidney obstruction, and others. Therefore, ultrasound devices for the urology segment are anticipated to hold a substantial market share after cardiology under this segment over the forecast period.

REGIONAL ANALYSIS

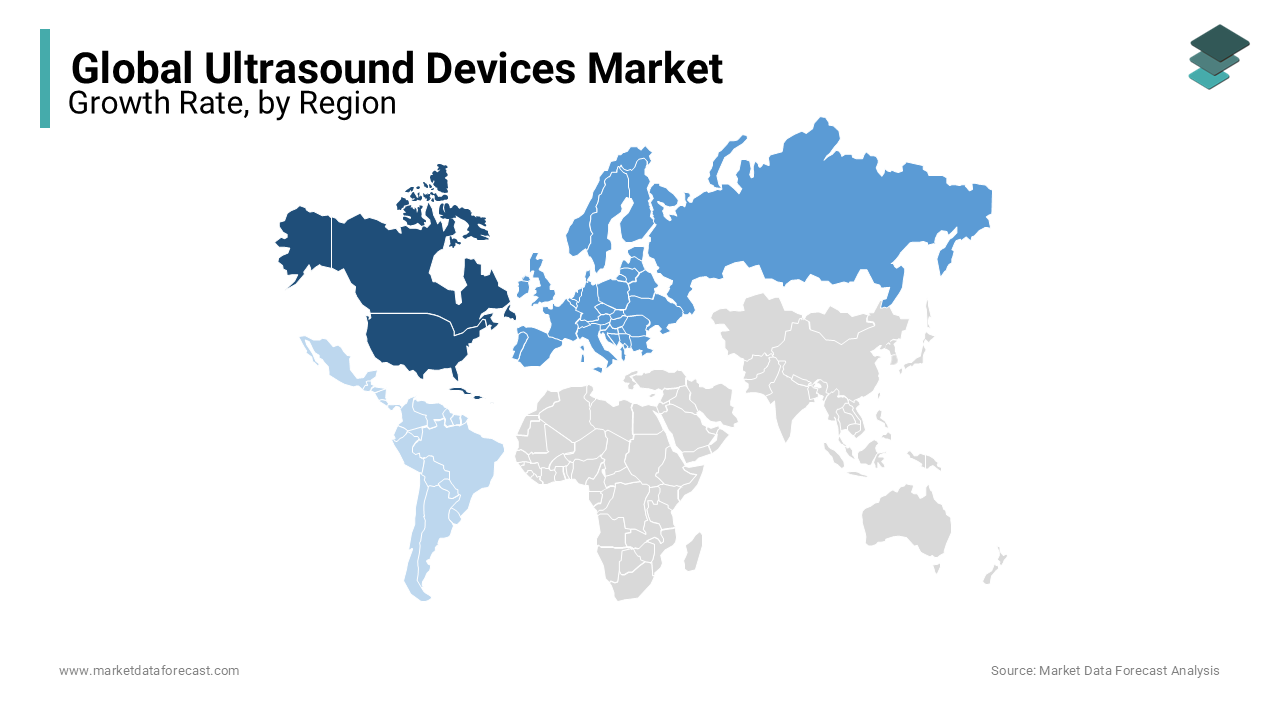

North America accounts for the largest share of the global market, followed by Europe. Factors such as an increase in the number of commercialized products and expansion in clinical applications of HIFU are driving the market in the North American region. As a result, the U.S. market held a dominating share of the North American region in 2023 and is anticipated to continue leading during the forecast period. On the other hand, the Canadian market is expected to hold a considerable share of the North American region in the coming future.

Europe is estimated to register a substantial global market share during the forecast period.

However, the market in Asia-Pacific is poised to be the fastest-growing region during the forecast period, owing to significant expansion and modernization of the healthcare infrastructure.

On the other hand, Latin America and MEA are anticipated to account for a relatively small share of the global market due to their ongoing developments in the healthcare infrastructure and increased funding from government agencies and large corporations.

KEY PLAYERS IN THE GLOBAL ULTRASOUND DEVICES MARKET

General Electric Company (U.S.), Koninklijke Philips N.V. (Netherlands), Toshiba Corporation (Japan), Siemens AG (Germany), Hitachi Ltd. (Japan), Samsung Electronics Co., Ltd. (South Korea), FUJIFILM Holdings Corporation (Japan), Esaote S.p.A. (Italy), Mindray Medical International Ltd. (China), and Analogic Corporation (U.S.) are some of the key players in the global ultrasound devices market.

Phillips company is one of the leading companies all around the world in the medical field; they have their mark of creating innovations with the latest technologies; EPIQ Elite ultrasound features an exceptional level of clinical performance, workflow, and advanced intelligence to meet the challenges of today's most demanding practices. The company's primary goal is to help physicians make accurate ultrasound imaging diagnoses in less time with high quality.

RECENT HAPPENINGS IN THE MARKET

- In November 2022, ReCor Medical, Inc. and Otsuka Medical Devices Co., Ltd. submitted Premarket Approval for the Paradise uRDN system to the FDA. This system uses the catheter to be placed in the main renal arteries, which delivers a seven-second ultrasound for lowering blood pressure.

- In November 2022, Royal Philips launched a next-generation compact portable ultrasound solution, the Philips Compact 5000 series, to improve patient outcomes with high-end cart-based ultrasound systems without compromising image quality.

- In November 2022, at the 108th Scientific Assembly of the Radiological Society of North America, Samsung Electronics will introduce the latest artificial intelligence technologies in ultrasound, digital radiography, and mobile computed tomography, improving customer experience to very high levels of satisfaction.

- In November 2022, Advanced Veterinary Ultrasound and Draminski S.A. partnered to introduce better, excellent, rich, and developed systems to market features such as the Draminski Blue, iScan2, and iScan Mini systems.

SEGMENTAL ANALYSIS

The global market for ultrasound devices market has been segmented and sub-segmented based on technology, device display, portability, application and region.

By Technology

- Diagnostic Ultrasound

- 2D Ultrasound

- 3D & 4D Ultrasound

- Doppler Ultrasound

- Therapeutic Ultrasound

- High-intensity Focused Ultrasound

- Extracorporeal Shockwave Lithotripsy

By Device Display

- Color

- Black and White

By Portability

- Trolley/Cart-based

- Compact/Handheld

By Application

- Radiology/General Imaging

- Cardiology

- Obstetrics/Gynecology

- Vascular

- Urology

- Other Applications

- Breast Imaging

- Hepatology

- Anesthesiology

- Emergency Care

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much was the global ultrasound devices market worth in 2024?

The global ultrasound devices market was worth USD 9.97 billion in 2024.

Which segment by product had the largest share of the global ultrasound devices market in 2024?

Based on the product, the digital ultrasound segment accounted for the most significant share of the ultrasound devices market in 2024.

Which region had the major share in the global ultrasound devices market in 2024?

Geographically, the North American region was the dominant region in the global market in 2024.

What are a few of the notable players in the ultrasound devices market?

Companies playing a key role in the ultrasound devices market are General Electric Company (U.S.), Koninklijke Philips N.V. (Netherlands), Toshiba Corporation (Japan), Siemens AG (Germany), Hitachi Ltd. (Japan), Samsung Electronics Co., Ltd. (South Korea), FUJIFILM Holdings Corporation (Japan), Esaote S.p.A. (Italy), Mindray Medical International Ltd. (China), and Analogic Corporation (U.S.).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]