Asia Pacific Compounding Pharmacies Market Size, Share, Trends & Growth Forecast Report By Therapeutic Area (Hormone Replacement Therapy, Pain Management, Specialty Drugs, Dermatology, Nutritional Supplements), Age Cohort (Pediatric, Adult, Geriatric), Compounding Type (PIA, CUPM, PA), Sterility (Sterile, Non-sterile), and Country (India, China, Japan, South Korea, Australia, New Zealand) – Industry Analysis From 2025 to 2033.

Asia Pacific Compounding Pharmacies Market Size

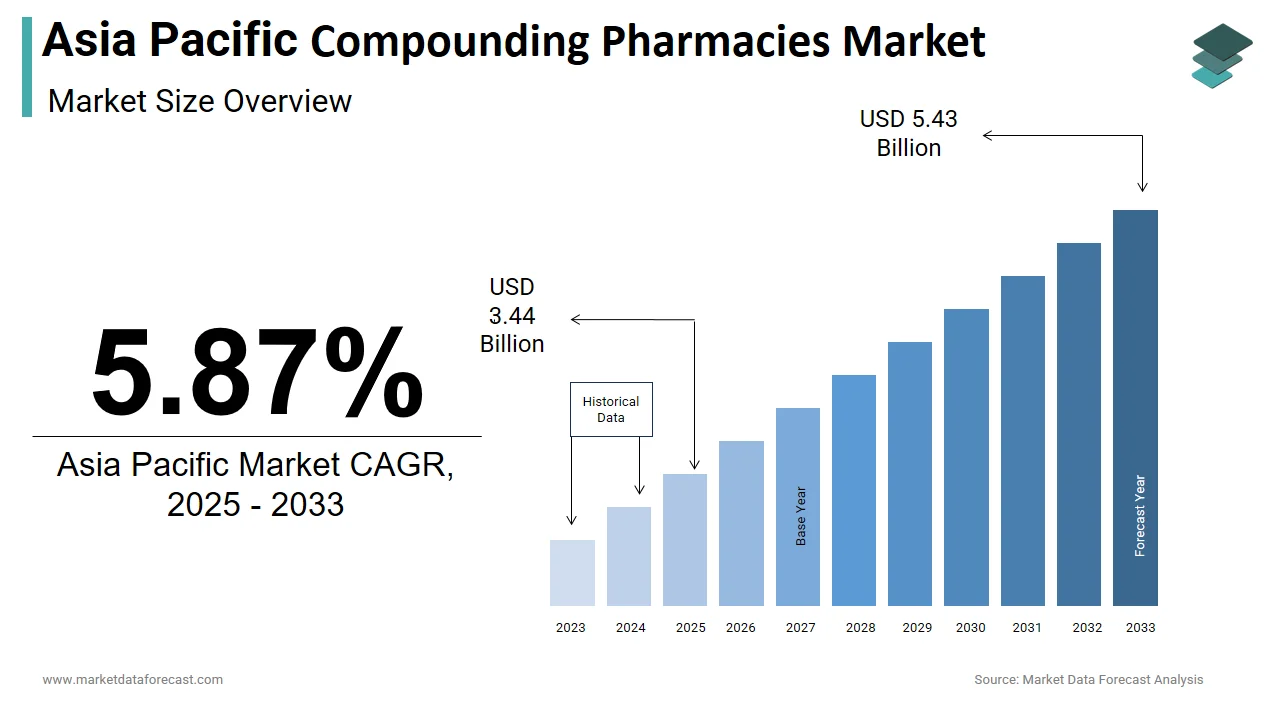

The size of the Asia Pacific compounding pharmacies market was worth USD 3.25 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 5.87% from 2025 to 2033 and be worth USD 5.43 billion by 2033 from USD 3.44 billion in 2025.

Compounding involves the preparation of personalized drug formulations that are not commercially available in standard forms, addressing specific requirements such as dosage adjustments, allergen-free formulations, or unique delivery methods like topical creams and oral suspensions. This sector is gaining prominence due to the region’s growing emphasis on patient-centric healthcare solutions.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases

The escalating burden of chronic diseases in the Asia Pacific serves as a major driver for the compounding pharmacies market. Compounding pharmacies play a pivotal role in addressing these needs by formulating medications tailored to individual patient profiles. For example, diabetic patients often require customized insulin formulations to manage blood sugar levels effectively. Furthermore, the increasing affordability of compounded drugs has empowered patients to seek alternatives to mass-produced medications, fostering preventive healthcare practices.

Increasing Demand for Personalized Medicine

The growing emphasis on personalized medicine is another significant driver for the Asia Pacific compounding pharmacies market. Compounding pharmacies are uniquely positioned to meet this demand by creating bespoke medications that cater to genetic predispositions, allergies, or specific therapeutic needs. Moreover, advancements in genomic research have enabled the development of targeted therapies, further amplifying the need for compounding services. Companies like Biocon and Pfizer are increasingly collaborating with compounding pharmacies to deliver tailored solutions, thereby fueling market growth.

MARKET RESTRAINTS

Regulatory Challenges

Regulatory hurdles pose a significant restraint to the growth of the Asia Pacific compounding pharmacies market. Also, a significant portion of countries in the region have comprehensive regulatory frameworks governing compounding practices, leaving a substantial gap in ensuring product safety and efficacy. This lack of uniformity creates hesitancy among healthcare providers and patients alike, limiting the widespread adoption of compounded medications. Also, high-profile incidents of contamination and adverse reactions have heightened public apprehension. Such incidents not only erode trust but also increase compliance costs for organizations striving to meet stringent quality standards. These challenges underscore the need for robust regulatory frameworks and technological safeguards to mitigate risks and foster confidence in compounded medications.

High Operational Costs

The substantial financial investment required for operating compounding pharmacies acts as a significant restraint, particularly for smaller clinics and independent pharmacies in the Asia Pacific. This financial burden is exacerbated by the need for continuous staff training and maintenance, which further escalates expenses. Rural and underdeveloped areas face even greater challenges, as they often lack the infrastructure and technical expertise necessary to support sophisticated compounding operations. This disparity widens the urban-rural divide in healthcare access, impeding the equitable distribution of compounded medications. Moreover, the return on investment (ROI) for compounding pharmacies is often uncertain, deterring risk-averse stakeholders.

MARKET OPPORTUNITIES

Expansion of Allergen-Free Formulations

The growing demand for allergen-free medications presents a significant opportunity for the Asia Pacific compounding pharmacies market. A major share of the population in the region suffers from allergies, with many individuals unable to tolerate commercially available medications containing lactose, gluten, or dyes. Compounding pharmacies are uniquely positioned to address this unmet need by formulating allergen-free alternatives that are both safe and effective. Additionally, regulatory bodies such as Japan’s Pharmaceuticals and Medical Devices Agency are encouraging the development of hypoallergenic formulations, further accelerating market growth. Advances in compounding techniques, such as the use of plant-based excipients, have also enhanced the appeal of these products.

Integration of Digital Technologies

The integration of digital technologies into compounding pharmacy operations represents another promising opportunity for the Asia Pacific market. Compounding pharmacies can leverage technologies such as artificial intelligence (AI) and machine learning to optimize formulation processes, ensuring precision and consistency in medication preparation. For example, Singapore’s Ministry of Health launched an initiative to integrate AI-driven analytics into compounding practices, achieving a reduction in formulation errors within six months. Furthermore, telepharmacy platforms have enabled remote consultations, allowing pharmacists to collaborate with physicians and patients in real-time to develop personalized treatment plans.

MARKET CHALLENGES

Ethical Dilemmas

Ethical dilemmas surrounding the use of compounded medications pose a formidable challenge to their widespread adoption in the Asia Pacific. One of the primary concerns is the potential for variability in formulation quality, which can lead to inconsistent treatment outcomes. This issue is particularly pronounced in the Asia Pacific, where cultural and linguistic diversity complicates the creation of inclusive compounding protocols. Besides, the delegation of critical decisions, such as formulation adjustments or dosage modifications, to non-specialized personnel raises questions about accountability. Another challenge is the potential misuse of compounding for profit-driven purposes, such as prioritizing expensive formulations over cost-effective alternatives. These ethical considerations necessitate the establishment of clear guidelines and oversight mechanisms to ensure responsible compounding practices.

Lack of Skilled Workforce

The shortage of skilled professionals proficient in both pharmaceutical sciences and compounding techniques presents a significant challenge to the growth of the Asia Pacific compounding pharmacies market. This skills gap is particularly acute in developing countries, where educational infrastructure lags behind technological advancements. This deficiency limits the ability of compounding pharmacies to fully leverage innovative tools, resulting in suboptimal outcomes. Furthermore, the rapid pace of innovation in compounding techniques exacerbates the problem, as existing professionals struggle to keep up with evolving technologies. For instance, Singapore’s SkillsFuture initiative has introduced compounding-focused certifications for pharmacists, aiming to equip them with the necessary competencies. However, scaling such initiatives across the region remains a daunting task, underscoring the urgent need for collaborative efforts to address this challenge.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Therapeutic Area, Age Cohort, Compounding Type, Sterility, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Walgreens Co; JL Diekman and AQ Touchard (Fresh Therapeutics Compounding Pharmacy); Fagron; Albertsons Companies; The London Specialist Pharmacy Ltd. (Specialist Pharmacy); Galenic Laboratories Ltd. (Roseway Labs); Aurora Compounding MEDS Pharmacy; Apollo Clinical Pharmacy; Formul8; Fusion Apothecary, and others. |

SEGMENTAL ANALYSIS

By Therapeutic Area Insights

Specialty drugs segment dominates the Asia Pacific compounding pharmacies market, capturing approximately 60% of the total market share, This segment’s leading place is driven by its ability to address complex weight-related conditions, such as obesity-linked chronic diseases and hormonal imbalances. One key factor propelling this dominance is the rising prevalence of non-communicable diseases (NCDs) in the region. Specialty drugs, often compounded to meet individual patient needs, enable precise treatment plans that cater to genetic predispositions and comorbidities. Another driving factor is the increasing investment in research and development (R&D) for innovative therapies. A significant share of biopharmaceutical companies in the region have prioritized R&D for specialty drugs targeting obesity and metabolic disorders. For instance, Japan’s Takeda Pharmaceutical has developed personalized drug formulations that integrate advanced biomarkers, achieving an improvement in patient adherence rates. Additionally, government initiatives promoting precision medicine, such as China’s “Healthy China 2030” policy, have bolstered the adoption of specialty drugs, further strengthening their position in the market.

The dermatology segment is the fastest-growing therapeutic area in the Asia Pacific compounding pharmacies market, with a projected CAGR of 18.5%. This is fueled by the increasing demand for aesthetic treatments and skin health solutions linked to weight management. One significant driver is the growing emphasis on self-image and wellness. Another factor is the rise of minimally invasive procedures. For example, South Korea’s Amorepacific Corporation has launched dermatological formulations integrated with AI-driven diagnostics, achieving an increase in consumer engagement. Furthermore, advancements in nanotechnology have enhanced the efficacy of dermatological compounds, making them more appealing to younger demographics.

By Age Cohort Insights

The adult age cohort segment commanded the Asia Pacific compounding pharmacies market in 2024. This is driven by the high prevalence of obesity and lifestyle-related disorders among adults. One key factor is the sedentary lifestyle prevalent in urban areas. According to the Asian Development Bank, a notable share of adults in metropolitan cities spend less than 30 minutes daily on physical activity, contributing to rising obesity rates. Compounded weight management solutions tailored for adults, such as customized dietary supplements and hormone therapies, are widely adopted to combat these issues. Another driving factor is the increasing awareness of preventive healthcare. Also, government campaigns promoting healthy living, such as India’s “Fit India Movement,” have further amplified the demand for adult-focused weight management solutions.

The pediatric age cohort is the rapidly advancing segment, with a CAGR of 16.2%. This expansion is propelled by the rising incidence of childhood obesity and metabolic disorders. One significant driver is the increasing consumption of processed foods. Compounded medications, such as appetite suppressants and metabolic boosters, are gaining traction as safe and effective solutions for pediatric weight management. Another factor is the growing emphasis on early intervention. Furthermore, advancements in pediatric compounding techniques have addressed concerns about dosage accuracy, making these solutions more viable for young patients.

By Compounding Type Insights

The PIA (Patient-Specific Internal Applications) segment spearheaded the Asia Pacific compounding pharmacies market by commanding 55.7% of the total market share in 2024. This segment’s development is supported by its ability to deliver highly personalized internal medications, such as oral suspensions and capsules, tailored to individual patient needs. One key factor is the increasing demand for precision medicine. Another driving factor is the growing prevalence of chronic diseases. Besides, regulatory frameworks supporting personalized therapies, such as Japan’s Pharmaceuticals and Medical Devices Act, have bolstered the adoption of PIA, ensuring its continued prominence in the market.

The PDA (Patient-Specific Dermatological Applications) is the fastest-growing segment, with a CAGR of 19.8% , as per Business Wire. This progress is backed by the increasing demand for aesthetic treatments and skin health solutions linked to weight management. One significant driver is the growing emphasis on self-image and wellness. Another factor is the rise of minimally invasive procedures. Furthermore, advancements in nanotechnology have enhanced the efficacy of dermatological compounds, making them more appealing to younger demographics.

COUNTRY LEVEL ANALYSIS

China led the Asia Pacific compounding pharmacies market by commanding a 35.8% market share in 2024. The country’s dominance is credited to its robust pharmaceutical industry and substantial government investments. One key factor is the rapid expansion of specialty drug production facilities. Another factor is the booming startup landscape.

India is holding a notable market share. The country’s position is bolstered by its large patient base and cost-effective manufacturing solutions. One driving factor is the government’s “Pharma Vision 2020,” which aims to create a unified pharmaceutical ecosystem. Another factor is the rise of contract manufacturing organizations (CMOs), which leverage compounding technologies to enhance scalability and efficiency.

Japan possesses a significant position in the market. The country’s advanced healthcare system and aging population drive compounding pharmacy adoption. One key factor is the integration of AI in geriatric care. One more aspect is the emphasis on precision medicine, with compounding pharmacies playing a central role in advancing genomics and drug discovery.

South Korea secures the notable share of the market. The country’s leadership is driven by its strong ICT infrastructure and proactive regulatory framework. One driving factor is the adoption of compounding pharmacies in public healthcare initiatives. A different point is the collaboration between academia and industry, fostering innovation in compounding practices.

Australia and New Zealand collectively progress is driven by its focus on research and ethical compounding practices. One key factor is the adoption of compounding pharmacies in remote healthcare delivery. A further factor is the emphasis on ethical guidelines, ensuring responsible compounding while fostering trust among stakeholders.

KEY MARKET PLAYERS

Some of the noteworthy companies in the Asia Pacific compounding pharmacies market profiled in this report are Walgreens Co; JL Diekman and AQ Touchard (Fresh Therapeutics Compounding Pharmacy); Fagron; Albertsons Companies; The London Specialist Pharmacy Ltd. (Specialist Pharmacy); Galenic Laboratories Ltd. (Roseway Labs); Aurora Compounding MEDS Pharmacy; Apollo Clinical Pharmacy; Formul8; Fusion Apothecary, and others.

TOP LEADING PLAYERS IN THE MARKET

Fagron Asia (Singapore)

Fagron Asia is a leading player in the Asia Pacific compounding pharmacies market, renowned for its expertise in developing innovative compounded medications tailored to individual patient needs. The company’s contributions to the global market include pioneering advancements in allergen-free formulations and personalized dermatological solutions. By leveraging cutting-edge technologies, such as AI-driven formulation analytics, Fagron has set benchmarks in precision and safety. Their commitment to sustainability is evident in their use of eco-friendly excipients, which aligns with global trends toward green healthcare practices. Fagron’s strategic partnerships with regional healthcare providers have solidified its position as a key enabler of patient-centric care worldwide.

Cipla Limited (India)

Cipla Limited is a prominent player in the Asia Pacific compounding pharmacies market, with a strong focus on affordability and accessibility. The company’s innovative compounded solutions cater to diverse therapeutic areas, including chronic diseases and pediatric care. Globally, Cipla has played a pivotal role in advancing personalized medicine by integrating micronutrient profiling into compounded formulations.

Amorepacific Corporation (South Korea)

Amorepacific Corporation is a major contributor to the Asia Pacific compounding pharmacies market, particularly in dermatological applications. The company’s focus on aesthetic treatments and skin health solutions has made it a preferred choice for patients seeking compounded medications for weight management-related skin issues. On a global scale, Amorepacific has been instrumental in promoting minimally invasive procedures through its advanced compounding techniques.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Partnerships

Key players in the Asia Pacific compounding pharmacies market are increasingly forming strategic partnerships with hospitals, research institutions, and government bodies to co-develop innovative solutions. These collaborations enable companies to leverage complementary expertise, accelerate product development, and expand their reach. For instance, partnerships with academic institutions often focus on refining compounding processes using real-world data, ensuring robustness and inclusivity in healthcare applications.

Investment in R&D

Investing heavily in research and development (R&D) is another dominant strategy adopted by market leaders. Companies are prioritizing the creation of cutting-edge compounded medications tailored to regional needs, such as addressing chronic diseases or improving pediatric care. This focus on innovation not only enhances their competitive edge but also ensures compliance with local regulatory standards, fostering trust among stakeholders. Also, advancements in compounding techniques, such as the use of plant-based excipients, have addressed concerns about allergens and contamination risks.

Expansion of Service Portfolios

To strengthen their market position, companies are diversifying their service portfolios by incorporating compounding into various healthcare domains, including telemedicine, dermatology, and pediatrics. By offering comprehensive solutions that address multiple pain points, these players can attract a broader customer base while reinforcing their brand as a one-stop provider for personalized healthcare services. For example, integrating AI-driven diagnostics with compounded medications has enabled companies to provide end-to-end solutions, enhancing patient outcomes and satisfaction.

COMPETITION OVERVIEW

The Asia Pacific compounding pharmacies market is characterized by intense competition, driven by the presence of both global giants and regional innovators. Established players like Fagron Asia and Cipla Limited compete alongside emerging startups such as Amorepacific Corporation and Biocon, creating a dynamic ecosystem. The competitive landscape is shaped by rapid technological advancements, increasing demand for personalized medications, and supportive government policies. Companies are striving to differentiate themselves through unique value propositions, such as proprietary compounding techniques, user-friendly interfaces, or specialized applications in dermatology and chronic disease management. Additionally, the race to secure intellectual property rights and comply with stringent regulatory standards further intensifies rivalry.

RECENT MARKET DEVELOPMENTS

- In April 2023, Fagron Asia launched an AI-driven formulation platform in collaboration with several Asian universities. This initiative aimed to enhance precision in compounding processes and reduce formulation errors, addressing critical needs in personalized medicine.

- In June 2023, Cipla Limited partnered with India’s Ministry of Health to develop affordable compounded medications for rural populations. This collaboration marked a significant milestone in expanding access to personalized healthcare solutions in underserved areas.

- In September 2023, Amorepacific Corporation introduced a line of compounded dermatological products integrated with nanotechnology. This innovation was developed in partnership with South Korean research institutions, highlighting the company’s commitment to advancing skin health solutions.

- In November 2023, Biocon acquired a Malaysian compounding pharmacy to strengthen its foothold in Southeast Asia. This acquisition enabled Biocon to expand its product portfolio and cater to growing demand in emerging markets.

- In January 2024, Pfizer launched a telepharmacy platform in Australia to offer remote consultations for compounded medications. This initiative was designed to enhance accessibility and convenience for patients in remote regions, further solidifying Pfizer’s leadership in the market.

MARKET SEGMENTATION

This Asia Pacific compounding pharmacies market research report is segmented and sub-segmented into the following categories.

By Therapeutic Area

- Hormone Replacement Therapy

- Pain Management

- Specialty Drugs

- Dermatology

- Nutritional Supplements

- Others

By Age Cohort

- Pediatric

- Adult

- Geriatric

By Compounding Type

- Pharmaceutical Ingredient Alteration (PIA)

- Currently Unavailable Pharmaceutical Manufacturing (CUPM)

- Pharmaceutical Dosage Alteration (PA)

- Others

By Sterility

- Sterile

- Non-sterile

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific compounding pharmacies market?

The Asia Pacific compounding pharmacies market is driven by rising chronic disease prevalence, demand for personalized medicine, technological advances like AI in formulation, and growing need for allergen-free and specialty drugs.

2. What challenges affect the Asia Pacific compounding pharmacies market?

The Asia Pacific compounding pharmacies market faces challenges from regulatory hurdles, high operational costs, shortage of skilled professionals, ethical concerns over formulation quality, and uneven access in rural regions.

3. What opportunities exist in the Asia Pacific compounding pharmacies market?

The Asia Pacific compounding pharmacies market offers opportunities in digital health integration, telepharmacy, development of hypoallergenic medications, AI-driven compounding, and expanding access to underserved populations.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]