Asia Pacific Chip Mounter Market Size, Share, Trends & Growth Forecast Report By Technology (Hole, Surface Mount, Fine Pitch), Application (Consumer Electronics, Medical, Automotive, Telecommunication), and Country (India, China, Japan, South Korea, Australia, New Zealand) – Industry Analysis From 2025 to 2033.

Asia Pacific Chip Mounter Market Size

The size of the Asia Pacific chip mounter market was worth USD 2.8 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 4.4% from 2025 to 2033 and be worth USD 4.13 billion by 2033 from USD 2.92 billion in 2025.

Chip mounters, also known as pick-and-place machines are essential for assembling printed circuit boards (PCBs) by accurately placing surface-mount devices (SMDs) onto substrates.Countries like China along with South Korea and Japan are at the forefront of adopting advanced chip mounter technologies ensuring precision and efficiency in high-volume production lines.Adopting of high-speed chip mounters has reduced assembly time by up to 30.39% enabling manufacturers to meet growing consumer demand for smartphones as well as automotive electronics and IoT devices.Technological advancements have further shaped this market. Innovations in vision systems and AI-driven placement algorithms have improved accuracy rates and reduced defects and enhanced product reliability.

MARKET DRIVERS

Rising Demand for Consumer Electronics

Escalating demand for consumer electronics is one of the primary drivers of the Asia Pacific chip mounter market and is fueled by urbanization and digital transformation. The increasing prevalence of smart devices in urban households driven by factors like rising urbanization and awareness of smart home technology is prompting manufacturers to adopt advanced chip mounting technologies This trend is mirrored across the region with South Korea leading the charge in producing cutting-edge electronics like foldable smartphones and 8K televisions. China’s electronics manufacturing sector grew by 25.02% annually over the past five years further necessitating investments in state-of-the-art chip mounters to handle complex PCB designs.

Expansion of Automotive Electronics

Rapid expansion of automotive electronics particularly in electric vehicles (EVs) and autonomous driving systems is another key driver of the Asia Pacific chip mounter market. Over 40.45% of new vehicles produced in Japan now incorporate advanced driver-assistance systems (ADAS) requiring sophisticated PCB assemblies. Chip mounters play a crucial role in ensuring the precision and reliability of these components which are integral to vehicle safety and performance. The surge in EV production often at a rate of 50.02% annually is creating a significant demand for high-speed chip mounters. Similarly, Thailand’s Board of Investment emphasizes that regional automotive hubs are adopting automated assembly lines equipped with chip mounters to enhance scalability and reduce production costs.

MARKET RESTRAINTS

High Initial Costs and Budget Constraints

High initial costs and budget requirements for procurement and integration present a significant barrier to the widespread adoption of advanced chip mounters in the Asia Pacific region.Setting up a fully automated chip mounting line can be highly expensive with costs varying based on the scale and complexity of the operation. This financial burden is particularly challenging for small and medium-sized enterprises (SMEs) in emerging economies like Vietnam and Indonesia where budget constraints often dictate manufacturing investments. Moreover, the ongoing operational costs associated with maintenance and software updates add to the overall expense. Annual maintenance costs for chip mounters can range from 10-15% of the initial investment deterring many manufacturers from upgrading their equipment.

Limited Skilled Workforce for Advanced Equipment

Shortage of skilled professionals capable of operating and maintaining advanced chip mounters is another critical restraint of the Asia Pacific chip mounter market. Fewer than 20.4% of local technicians receive formal training in modern electronics manufacturing technologies along with creating a bottleneck in service delivery. This knowledge gap often leads to inefficiencies and underutilization of equipment particularly in regions with limited access to technical education. Over 60.03% of manufacturers face challenges in integrating chip mounters into their existing workflows due to a lack of expertise. Addressing this issue requires targeted educational initiatives and partnerships with industry stakeholders to enhance workforce capabilities.

MARKET OPPORTUNITIES

Integration with Industry 4.0 Technologies

Rapid advancements in Industry 4.0 technologies present a significant opportunity for the Asia Pacific chip mounter market. Integrating chip mounters with AI-driven analytics and IoT platforms can improve production efficiency by up to 20.35% enabling real-time monitoring and predictive maintenance. Furthermore, the convergence of chip mounters with robotics and automation enhances scalability and flexibility in production lines. Combining these technologies has reduced defect rates and made them more attractive for large-scale applications. Governments in the region are incentivizing the adoption of Industry 4.0 solutions through subsidies and tax breaks further accelerating their implementation.

Growth of Outsourced Manufacturing Services

The growth of outsourced manufacturing services offers another promising opportunity for the chip mounter market. Over 50.27% of electronics production in Southeast Asia is outsourced to contract manufacturers who rely heavily on advanced chip mounters to meet client specifications. These systems enable manufacturers to deliver high-quality products at competitive prices while ensuring sustained demand for chip mounter technologies. Regional manufacturing hubs are expanding their capacity by adopting automated assembly lines equipped with chip mounters. This strategic shift toward outsourcing positions the chip mounter market for accelerated growth particularly in countries with favorable labor costs and regulatory frameworks.

MARKET CHALLENGES

Technological Obsolescence and Rapid Innovation

Technological obsolescence and the rapid innovation present a pressing challenge for the Asia Pacific chip mounter market often rendering existing equipment outdated.The average lifespan of a chip mounter is around five years after which it may struggle to meet the demands of increasingly complex PCB designs. This creates pressure on manufacturers to continuously upgrade their equipment which adds to operational costs and financial strain.

South Korea’s Electronics and Telecommunications Research Institute notes that the transition to 5G-enabled devices and miniaturized components requires next-generation chip mounters with higher precision and speed. Smaller manufacturers especially in emerging economies often struggle to keep pace with these advancements that limit their competitiveness in the global market.

Supply Chain Disruptions and Component Shortages

Supply chain disruptions and component shortages pose another significant challenge to the chip mounter market which impacts production timelines and availability. The global semiconductor shortage has led to delays in the production of critical components used in chip mounters and also affects manufacturing schedules across the region. This issue is particularly acute in countries like Malaysia and the Philippines where reliance on imported components is high. Over 30.21% of manufacturers experienced production delays due to supply chain bottlenecks in 2022. To mitigate this risk companies are exploring localized sourcing and inventory management strategies. However, these measures often increase costs and pose a challenge for smaller players in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Technology, Application, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

ASM Pacific Technology (ASMPT), Fuji Corporation, Yamaha Motor Co., Ltd., Panasonic Corporation, JUKI Corporation, Hanwha Precision Machinery Co., Ltd., Mycronic AB, Samsung Electronics Co., Ltd., Hitachi High-Tech Corporation, and Universal Instruments Corporation. |

SEGMENTAL ANALYSIS

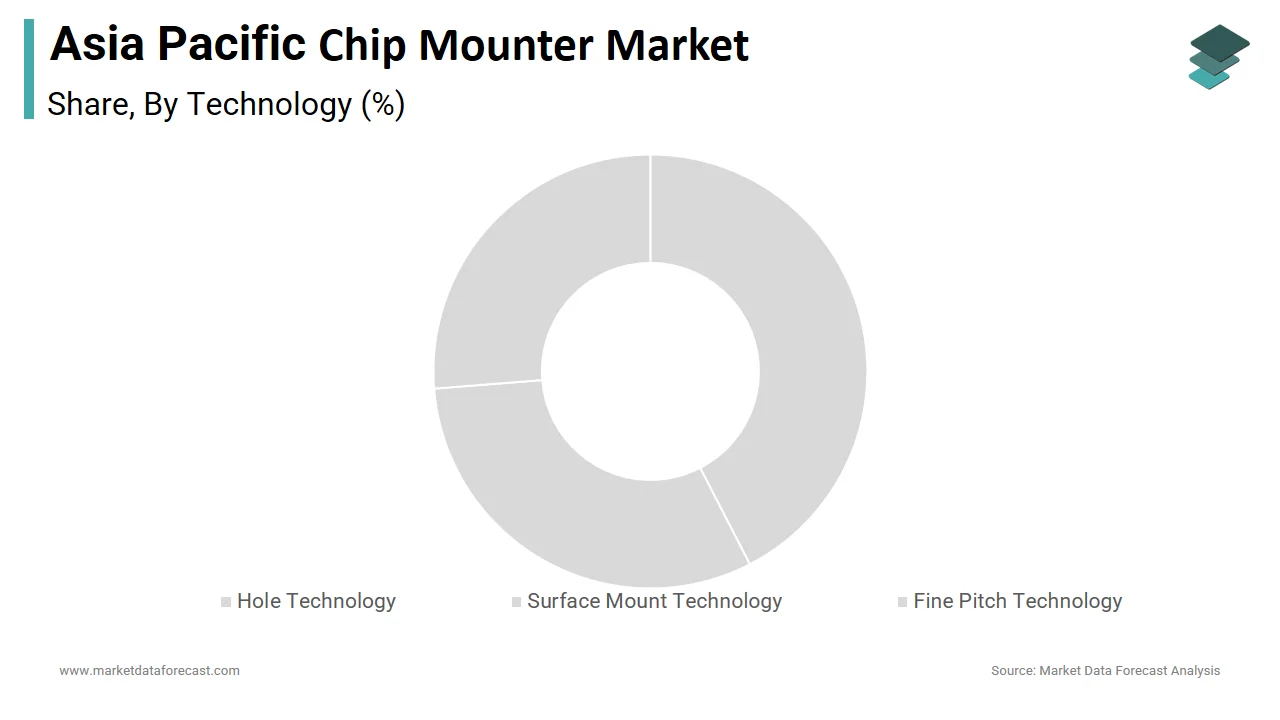

By Technology Insights

The Surface Mount Technology (SMT) segment was the largest and held 60.5% of the Asia Pacific chip mounter market by capturing 60.5% of share in 2024 with its superior precision, speed and compatibility with miniaturized components making it indispensable for modern electronics manufacturing. A key factor behind SMT’s dominance is its widespread adoption in consumer electronics. Over 70.46% of smartphones and tablets produced globally use SMT for PCB assembly which enables manufacturers to meet tight production deadlines while maintaining high-quality standards. The technology’s ability to handle complex designs with minimal defects aligns with regional manufacturing goals particularly in countries like China and South Korea where high-volume production is critical. Another contributing factor is the integration of AI-driven systems into SMT equipment. AI-enhanced SMT systems have improved placement accuracy by 15.03% reducing rework rates and enhancing product reliability.

The fine pitch technology segment is projected to witness a CAGR of 14.3% during the forecast period. This growth is fueled by the increasing demand for compact and high-density PCBs in advanced applications such as medical devices and IoT-enabled systems.One major driver is the rising adoption of miniaturized components in emerging industries. Fine pitch technology is essential for assembling PCBs used in wearable medical devices which require precise placement of micro-components. Additionally, government incentives are accelerating the adoption of fine pitch technology. Subsidies for advanced electronics manufacturing have encouraged companies to upgrade their equipment which further boosted the growth of this segment.

By Application Insights

The consumer electronics segment was the largest in the Asia Pacific chip mounter market by capturing 50.04% of the total market share in 2024 with the region’s status as a global hub for smartphone along with television and IoT device manufacturing which necessitates advanced chip mounters for high-speed and precise assembly. Over 60.03% of households in urban areas now own at least one smart device in turn driving manufacturers to adopt chip mounters capable of handling complex PCB designs. Another contributing factor is the emphasis on automation in production lines. Automated chip mounters have reduced assembly time by up to 25.06% enabling manufacturers to meet growing consumer demand while maintaining high-quality standards.

The automotive segment is projected to witness a CAGR of 12.8% during the forecast period. This growth is fueled by the rapid expansion of electric vehicles (EVs) and autonomous driving systems which require sophisticated PCB assemblies. One major driver is the increasing complexity of automotive electronics. Over 40.28% of new vehicles produced in China now incorporate advanced driver-assistance systems (ADAS) necessitating precise and reliable chip mounting solutions. This trend has led to a surge in demand for high-speed chip mounters capable of handling miniaturized components. Additionally, government initiatives are promoting the adoption of EVs and connected vehicles. Subsidies for EV production have increased investments in automated assembly lines equipped with chip mounters which further accelerate the growth of this segment.

COUNTRY LEVEL ANALYSIS

China was the top performer of the Asia Pacific chip mounter market and accounted for 35.9% of share in 2024. The country’s dominance is rooted in its massive electronics manufacturing base and strategic investments in semiconductor production. Beijing’s "Made in China 2025" initiative has spurred the adoption of advanced chip mounters which also ensures widespread integration into high-volume production lines. Additionally, the proliferation of consumer electronics and EV manufacturing has created a robust demand for chip mounters which strengthen China’s position as a market leader.

Japan was positioned second in holding the dominant share of the Asia Pacific chip mounter market and is driven by its reputation for technological innovation and high manufacturing standards. Tokyo and Osaka are hubs for advanced electronics manufacturing where chip mounters are widely adopted to ensure precision and efficiency. The government’s focus on exporting chip mounter technologies to neighboring countries further strengthens its position in the regional market.

The South Korea chip mounter market growth is driven by its strong position in semiconductor and consumer electronics manufacturing which fuels demand for state-of-the-art chip mounters. Seoul’s emphasis on developing next-generation technologies ensures sustained growth in the chip mounter market.

India’s chip mounter market growth is likely to have fastest growth opportunities in the next coming years. The country’s growing electronics manufacturing ecosystem supported by initiatives like "Make in India" has increased investments in chip mounters for consumer electronics and automotive applications. This strategic shift positions India as a key player in the regional market.

The Thailand chip mounter market is driven by the country's status as a regional automotive hub which boosts demand for EV production and advanced electronics manufacturing. Government incentives for outsourced manufacturing services further boost the adoption of chip mounters.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC chip mounter market profiled in this report are ASM Pacific Technology (ASMPT), Fuji Corporation, Yamaha Motor Co., Ltd., Panasonic Corporation, JUKI Corporation, Hanwha Precision Machinery Co., Ltd., Mycronic AB, Samsung Electronics Co., Ltd., Hitachi High-Tech Corporation, and Universal Instruments Corporation.

TOP LEADING PLAYERS IN THE MARKET

Yamaha Motor Co., Ltd.

Yamaha Motor Co., Ltd. is a global leader in the Asia Pacific chip mounter market renowned for its advanced surface mount technology (SMT) solutions and high-speed placement systems. The company’s focus on innovation has enabled it to deliver precision-driven equipment that caters to diverse applications from consumer electronics to automotive manufacturing. Yamaha’s commitment to sustainability aligns with regional environmental goals which ensure compliance with stringent manufacturing standards. Yamaha ensures its products meet diverse regulatory requirements while maintaining global standards.

Panasonic Corporation

Panasonic Corporation is another key player leveraging its expertise in automation and robotics to dominate the chip mounter market. The company specializes in developing scalable and modular systems that cater to high-volume production lines, particularly in industries like telecommunications and medical devices. Its emphasis on integrating AI and IoT into its equipment enhances operational efficiency and product reliability. Globally, Panasonic has contributed to advancing chip mounter technology by offering flexible solutions that adapt to evolving customer needs and strengthen its reputation as a trusted provider.

Samsung Techwin (Hanwha Techwin)

Samsung Techwin, now part of Hanwha Techwin is a prominent name in the chip mounter market known for its robust fine pitch technology systems. The company’s products are widely adopted in the semiconductor and automotive sectors due to their accuracy and speed. Hanwha Techwin’s focus on R&D ensures continuous improvement in system performance while addressing challenges like miniaturization and high-density PCB assembly. Hanwha continues to expand its footprint in the global chip mounter sector.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Partnerships with Regional Manufacturers

Strategic partnerships with regional manufacturers have been prioritized by key players in the Asia Pacific chip mounter market to align their offerings with local production needs. These collaborations enable companies to tailor their technologies to specific industry requirements such as automotive electronics or consumer devices. For instance, partnerships with contract manufacturers ensure seamless integration of chip mounters into automated assembly lines enhancing scalability and reducing production costs.

Focus on Innovation and Customization

Leading companies invest heavily in R&D to develop next-generation technologies such as AI-driven vision systems and predictive maintenance tools that address evolving customer demands. Customization is another critical aspect with firms offering solutions tailored to specific applications such as medical device assembly or IoT-enabled systems.

Expansion of After-Sales Services and Training Programs

Expansion of after-sales services covering maintenance along with repair and technical support is a key focus for leading players aiming to build long-term relationships with customers. These services ensure optimal performance of chip mounters throughout their lifecycle as well reducing downtime and operational costs for users.

COMPETITION OVERVIEW

The Asia Pacific chip mounter market is characterized by intense competition and is driven by the region’s dominance in electronics manufacturing and semiconductor production. Key players like Yamaha Motor Co., Ltd., Panasonic Corporation and Hanwha Techwin dominate the landscape leveraging their technological expertise and extensive service networks to capture market share. Yamaha focuses on high-speed SMT systems whereas Panasonic emphasizes AI-driven automation creating a dynamic rivalry. Smaller regional players also contribute to the competitive environment by offering cost-effective alternatives. Innovation serves as a key battleground with firms investing in R&D to develop next-generation chip mounter technologies. Despite the dominance of established players these emerging technologies and evolving customer preferences present opportunities for new entrants ensuring a vibrant and competitive ecosystem.

RECENT MARKET DEVELOPMENTS

- In March 2023, Yamaha Motor Co., Ltd. launched a collaboration with China’s Ministry of Industry and Information Technology to integrate AI-driven chip mounters into smart factories.

- In June 2023, Panasonic Corporation signed a partnership agreement with an Indian electronics manufacturer to retrofit existing assembly lines with high-speed SMT systems.

- In September 2023, Hanwha Techwin announced the establishment of a dedicated training center in South Korea.

- In November 2023, ASM Pacific Technology introduced a new line of IoT-enabled chip mounters specifically designed for Southeast Asian markets.

- In January 2024, Fuji Corporation partnered with a major Japanese automotive manufacturer to integrate predictive analytics into its chip mounting operations.

MARKET SEGMENTATION

This Asia Pacific chip mounter market research report is segmented and sub-segmented into the following categories.

By Technology

- Hole Technology

- Surface Mount Technology

- Fine Pitch Technology

By Application

- Consumer Electronics

- Medical

- Automotive

- Telecommunication

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific chip mounter market?

The Asia Pacific chip mounter market is driven by booming electronics manufacturing in China, Japan, and South Korea, rising demand for smartphones, EVs, and IoT devices, plus rapid adoption of advanced SMT and automation technologies

2. What challenges affect the Asia Pacific chip mounter market?

Major challenges for the Asia Pacific chip mounter market include high initial and maintenance costs, shortage of skilled operators, fast technological obsolescence, and supply chain disruptions impacting component availability

3. What opportunities exist in the Asia Pacific chip mounter market?

Key opportunities for the Asia Pacific chip mounter market are integration with AI and IoT, government incentives for Industry 4.0, growth in outsourced manufacturing, and rising demand for miniaturized, high-density electronics

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]