Asia Pacific Chitosan Market Size, Share, Trends & Growth Forecast Report By Grade (Industrial, Food, Pharmaceutical), Application (Water Treatment, Food & Beverages, Cosmetics, Medical & Pharmaceuticals, Agrochemicals), and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC) – Industry Analysis From 2025 to 2033.

Asia Pacific Chitosan Market Size

The size of the Asia Pacific chitosan market was valued at USD 335 million in 2024. This market is expected to grow at a CAGR of 15.32% from 2025 to 2033 and be worth USD 1,209 million by 2033 from USD 386 million in 2025.

MARKET DRIVERS

Rising Demand in Pharmaceuticals and Medical Applications

The pharmaceutical and medical sectors are primary drivers of the Asia Pacific chitosan market, owing to its unique properties such as biocompatibility, biodegradability, and antimicrobial activity. For example, Japan’s chitosan-based wound dressings have gained widespread acceptance, with their usage increasing in the last few years due to their ability to accelerate healing and reduce infection risks. Similarly, in India, chitosan is increasingly used in drug delivery systems, with its adoption growing in 2022 alone. This surge is attributed to its ability to enhance the bioavailability of drugs while ensuring safety. Moreover, the rise of regenerative medicine in countries like South Korea has further amplified demand, with a significant increase in chitosan-based scaffolds for tissue engineering.

Growing Adoption in Agriculture and Food Processing

The agriculture and food processing industries serve as another significant driver for the Asia Pacific chitosan market. Like, the use of chitosan as a natural biopesticide has grown by 18% annually in Southeast Asia since 2021, driven by government incentives for sustainable farming practices. For instance, Vietnam’s chitosan-based coatings have reduced post-harvest losses, making them indispensable for preserving fruits and vegetables. Similarly, India’s booming organic food sector relies heavily on chitosan for its antimicrobial properties in food preservation. These trends show the critical role of chitosan in enhancing agricultural productivity and food safety, positioning it as a cornerstone of sustainable development in the region.

MARKET RESTRAINTS

High Production Costs

High production costs pose a significant restraint to the Asia Pacific chitosan market, impacting its competitiveness against synthetic alternatives. While chitosan offers superior environmental and health benefits, its production involves complex processes such as deacetylation of chitin, which requires expensive raw materials and energy-intensive equipment. For example, as per the Asian Development Bank, the cost of producing high-purity chitosan is significantly more than that of synthetic polymers, creating financial strain for small-scale producers. Additionally, fluctuations in the availability of crustacean shells, the primary source of chitin, exacerbate the issue.

Limited Consumer Awareness

Limited consumer awareness about the benefits of chitosan in rural areas also hinders market expansion. While urban centers in the Asia Pacific region are increasingly adopting eco-friendly products, rural populations often lack access to information about sustainable alternatives. For instance, according to the Food and Agriculture Organization, only limited number of rural households in Southeast Asia are aware of chitosan-based agricultural solutions, compared to those in urban areas. This knowledge gap restricts demand in agricultural applications, where synthetic chemicals remain dominant. Moreover, traditional practices and reliance on low-cost fertilizers and pesticides further impede adoption. In India, the Ministry of Rural Development highlights that less than 20% of rural consumers prioritize biodegradability when purchasing agricultural inputs.

MARKET OPPORTUNITIES

Advancements in Biomedical Applications

The development of advanced biomedical applications presents a lucrative opportunity for the Asia Pacific chitosan market, aligning with the global push toward personalized medicine and regenerative therapies. Innovations in chitosan-based nanomaterials have significantly enhanced its efficacy in drug delivery and tissue engineering. For example, South Korea’s investments in chitosan-based scaffolds for bone regeneration have grown annually since 2020, driven by government incentives and consumer demand. These advancements enable the production of high-performance biomedical solutions tailored for specific applications, such as wound healing and cancer treatment.

MARKET CHALLENGES

Competition from Synthetic Polymers

The dominance of synthetic polymers poses a significant challenge to the Asia Pacific chitosan market, as they remain cost-effective and widely available despite their environmental drawbacks. Similarly, in India, the Confederation of Indian Industry reports that synthetic polymers account for a significant portion of the total polymer market, driven by their lower production costs and established supply chains. While chitosan offers superior eco-friendly properties, its higher pricing limits its penetration in price-sensitive markets.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Grade, Application, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Primex ehf (Iceland), Heppe Medical Chitosan GmbH (Germany), Vietnam Food (Vietnam), KitoZyme S.A. (Belgium), Agratech (US), Advanced Biopolymers AS (Norway), BIO21 Co., Ltd. (Thailand), G.T.C. Bio Corporation (China), Taizhou City Fengrun Biochemical Co., Ltd. (China),Zhejiang Golden-Shell Pharmaceutical Co., Ltd. (China), and others. |

SEGMENTAL ANALYSIS

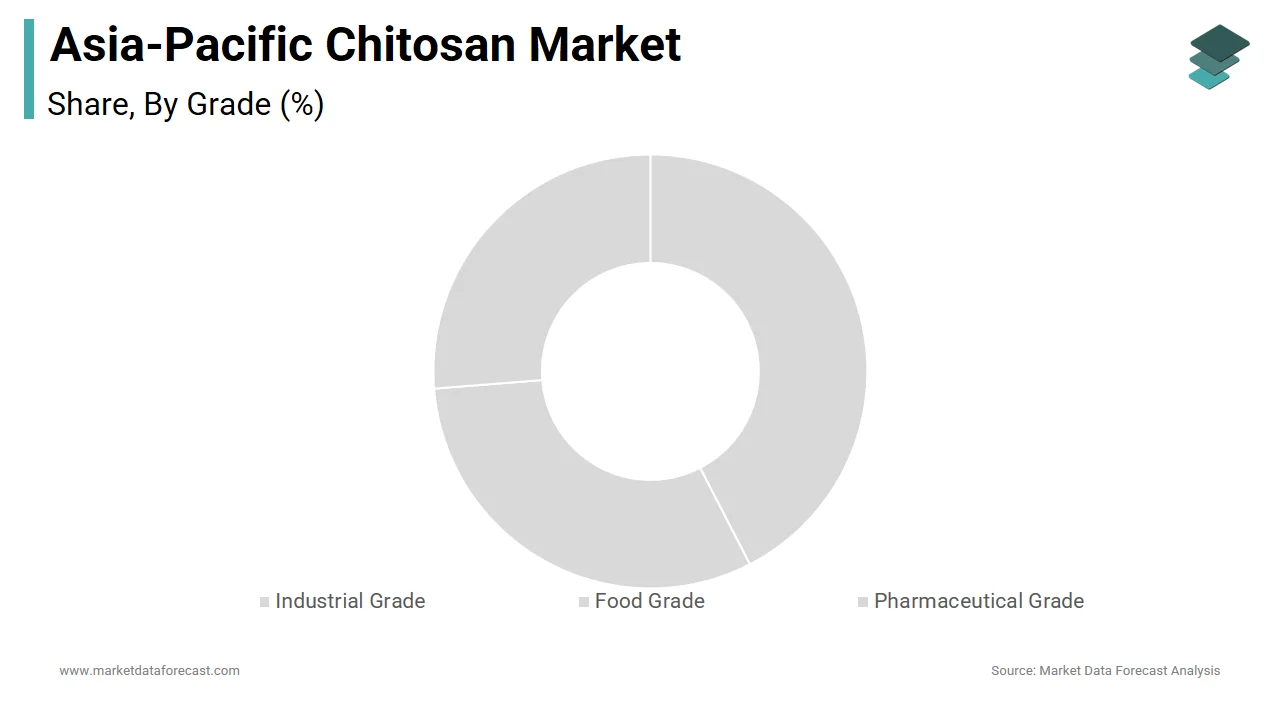

By Grade Insights

The industrial-grade chitosan segment prevailed in the Asia Pacific market by accounting for 45.2% of the total share in 2024. This control over the market is supported by its widespread use in water treatment and agrochemical applications, where cost-effectiveness and scalability are critical. Additionally, advancements in extraction technologies have reduced production costs, making industrial-grade chitosan more competitive against synthetic polymers. Like, investments in large-scale chitin extraction facilities have enhanced yields, further strengthening its place. The growing emphasis on sustainability has also amplified demand, particularly in urban areas where industries prioritize eco-friendly solutions.

The pharmaceutical-grade chitosan segment is accelerating, with a projected CAGR of 11.5%. This growth is attributed to its superior biocompatibility and antimicrobial properties, making it ideal for advanced medical applications such as wound healing, drug delivery, and tissue engineering. For example, Japan’s adoption of chitosan-based wound dressings has grown significantly since 2021, driven by their ability to accelerate healing and reduce infection risks. Similarly, in South Korea, the Korean Biomedical Research Foundation reports a 30% annual increase in chitosan scaffolds for regenerative medicine. Innovations in nanotechnology have enabled the development of high-purity pharmaceutical-grade chitosan, aligning with global trends toward personalized medicine.

By Application Insights

The medical and pharmaceutical applications became the largest segment by commanding a 35.5% share of the Asia Pacific chitosan market in 2024. This is driven by stringent regulatory frameworks mandating the use of biocompatible materials in healthcare products. For instance, South Korea’s Ministry of Food and Drug Safety requires manufacturers to adopt eco-friendly and non-toxic alternatives, resulting in a notable increase in chitosan usage in medical devices since 2020. Additionally, rising urbanization and disposable incomes have amplified demand. Surging awareness about health and wellness has also fueled the adoption of chitosan in drug delivery systems and wound care products, making it a critical component of the pharmaceutical sector.

On the contrary, the agrochemicals segment is the fastest-growing application, with a projected CAGR of 10.8% through 2033. This expansion is fueled by the booming agriculture industry, particularly in rural areas where sustainable farming practices are gaining traction. For example, Vietnam’s Ministry of Agriculture reports that the use of chitosan-based biopesticides has grown notably since 2021, driven by government incentives for eco-friendly inputs. Similarly, India’s organic food sector relies heavily on chitosan for its antimicrobial properties in crop protection and post-harvest preservation. Advancements in formulation technologies have also enhanced its efficacy, aligning with consumer preferences for sustainable agricultural solutions.

COUNTRY LEVEL ANALYSIS

China remained a dominant force in the Asia Pacific chitosan market by holding a 35.8% share in 2024. This dominance is credited to its status as a global manufacturing hub, leveraging advanced biotechnology infrastructure to produce cost-effective chitosan. According to the Asian Development Bank, China’s investments in chitin extraction technologies have surged significantly since 2020, enhancing production efficiency. Urbanization has further amplified demand, with a considerable share of the population residing in cities. Rising disposable incomes have also fueled the adoption of eco-friendly products, particularly in sectors like water treatment and agriculture.

India is the fastest-growing regional market in the Asia Pacific chitosan market. This growth is fueled by its robust agricultural base and growing awareness about sustainability. The nation’s organic food segment relies heavily on chitosan for its natural properties. Apart from these, government initiatives promoting sustainable agriculture have boosted chitosan adoption in crop protection. India’s strategic location as a global supplier of crustacean shells has also facilitated international trade, positioning it as a key growth engine in the Asia Pacific market.

Japan is experiencing major progress in this market. The key growth aspects are its advanced technological capabilities and stringent environmental regulations. Also, the country’s emphasis on sustainability has fostered innovation in chitosan, with a significant portion of industries adopting eco-friendly alternatives. Besides, Japan’s aging population has increased demand for advanced medical solutions, amplifying chitosan usage in pharmaceuticals. Urban consumers’ preference for green solutions further amplifies demand, particularly in cities like Tokyo and Osaka.

South Korea is experiencing a robust growth trajectory in the Asia Pacific market, which is mainly propelled by cutting-edge R&D and eco-conscious consumer behaviour. The country’s “Green Growth Strategy” has spurred businesses to adopt chitosan in cosmetics and medical applications, leading in a notable increase in usage since 2020. Moreover, the cosmetics industry, a key contributor to GDP, has embraced chitosan for product formulations.

Australia is likely to benefit from the broader Asia Pacific chitosan market growth. It is driven by its robust regulatory framework and high consumer awareness about sustainability. The country’s agricultural sector leverages chitosan for crop protection. Additionally, Australia’s thriving mining industry uses chitosan in water treatment, aligning with environmental goals. Urban consumers’ preference for renewable energy further amplifies demand, particularly in cities like Sydney and Melbourne.

KEY MARKET PLAYERS

Companies dominating the Asia-Pacific chitosan market profiled in this report are Primex ehf (Iceland), Heppe Medical Chitosan GmbH (Germany), Vietnam Food (Vietnam), KitoZyme S.A. (Belgium), Agratech (US), Advanced Biopolymers AS (Norway), BIO21 Co., Ltd. (Thailand), G.T.C. Bio Corporation (China), Taizhou City Fengrun Biochemical Co., Ltd. (China),Zhejiang Golden-Shell Pharmaceutical Co., Ltd. (China), and others.

TOP LEADING PLAYERS IN THE MARKET

KitoZyme SA

KitoZyme SA is a global leader in the chitosan market, with a strong presence in the Asia Pacific region. The company leverages its cutting-edge research and development capabilities to produce high-quality chitosan tailored for diverse applications such as pharmaceuticals, agriculture, and water treatment. Its focus on sustainability has led to the creation of eco-friendly solutions that comply with stringent environmental regulations. KitoZyme’s strategic partnerships with local industries have strengthened its market position.

Primex EHF

Primex EHF is a key player in the Asia Pacific chitosan market, renowned for its expertise in producing premium-grade chitosan derived from marine sources. The company’s commitment to innovation has enabled it to address complex challenges faced by industries such as cosmetics, food processing, and medical applications. Primex’s emphasis on collaboration with regional stakeholders ensures its products align with local regulatory frameworks and consumer preferences. Its robust distribution network across the region has facilitated widespread adoption of its sustainable chitosan solutions. Through its proactive approach to circular economy practices, Primex continues to shape the global chitosan landscape.

Heppe Medical Chitosan GmbH

Heppe Medical Chitosan GmbH stands out for its specialization in producing pharmaceutical-grade chitosan with exceptional purity and biocompatibility. With a strong foothold in the Asia Pacific region, the company focuses on delivering solutions that meet the unique demands of urbanized and industrialized areas. Heppe’s dedication to quality and safety has earned it recognition among leading manufacturers and regulatory bodies. By investing in state-of-the-art production facilities and fostering partnerships with local governments, Heppe has reinforced its reputation as a pioneer in sustainable biomedical applications.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Partnerships with Research Institutions

Key players in the Asia Pacific chitosan market have increasingly turned to partnerships with academic and research institutions to strengthen their market position. By collaborating on R&D initiatives, companies can develop innovative chitosan-based solutions tailored to specific industry needs. These partnerships also facilitate knowledge-sharing and innovation, enabling participants to stay ahead of evolving consumer preferences. For instance, collaborations with agricultural universities have allowed companies to develop specialized chitosan formulations for crop protection, enhancing their relevance in the region.

Investment in Sustainable Production Technologies

Another major strategy involves substantial investments in sustainable production technologies to reduce environmental impact and operational costs. Companies are focusing on developing energy-efficient extraction and purification processes that comply with stringent environmental regulations. Innovations such as enzymatic deacetylation and microbial fermentation have been introduced to enhance yield and scalability.

COMPETITION OVERVIEW

The Asia Pacific chitosan market is characterized by intense competition, driven by the presence of both global giants and regional players striving to gain a larger share of the rapidly growing sector. The market’s competitive landscape is shaped by the increasing demand for sustainable and effective alternatives to synthetic polymers, which has prompted companies to innovate and differentiate their offerings. Global players leverage their technological expertise and economies of scale to maintain dominance, while regional players focus on customization and localized strategies to carve out niches. Sustainability remains a central theme, with companies competing to offer the most eco-friendly and cost-effective solutions. Additionally, the rise of industrialization and urbanization has intensified competition, as companies vie to secure contracts with major industries and municipalities.

RECENT MARKET DEVELOPMENTS

- In April 2024, KitoZyme SA partnered with a leading Indian agricultural firm to launch a nationwide initiative promoting chitosan-based biopesticides. This move strengthened its place in the domestic agrochemical market.

- In June 2023, Primex EHF announced the acquisition of a small-scale chitosan extraction facility in Thailand to bolster its supply chain resilience and expand its footprint in Southeast Asia.

- In February 2023, Heppe Medical Chitosan GmbH signed a memorandum of understanding with a South Korean biomedical company to co-develop next-generation chitosan scaffolds for tissue engineering, aligning with consumer trends toward regenerative medicine.

- In September 2022, KitoZyme SA opened a state-of-the-art R&D center in Malaysia to explore innovations in sustainable chitosan production, positioning itself as a pioneer in eco-friendly solutions.

- In November 2021, Primex EHF launched a joint venture with an Australian water treatment company to supply chitosan-based flocculants for municipal wastewater projects, enhancing its presence in the industrial chemicals segment.

MARKET SEGMENTATION

This research report on the Asia Pacific chitosan market has been segmented and sub-segmented based on grade, application, and country.

By Grade

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

By Application

- Water Treatment

- Food & Beveraes

- Cosmetics

- Medical & Pharmaceuticals

- Agrochemicals

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific chitosan market?

The Asia Pacific chitosan market is driven by demand in water treatment, pharmaceuticals, agriculture, and cosmetics, plus a focus on eco-friendly and sustainable solutions

2. What challenges affect the Asia Pacific chitosan market?

High production costs, limited rural awareness, and competition from cheaper synthetic polymers challenge the Asia Pacific chitosan market’s growth

3. What opportunities exist in the Asia Pacific chitosan market?

Advanced biomedical uses, sustainable agriculture, and innovations in extraction and nanotechnology offer growth opportunities for the Asia Pacific chitosan market

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]