Asia Pacific Cardiac Holter Monitor Market Size, Share, Trends & Growth Forecast Report By Product Type (1-Channel, 2-Channel, 3-Channel, 12-Channel, Others), Component (Holter Monitoring Devices, Event Monitoring Devices, Holter Analysis System and Software), End User (Hospitals and Clinics, Ambulatory Surgical Centers (ASCs), Homecare, Others), and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC) – Industry Analysis From 2025 to 2033.

Asia Pacific Cardiac Holter Monitor Market Size

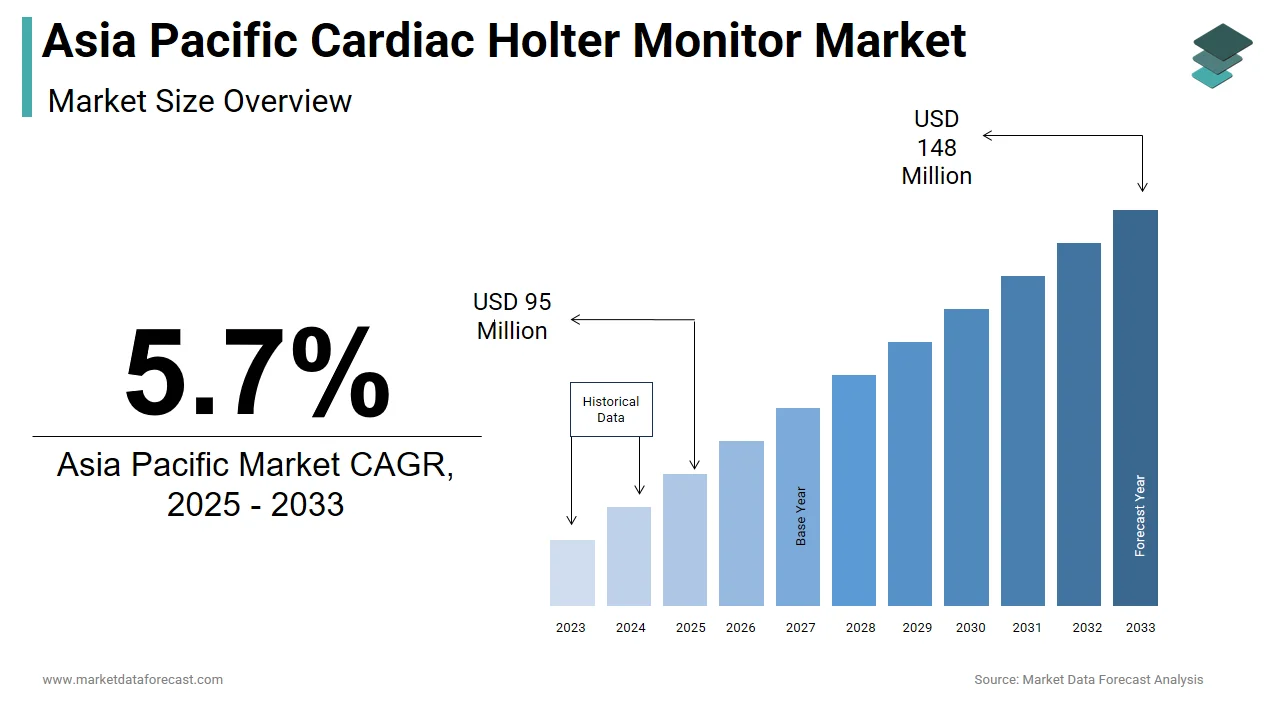

The size of the Asia Pacific cardiac holter monitor market was worth USD 90 million in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 5.7% from 2025 to 2033 and be worth USD 148 million by 2033 from USD 95 million in 2025.

The cardiac Holter monitor devices play a critical role in detecting intermittent arrhythmias along with assessing the effectiveness of cardiac treatments and identifying unexplained episodes such as palpitations or syncope. Holter monitors have become essential tools in both hospital-based cardiology departments and outpatient settings as cardiovascular diseases increasingly burden healthcare systems across the region. Cardiovascular diseases account for nearly one-third of all deaths in the Asia Pacific region with ischaemic heart disease and stroke being leading causes. In China, more than 300 million people suffer from some form of cardiovascular disorder which significantly increases the need for accurate ambulatory ECG diagnostics. Similarly, in India, rising hypertension prevalence and lifestyle-related risk factors are driving demand for Holter monitoring services especially in urban hospitals. Japan, with its aging population of over 28.72% aged above 65 years has seen increased adoption of advanced Holter technology integrated with telemedicine platforms.

MARKET DRIVERS

Rising Prevalence of Cardiovascular Diseases Across the Region

Escalating prevalence of cardiovascular diseases (CVDs) is one of the most significant drivers of the Asia Pacific cardiac Holter monitor market which has created an urgent demand for advanced diagnostic tools like Holter monitoring. CVDs accounted for over 9 million deaths in the Asia Pacific region in 2022 alone. In China, CVD remains the leading cause of mortality where nearly 330 million individuals suffer from conditions such as coronary artery disease, atrial fibrillation and heart failure ailments that necessitate long-term ECG evaluation. Similarly, in India nearly 60 million people suffer from various forms of heart disease where they require Holter monitoring for accurate rhythm assessment. In Malaysia and Indonesia, growing rates of diabetes and hypertension have also contributed to increased cardiac complications requiring ambulatory monitoring. Moreover, in Australia, sudden cardiac events are frequently detected through Holter analysis which makes it a vital tool in emergency cardiology.

Expansion of Telemedicine and Remote Cardiac Monitoring Services

Rapid expansion of telemedicine and remote cardiac monitoring services is another key driver fueling the growth of the Asia Pacific cardiac Holter monitor market. The integration of digital health technologies into cardiology practices has enabled physicians to diagnose and manage heart conditions outside traditional clinical settings. In Japan, the Ministry of Health, Labour and Welfare has actively supported wearable ECG monitoring as part of national initiatives aimed at elderly care and chronic disease prevention. In South Korea, major hospitals have adopted cloud-connected Holter systems that transmit real-time data to cardiologists thereby allowing for faster decision-making and reduced hospital readmissions. In Australia, rural access to specialized cardiac care is limited because of which the Royal Flying Doctor Service utilizes mobile Holter monitoring to assess patients in remote locations and relay findings to metropolitan heart centers. Additionally, in India, startups such as Thyrocare and Portea Medical have introduced home-based Holter monitoring packages linked with AI-driven interpretation software thus improving accessibility and affordability. The demand for Holter monitors compatible with telehealth ecosystems is poised for sustained growth throughout the Asia Pacific as digital transformation accelerates across healthcare systems.

MARKET RESTRAINTS

High Cost of Advanced Holter Monitoring Systems and Limited Reimbursement Coverage

A significant restraint affecting the widespread adoption of cardiac Holter monitors in the Asia Pacific region is the high cost associated with advanced systems and the limited availability of reimbursement policies in low and middle-income countries. Traditional 24-hour recorders remain relatively affordable however next-generation event recorders, implantable loop recorders and wireless Holter monitors come with considerably higher price tags. In countries like Indonesia, Vietnam and the Philippines out-of-pocket healthcare expenses exceed 50.14% thereby making expensive diagnostic procedures financially prohibitive for large segments of the population. In India,only a fraction of patients receive insurance coverage for Holter monitoring despite rising demand for cardiac diagnostics which limits access primarily to urban private hospitals. Even in more developed markets such as South Korea and Australia reimbursement for extended cardiac monitoring is often restricted to specific indications like unexplained syncope or post-arrhythmic event follow-up. Financial barriers were among the top reasons for delayed cardiac diagnostics in Southeast Asia.

Shortage of Skilled Professionals and Limited Awareness Among Patients

Shortage of trained professionals and the lack of awareness regarding the importance of continuous cardiac monitoring is another persistent challenge hindering the growth of the Asia Pacific cardiac Holter monitor market. Effective Holter interpretation requires expertise in ECG pattern recognition which is often scarce in primary healthcare settings. In countries like Bangladesh, Nepal and Papua New Guinea there are fewer than five cardiologists per million people thereby severely limiting the capacity to implement routine Holter assessments. In rural parts of China and India, general practitioners often lack formal training in Holter data analysis thus resulting in underutilization of available devices. Over 60.72% of patients in India and Thailand had little knowledge about the purpose and benefits of Holter monitoring which led to reluctance in undergoing the procedure. Cultural stigmas around prolonged medical testing and misconceptions about heart health further delay early diagnosis. In Australia, medical infrastructure is well-developed while shortages of electrophysiologists in regional areas create bottlenecks in service delivery. Addressing these educational gaps and workforce limitations is crucial for expanding Holter monitoring’s reach across the Asia Pacific.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence and Machine Learning in Holter Analysis

The integration of artificial intelligence (AI) and machine learning (ML) in ECG data analysis is a transformative opportunity shaping the future of the Asia Pacific cardiac Holter monitor market. Traditional Holter interpretation is labor-intensive and requires manual review of extensive recordings to detect transient arrhythmias. However, advancements in AI-driven diagnostics are enabling automated anomaly detection, pattern recognition and predictive analytics which significantly enhance diagnostic accuracy and efficiency. In Japan, companies like Fujitsu and Hitachi have collaborated with cardiology centers to develop AI-powered Holter analysis platforms capable of identifying subtle rhythm abnormalities that might be missed by human reviewers. AI-enhanced ECG analysis demonstrated over 90.74% sensitivity in detecting atrial fibrillation. In South Korea, Samsung Medical Center has implemented deep learning models to analyze Holter data in real time thereby reducing physician workload and expediting treatment decisions. Meanwhile, startups in India and Singapore are introducing AI-integrated mobile Holter solutions that enable remote diagnostics for underserved populations.

Growth of Preventive Cardiology Programs and Mobile Health Initiatives

The expansion of preventive cardiology programs and mobile health (mHealth) initiatives across the Asia Pacific region represents a compelling opportunity for the cardiac Holter monitor market. Governments and private healthcare organizations are increasingly emphasizing early detection and proactive management of cardiovascular conditions to reduce long-term disease burden. In China, the National Cardiovascular Disease Center has launched nationwide screening campaigns incorporating ECG monitoring to identify individuals at risk of arrhythmias and ischemic heart disease. Community-based cardiac screening programs have expanded to cover over 50 million individuals since 2020. In India, the Ayushman Bharat initiative includes provisions for mobile health clinics equipped with portable Holter monitors to serve rural populations lacking access to hospital cardiology departments. Similarly, in the Philippines, mobile heart screening units powered by solar energy and wireless connectivity are being deployed in remote islands to enhance access to cardiac diagnostics. In Australia, state-funded mHealth projects such as the Victorian Telehealth Network support remote Holter data transmission for patients in regional areas.

MARKET CHALLENGES

Regulatory Complexity and Divergent Approval Pathways Across APAC Countries

Regulatory complexity and divergent approval pathways across different countries is one of the foremost challenges confronting the Asia Pacific cardiac Holter monitor market. The Asia Pacific region presents a fragmented landscape where each country enforces distinct medical device certification requirements unlike the streamlined frameworks seen in Europe and North America. For instance, in China, the National Medical Products Administration mandates rigorous clinical evaluations and local testing before granting market approval whereas in Japan, the Pharmaceuticals and Medical Devices Agency subjects new devices to multi-stage reviews to ensure adherence to domestic safety standards. Navigating these disparate regulations can delay product launches by up to 18 months in certain jurisdictions which adds operational costs and limits timely access to innovative devices. Additionally, varying compliance expectations related to software validation, data privacy and cybersecurity create additional hurdles for manufacturers integrating digital functionalities into Holter monitors. In smaller ASEAN nations, the absence of centralized regulatory agencies further complicates compliance thereby forcing firms to adopt localized strategies that may not be scalable. These regulatory impediments pose a fundamental challenge to the harmonized growth and commercial scalability of Holter monitoring solutions across the Asia Pacific.

Supply Chain Disruptions and Manufacturing Constraints in Key Producing Nations

Another persistent challenge impacting the Asia Pacific cardiac Holter monitor market is the vulnerability of supply chains and manufacturing constraints in countries responsible for producing semiconductor components and sensor modules. Many Holter monitors rely on microchips and electronic components sourced from global suppliers and disruptions in logistics due to geopolitical tensions or natural disasters can severely affect production timelines. Semiconductor shortages in recent years disrupted the manufacturing of medical electronics including digital Holter recorders which delayed product availability in key markets such as South Korea and Taiwan. In China, Factory shutdowns due to pandemic-related restrictions created bottlenecks in the distribution of Holter monitoring products in areas where a significant portion of the region’s medical device exports originate. In India, local manufacturers faced difficulties in sourcing high-precision analog-to-digital converters and embedded processors thereby leading to price increases and production slowdowns. Additionally, import duties and regulatory delays in countries like Thailand and the Philippines have further complicated procurement processes for international brands aiming to scale operations. With ongoing trade uncertainties and logistical complexities, ensuring a stable and resilient supply chain remains a critical hurdle for players in the Asia Pacific cardiac Holter monitor sector.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Component, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

GE Healthcare, Koninklijke Philips N.V., Nihon Kohden Corporation, Mindray Medical International Limited, Fukuda Denshi Co., Ltd., Medtronic plc, Schiller AG, MicroPort Scientific Corporation, BPL Medical Technologies, and iRhythm Technologies, Inc. |

SEGMENTAL ANALYSIS

By Product Type Insights

The 12-Channel Holter Monitor segment held 40.81% of the Asia Pacific cardiac Holter monitor market share in 2024. This dominance is primarily attributed to the increasing demand for high-resolution ECG recordings that closely mimic traditional in-hospital electrocardiography. The 12-channel system allows more precise detection of complex arrhythmias and silent ischemic events thereby making it particularly valuable in clinical decision-making. In Japan, where advanced cardiology services are widely available and hospitals prefer 12-channel monitors for comprehensive rhythm analysis. Similarly, in South Korea, the Korean Society of Cardiology has endorsed the use of multichannel monitoring for long-term cardiac assessments. In China, the National Center for Cardiovascular Diseases has incorporated 12-channel Holter monitoring into its national guidelines for managing post-myocardial infarction patients. The 12-channel segment continues to set the standard in clinical applications across the Asia Pacific with growing emphasis on diagnostic accuracy and integration with digital health records .

The 1-Channel Holter Monitor segment is expected to exhibit a noteworthy CAGR of 12.81% from 2025 to 2033. This growth is being driven by increasing adoption in primary healthcare centers, rural clinics and homecare settings due to its affordability, portability and ease of use. In India, a rising number of healthcare providers are opting for 1-channel devices in telemedicine-based cardiac screening programs where cost-effective diagnostics are crucial for large patient volumes. According to the Public Health Foundation of India, mobile health initiatives in tier-2 and tier-3 cities have deployed basic Holter recorders to reach underserved populations suffering from undiagnosed arrhythmias. In Indonesia and the Philippines, government-led outreach programs have prioritized low-cost Holter solutions for community health workers conducting cardiovascular risk assessments. Additionally, startups in Australia and Singapore are introducing compact 1-channel devices compatible with smartphone apps thus enabling real-time transmission of ECG data to remote specialists.

By Component Insights

The Holter Monitoring Devices segment dominated the Asia Pacific cardiac Holter monitor market by capturing 55.06% of total market share in 2024. This dominance is primarily due to the essential role these devices play in continuous cardiac diagnostics in hospital and ambulatory care settings. In countries like China and Japan, hospitals rely heavily on Holter recorders for extended ECG tracking where cardiovascular diseases account for a significant portion of mortality. In India, private diagnostic chains such as Thyrocare and Metropolis Healthcare have expanded their offerings to include Holter device rentals and outpatient monitoring services. Additionally, in Australia, the Royal Australian College of General Practitioners recommends prolonged cardiac monitoring as part of routine assessment protocols for high-risk patients. The widespread adoption of both basic and advanced Holter recorders along with increasing awareness about arrhythmia management continues to reinforce this segment’s dominance in the regional market.

The Holter Analysis Systems and Software segment is projected to witness a fastest CAGR of 14.72% between 2025 and 2033. This rapid expansion is largely driven by the increasing integration of artificial intelligence (AI) and cloud-based platforms to enhance diagnostic efficiency and streamline data interpretation. In Japan, major manufacturers and research institutions have collaborated to develop AI-powered software capable of detecting subtle cardiac anomalies that would otherwise be missed through manual review.In South Korea, Samsung Medical Center has implemented deep learning algorithms to analyze large volumes of Holter data in real time thereby reducing cardiologist workload and improving turnaround times. Moreover, in India and Singapore, telehealth startups are offering cloud-connected Holter analysis platforms that allow physicians to remotely access and interpret ECG recordings. The demand for intelligent Holter software solutions is expected to accelerate across the Asia Pacific region as healthcare systems increasingly prioritize automation and digital transformation.

By End User Insights

The hospitals and Clinics segment was the largest in the Asia Pacific cardiac Holter monitor market by capturing 50.14% of total market share in 2024. This dominance is primarily due to the extensive reliance on Holter monitoring in inpatient and outpatient departments for diagnosing arrhythmias, assessing myocardial ischemia and evaluating treatment efficacy. In China,the Ministry of Health mandates Holter monitoring for post-discharge patients recovering from acute coronary syndromes. Over 90.81% of tertiary hospitals integrate Holter diagnostics into standard cardiology protocols. In India, public and private hospitals alike have been expanding their cardiology departments to meet rising patient demand thus leading to increased procurement of Holter monitors. Additionally, in Japan,hospitals routinely employ Holter monitoring as part of preventive cardiac check-ups where an aging population drives higher rates of atrial fibrillation and other rhythm disorders. The presence of well-established healthcare infrastructure coupled with the need for accurate and timely diagnosis ensures that hospitals and clinics remain the most critical end-user setting for Holter monitoring across the Asia Pacific.

The Homecare segment is anticipated to witness a fastest CAGR of 13.92% from 2025 to 2033. This surge is driven by increasing adoption of portable and wireless Holter monitors among patients seeking convenient and non-invasive cardiac diagnostics outside institutional settings. In Australia, Holter monitoring at home has gained significant traction where home-based chronic disease management is encouraged through Medicare-funded telehealth services. In India, startups such as Portea Medical and Apollo Home Healthcare offer Holter rental services combined with remote analysis thereby enhancing access to long-term cardiac diagnostics in tier-2 and tier-3 cities. Additionally, in South Korea, wearable Holter technology is being integrated into elderly care programs thus allowing continuous ECG tracking without frequent hospital visits. The homecare segment is positioned for sustained expansion throughout the Asia Pacific as the preference for decentralized healthcare grows .

COUNTRY-WISE ANALYSIS

China outperformed other regions in the Asia Pacific cardiac Holter monitor market by accounting for 30.16% of total market share in 2024. The country’s dominant position is supported by a combination of a vast patient pool suffering from cardiovascular diseases and strong policy backing for early diagnosis and cardiac screening. Over 330 million people in China suffer from various forms of heart conditions including hypertension, coronary artery disease and arrhythmias. The Chinese government has launched nationwide initiatives such as the China PEACE Million Persons Project aimed at identifying undiagnosed cardiac cases and integrating Holter diagnostics into primary healthcare networks.

Japan was positioned second in holding the dominant share of the Asia Pacific cardiac Holter monitor market. The country’s mature healthcare ecosystem and emphasis on preventive cardiology contribute significantly to the widespread adoption of Holter monitoring technologies. Over 28.93% of the population is aged above 65 years while making them highly susceptible to arrhythmias and other age-related cardiac conditions. As a result, Holter monitoring is a routine part of cardiac evaluations in hospitals, clinics and geriatric care facilities. Furthermore, Japan’s regulatory environment supports rapid adoption of new medical technologies thereby ensuring that next-generation Holter devices reach the market quickly.

India’s cardiac Holter monitors market growth is driven by rising incidence of cardiac disorders and expansion of private healthcare infrastructure. Cardiovascular diseases account for nearly one-quarter of all deaths in the country with arrhythmias and ischemic heart disease becoming increasingly prevalent. The launch of the Ayushman Bharat program has expanded access to cardiology diagnostics in newly established health and wellness centers and increased the prescription of Holter monitoring in both urban and semi-urban areas. Holter monitoring is gaining prominence as an essential tool for early cardiac intervention and long-term patient management as India transitions toward a more digitally integrated healthcare system.

Australia’s cardiac Holter monitors market is likely to grow with a healthy CAGR in the next coming years and is driven by a robust healthcare framework and proactive disease prevention policies. The Australian Institute of Health and Welfare reports that heart rhythm disorders such as atrial fibrillation affect over 500,000 individuals annually thus necessitating regular Holter assessments. The country's well-developed telehealth infrastructure enables patients in remote regions to undergo Holter monitoring at home with results transmitted directly to specialist cardiologists. Major hospitals in Sydney, Melbourne and Brisbane utilize advanced 12-channel Holter recorders for detailed ECG analysis in emergency medicine and cardiology wards.

South Korea’s cardiac Holter monitor market is likely to have significant growth opportunities during the forecast period and is distinguished by rapid technological innovation and strong governmental support for digital health solutions. The Korean Society of Cardiology emphasizes the importance of early detection and continuous cardiac monitoring which leads to increased prescriptions of Holter tests in hospitals and clinics. Cardiovascular diseases remain among the top three causes of mortality, prompting national efforts to expand ECG screening programs. Additionally, the Ministry of Health and Welfare has promoted the use of digital Holter platforms in telemedicine consultations in rural and underserved regions.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC cardiac holter monitor market profiled in this report are GE Healthcare, Koninklijke Philips N.V., Nihon Kohden Corporation, Mindray Medical International Limited, Fukuda Denshi Co., Ltd., Medtronic plc, Schiller AG, MicroPort Scientific Corporation, BPL Medical Technologies, and iRhythm Technologies, Inc.

TOP LEADING PLAYERS IN THE MARKET

Fukuda Denshi

Fukuda Denshi is a leading innovator in the Asia Pacific cardiac Holter monitor market and has played a pivotal role in advancing ECG monitoring technologies for over six decades. The company is renowned for its high-quality and reliable Holter recorders that are widely used in hospitals and research institutions across Japan and other parts of the region. Fukuda Denshi’s commitment to precision engineering and digital integration has positioned it as a global player in cardiology diagnostics. Its solutions support real-time data analysis and remote monitoring while contributing significantly to modern cardiac care frameworks.

Nihon Kohden

Nihon Kohden is a major participant in the Asia Pacific cardiac Holter monitor market by offering a broad range of clinical-grade cardiac monitoring devices tailored for both hospital and ambulatory settings. Recognized for its technological excellence and adherence to international standards consequently Nihon Kohden's Holter systems provide detailed and long-term ECG recordings essential for diagnosing complex arrhythmias. Nihon Kohden enhances the accessibility and accuracy of Holter monitoring through continuous innovation and strategic partnerships with medical institutions. Its influence extends globally thereby reinforcing its reputation as a trusted provider of advanced cardiac diagnostics.

Bionet (a subsidiary of Masimo Corporation)

Bionet has emerged as a key contributor to the Asia Pacific cardiac Holter monitor market by developing compact, user-friendly and digitally integrated Holter systems. Bionet focuses on delivering innovative cardiac monitoring solutions that bridge the gap between hospital and homecare environments. The company’s emphasis on wireless connectivity, cloud-based data management and AI-assisted interpretation has made it a preferred choice among clinicians and patients alike. Bionet’s products are increasingly adopted in telehealth and preventive cardiology programs. Its advancements reflect a broader shift toward decentralized cardiac diagnostics and enhanced patient engagement through technology-driven solutions.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Product innovation and digital integration is one major strategy employed by leading players in the Asia Pacific cardiac Holter monitor market . Companies are continuously investing in R&D to develop next-generation Holter monitors equipped with wireless capabilities, AI-driven analytics and cloud-based data storage. These enhancements cater to the growing demand for seamless integration within digital health ecosystems and help improve diagnostic efficiency and patient outcomes.

Strategic collaborations and partnerships with local healthcare institutions is another key approach . Manufacturers frequently engage in alliances with hospitals, telemedicine providers and government bodies to strengthen their regional presence. These partnerships enable them to tailor product offerings to regional needs, accelerate regulatory approvals and expand distribution networks across diverse healthcare settings.

A third impactful strategy is expanding into homecare and remote monitoring segments . Recognizing the rising preference for decentralized healthcare as a result companies are introducing portable and wearable Holter solutions designed for ease of use outside traditional clinical environments. This shift supports improved patient compliance and enables long-term cardiac monitoring without frequent hospital visits.

COMPETITION OVERVIEW

The competition in the Asia Pacific cardiac Holter monitor market is shaped by a mix of established global players and emerging domestic manufacturers striving for market share through differentiation, pricing strategies and expanded distribution. Multinational firms such as Fukuda Denshi, Nihon Kohden and Bionet leverage their brand recognition as well as technical expertise and extensive sales networks to maintain dominance in institutional procurement and premium segments. At the same time, regional players from China, India and South Korea are gaining traction by offering cost-competitive alternatives that appeal to budget-sensitive public health systems and private clinics. The market is witnessing intensified innovation with companies focusing on wireless connectivity, artificial intelligence and mobile integration to enhance diagnostic capabilities. Additionally, the increasing prevalence of cardiac disorders and the expansion of preventive cardiology initiatives have heightened the need for accessible and accurate monitoring tools.Firms are investing heavily in product development, forging strategic alliances and enhancing after-sales support to secure long-term growth in this dynamic and rapidly evolving market as demand for remote cardiac diagnostics grows.

RECENT MARKET DEVELOPMENTS

- In February 2024, Fukuda Denshi launched an updated version of its wireless Holter monitoring system compatible with cloud-based cardiac analytics platforms in major Japanese hospitals.

- In April 2024, Nihon Kohden signed a partnership agreement with a leading Australian telehealth provider to integrate its Holter data transmission system with virtual consultation platforms.

- In June 2024, Bionet introduced a new line of compact and wearable Holter recorders in Southeast Asia specifically designed for outpatient cardiac monitoring.

- In September 2024, Mindray Medical expanded its manufacturing facility in Shenzhen, China to increase production capacity for multi-channel Holter monitors.

- In November 2024, Schiller entered into a joint venture with a South Korean digital health startup to co-develop AI-powered Holter analysis software.

MARKET SEGMENTATION

This Asia Pacific cardiac holter monitor market research report is segmented and sub-segmented into the following categories.

By Product Type

- 1-Channel

- 2-Channel

- 3-Channel

- 12-Channel

- Others

By Component

- Holter Monitoring Devices

- Event Monitoring Devices

- Holter Analysis System and Software

By End User

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Homecare

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What factors are driving the growth of the Asia Pacific Cardiac Holter Monitor Market?

Growth is fueled by rising cardiovascular disease prevalence, sedentary lifestyles, aging population, and improved healthcare infrastructure

2. Which countries in Asia Pacific are leading in cardiac Holter monitor adoption?

China, Japan, and India are major contributors due to large populations, economic growth, and increased healthcare investments

3. What are the key applications of cardiac Holter monitors in the Asia Pacific region?

They are used for diagnosing arrhythmias, atrial fibrillation, bradycardia, and for post-surgical and elderly patient monitoring

4. How are technological advancements shaping the Asia Pacific Cardiac Holter Monitor Market?

Innovations include miniaturization, wireless connectivity, mobile device integration, and enhanced data analytics

5. What are the main end users of cardiac Holter monitors in Asia Pacific?

Hospitals, clinics, ambulatory surgical centers, diagnostic centers, and home healthcare settings are primary users

6. How is the aging population impacting the Asia Pacific Cardiac Holter Monitor Market?

A growing elderly demographic increases demand for continuous cardiac monitoring and early disease detection

7. What challenges does the Asia Pacific Cardiac Holter Monitor Market face?

Regulatory hurdles, reimbursement issues, lack of skilled personnel, and limited awareness in rural areas are key challenges

8. Who are the leading players in the Asia Pacific Cardiac Holter Monitor Market?

Key companies include GE Healthcare, Philips, Nihon Kohden, Medtronic, and regional manufacturers

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com