Asia Pacific Business Travel Market Size, Share, Trends & Growth Forecast Report By Service (Transportation, Food & Lodging, Recreation), Traveler (Solo, Group), Industry Type (Corporate, Government), and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC) – Industry Analysis From 2025 to 2033.

Asia Pacific Business Travel Market Size

The size of the Asia Pacific business travel market was valued at USD 348.55 billion in 2024. This market is expected to grow at a CAGR of 8.88% from 2025 to 2033 and be worth USD 749.55 billion by 2033 from USD 379.50 billion in 2025.

MARKET DRIVERS

Corporate Expansion and Cross-Border Collaborations

One of the primary drivers of the Asia Pacific business travel market is the surge in corporate expansion and cross-border collaborations. Multinational companies are increasingly establishing regional headquarters in cities like Singapore, Shanghai, and Sydney to tap into emerging markets. Like, a significant portion of Fortune 500 companies have a significant presence in Asia Pacific, necessitating frequent business travel for strategic meetings and project management. The rise of free trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP), has also facilitated smoother cross-border operations, driving demand for business travel.

Technological Advancements and Digital Transformation

Another significant driver is the adoption of advanced technologies that enhance the efficiency and convenience of business travel. These innovations cater to the evolving needs of tech-savvy professionals, particularly in industries like IT and finance, where agility and precision are paramount. Moreover, 65% of businesses in the region prioritize technology-enabled travel solutions to optimize costs and improve employee productivity. The integration of blockchain for secure transactions and real-time tracking systems has further streamlined travel logistics, making it more appealing for organizations to invest in corporate travel.

MARKET RESTRAINTS

Geopolitical Tensions and Regulatory Challenges

A significant restraint affecting the Asia Pacific business travel market is the rising geopolitical tensions and stringent regulatory frameworks across the region. According to a study by the Economist Intelligence Unit, geopolitical instability in areas such as the South China Sea and the Taiwan Strait has led to increased travel advisories and restricted movement for corporate travelers. For instance, visa restrictions and prolonged approval processes in countries like China and India have deterred seamless cross-border business interactions. Additionally, as per the International Chamber of Commerce, over 40% of businesses in the region have reported delays or cancellations of critical meetings due to sudden policy changes or diplomatic disputes. These uncertainties not only disrupt travel plans but also inflate operational costs, as companies must navigate complex compliance requirements.

Economic Uncertainty and Cost Pressures

Another major restraint is the economic uncertainty and escalating costs associated with business travel. Furthermore, as per McKinsey & Company, small and medium-sized enterprises (SMEs) in the region, which account for significant portion of businesses, are disproportionately affected by rising travel costs, limiting their ability to compete globally. Currency fluctuations have also played a role, with the depreciation of currencies like the Japanese yen making international travel more expensive for domestic businesses. These financial constraints have dampened the frequency of business trips, particularly for SMEs, posing a significant challenge to the growth trajectory of the Asia Pacific business travel market.

MARKET OPPORTUNITIES

Sustainable and Eco-Friendly Travel Solutions

One of the most promising opportunities in the Asia Pacific business travel market lies in the growing emphasis on sustainability and eco-friendly travel solutions. Airlines and hotels are responding by introducing green initiatives, such as carbon offset programs and energy-efficient accommodations. For instance, as per the International Air Transport Association, airlines in the region have reduced their carbon footprint bsince 2020 through the adoption of biofuels and fuel-efficient aircraft. Additionally, a survey revealed that 75% of businesses are willing to pay a premium for sustainable travel options, highlighting the untapped potential for providers offering eco-conscious services.

Emerging Markets and Tier-II Cities

Another significant opportunity is the expansion into emerging markets and tier-II cities across the Asia Pacific region. According to the United Nations Conference on Trade and Development, emerging economies like Vietnam, Indonesia, and the Philippines are experiencing high GDP growth rate, creating fertile ground for business travel. These markets are witnessing a surge in foreign direct investment, with companies seeking local partnerships and establishing manufacturing hubs. As per a report by JLL, tier-II cities such as Pune in India and Foshan in China are becoming hotspots for corporate activity, driven by lower operational costs and improved infrastructure. The proliferation of co-working spaces and business hubs in these cities further supports the influx of corporate travelers.

MARKET CHALLENGES

Health and Safety Concerns Post-Pandemic

A pressing challenge for the Asia Pacific business travel market is the lingering health and safety concerns stemming from the aftermath of the COVID-19 pandemic. Companies are now compelled to allocate additional resources for health insurance, quarantine arrangements, and contingency planning, which adds to operational complexities. These ongoing uncertainties have created a cautious approach to corporate mobility, hindering the full recovery of the business travel sector in the region.

Digital Divide and Infrastructure Disparities

Another critical challenge is the digital divide and disparities in infrastructure across the Asia Pacific region. According to the Asian Development Bank, while countries like South Korea and Singapore boast world-class digital ecosystems, others such as Cambodia and Laos lag significantly behind in terms of internet penetration and technological readiness. This imbalance affects the seamless adoption of virtual collaboration tools and digital travel solutions, which are essential for modern business travel. Additionally, inconsistent cybersecurity standards across the region expose corporate travelers to data breaches and privacy risks, further complicating travel logistics. These infrastructure gaps not only limit accessibility but also create inconsistencies in service quality, posing a formidable barrier to the harmonized growth of the Asia Pacific business travel market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Service, Traveler, Industry Type, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

U.S. Cold Storage, AmeriCold Logistics LLC, LINEAGE LOGISTICS HOLDING, LLC, VersaCold Logistics Services, NICHIREI LOGISTICS GROUP INC., CONGEBEC LOGISTICS INC., Burris Logistics, CONESTOGA COLD STORAGE, Kloosterboer, COLD BOX EXPRESS, INC, and others. |

SEGMENTAL ANALYSIS

By Service Insights

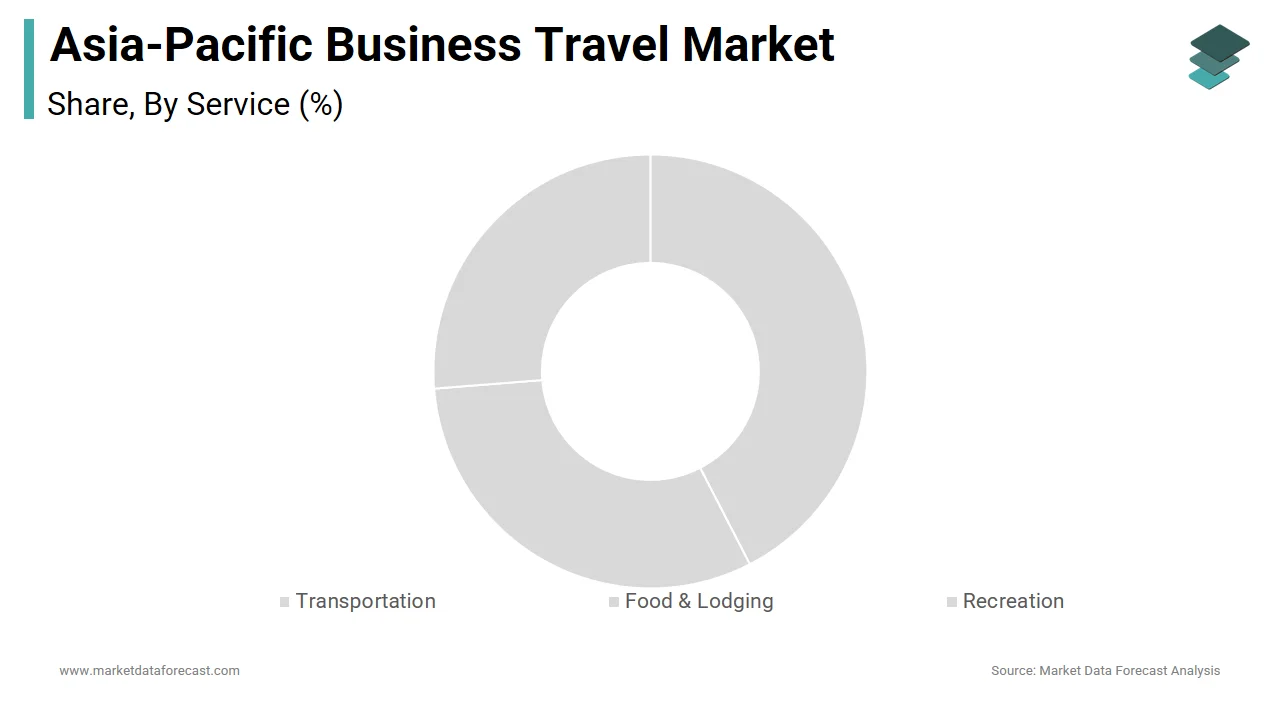

The Food & Lodging segment held the largest share of the Asia Pacific business travel market i.e. 45.5% of the total revenue in 2024. This dominance is driven by the growing emphasis on comfort and productivity during business trips, particularly in urban hubs like Singapore, Tokyo, and Sydney. Corporate travelers increasingly prioritize high-quality accommodations and dining experiences to maintain energy and focus during demanding schedules. According to a report by JLL, the hospitality sector in the region witnessed a 15% increase in bookings for premium hotels in 2023, reflecting the demand for upscale lodging options. Another driving factor is the rise of integrated hospitality solutions tailored for business travelers. As per McKinsey & Company, over 60% of corporate travelers in the region prefer hotels offering co-working spaces, wellness amenities, and seamless connectivity. Additionally, the proliferation of food delivery platforms like Grab and Zomato has transformed meal accessibility, with a surge in business-related food orders reported in 2023. These innovations cater to the evolving preferences of professionals who seek convenience without compromising quality.

The transportation is the fastest-growing segment in the Asia Pacific business travel market, with a projected compound annual growth rate (CAGR) of 9.8% from 2025 to 2033. This quick expansion is fueled by advancements in transportation infrastructure, including high-speed rail networks and smart airports, which enhance connectivity across the region. Another key driver is the adoption of digital tools for travel management. A significant share of businesses in the region have implemented AI-driven booking platforms, streamlining transportation logistics and reducing costs. Additionally, the rise of ride-hailing services like Grab and Gojek has revolutionized last-mile connectivity, with an increase in corporate usage reported in 2023. Furthermore, investments in sustainable aviation fuels and electric vehicles are reshaping the transportation landscape, aligning with corporate sustainability goals.

By Traveler Insights

The segment of solo travelers commanded the Asia Pacific business travel market, with a 60.6% share of the total traveler in 2024. This prominence is driven by the increasing preference for individualized travel arrangements, particularly among mid-level executives and consultants who require flexibility. According to a survey by the International SOS Foundation, over 75% of solo business travelers in the region value personalized itineraries that allow them to optimize their schedules. A significant factor is the rise of remote work policies, which have normalized independent travel for professional purposes. Like, companies in the region have reduced group travel budgets since 2020, encouraging employees to undertake solo trips for client meetings or project assignments. Additionally, as per JLL, the proliferation of co-working spaces in cities like Bangkok and Manila has facilitated solo travelers, with a 40% increase in bookings reported in 2023. This trend underscores the growing importance of catering to individual needs in the business travel ecosystem.

The group travelers segment is seeing the swiftest-growing in the Asia Pacific business travel market, with a CAGR of 8.5%. This progress is caused by the resurgence of large-scale corporate events, conferences, and training programs post-pandemic. For instance, as per the Asian Corporate Travel Association, the number of corporate events hosted in the region increased in 2023, driving demand for group travel packages. Another driving factor is the rise of collaborative projects involving multinational teams. As per Deloitte, over 60% of businesses in the region are engaging in cross-border partnerships, necessitating group travel for strategic planning and execution. Additionally, the integration of shared economy platforms like Airbnb for group accommodations has made travel more cost-effective, with a reduction in lodging expenses. Furthermore, airlines and hotels are tailoring bundled offers for groups, enhancing convenience and affordability.

By Industry Type Insights

The corporate travel dominated the Asia Pacific business travel market in 2024. This leading position is driven by the region’s robust corporate ecosystem, with multinational corporations and startups alike relying on face-to-face interactions to foster partnerships and drive innovation. Another key factor is the rise of intra-regional trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP), which facilitate cross-border collaborations. As per the World Trade Organization, intra-Asia Pacific trade volumes surged in 2023, necessitating frequent business trips for negotiations and deal closures. The proliferation of digital tools for expense management and itinerary tracking has further streamlined corporate travel, enhancing efficiency and adoption rates.

The government travel is the fastest-growing segment in the Asia Pacific business travel market, with a CAGR of 10.2%. This is propelled by increased government initiatives aimed at fostering international diplomacy and economic cooperation. For instance, as per the United Nations Conference on Trade and Development, diplomatic missions and trade delegations from countries like India and Indonesia have risen in the past year and is driving demand for official travel. Another significant driver is the focus on regional development projects funded by government bodies. Additionally, the adoption of digital platforms for visa processing and logistics has streamlined government travel, reducing administrative barriers.

COUNTRY LEVEL ANALYSIS

China is a major player of the Asia Pacific business travel market by contributing a 35.6% of the region’s total market share in 2024. This is underpinned by its status as the world’s second-largest economy and a hub for manufacturing and technology. According to the International Air Transport Association, Beijing and Shanghai alone account for a significant portion of all business travel spending in the country, driven by the presence of multinational headquarters and innovation centers. A key driver is the Belt and Road Initiative, which has intensified cross-border collaborations. Additionally, the country’s advanced high-speed rail network facilitates seamless domestic travel.

India is one of the largest market in the Asia Pacific business travel,. This prominence is attributed to its burgeoning IT and pharmaceutical industries, which rely heavily on face-to-face interactions for client engagements and regulatory approvals. Another driving factor is the rise of startup ecosystems in cities like Bangalore and Hyderabad, which have attracted global investors. A notable number of startups have been established in the past five years, necessitating frequent travel for fundraising and networking. Additionally, as per the Ministry of Civil Aviation, domestic air travel grew in 2023, showing the increasing mobility of professionals.

Japan is ranked among the top destinations for corporate travel. The country benefits from its advanced manufacturing and financial sectors, which prioritize precision and relationship-building. According to a study by the Japan External Trade Organization, a significant portion of foreign businesses operating in Japan require regular travel for operations and partnerships. Another key factor is the country’s focus on hosting international conferences and trade fairs. As per the International Congress and Convention Association, Japan hosted a large number of major events in 2023, attracting delegates from across the globe. Additionally, as per the Ministry of Land, Infrastructure, and Transport, Japan’s Shinkansen network transported over 400 million passengers, facilitating efficient travel for professionals.

Australia is recognized as a major hub for business activities in the Asia-Pacific region. This prominence is propelled by its robust mining and education sectors, which rely on international collaborations. According to the Australian Bureau of Statistics, the education sector alone accounts for notable share of business travel spending, with universities hosting global academic exchanges. Another significant factor is the country’s strong diplomatic ties with Asia Pacific nations. As per the Department of Foreign Affairs and Trade, Australia’s trade missions have increased by 15% in 2023, necessitating official travel. Additionally, as per Qantas, domestic and international flight bookings for corporate purposes grew by 20% in the same year.

South Korea boasts a substantial business travel market. This position in the market is supported by its tech-driven economy and global brands like Samsung and Hyundai, which require extensive travel for R&D and sales. Like, a significant portion of business travel in the country is linked to the technology sector. Another key driver is the government’s push for innovation hubs, which attract global talent. In addition, South Korea invested substantially in tech startups in recent years, fostering cross-border partnerships. Additionally, as per Korean Air, international business travel bookings increased in the same year, reflecting growing demand.

KEY MARKET PLAYERS

Companies dominating the Asia-Pacific business travel market profiled in this report are Caterpillar Inc. (United States), Cummins Inc. (United States), Aggreko (United Kingdom), Atlas Copco (Sweden), Kohler-SDMO (France), Shenton Group (United Kingdom), NIDS GROUP (India), Jassim Transport & Stevedoring Co. K.S.C.C. (Kuwait), Pump Power Rental (United Kingdom), United Rentals (United States), Sudhir Power Ltd. (India), Modern Hiring Service (India), Newburn Power Rental Ltd (United Kingdom), Global Power Supply (United States), FG Wilson (United Kingdom), ProPower Rental (United States), APR Energy (United States)., and others.

TOP LEADING PLAYERS IN THE MARKET

American Express Global Business Travel (GBT)

American Express GBT is a leading player in the Asia Pacific business travel market, renowned for its innovative solutions and customer-centric approach. The company has consistently contributed to the global market by offering tailored travel management services that cater to the unique needs of businesses operating in the region. Its presence in key hubs like Singapore and Sydney underscores its commitment to fostering seamless corporate mobility.

CWT (formerly Carlson Wagonlit Travel)

CWT is another dominant player, recognized for its robust network and expertise in managing large-scale corporate travel programs. The company’s contribution to the global market lies in its ability to integrate advanced digital tools with human expertise, ensuring efficient travel planning and execution. In the Asia Pacific region, CWT has strengthened its presence by collaborating with local airlines and hotels to offer exclusive deals for corporate travelers. Its focus on sustainability and traveler well-being has further solidified its reputation as a forward-thinking industry leader.

BCD Travel

BCD Travel stands out for its data-driven insights and strategic consulting services, which empower businesses to optimize their travel programs. The company’s global influence is evident in its ability to deliver cost-effective and innovative solutions to clients across diverse industries. In the Asia Pacific market, BCD Travel has differentiated itself through its emphasis on flexibility and adaptability, catering to the dynamic needs of regional businesses.

TOP STRATEGIES USED BY KEY PLAYERS IN THE MARKET

Digital Transformation and Innovation

One of the major strategies adopted by key players in the Asia Pacific business travel market is the integration of digital transformation initiatives. Companies are investing heavily in AI-driven platforms, mobile applications, and data analytics to streamline travel management processes. These innovations enable real-time tracking, personalized recommendations, and seamless expense reporting, enhancing the overall traveler experience.

Sustainability Initiatives

Another significant strategy is the adoption of sustainable practices to align with global environmental goals. Leading players are partnering with eco-friendly airlines, hotels, and transportation providers to offer green travel options. They are also implementing carbon offset programs and promoting virtual collaboration tools to reduce the need for frequent travel.

Localized Partnerships

The third key strategy involves forging localized partnerships to enhance service offerings and expand market reach. By collaborating with regional airlines, hospitality chains, and co-working spaces, companies can provide tailored solutions that cater to the unique preferences of local travelers.

COMPETITION OVERVIEW

The Asia Pacific business travel market is characterized by intense competition, driven by the presence of both global giants and regional players striving to capture market share. The competitive landscape is shaped by a combination of innovation, customer-centricity, and strategic collaborations. Global leaders like American Express GBT, CWT, and BCD Travel leverage their extensive networks and technological prowess to offer comprehensive solutions, while regional players focus on niche markets and localized expertise. This diversity creates a dynamic environment where companies must constantly innovate to stay relevant. Sustainability has emerged as a key differentiator, with firms adopting eco-friendly practices to appeal to environmentally conscious clients. Additionally, partnerships with local stakeholders and investments in digital tools are critical for addressing the unique demands of the region. The market is further influenced by geopolitical factors, economic fluctuations, and evolving traveler preferences, requiring participants to adopt agile strategies.

RECENT MARKET DEVELOPMENTS

- In April 2024, SS8 Networks, a provider of lawful interception solutions, partnered with European cybersecurity firm CyberShield to enhance its data monitoring capabilities. This collaboration is anticipated to strengthen SS8’s position in the European market by offering more robust compliance tools.

- In June 2023, Utimaco, a leading provider of encryption solutions, acquired a German-based lawful interception software developer. This acquisition enabled Utimaco to expand its portfolio and address growing demand for secure interception technologies.

- In September 2022, Verint Systems launched a new AI-driven analytics platform for lawful interception in Europe. This move was aimed at improving real-time data processing and enhancing investigative accuracy for law enforcement agencies.

- In January 2023, Cisco Systems integrated advanced lawful interception features into its networking solutions, targeting European telecom operators. This initiative reinforced Cisco’s leadership in providing secure communication infrastructure.

- In November 2022, Aqsacom, a provider of regulatory compliance solutions, signed a strategic agreement with a European government agency to deploy a nationwide lawful interception system. This project is expected to bolster Aqsacom’s presence in the region and set new standards for data security.

MARKET SEGMENTATION

This Asia Pacific business travel market research report is segmented and sub-segmented into the following categories.

By Service

- Transportation

- Food & Lodging

- Recreation

By Traveler

- Solo

- Group

By Industry Type

- Corporate

- Government

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific business travel market?

The Asia Pacific business travel market is driven by corporate expansion, cross-border collaborations, tech adoption, and rising demand in emerging economies

2. What challenges affect the Asia Pacific business travel market?

Geopolitical tensions, regulatory hurdles, rising travel costs, and health and safety concerns are key challenges for the Asia Pacific business travel market

3. What opportunities exist in the Asia Pacific business travel market?

Sustainability initiatives, digital transformation, and expansion into tier-II cities and emerging markets create major opportunities for the Asia Pacific business travel market

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com