Asia Pacific Caramel Chocolate Market Research Report – Segmented By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Non-Grocery Retailers, Others), Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

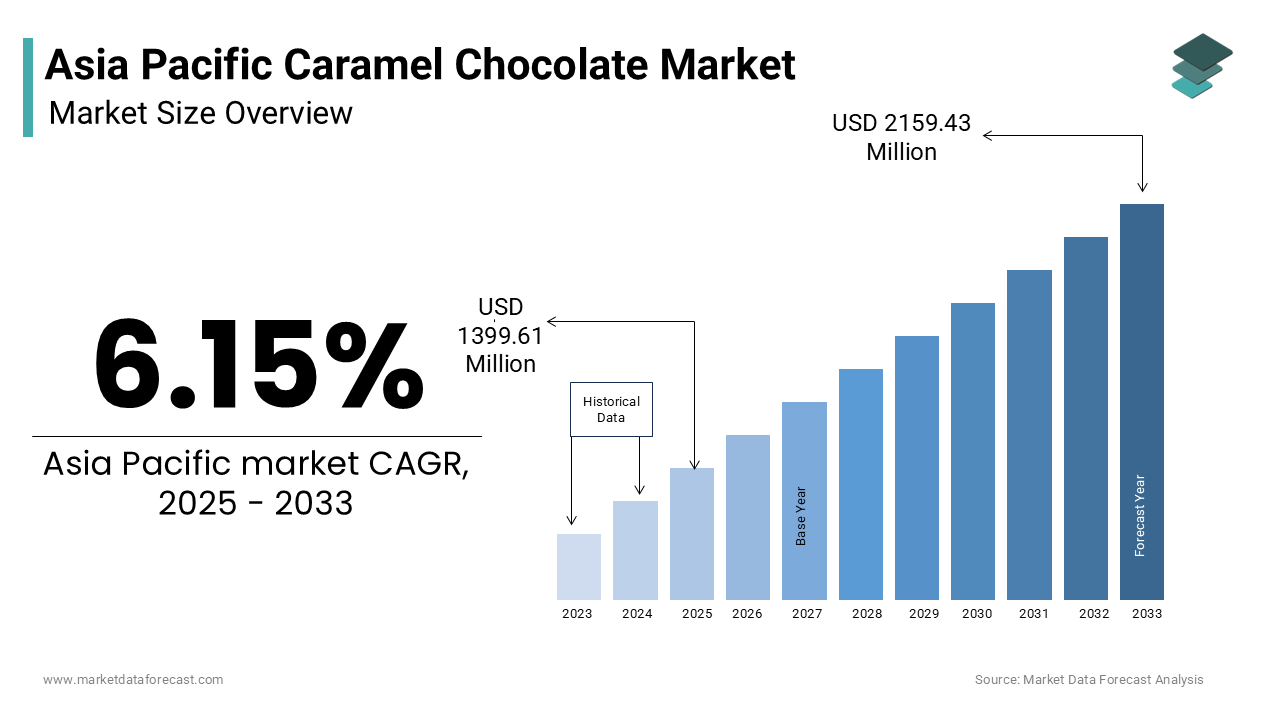

Asia Pacific Caramel Chocolate Market Size

The Asia Pacific Caramel Chocolate Market was worth USD 1262.00 million in 2024. The Asia Pacific market is expected to reach USD 2159.43 billion by 2033 from USD 1339.61 million in 2025, rising at a CAGR of 6.15% from 2025 to 2033.

The Asia Pacific caramel chocolate market refers to confectionery products that combine the rich, buttery taste of caramel with high-quality chocolate, often in the form of bars, truffles, bite-sized pieces, and seasonal offerings. This segment of the confectionery industry has gained popularity due to evolving consumer preferences for indulgent yet convenient snacks that offer a unique sensory experience. The region’s growing middle-class population, increasing disposable incomes, and urbanization have contributed to the rising consumption of premium chocolates, including caramel-infused variants.

According to Euromonitor International, confectionery sales in the Asia Pacific grew steadily between 2019 and 2023, with caramel chocolate gaining traction among younger demographics in China, India, and Southeast Asia. Additionally, the influence of Western confectionery culture through media, tourism, and global retail chains has further fueled demand. While traditional chocolate remains dominant, caramel-based options are increasingly positioned as celebratory or gifting items, particularly during festivals and holidays.

MARKET DRIVERS

Rising Disposable Incomes and Urbanization in Emerging Economies

A key driver influencing the growth of the Asia Pacific caramel chocolate market is the rising disposable income and rapid urbanization in emerging economies such as India, Indonesia, and Vietnam. As more consumers move into higher income brackets, spending on discretionary food items like premium confectionery has increased significantly. According to the Asian Development Bank, average household incomes in these countries rose by over 6% annually between 2020 and 2023 by creating a larger consumer base capable of purchasing branded and premium-priced chocolate products.

In India and China, where urban centers account for most of the consumption, retailers report a noticeable shift toward premium chocolate varieties, including caramel-flavored options. As per NielsenIQ, modern trade channels such as supermarkets and specialty stores have seen a surge in caramel chocolate purchases among millennials and Gen Z consumers who view these products as status symbols or personal treats. Furthermore, online confectionery platforms have expanded accessibility, enabling consumers in smaller cities and towns to access imported and gourmet caramel chocolate brands.

Increasing Popularity of Premium and Gourmet Chocolate Varieties

Another major factor driving the Asia Pacific caramel chocolate market is the growing preference for premium and gourmet chocolate offerings, especially in developed markets such as Australia, Japan, and South Korea. Consumers in these countries are increasingly seeking out high-quality ingredients, artisanal production methods, and unique flavor profiles with caramel being one of the most favored combinations. In South Korea, lifestyle and food trends heavily influenced by social media have led to a rise in boutique chocolate cafes offering handcrafted caramel chocolates tailored to aesthetic presentation and taste experimentation. Australian chocolatiers have similarly embraced small-batch caramel chocolate production, which emphasizes local sourcing and ethical branding. According to Euromonitor International, gourmet and premium chocolate brands have recorded double-digit growth in these markets over the past three years, indicating that caramel chocolate is not just a passing trend but a core component of the evolving premium confectionery landscape in the Asia Pacific.

MARKET RESTRAINTS

Health Concerns and Regulatory Scrutiny Over Sugar Intake

One of the primary restraints affecting the Asia Pacific caramel chocolate market is the growing consumer awareness around health issues associated with excessive sugar consumption in urbanized economies such as Singapore, Australia, and New Zealand. Governments in these regions have introduced policies aimed at curbing sugar intake, including taxes on sugary foods and beverages, front-of-pack labeling requirements, and public health campaigns promoting reduced-sugar diets.

As per the World Health Organization, several Asia Pacific countries have implemented sugar reduction strategies, influencing manufacturers to reformulate products. In response, some caramel chocolate producers have attempted to introduce lower-sugar versions; however, maintaining the signature sweetness and texture of caramel without compromising quality presents formulation challenges. According to Mintel, sales of full-sugar caramel chocolate faced headwinds in Australia between 2020 and 2023 as health-conscious consumers shifted toward dark chocolate or sugar-free alternatives. Similarly, in Singapore, where nutritional guidelines have been increasingly enforced, confectionery companies face additional hurdles in marketing indulgent products. Unless innovative low-sugar alternatives gain widespread acceptance, health concerns will continue to limit market expansion.

Volatility in Raw Material Prices Affects Production Costs

Another significant constraint impacting the Asia Pacific caramel chocolate market is the fluctuation in raw material prices for cocoa, dairy, and sugar as key components in caramel chocolate production. These price variations, driven by climate conditions, geopolitical instability, and supply chain disruptions, create cost pressures for manufacturers by limiting their ability to maintain stable pricing and profit margins.

According to the International Cocoa Organization, cocoa bean prices experienced sharp increases in 2023 due to adverse weather in West African producing regions, leading to supply shortages. In addition, as per Rabobank, dairy costs also surged across Oceania and East Asia due to rising feed prices and labor constraints. These increases directly affect the production economics of caramel chocolate, which requires both high-quality chocolate and cream-based caramel fillings. In markets like Japan and India, mid-tier chocolate brands have struggled to absorb these costs without raising retail prices, which risks deterring price-sensitive consumers. For smaller manufacturers, the challenge is even greater, as they lack the purchasing power of multinational firms.

MARKET OPPORTUNITIES

Expansion of Online Retail Channels and E-commerce Platforms

A major opportunity emerging in the Asia Pacific caramel chocolate market is the rapid expansion of e-commerce and direct-to-consumer digital platforms, which have transformed how consumers discover and purchase niche and premium confectionery products. The caramel chocolate brands can now reach a much wider audience beyond traditional retail outlets with internet penetration surpassing 70% in many parts of the region and mobile shopping becoming the norm.

In China, Tmall and JD.com have become major distribution points for imported caramel chocolates, while in India, platforms like Amazon and Flipkart routinely feature limited-edition caramel flavors from both domestic and international brands. In Australia, boutique chocolate makers have benefited from Shopify and Instagram-based store integrations, allowing them to build brand identity and engage directly with consumers. These digital avenues offer a scalable, cost-effective way for caramel chocolate brands to expand their regional footprint and cater to evolving consumer habits.

Growing Demand for Limited Edition and Seasonal Caramel Chocolate Offerings

Another promising avenue for growth in the Asia Pacific caramel chocolate market is the rising consumer interest in limited-time and seasonal releases, which create urgency and exclusivity around caramel chocolate products. This strategy has proven particularly effective in cultures that place strong emphasis on celebrations, gift-giving, and visual appeal—factors that align well with caramel chocolate's premium positioning.

As reported by Euromonitor International, seasonal caramel chocolate collections launched around occasions such as Valentine’s Day, Christmas, and Lunar New Year have consistently driven spikes in sales across Japan, South Korea, and the Philippines. In Japan, confectionery giants like Meiji and Lotte regularly release holiday-themed caramel chocolates, often in collaboration with popular anime or fashion brands, targeting younger consumers. According to Mintel, in Australia and New Zealand, caramel chocolate hampers and gift boxes have become a staple of festive season retail promotions. In India, caramel-filled chocolate assortments are increasingly featured in corporate gifting and wedding favor packages. These observations indicate that strategic timing and thematic marketing present substantial opportunities for caramel chocolate players to capture attention and drive repeat purchases throughout the year.

MARKET CHALLENGES

Cultural Preferences for Traditional Sweets Over Western-Style Chocolates

A significant challenge facing the Asia Pacific caramel chocolate market is the entrenched preference for traditional sweets and desserts in certain countries, which limits the adoption of Western-style chocolates, including caramel variants. In nations like Thailand, Malaysia, Indonesia, and parts of India, consumers have long-standing cultural inclinations toward locally made confections such as jalebi, kuih, mochi, and halwa, which differ in texture, sweetness level, and composition from European-style chocolates.

As per the ASEAN Food Industry Outlook, many consumers in these regions perceive caramel chocolate as overly sweet or heavy, making it less appealing compared to lighter, fruit-based, or coconut-infused native sweets. According to a survey conducted by NielsenIQ in 2023, only 28% of respondents in Jakarta and Kuala Lumpur considered caramel chocolate as a preferred treat, citing unfamiliarity and flavor intensity as deterrents. In response, some manufacturers have attempted localized adaptations, such as infusing caramel with pandan, mango, or matcha flavors, but success has been mixed.

Competition from Alternative Flavored Confectionery Products

Another major challenge confronting the Asia Pacific caramel chocolate market is the intense competition posed by alternative flavored confectionery products, particularly those incorporating fruit, nuts, mint, and matcha. These flavors have historically enjoyed strong consumer loyalty in various parts of the region and are often perceived as fresher, lighter, or more culturally aligned than caramel-based chocolates.

According to Euromonitor International, in markets like Japan and South Korea, green tea and citrus-based chocolates consistently outperform caramel variants in terms of repeat purchase rates and shelf space allocation. In India, nut-inclusive chocolates such as almond and cashew-based offerings dominate festival gifting baskets, overshadowing caramel selections. As per Mintel, in Australia and New Zealand, dark chocolate infused with sea salt or berry extracts has gained traction among health-conscious consumers, further fragmenting the premium chocolate segment. Additionally, confectionery companies frequently rotate flavor portfolios based on trending tastes, which leaves caramel with less room to establish long-term dominance. Without continuous innovation and targeted marketing, caramel chocolate risks remaining a secondary choice in an increasingly diversified and competitive confectionery landscape across the Asia Pacific.

SEGMENTAL ANALYSIS

By Distribution Channel Insights

Supermarkets and hypermarkets held the largest share of the Asia Pacific caramel chocolate market by capturing 42.3% of the market in 2024. According to NielsenIQ, over 70% of caramel chocolate sales in Japan and South Korea occur through supermarket and hypermarket channels due to strategic shelf placements and promotional bundling with other premium snacks. In Australia and New Zealand, Woolworths and Countdown have dedicated seasonal confectionery sections that prominently feature caramel chocolate assortments during festive periods. Additionally, as per Euromonitor International, in emerging markets like India and Indonesia, modern trade retail expansion has significantly boosted accessibility for mid- to high-income consumers seeking gourmet-style chocolates. The combination of convenience, product visibility, and trusted retail environments continues to make supermarkets and hypermarkets the primary gateway for caramel chocolate consumption across diverse demographics in the region.

The non-grocery retailers segment is lucratively to grow with a CAGR of 11.8% in the next coming years. The rapid growth of this segment is driven by the increasing popularity of premium and artisanal caramel chocolate brands that target affluent consumers seeking experiential purchases. According to Statista, boutique chocolate stores in China and Singapore have seen a surge in foot traffic, particularly among millennials who value unique packaging and brand storytelling. As reported by Mintel, in Japan, luxury department stores such as Takashimaya and Mitsukoshi have expanded their gourmet food sections to include limited-edition caramel chocolate collections from both domestic and European chocolatiers. Additionally, duty-free retailers at major international airports like Changi and Incheon have capitalized on outbound tourism trends by offering exclusive caramel chocolate gift sets.

REGIONAL ANALYSIS

Japan caramel chocolate market was the top performer with 24.4% of share in 2024, driven by its well-established confectionery culture and high consumer preference for premium chocolate variants. The country’s sophisticated taste profile and appreciation for gourmet products have made caramel-infused chocolates a staple in both everyday and seasonal offerings.

According to Euromonitor International, Japan recorded consistent growth in premium chocolate sales, with caramel being one of the most preferred flavors among younger consumers and gift buyers. Japanese confectionery giants such as Meiji and Lotte frequently launch limited-edition caramel chocolates, often featuring collaborations with popular anime, characters, and fashion brands, enhancing their appeal. As per the Japan External Trade Organization, caramel chocolate exports and imports also reflect strong demand, with imported European brands maintaining a niche presence in upscale retail outlets.

China was positioned second with 19.8% of the Asia Pacific caramel chocolate market share in 2024. The country's growing middle-class population, increasing exposure to Western confectionery trends, and expanding retail networks have collectively contributed to rising caramel chocolate consumption, especially in first- and second-tier cities.

According to Statista, online confectionery sales in China grew by over 30% in 2023, with caramel-flavored products gaining traction among Gen Z and millennial consumers. Platforms like Tmall and JD.com have played a crucial role in introducing both domestic and international caramel chocolate brands to a broader audience. As per Euromonitor International, premium chocolate brands have intensified marketing efforts around occasions like Valentine’s Day and Christmas, leveraging influencer endorsements and social media campaigns to drive engagement. Additionally, local producers have begun experimenting with fusion flavors, incorporating ingredients like matcha and black sesame into caramel chocolates to cater to evolving tastes.

Australia caramel chocolate market with an 11.4% of share in 2024, with the confectionery industry, high disposable incomes, and a strong preference for indulgent snack options. According to the Australian Food and Grocery Council, gourmet chocolate boutiques have proliferated in major cities like Sydney and Melbourne, offering handcrafted caramel truffles and seasonal editions tailored to local preferences. Additionally, sustainability and clean-label trends have influenced caramel chocolate formulations, with several brands launching organic or dairy-free caramel options to align with health-conscious consumer demands.

South Korea is likely to register a CAGR of the Asia Pacific caramel chocolate market in the coming years with its innovative product launches, digital-first retail strategies, and strong cultural emphasis on aesthetics and novelty in food consumption. According to the Korea Fair Trade Commission, caramel chocolates have become a prevalent choice for gift baskets and self-purchasing among young professionals in Seoul and Busan. As per Euromonitor International, leading Korean chocolate brands such as Choco Pie Company and Orion have launched limited-run caramel bars tied to seasonal promotions and K-pop celebrity endorsements, boosting visibility and appeal. Additionally, online platforms like Gmarket and Coupang have enhanced accessibility for niche caramel chocolate products, including imported and artisanal offerings.

The India Asia Pacific caramel chocolate market is likely to have prominent growth opportunities in the next coming years. E-commerce platforms such as Amazon and Nykaa have amplified access to premium caramel chocolate brands, both domestic and imported. As per the Indian Brand Equity Foundation, multinational players like Ferrero and Lindt have intensified their presence in tier-one cities, while homegrown brands such as Amul and Nestlé have introduced localized caramel variants to cater to evolving tastes. Moreover, caramel-themed promotions during events like Valentine’s Day and Mother’s Day have further boosted visibility.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Mondelez International, Nestlé S.A., Mars Inc., Ferrero Group, Lindt & Sprüngli, Meiji Holdings Co. Ltd., and Lotte Confectionery are some of the key market players in the Asia Pacific caramel chocolate market.

The competition in the Asia Pacific caramel chocolate market is marked by a dynamic mix of multinational confectionery giants, regional powerhouses, and emerging artisanal brands vying for consumer attention. Established players leverage strong brand recognition, extensive distribution networks, and well-funded marketing campaigns to maintain dominance, particularly in mature markets such as Japan, South Korea, and Australia. However, the rise of boutique chocolate makers and domestic producers experimenting with gourmet approaches is reshaping competitive dynamics, especially in developing economies like India and Southeast Asia. Localized product adaptations, creative packaging, and storytelling around quality and craftsmanship have enabled smaller entrants to carve niche positions. Additionally, the growing influence of e-commerce and direct-to-consumer models has intensified rivalry, allowing new players to bypass traditional trade barriers and compete more directly with larger firms. As consumer preferences shift toward premiumization and health-conscious indulgence, companies are under increasing pressure to innovate rapidly, refine product offerings, and adapt branding strategies to sustain relevance and growth in an increasingly fragmented market.

Top Players in the Asia Pacific Caramel Chocolate Market

Lotte Confectionery (South Korea)

Lotte Confectionery is a leading player in the Asia Pacific caramel chocolate market, known for its wide range of premium and innovative chocolate products tailored to local tastes. The company has been instrumental in popularizing caramel-infused chocolates in South Korea and expanding its influence across neighboring markets through strategic exports and retail collaborations. Lotte frequently introduces limited-edition caramel flavors aligned with seasonal trends and cultural preferences, reinforcing its brand image as a modern and youthful confectionery provider. Its emphasis on design-driven packaging and product differentiation has set industry benchmarks, making it a key influencer in shaping consumer expectations and purchasing behavior in the regional caramel chocolate segment.

Meiji Holdings Co., Ltd. (Japan)

Meiji is a dominant force in Japan’s caramel chocolate market and contributes significantly to the broader Asia Pacific landscape. With a strong heritage in dairy and confectionery manufacturing, Meiji has successfully integrated rich, creamy caramel into its chocolate portfolio, appealing to both domestic and international consumers. The company is recognized for its high-quality formulations and commitment to maintaining traditional Japanese flavor profiles while embracing global indulgence trends. Meiji’s caramel chocolate variants are often positioned as gifting items, particularly during festivals and corporate events, enhancing their market appeal. Through continuous innovation and brand trust, Meiji has solidified its presence not only in Japan but also in export markets throughout Southeast Asia.

Nestlé S.A. (Regional Presence – India, Oceania, China)

Nestlé maintains a substantial footprint in the Asia Pacific caramel chocolate market through its diverse portfolio of chocolate brands, including KitKat, Aero, and Milky Bar, many of which feature caramel variations tailored to regional preferences. The company has effectively localized its caramel offerings, adapting taste profiles and portion sizes to suit consumer habits in countries like India, Australia, and the Philippines. Nestlé leverages its extensive distribution network and marketing expertise to ensure the broad availability and visibility of caramel-based products in both urban and rural markets. By aligning with gifting traditions and festive consumption patterns, Nestlé has strengthened its position as a top-tier contributor to the caramel chocolate category across multiple Asia Pacific economies.

Top Strategies Used by Key Market Participants

One major strategy employed by key players in the Asia Pacific caramel chocolate market is product differentiation through flavor innovation and premium positioning. Companies continuously experiment with caramel blends, incorporating ingredients such as sea salt, matcha, nuts, and fruit extracts to cater to evolving consumer palates and create distinctive offerings that stand out in a crowded marketplace.

Another effective approach involves leveraging digital marketing and social media platforms to enhance brand visibility and consumer engagement. Leading brands collaborate with influencers, food bloggers, and lifestyle personalities to promote caramel chocolate as a trendy, aspirational indulgence, particularly among younger demographics who actively engage with online content and e-commerce platforms.

Lastly, forming strategic partnerships with specialty retailers, gourmet food chains, and duty-free operators allows caramel chocolate manufacturers to access upscale customer segments and tap into premium retail environments where impulse and gifting purchases are common. These collaborations help expand reach beyond conventional grocery channels and strengthen brand equity in the premium confectionery space.

RECENT MARKET DEVELOPMENTS

- In January 2024, Lotte Confectionery launched a new line of premium salted caramel chocolates in collaboration with a South Korean celebrity chef, aiming to elevate the brand’s gourmet appeal and attract younger, urban consumers seeking unique flavor experiences.

- In March 2024, Meiji introduced a limited-edition caramel chocolate gift collection designed specifically for Japan’s annual "White Day" celebrations, reinforcing its stronghold in the gifting segment and enhancing seasonal sales performance.

- In June 2024, Nestlé expanded its caramel-flavored KitKat variants in India by launching a mango-caramel fusion edition, targeting Gen Z consumers and leveraging local flavor preferences to boost market penetration in key metro cities.

- In August 2024, Ferrero entered into a partnership with luxury department stores across Singapore and Malaysia to offer exclusive caramel chocolate assortments at flagship retail counters, strengthening its foothold in the premium confectionery segment of Southeast Asia.

- In November 2024, Australian gourmet chocolate maker Koko Black released a series of single-origin caramel chocolate bars infused with native botanicals such as lemon myrtle and Tasmanian pepper berry, reinforcing its brand identity in the luxury chocolate category and attracting both domestic and international buyers.

MARKET SEGMENTATION

This research report on the Asia Pacific caramel chocolate market is segmented and sub-segmented into the following categories.

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Non-Grocery Retailers

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What drives the growth of the caramel chocolate market in Asia Pacific?

Key drivers include rising disposable incomes, westernization of taste preferences, growth of the confectionery sector, and increased gifting culture during holidays and festivals.

What challenges does the caramel chocolate market in Asia Pacific face?

Challenges include rising raw material costs, competition from other snack segments, and health-conscious consumers reducing sugar intake.

What is the future outlook of the Asia Pacific caramel chocolate market?

The market is expected to continue growing due to urbanization, innovation in flavors and formats, and expansion of e-commerce and global brands in emerging Asia Pacific countries.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com