Asia Pacific Commercial Standby Generator Sets Market Report – Segmented By Fuel (Gas, Diesel, Others), Power Rating, Application, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Commercial Standby Generator Sets Market Size

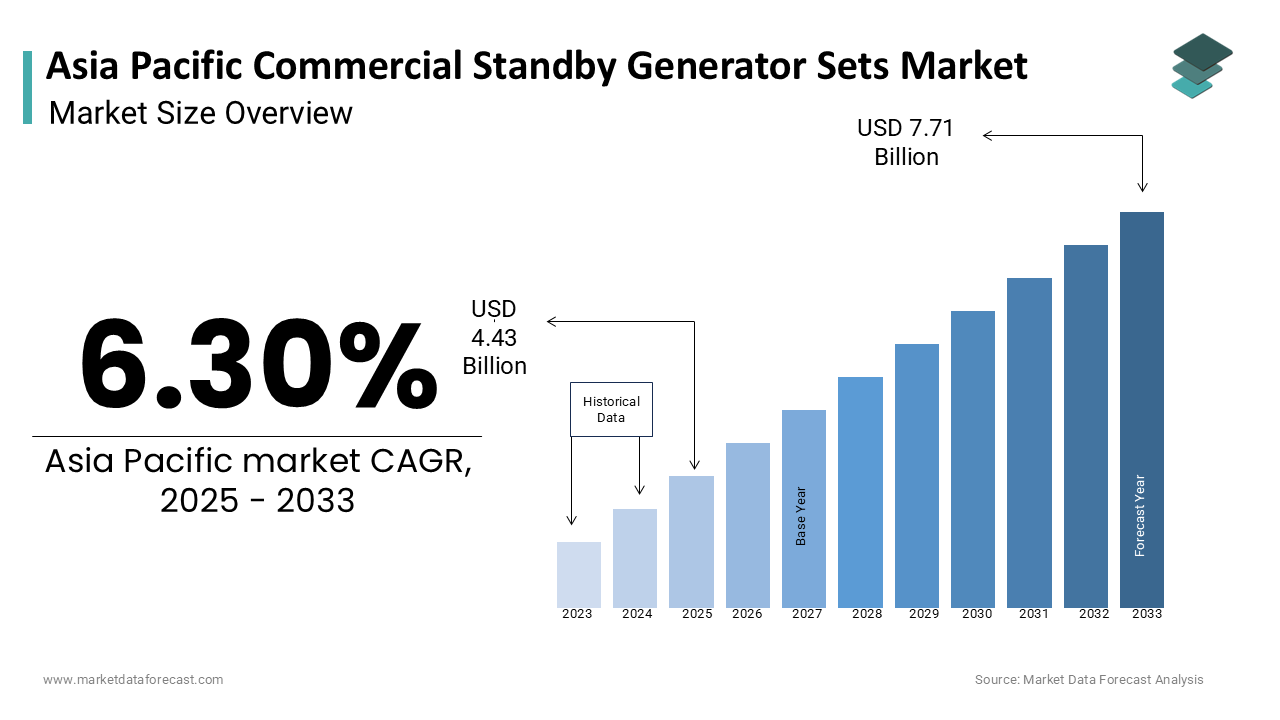

The Asia Pacific commercial standby generator sets market was worth USD 4.45 billion in 2024. The Asia Pacific market is expected to reach USD 7.71 billion by 2033 from USD 4.43 billion in 2025, rising at a CAGR of 6.30% from 2025 to 2033.

Commercial standby generators are robust power backup systems designed to provide electricity during grid failures and emergencies, safeguarding operations in sectors such as healthcare, retail, telecommunications and manufacturing. The increasing frequency of power outages coupled with the region's rapid urbanization and industrial growth highlights the significance of these systems. Similarly, Japan’s Meteorological Agency states that typhoons and earthquakes disrupt power supply annually and necessitate reliable backup solutions. Innovations in fuel efficiency and noise reduction have made modern generator sets more environmentally friendly and operationally efficient. These developments align with the region’s growing emphasis on sustainability particularly in countries like Singapore and South Korea, where green building certifications mandate energy-efficient backup systems.

MARKET DRIVERS

Frequent Power Outages and Grid Instability

Frequent power outages and grid instability are a primary driver of the Asia Pacific commercial standby generator sets market as they highlight the need for reliable backup power solutions in the face of unstable infrastructure and natural disasters. Over 30% of rural areas in South Asia face prolonged power interruptions due to inadequate grid capacity and maintenance. This issue is particularly acute in countries like Bangladesh and Indonesia where rapid urbanization has outpaced electrical infrastructure development. The Indian Healthcare Federation reports that hospitals in metropolitan cities like Mumbai and Delhi invest up to 20% of their operational budget in backup power systems to ensure patient safety during outages. The need for resilience against power disruptions remains a significant factor propelling market growth.

Rising Industrialization and Urbanization

Rising industrialization and urbanization are other major drivers which has increased the demand for reliable power backup solutions. The urban population in the region is projected to grow by 50% over the next decade creating a surge in energy consumption. Cities like Shanghai, Jakarta and Bangkok are hubs for manufacturing and commerce where uninterrupted power is critical for productivity. Small and medium enterprises (SMEs) account for over 90% of businesses in the region where many of which operate in industries requiring continuous power such as textiles and electronics. This alignment of industrial growth with regulatory requirements ensures sustained demand for commercial standby generators.

MARKET RESTRAINTS

High Initial Costs and Maintenance Expenses

High initial cost and ongoing maintenance expenses are a significant barrier to the widespread adoption of commercial standby generator sets in the Asia Pacific. The upfront investment required for installing a commercial-grade generator can exceed $50,000 depending on capacity and features. This financial burden is particularly challenging for small businesses operating on tight budgets. Annual maintenance costs for commercial generators can range from 5-10% of the initial purchase price which deter many operators from investing in these systems. While standby generators offer long-term benefits in terms of operational continuity where the substantial upfront investment remains a deterrent especially in price-sensitive markets like Vietnam and Thailand.

Environmental Concerns and Regulatory Restrictions

The environmental impact of diesel-powered generators and the associated regulatory restrictions are another critical restraint. Diesel generators contribute significantly to air pollution and emit harmful substances like nitrogen oxides and particulate matter. This environmental concern has led to stricter emission standards in countries like Singapore and South Korea limiting the use of traditional generators. Additionally, governments are promoting renewable energy alternatives such as solar-powered backup systems which pose a competitive threat to conventional generators. Subsidies for solar installations have reduced their cost by 30% over the past five years making them increasingly attractive to businesses. These regulatory and technological challenges hinder the growth of the commercial standby generator market in environmentally sensitive regions.

MARKET OPPORTUNITIES

Advancements in Hybrid and Solar-Powered Generators

Rapid advancements in hybrid and solar-powered generator technologies present a significant opportunity for the Asia Pacific commercial standby generator sets market. Hybrid generators which combine diesel engines with renewable energy sources can reduce fuel consumption by up to 40%. This innovation addresses both environmental concerns and operational costs making it an attractive option for businesses seeking sustainable solutions. Furthermore, the integration of solar power with battery storage systems has expanded the usability of standby generators. Solar-powered backup systems have gained traction in rural and semi-urban areas where grid reliability is low. These systems not only comply with green building standards but also offer long-term savings on energy costs.

Growing Demand for Data Centers and Telecommunications

The growth of data centers and telecommunications infrastructure in the Asia Pacific offers another promising opportunity for the commercial standby generator market. China’s Ministry of Industry and Information Technology emphasizes that rural telecommunication towers rely heavily on standby generators to maintain connectivity. This growing reliance on data centers and telecom networks positions the standby generator market for sustained growth in the coming years.

MARKET CHALLENGES

Competition from Renewable Energy Solutions

Competition from renewable energy solutions such as solar and wind-powered backup systems presents a pressing challenge for the Asia Pacific commercial standby generator sets market. The cost of solar panel installations has decreased by 25% over the past five years making them a viable alternative for businesses seeking eco-friendly power backup options. These systems not only reduce carbon emissions but also offer long-term operational savings. The Indian Ministry of New and Renewable Energy states that subsidies for solar-powered backup systems have encouraged businesses to transition away from traditional generators. This shift poses a significant challenge for manufacturers who must innovate to remain competitive in a rapidly evolving market landscape.

Limited Awareness and Technical Expertise

Limited awareness and technical expertise among end-users regarding the optimal use and maintenance of standby generators is another challenge for the Asia Pacific commercial standby generator sets market. Over 60% of small businesses in rural areas lack proper training on generator operation leading to inefficiencies and premature system failures. This knowledge gap often results in dissatisfaction and reluctance to invest in advanced backup solutions. Addressing these challenges requires targeted educational campaigns and partnerships with industry stakeholders to enhance user understanding and confidence in standby generator systems.

SEGMENTAL ANALYSIS

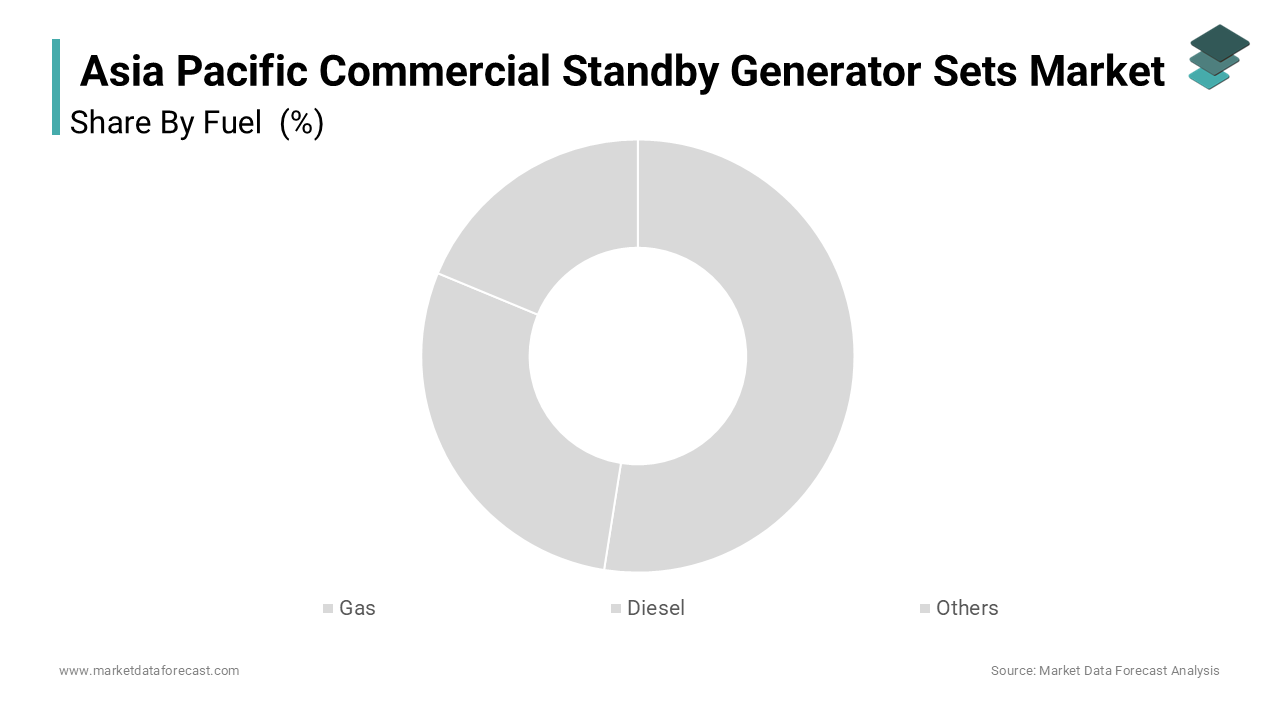

By Fuel Insights

The diesel segment dominated the Asia Pacific commercial standby generator sets market by capturing 65.4% of the share in 2024 with the widespread availability and reliability of diesel-powered generators which are preferred for their high energy density and ability to deliver consistent performance during prolonged power outages. A key factor behind diesel’s authority is its cost-effectiveness compared to alternative fuels. Diesel fuel costs up to 30% less than natural gas in many parts of Southeast Asia making it an attractive option for businesses operating on tight budgets. Additionally, diesel generators are well-suited for industrial applications where high power output is essential.

The gas segment is anticipated to grow with the fastest CAGR of 12.5% during the forecast period. This growth is fueled by increasing investments in natural gas infrastructure and the rising demand for cleaner energy solutions across the region. Gas generators produce up to 40% fewer emissions compared to their diesel counterparts aligning with stricter emission regulations in countries like Singapore and Australia. Additionally, advancements in dual-fuel technology have enhanced the efficiency of gas generators. Innovations in engine design have increased operational efficiency by 20%, reducing fuel consumption and operational costs. These technological improvements coupled with government incentives for clean energy adoption position gas-powered generators as the fastest-growing segment in the market.

By Power Rating Insights

The "≤ 75 kVA" segment was the largest and held 50.4% of the Asia Pacific commercial standby generator sets market share in 2024 due to its affordability and suitability for small and medium-sized enterprises (SMEs) which form the backbone of the region’s economy. A primary factor driving this segment is alignment with the needs of SMEs. Over 90% of businesses in Southeast Asia fall under the SME category with limited budgets for large-scale power backup solutions. Generators in this power range provide sufficient capacity for retail stores, clinics and educational institutions which ensure cost-effective reliability during power outages.

The "> 75 kVA - 375 kVA" segment is projected to achieve a CAGR of 14.3% in the next coming years. This growth is driven by the increasing demand for mid-range generators in industries such as healthcare, telecommunications and hospitality. A key factor propelling this growth is the expansion of data centers and telecom infrastructure. Over 60% of new data centers in the region require generators in this power range to support critical operations. Additionally, advancements in fuel efficiency and noise reduction have made mid-range generators more appealing. Recent innovations have reduced operational costs by 15% enhancing their attractiveness for commercial applications. This combination of technological progress and industrial demand positions the segment for rapid growth.

By Application Insights

The telecom segment held 35.4% of the Asia Pacific commercial standby generator sets market share in 2024 with the rapid digital transformation and the critical need for uninterrupted connectivity.

A key factor is the exponential growth of 5G networks and telecommunication towers. Regulatory push for resilient telecom infrastructure. The Indian Telecom Regulatory Authority projects that mandatory guidelines for disaster preparedness have compelled telecom operators to invest in standby generators.

The data center segment is lucratively growing with an estimated CAGR of 18.5% in the coming years. This growth is fueled by the increasing adoption of cloud computing and big data analytics across the region.

A major driver is the surge in data center investments. Data center capacity is expected to grow by 50% by 2025 necessitating advanced backup power solutions. These facilities require generators to safeguard against power disruptions ensuring seamless data processing and storage. Hybrid generators combining solar power with traditional systems are gaining traction in data centers offering sustainability and reliability. This dual advantage positions the segment for accelerated growth.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific commercial standby generator sets market and accounted for 30% of the share in 2024. The country’s dominance is rooted in its massive industrial base and frequent power outages due to aging grid infrastructure. Shanghai and Guangzhou are two of China’s busiest cities experiencing an average of 10 power interruptions annually which drive demand for standby generators. Additionally, the Chinese government offers subsidies for energy-efficient backup systems.

India was positioned second in holding the dominant share of the Asia Pacific commercial standby generator sets market driven by its unreliable power supply and rapid urbanization. Cities like Mumbai and Delhi face frequent power cuts compelling businesses to invest in standby generators. The government’s Smart Cities Mission has also mandated backup power systems in urban developments which further boost demand. The

Japan commercial standby generator sets market growth is likely to have a prominent CAGR in the foreseeable years. The country’s susceptibility to natural disasters like typhoons and earthquakes drives demand for reliable backup solutions. Tokyo and Osaka are hubs for commercial activities where uninterrupted power is critical. Government incentives for green energy adoption have also accelerated the transition to hybrid generators which will accelerate the growth of the market in this country.

Australia is deemed to showcase steady growth opportunities for the Asia Pacific commercial standby generator sets market. The country’s vast geography and reliance on remote telecommunications infrastructure drive demand for standby generators. Initiatives like the National Broadband Network have increased investments in telecom towers that ensure sustained growth in the market.

Indonesia's commercial standby generator sets market growth is expected to have a slow growth rate during the forecast period. The country’s archipelagic geography and frequent power outages in rural areas create a robust demand for standby generators. Government-backed programs promoting rural electrification have encouraged businesses to adopt backup power systems ensuring Indonesia’s continued growth in the market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Cummins Inc., Caterpillar Inc., Generac Holdings Inc., Kohler Co., MTU Onsite Energy, Kirloskar Oil Engines Ltd., Mahindra Powerol, Mitsubishi Heavy Industries Ltd., Perkins Engines Company Limited, and Hyundai Power Products are some of the key market players in the Asia Pacific Commercial Standby Generator Sets Market.

The Asia Pacific commercial standby generator sets market is characterized by intense competition driven by the region’s rapid industrial growth and increasing demand for reliable power backup solutions. Key players like Caterpillar Inc., Cummins Inc., and Kohler Co. dominate the landscape leveraging their technological expertise and extensive service networks to capture market share. While Caterpillar focuses on durability and performance Cummins emphasizes fuel efficiency and hybrid solutions creating a dynamic rivalry. Smaller regional players also contribute to the competitive environment by offering cost-effective alternatives.

Regulatory fragmentation across countries further intensifies competition as companies strive to adapt their offerings to meet diverse requirements. Innovation serves as a key battleground with firms investing in R&D to develop next-generation generator technologies. Despite the dominance of established players these emerging technologies and evolving customer preferences present opportunities for new entrants that ensure a vibrant and competitive ecosystem.

Top Players in the Asia Pacific Commercial Standby Generator Sets Market

Caterpillar Inc.

Caterpillar Inc. is a global leader in the Asia Pacific commercial standby generator sets market renowned for its robust and reliable power solutions. The company’s generators are widely adopted across industries such as healthcare, telecommunications and manufacturing due to their durability and high performance. Caterpillar’s commitment to innovation has enabled it to develop advanced fuel-efficient systems that align with the region’s growing emphasis on sustainability.

Cummins Inc.

Cummins Inc. is another key player leveraging its expertise in engine technology to deliver cutting-edge standby generators. The company’s products are designed to meet the unique needs of businesses in the Asia Pacific from small enterprises to large industrial facilities. Cummins’ focus is on integrating renewable energy solutions such as hybrid generators and ensuring compliance with stringent environmental regulations. Its strong distribution network and after-sales services enhance customer satisfaction making it a preferred choice for commercial establishments seeking reliable power backup solutions.

Kohler Co.

Kohler Co. is a prominent name in the market known for its innovative and eco-friendly generator systems. The company’s offerings cater to a wide range of applications including hospitality, retail and government infrastructure. Kohler’s emphasis on noise reduction and energy efficiency aligns with the region’s demand for sustainable technologies.

Top Strategies Used by Key Market Participants

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations with local governments, industry associations and energy providers have been prioritized by key players in the Asia Pacific commercial standby generator sets market. These collaborations enable companies to align their offerings with regional requirements such as disaster preparedness and green building standards. For instance, partnerships with telecom operators ensure the integration of reliable backup systems in critical infrastructure. Such alliances not only enhance brand visibility but also foster trust among end-users and strengthen market presence.

Focus on Product Innovation and Customization

Innovation remains a cornerstone strategy for maintaining a competitive edge. Leading companies invest heavily in R&D to develop advanced technologies such as hybrid generators and smart monitoring systems that address evolving customer needs. Customization is another critical aspect with firms offering solutions tailored to specific industries or environmental conditions.

Expansion of After-Sales Services and Training Programs

Expansion of after-sales services and training programs is a key focus for building long-term customer relationships with leading players, emphasizing comprehensive support that includes maintenance, repair, and technical assistance. These services ensure optimal performance of standby generators throughout their lifecycle reducing downtime and operational costs for users. Additionally, companies offer training programs to educate customers on the benefits and operation of their products.

RECENT MARKET SEGMENTATION

- In March 2023, Caterpillar Inc. launched a collaboration with Australia’s National Broadband Network to provide standby generators for rural telecom towers.

- In June 2023, Cummins Inc. signed a partnership agreement with a leading data center operator in Singapore to supply hybrid generators for new facilities.

- In September 2023, Kohler Co. announced the establishment of a dedicated training center in India.

- In November 2023, Mitsubishi Electric introduced a new line of solar-integrated standby generators specifically designed for commercial establishments in Japan.

- In January 2024, Generac Power Systems partnered with a major hospitality chain in Thailand to equip hotels with advanced noise-reduction generators.

MARKET SEGMENTATION

By Fuel

- Gas

- Diesel

- Others

By Power Rating

- ≤ 75 kVA

- 75 kVA - 375 kVA

- 375 kVA - 750 kVA

- 50 kVA

By Application

- Telecom

- Healthcare

- Data Centers

- Educational Institutions

- Government Centers

- Hospitality

- Retail Sales

- Agriculture

- Aquaculture

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the growth of the commercial standby generator sets market in Asia Pacific?

The market is driven by increasing demand for uninterrupted power supply, rapid urbanization, expanding data center infrastructure, and frequent grid failures in developing economies like India and Southeast Asia.

What is the future growth potential of the Asia Pacific commercial standby generator sets market?

The Asia Pacific commercial standby generator sets market is projected to witness steady growth due to increasing urbanization, infrastructure development, and the rising demand for uninterrupted power supply across commercial sectors. Expanding data centers, hospitals, commercial buildings, and telecom infrastructure will further drive the need for reliable backup power solutions across the region.

What is the long-term outlook for the Asia Pacific commercial standby generator sets market?

The long-term outlook is positive, with consistent demand anticipated from expanding urban and commercial infrastructure. Innovations in cleaner fuels, smart monitoring, and integration with hybrid energy systems will define the next phase of growth. The market will also benefit from government support for reliable power solutions in critical sectors.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com