Global IVF Market Size, Share, Trends & Growth Forecast Report – Segmented By Reagents and Media (Embryo Culture Media, Cryopreservation Media, Sperm Processing Media and Ovum Processing Media), Instruments (Imaging Systems, Sperm Separation Systems, Ovum Aspiration Pumps, Incubators, Micromanipulator Systems, Cryptosystems and Other Instruments), Technology (ICSI, PGD, FET/FER and Others), End-Users (Fertility and Surgical Centres, Hospitals and Research Laboratories and Cryobanks) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From 2025 to 2033

Global IVF Market Size

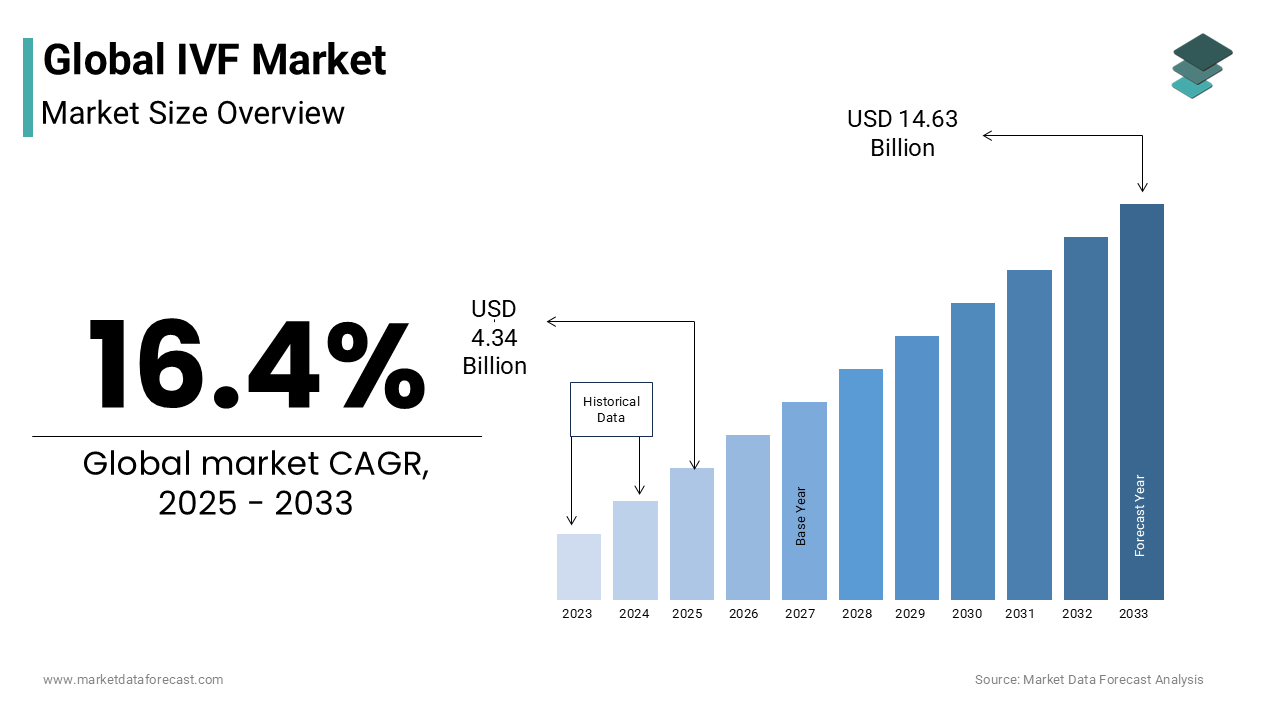

The global IVF market was valued at USD 3.73 billion in 2024. As per our recent report, the global IVF market size is expected to reach USD 14.63 billion by 2033 from USD 4.34 billion in 2025, growing at a CAGR of 16.4% during the forecast period.

The concept of IVF was introduced to the world in 1965, and since then, IVF has evolved and experienced several advancements with the help of technology and become a solution for couples and individuals to fight infertility. The popularity and the adoption of IVF have grown remarkably in the last decade of the timeline. The demand for IVF is continuously expanding due to factors such as delayed childbearing, rising awareness of infertility treatments among people and an increasing number of advancements in reproductive technologies. The U.S. is one of the countries with the highest usage rates of IVF worldwide. The population suffering from infertility is growing steadily in the U.S., which is primarily fueling the adoption of IVF in the U.S. Along with that, access to advanced reproduction technologies and insurance coverage for fertility treatments in some of the U.S. states are further contributing to the demand for IVF in the U.S. In the Asia-Pacific region, countries such as Japan, India, China, Australia, and New Zealand have been experiencing promising demand for IVF as the population increasingly seeks fertility treatments in these countries. Europe has gained popularity as a hub for fertility tourism worldwide. European countries such as Spain, Denmark, and Belgium have the highest usage rates of IVF, and these countries offer favorable healthcare policies and access to advanced medical infrastructure that support fertility. The usage rates of IVF have been taking flight in the Middle East and Africa, and this trend can be clearly seen, especially in countries such as Saudi Arabia and Israel, where cultural attitudes towards family and fertility have been changing, and access to advanced infertility technologies is improving. Considering these happenings, the global IVF market is predicted to register promising growth during the forecast period.

MARKET DRIVERS

The continuous increase in the population suffering from infertility worldwide is primarily driving the growth of the global IVF market.

As per the data published by the National Institutes of Health (NIH), 8% to 10% of couples are facing the issue of infertility. Another report from the CDC revealed that an estimated 6.1 million women in the U.S. aged between 15 to 44 years have issues of getting pregnant or holding the pregnancy. Lifestyle changes in people are significantly contributing to infertility among people. Lifestyle factors such as obesity and the consumption of smoking and alcohol can cause infertility among men and women, says the American Society for Reproductive Medicine (ASRM). In addition to that, delayed childbearing, environmental pollutants, stress, and underlying health conditions are some other notable reasons resulting in infertility among people. Obesity is also causing infertility among people. Fat deposits in a woman's abdomen prevent follicular stimulation, and fat deposits lower testosterone levels in men and cause a decrease in sperm production. Due to the growing prevalence of infertility, majority of the couples have been using advanced reproduction technologies such as IVF to achieve pregnancy and parenthood.

The rising adoption of IVF among LGBTQ+ couples is boosting the growth rate of the global IVF market.

An increase in the number of LGBTQ+ community couples is also leading to rising requirements as more gay and lesbian couples opt for IVF procedures using sperm and egg donors and surrogacies, which is another major factor propelling the global IVF market growth. In several countries, the acceptance of LGBTQ+ relationships is increasing, and the same growth can be seen in same-sex marriages. Couples of same-sex have been pursuing parenthood through assisted reproductive technologies such as IVF, and this trend is slowly accelerating and supporting the IVF market growth. For instance, as per the 2017 report of the Human Fertilization and Embryology Authority, an increase of 12% was noticed in same-sex female couples seeking fertility treatments in the U.K. between 2016 and 2017.

Furthermore, the rise in awareness among people regarding advanced reproduction technologies such as IVF, increasing R&D efforts by the key market participants, and initiatives from various governments in favor of IVF, such as favorable reimbursement policies, are boosting the global IVF market growth. An increase in the number of fertility procedures to treat male infertility, such as ICSI is promoting the IVF market growth. The wide availability of genomic testing to prevent the transfer of genetic diseases during IVF will drive market growth in the years to come. In addition, the growing number of IVF has prompted insurers to cover these procedures, leading to competitive prices and thus lowering treatment costs and these factors are predicted to aid the growth of the in vitro fertilization (IVF) market globally during the forecast period.

MARKET RESTRAINTS

The high costs associated with the invitro fertilization methods, as they involve the most complicated and frequent medication procedures, are the significant factors restraining the market growth rate.

The presence of various drawbacks of IVF treatment, such as higher cases of multiple pregnancies leading to pregnancy complications such as lower birth weight, high blood pressure, diabetes, and the chances of ectopic pregnancy, are hampering the adoption among the people, leading to restricted market growth. The presence of several side effects such as headaches, mood swings, pelvic discomfort, and nausea and the higher chances of unsuccessful cycles are hindering the market growth. The major reason for the failure of the IVF cycles is the preimplantation genetic screening, which restrains the market expansion. The higher risks associated with embryo transfer, and ovarian hyperstimulation syndrome, miscarriages, expensive procedures, emotional and psychological impact are a few factors contributing to the global market growth limitation. The primary concern with the IVF procedure is the poor quality of the embryo and egg, which leads to IVF failure. The increased risk of premature birth, maternal gestational diabetes, and placental complications are limiting the adoption rate among the people, which impedes market growth. The presence of limited knowledge regarding the benefits of IVF, a conservative approach, and concerns related to lengthy IVF procedures are major factors influencing people to avoid IVF treatment, restraining the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Reagents & Media, Instruments, Technology, End-Users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

CooperSurgical, Inc. (U.S.), Vitrolife AB (Sweden), Cook Medical, Inc. (U.S.), Irvine Scientific (U.S.), Thermo Fisher Scientific, Inc. (U.S.), EMD Serono, Inc. (U.S.), Genea Limited (Australia), ESCO Micro Pte. Limited (Singapore), IVFtech ApS (Denmark), and The Baker Company, Inc. (U.S.). |

SEGMENTAL ANALYSIS

By Reagents and Media

Based on reagents and media, the embryo culture media segment led the IVF market in 2024, accounting for 40.3% of the worldwide market share. Embryo culture media plays a vital role in the process of IVF. Embryo culture media provides a controlled environment for the development of embryos outside the body. Embryo culture media has experienced several advancements in the recent advancements in media formulations with focus being kept on optimizing embryo viability and implantation rates. Technological advancements and growing R&D activities of the market participants are majorly propelling the expansion of the embryo culture media segment in the IVF market. For instance, market participants such as Irvine Scientific, Cook Medical and Vitrolife are offering various embryo culture media formulations to address the needs of different patient profiles and IVF protocols.

The cryopreservation media segment is another lucrative segment and is expected to grow at a promising CAGR during the forecast period in the global IVF market. Cryopreservation is the most efficient process of freezing and storing cells. Freezing eggs and sperm helps overcome the problems of less fertility with aging and thus provides an option for parents who are not ready for kids yet but are hoping for children in the future. An increase in the demand for egg and sperm freezing services worldwide, rising acceptance of elective fertility preservation and technological innovations that enhance the efficiency and safety of cryopreservation procedures are majorly driving the growth of the cryopreservation media segment in the IVF market. Furthermore, technological advancements in cryopreservation media techniques, such as vitrification, the trend of delayed childbearing, and an increasing number of IVF clinics that offer cryopreservation services are further contributing to the growth of the cryopreservation media segment.

By Instruments Insights

Based on instruments, the imaging systems segment led the market worldwide in 2024 and held 23.9% of the global market share. The domination of the imaging systems segment is estimated to continue in the global market throughout the forecast period. Imaging systems help provide better patient care due to physicians' better understanding of the situation. The growth of the imaging systems segment is majorly driven by the continuous use of imaging systems during IVF procedures to judge the patient's condition. The rapid adoption of advanced imaging technologies such as ultrasound and time-lapse imaging systems that can enhance the precision and efficiency of IVF procedures and increasing advancements in imaging software are boosting the expansion of the imaging systems segment. Companies such as G.E. Healthcare, Fujifilm Holdings Corporation and Cook Medical have been putting significant efforts and investing hefty amounts to develop advanced imaging technologies, especially for IVF.

On the other hand, the sperm separation systems segment is another major segment in the IVF market and is expected to register the highest CAGR during the forecast period. The growing male population suffering from reduced sperm quality and increasing awareness of assistive reproduction technologies are contributing to the growth of the sperm separation systems segment. Sperm separation systems are used in reproductive technology such as ART such as artificial insemination, and IVF services. For instance, DxNow, Inc. won the U.S. FDA 510(K) approval for its Zymot ICSI and Zymot Multi-Sperm Separation Devices in March 2018.

By Technology Insights

Based on technology, the ICSI segment is currently leading the IVF market and accounted for 38.5% of the worldwide IVF market share in 2024. The growing male factor of infertility is primarily boosting the demand for ICSI procedures. For instance, male infertility has a share of 40% to 50% in the total number of infertility cases. The usage of ICSI is high in developed regions such as North America and Europe due to the favorable policies. Factors such as the high success rate of ICSI in overcoming male infertility issues such as low sperm count or poor sperm motility and advancements in ICSI techniques such as laser-assisted sperm selection and IMSI (Intracytoplasmic Morphologically Selected Sperm Injection) are majorly propelling the growth of the ICSI segment in the global IVF market.

The PGD segment is anticipated to be the fastest growing segment in the global IVF market during the forecast period based on technology. In regions such as North America and Europe, genetic screening for certain hereditary diseases is mandatory, which is favoring the expansion of the PGD segment in the global IVF market.

The Frozen Embryo Transfer/Replacement (FET/FER) segment is projected to perform well in the coming years.

By End-User Insights

Based on end-user, the fertility & surgical centers segment was the biggest segment in the global market and captured a share of 72.9% of the global market share in 2023 and the domination of the fertility and surgical centers segment is expected to continue throughout the forecast period. Fertility and surgical centers offer comprehensive care that includes diagnostics, consultations and advanced fertility treatments and provides specialized expertise and personalized care. The rising trend of medical tourism for IVF treatments, particularly in countries like India, Thailand and Spain and increasing investments from leading service providers such as Mayo Clinic, Cleveland Clinic and Shady Grove Fertility to employ advanced technologies to enhance success rates and patient satisfaction are fueling the expansion of the fertility & surgical centers segment in the global IVF market.

REGIONAL ANALYSIS

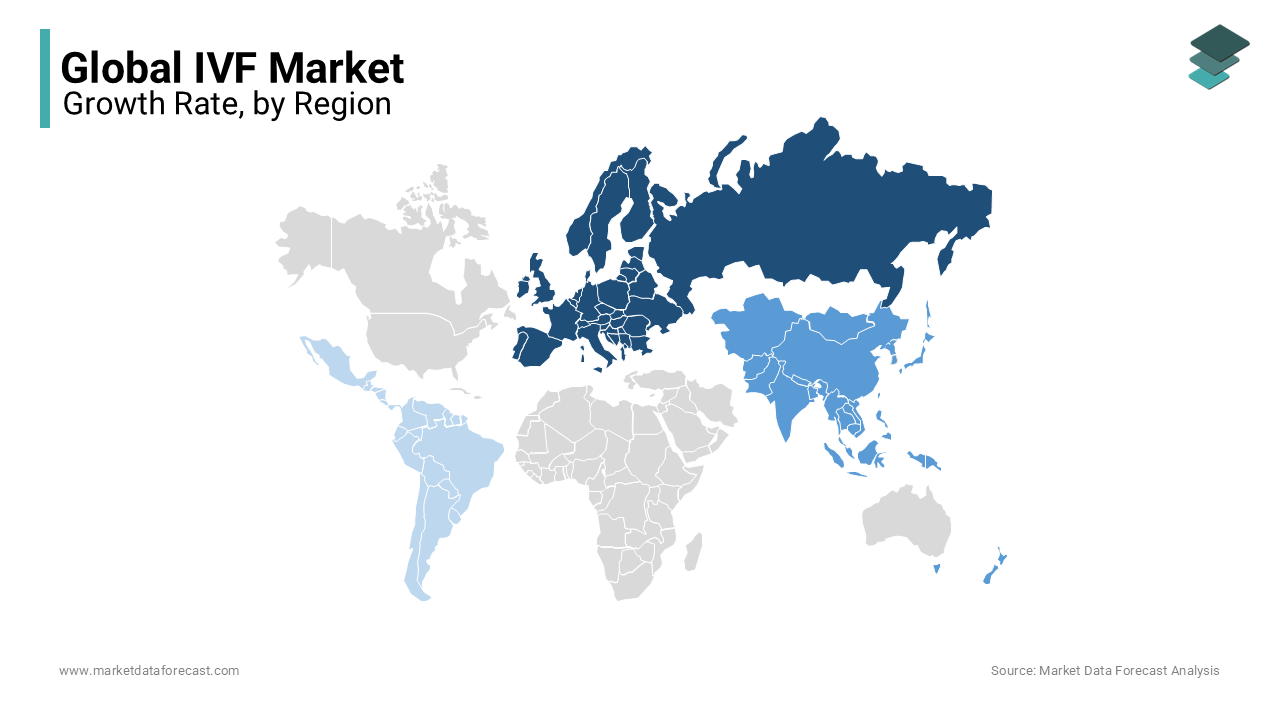

Europe was the biggest regional segment in the global market in 2024 and captured 37% of the global IVF market share in 2024. The growth of the European market is primarily driven by the rise in the prevalence of infertility and the increasing success rate of IVF treatment in countries such as Spain and Denmark. Europe has favorable regulations for infertility treatments, which is one the key factors propelling the European IVF market growth. European countries such as Denmark, Spain, and the Czech Republic have gained worldwide recognition as the popular destinations for fertility tourism and also have advanced facilities and relatively lower treatment costs. According to data published by the European Society for Human Reproduction and Embryology (ESHRE), the pregnancy rate per treatment in Europe was increased from 33.2% in 2023 to 34.7% in 2023. The presence of well-established healthcare systems and the availability of skilled healthcare professionals specializing in reproductive medicine across the European region are further promoting the growth of the Europe IVF market.

On the other hand, Asia-Pacific is estimated to grow at the highest CAGR of 18.4% during the forecast period. Asia Pacific accounted for the most significant number of IVF cycles performed in 2023 due to the large target population, low cost of treatment compared to developed regions and the availability of advanced technologies. The growing population with the changing lifestyle patterns that are resulting in delayed childbearing and the increasing number of initiatives from the governments of Asia-Pacific countries to promote fertility treatments are fueling the IVF market growth in the Asia-Pacific region. The fertility tourism market is on the rise in the Asia-Pacific, which is boosting the IVF market growth in this region. Japan, China, and India have been the main contributors to the region. Besides, the Singapore government is providing around 78% co-funding for various antiretroviral therapy procedures, such as in vitro fertilization (IVF), intrafallopian gamete transfer (GIFT), and intracytoplasmic sperm injection (ICSI).

The North American region is anticipated to account for a substantial global market share during the forecast period. The presence of several leading fertility centers offering cutting-edge technologies, favorable reimbursement policies, an increasing number of advancements in reproductive medicine, and R&D activities in assistive reproduction technologies are majorly driving the North American IVF market growth. The U.S. and Canada capture the majority of the North American market share due to the increasing number of IVF procedures being performed annually. An increasing number of R&D activities around assisted reproductive technologies in the U.S. is further boosting the growth of the U.S. IVF market.

Latin America is expected to project a moderate CAGR and MEA is estimated to register a sluggish growth rate during the forecast period.

KEY MARKET PLAYERS

Some of the notable participants operating in the global IVF market profiled in the report are CooperSurgical, Inc. (U.S.), Vitrolife AB (Sweden), Cook Medical, Inc. (U.S.), Irvine Scientific (U.S.), Thermo Fisher Scientific, Inc. (U.S.), EMD Serono, Inc. (U.S.), Genea Limited (Australia), ESCO Micro Pte. Limited (Singapore), IVFtech ApS (Denmark), and The Baker Company, Inc. (U.S.).

RECENT HAPPENINGS IN THE IVF MARKET

- In October 2022, Inception FertilityTM (Inception) announced today that its clinical research team has partnered with top technology companies on four fertility studies that will improve patient experience, advance fertility services, and improve pregnancy outcomes as part of its ongoing mission to lead advancements in reproductive science and medicine. A ground-breaking study conducted by OTO and Inception will examine the effects of stress on the success of IVF cycles. This study will provide a greater understanding of the relationship between stress and fertility, opening the door to potential novel treatments, services, and resources that will enhance the fertility journey and increase pregnancy rates and patient satisfaction.

- In November 2022, with its INVOcell® medical device and the intravaginal culture procedure it allows, INVO Bioscience, Inc., a commercial-stage fertility company, announced financial results for the third quarter that ended September 30, 2022, and gave a business update. $235,321 grew by 484% and 61% sequentially compared to the second quarter of 2022 from $40,303 in the previous year's third quarter. Revenue for the third quarter of 2021 totaled $218,874 with licensing income.

- In October 2022, Several macro variables, including the following, are driving up demand for reproductive treatments Same-sex couples are seeking services, people are beginning families later, and research suggests that male fertility has been progressively declining. In addition, after two years of research and development, Alife has released new artificial intelligence software to aid fertility clinics in optimizing and supporting clinical judgment throughout crucial IVF process phases.

- In November 2022, Co-op introduced a new leading colleague fertility treatment policy to coincide with the beginning of National Fertility Week. The policy offers flexible, unrestricted paid time off for employees to attend medical appointments while undergoing fertility treatment, including employees utilizing a surrogate, as part of the Co-goal op's to establish a truly inclusive workplace and achieve a fairer world for colleagues. The improved policy, which collaborates with Co-op unions and has the support of Fertility Matters at Work and Surrogacy U.K., offers a variety of flexible support.

- In August 2018, Thomson Medical announced IVF services in China in cooperation with assisted reproduction specialist IVI-RMA.

- In February 2018, In-vitro fertilization-focused machine learning company Univfy raised USD 6 million in Series funding. Univfy developed machine learning technology, which aims to reduce the financial burden on those affected by infertility.

MARKET SEGMENTATION

This research report on the global IVF market has been segmented and sub-segmented based on reagents and media, instruments, technology, end-users and region.

By Reagents and Media

- Embryo Culture Media

- Cryopreservation Media

- Sperm Processing Media

- Ovum Processing Media

By Instruments

- Imaging Systems

- Sperm Separation Systems

- Ovum Aspiration Pumps

- Incubators

- Micromanipulator Systems

- Cryptosystems

- Other Instruments (Gas Analyzers, Laser Systems and Accessories)

By Technology

- Intra-Cytoplasmic Sperm Injection (ICSI)

- Pre-Implantation Genetic Diagnosis (PGD)

- Frozen Embryo Transfer/Replacement (FET/FER)

- Other Technologies

By End Users

- Fertility and Surgical Centers

- Hospitals and Research Laboratories

- Cryobanks

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which region by technology led the IVF market in 2024?

The global IVF market size was valued at USD 3.73 billion in 2024.

Which region had the major share of the global IVF market in 2024?

Based on technology, the intracytoplasmic sperm injection segment dominated the IVF market in 2024.

Who are the major players in the IVF market?

Geographically, the European region led the IVF market in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]