Asia Pacific Animal Feed Additives Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Product, Source, Form Livestock And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Animal Feed Additives Market Size

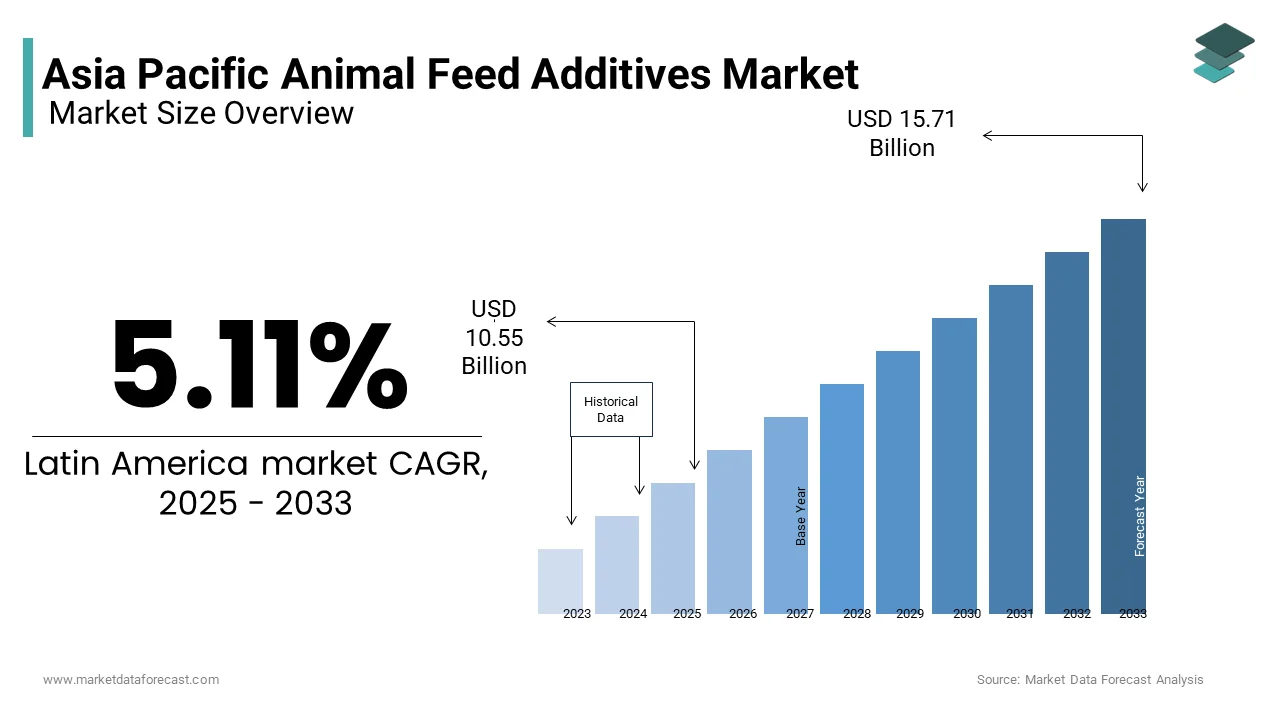

The Asia Pacific animal feed additives market size was valued at USD 10.03 billion in 2024 and is anticipated to reach USD 10.55 billion in 2025 from USD 63.14 billion by 2033, growing at a CAGR of 5.11% during the forecast period from 2025 to 2033.

Animal feed additives play a pivotal role in ensuring optimal animal health, productivity, and food safety. Animal feed additives are substances incorporated into animal diets to enhance nutritional value, improve digestion, boost immunity, or preserve feed quality. These additives include vitamins, amino acids, enzymes, probiotics, antioxidants, and antimicrobial agents, among others. The region’s rapid urbanization and growing population have significantly increased demand for high-quality animal protein, with per capita meat consumption in countries like China and India rising by nearly 30% over the past decade according to the Food and Agriculture Organization (FAO). This surge underscores the critical need for advanced feed solutions to meet production demands sustainably. For instance, the Asia Pacific region accounts for approximately 60% of global livestock production, making it a focal point for innovations in feed technology. The region's diverse agricultural ecosystems, coupled with increasing awareness about sustainable farming practices, have fueled the adoption of specialized feed additives. For instance, the use of enzyme-based additives has gained traction due to their ability to reduce feed wastage and improve nutrient absorption. Furthermore, regulatory frameworks promoting antibiotic-free livestock farming have accelerated the shift toward natural and non-therapeutic additives.

MARKET DRIVERS

Rising Demand for High-Quality Protein Sources

The escalating demand for animal-based protein across the Asia Pacific region is one of the key factors driving the growth of the animal feed additives market in Asia-Pacific. As per the International Livestock Research Institute (ILRI), the region consumes over 50% of the world’s total meat and dairy products, with projections indicating a 20% increase in demand by 2030. This surge is attributed to changing dietary habits, particularly in urban areas, where consumers increasingly prioritize protein-rich diets. To meet this demand, livestock farmers are compelled to adopt advanced feed formulations that enhance animal growth rates and meat quality. For instance, amino acid supplements such as lysine and methionine are extensively used to optimize feed conversion ratios, enabling farmers to achieve higher yields without expanding resource inputs. According to a study by the Global Agricultural Information Network (GAIN), the inclusion of amino acids in poultry diets has been shown to improve weight gain by up to 15%, while reducing nitrogen excretion by 20%. Such outcomes not only address economic concerns but also align with growing environmental sustainability goals. The proliferation of organized retail chains offering premium meat products further amplifies the need for superior feed additives, creating a robust market ecosystem driven by consumer expectations and industry innovation.

Growing Focus on Disease Prevention and Animal Health

The rising emphasis on disease prevention and animal health that are spurred by frequent outbreaks of zoonotic diseases is further boosting the expansion of the animal feed additives market in Asia-Pacific. For instance, the Asia Pacific region has witnessed an annual increase of 5% in livestock disease incidents over the past five years. This trend has necessitated the integration of health-promoting feed additives, such as probiotics, prebiotics, and organic acids, into animal diets. Probiotics, for example, have gained prominence due to their ability to enhance gut microbiota balance, thereby improving immune responses. A report by the International Probiotics Association states that the use of probiotics in livestock can reduce mortality rates by up to 10% and lower antibiotic dependency by 25%. Additionally, governments across the region are implementing stringent regulations to curb the use of antibiotics in animal farming, further propelling the adoption of alternative feed solutions. For instance, China’s Ministry of Agriculture has mandated the complete phase-out of antibiotic growth promoters by 2025, accelerating the shift toward natural additives. This regulatory push, combined with the increasing awareness of animal welfare, underscores the critical role of feed additives in safeguarding livestock health and ensuring sustainable production practices.

MARKET RESTRAINTS

Fluctuating Raw Material Costs

One significant restraint hindering the growth of the Asia Pacific animal feed additives market is the volatility in raw material prices. Key ingredients such as soybean meal, corn, and fishmeal that form the backbone of many feed additive formulations, are subject to price fluctuations due to climatic conditions, geopolitical tensions, and supply chain disruptions. According to the United Nations Conference on Trade and Development (UNCTAD), the cost of soybean meal, a critical source of protein in feed, surged by 40% in 2022 alone due to droughts in major producing countries like Brazil and Argentina. Such price spikes directly impact the affordability of feed additives, particularly for small-scale farmers who dominate the livestock sector in countries like India and Vietnam. A study by the Asian Development Bank highlights that nearly 70% of livestock farmers in Southeast Asia operate on marginal profit margins, making them highly sensitive to input cost variations. Consequently, the unpredictability of raw material costs creates a barrier to consistent adoption of advanced feed additives, limiting market expansion. Furthermore, the lack of local substitutes for imported raw materials exacerbates the situation, leaving producers vulnerable to global market dynamics and undermining long-term investment in innovative feed solutions.

Regulatory Fragmentation Across Countries

The fragmented regulatory landscape governing the use of animal feed additives across the Asia Pacific region is further impeding the animal feed additives market growth in Asia-Pacific. While some countries have established comprehensive frameworks, others lag behind in standardizing guidelines, leading to inconsistencies in product approvals and usage restrictions. According to the World Trade Organization (WTO), discrepancies in maximum residue limits (MRLs) for certain additives like antibiotics and synthetic vitamins create hurdles for multinational companies seeking to introduce new products across multiple markets. For instance, Japan enforces stringent MRLs for copper additives, while neighbouring countries like Thailand and Indonesia have more lenient thresholds. This regulatory divergence complicates compliance efforts and increases operational costs for manufacturers, discouraging innovation and market entry. Moreover, as per the Food Safety and Standards Authority of India (FSSAI), delays in regulatory approvals for novel feed additives can extend up to two years in some cases, stifling timely market access. The absence of harmonized standards not only impedes trade but also undermines consumer confidence in the safety and efficacy of feed additives, posing a significant challenge to market growth in the region.

MARKET OPPORTUNITIES

Expansion of Organic and Natural Feed Additives

The growing demand for organic and natural feed solutions is one of the biggest opportunities in the Asia Pacific animal feed additives market. As per the Organic Trade Association, the global organic livestock sector is projected to grow at a compound annual growth rate (CAGR) of 12% through 2030, with the Asia Pacific region leading this transformation. Consumers are increasingly gravitating toward organic meat and dairy products, driven by heightened awareness of health and environmental sustainability. This trend has catalyzed the development of natural feed additives such as plant extracts, essential oils, and microbial cultures, which serve as alternatives to synthetic chemicals. For instance, studies conducted by the Indian Council of Agricultural Research indicate that phytogenic feed additives derived from herbs like turmeric and neem can enhance antioxidant activity in poultry by up to 30%, while reducing oxidative stress. Furthermore, government initiatives promoting organic farming, such as China’s National Organic Product Certification Scheme, provide a conducive environment for the adoption of these additives. With over 40% of Asia’s agricultural land now transitioning to organic practices, there is immense potential for manufacturers to capitalize on this shift by developing tailored solutions that cater to niche markets, fostering both profitability and ecological balance.

Technological Advancements in Precision Nutrition

The second major opportunity stems from technological advancements enabling precision nutrition in livestock farming. As per the International Center for Agricultural Research in the Dry Areas (ICARDA), the integration of digital tools such as artificial intelligence (AI) and big data analytics is revolutionizing feed formulation processes. These technologies allow for the customization of feed additives based on specific animal needs, optimizing nutrient delivery and minimizing waste. For example, AI-driven platforms can analyze real-time data on animal health, genetics, and environmental conditions to recommend precise dosages of vitamins and minerals, enhancing overall productivity. According to the Australian Department of Agriculture, Water and the Environment, farms utilizing precision nutrition techniques have reported a 25% reduction in feed costs while achieving a 15% improvement in growth rates. Additionally, the advent of blockchain technology ensures traceability and transparency in the supply chain, bolstering consumer trust in feed additive quality. With the Asia Pacific region investing heavily in smart agriculture infrastructure, the convergence of technology and animal nutrition presents a lucrative avenue for innovation and market differentiation, positioning precision nutrition as a cornerstone of future growth.

MARKET CHALLENGES

Limited Awareness Among Small-Scale Farmers

One of the significant challenges for the animal feed additives in Asia-Pacific is the limited awareness and understanding of advanced feed solutions among small-scale farmers, who constitute a substantial portion of the region’s livestock producers. According to the Consultative Group on International Agricultural Research (CGIAR), approximately 85% of livestock farmers in South Asia operate on smallholdings, often lacking access to technical knowledge and resources. Many of these farmers rely on traditional feeding practices, using locally sourced materials without incorporating scientifically formulated additives. This gap in awareness is compounded by inadequate extension services and training programs, leaving farmers ill-equipped to evaluate the benefits of modern feed technologies. For instance, a survey conducted by the Philippine Department of Agriculture revealed that less than 30% of small-scale poultry farmers were familiar with the advantages of probiotic additives in improving flock health. The absence of targeted educational campaigns and financial incentives further impedes adoption, creating a disconnect between technological advancements and grassroots implementation. Bridging this knowledge divide remains a critical challenge for stakeholders aiming to unlock the full potential of the feed additives market in the region.

Environmental Concerns and Sustainability Pressures

The mounting scrutiny over the environmental impact of animal feed additives, particularly those derived from non-renewable resources or linked to greenhouse gas emissions is another major challenge for the Asia-Pacific animal feed additives market. According to the Intergovernmental Panel on Climate Change (IPCC), livestock farming contributes approximately 14.5% of global greenhouse gas emissions, with feed production accounting for a significant share. Additives such as synthetic amino acids and chemical preservatives often require energy-intensive manufacturing processes, raising concerns about their carbon footprint. For instance, the production of methionine, a widely used feed additive, generates an estimated 2.5 kilograms of CO2 equivalent per kilogram of product. Additionally, the improper disposal of leftover feed additives can lead to soil and water contamination, further exacerbating environmental degradation. As per the Environmental Defense Fund, regulatory bodies in countries like Australia and New Zealand are increasingly imposing stricter emission targets and waste management protocols, compelling manufacturers to adopt greener practices. Balancing the need for high-performance additives with sustainable production methods poses a formidable challenge, requiring significant investment in eco-friendly alternatives and lifecycle assessments to mitigate adverse ecological impacts.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.11% |

|

Segments Covered |

By Product, Source, Form, Livestock, And Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC |

|

Market Leaders Profiled |

Cargill, Inc, Danisco Animal Nutrition, Koninklijke DSM NV, BASF SE, Archer Daniels Midland Company, Nutreco NV, Evonik Industries AG, Addcon Group, KeminIndustries Inc, Aliphos Belgium SA, Alltech, Inc, Phibro Animal Health Corporation, Ajinomoto Co., Inc, Biomin, Adisseo France SAS. |

SEGMENT ANALYSIS

By Product Type Insights

The vitamins segment had the leading share of 26.1% of the Asia Pacific animal feed additives market in 2024. The critical role that vitamins play in ensuring optimal animal health and performance is majorly contributing to the dominance of vitamins segment in the Asia-Pacific market. Vitamins such as A, D3, and E are indispensable for immune function, bone development, and antioxidant activity, making them integral to livestock diets. The growing awareness among farmers about the economic benefits of vitamin supplementation is further boosting the expansion of the vitamins segment in the Asia-Pacific market. According to the Food and Agriculture Organization (FAO), vitamin-enriched feeds can enhance livestock productivity by up to 15%, reducing mortality rates and improving meat and milk quality. Additionally, regulatory frameworks mandating minimum nutritional standards have further solidified the demand for vitamins. For instance, China’s Ministry of Agriculture has enforced guidelines requiring fortified feeds for poultry and swine, boosting vitamin consumption. Another contributing factor is the rising adoption of intensive farming practices, which necessitate nutrient-rich diets to counteract stress-related deficiencies. The proliferation of contract farming models in countries like India and Vietnam has also amplified the accessibility of vitamin-based additives, fostering widespread adoption.

The phytogenics segment is projected to grow at a remarkable CAGR of 9.9% over the forecast period owing to the growing preference for natural and sustainable feed solutions. Phytogenic additives, derived from herbs, spices, and essential oils, offer multifunctional benefits, including antimicrobial, anti-inflammatory, and digestive enhancement properties. As per the Indian Council of Agricultural Research, phytogenics have been shown to improve feed efficiency by 10-12% while reducing reliance on synthetic antibiotics. The phase-out of antibiotic growth promoters in countries like South Korea and Australia has created a fertile ground for phytogenic adoption. Furthermore, consumer-driven demand for organic and residue-free animal products has incentivized manufacturers to invest in phytogenic research and development. For example, farms using phytogenic additives have witnessed a 20% increase in premium product sales in Japan. The convergence of regulatory support, technological advancements, and shifting consumer preferences positions phytogenics as the fastest-growing segment in the region.

By Source Insights

The synthetic feed additives segment dominated the Asia Pacific market by accounting for 66.7% of the regional market share in 2024. The leading position of synthetic feed additives segment in the Asia-Pacific market is attributed to their cost-effectiveness and consistent efficacy compared to natural alternatives. Synthetic additives such as amino acids, vitamins, and preservatives are mass-produced through advanced chemical processes, ensuring scalability and affordability. According to the Asian Development Bank, synthetic additives reduce feed formulation costs by up to 30%, making them particularly attractive for small-scale farmers operating on tight budgets. Additionally, the robust supply chain infrastructure for synthetic products in industrialized nations like China and Japan further bolsters their market position. Government subsidies and incentives for synthetic additive manufacturers have also contributed to their widespread availability. For instance, Thailand’s Department of Industrial Promotion provides tax breaks to companies producing synthetic methionine, a critical feed additive. The established regulatory framework favoring synthetic additives, coupled with their proven track record in enhancing animal productivity, ensures their continued leadership in the market.

The natural feed additives segment is poised to grow at a CAGR of 11.4% over the forecast period owing to the escalating demand for clean-label and organic animal products. Consumers are increasingly scrutinizing the origins of their food, prompting livestock producers to adopt natural additives such as plant extracts, probiotics, and organic acids. According to the Australian Department of Agriculture, farms using natural additives have reported a 25% reduction in antibiotic usage while maintaining comparable productivity levels. Regulatory bodies in the region, such as India’s FSSAI, are promoting the use of natural additives to align with global sustainability goals. Moreover, the rise of e-commerce platforms has facilitated direct-to-consumer sales of natural feed solutions, enabling smaller manufacturers to penetrate niche markets. For example, Malaysia’s GreenFeed initiative has successfully introduced herbal-based additives to over 1,000 smallholder farmers, achieving a 15% increase in livestock yield. The synergy between consumer trends, regulatory support, and innovative distribution channels propels the natural segment’s exponential growth.

By Form Insights

The dry feed additives segment held the lion’s share of the Asia Pacific market by capturing 68.7% of the regional market share in 2024. The dominating position of dry feed additives segment in the Asia-Pacific market is primarily due to their superior shelf life and ease of storage, which make them ideal for regions with limited cold chain infrastructure. Dry additives, including powders and granules, are widely used in rural areas where logistical challenges often hinder the adoption of liquid alternatives. A study by the Philippine Department of Agriculture highlights that dry additives reduce spoilage rates by up to 40%, ensuring consistent quality and efficacy. Additionally, the versatility of dry formulations allows for seamless integration into various feed types, catering to diverse livestock species. For instance, dry probiotics have gained traction in India’s poultry sector, with over 60% of farmers reporting improved flock health. The proliferation of contract manufacturing facilities in China and Vietnam has further strengthened the supply chain for dry additives, driving their widespread adoption across the region.

The liquid feed additives segment is projected to grow at a CAGR of 8.78% over the forecast period due to the advancements in formulation technologies that enhance bioavailability and absorption rates. Liquid additives, such as enzyme blends and acidifiers, are gaining popularity for their ability to deliver nutrients more efficiently than dry counterparts. For instance, liquid additives improve nutrient utilization by up to 20%, resulting in higher weight gain and reduced feed wastage. The urbanization trend in countries like Indonesia and Thailand has led to the establishment of large-scale commercial farms, where liquid additives are preferred for their precision dosing capabilities. Additionally, government initiatives promoting sustainable farming practices have encouraged the use of liquid phytogenics and probiotics. For example, South Korea’s Ministry of Agriculture has partnered with local manufacturers to develop eco-friendly liquid additives, achieving a 30% reduction in greenhouse gas emissions. The combination of technological innovation and regulatory support positions liquid additives as the fastest-growing form in the market.

By Livestock Insights

The poultry segment captured the leading share of the Asia-Pacific animal feed additives market in 2024. The prominent position of poultry segment in the Asia-Pacific market is attributed to the region’s insatiable appetite for poultry products, with per capita chicken consumption in countries like China and India increasing by 25% over the past decade. The high protein content and affordability of poultry meat make it a dietary staple, fueling demand for advanced feed additives. For instance, the inclusion of enzymes and amino acids in poultry diets has been shown to enhance feed conversion ratios by up to 15%, significantly boosting profitability. Additionally, the prevalence of vertically integrated poultry operations in countries like Thailand and Vietnam has streamlined the adoption of specialized additives. For instance, Charoen Pokphand Foods, a leading poultry producer in Thailand, incorporates customized feed additives to achieve a 10% reduction in production costs. The alignment of consumer preferences, operational efficiencies, and industry consolidation cements poultry’s leadership in the feed additives market.

The aquaculture segment is emerging as the fastest-growing segment and is predicted to witness a CAGR of 10.8% over the forecast period due to the rising demand for seafood, driven by its reputation as a healthy and sustainable protein source. Countries like Indonesia and Vietnam are investing heavily in aquaculture infrastructure, creating a conducive environment for feed additive innovation. For example, the Indonesian Ministry of Marine Affairs reports that the use of probiotic additives in shrimp farming has increased survival rates by 20%, while reducing disease incidence. Additionally, the shift toward recirculating aquaculture systems (RAS) in Australia and New Zealand has heightened the need for specialized additives that optimize water quality and nutrient delivery. According to the Australian Seafood Cooperative Research Centre, farms utilizing enzyme-based additives have achieved a 25% improvement in feed efficiency. The convergence of technological advancements, regulatory support, and consumer demand positions aquaculture as the most dynamic segment in the market.

COUNTRY ANALYSIS

Top 5 Leading Countries in this Market

China occupied the leading share of 33.7% of the Asia-Pacific animal feed additives market in 2024. The dominance of China in the Asia-Pacific market is underpinned by its status as the world’s largest livestock producer, with an annual output exceeding 800 million metric tons. The government’s push for modernization in agriculture, exemplified by initiatives like the “Made in China 2025” plan, has spurred investments in advanced feed technologies. For instance, China’s feed additive imports grew by 18% in 2022, reflecting the increasing adoption of imported vitamins and amino acids. Additionally, the proliferation of large-scale pig farms has driven demand for specialized additives, with over 70% of swine producers incorporating lysine supplements to enhance growth rates. The integration of digital tools in feed formulation has further bolstered China’s leadership, positioning it as a hub for innovation and scale.

India is another promising market for animal feed additives in the Asia-Pacific region. The burgeoning livestock sector in India that supported by programs like the Rashtriya Gokul Mission has catalyzed the adoption of feed additives, which is one of the key factors propelling the Indian animal feed additives market growth. According to the National Dairy Development Board, India’s dairy industry alone accounts for 22% of global milk production, creating a robust demand for nutrient-rich additives. Smallholder farmers, who constitute 80% of the livestock workforce, are increasingly adopting cost-effective solutions such as phytogenics and probiotics. For instance, farms using herbal additives have reported a 15% reduction in disease incidence. Furthermore, the government’s focus on doubling farmers’ incomes by 2025 has incentivized the use of fortified feeds, driving market expansion.

Japan is likely to account for a notable share of the Asia-Pacific animal feed additives market over the forecast period. The emphasis of Japan on high-quality animal products is majorly driving the Japanese market growth. The stringent food safety regulations of Japan have mandated the use of natural and organic additives, fostering innovation in phytogenics and probiotics. For instance, organic livestock farms using natural additives have witnessed a 30% increase in premium product sales. Additionally, Japan’s aging population has heightened demand for health-conscious options, encouraging the adoption of omega-3 enriched feeds for poultry and aquaculture. The government’s subsidies for sustainable farming practices have further reinforced Japan’s position as a leader in premium feed solutions.

South Korea is predicted to witness a healthy CAGR in the Asia-Pacific market over the forecast period due to its advanced agricultural infrastructure and focus on technological integration. The livestock sector of South Korea is characterized by high-tech farms that utilize precision nutrition techniques, driving demand for enzyme-based and liquid additives. According to the Korean Ministry of Agriculture, the adoption of smart feeding systems has increased feed efficiency by 25%. Additionally, the phase-out of antibiotic growth promoters has accelerated the shift toward alternative additives, with over 60% of poultry farms now using probiotics. The convergence of policy support and technological advancements positions South Korea as a key player in the regional market.

Australia and New Zealand are expected to do well in this regional market over the forecast period owing to their strong focus on sustainable and export-oriented livestock production. The stringent environmental regulations of these countries have incentivized the use of eco-friendly additives, such as phytogenics and organic acids. For instance, farms using enzyme-based additives have achieved a 20% reduction in greenhouse gas emissions. Additionally, the region’s reputation for high-quality dairy and meat products has fostered demand for premium feed solutions. The integration of blockchain technology ensures traceability, further enhancing consumer trust and market competitiveness.

KEY MARKET PLAYERS

Cargill, Inc, Danisco Animal Nutrition, Koninklijke DSM NV, BASF SE, Archer Daniels Midland Company, Nutreco NV, Evonik Industries AG, Addcon Group, KeminIndustries Inc, Aliphos Belgium SA, Alltech, Inc, Phibro Animal Health Corporation, Ajinomoto Co., Inc, Biomin, Adisseo France SAS. are the market players that are dominating the Asia Pacific animal feed additives market.

Top Players in the Market

Cargill Incorporated

Cargill is a global leader in the animal feed additives market, with a strong foothold in the Asia Pacific region. The company’s extensive portfolio includes vitamins, amino acids, and probiotics tailored to meet the diverse needs of livestock farmers. Cargill has contributed significantly to the global market by pioneering innovations in precision nutrition, enabling livestock producers to optimize feed efficiency. Its commitment to sustainability is evident through initiatives promoting antibiotic-free farming practices, aligning with regional regulatory trends. Additionally, Cargill’s robust supply chain infrastructure ensures consistent product availability, reinforcing its leadership position.

Evonik Industries AG

Evonik Industries is renowned for its expertise in amino acids and enzyme-based additives, catering to the growing demand for high-performance feed solutions in the Asia Pacific. The company’s research-driven approach has led to the development of advanced formulations that enhance animal health and productivity. Evonik’s contributions to the global market extend beyond product innovation; it actively collaborates with governments and industry stakeholders to promote sustainable livestock practices. By focusing on eco-friendly solutions, Evonik continues to set benchmarks in feed additive quality and performance.

BASF SE

BASF SE is a key player in the Asia Pacific animal feed additives market, offering a wide range of products, including vitamins, carotenoids, and antioxidants. The company’s emphasis on research and development has enabled it to introduce cutting-edge solutions that address evolving consumer preferences. BASF’s global influence is bolstered by its commitment to transparency and traceability, ensuring compliance with stringent food safety regulations. Through strategic partnerships with regional distributors, BASF has strengthened its market presence while fostering innovation in sustainable feed technologies.

Top Strategies Used By Key Players In The Market

Strategic Collaborations and Partnerships

Key players in the Asia Pacific market have increasingly focused on forming strategic collaborations with local distributors, research institutions, and government bodies. These partnerships enable companies to penetrate underserved markets, gain insights into regional requirements, and co-develop innovative solutions. For instance, alliances with agricultural universities have facilitated the customization of feed additives to suit specific livestock species and climatic conditions, enhancing product efficacy and adoption rates.

Emphasis on Sustainability and Eco-Friendly Solutions

Sustainability has emerged as a cornerstone strategy for leading companies seeking to strengthen their market position. By investing in the development of natural and organic feed additives, these players cater to the rising demand for clean-label animal products. Additionally, they adopt environmentally friendly manufacturing processes and advocate for responsible farming practices, aligning with regional regulatory frameworks and consumer expectations. This focus on sustainability not only enhances brand reputation but also fosters long-term customer loyalty.

Expansion of Production Facilities and Distribution Networks

To meet the escalating demand for feed additives, companies are expanding their production capacities and distribution networks across the Asia Pacific region. Establishing localized manufacturing units reduces logistical challenges and ensures timely delivery of products. Furthermore, enhancing distribution channels, particularly in rural areas, enables companies to reach small-scale farmers who form a significant portion of the livestock sector. This strategy strengthens market penetration and solidifies competitive advantage.

COMPETITION OVERVIEW

The Asia Pacific animal feed additives market is characterized by intense competition, driven by the presence of both global giants and regional players striving to capture market share. Leading companies leverage their technological expertise and extensive R&D capabilities to introduce innovative products that cater to evolving consumer demands. The market landscape is further shaped by regulatory dynamics, with stringent standards promoting the adoption of natural and sustainable additives. Regional players often focus on niche segments, offering cost-effective solutions tailored to local needs, thereby challenging the dominance of multinational corporations. Strategic initiatives such as mergers, acquisitions, and partnerships are prevalent, enabling companies to consolidate their positions and expand their geographic reach. Additionally, the growing emphasis on sustainability and digital transformation has intensified rivalry, as firms strive to differentiate themselves through eco-friendly offerings and precision nutrition technologies. This competitive environment fosters innovation and drives continuous advancements in the feed additives sector.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Cargill Incorporated launched a new line of phytogenic feed additives in India, aimed at enhancing gut health and reducing reliance on antibiotics. This initiative strengthened its position in the rapidly growing natural additives segment.

- In June 2023, Evonik Industries AG expanded its production facility in China to increase the output of amino acids and enzymes. This move was designed to meet the surging demand for high-performance feed solutions in the Asia Pacific region.

- In August 2023, BASF SE partnered with a leading agricultural research institute in Thailand to develop customized feed formulations for aquaculture. This collaboration reinforced its commitment to addressing regional livestock challenges.

- In October 2023, ADM Animal Nutrition acquired a regional distributor in Vietnam to enhance its distribution network and improve accessibility to rural livestock farmers. This acquisition bolstered its market presence in Southeast Asia.

- In December 2023, Nutreco NV introduced a digital platform in Australia to provide real-time insights into feed formulation and additive usage. This innovation positioned the company as a leader in precision nutrition technologies.

MARKET SEGMENTATION

This research report on the Asia Pacific animal feed additives market is segmented and sub-segmented into the following categories.

By Product

- Vitamins

- Antibiotics

- Feed Enzymes

- Acidifiers

- Aminoacids

- Antioxidants

By Livestock

- Ruminants

- Poultry

- Swine

- Aquatic Animal

By Form

- Dry

- Liquid

By Source

- Natural

- Synthetics

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is the current role of animal feed in Asia-Pacific’s livestock sector?

Animal feed is a cornerstone of livestock production in Asia-Pacific, directly influencing meat, dairy, and egg output across rapidly expanding poultry, swine, and aquaculture industries in countries like China, India, and Vietnam.

What factors are driving the growth of the animal feed market in the Asia-Pacific region?

Growth is driven by rising population, increased protein consumption, expanding commercial farming, and government support for food security through modern animal husbandry practices.

What types of feed additives and ingredients are gaining traction in this region?

High-performing amino acids, probiotics, enzymes, and plant-based additives are gaining popularity due to their roles in enhancing animal health, improving feed efficiency, and meeting antibiotic-free production goals.

What challenges does the Asia-Pacific feed market currently face?

Challenges include raw material price volatility, fragmented supply chains, low feed conversion ratios in traditional farming, and stricter regulations on antibiotic use and feed safety.

What trends will shape the future of the Asia-Pacific animal feed market?

Future growth will be fueled by smart feed technologies, increased demand for sustainable and organic feed inputs, digital monitoring tools, and a shift toward species-specific, nutrient-optimized feed formulations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com