Asia Pacific Consumer Electronics Market Size, Share, Trends & Growth Forecast Report By Sales Channel (Offline, Online), Product (Smartphones, Tablets, Desktops, Laptops/Notebooks, Digital Cameras, Hard Disk Drives, Television, E-readers), and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC) – Industry Analysis From 2025 to 2033.

Asia Pacific Consumer Electronics Market Size

The size of the Asia Pacific consumer electronics market was valued at USD 285.33 billion in 2024. This market is expected to grow at a CAGR of 7.37% from 2025 to 2033 and be worth USD 541.12 billion by 2033 from USD 306.36 billion in 2025.

The Asia Pacific consumer electronics market is a dynamic and rapidly evolving sector. Also, the proliferation of smartphones, smart home devices, and wearable technology has been instrumental in shaping this landscape. Additionally, urbanization trends have played a critical role, with a large share of the population expected to reside in urban areas by 2030. This demographic shift has fueled the adoption of cutting-edge gadgets among tech-savvy consumers. Furthermore, government initiatives promoting digital transformation, such as India's Digital India program, have accelerated market growth. Despite challenges like supply chain disruptions, the region’s resilience is evident.

MARKET DRIVERS

Rising Disposable Income and Urbanization

The surge in disposable income across the Asia Pacific region has significantly bolstered consumer spending on electronics. Like, the average GDP per capita in emerging economies like India and Indonesia grew notably between 2018 and 2022, enabling households to allocate more resources toward premium gadgets. Urban centers, in particular, exhibit heightened demand, with cities like Shanghai, Tokyo, and Mumbai driving sales of high-end products such as OLED TVs and AI-powered speakers. A study notes that urban households spend a large portion of their income on electronics, compared to rural counterparts.

Technological Advancements and Innovation

Technological innovation remains a cornerstone of growth in the Asia Pacific consumer electronics market. This advancement has spurred the development of next-generation products, including augmented reality (AR) glasses and smart home ecosystems. South Korea, for instance, boasts a high 5G penetration rate, fostering early adoption of IoT-based appliances. Similarly, advancements in semiconductor technology, particularly from Taiwan and South Korea, have reduced production costs, making devices more affordable. Besides, artificial intelligence integration into everyday gadgets, such as voice assistants and smart refrigerators, has captivated consumers seeking enhanced functionality. With R&D investments surging considerably across the region, continuous innovation ensures that the market remains vibrant and competitive, catering to evolving consumer preferences.

MARKET RESTRAINTS

Supply Chain Disruptions and Component Shortages

Supply chain vulnerabilities have emerged as a significant restraint for the Asia Pacific consumer electronics market. The region relies heavily on intricate global supply networks, particularly for semiconductors and rare earth materials. Also, the global semiconductor shortage caused a decline in electronic device production in 2021, disproportionately affecting Asia Pacific manufacturers. Furthermore, geopolitical tensions, such as those between China and Taiwan, exacerbate risks, given Taiwan's dominance in semiconductor manufacturing, controlling a notable share of global output. These disruptions lead to increased costs, with component prices surging during peak shortages. For smaller enterprises, these fluctuations pose existential threats, while larger firms struggle to maintain consistent product availability.

Environmental Concerns and Regulatory Pressures

Environmental sustainability is another pressing challenge impacting the Asia Pacific consumer electronics market. E-waste generation in the region reached 24.9 million metric tons in 2020, accounting for nearly half of the global total, according to the Global E-waste Monitor. Governments are increasingly enforcing stringent regulations to curb environmental degradation, such as China’s Extended Producer Responsibility policy, which mandates manufacturers to manage end-of-life product disposal. Compliance with these regulations often necessitates substantial financial outlays. Apart from these, consumer awareness about sustainable practices is growing. However, transitioning to greener alternatives, such as biodegradable materials or energy-efficient designs, involves technical complexities and higher costs.

MARKET OPPORTUNITIES

Growing Demand for Smart Home Solutions

The burgeoning interest in smart home technologies presents a lucrative opportunity for the Asia Pacific consumer electronics market. Countries like Japan and South Korea are at the forefront, with a considerable number of urban households already equipped with smart devices such as thermostats, lighting systems, and security cameras. The integration of AI and IoT into these solutions enhances user experience, driving adoption among tech-savvy consumers. For instance, Samsung's SmartThings platform has gained traction, with active users increasing. Furthermore, the rise of affordable housing projects in emerging economies like India and Indonesia creates new avenues for smart home penetration.

MARKET CHALLENGES

Intense Price Competition and Marginal Profits

Price wars among manufacturers pose a formidable challenge to profitability in the Asia Pacific consumer electronics market. In highly saturated markets like smartphones, brands such as Xiaomi and Realme aggressively undercut competitors, eroding profit margins. This relentless focus on affordability often compromises product quality, leading to shorter device lifespans and increased e-waste. Moreover, smaller players struggle to compete with established giants, resulting in market consolidation. With consumer expectations for low-cost, high-performance devices rising, companies face the daunting task of balancing innovation with cost management.

Rapid Technological Obsolescence

The pace of technological advancement in the Asia Pacific consumer electronics market introduces the challenge of rapid obsolescence. This shift is particularly pronounced in categories like smartphones and laptops, where hardware upgrades occur biannually. For example, Apple's introduction of the M1 chip rendered previous MacBooks less appealing, impacting resale values and consumer loyalty. Also, the constant need for innovation drives up R&D costs, with firms allocating a major part of revenues to stay competitive. Consumers, accustomed to frequent upgrades, exhibit shorter brand loyalty, exacerbating the issue. This cycle not only strains manufacturers financially but also contributes to mounting e-waste.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Sales Channel, Product, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Acer Inc., Apple Inc., ASUSTeK Computer Inc., Canon Inc., Dell Technologies, Google LLC, Hewlett Packard Enterprise Development LP, HTC Corporation, Huawei Technologies Co., Ltd., Lenovo, LG Electronics, Micromax, Motorola Mobility LLC, Nikon, Panasonic Holdings Corporation, Samsung Electronics Co., Ltd., Seagate Technology LLC, Sony Corporation, Toshiba Corporation, ZTE Corporation, and others. |

SEGMENTAL ANALYSIS

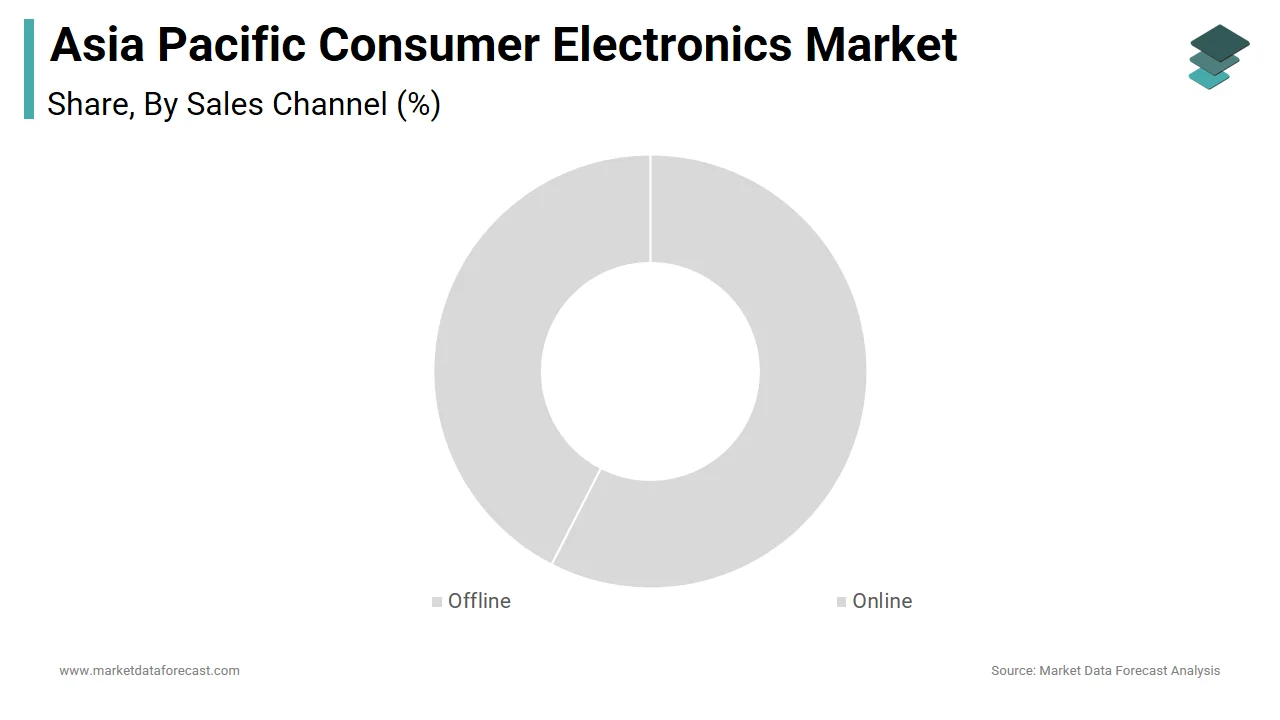

By Sales Channel Insights

The offline sales segment dominated the Asia Pacific consumer electronics market by capturing a 65.5% of the total revenue in 2024. This prominence is driven by several factors, with accessibility being a key driver. Traditional brick-and-mortar stores offer consumers the advantage of physically interacting with products before purchase, which is particularly appealing for high-value items like laptops and smart home devices. Also, offline channels benefit from established distribution networks, especially in rural areas where internet penetration remains limited. Like, rural internet access in Southeast Asia lags behind urban areas, making physical stores indispensable. Another driving factor is trust, with many consumers associating offline purchases with authenticity and after-sales service reliability. A report by McKinsey brings to light that 60% of Chinese consumers prioritize brand-authorized retail outlets for warranty support. These elements collectively reinforce the stronghold of offline sales in the region.

The online sales channel segment is the fastest-growing in the Asia Pacific consumer electronics market, with a projected CAGR of 18.5% from 2025 to 2033. This is fueled by increasing internet penetration and the proliferation of e-commerce platforms. For example, China boasts an internet user base exceeding 1 billion, as reported by the China Internet Network Information Center, enabling seamless adoption of online shopping. Besides, the convenience of doorstep delivery and competitive pricing strategies have attracted price-sensitive consumers, particularly in emerging markets like India and Indonesia. The integration of advanced technologies like augmented reality (AR) on e-commerce platforms also enhances customer experience. For instance, Flipkart introduced AR features allowing users to visualize smartphones in real-time, boosting conversion rates by 30%. Moreover, the pandemic-induced shift toward digital lifestyles has accelerated this trend, with Forrester estimating that 40% of urban households now prefer online channels for electronics.

By Product Insights

On the other hand, the smartphones accounted for the largest share of the Asia Pacific consumer electronics market i.e. 50.5% of the total revenue in 2024. This control over the market is caused by their multifunctionality, affordability, and widespread adoption across all demographics. In developing nations like India and Indonesia, low-cost smartphones priced below $200 make them accessible to a broader audience. Furthermore, the integration of advanced features such as 5G connectivity and AI-powered cameras has elevated consumer expectations. South Korea, for instance, leads in 5G adoption, with a large portion of its population using 5G-enabled devices.

The laptops and notebooks are the quickest expanding product, with a projected CAGR of 12.3%. This acceleration is propelled by the surge in remote work and online learning, trends that gained momentum during the pandemic. Besides, advancements in processing power and battery life have enhanced usability, attracting both professionals and students. A study by PwC reveals that a large share of corporate employees in the Asia Pacific region use laptops as their primary work device, driving enterprise adoption. The rise of hybrid work models further amplifies this trend, with companies investing heavily in IT infrastructure. For example, Lenovo reported a year-over-year increase in commercial laptop sales in India, attributed to corporate bulk purchases. Moreover, affordability initiatives by manufacturers, such as installment payment options, have made laptops accessible to mid-income households.

COUNTRY LEVEL ANALYSIS

China was the leader in the Asia Pacific consumer electronics market, with a 40.5% of the region’s total revenue in 2024. This influence is due to robust manufacturing capabilities and a vast domestic consumer base. Also, the country hosts global tech giants like Huawei and Xiaomi, which leverage economies of scale to produce affordable yet innovative devices. Like, China filed over 68,000 patents in electronics in 2021, showing its commitment to innovation. In addition, government initiatives such as "Made in China 2025" have spurred investments in semiconductor development, reducing reliance on imports. Urbanization also plays a critical role, with cities like Shenzhen emerging as tech hubs.

Japan is another key player in the Asia Pacific consumer electronics market. Known for its cutting-edge technology, Japan excels in producing high-end products like OLED TVs and robotics. Sony and Panasonic, two of the nation’s flagship brands, command significant global market shares, with Sony’s revenue surging in 2022. The aging population also fuels demand for healthcare-focused electronics, such as wearable health monitors. According to the Japanese Ministry of Health, over 28% of the population is aged 65 or above, creating opportunities for specialized devices. Furthermore, Japan’s emphasis on sustainability aligns with consumer preferences.

South Korea holds a pivotal position in the Asia Pacific consumer electronics market. Renowned for its semiconductor prowess, the country supplies a major share of global memory chips, according to the Semiconductor Industry Association.

India emerges as a rapidly growing player in the Asia Pacific consumer electronics market. The country’s burgeoning middle class drives demand for affordable electronics. Local brands like Micromax and multinational firms like Apple cater to diverse consumer segments, with Apple’s iPhone sales growing rapidly. Government initiatives like "Digital India" promote digital literacy, increasing smartphone penetration. Moreover, the startup ecosystem fosters innovation, with a significant number of tech startups developing solutions tailored to local needs.

Australia continues to be a key consumer in the makret. The country’s affluent population and high disposable incomes enable the adoption of premium products, such as gaming laptops and smart home systems. Also, Australia’s tech-savvy workforce benefits from a robust education system, fostering early adoption of innovations like virtual reality headsets and AI assistants. According to the Australian Bureau of Statistics, the ICT sector contributes substantially to the economy, supporting sustained market growth.

KEY MARKET PLAYERS

Companies dominating the Asia-Pacific consumer electronics market profiled in this report are Acer Inc., Apple Inc., ASUSTeK Computer Inc., Canon Inc., Dell Technologies, Google LLC, Hewlett Packard Enterprise Development LP, HTC Corporation, Huawei Technologies Co., Ltd., Lenovo, LG Electronics, Micromax, Motorola Mobility LLC, Nikon, Panasonic Holdings Corporation, Samsung Electronics Co., Ltd., Seagate Technology LLC, Sony Corporation, Toshiba Corporation, ZTE Corporation, and others.

TOP LEADING PLAYERS IN THE MARKET

Samsung Electronics

Samsung is a global powerhouse and a dominant player in the Asia Pacific consumer electronics market, renowned for its innovation and premium product offerings. The company’s diverse portfolio spans smartphones, televisions, home appliances, and semiconductors, making it a one-stop solution for tech-savvy consumers. Samsung’s commitment to R&D has enabled it to pioneer advancements like foldable smartphones and QLED displays, setting industry benchmarks.

Sony Corporation

Sony stands as a symbol of quality and innovation, particularly excelling in audio-visual products and gaming consoles. The company leverages its expertise in imaging sensors and entertainment content to deliver immersive experiences through devices like OLED TVs and PlayStation gaming systems. Sony’s strategic focus on integrating hardware with software ecosystems, such as its PlayStation Network, enhances customer engagement. Additionally, its emphasis on sustainability and energy-efficient designs aligns with evolving consumer preferences, bolstering its reputation as a forward-thinking brand. Sony’s ability to blend artistry with technology ensures its enduring influence in the global market.

Apple Inc.

Apple commands a significant presence in the Asia Pacific consumer electronics market, driven by its iconic iPhone lineup and ecosystem of products like MacBooks, iPads, and AirPods. The company’s seamless integration of hardware, software, and services creates a cohesive user experience, fostering brand loyalty. Apple’s design philosophy emphasizes minimalism and functionality, appealing to affluent consumers seeking premium gadgets. Moreover, its retail strategy, including flagship stores and online platforms, enhances accessibility while maintaining exclusivity.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Partnerships and Collaborations

Key players in the Asia Pacific consumer electronics market often engage in strategic partnerships to expand their reach and enhance product offerings. Collaborations with local firms, governments, and research institutions enable companies to tap into regional expertise and address unique consumer needs. For instance, partnerships with telecom providers facilitate the rollout of 5G-enabled devices, ensuring compatibility with emerging technologies.

Investment in Research and Development

Innovation remains a cornerstone of success in the consumer electronics sector. Leading companies allocate substantial resources to R&D to develop cutting-edge technologies and stay ahead of competitors. This includes exploring advancements in artificial intelligence, IoT, and sustainable materials. By introducing first-to-market features, such as foldable screens or AI-powered cameras, brands differentiate themselves and capture consumer attention. Additionally, R&D investments ensure compliance with evolving environmental regulations, positioning companies as responsible stewards of technology while meeting eco-conscious demands.

COMPETITION OVERVIEW

The Asia Pacific consumer electronics market is characterized by intense competition, driven by a mix of established giants and emerging challengers vying for dominance. Multinational corporations like Samsung, Sony, and Apple compete fiercely with regional players such as Xiaomi, Oppo, and Panasonic, creating a dynamic landscape marked by rapid innovation and aggressive pricing strategies. The market’s diversity—spanning developed economies like Japan and South Korea to emerging markets like India and Vietnam—requires companies to adopt multifaceted approaches to succeed. While larger firms leverage economies of scale and technological expertise, smaller enterprises focus on affordability and niche innovations to carve out their share. Regulatory pressures, environmental concerns, and shifting consumer behaviors further intensify rivalry, compelling brands to prioritize sustainability and digital transformation. E-commerce platforms have also leveled the playing field, enabling new entrants to disrupt traditional distribution channels.

RECENT MARKET DEVELOPMENTS

- In April 2024, Samsung Electronics launched its "Galaxy Upcycling" initiative in South Korea, encouraging consumers to repurpose old smartphones into IoT devices. This move aligns with growing environmental awareness and strengthens Samsung's image as a sustainable brand.

- In June 2023, Sony Corporation partnered with Tencent Games to co-develop exclusive content for the PlayStation platform in China. This collaboration expanded Sony's gaming ecosystem and solidified its position among Chinese gamers.

- In September 2023, Apple unveiled its "Made in India" campaign, showcasing locally manufactured iPhones during a high-profile event in Mumbai. This initiative aimed to deepen Apple's ties with Indian consumers and boost production capabilities within the region.

- In February 2024, Xiaomi announced a strategic alliance with Reliance Retail in India to enhance offline distribution networks. By leveraging Reliance's extensive retail footprint, Xiaomi sought to increase accessibility to its budget-friendly devices.

- In November 2023, LG Electronics introduced its "Smart Home Ecosystem" in Japan, integrating AI-driven appliances with voice assistants. This launch positioned LG as a leader in smart living solutions, catering to tech-savvy urban households.

MARKET SEGMENTATION

This research report on the Asia Pacific consumer electronics market has been segmented and sub-segmented based on sales channel, product, and country.

By Sales Channel

- Offline

- Online

By Product

- Smartphones

- Tablets

- Desktops

- Laptops/Notebooks

- Digital Cameras

- Hard Disk Drives

- Television

- E-readers

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific consumer electronics market?

The Asia Pacific consumer electronics market is driven by rising disposable incomes, rapid urbanization, tech innovation, and strong demand for smartphones and smart home devices

2. What challenges affect the Asia Pacific consumer electronics market?

The Asia Pacific consumer electronics market faces supply chain disruptions, rapid product obsolescence, price wars, and strict environmental regulations on e-waste

3. What opportunities exist in the Asia Pacific consumer electronics market?

The Asia Pacific consumer electronics market sees opportunities in smart home tech, AI integration, e-commerce growth, and sustainable product development

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]