Asia Pacific Consumer Healthcare Market Size, Share, Trends & Growth Forecast Report By Product, Distribution Network and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From (2025 to 2033)

Asia Pacific Consumer Healthcare Market Size

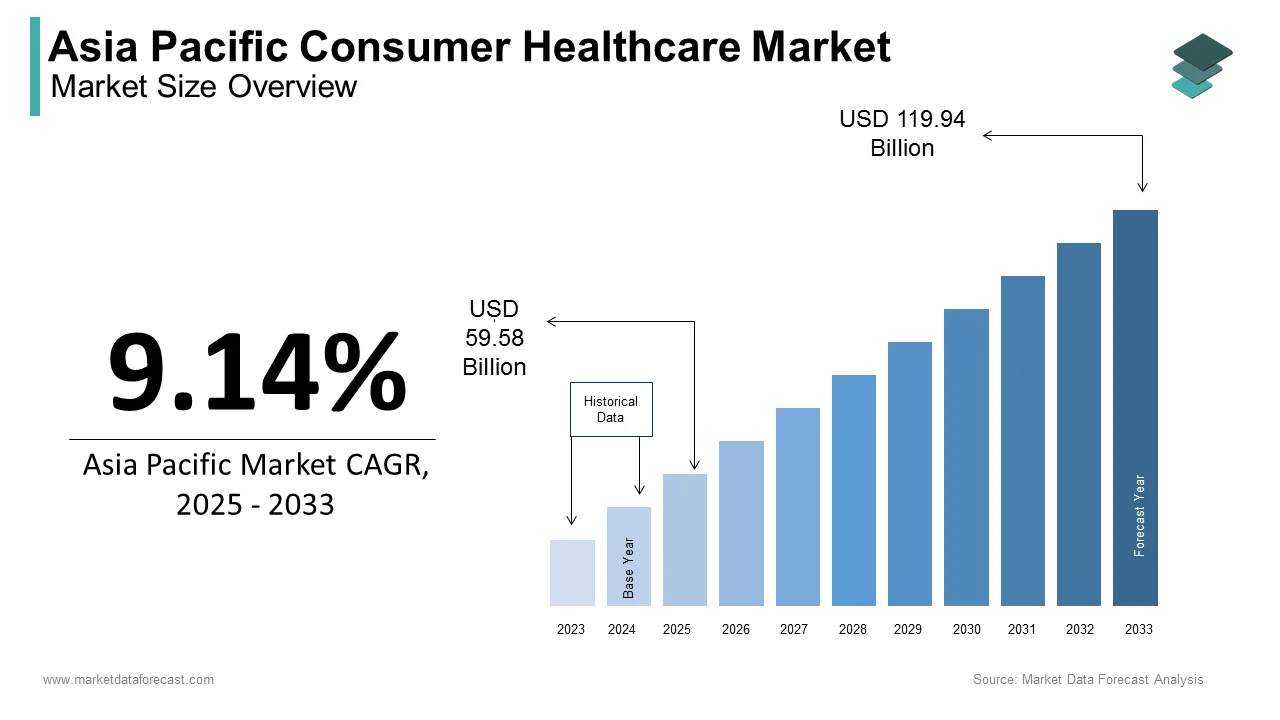

The size of the consumer healthcare market in Asia Pacific was valued at USD 54.59 billion in 2024. The Asia Pacific market is expected to be valued at USD 59.58 billion in 2025 and USD 119.94 billion by 2033, exhibiting a CAGR of 9.14% from 2025 to 2033.

MARKET DRIVERS

Rising Self-Medication & Over-the-Counter Demand

The major factors contributing to the growth of the Asia Pacific consumer healthcare market include high demand for self-medication, rising healthcare costs, increasing geriatric population, which is more prone to disease, deterioration of mental health, and the shift from prescription-to-prescription drugs and over-the-counter products.

In addition, the approval of preventive medicine and wellness and the increase in disposable income further drive the market's growth. Medical tourism increases the influx, the lucrative activity of day surgery with less investment and more profits, the increase of specialized hospitals, the increase in private health insurance coverage, and the updating of IT and healthcare operations tend to drive the APAC healthcare market. In addition, the transformation of pharmacies with e-commerce, investments by major players, the launch of telecommunications for home health platforms, stricter regulations in favor of consumers, and the increase in mergers and acquisitions in the health sector are factors responsible for the growth of the health sector in the APAC region.

Growth of Online Healthcare Sources

The increase in chronic and non-communicable diseases (NCDs) tends to put pressure on the extensive health system in the APAC region. According to the World Economic Forum, by 2030, cardiovascular disease (CVD), chronic respiratory disease, cancer, diabetes, and mental illness will cost the global economy $ 48 trillion. Therefore, the development and accelerated use of online sources and the growing demand for branded, private-label, and generic OTC products will provide many opportunities shortly.

MARKET RESTRAINTS

Strict Government Regulations

Several strict government regulations and the presence of many counterfeit pharmaceutical companies restraints the growth of the Asia-Pacific market. In addition to this, limited financial resources, diverse consumer segments creating complexities, an underdeveloped medical infrastructure, inconsistent reimbursement regimes, intense competition from major players in adjacent industries (high-tech and consumer electronics), and regional startups hamper the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Distribution Network, and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest Of APAC. |

|

Market Leader Profiled |

Johnson & Johnson, Boehringer Ingelheim GmbH, GlaxoSmithKline plc, Amway, Bayer AG, Pfizer Inc., Abbott Laboratories, Sanofi, BASF SE, DSM, American Health, Herbalife, The Himalaya Drug Company, Kellogg, Takeda Pharmaceuticals, Teva Pharmaceuticals, and Others. |

SEGMENTAL ANALYSIS

By Product Insights

REGIONAL ANALYSIS

Geographically, Health expenditure for APAC countries was USD 210 billion in 2023.

Indonesia's total health expenditure was USD 28 billion and is expected to grow at a CAGR of 7.9% by 2030. Singapore is the fourth-best health infrastructure globally, with less than 5% of GDP spent on health care and provides multiple levels of care to each resident. With strong economic growth in the APAC region comes benefits and challenges for the health sector. Despite the increase in hospitals, patients in both rural and urban areas still face accessibility and affordability challenges. Technological innovation solves the challenges of digital activation; for example, Sustainable Healthcare Solutions (SHS) from GE Healthcare develops clinically and economically relevant technologies, providing professional training for medical staff and solutions for financial help to companies.Inequalities in the Philippines affect the healthcare sector, enabling Hospital Management Asia to provide specific solutions for digitizing and improving information communication in healthcare, telemedicine, and business development. The Philippines accounts for about 48% of direct medical expenditure. However, prescription drugs continue to dominate the market. With laws such as the Cheapest Medicines Act of 2008 and the Universal Health Care Act of 2013 that stimulate the growth potential of the generic drug market, 5 in 10 Filipinos use generic drugs.To reduce the costs of pharmaceuticals, the Japanese government is implementing policies to expand the use of generic drugs, thus helping the APAC consumer healthcare market in upcoming years.

KEY MARKET PLAYERS

Companies such as Johnson & Johnson, Boehringer Ingelheim GmbH, GlaxoSmithKline plc, Amway, Bayer AG, Pfizer Inc., Abbott Laboratories, Sanofi, BASF SE, DSM, American Health, Herbalife, The Himalaya Drug Company, Kellogg, Takeda Pharmaceuticals, and Teva Pharmaceuticals are some of the leading companies in the APAC consumer healthcare market profiled in this report.

MARKET SEGMENTATION

This research report on the Asia Pacific consumer healthcare market has been segmented and sub-segmented based on product, distribution network, and country.

By Product

- OTC Pharmaceuticals

- Dietary Supplements

By Distribution Network

- Departmental Stores

- Independent Retailers

- Pharmacies or Drugstores

- Specialist Retailers

- Supermarkets or Hypermarkets

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com