Asia Pacific Acetic Acid Market Size, Share, Trends & Growth Forecast Report By Application (Vinyl Acetate Monomer, Purified Terephthalic Acid, Ester Solvents, Acetic Anhydride), End-use Industry (Plastics & Polymers, Food & Beverages, Adhesives, Paints and Coatings, Textile), and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC) – Industry Analysis From 2025 to 2033.

Asia Pacific Acetic Acid Market Size

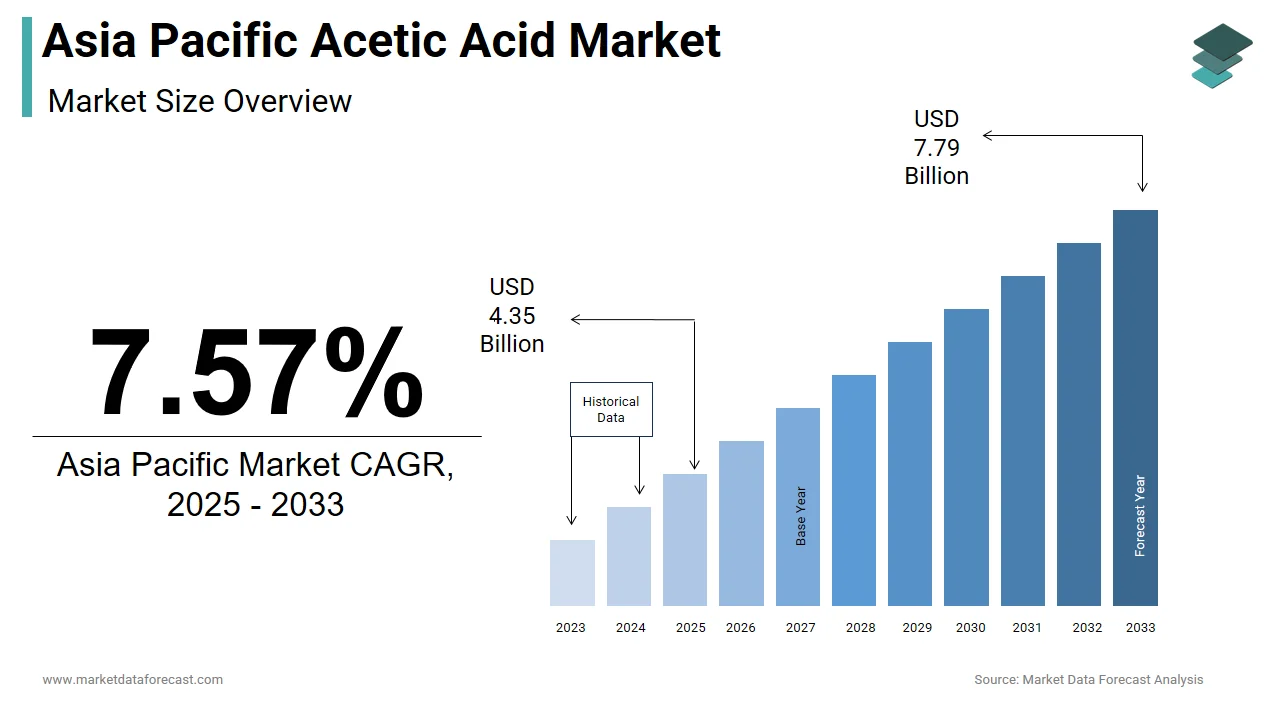

The size of the Asia Pacific acetic acid market was valued at USD 4.04 billion in 2024. This market is expected to grow at a CAGR of 7.57% from 2025 to 2033 and be worth USD 7.79 billion by 2033 from USD 4.35 billion in 2025.

Acetic acid, a versatile organic compound, serves as a critical raw material in the production of vinyl acetate monomer (VAM), purified terephthalic acid (PTA), and other derivatives essential for manufacturing adhesives, textiles, paints, and pharmaceuticals.

MARKET DRIVERS

Rising Demand for Purified Terephthalic Acid (PTA)

The surging demand for purified terephthalic acid (PTA) is a primary driver of the Asia Pacific acetic acid market, given its critical role as a precursor in polyester production. According to the International Council of Chemical Associations, polyester fibers account for over 50% of global fiber production, with the Asia Pacific region being the largest hub for textile manufacturing. Countries like China and India dominate this space, producing millions of tons of polyester annually, which directly increases the need for PTA. Acetic acid is an indispensable component in the production of PTA, as it acts as a solvent and catalyst during the manufacturing process.

Moreover, the growing urbanization and rising disposable incomes in the region have fueled consumer demand for affordable and durable clothing, further propelling polyester production. This trend is complemented by the expansion of packaging industries, which rely on PET bottles and films made from PTA. As polyester continues to replace traditional materials due to its cost-effectiveness and versatility, the demand for acetic acid is expected to grow proportionally, ensuring its prominence in the chemical supply chain.

Expansion of Vinyl Acetate Monomer (VAM) Applications

The increasing utilization of vinyl acetate monomer (VAM) in diverse industries is another significant driver of the Asia Pacific acetic acid market. Like, VAM derivatives such as polyvinyl acetate (PVA) and ethylene-vinyl acetate (EVA) copolymers are widely used in adhesives, paints, coatings, and construction materials. The booming infrastructure development in countries like China, India, and Indonesia has created a robust demand for these products, indirectly boosting acetic acid consumption. Furthermore, the automotive industry’s shift toward lightweight materials has amplified the use of EVA in vehicle interiors and components.

MARKET RESTRAINTS

Volatility in Raw Material Prices

One of the major restraints affecting the Asia Pacific acetic acid market is the volatility in raw material prices, particularly methanol and carbon monoxide, which are essential feedstocks for acetic acid production. Similarly, fluctuations in crude oil prices significantly impact methanol costs, as it is often derived from natural gas or coal. For instance, geopolitical tensions and supply chain disruptions have caused unpredictable price spikes, making it challenging for manufacturers to maintain stable production schedules.

In addition, as per the Asian Development Bank, the reliance on imported raw materials in countries like Japan and South Korea exacerbates cost pressures, reducing profit margins for producers. This instability not only affects pricing strategies but also discourages investments in capacity expansions. The unpredictability of raw material availability creates operational inefficiencies, hindering the market’s ability to meet growing demand consistently.

Environmental and Regulatory Challenges

Stringent environmental regulations pose another significant restraint to the Asia Pacific acetic acid market. According to the United Nations Framework Convention on Climate Change, the chemical industry is under increasing scrutiny for its carbon emissions and waste management practices. Acetic acid production, particularly through traditional petrochemical routes, generates substantial greenhouse gases and hazardous byproducts, prompting governments to impose strict emission limits and waste disposal norms. Moreover, the high costs associated with upgrading facilities to meet regulatory requirements often deter smaller players from entering the market.

MARKET OPPORTUNITIES

Adoption of Bio-Based Acetic Acid Production

The adoption of bio-based acetic acid presents a transformative opportunity for the Asia Pacific market which is aligning with global sustainability goals. According to the World Biotechnology Report, bio-based acetic acid is produced through fermentation processes using renewable feedstocks like sugarcane, corn, and agricultural waste. This eco-friendly alternative reduces reliance on fossil fuels and significantly lowers carbon emissions, addressing environmental concerns associated with conventional production methods.

Countries like Thailand and Malaysia, with abundant agricultural resources, are well-positioned to capitalize on this opportunity. As per the Food and Agriculture Organization, Thailand alone produces over 100 million tons of sugarcane annually, providing a sustainable source for bio-based acetic acid. Furthermore, government incentives promoting green chemistry, encourage investments in bio-based technologies.

Growth of Specialty Chemicals and Pharmaceuticals

The burgeoning specialty chemicals and pharmaceuticals sectors offer another promising opportunity for the Asia Pacific acetic acid market. Like, specialty chemicals, including solvents, intermediates, and catalysts, are witnessing rapid growth due to their applications in electronics, coatings, and healthcare. Acetic acid plays a crucial role in synthesizing these chemicals, driving demand in the region.

Moreover, acetic acid is extensively used in the production of active pharmaceutical ingredients (APIs) and drug formulations, making it indispensable for pharmaceutical manufacturers. Collaborations between chemical firms and pharmaceutical companies, as noted by the United Nations Industrial Development Organization, further amplify opportunities for innovation and market expansion.

MARKET CHALLENGES

Supply Chain Disruptions and Geopolitical Risks

Supply chain disruptions and geopolitical risks present significant challenges to the Asia Pacific acetic acid market, threatening operational continuity and market stability. Also, trade tensions and sanctions between major economies, such as the U.S. and China, have disrupted the flow of raw materials and intermediate goods essential for acetic acid production. For example, restrictions on exports of methanol and other feedstocks have created bottlenecks, forcing manufacturers to seek alternative suppliers at higher costs.

Limited Awareness About Sustainable Alternatives

Limited awareness about sustainable alternatives to conventional acetic acid production poses another challenge, hindering the adoption of eco-friendly technologies. Like, many small and medium enterprises (SMEs) in the Asia Pacific lack knowledge about bio-based and green chemistry solutions, opting instead for traditional methods due to familiarity and cost considerations. This gap in awareness impedes efforts to transition toward more sustainable practices. Furthermore, consumer education about the benefits of bio-based acetic acid remains inadequate, resulting in low demand for green products.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Application, End-Use Industry, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Mitsubishi Chemical Group Corporation (Japan), Shanghai Huayi (Group) Company (China), LyondellBasell Industries (Netherlands), Daicel Corporation (Japan), Jiangsu Sopo (Group) Co. Ltd. (China), Airedale Group (U.K.), Eastman Chemical Company (U.S.), Gujarat Narmada Valley Fertilizers & Chemicals Limited (India), Wacker Chemie AG (Germany), Celanese Corporation (U.S.), INEOS (U.K.)., and others. |

SEGMENTAL ANALYSIS

By Application Insights

The purified terephthalic acid (PTA) segment dominated the Asia Pacific acetic acid market with a 45% share and that is driven by its critical role in polyester production. Reports indicate that polyester fibers account for over 50% of global fiber production, with the Asia Pacific region leading in textile manufacturing. Countries like China and India are major contributors, producing millions of tons of polyester annually for clothing, packaging, and industrial applications. Acetic acid is indispensable in PTA synthesis, acting as both a solvent and catalyst during the esterification process.

The growing demand for PET bottles and films further amplifies this dominance. Similarly, the beverage industry’s shift toward sustainable packaging has increased the use of PET bottles, particularly in urban areas. For instance, in Southeast Asia, where plastic recycling rates remain low, the demand for virgin PET materials is rising, driving the need for PTA. Besides, the automotive industry’s adoption of lightweight materials, such as PET-based composites, shows the versatility of PTA derivatives.

The ester solvents segment is the fastest-growing application, registering a CAGR of 8.2% which is fueled by their expanding use in paints, coatings, and adhesives. These solvents enhance durability, adhesion, and resistance to environmental factors, making them indispensable for infrastructure projects.

Apart from these, as per the World Economic Forum, the rise of green building initiatives has increased the demand for water-based paints, which utilize bio-based ester solvents derived from acetic acid. This trend is particularly evident in countries like Japan and South Korea, where stringent environmental regulations mandate the use of eco-friendly materials. Moreover, the electronics industry’s expansion in Southeast Asia has boosted the use of ester solvents in cleaning agents and surface treatments.

By End-Use Industry Insights

The plastics and polymers segment represented the largest end-use industry in the Asia Pacific acetic acid market. It captured 35.8% of the total share in 2024. Also, the region’s dominance in polyester and polyvinyl acetate (PVA) production drives this demand, particularly in China and India, which are global leaders in polymer manufacturing. Urbanization and industrialization further amplify this dominance. As per the United Nations, the Asia Pacific region is home to over half of the world’s population, with urban areas experiencing rapid growth. This demographic shift increases the need for durable and cost-effective materials, such as PET bottles and PVA-based adhesives. In addition, the Asian Development Bank noted that government investments in infrastructure development have spurred demand for polymer-based products used in construction and packaging.

The food and beverages industry is the rapidly expanding end-use segment, with a CAGR of 9.1% This is driven by its increasing reliance on acetic acid as a preservative and flavoring agent. According to the Food and Agriculture Organization, the Asia Pacific region is the largest consumer of processed foods, accounting for a significant share of global consumption. Acetic acid, commonly used in vinegar production, plays a vital role in enhancing shelf life and taste, aligning with consumer preferences for convenience and safety.

Moreover, as brought to light by the World Health Organization, the growing awareness about food safety standards has prompted manufacturers to adopt high-quality preservatives, boosting demand for food-grade acetic acid. This shift is mainly evident in countries like Thailand and Vietnam, where agricultural exports are booming. Besides, the expansion of e-commerce platforms has increased the availability of packaged and preserved foods, further driving consumption.

COUNTRY LEVEL ANALYSIS

China led the Asia Pacific acetic acid market with a 40% share which reflecting its status as the world’s largest chemical producer. According to the International Council of Chemical Associations, China accounts for major portion of global chemical production, with acetic acid being a cornerstone of its industrial activities. The country’s massive textile and packaging industries drive demand for purified terephthalic acid (PTA) and vinyl acetate monomer (VAM), both of which rely heavily on acetic acid.

Government policies promoting self-sufficiency in chemical production further bolster the market. As per the Ministry of Industry and Information Technology, China has invested billions in upgrading its chemical infrastructure, including bio-based acetic acid facilities. Besides, the Belt and Road Initiative has facilitated exports to neighboring countries, strengthening China’s leadership in the regional market.

India held a notable market share, driven by its burgeoning textile and pharmaceutical industries. Also, the country is the world’s second-largest textile producer, creating significant demand for acetic acid in polyester production. Furthermore, India’s pharmaceutical sector relies on acetic acid for synthesizing active pharmaceutical ingredients (APIs).

As per the Ministry of Chemicals and Fertilizers, government initiatives like "Make in India" aim to boost domestic chemical manufacturing, reducing dependency on imports. Investments in renewable feedstock-based acetic acid production also align with India’s sustainability goals, positioning it as a key player in the regional market.

Japan remains a major player which is supported by its advanced technological capabilities and focus on sustainability. The nation’s emphasis on green chemistry propelled innovation in specialty chemicals and pharmaceuticals. Apart from these, Japan’s aging population fuels demand for healthcare products, further propelling the market.

South Korea commanded a notable market share. It was backed by its strong presence in the electronics and automotive industries. Also, the country is a global leader in semiconductor and display manufacturing, creating demand for acetic acid in cleaning agents and surface treatments. The government’s Green Growth Strategy promotes sustainable practices, encouraging investments in bio-based acetic acid production. As per the Ministry of Environment, South Korea aims to reduce industrial emissions by 20% by 2030, fostering innovation in eco-friendly chemical processes.

Thailand is a significant acetic acid player in the Asia-Pacific region that is supported by its robust agricultural sector and export-oriented economy. Similarly, Thailand is one of the largest producers of sugarcane and cassava, providing renewable feedstocks for bio-based acetic acid production. In addition, the country’s focus on sustainable agriculture aligns with global trends toward green chemistry. Further, Thailand’s strategic location facilitates trade with neighboring ASEAN countries, enhancing its market presence. Investments in biotechnological advancements further strengthen Thailand’s position in the Asia Pacific acetic acid market.

KEY MARKET PLAYERS

Companies dominating the Asia-Pacific acetic acid market profiled in this report are Mitsubishi Chemical Group Corporation (Japan), Shanghai Huayi (Group) Company (China), LyondellBasell Industries (Netherlands), Daicel Corporation (Japan), Jiangsu Sopo (Group) Co. Ltd. (China), Airedale Group (U.K.), Eastman Chemical Company (U.S.), Gujarat Narmada Valley Fertilizers & Chemicals Limited (India), Wacker Chemie AG (Germany), Celanese Corporation (U.S.), INEOS (U.K.)., and others.

TOP LEADING PLAYERS IN THE MARKET

Celanese Corporation

Celanese Corporation is a global leader in acetic acid production, with a strong presence in the Asia Pacific region. The company leverages its advanced manufacturing technologies and extensive distribution networks to meet the growing demand for acetic acid in industries such as textiles, packaging, and pharmaceuticals. Celanese’s focus on sustainability has led to investments in bio-based acetic acid production, aligning with regional and global environmental goals.

Eastman Chemical Company

Eastman Chemical Company is renowned for its innovative solutions in the acetic acid market, particularly in the Asia Pacific region. The company specializes in producing high-purity acetic acid for applications in food, pharmaceuticals, and specialty chemicals. Eastman’s commitment to sustainability is evident in its adoption of circular economy principles, where waste streams are converted into valuable resources. Through strategic partnerships with local manufacturers and research institutions, Eastman enhances its product offerings and strengthens its market position.

Sinopec Group

Sinopec Group, a leading Chinese conglomerate, plays a pivotal role in the Asia Pacific acetic acid market through its vast production capabilities and integration across the chemical value chain. The company’s emphasis on self-sufficiency and innovation has enabled it to produce cost-effective and sustainable acetic acid solutions. Sinopec actively invests in bio-based feedstocks and advanced recycling technologies, reducing its carbon footprint while meeting industrial demands.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Investment in Sustainable Technologies

Key players are prioritizing investments in sustainable technologies to address environmental concerns and meet regulatory requirements. For instance, companies are adopting bio-based feedstocks and renewable energy sources to reduce their reliance on fossil fuels. These efforts not only enhance operational efficiency but also align with global sustainability goals, fostering consumer trust and loyalty.

Expansion of Regional Footprints

To strengthen their market presence, companies are expanding their regional footprints through strategic acquisitions and partnerships. Collaborations with local manufacturers and distributors ensure better access to raw materials and end-use industries, enabling firms to cater to diverse customer needs. Also, establishing production facilities in emerging markets allows companies to capitalize on cost advantages and tap into untapped growth opportunities, enhancing their competitiveness in the Asia Pacific region.

Focus on Product Innovation and Diversification

Product innovation and diversification are critical strategies for staying ahead in the acetic acid market. Companies are investing in research and development to create high-performance derivatives tailored to specific applications, such as specialty chemicals and pharmaceuticals. By offering a wide range of products, firms can address evolving customer preferences and emerging trends, ensuring long-term relevance and growth.

COMPETITION OVERVIEW

The Asia Pacific acetic acid market is characterized by intense competition, driven by the convergence of industrial growth, technological advancements, and sustainability trends. Established players leverage their expertise in chemical manufacturing and extensive distribution networks to maintain dominance, while emerging companies introduce innovative solutions to capture niche segments. The market landscape is shaped by collaborations between private firms, governments, and research institutions, fostering a collaborative approach to tackling environmental challenges. Regulatory pressures and consumer demand for eco-friendly products have heightened rivalry, pushing companies to adopt aggressive strategies such as mergers, acquisitions, and partnerships. Additionally, the race to achieve cost-effective and scalable production methods has further intensified competitive dynamics.

RECENT MARKET DEVELOPMENTS

- In January 2024, Celanese Corporation launched a bio-based acetic acid facility in China, focusing on renewable feedstocks to support sustainable growth and meet regional demand.

- In March 2024, Eastman Chemical Company partnered with a Japanese biotech firm to develop a novel fermentation process for producing eco-friendly acetic acid, enhancing its product portfolio.

- In May 2024, Sinopec Group acquired a stake in an Indonesian chemical startup, gaining access to proprietary technologies for converting agricultural waste into bio-based acetic acid.

- In July 2024, a South Korean chemical manufacturer introduced a carbon-neutral acetic acid product line, certified by international environmental organizations, to cater to the growing demand for sustainable chemicals.

- In September 2024, a Thai agrochemical firm signed a memorandum of understanding with a government agency to establish a pilot project for recycling industrial waste into acetic acid, promoting circular economy principles.

MARKET SEGMENTATION

This Asia Pacific acetic acid market research report is segmented and sub-segmented into the following categories.

By Application

- Vinyl Acetate Monomer (VAM)

- Purified Terephthalic Acid (PTA)

- Ester Solvents

- Acetic Anhydride

- Others

By End-use Industry

- Plastics & Polymers

- Food & Beverages

- Adhesives, Paints, and Coatings

- Textile

- Others

By Application

- Semiconductor

- Nanotechnology

- Electronics

By End User

- Industrial

- Research Institutes

- Blood Bank

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives growth in the Asia Pacific acetic acid market?

Growth is driven by demand in textiles, paints, coatings, plastics, and packaging industries, especially for polyester and vinyl acetate monomer production.

2. What challenges affect the Asia Pacific acetic acid market?

Challenges include raw material price volatility, supply chain disruptions, and stringent environmental regulations impacting production costs.

3. What opportunities exist in the Asia Pacific acetic acid market?

Opportunities lie in bio-based acetic acid, expanding specialty chemical applications, and rising demand from pharmaceuticals and sustainable packaging sectors.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com