Asia Pacific Base Oil Market Size, Share, Trends & Growth Forecast Report By Type (Group I, Group II, Group III, Group IV), Application (Engine Oils, Transmission and Gear Oils, Metalworking Fluids, Hydraulic Fluids, Greases), and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC) – Industry Analysis From 2025 to 2033.

Asia Pacific Base Oil Market Size

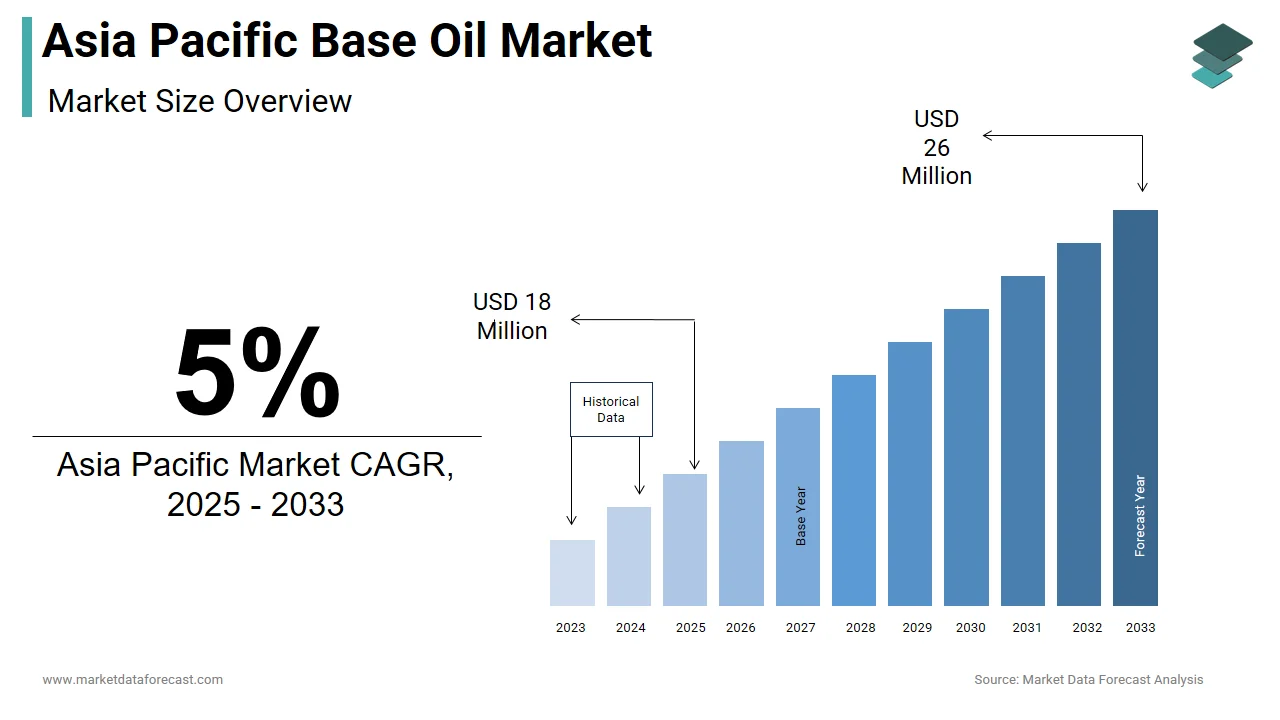

The size of the Asia Pacific base oil market was valued at USD 16.8 million in 2024. This market is expected to grow at a CAGR of 5% from 2025 to 2033 and be worth USD 26 million by 2033 from USD 18 million in 2025.

Base oils are refined from crude oil or natural gas and classified into categories such as Group I, II, III, IV (synthetic), and V (specialty oils), each catering to specific performance requirements.

MARKET DRIVERS

Rising Demand for High-Performance Lubricants

The escalating demand for high-performance lubricants is a significant driver propelling the Asia Pacific base oil market. According to the Society of Automotive Engineers (SAE), a significant portion of modern vehicles require advanced lubricants to meet stringent emission standards and enhance fuel efficiency. This trend is particularly pronounced in countries like China and India, where the adoption of Euro VI emission norms has necessitated the use of Group III and synthetic base oils. For instance, a study by the Chinese Academy of Sciences shows that vehicles using synthetic lubricants achieve a 15% improvement in fuel economy compared to conventional oils, addressing consumer concerns about mileage limitations. Additionally, the proliferation of electric vehicles (EVs) has intensified demand for specialized lubricants that reduce friction and wear in EV drivetrains. A report by the Japanese Automobile Manufacturers Association underscores that EV manufacturers adopting synthetic base oils achieve a 20% reduction in maintenance costs over the vehicle's lifespan.

Expansion of Industrial and Manufacturing Sectors

Another major driver is the rapid expansion of industrial and manufacturing sectors across the Asia Pacific region. Like, the region accounts for a large portion of global manufacturing output, with industries such as steel, cement, and chemicals driving demand for industrial lubricants. High-grade base oils, such as Group II and III, are extensively used in heavy machinery and equipment to ensure smooth operation and reduce downtime. In addition, the growing emphasis on automation and smart manufacturing has increased the need for precision lubricants capable of withstanding extreme operating conditions. Governments across the region are incentivizing industrial growth through subsidies and policy reforms, further amplifying demand for base oils.

MARKET RESTRAINTS

Fluctuating Crude Oil Prices

One of the most significant restraints impacting the Asia Pacific base oil market is the volatility of crude oil prices, which directly affects production costs. According to the Organization of the Petroleum Exporting Countries (OPEC), crude oil prices experienced fluctuations between 2020 and 2022 due to geopolitical tensions and supply chain disruptions. Since base oils are derived from crude oil refining, these price swings create uncertainty for manufacturers and end-users alike. Every $10 increase in crude oil prices elevates base oil production costs, squeezing profit margins and deterring investment. This instability is particularly challenging for small-scale suppliers in developing countries like Vietnam and Thailand, where financial resources are limited. Moreover, the lack of long-term hedging mechanisms leaves stakeholders vulnerable to sudden price spikes, undermining project feasibility and timelines.

Stringent Environmental Regulations

Another critical restraint is the mounting scrutiny over the environmental impact of base oil production and usage. According to the Intergovernmental Panel on Climate Change (IPCC), the refining process contributes significantly to greenhouse gas emissions, with base oil production accounting for a major portion of the region’s total carbon footprint. Regulatory bodies in countries like Australia and Japan have imposed stricter emission standards, mandating the use of low-carbon alternatives. For instance, Japan’s Ministry of the Environment enforces guidelines requiring refineries to adopt energy-efficient processes, limiting flexibility for manufacturers. Also, the extraction of crude oil, the primary raw material for base oils, faces opposition from environmental groups advocating for renewable alternatives. According to the World Wildlife Fund, a significant share of consumers in the region prioritize eco-friendly products, pressuring companies to adopt greener practices.

MARKET OPPORTUNITIES

Adoption of Synthetic and Specialty Base Oils

A burgeoning opportunity in the Asia Pacific base oil market lies in the increasing adoption of synthetic and specialty base oils, driven by the global push for high-performance lubricants. Like, synthetic base oils exhibit superior thermal stability and oxidation resistance, making them ideal for applications in extreme environments such as aerospace and marine industries. For instance, generally, marine vessels using synthetic lubricants achieve a reduction in engine wear, extending operational lifespans by up to five years. Further, the integration of bio-based feedstocks into specialty base oils aligns with sustainability goals, particularly in countries like Singapore and Malaysia, where environmental regulations are stringent. A pilot project in Thailand demonstrated that bio-based base oils could reduce lifecycle greenhouse gas emissions, showcasing their economic and environmental benefits.

Growth of Electric Vehicle (EV) Lubricants

Another significant opportunity stems from the growing demand for lubricants tailored to electric vehicles (EVs), which require specialized formulations to address unique challenges such as reduced heat dissipation and increased electrical conductivity. According to BloombergNEF, EV sales in the Asia Pacific region are projected to account for 40% of total vehicle sales by 2030, creating a robust demand for advanced base oils. For example, EV-specific lubricants formulated with Group III and synthetic base oils reduce friction losses, enhancing battery efficiency and range. Apart from these, governments across the region are incentivizing the development of these technologies through subsidies and research grants, providing additional impetus for their adoption. A report by the Chinese Ministry of Industry and Information Technology underscores that EV manufacturers adopting synthetic base oils achieve an improvement in drivetrain performance, underscoring their value proposition.

MARKET CHALLENGES

Limited Awareness Among Small-Scale End-Users

A significant challenge facing the Asia Pacific base oil market is the limited awareness among small-scale end-users, who form a vital part of the regional supply chain. This knowledge gap is exacerbated by inadequate marketing and educational campaigns, leaving industries hesitant to transition to newer technologies. Further, misconceptions about higher operational costs and limited availability further deter adoption, despite advancements in technology addressing these issues. Regulatory bodies in countries like Thailand and the Philippines are attempting to address these challenges through awareness programs, but progress remains slow due to entrenched practices and limited outreach.

Recycling and Waste Management Challenges

Another pressing challenge is the lack of adequate recycling infrastructure and technological barriers hindering the effective reuse of spent lubricants and base oils. Spent lubricants, if not properly managed, contribute to soil and water contamination, posing significant environmental risks. For example, a study by the Malaysian Department of Environment notes that improper disposal of spent lubricants generates over 2 million tons of hazardous waste annually, exacerbating pollution levels. In addition, the absence of standardized protocols for collecting and reprocessing used oils creates inconsistencies in material recovery rates. Governments in countries like Indonesia and Vietnam are attempting to address these issues through policy reforms, but progress remains slow due to limited funding and technological expertise.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Chevron Corporation, Exxon Mobil Corporation, GS Caltex Corporation, Neste, HP Lubricants, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The group II base oils segment dominated the Asia Pacific base oil market by commanding a market share of 45% in 2024. This leading position is primarily driven by their superior performance characteristics compared to Group I oils, offering better oxidation stability and lower volatility. Like, Group II oils are widely used in modern engine lubricants, particularly in countries like China and India, where the adoption of Euro VI emission norms has necessitated high-quality formulations. The vehicles using Group II base oils achieve an improvement in fuel efficiency compared to conventional oils, addressing consumer concerns about mileage limitations. In addition, advancements in refining technologies have enabled cost-effective production of Group II oils, making them accessible for both automotive and industrial applications.

The group III base oils segment is projected to grow at a CAGR of 8.5%. This rapid expansion is fueled by their exceptional thermal stability and suitability for high-performance lubricants required in advanced machinery and electric vehicles (EVs). Also, Group III oils exhibit a improvement in oxidation resistance compared to Group II oils, making them ideal for extreme operating conditions. For example, marine vessels using Group III-based lubricants achieve reduction in engine wear, extending operational lifespans by up to five years. In addition, the growing emphasis on sustainability has propelled the adoption of bio-based feedstocks in Group III production, aligning with environmental goals. Governments across the region are incentivizing the development of these technologies through subsidies and research grants, providing additional impetus for their adoption.

By Application Insights

The engine oils segment represented the largest application in the Asia Pacific base oil market by accounting for a 50.5% of total demand in 2024. This prominence is propelled by the widespread use of engine oils in automotive and industrial engines, where their ability to reduce friction and wear enhances performance and longevity. Besides, the proliferation of electric vehicles (EVs) has intensified demand for specialized engine oils that reduce friction losses and enhance drivetrain efficiency.

The metalworking fluids are emerging as the fastest-growing application segment, with a projected CAGR of 9.2%. This progress is propelled by the rapid expansion of manufacturing sectors across the Asia Pacific region, particularly in countries like China, India, and Vietnam. For example, a study by the Malaysian Industrial Development Authority reveals that industries using Group III-based metalworking fluids achieve an improvement in tool lifespan, significantly reducing replacement costs. Beides, the growing emphasis on automation and smart manufacturing has increased the need for precision lubricants capable of withstanding extreme operating conditions. Governments across the region are incentivizing industrial growth through policy reforms, further amplifying demand for metalworking fluids.

COUNTRY LEVEL ANALYSIS

China stood as the cornerstone of the Asia Pacific base oil market, commanding a market share of a 35.4%. The country’s dominance is supported by its status as the world’s largest manufacturing hub, with a significant portion of global industrial output originating from its factories. Also, the proliferation of heavy machinery and automotive industries has intensified demand for high-quality base oils, particularly Group II and III varieties. Yes, industries using advanced base oils achieve a reduction in maintenance costs, reinforcing their adoption across sectors. Further, the integration of bio-based feedstocks into base oil production aligns with national decarbonization goals, creating a robust demand-supply ecosystem.

India is a notable player in this market. The country’s rapid urbanization and population growth have spurred unprecedented demand for automotive and industrial lubricants, driving the adoption of high-grade base oils. Initiatives like the “Make in India” campaign have accelerated the transition to advanced manufacturing practices, necessitating the use of Group II and III base oils. According to the Federation of Indian Chambers of Commerce and Industry, the use of synthetic base oils in the automotive sector has gained traction, with pilot projects demonstrating a 15% improvement in fuel efficiency. Furthermore, the adoption of automated refining technologies has streamlined production processes, reducing material wastage and costs.

Japan holds a significant which is driven by its focus on high-performance and sustainable industrial solutions. The country’s aging infrastructure, necessitates extensive refurbishment projects using advanced base oils. According to the Japanese Society of Mechanical Engineers, industries incorporating Group III base oils exhibit a major improvement in equipment lifespan, enhancing durability and performance. Besides, Japan’s emphasis on eco-friendly manufacturing practices has accelerated the adoption of bio-based feedstocks and renewable alternatives. The alignment of regulatory frameworks, technological expertise, and sustainability goals reinforces Japan’s position as a leader in premium base oils.

South Korea is a key market and is propelled by its strong focus on innovation and premium manufacturing. The country is home to leading automakers like Hyundai and Kia, which prioritize lightweight materials and high-performance lubricants to enhance fuel efficiency and performance. Like, the adoption of synthetic base oils has reduced engine wear, addressing consumer concerns about maintenance costs. Besides, the shift toward electric vehicles (EVs) has intensified demand for advanced formulations, such as Group III and IV oils, which improve battery efficiency.

Australia and New Zealand collectively account for a considerable share, driven by their strong focus on sustainability and climate-resilient industrial solutions. The region’s stringent environmental regulations have incentivized the use of eco-friendly base oils, such as bio-based and recycled materials. According to the New Zealand Ministry for the Environment, the adoption of renewable feedstocks in base oil production has reduced lifecycle greenhouse gas emissions, aligning with regional decarbonization goals. In addition, the prevalence of extreme weather conditions has heightened demand for durable lubricants capable of withstanding temperature fluctuations. The integration of digital tools for supply chain management further enhances efficiency, positioning the region as a leader in sustainable base oils.

KEY MARKET PLAYERS

Companies dominating the Asia-Pacific base oil market profiled in this report are Chevron Corporation, Exxon Mobil Corporation, GS Caltex Corporation, Neste, HP Lubricants, and others.

TOP LEADING PLAYERS IN THE MARKET

ExxonMobil Corporation

ExxonMobil is a global leader in the base oil market, with a significant presence in the Asia Pacific region. The company’s extensive portfolio includes high-performance Group II and III base oils tailored to meet the evolving demands of automotive and industrial applications. ExxonMobil’s contributions to the global market are underscored by its focus on innovation, particularly in refining technologies that enhance product quality and sustainability. Through strategic partnerships with automakers and lubricant manufacturers, ExxonMobil has facilitated the integration of advanced base oils into their supply chains.

Royal Dutch Shell plc

Royal Dutch Shell is a key player in the Asia Pacific base oil market, offering advanced products designed for durability and performance. The company emphasizes research and development, introducing innovations such as bio-based feedstocks and synthetic formulations. Shell’s global influence is bolstered by collaborations with OEMs to develop specialized lubricants for electric vehicles (EVs) and heavy machinery. By focusing on eco-friendly practices, Shell addresses environmental concerns while promoting efficiency and reliability.

Chevron Corporation

Chevron Corporation is renowned for its specialty base oils, catering to niche applications in the industrial and marine sectors. The company’s expertise lies in developing high-grade Group II and III oils that offer superior thermal stability and oxidation resistance. Chevron’s contributions to the global market extend beyond product innovation; it actively engages in knowledge-sharing initiatives to educate stakeholders about modern base oil technologies. The company’s emphasis on sustainability is reflected in its adoption of renewable energy and waste reduction practices.

TOP STRATEGIES USED BY KEY PLAYERS IN THE MARKET

Focus on Sustainability and Eco-Friendly Solutions

Key players in the Asia Pacific market have increasingly prioritized sustainability by developing eco-friendly base oils. Innovations such as bio-based feedstocks and low-carbon formulations align with stringent environmental regulations and consumer expectations for green products. Companies actively collaborate with governments and industry bodies to promote circular economy practices. For instance, partnerships with universities facilitate research into renewable alternatives, enhancing product viability.

Strategic Collaborations and Partnerships

Strategic collaborations with end-users, suppliers, and research institutions are pivotal for strengthening market positions. These partnerships enable companies to gain insights into regional requirements, co-develop customized solutions, and streamline distribution networks. For example, alliances with EV manufacturers facilitate the use of advanced base oils in battery enclosures and drivetrain systems. Additionally, joint ventures with construction firms ensure timely project execution and consistent product availability.

Expansion of Production Facilities and Distribution Networks

To meet escalating demand, companies are expanding their production capacities and distribution networks across the Asia Pacific region. Establishing localized manufacturing units reduces logistical challenges and ensures compliance with regional standards. Furthermore, enhancing distribution channels, particularly in rural areas, enables companies to reach small-scale industries who form a significant portion of the market. Investments in digital tools for supply chain management improve operational efficiency, reducing lead times and costs.

COMPETITION OVERVIEW

The Asia Pacific base oil market is characterized by intense competition, driven by the presence of both multinational corporations and regional players striving to capture market share. Leading companies leverage their technological expertise and R&D capabilities to introduce innovative solutions that cater to evolving industrial demands. The market landscape is shaped by regulatory dynamics, with stringent environmental standards promoting the adoption of sustainable base oils. Regional players often focus on cost-effective solutions tailored to local needs, challenging the dominance of global giants.

RECENT MARKET DEVELOPMENTS

- In March 2023, ExxonMobil launched a new line of bio-based Group III base oils in China, aimed at reducing carbon emissions during production. This initiative reinforced its commitment to sustainability and positioned it as a leader in eco-friendly solutions.

- In May 2023, Royal Dutch Shell partnered with a leading EV manufacturer in South Korea to develop specialized lubricants for electric drivetrains. This collaboration enhanced its product portfolio and addressed regional demands for high-performance lubricants.

- In July 2023, Chevron expanded its production facility in India to increase the output of high-grade Group II oils. This move was designed to meet the growing demand for durable engine oils in the automotive and industrial sectors.

- In November 2023, TotalEnergies introduced a digital platform in Japan to provide real-time insights into material performance and application techniques. This innovation positioned the company as a pioneer in integrating technology with traditional manufacturing practices.

MARKET SEGMENTATION

This Asia Pacific base oil market research report is segmented and sub-segmented into the following categories.

By Type

- Group I

- Group II

- Group III

- Group IV Other Types (Group V and Naphthenic)

By Application

- Engine Oils

- Transmission and Gear Oils

- Metalworking Fluids

- Hydraulic Fluids

- Greases

- Other Applications (Food-grade Lubricants, Process Oil, etc.)

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives growth in the Asia Pacific base oil market?

Growth is driven by rapid industrialization, rising automotive production, demand for high-performance lubricants, and government investments in infrastructure and cleaner technologies.

2. What challenges affect the Asia Pacific base oil market?

Challenges include crude oil price volatility, environmental regulations, limited recycling infrastructure, and low awareness among small-scale users.

3. What opportunities exist in the Asia Pacific base oil market?

Opportunities lie in synthetic and specialty base oils, bio-based feedstocks, rising EV lubricant demand, and expanding manufacturing in emerging economies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com