Asia Pacific Ceramic Fiber Market Size, Share, Trends & Growth Forecast Report By Type (Refractory Ceramic Fiber (RCF), Alkaline Earth Silicate (AES) Wool), By Product Form (Blanket, Board, Paper, Module), By End-use Industry (Refining & Petrochemical, Metal, Power Generation), and Country (India, China, Japan, South Korea, Australia, Rest of APAC) – Industry Analysis From 2025 to 2033.

Asia Pacific Ceramic Fiber Market Size

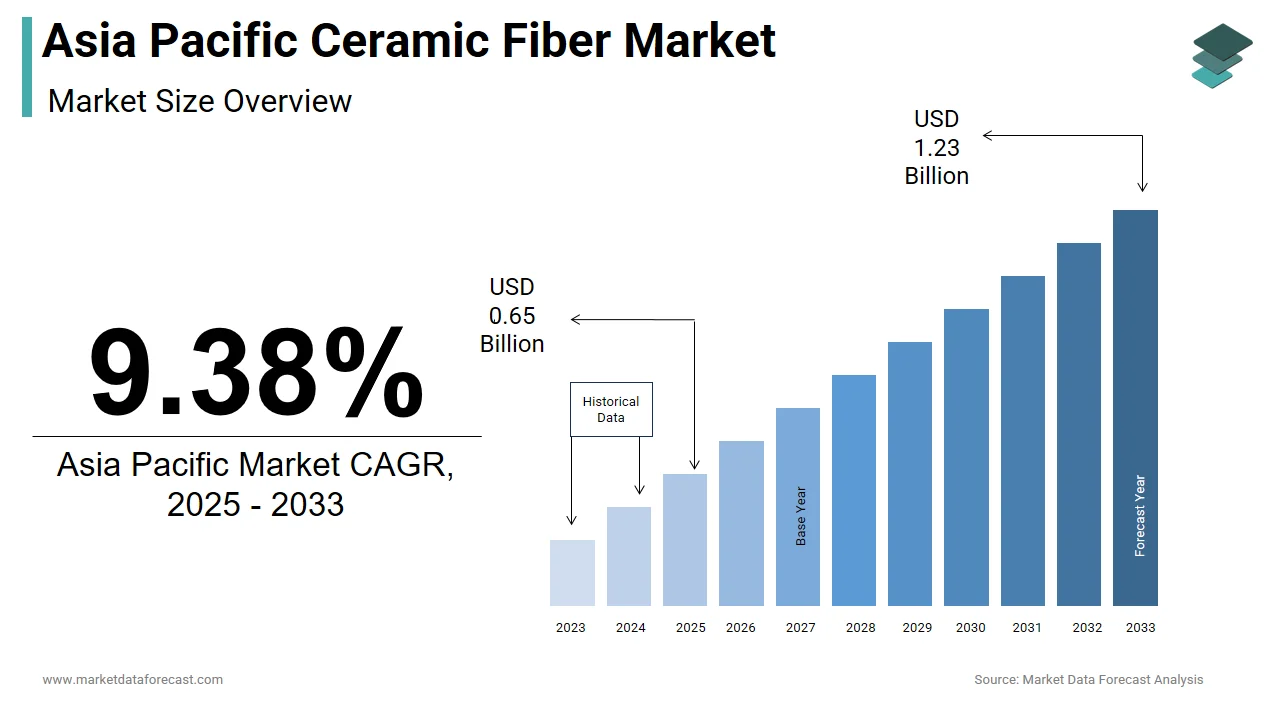

The size of the Asia Pacific ceramic fiber market was worth USD 0.55 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 9.38% from 2025 to 2033 and be worth USD 1.23 billion by 2033 from USD 0.60 billion in 2025.

The Asia Pacific ceramic fiber market refers to the production, distribution, and application of high-temperature insulation materials composed primarily of aluminum silicate-based fibers. These fibers are used across a range of industrial sectors, including steel manufacturing, petrochemicals, automotive, and energy, due to their excellent thermal resistance, low heat storage, and chemical stability. The region has emerged as a critical growth hub for this market, driven by rapid urbanization, infrastructure expansion, and rising investments in energy-efficient technologies.

MARKET DRIVERS

Expansion of the Industrial Furnace and Kiln Sector

One of the major drivers of the Asia Pacific ceramic fiber market is the rapid expansion of the industrial furnace and kiln sector in manufacturing-intensive economies like China, India, and South Korea. Ceramic fibers are extensively used as insulation materials in furnaces, kilns, and other high-temperature equipment due to their ability to retain heat efficiently while minimizing energy loss. According to the International Energy Agency, industrial heating accounts for over 20% of total final energy consumption in the manufacturing sector globally, with Asia Pacific contributing a significant share.

Moreover, stricter environmental regulations in countries like Japan and South Korea have led to a shift from traditional refractories to lightweight, high-efficiency ceramic fiber-based insulation. As per the Japan Furnace Industry Association, over 60% of newly commissioned industrial furnaces in 2024 incorporated ceramic fiber linings to meet emissions targets and improve operational efficiency. This trend is expected to continue, reinforcing the role of industrial furnace expansion as a primary growth driver for the ceramic fiber market in the region.

Rising Demand in Petrochemical and Refinery Applications

Another key driver fueling the Asia Pacific ceramic fiber market is the increasing demand from the petrochemical and refinery sectors, especially in countries such as Saudi Arabia, India, and Malaysia. Ceramic fibers are widely used in these industries for insulating pipelines, reactors, and distillation columns that operate at elevated temperatures ranging between 800°C and 1,400°C. Their lightweight nature, chemical inertness, and excellent thermal shock resistance make them ideal for use in environments where conventional insulation materials fail.

Additionally, China's State Energy Administration revealed that the country's ethylene production capacity reached 45 million metric tons in 2024, up from 38 million metric tons in 2022, leading to a corresponding increase in ceramic fiber consumption. As per industry estimates, each million metric tons of ethylene production capacity requires approximately 200 metric tons of ceramic fiber annually for reactor insulation.

MARKET RESTRAINTS

Volatility in Raw Material Prices

One of the major restraints affecting the Asia Pacific ceramic fiber market is the volatility in raw material prices, particularly for alumina and silica, which constitute the core components of ceramic fibers. These materials are sourced from mineral ores such as kaolin, bauxite, and quartz, all of which are subject to price fluctuations due to geopolitical tensions, supply chain disruptions, and environmental regulations.

According to the U.S. Geological Survey, the price of calcined alumina increased by approximately 18% in 2024 compared to the previous year, primarily due to reduced exports from Australia and Brazil caused by mine closures and stricter mining policies. This has directly impacted the cost structure of ceramic fiber manufacturers, leading to margin compression and forcing some smaller players to

Stringent Environmental Regulations on Emissions and Waste Disposal

Stringent environmental regulations concerning emissions and waste disposal pose a significant restraint on the Asia Pacific ceramic fiber market. Although ceramic fibers themselves are known for enhancing energy efficiency, the manufacturing process involves high-temperature melting and spinning techniques that generate considerable carbon emissions and hazardous waste.

In response to global climate goals, several governments in the region have introduced stricter emission norms. For instance, the Chinese Ministry of Ecology and Environment implemented new air pollution control measures in 2024, requiring ceramic fiber production units to adopt cleaner technologies or face penalties. Compliance with these standards necessitates substantial capital expenditure on filtration systems, scrubbers, and waste heat recovery units.

Japan’s Ministry of the Environment mandated tighter controls on particulate matter emissions from industrial processes, including ceramic fiber production. According to the Japan Fiberglass and Insulation Association, nearly 25% of Japanese ceramic fiber manufacturers had to temporarily halt operations in 2023 to upgrade their facilities. These regulatory pressures not only increase production costs but also slow down the rate of new project approvals, thereby limiting market expansion in the short to medium term across the Asia Pacific region.

MARKET OPPORTUNITIES

Growth in Renewable Energy Infrastructure Projects

A major opportunity driving the Asia Pacific ceramic fiber market is the accelerated development of renewable energy infrastructure projects, particularly in solar thermal power generation and geothermal energy systems. Ceramic fibers are increasingly being used in these applications due to their high thermal resistance, durability under cyclic temperature changes, and ability to provide efficient insulation in extreme conditions.

Similarly, in India, the Ministry of New and Renewable Energy has launched multiple tenders for geothermal power projects in states like Gujarat and Jammu & Kashmir. Geothermal plants operate with high-pressure steam and hot water extraction systems, necessitating robust insulation solutions. As per the Indian Renewable Energy Development Agency, the average geothermal plant uses about 100 metric tons of ceramic fiber insulation in piping and turbine enclosures. With ASEAN nations also ramping up investments in clean energy, the demand for ceramic fiber insulation in renewable energy infrastructure is expected to grow significantly in the coming decade.

Increasing Adoption in Lightweight Automotive Components

Another promising opportunity for the Asia Pacific ceramic fiber market lies in the growing adoption of lightweight materials in the automotive sector, particularly in electric vehicles (EVs) and hybrid models. Ceramic fibers are being increasingly used in exhaust systems, battery enclosures, and under-the-hood insulation due to their low density, high thermal resistance, and fire-retardant properties.

Japanese automakers such as Toyota and Honda have also started using ceramic fiber-reinforced materials in battery casings to prevent thermal runaway in lithium-ion batteries. As per the Japan Automobile Manufacturers Association, the average EV now contains over 20 kg of ceramic fiber-based insulation components, a figure expected to rise with advancements in battery technology.

MARKET CHALLENGES

Intense Competition from Substitute Insulation Materials

One of the primary challenges facing the Asia Pacific ceramic fiber market is the intense competition from alternative insulation materials such as mineral wool, basalt fiber, and aerogel-based insulations. These substitutes offer comparable thermal performance at lower costs, which is making them attractive options for budget-conscious industrial buyers. Mineral wool, for instance, remains a popular choice in industrial insulation due to its relatively low cost and widespread availability. Additionally, aerogel insulation is gaining traction in high-end applications such as LNG terminals and aerospace due to its ultra-low thermal conductivity and thin profile. While aerogels are more expensive than ceramic fibers, their superior efficiency in space-constrained settings is attracting interest from industries seeking compact insulation solutions.

Fluctuating Demand from Traditional Heavy Industries

Another significant challenge confronting the Asia Pacific ceramic fiber market is the fluctuating demand from traditional heavy industries such as steel, cement, and glass manufacturing. These sectors remain the largest consumers of ceramic fiber products, yet they are highly sensitive to economic cycles, policy shifts, and technological transitions.

These cyclical variations create uncertainty for ceramic fiber suppliers, making it difficult to plan production schedules and manage inventory effectively, thus posing a persistent challenge to steady market growth in the region.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Product Form, End-use Industry, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Morgan Advanced Materials plc. (UK), Alkegen (US), IBIDEN Co., Ltd. (Japan), NUTEC Incorporated (Mexico), HarbisonWalker International Inc. (US), Isolite Insulating Products Co., Ltd. (Japan), YESO INSULATING PRODUCTS COMPANY LIMITED (China), RATH Group (Austria), ZIRCAR Ceramics Inc. (US), and others. |

SEGMENTAL ANALYSIS

By Type Insights

The refractory ceramic fiber (RCF) segment was the largest and held a dominant share of the Asia Pacific ceramic fiber market. According to the China Association of Metallurgical Enterprises, over 75% of industrial furnaces in China utilize RCF-based linings due to their ability to withstand extreme heat cycles without degradation. In India, the Ministry of Steel reported that crude steel production reached 120 million metric tons in 2023–24, directly boosting demand for RCF products used in ladle and tundish linings. Additionally, regulatory support for energy efficiency in manufacturing sectors has reinforced RCF adoption. Japan’s Ministry of Economy, Trade and Industry indicated that industries adopting RCF insulation achieved up to 18% reduction in fuel consumption in furnace operations.

The Alkaline Earth Silicate (AES) Wool is lucratively growing with a CAGR of 9.3% in the next coming years. This growth is driven by increasing environmental concerns and the need for safer, biodegradable alternatives to traditional ceramic fibers. AES wool is considered a next-generation insulation material due to its low biological persistence and reduced health risks compared to RCF, which has been classified as a potential carcinogen by several international agencies. As per the International Commission on Occupational Health, several countries in the Asia Pacific region have begun phasing out RCF in favor of AES wool in applications involving direct human exposure, especially in automotive and construction sectors.

By Product Form Insights

The ceramic fiber blanket was the largest and held 43.2% of the Asia Pacific ceramic fiber market share in 2024. These blankets can be easily cut, shaped, and wrapped around complex geometries, making them ideal for dynamic insulation requirements in metallurgy and ceramics industries. Another significant driver is the growing demand from the power generation sector. In China, the National Energy Administration noted that more than 50% of coal-fired and gas-based power plants installed ceramic fiber blankets in boiler insulation systems during 2023–2024. The lightweight nature and excellent thermal resistance of these blankets enable improved energy efficiency and reduced maintenance downtime.

The ceramic fiber module is likely to grow with a CAGR of 10.7% during the forecast period. This rapid growth is largely driven by the increasing adoption of pre-fabricated insulation solutions in large-scale industrial projects. Ceramic fiber modules offer advantages such as uniform density, quick installation, and enhanced structural integrity, making them highly suitable for use in continuous process industries like steelmaking and petrochemical refining. Moreover, government initiatives promoting energy-efficient manufacturing are accelerating the uptake of ceramic fiber modules. In Malaysia, the Ministry of Energy and Natural Resources reported that new industrial zones established under the National Green Technology Policy included mandatory specifications for modular ceramic fiber insulation in all high-temperature equipment.

By End-use Industry Insights

The metal industry segment was the largest and held 38.7% of the Asia Pacific ceramic fiber market in 2024. A primary driver of this segment’s dominance is the ongoing expansion of the steel industry across key markets. According to the World Steel Association, China produced over 1.01 billion metric tons of crude steel in 2024, representing nearly half of global output. Each ton of steel produced requires extensive use of ceramic fiber-based insulation in ladles, tundishes, and reheating furnaces to ensure operational efficiency and reduce energy losses.

The power generation industry segment is likely to grow with a CAGR of 9.8% in the coming years. Thermal power plants that operate on natural gas and coal extensively use ceramic fiber products in boiler linings, ductwork, and turbine insulation. According to the International Energy Agency, Asia Pacific accounted for over 60% of new thermal power capacity additions globally in 2024, with China and India contributing significantly to this growth. The State Grid Corporation of China reported that over 45 GW of new thermal power projects initiated in 2023 required approximately 18,000 metric tons of ceramic fiber insulation.

Additionally, in Southeast Asia, Vietnam’s Electricity of Vietnam (EVN) announced plans to install 15 GW of new power capacity by 2030, including biomass and coal-fired plants, where ceramic fiber modules are being specified for high-temperature insulation. With governments focusing on stable and efficient power supply amid rising industrialization, the power generation segment is poised for strong growth in ceramic fiber consumption.

COUNTRY LEVEL ANALYSIS

China was the outperformer in the Asia Pacific ceramic fiber market with 50.4% of the share in 2024. As the world’s largest manufacturing hub, China's vast industrial base drives consistent demand for high-temperature insulation solutions across sectors such as steel, cement, and petrochemicals.

According to the National Bureau of Statistics of China, the country’s industrial output expanded by 6.8% year-over-year in early 2024, with heavy industries contributing significantly to this growth. The Ministry of Industry and Information Technology reported that over 9 million electric vehicles were sold in 2024, many of which incorporate ceramic fiber-based insulation in battery enclosures, adding a new dimension to market demand.

India ceramic fiber market was next with 12.3% of the share in 2024. The country’s industrial expansion, supported by government policies such as Make in India and Production-Linked Incentive (PLI) schemes, has created substantial demand for ceramic fiber products.

The renewable energy sector is also contributing to market expansion. According to the Ministry of New and Renewable Energy, India added over 15 GW of new solar and wind capacity in 2024, necessitating ceramic fiber insulation in thermal storage units and high-temperature piping.

Japan is growing lucratively by maintaining a strong presence due to its advanced industrial infrastructure and emphasis on precision manufacturing. Unlike emerging economies, Japan’s demand is primarily driven by high-end applications in electronics, semiconductors, and aerospace.

The Japan Furnace Industry Association reported that over 60% of newly commissioned industrial furnaces in 2024 incorporated ceramic fiber linings to meet stringent emissions standards and improve energy efficiency. Japanese automakers, including Toyota and Honda, have increasingly adopted ceramic fiber-based insulation in lithium-ion battery casings to prevent thermal runaway, aligning with the country’s EV transition strategy.

South Korea's ceramic fiber market growth is with its reliance on high-performance materials in semiconductor fabrication, shipbuilding, and automotive manufacturing. The country’s well-developed industrial ecosystem supports consistent demand for specialized ceramic fiber products.

Australia's ceramic fiber market growth is driven primarily by its mining, minerals processing, and energy-intensive industries. Though smaller in scale compared to China or India, the Australian market is notable for its high-value applications and compliance with strict occupational health and safety regulations.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC ceramic fiber market profiled in this report are Morgan Advanced Materials plc. (UK), Alkegen (US), IBIDEN Co., Ltd. (Japan), NUTEC Incorporated (Mexico), HarbisonWalker International Inc. (US), Isolite Insulating Products Co., Ltd. (Japan), YESO INSULATING PRODUCTS COMPANY LIMITED (China), RATH Group (Austria), ZIRCAR Ceramics Inc. (US), and others.

TOP LEADING PLAYERS IN THE MARKET

Unifrax Corporation

Unifrax is a leading global manufacturer of ceramic fiber products and holds a strong presence in the Asia Pacific market. The company offers a wide range of high-temperature insulation solutions tailored for industries such as steel, glass, petrochemicals, and automotive. With strategic partnerships and production facilities across China and India, Unifrax plays a pivotal role in shaping regional demand trends. Its focus on innovation and sustainable product development has positioned it as a preferred supplier in both traditional and emerging applications.

Morgan Advanced Materials

Morgan Advanced Materials is a key player known for its advanced thermal management solutions using ceramic fibers. The company serves diverse sectors, including energy, aerospace, and industrial manufacturing across the Asia Pacific region. Morgan’s technical expertise and customized insulation systems have made it a trusted partner for large-scale infrastructure and industrial projects. Its ability to deliver high-performance, application-specific products enhances its competitive edge in the regional market.

Isover (Saint-Gobain Group)

Isover, part of the Saint-Gobain Group, is a major contributor to the ceramic fiber market with a focus on energy-efficient and fire-resistant insulation materials. In the Asia Pacific region, Isover leverages its global R&D capabilities to develop tailored ceramic fiber solutions that meet local regulatory and performance standards. The company's extensive distribution network and commitment to sustainability support its growth and reinforce its position in the industrial insulation sector.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by leading players is product innovation and development. Companies are continuously investing in research to enhance ceramic fiber properties such as thermal resistance, durability, and environmental safety.

Another key approach is strategic partnerships and collaborations. By forming alliances with local manufacturers, distributors, and engineering firms, companies can strengthen their regional presence, gain access to new markets, and improve supply chain efficiency. These collaborations also facilitate knowledge transfer and localized product customization.

Lastly, expansion through acquisitions and facility investments is widely pursued. Several companies have been acquiring smaller regional players or setting up new production units to increase capacity and reduce logistics costs. This helps in better serving growing industrial sectors and responding swiftly to customer demands across the Asia Pacific region.

COMPETITION OVERVIEW

The competition in the Asia Pacific ceramic fiber market is characterized by the presence of both global leaders and regional players striving to capture market share through differentiation and innovation. Established multinational corporations leverage their technological expertise, broad product portfolios, and well-established distribution networks to maintain dominance, particularly in high-value applications. At the same time, domestic manufacturers in countries like China and India are gaining traction by offering cost-effective alternatives and catering to localized demand patterns. As industries across the region increasingly prioritize energy efficiency and compliance with environmental regulations, companies are focusing on developing safer, more sustainable ceramic fiber solutions. The market is witnessing intensified rivalry not only in pricing but also in product performance, technical support, and after-sales services. Strategic moves such as mergers, acquisitions, joint ventures, and capacity expansions are becoming common as firms aim to consolidate their positions and respond to dynamic industrial needs across diverse end-use sectors.

RECENT MARKET DEVELOPMENTS

- In February 2024, Unifrax launched a new line of bio-soluble ceramic fiber products specifically designed for use in the automotive and electronics industries across Asia. This initiative was aimed at addressing growing health and safety concerns associated with traditional refractory ceramic fibers and strengthening its foothold in high-growth sectors.

- In May 2024, Morgan Advanced Materials expanded its production facility in Shanghai, China, to increase local manufacturing capacity and reduce lead times for customers in the region. The expansion was part of the company’s broader strategy to enhance its service offerings in industrial insulation and support the rapid pace of infrastructure development.

- In August 2024, Isover, under the Saint-Gobain umbrella, entered into a strategic partnership with an Indian insulation distributor to expand its reach in South Asia. The collaboration enabled Isover to tap into new customer segments and improve its supply chain efficiency in one of the fastest-growing markets for industrial insulation.

- In November 2024, Shandong Luyang Co., Ltd., a leading Chinese ceramic fiber manufacturer, announced a joint venture with a Japanese industrial equipment firm to co-develop advanced ceramic fiber modules for use in high-efficiency furnaces. This move was intended to enhance product innovation and meet rising demand from metal processing industries.

- In March 2025, Thermasil Limited opened a new regional technical center in Singapore to provide localized R&D support and application engineering services.

MARKET SEGMENTATION

This Asia Pacific ceramic fiber market research report is segmented and sub-segmented into the following categories.

By Type

- Refractory Ceramic Fiber (RCF)

- Alkaline Earth Silicate (AES) Wool

By Product Form

- Blanket

- Board

- Paper

- Module

By End-use Industry

- Refining & Petrochemical

- Metal

- Power Generation

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific ceramic fiber market?

The Asia Pacific ceramic fiber market is driven by rapid industrialization, demand for energy-efficient thermal insulation, expansion in power, steel, and petrochemical sectors, and strict environmental regulations

2. What challenges affect the Asia Pacific ceramic fiber market?

The Asia Pacific ceramic fiber market faces challenges like raw material price volatility, regulatory scrutiny on health and safety, and competition from alternative insulation materials

3. What opportunities exist in the Asia Pacific ceramic fiber market?

The Asia Pacific ceramic fiber market offers opportunities in product innovation, sustainable manufacturing, expansion in high-temperature applications, and growing infrastructure and industrial investments

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com